A YEAR OF PROGRESS[1]

What a difference a year makes. This is how we started the January 2023 letter:

Dear Investors,

Let’s pretend it’s January 1, 2022. Imagine that I told you that by January 17, 2023 Tesla would be down 63%, Meta down 60%, Amazon -42%, PayPal -57%, Square -54%. It was the worst-ever year on record for U.S. bond investors. According to an analysis by Edward McQuarrie, a professor emeritus at Santa Clara University who studies historical investment returns:

“Even if you go back 250 years, you can’t find a worse year than 2022.”

Now, I ask you to guess how much Bitcoin would be down. I’d imagine that the majority would say more than 54%…

Blockchain’s resilience in the face of a terrible macro market for risk assets and historic idiosyncratic disasters is impressive…

Blockchain is going to change the world. It will certainly survive these issues.

It did – impressively.

The price of bitcoin was down in line with those tech companies last year. This year it has massively out-performed most.

That’s the 14-year story of bitcoin – higher lows and higher highs each cycle.

(More on that at the end of the letter.)

The naysayers and retrograde politicians are so good at being negative that it’s important to step back and appreciate the huge amount of progress the blockchain industry made in 2023.

The dominos fell relentlessly in 2022 – one toppling into the next, causing a relentless cascade of failures. We saw hopefully the last few bad dominos topple this year. Binance, the largest of those remaining pieces, will be addressed later in the letter.

The interlocking dominos seem to have fully played out. The reason to be very bullish is that the vast majority of significant events in 2023 were good news and the blockchain industry made meaningful, necessary progress.

Some of the key takeaways:

– Institutional adoption has accelerated. The headline news has been the imminent approval of spot Bitcoin ETFs sponsored by large names in traditional finance – like BlackRock and Fidelity – and the leader in blockchain ETFs, Bitwise. Similar to the first international gold ETF in 2003 and U.S. gold ETF in 2004, this opens a new channel for traditional capital to flow into “digital gold” that might not have participated previously.

– Our ability to rely on the U.S. court system to be fair and impartial has been reassuring. Ripple’s native token XRP ruled as not a security, Grayscale’s win in their lawsuit against the SEC regarding their Bitcoin ETF application – a few indications that a favorable regulatory landscape for blockchain in the U.S. can be achieved, enabling further innovation to occur onshore.

– Blockchain’s “dial-up” to “broadband” moment is happening. We can see this with the growth of Ethereum layer 2s and hyperscale blockchains – Arbitrum has accounted for nearly 100% of the increase in transaction growth this year in the Ethereum ecosystem.

– The market has rebounded since the start of the year. Bitcoin’s yearly low was $16,680 on January 2nd. The overall market capitalization of cryptocurrencies has doubled, from $0.8tn to $1.6tn.

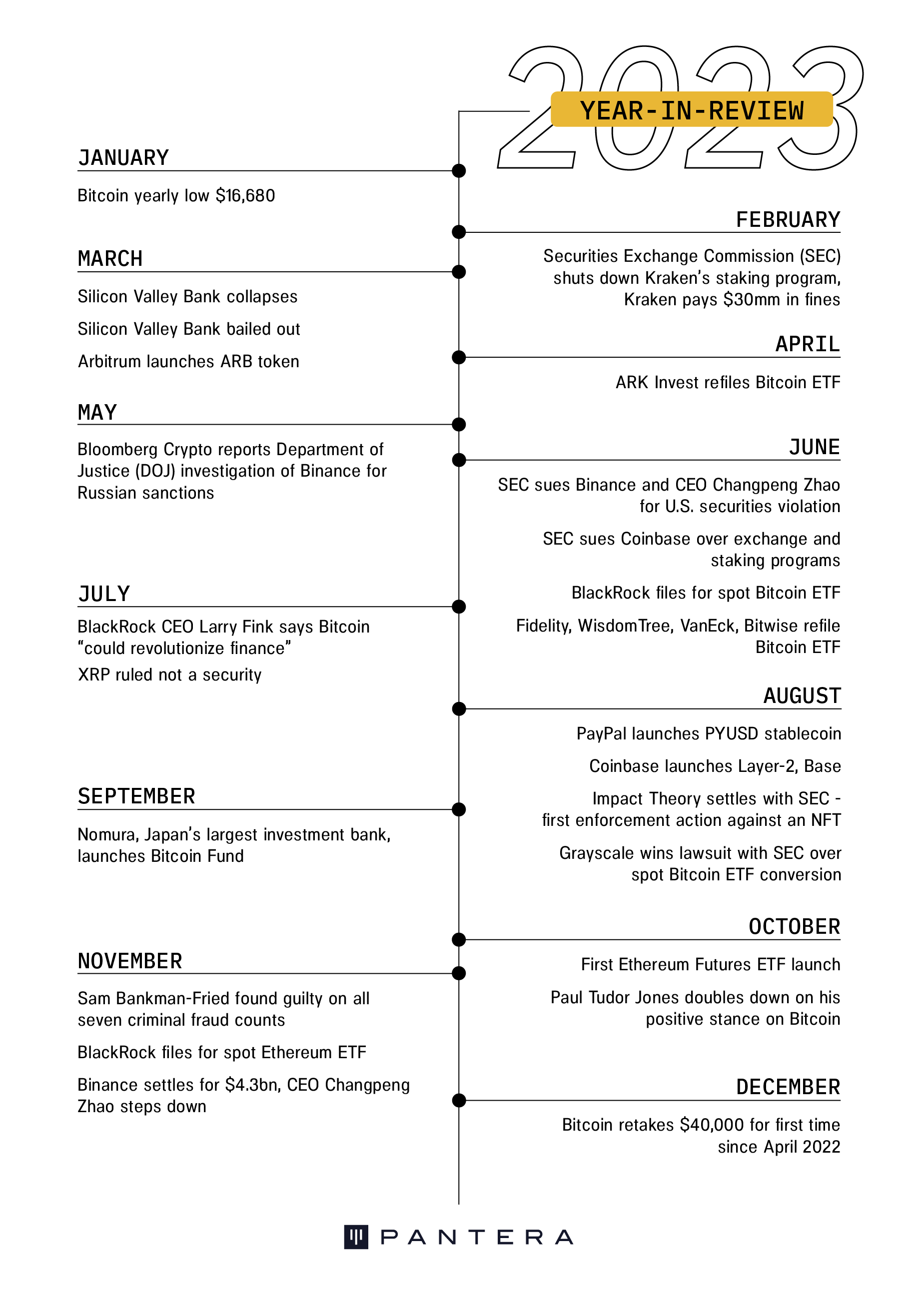

We’ll dive deeper into some of these in this letter. First, here’s a visual recap of some of the major events of 2023:

CRYPTO MARKET UPDATE

By Jeff Lewis, Product Manager, Hedge Funds

Exactly a year ago, the European Central Bank put out this not-so-prescient tweet calling for Bitcoin’s final moments before fading into “irrelevance”.

The ultimate tell was the ornamentation and exaggeration of language.

Hindsight is 20/20, but really?

“artificially induced last gasp”

“embarks on a road to irrelevance”

At that time, I took it upon myself to respond to this drivel, laying out a four-point explanation for why we may see better days ahead for crypto.

You can read the full thing here, but I wanted to revisit the first point I made:

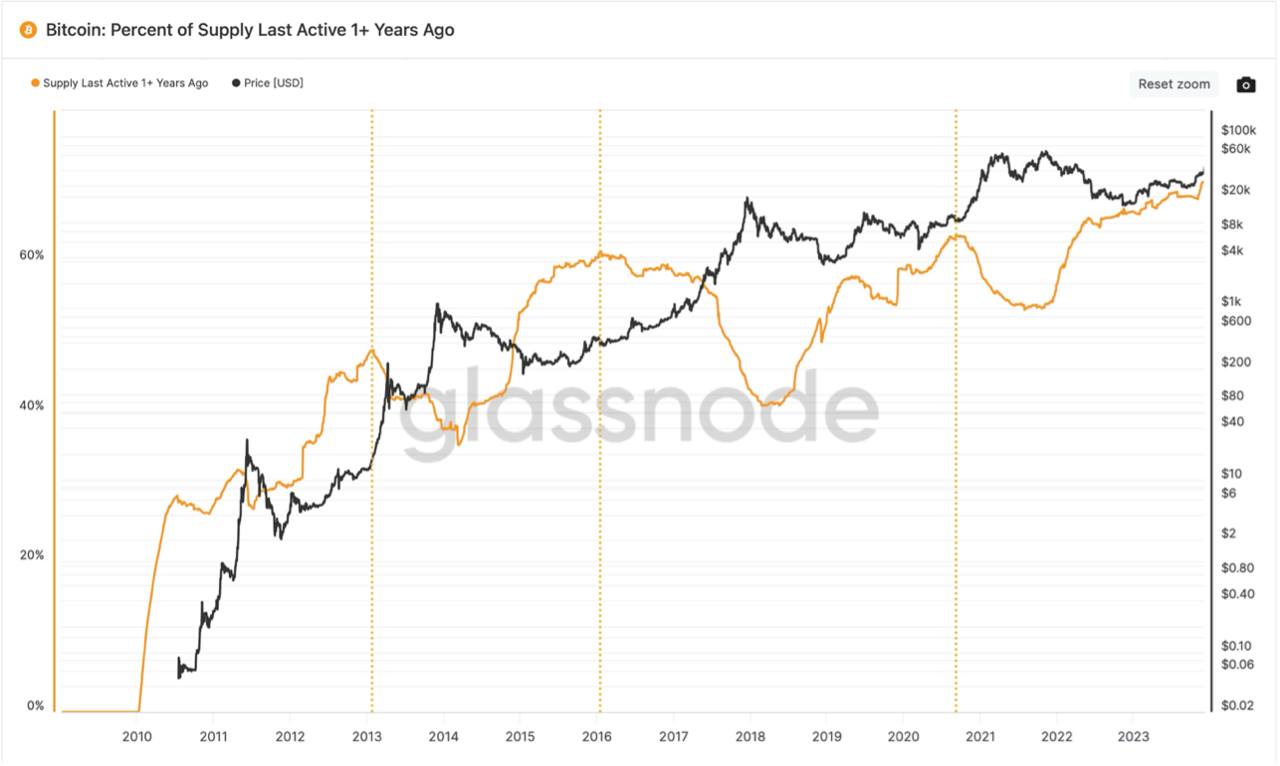

“1. The percentage of BTC held by wallets that have not sold in over a year is now 2/3, the highest reading ever, according to Glassnode [for this letter, we’ll refer to this metric as the “1-Year HODL Wave” or “indicator”]. In the past, new highs in this indicator have correlated with market lows. The accuracy of this indicator makes a lot of sense as the market has effectively restricted tradeable supply when it makes a high. Last fall, when BTC peaked, that indicator was at a two-year low of roughly 53%. Roughly $100B would buy every BTC in existence that is not in a long-term wallet. That is not a big number.”

The day of the ECB tweet, bitcoin opened at $16,445 – just nine days after the market bottomed on November 21st at $15,599 post-FTX fallout.

I don’t need to explain what happened next.

1-Year HODL Wave :: Where In The Cycle Are We?

Now that Bitcoin has rallied 160% since the ECB tweet, a question people are asking themselves is, “where are we within this cycle today?”

The 1-Year HODL Wave could help us answer that question. It tracks the percentage of all bitcoins that have not been moved from one wallet to another for at least one year. Side note: “HODL” is an acronym for “Holding On for Dear Life” but originated from a community member who misspelled “hold” in a post to a Bitcoin forum in 2013.

How is that metric useful?

As bitcoin’s price approaches a new cycle peak, there’s a noticeable reduction in the percentage of coins held for over a year. This trend is partly attributed to holders of these coins opting to realize profits by selling, leading to these coins no longer being categorized as 1yr+ in this analysis. As a result, the 1-Year HODL Wave, represented by the orange line, declines while the price, shown by the black line, rises.

Historically, the price of bitcoin has increased slowly and steadily into the indicator’s peaks.

After peaking and rolling over, the price has ramped up quickly and steeply, with those rallies lasting 1.3 years on average from the indicator peak to the peak in price.

Here are the returns heading into 1-Year HODL Wave peaks and what occurred after.

For this cycle, we haven’t seen any clear indication that the indicator has topped out.

The punchline is: if historical price action around peaks in the 1-Year HODL Wave is any indication of future performance, the majority of gains this cycle have yet to come.

A natural follow-up question would then be, “when does the indicator peak this cycle and we see a sharp run-up in price?”

What’s interesting is that the peaks in the indicator have occurred no more than two quarters from Bitcoin Halvings – 0.2, 0.5, and 0.3 years before or after halvings. The next halving is expected to occur at the end of April 2024.

![]()

JAMIE DIMON, THE LONGSHOREMEN’S UNION OF MONEY MOVEMENT

“If I was the government, I’d close it down.”

— Jamie Dimon, JPMorgan, CEO, Congressional Hearing, December 6, 2023

He reminds me of the longshoreman’s union in On the Waterfront. (A 1954 film about an ex-prize fighter turned longshoreman who struggles to stand up to his corrupt union bosses.) He’s always trying to shut down the competition.

The Marlon Brando character says:

Terry: “Hey, you wanna hear my philosophy of life? Do it to him before he does it to you.”

Jamie Dimon has been trying to kill bitcoin since 2014.

“I’ve always been deeply opposed to crypto, bitcoin, etc. You pointed out the true use case for it is criminals, drug traffickers, anti-money laundering, tax avoidance….”

— Jamie Dimon, JPMorgan, CEO, Congressional Hearing, December 6, 2023

So, let me get this straight: the CEO believes it’s only for criminals, drug traffickers, anti-money laundering, tax avoidance…but he sells the product to the bank’s clients?

Isn’t that an ethics issue? I guess not to him. According to the Good Jobs First violation tracker, JPMorgan has incurred $35bn in penalties for financial and consumer-protection-related crimes, frauds, and other offenses.

Satoshi Nakamoto created bitcoin, has $50bn of bitcoin, and has never used a penny. Satoshi gifted this technology to the world for free, without patent – to release billions of people from predatory banking and remittance fees.

“He that is without sin among you, let him first cast a stone.”

— John 8:7

Nobody’s voting for Jamie Dimon to cast the first stone. But what strange bedfellows anti-bitcoin rhetoric makes.

“I am not usually holding hands with the CEOs of multibillion-dollar banks. But this is a matter of national security,”

— Senator Elizabeth Warren, replying to Jamie Dimon’s comments, Congressional Hearing, December 6, 2023

It boggles the mind that a Progressive can’t see the sublime beauty of bitcoin. That Elizabeth Warren supports anti-competitive oligopolists like Jamie Dimon over the interest of the world’s population is hard to fathom.

While pondering this I happened to look up at my wall. There it is! The opening line of the Bitcoin paper:

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

— Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, 2008

Wouldn’t a populist want the people to be able to move money themselves – without going through a financial institution? How odd that she’s holding hands with somebody who has extracted a half a trillion of value from the people.

Senator Warren may not be as tight with her Native American ancestors as she once was, but one Congressman actually lives in the Bronx – Ritchie Torres D-NY. Congressman Torres actually knows how hard it is for his constituents.

Rep. Torres’s bio on X (f.k.a. Twitter) is as succinct as it gets:

Born & bred in the Bronx. Grew up in poverty. Product of public housing.

He knows how the system works:

“The lowest-income families in the Bronx are often forced to pay predatory fees to transfer their own money to their loved ones abroad.”

— Congressman Ritchie Torres, U.S. representative for New York’s 15th congressional district at Pantera Blockchain Summit 2022

He knows that many of his constituents work for an entire month to pay their money-transfer fees. Their families back home only get 11 months’ of their wages. (The average remittance fee is 8.00% — one-twelfth of the income.)

Rep. Torres shared his enthusiasm for bitcoin and blockchain at Pantera Blockchain Summit last year:

“I approach it as a representative of the South Bronx, which is often said to be the poorest congressional district in America. And crypto for me can be a powerful tool for addressing many of the symptoms of racially concentrated poverty….

“I feel like there are some use cases that have the potential to fundamentally reshape the lives of the most vulnerable communities. We have a traditional financial system that has fundamentally failed the lowest income Americans who are often left behind. 20% of the residents in the South Bronx are unbanked, 30% are under-unbanked….

“There is concern that DeFi could present a challenge to the traditional financial system, to which I would reply, “so what?” I mean that’s the nature of technology, creative disruption, right? We have no obligation to protect legacy institutions or incumbent institutions. If those institutions are failing to serve communities like mine, that’s their problem. We should welcome dynamism and creative disruption….”

— Congressman Ritchie Torres, U.S. representative for New York’s 15th congressional district

Look at the man Senator Warren supports:

Jamie Dimon’s bank won’t accept 99% of the world’s population as a customer and is extracting value equal to $458 billion market capitalization from those it is willing to do business with.

vs.

Bitcoin is permissionless. Anybody on earth with a smartphone is welcome to use it. Satoshi extracted not a penny. Isn’t that a populist’s dream?

Senator Warren is right that blockchain is a matter of vital national security interest – she just has it backward. The former chairman of the U.S. Securities and Exchange Commission Jay Clayton wrote an op-ed to stress this:

“Regulation is essential to our financial markets, and there is no doubt that tokenized financial assets should be regulated to ensure financial stability, promote capital formation, prevent illicit activity, and protect consumers. But there is more the U.S. government must do. Innovators must have assurances that if they follow time-tested regulatory principles, they will be free to pursue the market opportunities provided by better functionality. The government should actively facilitate the adoption of technology in core U.S. dollar funding and payments markets. This is a matter of national security and financial stability.”

— Former SEC Chairman Jay Clayton, “America’s Future Depends on the Blockchain”, Wall Street Journal

The United States is losing this key strategic area to China. The longer the retrograde politicians repress development in the United States the further back the U.S. falls.

On the Waterfront includes the iconic line, ranked #3 in the American Film Institute’s list of the top 100 movie quotations in American cinema:

Terry Malloy: “You don’t understand, I could have had class. I could have been a contender. I could have been somebody.”

Bitcoin is a title-belt contender. It will help billions of people get access to the financial services which are denied to them by the legacy oligopolists.

Jamie Dimon’s 10-year struggle against the future reminds me of Br’er Rabbit.

— Joel Chandler Harris, The Tales of Uncle Remus: As Told by Julius Lester, 1987

This guy better be careful. The more he hits Br’er Bitcoin the more his legacy is going to be totally stuck to it…

![]()

NO MORE SHOES TO DROP

By Jeff Lewis, Product Manager, Hedge Funds, and Erik Lowe, Head of Content

After the fallout of FTX, many market participants were wondering, “who’s next?” or “what’s the next shoe to drop?”

On November 21, in what came as a surprise headline to many, the U.S. Department of Justice announced they had settled a criminal case with Binance and now former CEO Chengpang Zhao (known as “CZ”).

“Binance admits it engaged in anti-money laundering, unlicensed money transmitting, and sanctions violations in largest corporate resolution to include criminal charges for an executive.”

— Office of Public Affairs, U.S. Department of Justice, November 21, 2023

CZ was forced to step down and will possibly face jail time. Binance must pay $4.3bn in penalties to the CFTC, FinCEN, and OFAC – nothing to the SEC. Luckily for Binance, they can turn the page, refine their compliance practices, and still operate – there’s a long list of obligations that imply that the U.S. government is effectively in charge of their compliance department for the coming years.

Despite what may have felt like an anticlimactic resolution in comparison to the SBF/FTX saga, the Binance settlement marks a major milestone in the industry’s transition.

The market dipped 5% on the news but recovered immediately.

We believe the industry can now move on and away from the negative associations that have encumbered it to date.

The path from here is forward.

![]()

2023 REGULATORY RECAP

By Katrina Paglia, Chief Legal Officer

This year was full of developments in the blockchain regulatory landscape. Positive rulings on high-profile cases have generated renewed interest from investors. In addition, there are many areas to monitor from rulemaking to pending litigation that will have meaningful implications over the coming year.

In both this letter and future communications, such as our regulatory newsletter, we will highlight many of these developments, providing digestible information and practical insights to help our investors and entrepreneurs stay informed in this rapidly changing regulatory landscape. If you are interested in receiving our regulatory newsletter please sign up here where you can read a more detailed analysis on all of the below as well as follow for our future publications.

Settled Enforcement Actions

NFTs

The SEC recently announced their first two enforcement actions against non-fungible token (“NFT”) issuers under federal securities laws: Impact Theory, a California-based media and entertainment company and Stoner Cats 2, the producer of an adult animated television series. This marked a notable expansion in the commission’s regulatory focus. The SEC alleged in both cases that the NFTs being sold were unregistered securities. Subsequent to the charges being announced, both companies agreed to settle with the SEC for ~$6.1 m (Impact Theory) and $1m (Stoner Cats).

The SEC’s case in both instances was centered around the way that the issuers primed investor expectations by promoting and marketing its NFTs, leading investors to believe that they would profit based on the efforts of others, a key aspect of the Howey Test that is used in evaluating digital assets as potential securities. The increased scrutiny on NFTs is intriguing since the spotlight had previously been on digital assets rather than NFTs.

Both enforcement actions strongly suggest that there could be additional SEC scrutiny of NFTs and that issuers selling these assets should look closely at, among other things, the way they design, market and promote their product. In light of these developments, we are paying particular attention internally and with our portfolio companies as to how a digital asset or project is promoted and sold.

Exchanges

Another material SEC settlement action this year was with Kraken, a leading digital asset exchange, which settled with the SEC for $30 million on the basis that their staking service was an unregistered security and met the definition of an investment contract.

Similar to the SEC’s findings in the NFT enforcement actions against Impact Theory and Stoner Cats, the SEC highlighted, among other things, the way in which Kraken promoted its staking service, which advertised an annual return of as much as 21%. Kraken also could change the yield on the staking service at its own discretion and co-mingled its assets with its customers.

The SEC focused on “efforts of others and expectation of profit” in that settlement, and Kraken immediately ceased all their staking services in the US in connection with that settlement.

Case Law

SEC vs. Coinbase

A central regulatory theme throughout the past year was the SEC’s aggressive enforcement stance towards some of the ecosystem’s largest exchanges. Coinbase was amongst the biggest exchanges that was charged by SEC.

To summarize, the SEC’s complaint against Coinbase alleges that the exchange has been operating an unregistered securities exchange, an unregistered broker dealer, and an unregistered clearing agency. And, like their case with Kraken, the SEC alleged that Coinbase’s staking service was an unregistered security. Coinbase then responded to the complaint by filing a motion to dismiss, with a ruling expected in January. To the extent the court does not rule in favor of Coinbase with respect to its motion to dismiss, which is an extremely high standard to satisfy, we expect this battle to be drawn out and last for quite some time. It’s interesting to note that a couple of months before the SEC filed its charges, Coinbase sued the SEC under the Administrative Procedure Act, or the APA, to compel the SEC to respond to its previously filed Petition for Rulemaking for digital assets. Essentially, Coinbase, through its lawsuit, is trying to force the SEC to write regulations explaining how securities laws apply to cryptocurrency and to engage in a formal notice-and-comment process to allow the public to weigh in.

Under its complaint against Coinbase, the SEC will need to successfully prove, among other things, that digital assets or, in the case of the staking allegation, arrangements involving digital assets, constitute investment contracts and are securities. In addition, with respect to the unregistered exchange, broker-dealer and clearing agency allegations, the SEC, also named several digital assets claiming that they are unregistered securities, including widely traded assets such as Solana, Polygon, NEAR, and MATIC.

In this case, as with many other SEC complaints, the commission is not only going after the intermediary. While the Commission has not actually sued or charged Solana, NEAR, MATIC, or Polygon, by naming them in the Coinbase complaint, they are effectively putting them on notice by claiming that each of these digital assets are, in their view, operating illegally as unregistered securities. In light of this and to the extent the SEC decides to continue to be aggressive vis a vis its enforcement stance, we should expect an action packed 2024.

SEC vs. Ripple

Another big headline driven by the SEC this past year revolved around its ongoing battle with Ripple Labs, where the SEC asserted that Ripple’s token, XRP, is a security. In July of this year, Judge Torres, the presiding judge over the case, which was heard in the District Court for the Southern District of New York, ruled both in favor of Ripple and the SEC on various motions. In making her decision, Judge Torres essentially reviewed and ruled on four distinct sales or distributions by Ripple of its native XRP token:

1. XRP sales by Ripple, through wholly owned subsidiaries, to a number of institutional buyers were investment contracts due to an expectation of profit based on the efforts of others.

2. XRP sales by Ripple on crypto exchanges “programmatically,” or through the use of trading algorithms are NOT investment contracts. Because the sales were “blind bid/ask transactions”, the buyers could not have known if their payments of money went to Ripple, or any other seller of XRP.” Therefore, the buyers in the Programmatic Sales had no expectation of profit based on Ripple’s efforts so Judge Torres concluded that the XRP sold in the Programmatic Sales were not investment contracts under the Howey Test.

3. XRP distributions by Ripple to various employees, as compensation, or to fund third parties that would develop new applications for XRP and the XRP blockchain ledger were not investment contracts.

4. XRP sales by Ripple’s CEO and Chief Legal Officer, in their individual capacities, on crypto exchanges were not investment contracts for the same reason that the programmatic sales were not investment contracts – given that the CEO and CLO did not know the identity of the sellers whom they sold XRP to. Therefore, these purchases were not made with an expectation of profit based on Ripple’s efforts, and so could not be investment contracts.

While the ruling on these transactions is quite complicated, the key implication for our industry is that Judge Torres’ ruling made clear that XRP in and of itself is not a security. Based on Judge Torres’ ruling, we would have to look at how the assets are sold to determine if it is a security.

Taking Judge Torres’ ruling in totality, it was received as decisively positive for the industry given the only instance where she ruled in favor of the SEC was in direct sales of digital assets from the issuer to institutions. However, while the ruling was undoubtedly a blow to the SEC’s enforcement campaign, the case is still on appeal and subject to being overturned. On that note, another decision from a judge in the same district was issued shortly after Judge Torres’ Ripple ruling.

Judge Rakoff, in the Southern District of New York (SDNY), denied a motion to dismiss an SEC complaint alleging that Terraform Labs and its CEO, Do Kwon, violated securities laws through the offering and sale of multiple crypto assets. In his ruling, Judge Rakoff explicitly disagreed with his colleague, Judge Torres’ distinction between purchasers of crypto assets in primary offerings and the “blind” transactions of on-exchange crypto asset purchasers. Specifically, Judge Rakoff did not draw the same distinction between direct primary sales and secondary sales, but focused, again, on the purchaser’s expectation of profit, similar to what the SEC continues to emphasize in its lawsuits, as previously discussed.

Following these two conflicting decisions and subsequent motions and appeals, it appears that for the time being, the SDNY is split as to whether and when on-exchange transactions in crypto assets amount to offers and sales of investment contracts. A clear answer to this question is likely to be of vital importance to crypto market participants.

Bitcoin ETF Applications

Another topic we have seen dominating headlines and discussions, particularly recently, is the pending applications by several large institutions for an SEC-approved Bitcoin Spot Exchange Traded Fund (“ETF”).

Grayscale has been in a battle with the SEC for years over its application to have the Grayscale Bitcoin Trust (“GBTC”) listed on a securities exchange as an SEC-approved exchange traded product. In June 2022, the SEC denied Grayscale’s application to launch a spot Bitcoin ETF and Grayscale counter-sued the SEC, claiming the SEC “arbitrarily and capriciously” denied the GBTC application while simultaneously approving applications for Bitcoin futures products. Grayscale came away with a partial win in the D.C. Circuit when the judge recently found that the SEC did not have sufficient basis for denying the GBTC application, which means, essentially, the SEC must now reconsider the application.

We are expecting an answer soon on this latest SEC review of the application because there are certain timelines under which the SEC must make a decision. Specifically, any time between now and early January 2024, we expect to have a decision on GBTC, and then the SEC’s decision on the other applicants either simultaneous or in short order thereafter.

DeFi Regulation

There have been a few lawsuits and regulatory actions in the DeFi space as well this year.

Ooki DAO

Ooki was a case brought by the Commodities Futures Trading Commission (“CFTC”) whereby the CFTC alleged that the Ooki DAO (“decentralized autonomous organization”) and any person or entity that held a token and voted for certain governance proposals on that DAO were operating as an unregistered futures commission merchant (“FCM”) by soliciting and accepting orders from customers, accepting money or property as margin, and extending credit, in violation of the Commodities Exchange Act (CEA). One material hurdle in this case was whether and how a decentralized protocol was able to be properly served. The CFTC alleged, and the court ultimately agreed, that Ooki Dao is an entity capable of being sued as an “unincorporated association under state law”, rather than just being a technology.

The judge issued a default judgement in favor of the CFTC finding that Ooki DAO was an illegal trading platform, was acting as an unlawful unregistered FCM and failed to adopt an appropriate Know Your Customer program, ordering the DAO to pay fines of approximately $640,000 and to cease its operations. While the monetary penalty may not be as large as other settlements, the key impact of this case was the fact that the court determined a DAO could in fact be considered a legal entity, giving concern to token holders who participate in various governance votes, as to whether the individual token holders could also be found liable in future actions.

Compound

A private class-action litigation to be aware of involves Compound Labs. To note, this was not brought by a regulator. Compound Labs is a DeFi protocol that issued compensation tokens, COMP. In December 2022, a class action lawsuit was filed alleging that the COMP token is an unregistered security and claimed that Compound Labs and the associated venture capital investors violated securities laws by soliciting the purchase of the COMP token by the plaintiffs.

The court, in September 2023, denied the defendants’ motion to dismiss finding that the plaintiffs had “plausibly alleged” that each defendant did solicit the purchase of the COMP tokens. While still in early stages of the litigation, this will be an important case to monitor and we will continue to do so throughout 2024.

Future Regulatory Updates

This year, we’ve embarked on a few initiatives to help educate our portfolio companies and those interested in keeping a pulse on the regulatory landscape.

We partnered with prominent law firms to produce our regulatory newsletter. The newsletter is distributed on a regular basis with the primary goal of taking regulatory headlines (like the information above) and synthesizing them into bite-size snippets for our portfolio companies to use. We want them to understand what’s important, what matters, and provide information in a way that makes sense as they continue to build going forward.

In 2024, we plan to have even more thought leadership and content distributed. We’re going to start in January with a panel that I’ll be moderating with senior thought leaders in the blockchain policy space. Stay tuned for our January Blockchain Letter, which will recap this discussion.

In addition, we will continue producing more content in 2024 which provides updates on the blockchain regulatory and policy space.

It has been an exciting 2023 for our industry and we look forward to even more in 2024.

![]()

DEVIATION FROM TREND

I can imagine an investor thinking: “Bitcoin is up 162% this year. Well, I missed it.” and giving up.

No. That’s the wrong mindset. It’s up almost that much EVERY year (on average). The 13-year trend growth rate is 117%.

Bitcoin, as a proxy for our industry, is still very cheap relative to its 13-year exponential trend.

Zooming into the graph of the log trend of bitcoin you can see that the rally in 2023 is just normal – the gold line has barely outpaced the 13-year trend.

So, even the rally we’re experiencing isn’t doing much to change the relative undervaluation of bitcoin. Here’s a graph of the deviation of bitcoin from its 13-year trend growth rate. Even after the rally it’s still 74% cheap to the trend.

It’s only spent 13% of the last 13 years at that level or cheaper.

![]()

TOP-5 READS OF 2023

We want to share some of the most-read content of 2023:

|

The Year Ahead – Jan 2023 Following what was a difficult year for the blockchain industry in 2022, we discuss some of the major events in a year-in-review recap. The investment team also shares their perspectives on how 2023 may unfold, including insights into which sectors we are monitoring for potential growth. Founder and Managing Partner Dan Morehead also discusses his view on the digital asset markets in the broader macro context. |

|

|

The Seventh Bull Cycle – Feb 2023 Various members of the investment team reflect on prominent themes within our industry, including how trust can be rebuilt in CeFi, the evolution of consumer applications such as gaming and metaverse experiences, as well as blockchain infrastructure developments. This edition also overviews Bitcoin price cycles, contextualizing where we are in the broader arc of the digital asset markets. |

|

|

A **Positive** Black Swan – Aug 2023 In an interview with Jay Clayton at the Bloomberg Invest Conference, Dan predicted that regulatory clarity could be the **positive** black swan nobody was expecting. It happened. After the longstanding lawsuit between Ripple and the SEC, a judge ruled that XRP in and of itself is not a security. We discuss the potential implications of this ruling on our industry, including a recap of the details of the case. |

|

|

Market Update – Apr 2023 Pantera portfolio company Offchain Labs, the developer of Arbitrum, had a major milestone with the launch of the Arbitrum DAO token. We share our thoughts on the importance of this launch and the progress they’ve made as a leading layer-2 scaling solution. The team also revisits how DeFi worked great – so great that even centralized exchanges like Coinbase are launching their own chains. |

|

|

Emerging Catalysts In Crypto – Sep 2023 Following the news that the U.S. appeals court ruled in favor of Grayscale in their lawsuit against the SEC regarding the conversion of GBTC to a spot Bitcoin ETF, we discuss the implications of this on the likelihood of an ETF approval. Portfolio Manager Cosmo Jiang also shares his perspectives on the parallels between the crypto industry and maturity in equities. |

|

![]()

“WE WON”? :: THE INFINITE GIFT THAT IS PAUL KRUGMAN

Although his gift truly is infinite, I promise I’ll wind this down after one last perspective…

“At very little cost”?!?!?

The delusional self-congratulatory line of Krugman’s is simply staggering.

We defeated fascism for less.

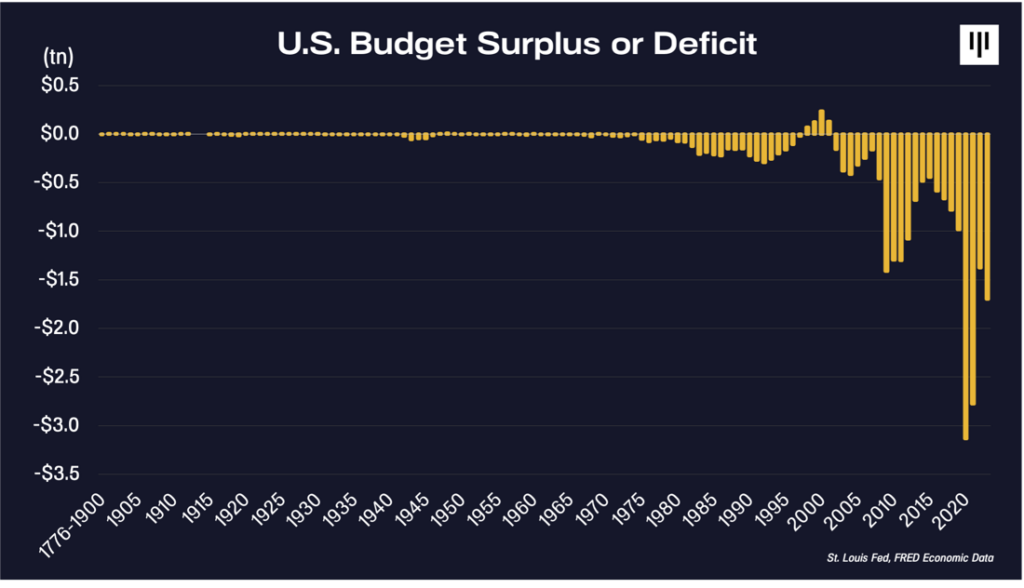

The policies he’s bragging about caused the United States to print more money in June 2020 than in the first two centuries after its founding. The U.S. budget deficit that month – $864 billion – was larger than the total debt incurred from 1776 through the end of 1979.

With that first trillion we defeated British imperialists, bought Alaska and the Louisiana Purchase (13 states’ worth of territory), defeated fascism, ended the Great Depression, built the Interstate Highway System, went to the Moon, and some other stuff.

The budget deficit has been out of control since that month. A quick glance at the graph shows it ain’t “very little”.

The U.S. deficit in 2020 – as a percentage of GDP – was the same as the average annual deficit the United States incurred while fighting World War II. That’s simply crazy.

The budget deficit as a percentage of GDP used to be much lower than the unemployment rate. Just as important, it rose and fell with the economy and the rate of unemployment.

Krugman-endorsed policies are now disconnected with what has worked for centuries. We now have massive deficits in boom times – even with record low unemployment.

Stay long crypto until they get the gold line below the white line.

![]()

Wishing you all the best for 2024!

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[2]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

The Year Ahead Conference Call

An overview of the year ahead in blockchain, including discussions on investment themes Pantera is most interested in and how we anticipate the year to unfold.

Thursday, January 18, 2024 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.zoom.us/webinar/register/WN_D81576yJQ4KI8Ai454HPAg

Pantera Liquid Token Fund Investor Call

Tuesday, January 30, 2024 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Regulatory Developments in Blockchain

Pantera Chief Legal Officer Katrina Paglia will provide a top-down overview of the current crypto regulatory landscape.

Tuesday, February 6, 2024 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

https://panteracapital.zoom.us/webinar/register/WN_THwez-bKQB2UtTQc9pLLZQ

Pantera Early-Stage Token Fund Investor Call

Tuesday, February 13, 2024 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Investing in Blockchain Conference Call

A discussion of the blockchain opportunity set and how Pantera’s funds are structured to capture value in the current and evolving market environment.

Tuesday, February 20, 2024 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.zoom.us/webinar/register/WN_18CAcYchR-iRBw3Fm52N2w

Pantera Venture Fund II Investor Call

Tuesday, March 5, 2024 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Venture Fund III Investor Call

Tuesday, March 19, 2024 9:00am PDT / 17:00 CET / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Blockchain Fund Investor Call

Tuesday, April 2, 2024 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PORTFOLIO COMPANY OPEN POSITIONS[3]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Below are open positions that our portfolio companies are actively hiring for:

-

Omni Network – Senior Go Engineer (Remote)

-

Injective Labs – VP of Engineering (New York / Remote)

-

Cega – Product Manager, Smart Contracts (Remote)

-

Offchain Labs – Site Reliability Engineer (Remote)

-

Ondo Finance – Sales Director (Remote)

-

Alchemy – Software Engineer, Rust (New York or San Francisco)

-

Starkware – Senior Software Engineer (Netanya, Israel)

-

0x Labs – Financial Analyst (Remote)

-

Obol – Head of Ecosystem (New York, Remote)

-

Flashbots – Head of Ops (Remote)

-

Waterfall – Software Engineer (New York)

-

CoinDCX – Engineering Manager (Remote)

-

Braavos – Senior Full Stack Engineer (Tel Aviv)

-

Bitso – Senior Product Manager, Ramps (Remote)

-

Metatheory – Backend Engineer (Remote)

-

Pintu – Data Engineer (Jakarta, Hybrid)

-

VALR – AML Analyst (Remote)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

DISCLOSURES

[1] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

[2] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[3] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.