THE LIGHT AT THE END OF THE “BITCOIN-ETF TUNNEL”[1]

By Cosmo Jiang, Portfolio Manager, and Erik Lowe, Head of Content

The regulatory landscape for crypto in the U.S. has seen some positive developments over the past few months. In our previous blockchain letter, we wrote about the three-year lawsuit between the SEC and Ripple Labs, where the District Court for the Southern District of New York ruled that XRP is not a security. We called it the **positive** black swan few were expecting.

Crypto had yet another unexpected recent victory. On August 29th, a U.S. appeals court ruled in favor of Grayscale in their lawsuit against the SEC after their spot Bitcoin ETF application was denied last year. We believe this substantially increases the chances that spot Bitcoin ETF applications by firms like BlackRock, Fidelity, and others will be approved.

While the U.S. has seemingly lagged many parts of the world in embracing digital assets, numerous countries have adopted the same or even more draconian measures against crypto. But what is redemptive about the U.S. is that it has a court system committed to procedural due process, ensuring that when boundaries are overstepped, there’s a path to rectification.

“The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products. We therefore grant Grayscale’s petition and vacate the order.”

– Opinion for the Court filed by Circuit Judge RAO

We have been emphasizing the need for trustless systems. In our industry, this means users can rely on blockchain-based architectures to execute fairly and as designed. Our ability to rely on the American court system to do the same could help shape a promising regulatory landscape for crypto in the future, enabling further innovation to occur onshore.

We’ve long discussed the potential for a spot Bitcoin ETF, but now we see some light at the end of the tunnel.

Grayscale vs SEC Key Takeaways

The Decision: D.C. Court of Appeals ordered that the SEC’s order denying Grayscale’s Bitcoin ETF conversion be vacated.

– The denial of Grayscale’s proposal to convert to an ETF was “arbitrary and capricious” because the SEC failed to explain its different treatment of similar products (approval of Bitcoin futures ETPs vs rejection of Bitcoin spot ETPs).

– This was a 3-0 unanimous decision from the panel of three judges, which was a resounding judgment vs. expectations for it to be a split decision.

– Note: it is rare for a federal circuit court to find an agency has violated the Administrative Procedures Act.

The Core of the debate:

- – Grayscale argued that the Bitcoin futures ETF surveillance arrangements, by the CME, should also be satisfactory for Grayscale’s spot ETF, since both products rely on Bitcoin’s underlying price.

- – SEC, however, argued Grayscale lacks data to determine whether the CME futures surveillance agreement could also detect potential manipulation in the spot markets.

The Court summarized the argument and its decision into two primary points:

-

- – The SEC itself said that fraud in either spot or futures market could be detected by surveillance of the CME futures market, when approving the Bitcoin futures ETPs.

-

- – SEC’s rejection based on application of “significant market test” lacked a reasonable and coherent explanation.

-

-

– The court found that the futures price is 99.9% correlated with the spot price, and therefore fraud in the spot market would be reflected in the futures market.

- – The SEC itself said that fraud in either spot or futures market could be detected by surveillance of the CME futures market, when approving the Bitcoin futures ETPs.

Timeline: Both parties have 45 days to appeal the ruling, and the SEC could still find other means to reject the Bitcoin spot ETF application.

- – The SEC can appeal to the full panel of U.S. District Court judges or take it up with the Supreme Court, but that is unlikely because this case isn’t that important as a matter of law (even if it matters a lot for this specific industry).

- – Grayscale has previously announced its intentions to pursue an ETF conversion upon a court win, which would likely proceed after the appeal period.

- – This mid-October timing for the appeal also lines up with the deadline for the SEC to respond to all the other Bitcoin spot ETF applications.

You can read the court’s decision here.

![]()

CRYPTO INDUSTRY PARALLELS TO MATURITY IN EQUITIES

By Cosmo Jiang, Portfolio Manager

The digital asset space’s maturity today may be analogous to inflection points in industry maturity in equities.

Tokens are a new form of capital formation, and they may replace equity for a whole generation of businesses. That means that many companies may never have an equity listed on the New York stock exchange. Instead, they’ll just have a token. This is how businesses align incentives with management teams, employees, token holders, and – uniquely to digital assets – potentially other stakeholders like customers.

There are around 300 publicly traded liquid tokens with more than a hundred-million-dollar market capitalization. This investible universe is expected to grow over time as the industry expands. There is an increasing number of protocols with product use cases, revenue models, and strong fundamentals. Applications such as Lido or GMX didn’t exist as recently as two or three years ago. In our view, a big source of alpha generation may come from filtering this large universe for ideas, because just like in equities where not all equities are created equal, not all tokens are created equal.

Pantera is focused on finding protocols that have product market fit, strong management teams, and a path to attractive and defensible unit economics, and believe this is a strategy that has been generally overlooked. We believe we’re at an inflection point in this asset class – that traditional and more fundamental frameworks will be applied to digital asset investing.

In many ways, there are parallels to major inflections in how equities evolved over time. For example, fundamental value investing today is taken for granted, but it only became popularized in the ‘60s when Warren Buffett launched his first hedge fund. He was an early pioneer and practitioner of applying the lessons of Benjamin Graham, which jumpstarted the long/short equity hedge fund industry as we know it today.

Crypto investing is also similar to emerging markets investing in the 2000s. It faces many similar criticisms to those of Chinese equities in that period, where there were concerns that many were tiny companies in retail-driven irrational stock markets. You didn’t know if the management teams were misleading investors or misappropriating funds. While there was some truth to all of that, there were also many quality companies with strong long-term growth prospects that were great investing opportunities. If you were a discerning, fundamentals-oriented investor who ventured abroad and was willing to take the risk and do the work to find those good ideas, you were able to find incredible investment success.

The main prong of our thesis is that digital asset prices will increasingly trade on fundamentals. We believe the rules that apply in traditional finance will also apply here. There are now many protocols with real revenue and product market fit attracting loyal customers. And now there are an increasing number of investors with this fundamentals lens that are applying traditional valuation frameworks to price these assets.

Even data service providers are beginning to look a lot like those in traditional finance. But instead of Bloomberg and M-Science, they’re called Etherscan, Dune, Token Terminal, and Artemis. Effectively their purpose is the same: tracking company KPIs, P&Ls, management team actions and changes, etc.

In our view, as the industry matures, the next trillion dollars that are coming into this space will be from institutional asset allocators trained in these fundamental valuation techniques. By investing with those frameworks today, we believe we are positioned ahead of that secular trend.

FUNDAMENTALS-BASED INVESTING PROCESS

The investment process of a fundamentals-based approach for digital assets looks similar to that for traditional equities. This may be a pleasant surprise and a key misunderstanding for investors in traditional asset classes.

Step one is doing the fundamental diligence – answering the same questions that we would for analyzing public equities. Does the product have product market fit? What’s the total addressable market (TAM)? What’s the market structure? Who are the competitors and what’s their differentiation?

Next is business quality. Is there a competitive moat to this business? Does it have pricing power? Who are their customers? Are they sticky or do they churn quickly?

Unit economics and value capture are also incredibly important. As much as we are growth investors with a long-term time horizon, at the end of the day cash is king, and we want to invest in sustainable businesses that can eventually return capital to their token holders. That requires sustainable profitable unit economics and value capture.

The next layer of our diligence process is looking at the management team. We care about the management team’s background, track record, incentive alignment, and what their strategic and product roadmap are. What is their go-to-market plan? What strategic partnerships do they have and what is their distribution strategy?

Compiling all that fundamental diligence information for each investible opportunity is step one. This culminates in building financial models and investment memos on all our core positions.

Step two is translating this information into asset selection and portfolio construction. For many of our positions, we have multi-year three-statement models with capital structures and forecasts. The models we create and memos we write are at the core of our process-oriented investing framework, which enables us to have the knowledge and foresight to select investment opportunities and adjust position sizing based on event path catalysts, risk/reward, and valuation.

After making investment decisions, step three is monitoring our investments on an ongoing basis. We have a systematic process for collecting and analyzing data which is utilized to track key performance indicators. For example, with Uniswap, which is a decentralized exchange we’re invested in, we actively ingest on-chain data in our data warehouse to monitor trading volumes for Uniswap and its competitors.

In addition to monitoring these KPIs, we strive to maintain dialogue with management teams of these protocols. We find it important to be out there doing field research calls with the management team, their customers, and different competitors. As an established investor in this space, we are also able to utilize Pantera’s broader network and connectivity with the community. We view ourselves as partners and aim to add value where we can to help management teams and contribute to the growth of these protocols, especially in areas such as reporting, capital allocation, or management best practices.

FUNDAMENTALS-BASED INVESTING IN PRACTICE :: ARBITRUM

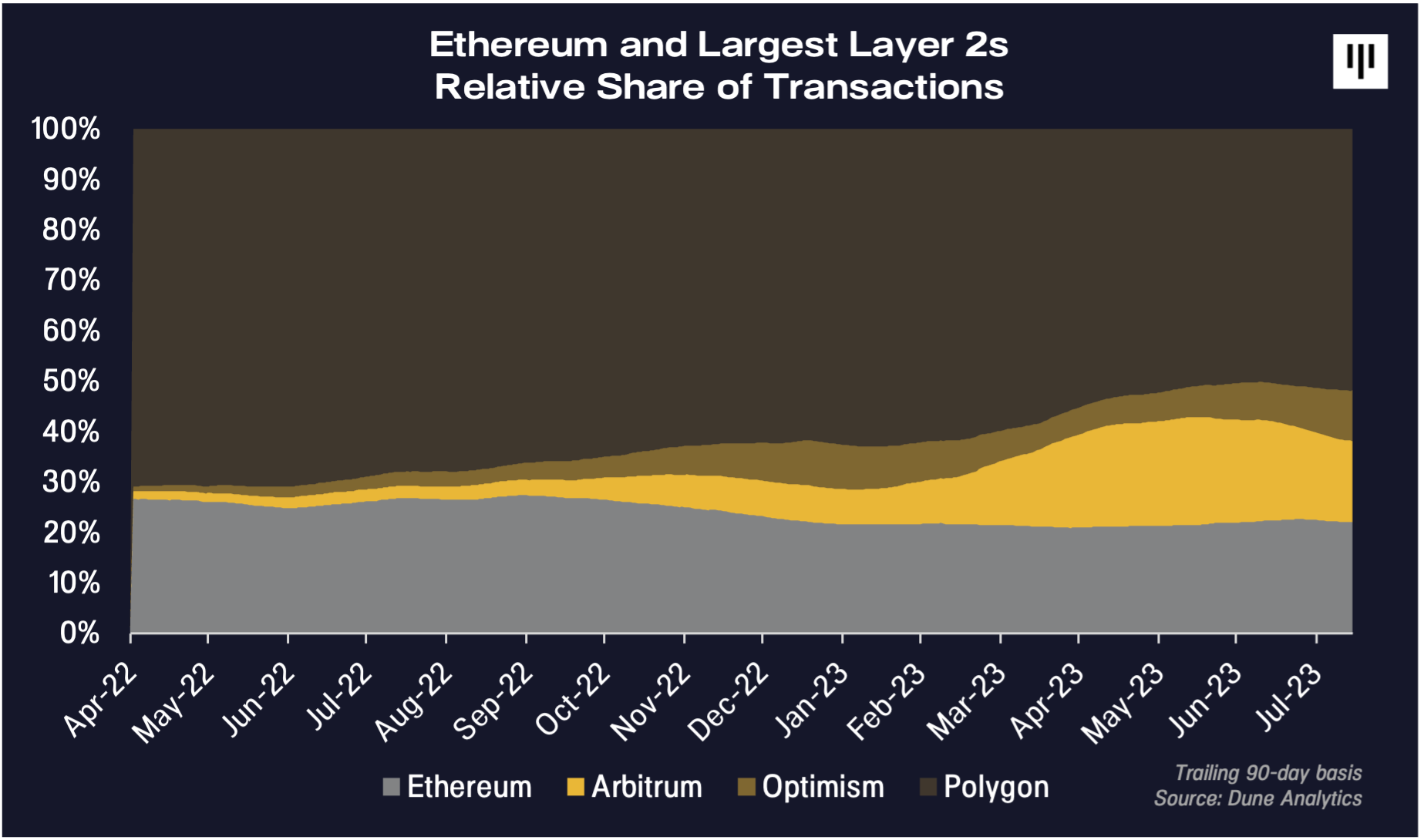

A primary criticism of Ethereum has been that, during periods of heightened activity, transacting on the base layer may be slow and expensive. While the roadmap to creating a scalable platform has been heavily debated, layer 2s such as Arbitrum are emerging as a viable solution.

Arbitrum’s key value proposition is simple: faster and cheaper transactions. It’s 40x faster and 20x cheaper to transact than on Ethereum, all while being able to deploy the same applications and have the same security as transacting on Ethereum. As a result, Arbitrum has found product market fit and has shown strong growth, both on an absolute basis and relative to its peers.

For a fundamentals-focused investor looking for evidence of protocols with fundamental traction growth, Arbitrum would sit high on that list. It’s one of the fastest growing layer 2s on Ethereum and has taken meaningful market share of transactions over the past year.

To dig deeper into that last point, Arbitrum has been one of the few chains that has shown transaction volume growth throughout this bear market year to date in which usage overall has been weak. In fact, breaking apart the data, you’ll find that across Ethereum and all its other layer 2s, Arbitrum has effectively contributed 100% of the incremental growth this year in the Ethereum ecosystem. Arbitrum is a massive share taker within the Ethereum ecosystem, and Ethereum in turn has itself been a massive share taker across all of crypto.

Arbitrum’s network flywheel is spinning. Based on our field research, it is evident that developers are attracted to the increasing usage and user base that exists on Arbitrum. This is the positive network flywheel: more users translates into more developers being interested in creating new applications on Arbitrum, which in return attracts more users. But as fundamental value investors, we must ask ourselves whether any of this matters unless there is a way to monetize that activity, right?

Answering that question is why we believe this is a good fundamental investment opportunity – Arbitrum is a profitable protocol with multiple upcoming potential catalysts.

Many casual investors in this space may not be aware that there are protocols that actually generate profit. Arbitrum generates revenue by collecting transaction fees on its network, batching these transactions, and then paying the Ethereum base layer to post this large, consolidated transaction. When a user spends 20 cents on a transaction, Arbitrum collects that. They then bundle these transactions in big batches, and then they post those transactions onto the Ethereum layer 1, paying about 10 cents in fees per transaction. This simple math implies that Arbitrum makes about 10 cents gross profit per transaction.

We’ve identified a protocol that has found product market fit and has unit economics that make sense, which ultimately leads us to believe that the valuation is defensible.

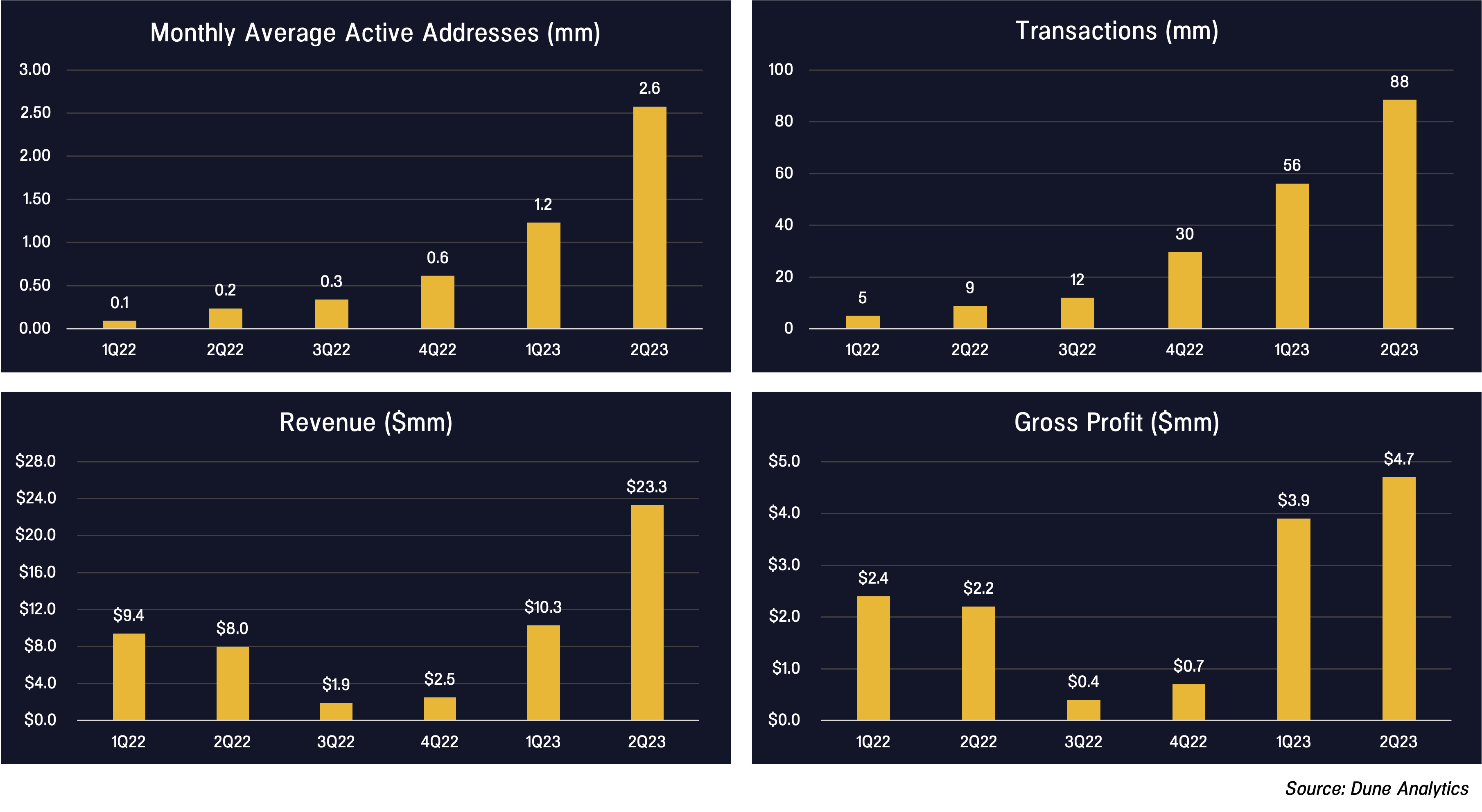

Arbitrum Growth Across Key Operating Metrics

Below are a few charts that elucidate some of the fundamentals.

Active users have grown quarter-over-quarter since launch, and transactions are nearing 90 million per quarter. Revenue was $23mm in Q2, and gross profit reached nearly $5mm in Q2 or $20mm annualized. These are some of the key KPIs that we can track and verify daily on the blockchain to monitor if Arbitrum is tracking with our investment thesis and financial projections.

Today, there are about 2.5 million monthly average users, each making 11 transactions per month on average, or roughly 350 million transactions a year. Based on these figures, Arbitrum is nearly a $100mm annual revenue business generating around $50mm of normalized gross profit. Suddenly, that becomes a very interesting business.

As far as catalysts and what makes this a timely investment, a key part of our research process is following the entire Ethereum technical roadmap. The next big step is an upgrade called EIP-4844, which effectively will lower transaction costs for roll-ups like Arbitrum. Arbitrum’s main cost, that 10-cent transaction cost, could decrease as much as 90% to one cent a transaction. At that point, Arbitrum will have two choices. They can either pass through those savings to users and further accelerate adoption, they can keep the savings themselves as profit, or do some combination of the two. Either way, we foresee this being a material catalyst to increase usage and profitability for Arbitrum.

Being valuation conscious is an important part of fundamental investing. Arbitrum currently has a $5bn market capitalization on an issued shares basis. In our view, that is quite attractive relative to a number of other layer 1 and layer 2 protocols that trade at similar market capitalizations but with a fraction of the usage, revenue, and profit that Arbitrum has.

To put that valuation in the context of growth, over the next year we believe that Arbitrum could grow to over a 1 billion-transaction run rate at 10 cents profit per transaction. That translates to about a hundred million in earnings, which implies, at a $5bn market capitalization, a valuation of about 50 times forward earnings. That looks expensive on an absolute basis, but in our view, it is reasonable for an asset still growing in the triple digits. When compared to real-world businesses valuations, if you look at well-liked software names that are growing topline in the double digits like Shopify, ServiceNow, or CrowdStrike, those all trade on average around 50 times earnings and they’re growing much slower than Arbitrum.

Arbitrum is a protocol that has product market fit, is growing extremely fast (on an absolute basis and relative to the industry), is demonstrably profitable, and is trading at a reasonable valuation relative to its own growth, other assets in crypto, and other assets in traditional finance. We continue to closely track these fundamentals in hopes that our thesis plays out.

BIG-PICTURE CATALYSTS

There are a few big-picture catalysts on the horizon that may have meaningful implications on the digital asset market.

While institutional interest has pulled back over the past year, we are monitoring upcoming events that may spark renewed interest among investors. Most notably are potential spot Bitcoin ETF approvals. In particular, BlackRock’s filing is a big deal for two reasons. First, as the largest asset manager in the world, BlackRock is subject to intense scrutiny and only makes decisions after careful consideration. BlackRock is choosing to double down on the digital assets industry even amidst the regulatory fog and current market climate. We see this as a signal to investors that crypto is a legitimate asset class with a durable future. Secondly, we believe an ETF will increase access to and demand for the asset class faster than most would anticipate. In recent news, the U.S. appeals court ruled in favor of Grayscale in their lawsuit against the SEC’s denial of their spot Bitcoin ETF application last year. We believe this substantially increases the chances that spot Bitcoin ETF applications by firms like BlackRock, Fidelity, and others will be approved, potentially as soon as mid-October.

While the regulatory environment is beginning to see some clarity, it’s still perhaps the biggest weight holding back the market, especially for prices of longer tail tokens. In some respects, the tide appears to be turning against the SEC as courts have begun pushing back against their “regulation by enforcement” actions. In addition to the Grayscale spot Bitcoin ETF news, the court siding in Ripple’s favor in its case against the SEC is positive for the interpretation of digital assets as not being securities. This is a big deal, because it shows that regulation around digital assets can and should be more nuanced. Regulatory clarity is important, not only for the protection of consumers, but also for entrepreneurs who need the proper frameworks and guidance in order to have the confidence to create new applications and unlock innovation.

Lastly, crypto is in what we call its “dial-up-to-broadband moment”. We’ve alluded to this before in prior letters about how crypto is at a point much like the internet was 20 years ago. Scaling solutions for Ethereum like Arbitrum or Optimism are making tremendous progress, and we are seeing an increase in transaction speeds at lower cost and the capabilities that come with it. Similar to how we could not envision the breadth of internet businesses that were created after internet speeds accelerated from dial up to broadband, we think the same will happen with crypto. In our view, we have not seen anywhere close to the proliferation of new use cases that will come out of this massive improvement in blockchain infrastructure and speed.

![]()

DIGITAL PROPERTY RIGHTS AND SCARCITY

By Matt Stephenson, Head of Cryptoeconomics

Digital scarcity is a powerful force. Facebook initially exploded by requiring digitally scarce “Harvard.edu” email addresses for signups, Amazon uses DRM technologies to sell digital books, and the iPhone dominates with Gen Z because there is a stigma to having green-colored text messages.

But that type of scarcity is essentially fake: Apple can choose any color it wants for texts. Harvard can issue as many email addresses as it likes. And Amazon can’t actually sell out of ebooks.

Real internet-native scarcity seemed to emerge with Bitcoin. Unlike the endless copy machine of open internet, or centralized strategic decisions about Kindle e-book pricing, Bitcoin’s supply was closer to natural scarcity. It was a fact about the world written into mutually shared code that was extremely hard to undo.

Creating Minimum Viable Scarcity

In mathematical logic there is a phrase (one that’s sure to make you a hit at dinner parties) that describes the way blockchains create digital scarcity: “hypostatic abstraction.” Hypostatic abstraction is a process by which abstract qualities emerge from processes. The way, for instance, keratin proteins moving coherently through space comes to be thought of as a wool scarf.

The great Strategist Thomas Schelling notes that enforcement and mutual perception can give rise to this abstraction process. In the scarf’s case, physics does the enforcement for us, and our shared visual system manages the mutual perception. But Schelling offers extensive examples, notably one of state boundaries. These boundaries, created by enforcement and mutual perception (via maps), often seem real enough that it is not out of the ordinary for people to do things like travel to “The Four Corners”, the spot where the boundaries of four U.S. states meet at right angles, so they can “stand in four different states at once”. That these boundaries are enforced and mutually perceived makes them effectively real.

Perhaps it’s no surprise that blockchains use these same features of mutual perception and enforcement to create scarcity. The scarcity of your crypto is mutually perceived on an open digital ledger and the rules governing its use are credibly enforced by the protocol. As a result, the scarcity is real.

Digital Scarcity Enables Digital Property Rights

How blockchains create mutual perception is intuitive enough: there is an open digital ledger. This is analogous to Schelling’s example of maps. Blockchains also commit to enforcement, though note it’s commonly a special kind of enforcement: enforcement of property rights.

The two pillars of property rights are exclusivity and alienability. That is, you can exclude others from the crypto you own, and you could “alienate” yourself from it by selling, transferring, or burning it. These two aspects of property rights “loom large” over other ascribed property rights. And note further that, in economics, these are not essentially legal concepts – they may also simply emerge from cooperative action.

In a blockchain context, these “cooperative actions” are non-legal protocol rules. The rules are sustained, to a substantial degree, because they would require a massive coordinated effort (e.g. a 51% attack) to change.

The Inversion of the Web2 Business Model

Blockchain enforcement of scarcity is credible because violating protocol rules in a blockchain environment is incredibly costly. It is a massive coordination problem, essentially the same massive coordination problem that Web2 uses against us. But here it is used to create and sustain “the safety and liveness of complex systems of coordination and collaboration”, as Vitalik Buterin describes the goal of cryptoeconomics.

That is, whereas Web2 business models use network entrenchment to trap users, crypto uses it to entrench desirable rules. Web2 users who’d like to exit a Web2 social media platform face a massive coordination problem in that they must get all of their friends to switch too, and preferably at the same time. Web3 users can simply fork away the protocol, because that fork-ability is something we’ve enabled.

The utopians of the early internet believed that by ignoring scarcity you could create abundance. In the vacuum they left, there emerged extractive Web2 business models that sought to trap users, herding them into a pen and making them watch ads. But it has always been harnessing scarcity that creates abundance. And for the first time in the digital realm, we have it.

![]()

Sincerely,

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[2]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Investing in Blockchain Conference Call

A discussion of the blockchain opportunity set and how Pantera’s funds are structured to capture value in the current and evolving market environment.

Tuesday, September 12, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Venture Fund III Investor Call

Tuesday, September 26, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Blockchain Fund Investor Call

Tuesday, October 3, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Venture Fund II Investor Call

Tuesday, October 10, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PORTFOLIO COMPANY OPEN POSITIONS[3]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Below are open positions that our portfolio companies are actively hiring for:

- Omni Network – Senior Blockchain Engineer (Remote)

- Injective Labs – VP of Engineering (New York / Remote)

- Cega – Software Engineer, Solidity (Remote)

- Offchain Labs – Product Manager (Remote)

- Ondo Finance – Sales Director (Remote)

- Alchemy – Engineering Manager (New York or San Francisco)

- StarkWare – Senior Software Engineer (Netanya, Israel)

- Rarify – Head of Developer Relations (Remote)

- Livepeer – Growth Marketer (Remote)

- 0x Labs – Site Reliability Engineer (Remote)

- Obol – Technical Recruiter (Barcelona, Remote)

- Flashbots – Engineering Manager (Remote)

- Waterfall – Software Engineer (New York)

- CoinDCX – Engineering Manager (Remote)

- Brine – Infrastructure Engineer (Bengaluru, Karnataka, India)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

[1] Important Disclosures – Certain Sections of this Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically marked sections of this this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial or other advice or recommendation.

[2] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[3] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.