TABLE OF CONTENTS[1]

2. Blockchain Venture Fundraising Trends

3. DeFi Worked Great :: That’s Why Centralized Exchanges Are Launching Chains

4. Pantera Blockchain Summit 2023

5. The Metaverse Is Arriving “Object First” With NFTs

6. Pantera Portfolio Company Updates

![]()

ARBITRUM TOKEN LAUNCH[2]

Last month’s launch of the $ARB governance token was a significant milestone for Arbitrum, a layer-2 scaling solution for Ethereum. As part of the Arbitrum DAO, token holders can vote on things like protocol upgrades and future roadmap decisions.

The Arbitrum network is designed to alleviate congestion and high gas fees on the Ethereum network by enabling fast and cheap transactions without compromising on security. It seeks to achieve this by using Optimistic Rollup technology that bundles multiple transactions into a single batch and submits it to the Ethereum mainnet, thereby reducing the number of transactions that need to be processed on the mainnet. This reduces the transaction fees and makes the network more accessible to users.

Arbitrum has emerged as a leading layer 2 with over $7 billion in total value locked (TVL) and represents 66% of the rollup market according to its website. The network has gained immense traction due to its adoption by prominent protocols like GMX, Uniswap, and others.

It’s been quite a journey since meeting Offchain Labs Co-Founder and Chief Scientist Ed Felten back in 2014 and the fantastic team working on Arbitrum over the years.

![]()

BLOCKCHAIN VENTURE FUNDRAISING TRENDS

By Paul Veradittakit, Managing Partner

I spoke to Gil Rosen who runs the Stanford Blockchain Club about a number of topics surrounding blockchain venture, including fundraising, team formation, trends, and how crypto ventures compare to non-crypto ventures. Here are takeaways from that conversation.

Gil: “What are some valuation ranges that you’re seeing in pre-seed and seed now vs nine months to a year ago?”

Paul: “The later the round, the greater the discount right now. That discount lowers as you get earlier because there’s more VCs that are focused on the earlier stages or can go earlier. Everyone can go earlier, but not many can go the other way around. I’d say the discounts shrink all the way down to maybe like 30% to seed or something like that. Right now, I’m starting to see pre-seeds going from around 6 to 13 million. I’m starting to see seeds go from 13 million all the way up to 40 million post. On the Series A, it can go from around 40 million to 200 million.

“One way to think about it right now is when we were in more of a bull market, we would see companies diluting themselves in around between 5% to 10%, which is not that much compared to the norm, but in a bear market where investors have a little bit more leverage, we’re starting to see dilution between 20% and 30%.

“Crypto has also expanded beyond just crypto VCs – we now see a lot of traditional VCs that are looking to space. There’s now an opportunity where if you are doing something that crosses between crypto and non-crypto, you can actually have co-lead scenarios where you can get two fairly prominent firms and still get them in for at least 10% each.”

Gil: “Post Series A, what kind of trends are you seeing?”

Paul: “Post Series A varies the most. You can have someone that previously sold a company for hundreds of millions of dollars who is launching a new company and you just jump straight to Series A.

“The normal Series A would be companies that really demonstrated product market fit and you really can do things like look at different cohorts and really understand what the retention is and what the average customer value is and lifetime value is. You can actually just dive into the data a bit more and really understand if they are leading a certain category, what their competitors look like, and what the team looks like. Hiring is a bit less risky, technology has been battle-tested, and you feel like the team has a good shot at winning their category.

“On the token side of things, it becomes a bit more of a gray area where it could still be very early and you would hope that they were able to test out their product with something like fake token testing or being able to get a certain list of beta customers. But again, you can’t really go public until the token launch. Really some of these Series As are to really just get the right strategic partners involved and those that can only invest into a private round or are highly likely to invest into a private round. A lot of these Series As are done by either the larger funds that really want to double down into existing winners or feel like there’s a lot of potential here and enough has been de-risked for them to put in quite a bit of capital.

“Then you see how the community is taking the project and you really start to see where the token price is landing.”

Gil: “How do you think about product market fit in the current climate versus the bull market? How do you disentangle speculation frenzy and interest in just appreciating tokens versus utility of an actual platform?”

Paul: “If you are investing at the earliest of stages, then you can take a little bit more of a flyer on the space. But if you are investing into Series B or Series C, then you really have to think about how big this space could get based off of market size. And if you’re going into the infrastructure side of things, then it’s really a bet on the space and the team versus if you’re betting on a specific application.

“If the product is only enticing with the token, the team should really figure out product market fit before laying on a token, because the token should not be a reason why a product is being used.”

Gil: “What are some ideas that a year ago you would’ve been excited in investing into that now you’re not?”

Paul: “Anything consumer related is pretty tough right now, especially in areas that haven’t been proven out in terms of having some fairly large winners, at least from a revenue or evaluation perspective. Decentralized social is interesting though.”

Gil: “What are common failure points for blockchain ventures and things that you’ve seen that have killed a venture?”

Paul: “I think first is managing burn, which can be very difficult in crypto because the highs are highs and you can really think that you’re having product market fit. You can just be spending just a ton of money on acquiring users and doing all of that – and then all of a sudden the lows are really low and fundraising becomes a lot harder. Everything just gets compounded when you have a token involved too, and so it can be really tough to just manage burn when the market comes down.

“Another thing is regulations, that’s something that’s really tough to control. If you know that it’s an area that could be heavily regulated, it is about not being afraid to pivot away if things are not looking good.

“The last thing is around timing: sometimes it’s just too early for certain use cases. Sometimes it’s too early for voting on the blockchain. In 2017 when we were betting on NFT companies, it was just too early – the awareness of crypto wasn’t there, the brands weren’t there, the influencers weren’t there, the infrastructure wasn’t there.

“A great example is Circle. They started off in 2014 and they were competing with Coinbase and it looked pretty good but it was a little bit of an uphill battle since they started a little bit later. They decided to move away from crypto, and they luckily got back into crypto at the right time with the right idea. I think all those things that they did to figure out USDC was helpful and gave them the runway to finally get to USDC. It’s those types of founders that can really quickly figure out if something’s working, and if not, move on to something else and just keep being persistent.”

Gil: “What are your thoughts on the biggest gaps or critical challenges that teams could work on?”

Paul: “I think it’s twofold. I think we definitely have to continue to build and make it a lot easier for developers. What stems from that is better user experiences for both retail and institutions.

“New technologies like zero knowledge will be interesting. I think the other piece is really on the education side. When there’s something that is picking up traction, it’s really about being able to educate folks on why blockchain is necessary and being able to flesh out different use cases so that it’s understandable for people.

“Part of it is hopefully going to be non-speculative use cases, but once we do hit some of those, then it’s really just education on the market so we can improve upon the brand since the space has a brand problem right now.”

![]()

DEFI WORKED GREAT :: THAT’S WHY CENTRALIZED EXCHANGES ARE LAUNCHING CHAINS

By Chia Jeng Yang, Principal

Coinbase has launched a new product called BASE, which I believe represents long-standing evidence that DeFi has always worked great – a core thesis at Pantera.

It is interesting to imagine the implications of this. In the context of the continued SEC focus — which has consistently been aggressive for certain tokens that are not bitcoin or ethereum (frequently treated as commodities)[3] — I have been thinking about what the world could look like years from today, with a specific scenario in mind that people are not talking much about.

There is a universe where U.S. companies off-shore, U.S. centralized exchanges (CEXs) do not list anything but bitcoin and ethereum, and international CEXs that are willing to list the long-tail of tokens do not list U.S.-listed tokens. I do not think this is a world that is ultimately beneficial to crypto, but could happen because this seems to me to be the easiest thing to do right now (I do not presume easy equals good/desirable).

If you are a U.S. project, it then might make sense to be off-shore and decentralize as quickly as possible. Once this project reaches the level of decentralization that Bitcoin and Ethereum enjoy, the project and/or its token then may potentially be listed on U.S. CEXs.

If you are a U.S. CEX, it makes sense to stop offering non-bitcoin or ethereum swaps on your platform and launch it through a decentralized exchange (DEX) instead.

But building a regulated permissionless DEX is expensive, hard, and would take too long. What if you instead launch a CEX-branded wallet that gets funded by the bitcoin or ethereum that your users have compliantly on-ramped and then offer DeFi functionality?

This is essentially Coinbase and the release of its BASE product. Coinbase users can now interact with DeFi in a way that creates less risk for Coinbase.

This is more than just reacting to regulatory differences. It is also a means of establishing secure blockchain investment venues in compliance with regulations. Coinbase already possesses user data for KYC/AML, jurisdiction, and other important identification details. This could enable millions of users to engage in regulated activities leveraging the potential of blockchains without having to undergo additional onboarding procedures. As demonstrated by the success of the Binance Smart Chain, a blockchain controlled by a large, centralized exchange capable of offering fiat/crypto on/off ramps can be an incredibly effective method of bringing new users onto the blockchain.

This would have struck many as a crazy idea two to three years ago, but in my view, it is clear that Coinbase feels comfortable prioritizing this product because of its strategic nature as a hedge against a widespread U.S. clampdown on CeFi and DeFi.

Coinbase (and other CEXs) then become the distribution channel and entry-point for the mainstream into DeFi, even for dApps not built on BASE.

This is certainly a great inflection point for the industry as we realize that the short-term costs and the long-term benefits of decentralized systems converge.

What are the potential implications of this?

We need to be able to decentralize quickly. CEXs need to learn how to launch decentralized products as quickly as possible. There should be a decentralization-as-a-service platform that easily onboards individual validators onto dApps and protocols.

Institutional adoption of DeFi is likely to accelerate tremendously as they now have immediate access to the largest KYC’ed userbase to interact with directly on DeFi. DeFi swaps by XYZ institution become as easy as just launching on BASE.

AML compliance as an industry likely becomes far easier as capital that on-ramps into Coinbase interacts across BASE, and off-ramps from Coinbase are completely and easily traceable. If BASE begins to occupy significant market share for dApps, and significant mainstream activity never needs to leave the Coinbase ecosystem, AML compliance costs are lowered accordingly.

If this world becomes true, we would expect to see U.S. operators incorporate overseas across Switzerland, Dubai, and Singapore. It is possible U.S. crypto networks become more fragmented as a result.

![]()

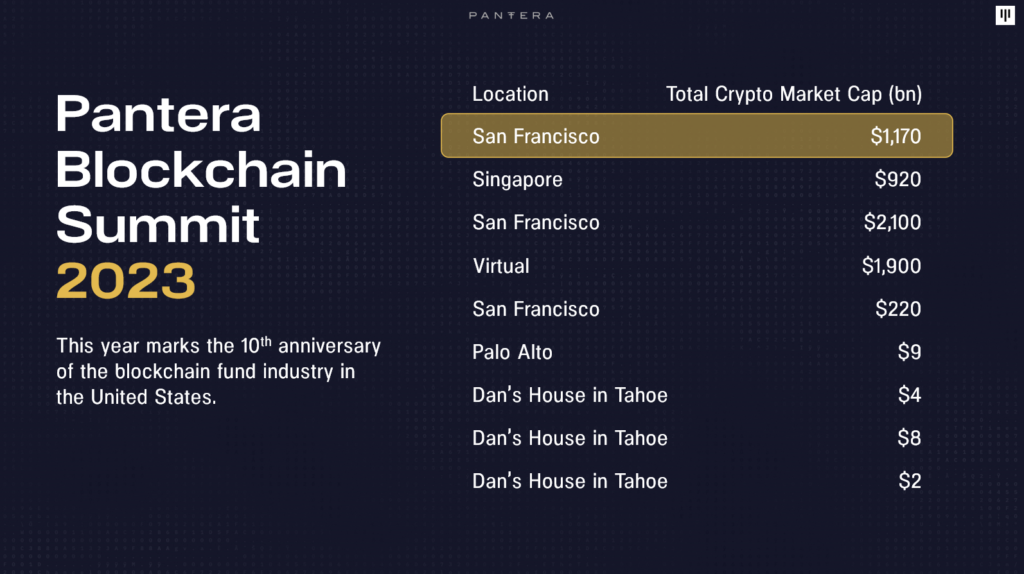

PANTERA BLOCKCHAIN SUMMIT 2023

Earlier this month, we hosted our 10th Anniversary Summit in San Francisco.

The Summit is curated by the Pantera investment team and focused on the most important and exciting topics in the blockchain industry. Our goal is to uncover valuable insights, foster great conversations, and empower the entire Pantera network to move our industry forward.

We are excited to share video recordings of some of the sessions. We’ll release more next month.

|

Pantera Founder and Managing Partner Dan Morehead provides a history of our Summits and the firm’s current outlook on the industry. In addition, Managing Partner Jasper Lewitton provides an overview of the firm’s vision for the space and Pantera’s role in that world. |

|

|

Fireside Chat with Chris Giancarlo

A conversation with former CFTC Chairman Chris Giancarlo on digital asset regulation and the potential for blockchain technology to transform financial markets for the better. |

|

|

Real-World Use Cases in Action

A discussion about real-world use cases of blockchain technology with entrepreneurs that are building consumer-facing products. |

|

![]()

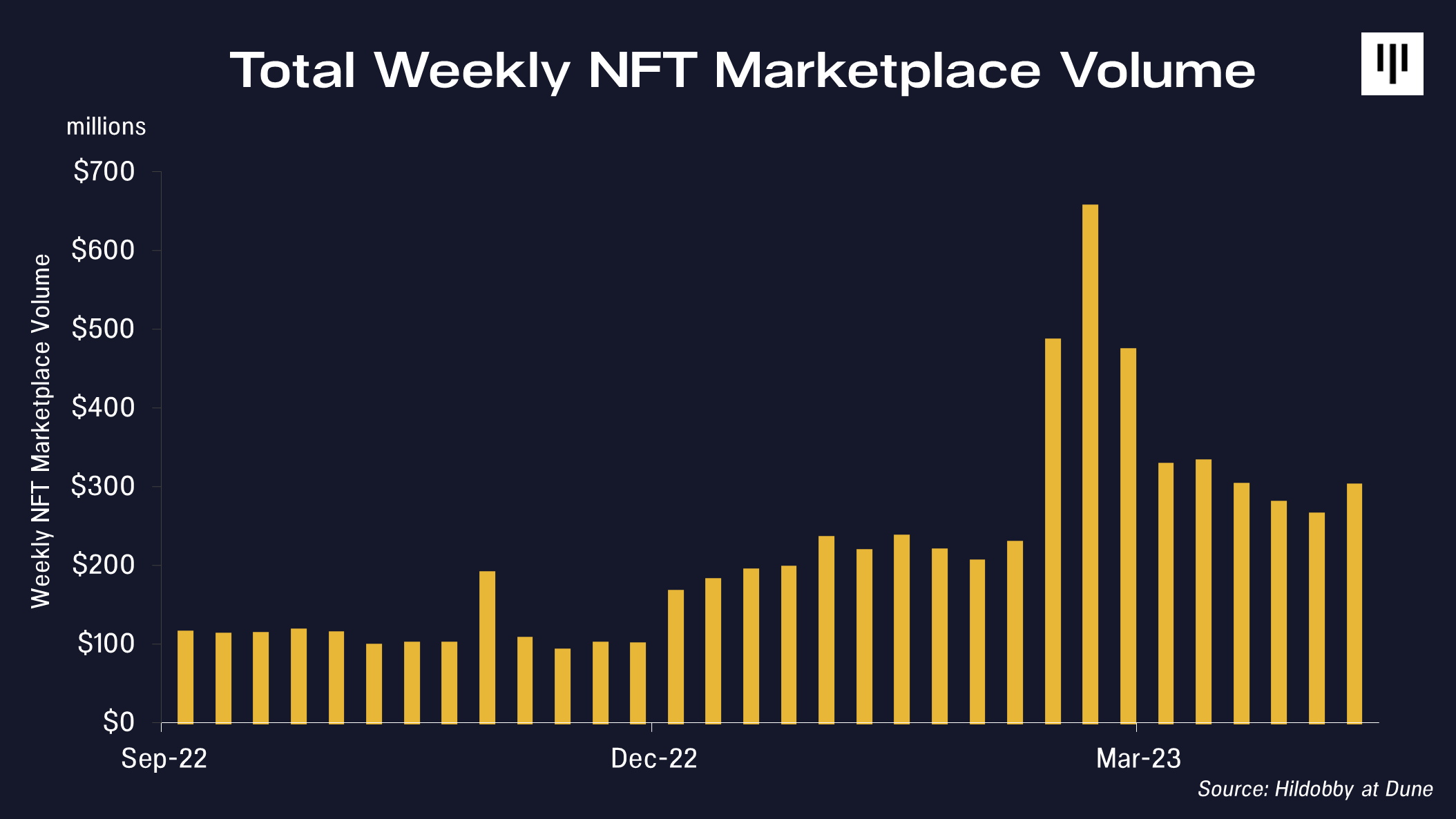

THE METAVERSE IS ARRIVING “OBJECT FIRST” WITH NFTs

By Matt Stephenson, Head of Cryptoeconomics

We’re going to skip the “NFT market is showing signs of recovery” type of analysis.

While it’s true, it’s thinking a bit small. Cutting through the noise, let’s talk about the phenomenal promise of NFTs and what it could mean for visions of the metaverse.

Metaverse pioneers imagined a vast VR world in which we could all play and build. The first to write about it was a fellow Stephenson — Neal Stephenson, that is (no relation) — imagining it as a shared substrate owned by a single organization: the “Association for Computing Machinery”. The political economy of such a vision — exactly who owns and controls this one precious resource — is more than a little concerning.

But this is not really what we’re seeing so far. Instead of one big shared virtual world, we have shared virtual objects in NFTs.

The “Object First” Metaverse

NFTs represent the “object first” metaverse. We own them, sell them, display them, and even burn them if we like. Then, where it’s possible, we bring these virtual objects with us into the shared spaces we inhabit on the internet — Twitter, Discord, blogs, games, etc. NFTs force interoperability on and between these spaces, creating an effective metaverse where the NFT objects are the fundamental components of it and, despite intuition, the interoperating spaces themselves are not.

This explains a lot about the NFT markets. If NFTs are the object metaverse, it’s no surprise to discover that the most popular NFT categories capitalize on the shared virtual spaces that exist today. The endless proliferation of PFP projects since 2021 is the most obvious example — profile pictures are the visual shared spaces today’s internet gives us. This is true of other successful categories as well — our membership NFT can open the gate of a Discord or a Telegram. The elegant code of our on-chain generative art NFT can be viewed on GitHub or Etherscan. The idea behind our conceptual art NFT can be written about on a blog or on Twitter. We can take our NFT from one walled garden to another.

Challenges For NFTs

NFTs force interoperability on our shared virtual spaces, but it’s easier to do this for a prominent space that already exists, as with a profile pic. We haven’t exhausted the good existing spaces yet — Ordinals, for instance, recently managed to create NFTs on the shared space of Bitcoin Blockchain. But it might be helpful to create more, perhaps in a game. Creating a good game is its own challenge — a great artist may not make the best game — but Yuga Lab’s recent hiring of Blizzard’s Daniel Alegre suggests the possibility of acquiring the necessary competencies to do both.

Another challenge is wallet pollution, made worse by layer 2. An important shareable space for NFTs is in a user’s crypto wallet and it’s very common to browse someone’s wallet to see their NFTs. You can see what they’ve collected, see their taste, and (let’s face it) in many cases see their status symbols. But now, with the rise of NFT spamming, it’s hard to differentiate which NFTs reflect their taste and which NFTs were simply spammed to them. Because the transfer costs on L2 are so low, this is especially a problem there.

A further issue is price and value discovery in NFT markets, again affected by layer 2. NFT rankings sites largely use trading volume as a proxy for the popularity of an NFT collection. This creates a bias toward NFT collections (rather than, say, one of ones) but perhaps a larger problem is that it only functions when there are non-trivial transaction costs. Anyone can try to fake an NFT’s volume to drive up its popularity ranking, but they will quickly find that the gas fees and perhaps the creator royalties and platform fees will quickly add up. Those fees may act as a tax on NFT transactions and harm buyers and sellers perhaps, but they also allow for a type of credible sense making in the marketplace. On an inexpensive L2 with no creator fee or platform fee, faking volume is easy.

NFTs Cleared For Takeoff

When NFTs hit the mainstream in 2021, they faced some immediate pushback. Initially the momentum was slowed by a popular counternarrative: that they were bad for the environment because of Proof of Work. Multiple articles in major media outlets highlighted this and NFT artists were routinely harassed on Twitter for boiling the planet. With the Merge, this narrative is effectively dead for most blockchains. Even NFT enthusiasts became frustrated with the expensive fees for interacting with NFTs on Ethereum, and the spiking gas fees every time there was a new mint. But with the rise of EVM-compatible L2s, this too may be a non-issue the next time NFTs have their big moment.

Reading between the lines, we believe the medium-to-long-term future for NFTs seems bright indeed. We seem to have stumbled on an alchemy that makes bits feel like objects to people. And it’s evidently not by making them look identical to real-world objects, or by putting them in a big VR we all share, but by uniquely representing them on a distributed ledger and letting people own them. If that’s the recipe for turning bits to objects then it’s not just good news for NFTs; it’s incredible news for blockchains.

Joining Pantera[4]

It’s an honor to be joining Pantera Capital as the Head of Cryptoeconomics. Pantera’s leadership in the space is beyond impressive: from launching the first U.S. blockchain fund in 2013, to writing about (and investing in) proto-NFT concepts in 2015, to championing the best of DeFi in 2019. Pantera’s present tends to look like the industry’s future. And so I’m grateful for the opportunity to help build that future alongside our remarkable team and portfolio.

For over a decade, I’ve been between the academic and crypto worlds — first buying bitcoin in 2011 and then unfortunately selling it to help fund an MSc in Economics from Warwick University (a Fulbright Scholarship helped too). At Warwick, I did my econometrics thesis on Bitcoin data. The following year, I was fortunate to be the only candidate accepted into the Strategy PhD program at Columbia, focusing on behavioral economics and game theory.

You can check out my full post on the Pantera blog here.

![]()

Pantera Portfolio Company Updates

Investing In M^ZERO

Decentralized Finance (DeFi) has emerged as a promising alternative to traditional finance by continuously developing innovative financial products and services with increased levels of security and transparency accessible to a broad audience. However, the ecosystem continues to face challenges when it comes to attracting and onboarding institutional liquidity. These obstacles are highlighted by issues relating to DeFi’s limited access to a wide range of non-digitally native assets and its lack of institutional-quality governance along with the regulatory uncertainty that exists in the landscape today.

Founded by a group of ex-leaders from MakerDAO and from the financial industry, M^ZERO Labs aims to address these challenges by building the financial infrastructure that will allow institutional liquidity and asset providers to interact in an on-chain manner. This solution will be housed in a censorship-resistant environment that will be overseen and managed by fully decentralized institutional-quality governance. Furthermore, the protocol’s first use-case will be M^ZERO’s native token, a permissionless stablecoin backed by distributed US short-term government debt.

“What Visa, Mastercard and American Express have done for payments, M^ZERO wants to do to value distribution,” said Paul Veradittakit, Managing Partner at Pantera Capital, “It will be an open-source, credibly neutral protocol where providers of liquidity and collateral can freely meet in a decentralized market on blockchain rails.”

Institutional Liquidity: Protocols have struggled to attract large institutional players due to concerns around security, compliance, and regulatory uncertainty. M^ZERO aims to address this issue by creating a hub-and-spoke model, where their platform would be the neutral engine facilitating the distribution of value and liquidity, while regulated bridges (the spokes) would connect to it in compliance with their own regulatory requirements.

Institutional-Quality Governance: While many protocols have struggled with governance due to the lack of a clear decision-making process and the potential for major stakeholders to dominate decision-making, M^ZERO’s solution is to create a decentralized consortium that can permission which asset providers and liquidity providers can connect to the protocol, creating a more democratic and decisive decision-making process.

M^ZERO’s goal of becoming the first financial infrastructure designed to allow institutional liquidity and asset providers to interact on-chain is ambitious, and their seasoned team and innovative approach make them an exciting addition to the Pantera portfolio.

M^ZERO’s founding members have years of experience in the areas of stablecoin and crypto governance design, as well as traditional finance and securitization services. The team includes Greg Di Prisco as Lead Architect, Oliver Schimek as COO, and Luca Prosperi as CEO. They will lead a group of engineering, structuring, and regulatory professionals to bring the M^Zero vision to life. Greg Di Prisco was formerly the Head of Business at Maker and founder of RWA Co. and Distributed Capital, and has worked as a trader and economist. Oliver Schimek was previously the founder and CEO of CrossLend, a European securitization expert, and an approved MD with 15 years of experience in fintech. Luca Prosperi was a core team member at MakerDAO, senior finance professional for 15 years, and has a well-known following through his analysis at dirt roads.substack.com.

Our view is that M^ZERO’s creation of an open-source, credibly neutral protocol where providers of liquidity and collateral can freely meet in a decentralized market on blockchain rails will do for value distribution what Visa, Mastercard, American Express, SEPA and Euroclear did for payments and securities settlements in traditional finance.

For these reasons and many more, we are proud to lead M^ZERO’s funding alongside Road Capital Management, AirTree, Standard Crypto, The SALT Fund, ParaFi, and other top-tier partners.

Learn more about M^ZERO on their website or follow them on Twitter here.

Investing In Worldwide Webb

In 1999, Nintendo released Super Smash Bros. for the Nintendo 64 platform. A pioneering idea, it was the first game featuring characters from across the classic Nintendo menagerie. In future instances of Smash, characters external to the Nintendo universe would join these first-party characters. Users could finally experience the epic battle between 90’s console gaming mascots: Mario vs. Sonic!

Ever since Smash, gaming has embraced similar cross-universe models. The formula has remained successful even for genres beyond fighting games.

Crossovers like this have become a staple. But what if you could bring a character or avatar you own to a universe, where you could interact with other unique 1-of-1 NFT avatars of other users?

How about taking your favorite Bored Ape and battling your friend’s Cool Cat? Or how about porting your favorite rare NFT from one game into another universe you’ve just begun exploring?

Enter our latest portfolio investment, Worldwide Webb. With over 55 NFT projects integrated, Worldwide Webb’s upcoming PvP (player-vs.-player) game Blockbusterz makes these cross-universe NFT interactions possible. The Blockbusterz PvP mini-game is only the starting point (a proof-of-concept) for what these interactions could look like in the future.

Thomas Webb, founder of Worldwide Webb, recognized that the benefit of creating a 2D MMORPG-style game is that this particular model allows his team to continue releasing all sorts of creative mini-games, keeping communities engaged, entertained, and delighted at all times – a key factor for any successful Web3-based game.

(Gameplay from Worldwide Webb’s NFT PvP Game)

Worldwide Webb is a browser-based MMORPG with a pixelated, retro aesthetic. The broader game was originally launched in 2020. In the game, players can use their own NFTs in a virtual social space where Web3 avatars and users from different blockchains can connect, interact, and play together. The game bridges the gap between traditional gaming and NFT communities via an ever-expanding catalog of browser-based mini-games, where every player can leverage a unique identity (in the form of an NFT).

Not only has Webb’s rapid-iteration on game development led to fun and engaging mini-games, but the Worldwide Webb platform has provided yet another channel for NFT communities to enhance engagement and community building.

We’re excited to see how WorldWide Webb evolves from an MMORPG whose development is centrally-led to a fully player-owned metaverse with user-generated-content dominating the gameplay and community experience.

Learn more about Worldwide Webb at webb.game, play the game here and follow the project on Twitter @Worldwide_WEB3.

Investing In Maverick – Capital Efficiency

Maverick Protocol is a new infrastructure for decentralized finance, built to bring higher capital efficiency and greater capital control to traders, liquidity providers, DAO treasuries, and developers, powered by a revolutionary Automated Market Maker (AMM).

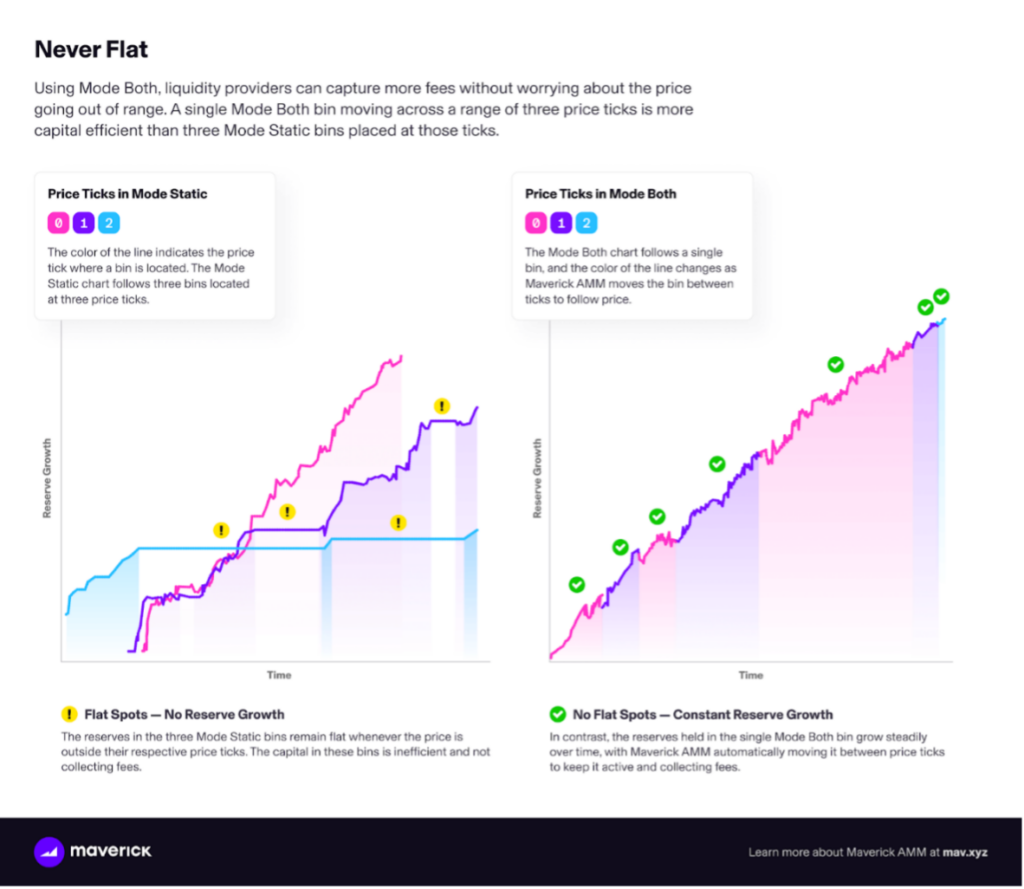

By automating the movement of liquidity distributions to follow price, Maverick AMM is capable of achieving high capital efficiency with minimum effort for LPs. In existing range AMMs like Uniswap V3, an LP typically spreads their liquidity across a range of bins around the price in the hope of capturing fees as price moves. This approach can be modeled using Maverick’s Mode Static, which doesn’t engage the AMM’s movement automation. The chart on the left tracks the liquidity reserves held in three bins around the current price. Each bin sits at a different price range and is activated when the price in the pool hits that range. Because only one bin can be active at a time, two of the three bins are always inactive, leading to the flat spots on the chart. When the line is flat, the liquidity in that bin isn’t earning any fees and so the reserve stays flat. In other words, the liquidity in those bins has zero capital efficiency.

Maverick AMM’s movement modes solve this problem by moving an LP’s liquidity to follow the price. This keeps the liquidity active and earning fees. The chart on the right shows a single bin in Maverick’s Mode Both which is moved with price to cover the same range as the three bins in the Mode Static chart. Since this mode keeps moving the bin into the active price range, there are no flat spots and no bins are left idle while the price is out of range. The result is high capital efficiency and constant growth in the liquidity reserves held in the bin. Staking a single bin in Mode Both is more capital efficient than staking three static bins, where two of the bins are always idle. This capital efficiency generally means more fees for LPs.

![]()

Regards,

The Pantera Team

PANTERA CONFERENCE CALLS[5]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Pantera Liquid Token Fund Investor Call

Tuesday, May 9, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Early-Stage Token Fund Investor Call

Wednesday, May 17, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Investing in Blockchain Conference Call

A discussion of the blockchain opportunity set and how Pantera’s funds are structured to capture value in the current and evolving market environment.

Tuesday, May 23, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PORTFOLIO COMPANY OPEN POSITIONS[6]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Our portfolio companies are actively hiring for the following roles:

- Alchemy – Engineering Manager (New York or San Francisco)

- Obol – Site Reliability Engineer (Remote)

- Arbitrum – Blockchain Developer (Remote)

- Bitso – Systems Engineer (Remote)

- 0x Labs – Head of Business Development (Remote)

- Rarify – Head of Business Development (Remote)

- Rift Finance – Protocol Engineer (Remote, New York)

- Starkware – Product Manager (Netanya, Israel)

- Pintu – Quant Engineer (Hybrid Remote)

- Circle – Sr. Software Engineer (Remote)

- Cosmos – Full Stack Rust Engineer (Remote)

- Waterfall – Software Engineer (New York)

- Injective Protocol – Rust Developer (Remote)

- Aurora – Head of Business Development (Remote)

- Wintermute – Quant Developer (Hybrid, London)

- Audius – Social Media & Marketing Strategist (Remote)

- Protocol Labs – Engineering Manager (Remote)

- Abra – Quantitative Developer (Remote)

- InfiniGods – Experienced UI/UX Designer (Hybrid)

- CoinDCX – Director – Growth Marketing (Remote)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

[1] Important Disclosures – Certain Sections of this Letter Discuss Pantera’s Advisory Services. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management Puerto Rico LP and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences.

[2] Important Disclosures — General Market Commentary / No Offer of Advisory Services: This section provides educational content and general market commentary. Except for specifically marked sections of this this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial or other advice or recommendation. Statements that the historical performance of any asset or sector are not a guarantee of futures outcomes or returns.

[3] While this is true for bitcoin, the SEC still has not given its official position on ethereum and has even made suggestions that ETH may be a security.

[4] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[5] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[6] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.