BLOCKCHAIN’S “DIAL-UP TO BROADBAND” MOMENT[1]

By Franklin Bi, General Partner, Jonathan Gieg, Senior Platform Associate, and Nihal Maunder, Junior Partner

Crypto’s “dial-up to broadband” moment is here.

The early version of the Internet was slow, clunky, and broken. When broadband replaced dial-up connections, the Internet exploded with new activity and products. The massive upgrade in bandwidth unlocked the full potential of a global information network. Today, that same upgrade is occurring on blockchain networks.

The Ethereum ecosystem has scaled by ~10X over the past two years, powered by Layer 2 blockchains. Layer 2 chains achieve greater speeds and lower costs by batch processing transactions to be settled on an independent blockchain, the Layer 1. This scaling approach is known as a “rollup chain.”

Total transaction throughput on Ethereum-based Layer 2s is currently over 140 TPS (transactions per second), compared to 14 TPS on Layer 1 (see chart).

Today’s leading Layer 2 is Arbitrum. Since its 2021 launch, Arbitrum has led the L2 landscape in all the metrics that matter: from transaction volumes and developer activity to onchain fee revenue. The Layer 2 protocol is designed with Ethereum compatibility as a top priority. Users and developers can have an identical experience using and building on Arbitrum as they would on Ethereum, except cheaper and faster.

The result is a giant step forward in Ethereum’s scalability. Over the last 30 days, the Arbitrum network has processed four times as many transactions as Ethereum. The 7-day transaction count on Ethereum has increased 20% compared to a year ago, from 7.7 million to 9.2 million. The same 7-day transaction count on Layer 2s has increased over 850%, from 18.6 million to 163 million. The “broadband moment” has arrived for blockchain networks.

Arbitrum, Day Zero

At the second Pantera Blockchain Summit in 2015, we gathered a small group of industry friends to a lake house in Tahoe. Among the group was a Princeton University professor named Ed Felten. Dr. Felten was an accomplished computer scientist and technology policy advisor, known for groundbreaking work on cybersecurity and digital content protection. But it was his growing interest in Bitcoin that drew him out west.

At the time, Ed was actively conducting research on Bitcoin, often collaborating with fellow academics – including two postdoc researchers, Steven Goldfeder and Harry Kalodner. The three of them were studying Bitcoin wallet security, until they shifted their attention to the industry’s most pressing issue: how to scale blockchains for mass adoption. The key insight was an idea that Ed conceptualized 10 years ago, which now defines an entire class of scaling solutions: “interactive fraud proofs”.

In 2018, Steven, Harry, and Ed publicly shared a research paper titled: “Arbitrum: Scalable, private smart contracts”. The proposal was elegantly simple and straightforward. But the important work of implementing would require much greater effort and thus we found ourselves reunited with Ed, now a co-founder of Offchain Labs alongside Steven and Harry.

On meeting the Offchain Labs founding trio, we discovered that their strengths went far beyond technical brilliance. They brought to the table:

– a deep passion for the power of blockchains to build a better world;

– an unwavering commitment to open-source development and community;

– and a laser focus on creating the best developer experience for Web3 creativity to flourish.

From there, it was an easy decision to write their first check and ultimately lead their seed round in late 2018, kicking off Day One of the journey to scale Ethereum.

The Arbitrum Ecosystem

Since launching in 2021, Arbitrum has seemingly become the Layer 2 of choice for leading Web3 projects and developers. Much of its early growth has come from DeFi activity. Arbitrum’s trading volumes rank third among all blockchains, behind only Ethereum and Solana.

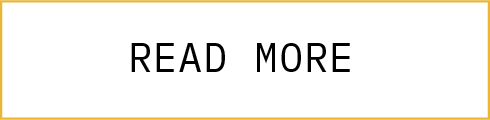

Today, the fast-growing Arbitrum ecosystem consists of:

– 500+ projects (more than any other Layer 2).

– 1,800+ monthly active developers (more than Solana).

– $16 billion of assets bridged from other chains (top among all Layer 2s).

– $3 billion of value deposited in DeFi on Arbitrum (3x more than the next closest Layer 2).

Many established teams have expanded from Ethereum and other Layer 2s to Arbitrum, often with greater success than any previous chains. For example: Uniswap, the market-leading decentralized exchange, now processes the majority of its Layer 2 volumes on Arbitrum, despite initially building on Optimism. The Arbitrum instance of Uniswap recently became the first to reach $1 billion in daily trading volume on a Layer 2.

One of Arbitrum’s most remarkable qualities is its homegrown talent. Arbitrum-first teams have gained impressive traction in multiple verticals, from DeFi to gaming. Here’s a selection of leading projects from the Arbitrum ecosystem:

Decentralized Finance

– Robinhood: Investing platform announced Arbitrum DEX integration for Robinhood Wallet users.

– GMX: Decentralized perpetual futures exchange; $190 billion in cumulative volumes.

– Camelot: Decentralized spot exchange; $12 billion in cumulative volume across 900k users.

– Radiant: Cross-chain lending protocol; $120+ million in total borrow volume.

Gaming

– InfiniGods: Mobile-first Web3 gaming studio building King of Destiny; 25k+ downloads globally.

– Treasure: Decentralized game publishing platform; $280 million in total marketplace volume; 150k players across 15+ games.

– Hytopia: Open-source worlds inspired by Minecraft; over 1.1 million players pre-registered.

– XAI: Web3 gaming infrastructure; ~100k+ daily transactions and 600k+ connected wallets.

Real-World Asset Tokenization

– Kinto: Financial services-focused chain with user-owned KYC across 80+ countries.

– Plume Network: Real-world asset tokenization protocol; over 100 projects onboarded.

Arts & Entertainment

– AnimeChain: Decentralized IP ecosystem for anime; partnered with top-3 NFT project Azuki.

– ApeChain: Dedicated network to support two top-3 NFT projects, Bored Apes and CryptoPunks.

– RARI Chain: Creator-focused chain with NFT royalties enforcement.

– Reddit: Previously selected Arbitrum in “Scaling Bake-off” for Community Points initiative.

As Arbitrum continues to attract top teams and projects, we believe its ecosystem growth is set to accelerate further. The roadmap includes key developments to expand their developer base and onboard new builders, including:

– Arbitrum Stylus: A custom programming environment for writing smart contracts in Rust, C, and C++, minimizing the need for aspiring Web3 developers to learn new languages (e.g., Solidity) to start building on Arbitrum.

– Arbitrum Bold: An improved, permissionless version of fraud-proof technology that can speed up transaction processing.

Arbitrum’s journey from a DeFi cornerstone to a flourishing blockchain ecosystem exemplifies both its technical strength and the high-quality community behind its rapid growth.

Looking At The Numbers

Active community engagement, top-tier developer experience, and technical breakthroughs have positioned Arbitrum as the leading contender in the Layer 2 landscape. The numbers support this.

Let’s look at the fundamental metrics driving Layer 2 adoption:

Total Value Locked (“TVL”) measures the value of assets deposited on a blockchain to support liquidity or lending activity. 39% of TVL in Layer 2 rollups is in Arbitrum. Arbitrum has $4.0 billion held in its DeFi protocols, while the next closest competitor, Blast, has $1.4 billion locked. This metric is meaningful because TVL serves as an indicator of transaction activity, liquidity, and overall health of the project. High TVL indicates strong user engagement and confidence in the platform.

Arbitrum has predominantly been the top revenue generator compared to other L2 scaling solutions. Other chains’ fee generation capabilities fluctuate, especially when in anticipation of a token airdrop (as is happening with zkSync currently), while the Arbitrum community’s organic activity ensures predictable revenue regardless of external dynamics. Arbitrum did this by carving out niches like DeFi, where they nurtured protocols like GMX and Uniswap, so they could cultivate the brand of being a go-to chain for DEX swaps and perp trades.

Looking past current dominance, the reason we believe in Arbitrum’s ability to remain a go-to scaling solution for Ethereum is its focus on developer activity. As the table above shows, Arbitrum has built the most compelling platform for developers seeking to deploy decentralized applications. Users will eventually gravitate towards the ecosystem where the best applications reside, and by doubling down on their developer community, we believe Arbitrum is securing their long-term sustainability.

Thematic Call :: Scaling Blockchain for Mass Adoption with Arbitrum and StarkWare

We hosted a webinar on blockchain scalability with two experts in the field whose projects are paving the way for blockchain’s mass adoption.

Here are some highlights from the discussion:

“The Arbitrum ecosystem has a very big focus on sustainability and that’s going to be a differentiator long-term from others. The system has to run, has to work, and has to sustain itself. It can’t just prioritize short-term growth through unsustainable mechanisms.”

– Steven Goldfeder, Co-Founder and CEO of Offchain Labs | Arbitrum

“I prefer to call the technology that we’re building ‘integrity webs’ rather than ‘blockchains’ because it really puts the emphasis on that it is a ‘web’, just like the worldwide web. But what this technology also delivers is integrity and integrity means doing the right thing even when no one is watching.”

– Eli Ben-Sasson, Co-Founder and CEO of StarkWare

Offchain Labs | Arbitrum Open Roles

If you are interested in working at Offchain Labs, the primary developer behind Arbitrum, feel free to apply to any of the open positions below.

Senior Rust Engineer (Remote)

Site Reliability Engineer (Europe)

Partnerships Manager (Remote) – Orbit

Marketing Coordinator (Remote) – Partnerships

Executive Assistant (New York)

![]()

UNISWAP CAPITAL ALLOCATION INFLECTION

By Cosmo Jiang, Portfolio Manager, Liquid Strategies, and Erik Lowe, Head of Content

A defining thesis for us is that tokens are a new form of capital formation and are replacing equity for a generation of businesses. The emergence of protocols that generate real revenues, have product market fit, are guided by strong management teams, and have paths to sustainable unit economics is enabling fundamentals-based valuation frameworks to be applied to digital asset investing. We believe we are at an inflection point in this asset class.

Sustainable Governance Through Economic Alignment

Uniswap is one of the largest decentralized exchanges in the DeFi ecosystem with $5.8 billion in TVL and generates $1.8 billion in trading fees annually.

In February, the Uniswap Foundation proposed a major change to the protocol’s governance system that will result in capital return to tokenholders, directly linking the token to the protocol’s value creation. If passed, a portion of trading fees would be distributed to tokenholders, but only those that actively contribute to the protocol by participating in protocol governance.

“This proposal seeks to invigorate and strengthen Uniswap’s governance system by incentivizing active, engaged, and thoughtful delegation. Specifically, we propose to upgrade the protocol so that its fee mechanism rewards UNI token holders that have delegated and staked their tokens.”

– Erin Koen, Governance Lead at Uniswap Foundation, March 1, 2024

In our view, this is a big deal for the credibility of tokens and their current or future paths to value accrual. We believe our thesis is becoming increasingly true. Following in the footsteps of Uniswap, other revenue-generating protocols that may have been reticent before now have a template to pursue capital return plans. We think this will drive further credibility to the DeFi ecosystem and more investors will converge on applying fundamental valuation frameworks to digital asset investing as a result.

To get into the details of the corporate governance, it is important to note that this proposal was put up by the Uniswap Foundation as a representative of the Uniswap DAO, which governs the Uniswap protocol. Uniswap DAO is an independent entity from Uniswap Labs, a US-based business with headquarters in Brooklyn, New York, whose team spun out more than a year ago and which acts as a third-party service provider to the protocol and was not involved with this decision. One can imply that the Uniswap Foundation conducted legal analysis and determined that this was a regulatorily acceptable path. Before this, legal considerations have likely played a role in the cautious approach to returning protocol value to token holders. The regulatory landscape for DeFi is complex and evolving, but we see this as a positive signal for protocols seeking to implement value-accrual mechanisms for their underlying tokens.

Pantera’s Liquid Token Fund is invested in a number of protocols that have begun looking into Uniswap’s proposal and are considering similar value-accrual mechanisms of their own. We believe this would be a positive fundamental step forward for our investments.

Market Reaction

We believe the market’s reaction to the news highlights the importance of proper economic alignment and incentives for tokenholders, especially as it may translate to the long-term sustainability and continued growth of protocols through strong governance. The UNI token traded up 60% a couple of hours after the initial news dropped of the proposal, and is currently up 50%.

![]()

WHO PAYS FOR THIS DRIVEL?

By Erik Lowe, Head of Content

In November 2022, soon after the collapse of FTX, the European Central Bank published a not-so-prescient article titled “Bitcoin’s Last Stand”, predicting that Bitcoin would soon embark on a “road to irrelevance”. It didn’t. In fact, bitcoin is trading 320% above where it was at the article’s publication.

Rather than conceding, in a recent blog post, the ECB revisited a few of the arguments cited in their 2022 article, doubling down on their skepticism.

We want to take a moment to respond to these claims, including additional points they made in their latest post, offering an alternative view.

ECB Claim #1 :: Outside of darknet criminal activities, Bitcoin is hardly used for payments.

There are two claims to address that we’ll tackle separately.

First, the misconception that bitcoin is a useful tool for financing terrorism or money laundering stems from its early associations with the Silk Road and dark web marketplaces. As the world got up to speed on Bitcoin, it soon found out that an open public ledger is not the best method to move money around discreetly. Bitcoin’s trackability and traceability is a financial fraud investigator’s dream. The reason the U.S. Department of Justice was successful in tracking down those responsible for the 2016 Bitfinex hack is because of Bitcoin’s public ledger.

“Today’s arrests, and the department’s largest financial seizure ever, show that cryptocurrency is not a safe haven for criminals. In a futile effort to maintain digital anonymity, the defendants laundered stolen funds through a labyrinth of cryptocurrency transactions….

“Today, federal law enforcement demonstrates once again that we can follow money through the blockchain, and that we will not allow cryptocurrency to be a safe haven for money laundering or a zone of lawlessness within our financial system….”

– Deputy Attorney General Lisa O. Monaco

Beyond being a poor method for moving money discreetly, illicit activity conducted through cryptocurrency accounted for just 0.24% of transactions in 2022 according to Chainalysis’ 2023 Crypto Crime Report. Not to mention, cash still remains the primary means for conducting terror financing according to the Senior Legal Officer at the Counter-Terrorism Committee Executive Directorate (CTED).[2]

The ECB’s second point about bitcoin not being a successful means of payment is, in fact, correct. But they are missing the point.

Yes, the original promise of Bitcoin, a “peer-to-peer electronic cash system”, was, first and foremost, to enable fast, cheap transfers of value without third-party involvement.

The subsidiary benefit of Bitcoin was that it was supposed to be a hedge against inflation and currency devaluation due to its limited supply. Governments constantly print money, eroding the value of their citizens’ hard-earned savings. Holding bitcoin was expected to solve that problem – it’s done so quite well, currently storing $1.4 trillion in global wealth. In its discovery phase, Bitcoin has emerged as “digital gold” and its robustness as such is optimized through its simple design.

We should note that Bitcoin layers like Lightning Network, a dedicated payments layer, and Stacks, a programmable layer for smart contracts, may ultimately fulfill the payments narrative in the future. An analogy sometimes used is that Bitcoin is like Fedwire, the base payment layer upon which all transactions ultimately settle, and additional layers like Lightning will be akin to Mastercard or Visa. Layer 1 Bitcoin has proven not to be the payment rail of choice for morning coffees – certainly not pizzas. In our view, it doesn’t need to be. What may fill this void are stablecoins built on faster, higher throughput networks, whether on Bitcoin L2s or other blockchains. You can read more detailed thoughts on that here.

ECB Claim #2 :: Bitcoin is still not a suitable investment.

It’s a peculiar assertion that an asset, particularly one that has nearly doubled in value annually over the past 11 years, is “still not suitable as an investment”. Apart from that, in our view, the notion that Bitcoin does not generate cash flows, lacks the social benefits associated with items like jewelry, or cannot be subjectively appreciated for outstanding abilities like artwork, does not disqualify it as a suitable investment.

The fact of the matter is that there really isn’t much intrinsic value in most stores of wealth or mediums of exchange, including the dollar. One could argue that the government has imparted some value to the dollar by requiring that it be used to satisfy tax obligations. But if you actually tried accessing the true intrinsic value of US currency by, for example, melting pennies to capture the value of its mineralogical components, that’s actually a felony. Some may argue that the dollar itself is a confidence scheme and with US national debt at a record percentage of GDP, having confidence in the value of the dollar might be less rational than having confidence in the value of bitcoin.

There are also enormously important stores of wealth with very little intrinsic value, such as Jackson Pollock paintings. The actual value of the paint and canvas in a Pollock painting is 40 bucks. They trade for $100mm because people believe that in the future, they will sell for at least that or maybe much more. That’s the case with bitcoin; people can store their wealth in it with the expectation that it will be worth at least as much if not much more in the future.

As far as cash flows and dividends, the emergence of protocols generating real revenues is occurring, e.g. Uniswap, enabling traditional and more fundamental valuation frameworks to be applied to digital assets. We discussed this more in February’s blockchain letter.

ECB Claim #3 :: The price of Bitcoin is manipulated.

In our opinion, concerns about price manipulation are much bigger than they rationally should be. It’s like the outdated stigma that bitcoin is used for illicit activity. We believe the same applies for market manipulation. We haven’t seen any evidence that there is more manipulation in the bitcoin market than any other of its size. In the last 30 days, bitcoin has seen a daily trading volume averaging $47 billion. By comparison, only one stock in the “Magnificent 7” surpassed that, NVIDIA. The total market capitalization of bitcoin is $1.4 trillion.

Smaller exchanges outside the U.S. and Europe sometimes inflate their volumes to push themselves up the league tables to try to attack new customers. Fake volume obviously has no directional impact on the market. Most important, it’s not present in the activity reported by the regulated exchanges like Coinbase, Bitstamp, et al.

![]()

NEW RECORDS IN BITCOIN PRICE ACTION

By Erik Lowe, Head of Content

Bitcoin witnessed the largest price increase ever in one month this February. The price of one bitcoin went up $18,600. It took nine years to get there the first time in December 2017 and it was at $18,600 just a year ago.

In addition, Bitcoin is on its longest streak of months with positive performance in its history – seven! The longest streak prior was six months, which happened three times over the last 14 years.

![]()

A REGULATORY UPDATE

By Andrew Harris, Senior Platform Associate

U.S. state regulators and the federal courts have continued to be active in the crypto space. The SEC continues to open cases against crypto asset platforms, this time with a complaint against Kraken, a platform that the SEC had earlier sued and settled with over its staking program. Binance reached a settlement of a staggering size with a number of regulators, including the CFTC and the Department of Treasury…. but not the SEC. Furthermore, New York’s Attorney General expanded an already significant complaint against Genesis, Gemini, and Digital Currency Group, now alleging that investors had been defrauded of around $3 billion through a lending program.

Regulatory actions outside the courts have also continued at state and federal levels. The SEC sought to clarify the definition of a “dealer” under the Securities Exchange Act of 1934, in a way that will almost certainly require many crypto asset market makers and trading firms to determine whether they need to register with the SEC and FINRA. The Consumer Financial Protection Bureau (CFPB) published a proposed rule that, if made final, would bring under the CFPB’s supervisory jurisdiction certain large nonbank companies that facilitate “covered consumer payment transactions” through digital wallets, payment applications, and other payment functionalities. California finalized a wide-ranging rule to regulate entities dealing in “digital financial assets” in a manner that will likely sweep in many gaming and other crypto companies.

Key Takeaways

– The SEC is continuing to sue crypto asset trading platforms, most recently Kraken – the Commission’s actions against Binance and Coinbase also continue.

– State regulators, particularly in New York, are also active, as the New York Attorney General’s recent expansion of its suit against Gemini, Genesis, and Digital Currency Group. The regulatory trend of actions against crypto asset market participants looks set to continue in the short to medium term.

– Beyond enforcement, both federal and state regulators are continuing to propose and finalize rules with significant impacts for crypto. Recent examples of these are the CFPB’s proposed rule regarding larger entities that provide wallets and payment functionalities, the SEC’s adoption of a final rule defining which entities (including crypto trading entities) constitute “dealers” under the Exchange Act, and California’s broad-ranging new law around digital financial assets.

![]()

THEY SAID BLOCKCHAIN WAS A “ZIRP PHENOMENON”

By Erik Lowe, Head of Content

As digital assets were falling in 2021 and 2022 amidst a challenging global macro backdrop and once-in-a-generation occurrences in the centralized blockchain infrastructure space, many were claiming that crypto was just a ZIRP phenomenon – that its success was defined by 0% interest rates and excess liquidity sloshing around during the pandemic era.

People were asking themselves, “Must the Fed turn on the printer in order for bitcoin to go up?”

Over the past couple of years, we’ve shared our view that blockchain should be able to trade independently of rising rates – that it has no mathematical connection to rates like how bonds, stocks, and real estate do. We were met with a quite a bit of pushback on that perspective.

As interest rates have risen over the past couple years, blockchain has been able to rally.

![]()

Sincerely,

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[3]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Bringing Programmability To Bitcoin With Stacks Co-Creator Muneeb

A discussion with Muneeb, co-creator of Stacks and CEO at Trust Machines, on how Bitcoin Layer 2s are unlocking a trillion dollars of capital.

Tuesday, April 23, 2024 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Liquid Token Fund Investor Call

Tuesday, April 30, 2024 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Early-Stage Token Fund Investor Call

Thursday, May 9, 2024 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Fund V Launch Call

An overview of Pantera’s latest venture-style fund that offers exposure to the full spectrum of blockchain assets.

Tuesday, May 14, 2024 8:00am PDT / 17:00 CEST / 11:00pm Singapore Standard Time

https://panteracapital.com/future-conference-calls/

The Integration of AI and Web3 Technologies

A discussion of how the integration of AI and blockchain technology has the potential to enhance reasoning, data privacy, and incentivization in AI systems.

Tuesday, May 28, 2024 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PORTFOLIO COMPANY OPEN POSITIONS[4]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Below are open positions that our portfolio companies are actively hiring for:

Omni Network – Senior Solidity Engineer (Remote)

Avantis Labs – Fullstack Engineer (Remote)

M^0 – Senior Solidity Engineer (Remote)

Cega – Product Manager, Smart Contracts (Remote)

Helika – Senior Software Engineer (Canada)

Synfutures – Research Analyst (Remote)

Offchain Labs – Site Reliability Engineer (Remote)

Ondo Finance – Sales Director (Remote)

Alchemy – Software Engineer, Rust (New York or San Francisco)

Starkware – Senior Software Engineer (Netanya, Israel)

0x Labs – Director of Engineering (Remote)

Obol – Senior Protocol Engineer, Go (Remote)

Flashbots – General Counsel (Remote)

Waterfall – Software Engineer (New York)

CoinDCX – Engineering Manager (Remote)

Braavos – Senior Full Stack Engineer (Tel Aviv)

Bitso – Senior Product Manager (Remote)

Pintu – Data Engineer (Jakarta, Hybrid)

VALR – Backend Engineer (Remote)

NEAR – Senior Cryptographer, Zero Knowledge (Remote)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

Chief Operating Officer – New York City

Junior Partner, Venture Strategies – San Francisco

Investment Analyst, Liquid Strategies – New York City

Investor Relations Associate – San Francisco

Junior Accountant – San Juan

Lead Executive Assistant to Founder, Managing Partner – New York City, San Juan, or San Francisco

Executive Assistant to Founder, Managing Partner – San Juan

If you have a passion for blockchain and want to work in New York City, San Francisco, Menlo Park, or San Juan, please follow this link to apply. Some positions can be done remotely.

[1] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

[2]https://timesofindia.indiatimes.com/videos/news/global-trends-cash-and-hawala-are-predominant-methods-of-terror-financing-svetlana-martynova/videoshow/95175377.cms?from=mdr

[3] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[4] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.