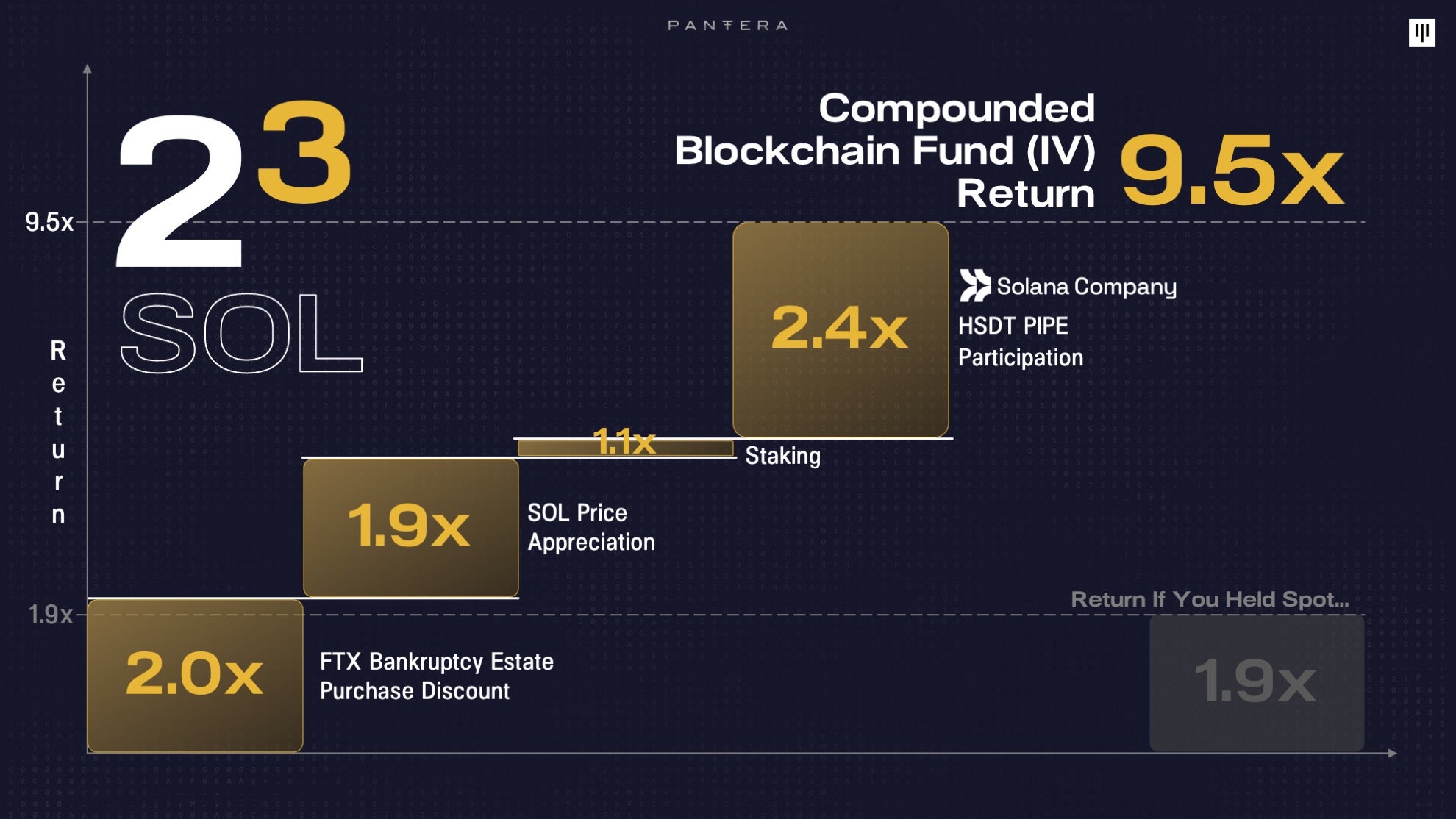

23 SOL

Since we launched Pantera Blockchain Fund (IV) in 2021 we’ve tried to convey the power of the hybrid structure that we created. It’s part venture fund, part opportunistic hedge fund. But it’s complicated and I’m not sure our attempts have really landed.

My partner Jeff Lewis suggested this visual. It’s so cool.

We’ve doubled the value of the Fund’s Solana position – three times.

We originally contacted the FTX bankruptcy estate which we thought might need a block buyer. The Fund ultimately bought SOL at a 50% discount from spot at the time. That Special Opportunities discount collapsing to par has doubled the value.

The spot price of Solana has also roughly doubled.

(The Fund made 7% staking the tokens – which ETFs and most investors can’t manage.)

And then we doubled it again in the Fund’s PIPE transaction we created.

We initiated our trade when SOL was trading at $125. It’s now at $231. Had an investor bought SOL spot and held over the same period they’d have a return of 84%.

Our Fund has made a return of 850%.

It’s like Calvin & Hobbes’s Transmogrifier.

“The Transmogrifier is an invention of Calvin’s that would turn one thing into another. Like most of his inventions, it was made originally from a cardboard box, though a later model was made using a water gun. Calvin used the transmogrifiers many times, turning himself and Hobbes into quite a wide array of creatures. The transmogrifier first appeared on March 23, 1987.”

– https://calvinandhobbes.fandom.com/wiki/Transmogrifier

We put Solana in one side and 9.5 as much popped out the other side.

There is just so much power in this hybrid structure.

![]()

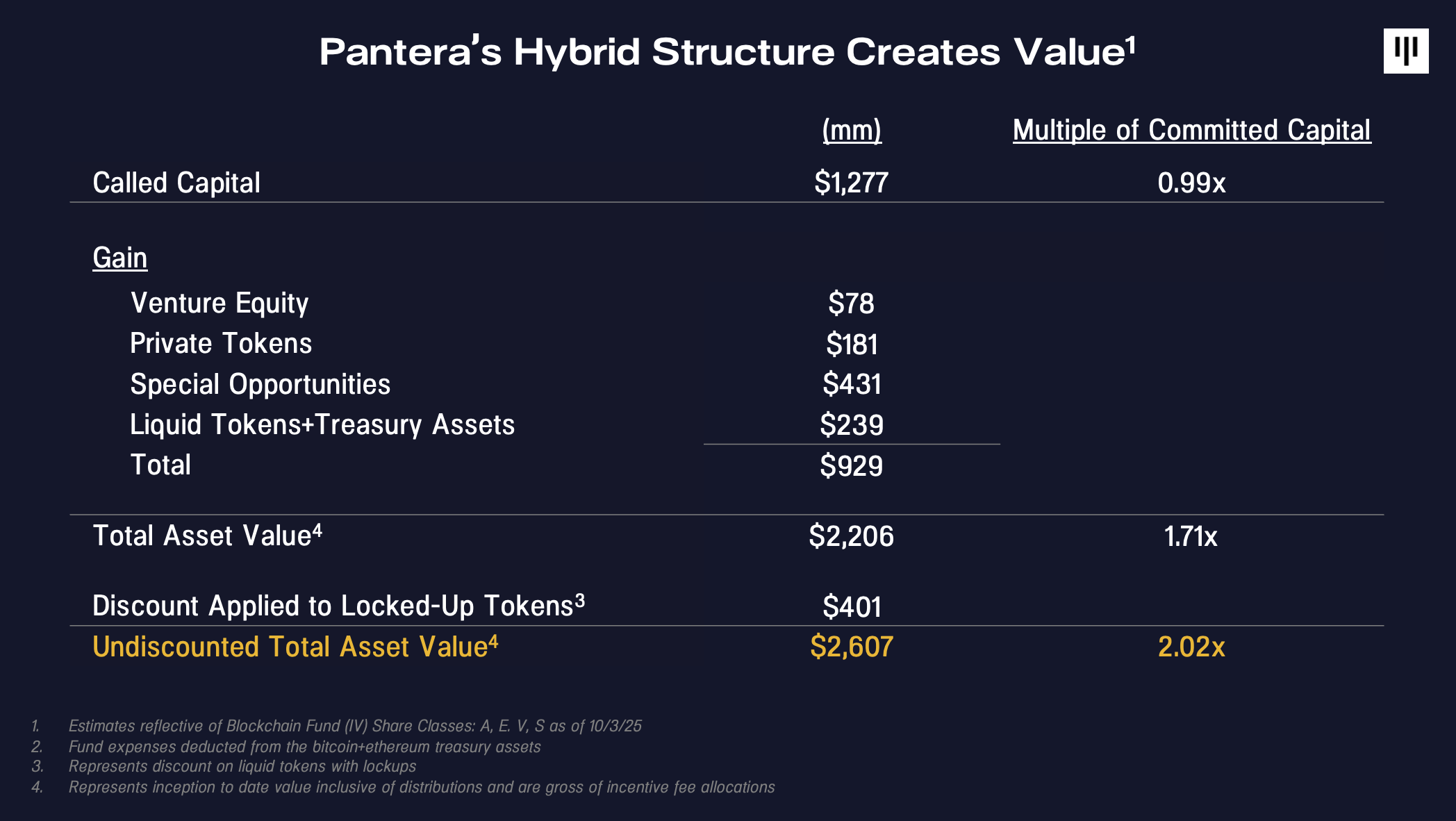

HYBRID STRUCTURE CREATES VALUE[1]

Pantera Blockchain Fund (IV) is a private equity, venture-style fund with hedge fund characteristics to it. The setup was complex to develop, but we believe it is incredibly powerful. This hybrid structure has generated substantial value for our Limited Partners.

The structure allows us to take advantage of massive swings in the pendulum of value from publics to privates. In 2022, when tokens crashed, we bought bitcoin and ethereum as treasury tokens and put on other trades via our liquid token sleeve. We waited while overpriced venture reset. While there was indeed a period of choppiness, these decisions have added $239 million of gains to the Fund, which may be deployed across the various strategies.

In addition, $431 million of profits has been added through Special Opportunities. These deals typically come to us because we are the oldest and perhaps one of the largest firms in the space – with a reputation for being able to execute unusual transactions. Examples of deals we’ve engaged on:

– Purchasing TON directly from a strategic entity at a discount

– Seeding Bitwise’s bitcoin ETF for essentially free equity by utilizing the Fund’s treasury and positioning Pantera as a strategic partner

– Acquiring discounted Solana through the FTX estate auction

– Investing in the PIPE for HSDT Solana Company

Before the Fund has completed calling capital, it already has $1.3bn of additional assets on the books. That is double the committed capital.

![]()

FIRST CLOSE OCTOBER 31ST :: PANTERA FUND V

Similar to its predecessor, Pantera Fund V will leverage this hybrid structure, aiming to generate value across the full spectrum of opportunities.

The Fund will have its first close on October 31st. Limited Partners have the flexibility to invest in just venture (Class V for “Venture”), or in venture, private tokens, and locked-up treasury tokens (Class P for “Privates”), or the all-in-one Class A.

We are wrapping up the first close. If you’re ready to invest, please click the button below to begin the process.

![]()

Forward Outlook on the Opportunity Set for Fund V

By Franklin Bi, General Partner [adapted from a note to Pantera Blockchain Fund (IV) LPs]

In the wake of the US presidential election, our industry’s headwinds have become tailwinds. The long-term impact on blockchain innovation and entrepreneurship is profound. It’s impossible to measure the progress that was previously obstructed because of crypto’s unfair and unclear treatment by previous administrations. That progress can now be unlocked as we look ahead towards emerging trends and portfolio strategies for Fund V.

Rise of token fundamentals: The market is increasingly beginning to focus on tokens with sound fundamentals. We are seeing that play out in relative performance. Fundamentally sound tokens, in particular those with revenue and cash flows, have recently outperformed those that are more speculative or, candidly, just vaporware. As painful as it has been, we believe the capital destruction in fundamentally value-less tokens is a healthy dynamic. This is important if the industry is to grow in a healthy way going forward and for our Fund V strategy to perform.

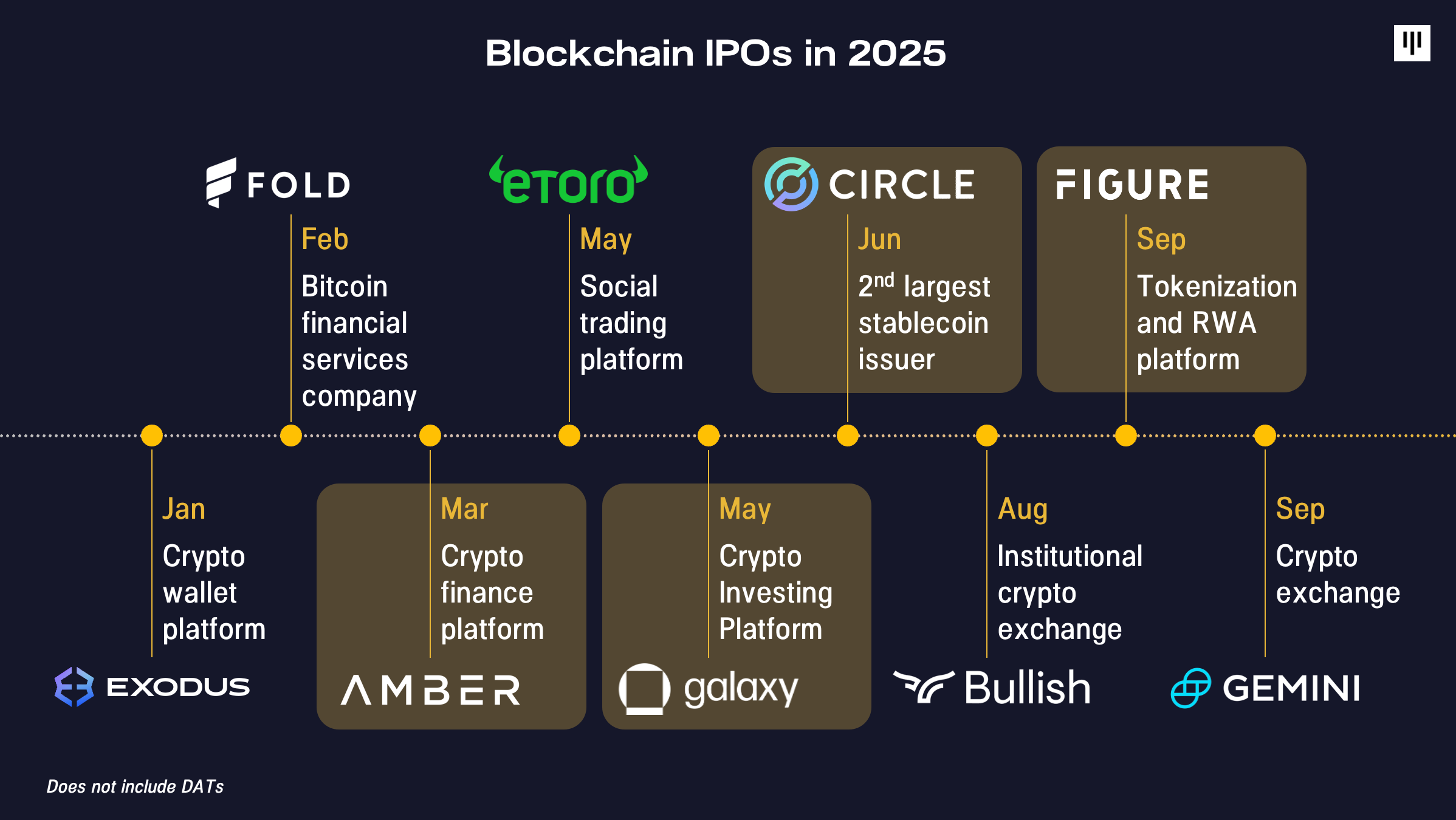

New paths to liquidity: The new regulations and recent blockchain company IPOs have opened up traditional routes to liquidity, like IPOs and M&A. Figure’s IPO is the third public listing of 2025 for the broader Pantera portfolio, alongside Circle and Amber. There is a clear runway for major acquisitions by FinTech and payments incumbents, similar to Stripe’s recent $1.1 billion acquisition of Bridge. We plan to continue leveraging our deep network to facilitate and support M&A activity across our portfolio, as we’ve done successfully in previous transactions. It’s also difficult to overstate the positive impact of a fair and reasonable U.S. regulatory regime on the prospects of new token launches and crypto company IPO’s. These tailwinds will likely help buoy traction and revenue growth for existing and future portfolio companies.

Convergence of crypto and AI: Crypto is no longer siloed as it converges with today’s cutting edge in AI and robotics. OpenMind’s OM1 + FABRIC stack addresses the “missing layer” in the robotics industry, allowing different robots to work together through a decentralized approach. Worldcoin’s iris-scanning identity verification system leverages a blockchain-based identity layer that could enable AI agents to authenticate and transact autonomously, addressing the critical challenge of agents interacting securely in crypto. Decentralized AI platforms like Sahara AI (a decentralized alternative to Scale AI) and Sentient (a decentralized Hugging Face) are disrupting traditional AI infrastructure. The application layer of crypto AI is still nascent, but the potential that it harbors could create an entirely new market structure through onchain agents and trading infrastructure. This convergence is pooling experts from AI, fintech, and consumer tech, blurring industry lines. Crypto’s role as a backbone for globally-distributed, complex systems is becoming apparent as a critical layer in the tech stack of tomorrow and as a counterforce to AI’s emerging challenges.

![]()

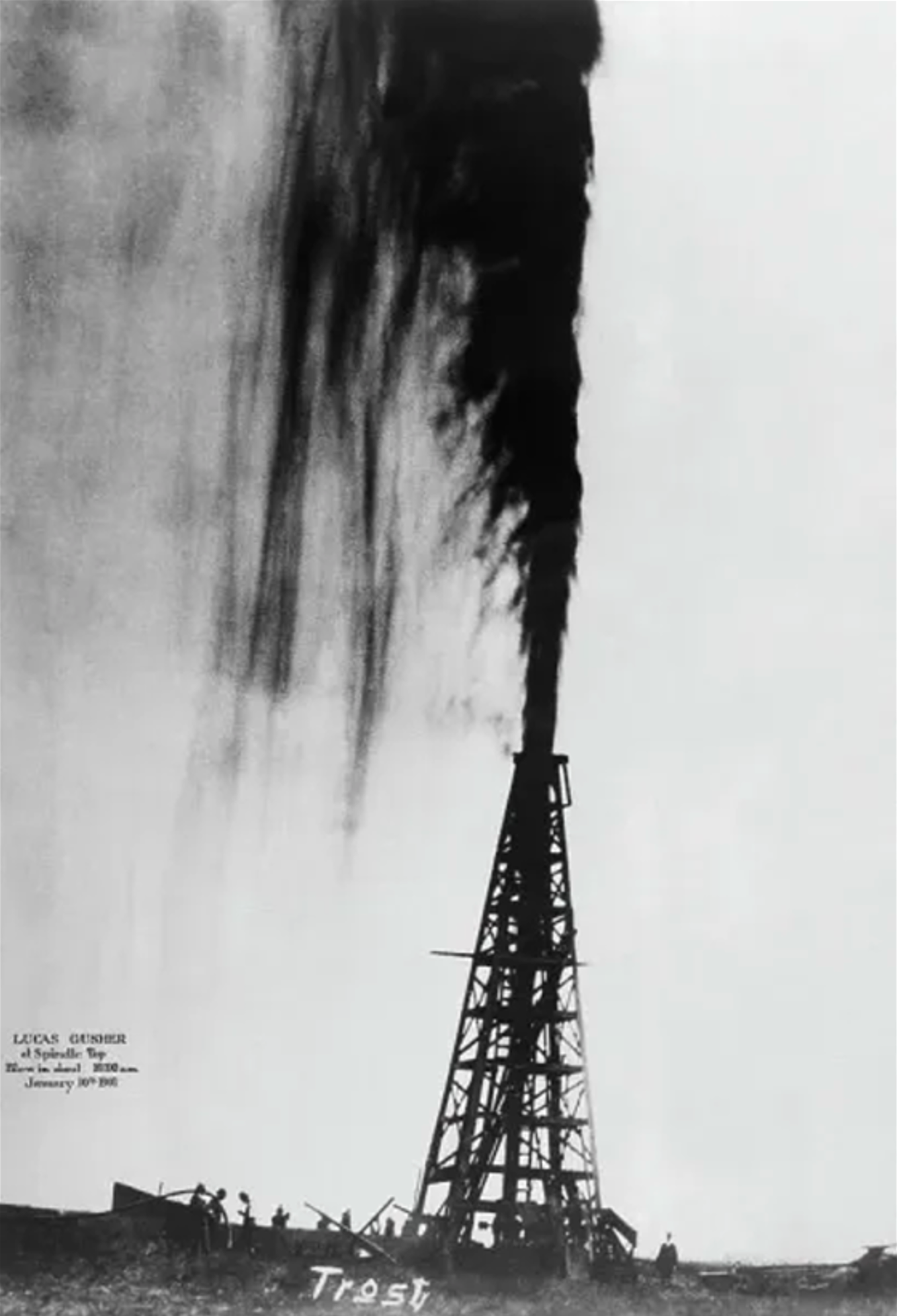

IPO GEYSER

Like any liquid which when held back and compressed/repressed – when the barrier is punctured it results in a geyser.

Years of pressure suppressing blockchain IPOs like Circle just got punctured.

The backlog of blockchain companies going public is now released. This year, nine non-DAT companies have entered the public markets – three are Pantera portfolio companies plus our long-time partner Galaxy. We’re also monitoring BitGo who officially filed their S-1 on September 19th.

It’s awesome to see the success of these innovative companies being recognized by the public equity markets. In our view, the years to come won’t look much different.

![]()

RETURN SINCE IPO

If you put $1 in each of the five Pantera-affiliated IPOs this year, you’d have $11 – a 117% return.

![]()

NEW NAME :: SOLANA COMPANY

It’s characteristic of our funds to have self-evident names: Pantera Bitcoin Fund, Early-Stage Token Fund, Liquid Token Fund, etc.

“Helius Medical Technologies” – the name of the existing company we led the $500mm PIPE into to create our Solana DAT – obviously had to change.

Last week, we announced a corporate name change to “Solana Company” and in conjunction signed a Letter of Intent with the Solana Foundation – formalizing a shared commitment to accelerate the ecosystem’s growth.

New name, same ticker:

Solana Company HSDT

A Decade at the Forefront of Providing Access

Pantera has always been focused on providing investors access to the dynamic and rapidly evolving blockchain opportunity set.

We first began providing access to bitcoin when MtGox was the alternative. We then launched the first exclusively blockchain venture fund, the first exclusively private token fund, followed by a diverse array of products covering the broad spectrum of assets and opportunities. Below is a visual of that history.

Unfortunately we’ve had to have our minimums set typically at a million dollars – and for Accredited Investors or Qualified Purchasers as defined by the SEC.

Over twelve years of providing access to blockchain, Pantera funds have received 6,685 investments.

HSDT is the next evolution in Pantera providing access to blockchain – enabling anyone with a brokerage account to participate in one of the fastest-growing ecosystems.

In two weeks of trading, HSDT has traded 204,000 times!

The median HSDT trade size is $2,200. That’s three orders of magnitude smaller than our average investor.

The Simple Case For Solana From A Venture Perspective

As venture investors, we pay close attention to where developer momentum is strongest.

Over the past two years, Solana has attracted more full-time developers than Ethereum.

“Skate to where the puck is going.”

– Walter Gretzky

As a platform, through its fast, accessible, and affordable architecture, Solana has excelled on nearly every metric. It leads in:

– DEX volumes: $1.4tr annualized

– Daily Active Addresses: 4mm

– Real Economic Value: $800mm annualized

– Application Revenue: $1.7bn annualized

– Real transactions: 3,500 /second

Solana is blockchain’s “dial-up to broadband” moment. Broadband unleashed a wave of internet companies, business models, and applications that dial-up couldn’t support – and we believe Solana will do the same for the onchain economy.

Solana x DATs Call Highlights

Pantera hosted a call covering everything Solana and DATs. Founder and Managing Partner Dan Morehead and General Partner Cosmo Jiang delved into the case for Solana and explored why DATs may be a better vehicle for token exposure compared to holding spot or an ETF.

Watch the full video here. Below we’ve provided some of the highlights.

Capital Group Mark Casey’s MicroStrategy Trade | Dan

“Four years ago, a friend of mine, a neighbor named Mark Casey, who is at Capital Group, told me he owned 10% of MicroStrategy. Frankly, I thought that was kind of crazy. I didn’t know enough about it. I had met Michael Saylor. I vaguely knew what they were doing. But since we manage alternative funds, I never had spent much time thinking about it.

“But his answer to it was so important, and it’s why we’re in this space, he said he was a 40 Act mutual fund, and he was very bullish on Bitcoin, and MicroStrategy was literally the only way he could invest in bitcoin and give his mutual fund investors exposure to bitcoin.

“They spent a bit less than a billion on buying that stock, and it’s now six billion. He’s made five billion for his investors.”

The success of crypto IPOs | Dan

“There’s a saying on Wall Street ‘Supply creates its own demand.’ Like any kind of Yogi Berra-ism, it sounds nonsensical on one level, but it is also really true. The more these companies go public and do incredibly well, like Circle and Figure have all done incredibly well in the public markets, that makes people notice it, makes them pay attention. Once they pay attention, they’re like, ‘Hey, something big is going on here,’ and they want to get exposure to it.”

How Pantera got involved in DATs | Cosmo

“Pantera has really been at the forefront of this emerging new industry. We developed the conviction to make what was then a very non-consensus bet in early April of helping to anchor and bring to life the first DAT launches here in the U.S.

“I remember when we got the first pitch, which was DeFi Development Corp, or DFDV, I thought there was a real opportunity to reproduce the success of MicroStrategy, but that would clearly be a one-of-a-kind moonshot. Then, the following week, Cantor approached us after seeing us take a leading role in that, and told us about their plans to launch a bitcoin DAT with Tether and SoftBank, what would eventually become Twenty One or Cantor Equity Partners.

“At the time I thought, ‘Wow. Well, this is clearly two and done.’ But of course now, we’re sitting here less than six months later, having taken more than 150 pitches, and having seen more than $20 billion of capital raised across the industry, and tens of billions of dollars of market value created.”

The “Big Bang” of DATs and what they seek to accomplish | Cosmo

“There’s been a ‘big bang’-like event recently with the creation of what I think of as a whole new category of companies, Digital Asset Treasuries. These companies’ goals are to accumulate as many tokens to maximize book value, or NAV per share. They do so through a variety of accumulation strategies, including raising more capital in a per-share-accretive way, and/or achieving yields on their existing assets.”

Analogizing DATs to banks and how valuation multiples can be justified | Cosmo

“One way to think of DATs is as a balance sheet financial services company like a bank. What’s the bank business model? Well, banks are effectively a pile of cash and they go out and try to seek yield on that cash, either through financial engineering, or originating loans, or selling insurance, or other financial tools.

“Investors choose to value a bank at a premium to its book value based on whether it can generate a return on equity higher than its cost of capital. If you do, the highest quality of banks that earn an excess return trade at a high premium to NAV, or book value, such as JP Morgan at two times NAV. And if you don’t, then you trade – as many regional banks do – below book value.

“So, there is a reason if you can grow your book value per share in a sustainable, durable way over time, you deserve to trade at a higher multiple of book. Similarly, investors may choose to value a DAT at a premium to NAV, if they believe the DAT can sustainably grow their NAV per share.”

“A DAT is analogous to banks, except instead of local currency being USD for JP Morgan – so not something you necessarily think about when you value any bank – for DATs, their balance sheet’s denominated in token, such as bitcoin for a bitcoin DAT, or Solana for a Solana DAT. DATs then hope to generate yield to grow their asset base on a per-share-accretive way.”

Why Solana is for Stablecoins | Cosmo

“Solana is for stablecoins. Solana stablecoin transaction volume has continued to go up over time. Stablecoin supply has also continued to grow very quickly. Stripe has enabled merchants to accept stablecoin payments through Solana. PayPal has launched PYUSD stablecoin on Solana to enable value transfer between crypto wallets and the PayPal ecosystem. All these global payments platforms are choosing to use Solana, and that’s why we’re seeing it show up in stablecoin volume and stablecoin supply.”

Why Solana is for DePIN | Cosmo

“When people ask me about what are the most exciting use cases that are touching the real world, and have real world customers? Well, you can point to DePIN. Almost every DePIN application is choosing to launch on Solana, the vast majority, certainly. When you look at 60% of DePIN token market cap, it is on Solana….

“The reason why Helium, Hivemapper, and Geodnet, and all these DePIN protocols have chosen Solana, are for all the reasons I described, which are the, Solana is faster, cheaper, more accessible. And so, it has a scale that enables these DePIN use cases.”

Five ways DATs are helping shape the digital asset industry | Cosmo

“The first is that they are a long-term, permanent capital vehicle. The DATs raise permanent capital pools from equity investors that protect them from liquidity pressures that are faced by traditional funds, and allow for opportunistic investment during market dislocations.

“The next is, DATs really advocate and assist the token ecosystem, by being the most important vehicle in the system, by being a large holder of tokens. The most important job for a DAT is to advocate for the token, and make sure the token has underlying value. And so, DATs, in a really special way, can advocate and assist in growing the token ecosystem, including participating in DeFi.

“And when I think about DATs, when I think about how these protocols have evolved, historically, the most important entities within a protocol ecosystem had been the foundation, or nonprofit foundation, as well as the lab entity, or the software developer that helped create the protocol. I think both of them have been hampered in some way by talking about the token. Whereas DATs are really a great third leg of the stool, in balancing what the foundation can do and labs can do, and do more. DATs can really advocate for the token in a foot-forward way. DATs can invest in the ecosystem in a foot-forward way, without having to be credibly neutral, and really be strong actors that help the ecosystem in a complementary way to the foundation and labs.

“They are active ecosystem participants, whether that’s DeFi or governance.

“DATs also give access to a whole new investor base, and by doing so, it increases the amount of investors that appreciate and can trade this asset. And so, DATs are really helpful for all these reasons, and I think have long-lasting staying power, and real value-add to the protocols over time.”

Solana Company In The News

Bloomberg: Pantera’s Dan Morehead on How Solana Became Crypto’s Most Attractive Asset

CNBC: Helius soars after securing funding to launch solana treasury company: CNBC…

Fortune: Pantera and Summer Capital raise $1.25 billion to turn neurotech firm…

CNBC:Solana’s had better performance than bitcoin over the last four years, says…

GlobeNewswire: Preeminent SOL Treasury Company Helius Announces Name Change…

MarketWatch:Helius Medical Tech Jumps on Funding to Launch Solana Treasury

CoinDesk: Pantera-Backed Solana Treasury Firm Helius Raises $500M, Stock…

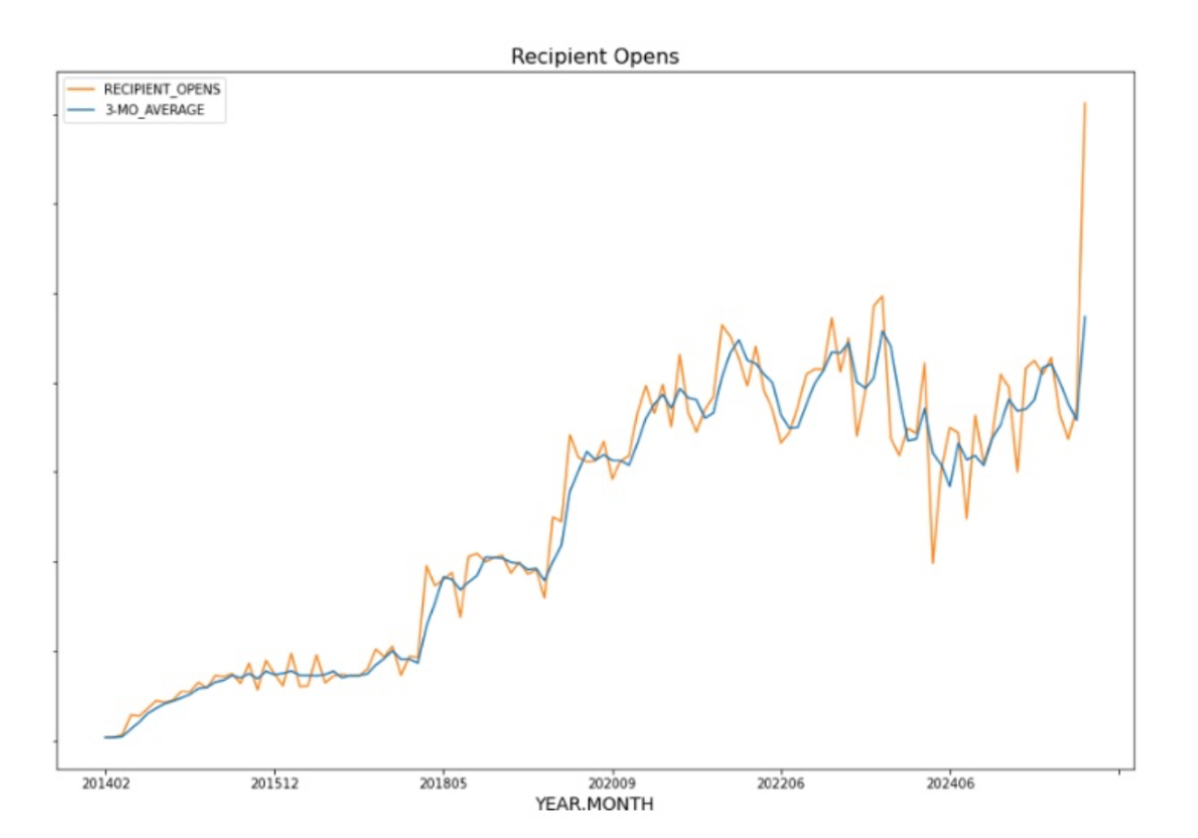

![]()

The viral interest in DATs is easy to see – the recent Blockchain Letter on our Solana Company HSDT public listing was the most-read of all time – by a mile.

![]()

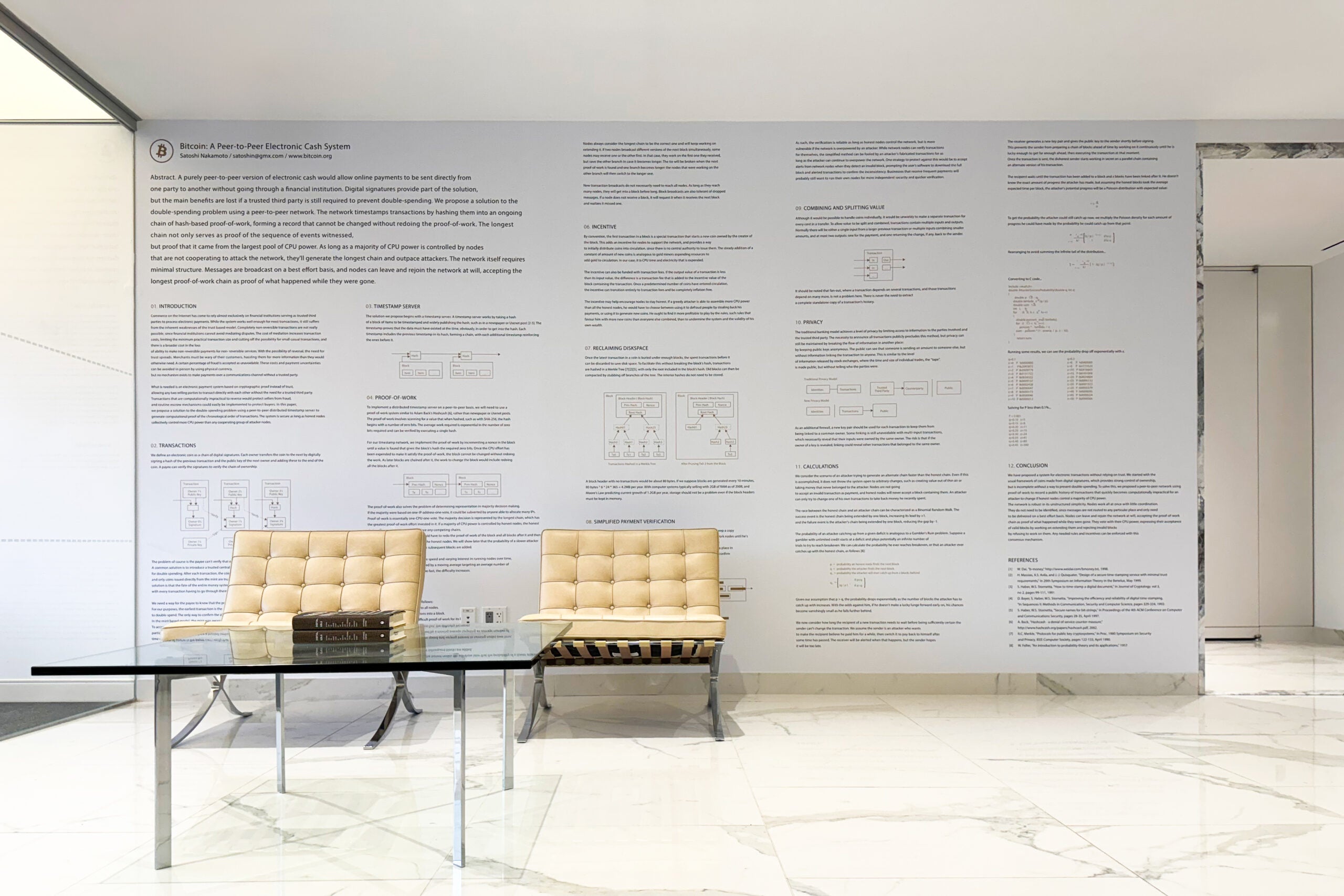

WHITE PAPER WALLPAPER

October 31st is Bitcoin’s 17th birthday.

I believe Nakamoto-san’s white paper will change the world – in so many wonderful ways: financial inclusion, property rights, migrants no longer working an entire month just to pay their remittance company, refugee identity/direct aid transfers, etc.

Bitcoin democratizes access to financial assets.

Bitcoin technology devolves power from centralized and all-too-fallible bureaucracies, returning it back to the people.

Bitcoin is changing the world for the good.

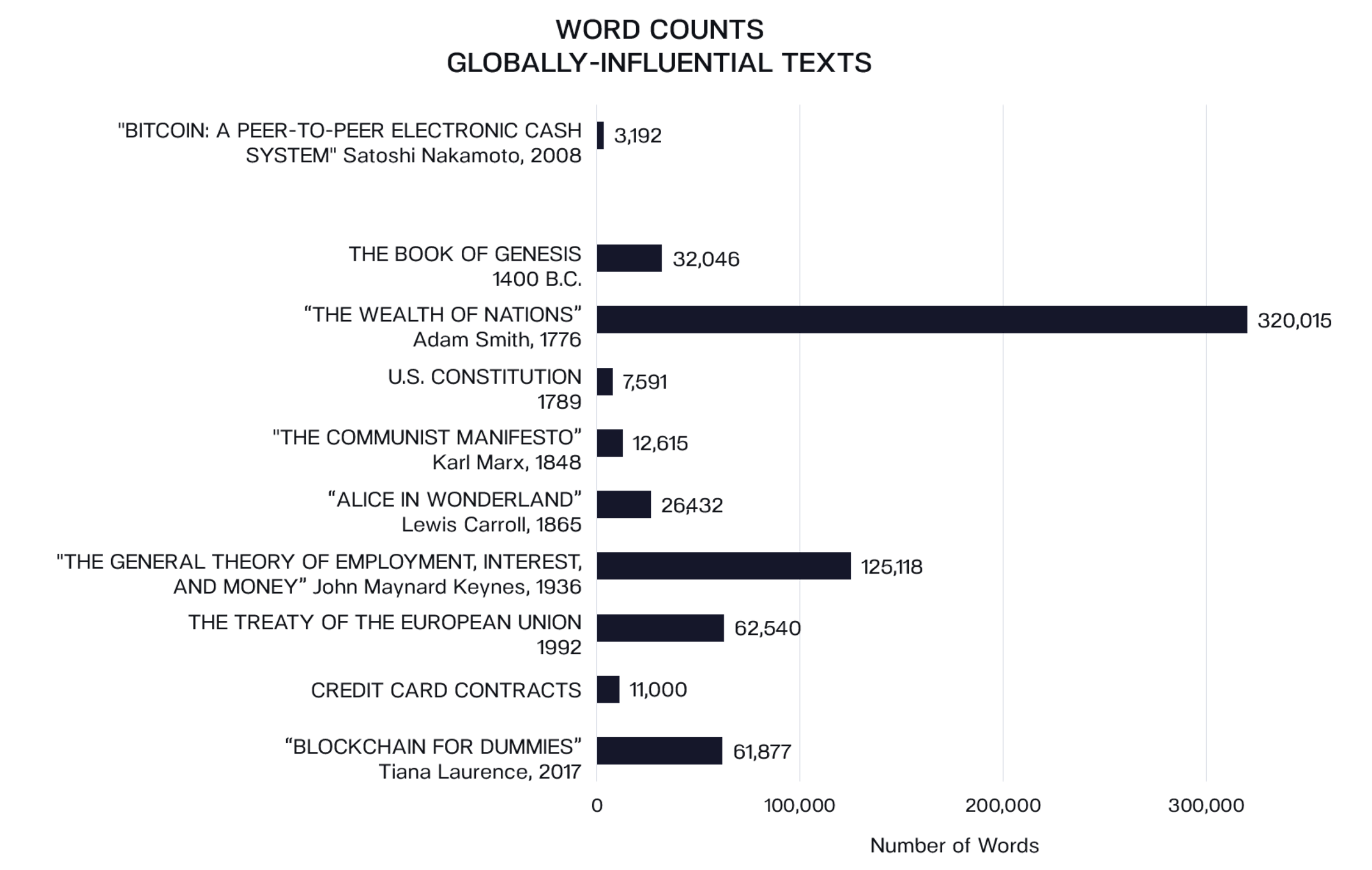

The mind-blowing bit is the revolution was sparked by just 3,192 words.

Bitcoin: A Peer-To-Peer Electronic Cash System easily fits on a wall of each of our offices.

To share a sense of how distilled the genius in the paper is, we’ve shown how few words it took to convey this powerful idea to the world. The word count of the bitcoin white paper is shown below in relation to a selection of globally-influential texts:

My favorite – it took Satoshi only 5% as many words to completely describe and define the entirety of the project which has already impacted 220 million people’s lives as were used in writing Blockchain for Dummies. Go figure.

![]()

Looking forward to seeing our Limited Partners tomorrow at The Plaza for Pantera Blockchain Summit 2025 :: The Next Decade.

“Put the alternative backs in Alts”

PANTERA CONFERENCE CALLS[2]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Venture Fund II Investor Call

Thursday, October 16, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Venture Fund III Investor Call

Tuesday, October 21, 2025 12:00pm Eastern Daylight Time / 17:00 Central European Standard Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Blockchain Fund (IV) Investor Call

Tuesday, November 4, 2025 12:00pm Eastern Standard Time / 18:00 Central European Standard Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Early-Stage Token Fund Investor Call

Tuesday, November 11, 2025 12:00pm Eastern Standard Time / 18:00 Central European Standard Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Fund V Call

A deep dive on the compelling investment themes in blockchain and how Fund V is structured to capture value in the evolving digital asset landscape.

Tuesday, December 9, 2025 12:00pm Eastern Standard Time / 18:00 Central European Standard Time / 1:00am Singapore Standard Time

https://panteracapital.zoom.us/webinar/register/WN_WeYc-yxFRfi63gXtesZK7Q

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PANTERA FUND V

We’ve found that most investors view blockchain as an asset class and would prefer to have a manager allocate amongst the various asset types. This compelled us to create Pantera Blockchain Fund (IV) in 2021, a wrapper for the entire spectrum of blockchain assets. We are now opening its successor — Pantera Fund V — for subscriptions.

Similar to its predecessor, we believe this new fund is the most efficient way to get exposure to blockchain as an asset class. It is a continuation of the strategies we have employed at Pantera for twelve years across twelve venture and hedge funds.

Limited Partners have the flexibility to invest in just venture (Class V for “Venture”), or in venture, private tokens, and locked-up treasury tokens (Class P for “Privates”), or the all-in-one Class A.

As in all previous Pantera venture funds, we strongly support helping our LPs get access to private deals in this fund. Fund LPs with capital commitments of $25mm or more will have the option to collectively co-invest in at least 10% of each venture equity, private token, and special opportunity deal that the Fund invests over $10mm in. There is no management fee or carried interest on co-investments for those with co-investment rights.

We will endeavor to offer co-investment opportunities, on a capacity available-basis, to other LPs as well. These co-investment opportunities are subject to 1/10% fees.

We are now accepting subscriptions for Fund V. If you’re ready to invest, please click the button below to begin the process.

If you are new to Fund V and would like to receive additional information, click here. We also invite you to join our next call on Pantera Fund V on Tuesday, December 9, at 9:00am PDT / 12:00pm EDT. You may register here.

Pantera donates 1% of revenue from all new funds to 1% For The Planet.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

-

Director, Capital Formation – US East – (New York City)

-

Senior Director, Capital Formation – Gulf Region – (Abu Dhabi)

-

Senior Director, Capital Formation – Asia Pacific – (Singapore)

-

Head of Capital Formation – (New York City)

-

Capital Formation Associate – (New York City)

If you have a passion for blockchain and want to work in New York City, San Francisco, San Juan, Abu Dhabi, or APAC region, please follow this link to apply. Some positions can be done remotely.

[1] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Partners LP and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically-marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

[2] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.