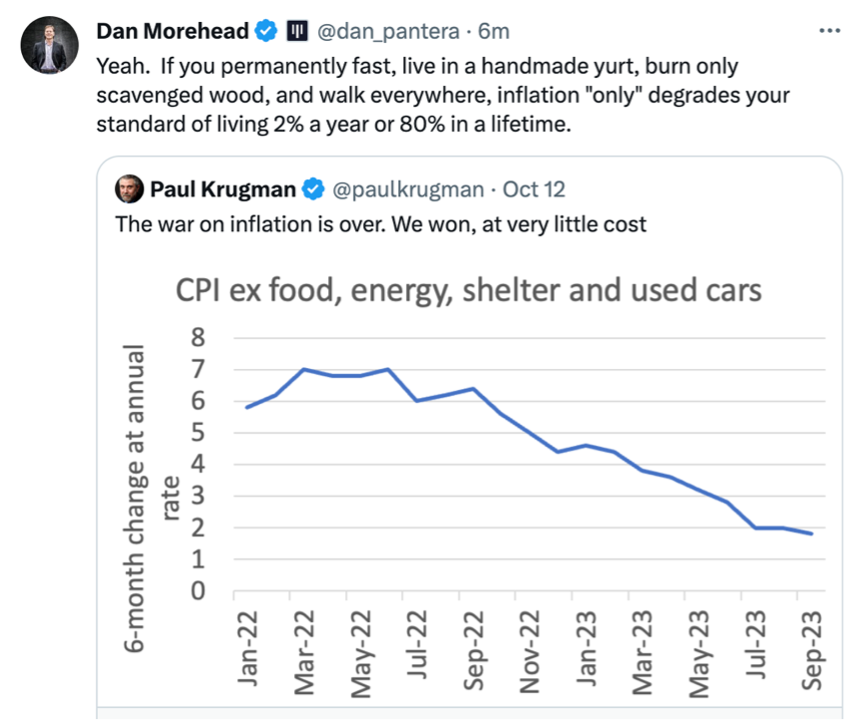

THE INFINITE GIFT THAT IS PAUL KRUGMAN[1]

Next month we will address the staggering self-centeredness of who “we” is in Krugman’s boast that “We won”. For sure, rich old guys like Krugman won; but the majority of Americans did not.

EQUITIES ARE “WILDLY OVERVALUED”

CNBC Squawk Box, October 5, 2023:

Andrew Ross Sorkin: “Treasury yields coming down from fresh 16-year highs yesterday. Our next guest says the yield on the 10-year could hit 5.00%. Joining us right now to talk about that and, of course, cryptocurrency is Dan Morehead, the Founder and Managing Partner of crypto hedge fund, Pantera Capital. Dan was formerly the CFO and Head of Macro Trading at Tiger Management. Good morning.

“Let’s talk crypto in just a second, but let’s talk about bonds because it very well may be that the bond market will have an impact, I imagine, on crypto. But where you really think we’re headed and what do the next twelve months look like to you given what we’ve even seen in the last week?”

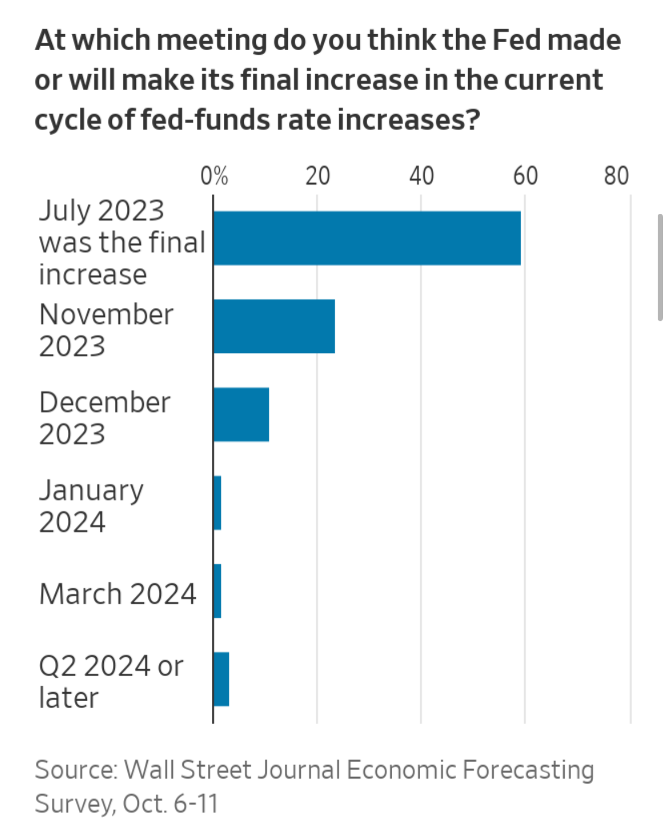

Dan Morehead: “I think we have a failure of imagination. No working-age person has invested in a rising rate environment. I came to Wall Street in the 80’s. It was already six years into falling interest rates. Everything got bailed out by the Fed lowering rates for the last 40 years. We’re in a different regime. Two years ago, when Fed funds were zero and the 10-year was 1.34%, I predicted they would both go to at least 5.00%. We’re here. I think they’re going higher.

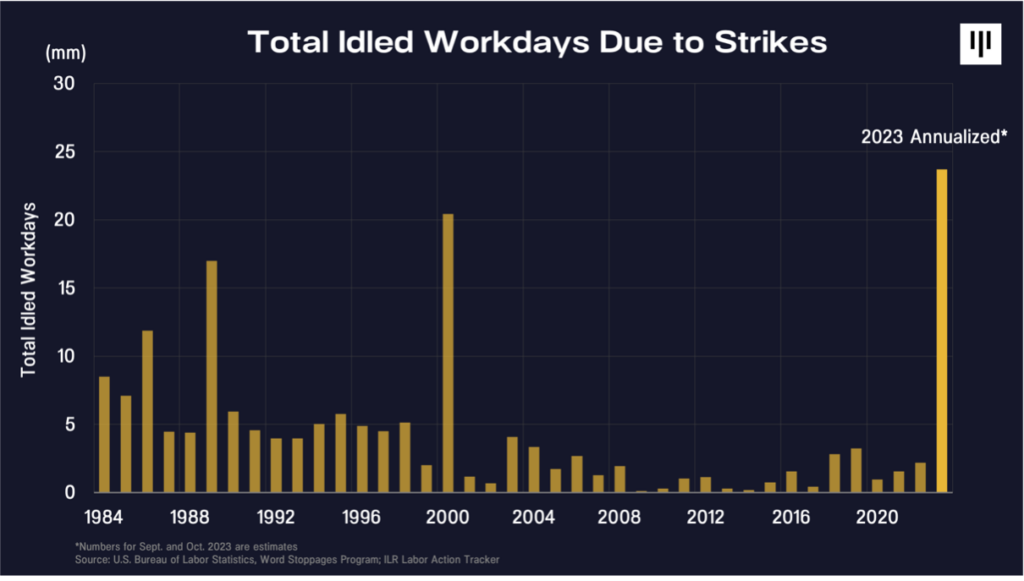

“Wage inflation is double the Fed’s target. We have record labor strikes going on right now. So, the Fed has to keep doing more. The 10-year note is flat to Fed funds. It’s typically at a term premium – 1.15% above the cost of funds.”

Joe Kernen: “Earlier today we had a guy on, Bob Michele, who said that inflation’s at 2.16% (if you take core CPI over the last 3 months and annualize it)… What are you saying inflation is now? What number are you using?”

Dan Morehead: “Core inflation is 4.4%, more than double the quote ‘stable prices’ that the Fed targets.”

Joe Kernen: “He said inflation’s already at a point where rates are too high. That’s what he was saying.”

Dan Morehead: “They’re supposed to keep inflation under 2.0%, and it’s at 4.4% with wage inflation at 4.5% and increasing.”

Andrew Ross Sorkin: ”Right, the question is when you have, a Barry Sterling will tell you that what he would call real inflation he would think is when you really calculate the full thing. He would say we’re already there. And the question is whether you think the Fed either thinks we’re already there or even if you think that’s real.”

Dan Morehead: “At 2%?”

Andrew Ross Sorkin: “Yeah.”

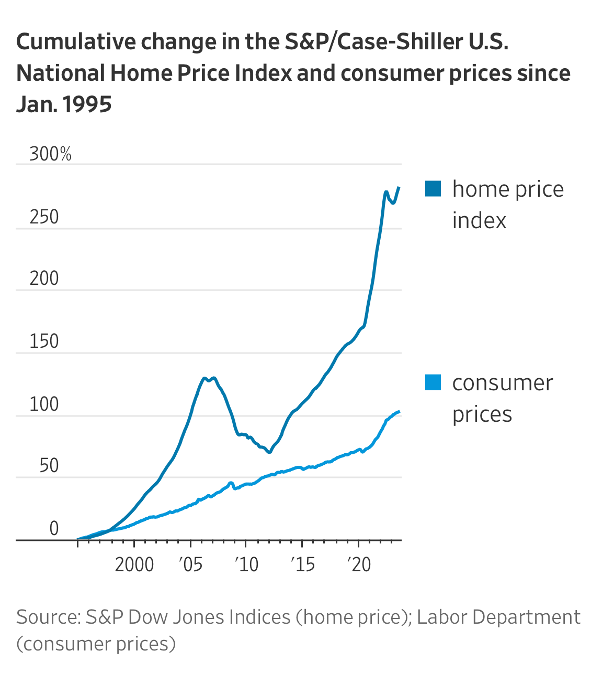

Dan Morehead: “We’re not there. There’s an Owner’s Equivalent Rent measure in inflation. It takes two years to fully pass through. Even if houses stayed stable for the next two years, CPI will still go up 1.1% just because of previous housing increases, according to the Atlanta Fed. There’s still a lot more inflation from two years ago in the pipeline. The S&P/Case-Shiller U.S. National Home Price Index is still hitting new record highs.”

Andrew Ross Sorkin: “So, if you’re right, we’re talking about increased rates, nobody lowering rates in the next 12 months.”

Dan Morehead: “Yes. Maybe for several years. I think that’s what people are having a hard time thinking or getting their heads around – rates could stay up for five years.”

Andrew Ross Sorkin: “If that’s true then equities are wildly overvalued.”

Dan Morehead: “That’s true.”

Joe Kernen: “And you would think bitcoin would?”

Andrew Ross Sorkin: “But then I would think that crypto would be wildly overvalued too.”

Dan Morehead: “Equities are overvalued because the P/E is the same level it was when rates were falling, but now rates are much higher and rising. If you took the 50-year average equity risk premium with a 5.00% 10-year note, equities should be 23% lower than today.”

Rebecca Quick: “Wait, equities should be 23% lower today? Are you talking about the S&P?”

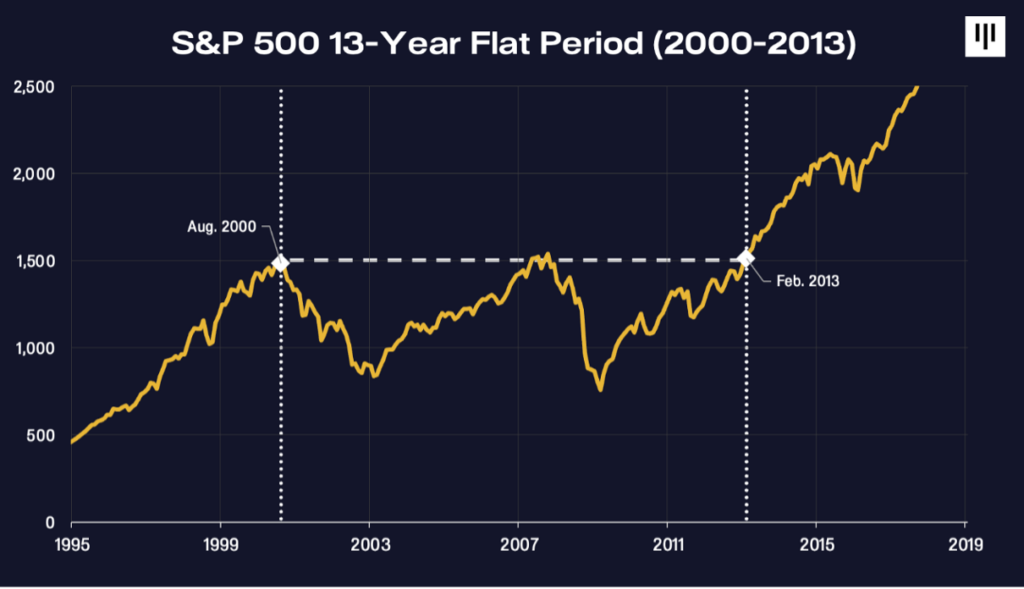

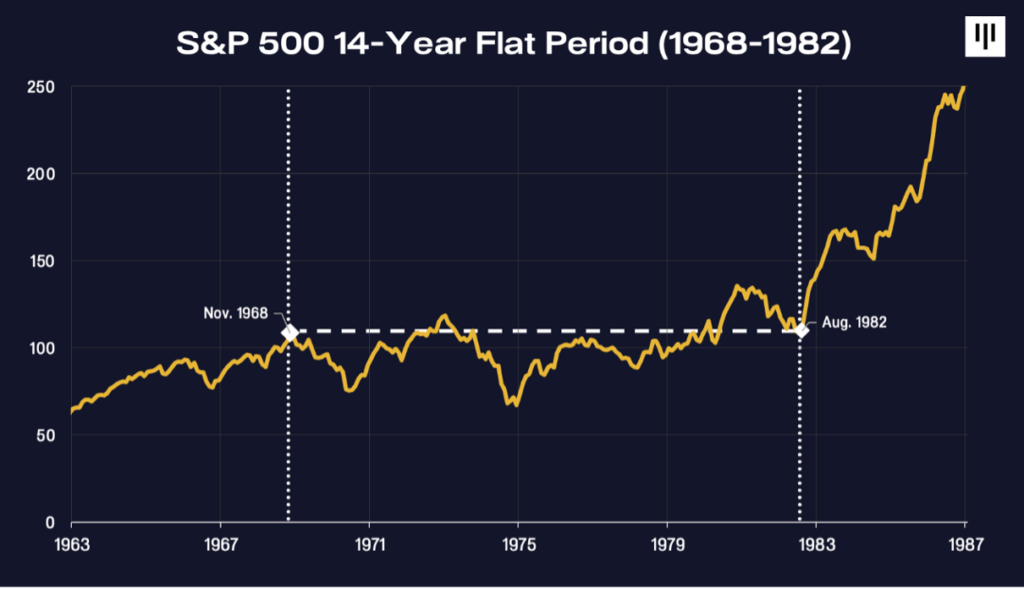

Dan Morehead: “Yes, the S&P. If you used the equity risk premium only in rising rate environments – like now – equities would be 43% lower. I’m not saying -43% is going to happen overnight, but we have to keep in mind there have been two 13-year periods where equities were flat – in the 2000s and in the 70’s, 80’s. We could easily see that again.”

Rebecca Quick: “You think -23% is going to happen and, if not, -43%?”

Dan Morehead: “Yes, I think equities are going to go down for the next few years. That’s why crypto is so relevant because blockchain is not tied to interest rates. That’s a pretty rare feature in an asset class.”

Joe Kernen: “You need the Fed opening the spigots for bitcoin to go up.”

Dan Morehead: “Well, the Fed opening the spigots in 2020 was unambiguously wonderful for anything that had a fixed quantity.”

Andrew Ross Sorkin: “There’s some people today who would say ‘there’s crypto and then there’s bitcoin, and they should actually be completely separated, we shouldn’t even have them on the same screen together’. Do you believe that?”

Dan Morehead: “Bitcoin is the first brand of blockchain. There is Ethereum and other brands of blockchain. Bitcoin has worked for 14 years, 24×7, no downtime. It’s amazing – Facebook goes down, everybody else goes down. We just heard about Clorox getting hacked. Bitcoin’s always worked, never been hacked. It has about 50% of the entire market cap. Other cryptocurrencies are also very important. There’s a project called Arbitrum that’s helping scale blockchains. Ethereum has worked very well. That project did ‘The Merge’ last year. They changed live software for 232 million people and it all worked perfectly. That was the news story but nobody wants to publish good news.”

Rebecca Quick: “If you think that equities could come down 23% or maybe should just based on historic valuations, where do you think bitcoin should be valued?”

Dan Morehead: “That’s a great question. We talk to asset allocators all the time. If you’re thinking put money to work in bonds, I think that’s pretty dangerous. Put money to work in real estate which is coming off all-time highs. Equities, I think, are overvalued. That does leave a couple of asset classes, like real commodities and blockchain. Blockchain is a trillion-dollar asset class. Most institutions have essentially zero exposure right now. They should dial it up to a couple percent.”

Rebecca Quick: “Which gets bitcoin itself to what level? If it’s $27,700 now.”

Dan Morehead: “Bitcoin has a 14-year trend growth of 145% a year. That’s my generic forecast – it will re-assert its trend and will more than double every year.”

Andrew Ross Sorkin: “Every year it will more than double?”

Dan Morehead: “On average, it’s been doing that for 14 years.”

Link to interview here.

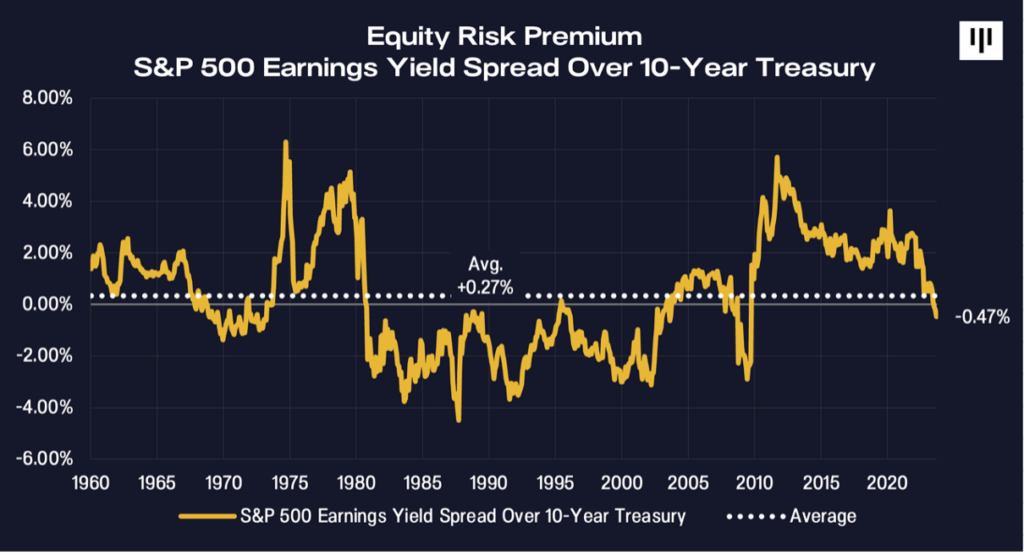

S&P 500 MASSIVELY OVER-VALUED[2]

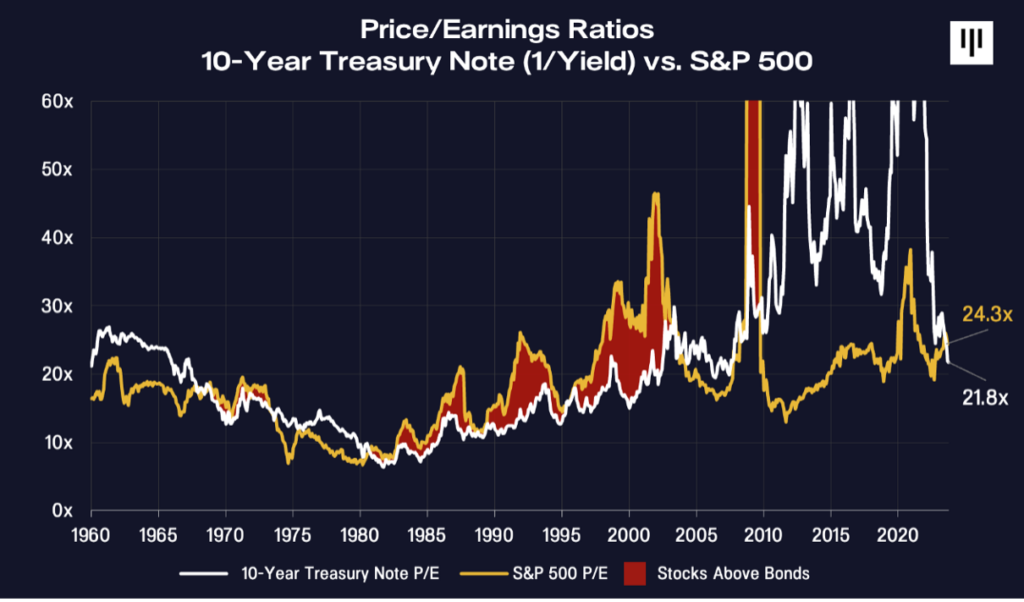

Stock market investors are used to seeing the Price/Earnings (P/E) ratio for stocks. In recent decades it has been typically something like 20 times earnings.

I grew up in the bond markets, so I feel that it’s easier to relate to as a yield. If you invert the P/E ratio you get the earnings yield on equities. Earnings yield is the P/E upside down.

The earnings yield has come down with the secular decline in yields generally. Yields came down on bonds, real estate cap rates, equities, everything.

Typically an investor requires an equity risk premium to invest in equities instead of the certain cashflows in a government bond. The massive, secular rally in yields confused that for a while. Investors bought stocks often at a lower yield than bonds. For much of the 80s and 90s, the earnings yield on stocks was actually below bonds (the red area in the graph below). In hindsight that was rational as declining rates kept producing stock equity price returns.

Since the mid-2000s, equity risk premium has been where it normally should – positive.

For the last twelve years, equities were arguably very cheap. There were many times in the past decade that equity earnings yield was more than 4.00% above bonds.

As we’ve argued for two years, bonds were very over-valued. Bonds are now roughly fair value. It’s equities that are now massively overvalued. The earnings yield on equities is below that of treasuries.

The 50-year average equity risk premium has been +0.27%.

If the 10-year treasury goes to 5.00% and the earnings yield reverts to its 50-year average spread over treasuries, equities would fall 23%. That is my central forecast.

Another possible outcome is a very long period of flat prices. There are two periods of roughly 13 years that stocks didn’t go up. That’s kind of like my “best case scenario”.

S&P 500 FLAT PERIODS[3]

And then to complete the scenarios, I can definitely see a chance that equities revert to the average equity risk premium we’ve experienced in environments like this – rising rates. Those two periods averaged +2.25% above bond yields. If equities repriced to that, they would fall -43%.

My central forecast is in gold below.

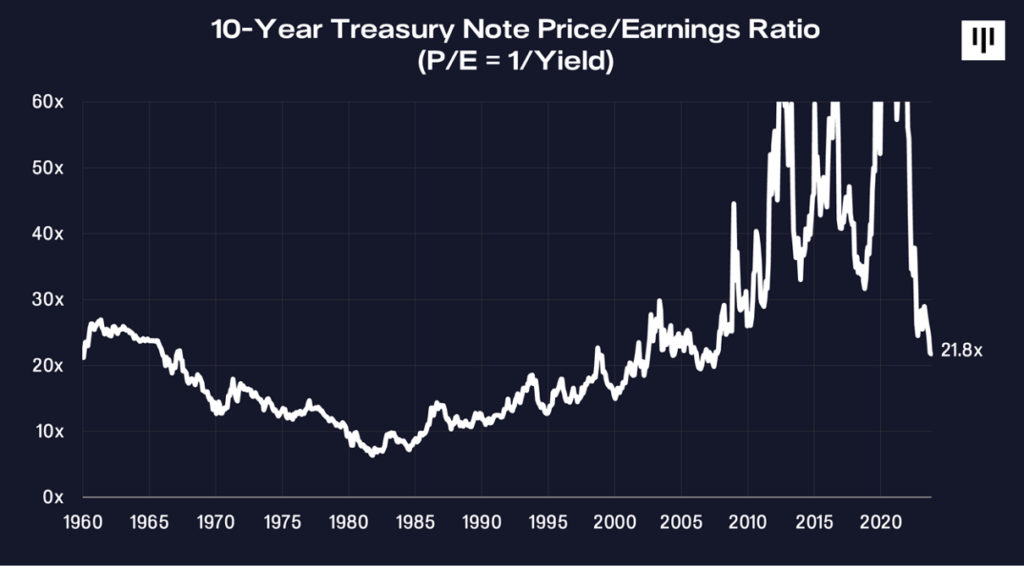

SHOWN IN P/E TERMS[4]

I like yields but I know most stock investors like P/Es. Here are the graphics above inverted into Price/Earnings terms – showing 10-year treasury bonds price to earnings ratio too.

This has been an unusual time. Rates have been falling for decades and the Fed always just cuts them further if something bad happens to stock prices.

That’s over now.

Here’s how the Price Earnings ratio has looked over decades.

The price earnings multiple was a third of today’s level in the past. It used to be easy to dismiss that as “Oh, but those were the 80’s. Totally different.”

Not really. We’re re-entering the 80’s.

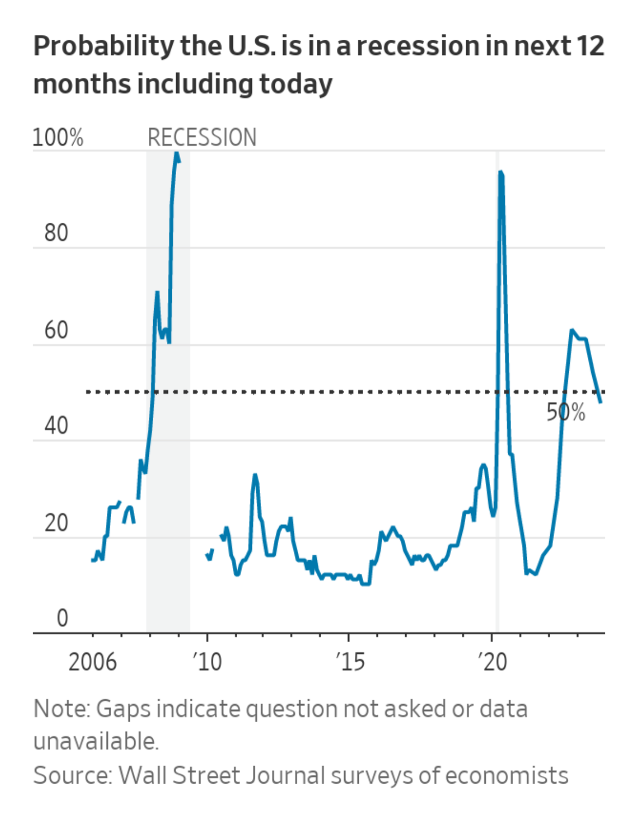

WHAT RECESSION?

For years all these pundits have been talking about recession. The majority of economists recently have been calling for a recession.

What recession?

Do pundits work exclusively now on Zoom up in their ivory towers?

Have they been to an airport recently? Nobody that’s tried to get through record crowds in the real world could even dream of forecasting a recession.

It’s boom time everywhere you look. The median home price still hitting all-time highs. Too much paper money chasing too few goods.

The median home in the entire United States inflated +46% from February 2020 to September 2023.

And still the majority of economists call the next Fed move to be an easing?!?!

HOUSING

Paul Krugman may live in a handmade yurt, but for the rest of society, housing is the single largest expense. The Fed manipulated the mortgage market so severely that the price of shelter rose 2.5x as much as the general inflation index (which is itself 32% housing).

CREATING INFLATION

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

– Milton Friedman

Reducing inflation is hard work. It takes years of coordinated policy effort, buy-in from various groups, etc. A shared goal of reducing can be achieved, but it’s a grind.

On the flip side, if you want to create inflation it’s very easy. As Congress and the Fed showed in the past three years – BOOM! 18.6% inflation in everything since SARS-2 washed up on our shores.

Uh, yup. Congress printed 4.8 trillion new pieces of paper money and mailed them to literally EVERY American.

Creating inflation is particularly easy if you’re the President. All you have to do is somehow acquire a megaphone and in a move never seen in U.S. history – the President of the United States of America walking a union picket line – demand more expensive cars.

BOOM! 25% increase in the labor cost of building a car that will raise the price of all Ford vehicles by $875. That was easy – only took two months. Those contracts last four and a half years.

I hope Krugman walks everywhere. The rest of us can’t just ignore car prices. After shelter, it’s the next largest purchase most people make.

You don’t need a PhD in Economic History to remember how this movie ends. The Big Three controlled 91% of the U.S. auto market when I was a kid. The UAW has gotten “The Big Three” down to 6% of the market capitalization of the global car industry. A generation from now, probably zero. Cars made by free-market workers are replacing The Big Three at an accelerating rate. But that doesn’t mean the UAW’s stagflationary tactics won’t negatively impact the economy during the next decade or two.

It is ironic that Ronald Reagan was the only lifetime union member in presidential history.

Speaking of past presidents, it’s important to mention that President Carter is on hospice care. He turned 99 recently. He’s widely acclaimed to have been the best ex-president in American history.

“Once he was free of the circus of politics, Carter could be who he really was — a profoundly decent man who tried to live a life of service to others. Carter could have cashed in or become a political kingmaker or simply played golf all day. Instead, he devoted his time to nonprofits like Habitat for Humanity. He established his own nonprofit, the Carter Center, which worked to improve the lives of people in the most impoverished and unstable parts of the world. The Carter Center helped to ensure democracy, peace, and health in places that the Davos crowd didn’t care much about. Carter was humble and true to his roots — he lived his entire ex-presidency in the same modest ranch house he built in 1961.”

– George Dillard, “Who Were the Best Ex-Presidents?” March 2nd, 2023

Zbigniew Brzezinski, the Polish-American diplomat who served as President Jimmy Carter’s National Security Advisor, had a great line, which I have to paraphrase as I can’t easily find it:

“Imagine how the world would be different if Karol Wojtyla had been president and Jimmy Carter pope.”

Jimmy Carter would have made a wonderful pope.

IT’S THE 80s

We’re enmeshed in the 80’s because we’re reliving it. For two years we’ve been forecasting a return to the 80’s.

Record labor outages due to union strikes.

Largest days lost to union strikes since the 80s.

Longest UAW strike ever – the previous record from September 22-November 2, 1982.

“If approved by workers, the deal marks the union’s biggest contract gains in decades and a resolution to Ford’s first UAW national strike in more than 40 years [Editor’s note: a.k.a. The 80s].”

– Wall Street Journal, “Ford Reaches Tentative Labor Deal With UAW Six Weeks Into Historic Strike”, October 25, 2023

![]()

PAYPAL 1.0 :: THE $37 BILLION STABLECOIN

By Jeff Lewis, Product Manager, Hedge Funds

The original promise of Bitcoin, a “peer-to-peer electronic cash system”, was, first and foremost, to enable fast, cheap transfers of value without third-party involvement.

A subsidiary benefit of Bitcoin was that it was supposed to be a hedge against inflation and currency devaluation due to its limited supply. Governments continuously print money, eroding the value of their citizens’ hard-earned savings. Holding bitcoin was expected to solve that problem as well. Bitcoin has certainly been a roaring success with mass adoption. There are 220 million bitcoin holders. The blockchain has processed 900 million on-chain transactions and there have been 25 versions of the Bitcoin Core software, all without a CTO or central authority. Since its inception, the Bitcoin blockchain has proven to be highly secure, with no successful attacks on the protocol itself, and it has maintained near 100% uptime. We have witnessed a remarkably successful experiment in decentralization.

Governments have in turn interpreted this mass adoption of Bitcoin as a potential threat to their sovereignty. Some United States officials even fear that Bitcoin could imperil the dollar’s status as the world’s reserve currency.

Those fears now appear to have been overblown, because Bitcoin is arguably not a very good replacement for money due to its lack of speed and scalability compared to legacy systems. The Bitcoin blockchain is impressive, but it’s not a very sophisticated software platform. Consequently, Ethereum was created to address Bitcoin’s shortcomings.

We believe Ethereum has found product market fit, emerging as the leading platform on which decentralized applications are built. Ethereum has become the programmable decentralized system that Bitcoin alone could not be, giving birth to a crypto economy of NFTs, blockchain-based games, Web3 applications, and Decentralized Finance, all powered by the reserve currency of this new crypto realm, ethereum.

Unfortunately, ethereum is almost as volatile as bitcoin, making it unsuitable as a stable currency. The NFT market, which had the potential to revolutionize the art and collectibles world, has devolved into an ethereum derivative where the marketplace’s value is more influenced by ethereum’s price than the underlying utility of the products themselves.

So, while Bitcoin and Ethereum have been wildly successful, they have not fulfilled the original expectations we had for crypto.

The big hopes for crypto were that it would:

– Enable peer-to-peer transfers of value;

– Shield people from their unstable currencies; and

– Free users from having to rely on or trust service providers.

The big drawbacks for crypto were that it would:

– Pose a threat to the dollar and other fiat currencies;

– Empower bad actors; and

– Never achieve mass adoption.

Stablecoins are about to fulfill those hopes and alleviate those fears.

Enter the Stablecoin

Transfers of value – stablecoins are digital cash, free from the volatility of bitcoin and ethereum. Users can comfortably use them to pay for goods and services, from their morning coffee to their next house.

Currency devaluation – U.S. money-market yields track inflation. Most of us keep our money in banks for easy access and so that it is readily available to be transferred. However, when we move it to yield-bearing investments like money-market funds or mutual funds, there’s a lot of friction and delay. As a result, most of our money ends up earning less than it should. Once we can hold something instantly transferable that earns a market return, our wealth will be less susceptible to inflation. We are already seeing international banks offering U.S. dollar stablecoins with yield that enable their clients to transfer whatever savings they have both quickly and cheaply out of local currency.

Trust problem – Reagan once famously said of the Soviets when he was negotiating with them: “Trust. But verify.” What he really meant was: you can’t trust anything that you can’t verify. The beauty of the coming stablecoin revolution is that whether we are using a tokenized asset as a means of exchange, or a stablecoin with tokenized visible assets, we will no longer have to trust that the banker or the stablecoin provider is actually doing what he is supposed to do. We will be able to see the solvency for ourselves.

Threat to the dollar – A vibrant, regulated stablecoin system actually boosts demand for the dollar and U.S. Treasuries. Rather than competing with fiat, it perfects it by attaching yield to it.

Bad actors – Fully collateralized and transparent balance sheets are the antidote to fraud and mismanagement by sponsors or managers. KYC/AML in a new system will prevent stablecoins from being used to circumvent government regulations.

Mass adoption – Here’s where the story of PayPal comes in. Consumers have already widely adopted stablecoins, even if they don’t realize it.

Most U.S. consumers are unfamiliar with stablecoins unless they trade crypto tokens and use stablecoins to pay for them.

Over 435 million consumers use PayPal. As of June 30, 2023, according to the company’s 10-Q, digital customer accounts (i.e. wallets) held over $37 billion in assets on the private, centralized PayPal ledger.

What is PayPal? It’s a private ledger stablecoin. It does exactly what stablecoins do, or at least should do. One can transfer digital ledger entries worth one dollar to merchants and peers at low cost in an instant, all over the world. It’s not surprising that PayPal’s outstanding balance is 50% larger than Circle’s USDC stablecoin because PayPal appeals to the masses, not just the crypto community.

Just like most stablecoins historically, PayPal pays no interest. Any consideration by the company of gaining market share by adding a yield was probably tempered by fears of raising the ire of bank or securities regulators.

The next step, a “PayPal 2.0” that is trustless, transparent, and yield-bearing is on the horizon. That stablecoin is coming because as soon as regulations are clear, market conditions will force providers to offer money market yields to be competitive. We are already witnessing an explosion in the stablecoin market of coins with yields generated by underlying money-market investments as well as the tokenization of the money-market itself.

The financial industry knows this future is around the corner. Franklin Templeton recently introduced “Benji”, a tokenized money market fund. Both JP Morgan and Citi have fully operational private blockchains enabling instant, frictionless transactions between bank customers. PayPal itself has introduced a stablecoin with Paxos, PYUSD. Pantera portfolio company Ondo has introduced USDY, a tokenized note backed by U.S. Treasuries and bank deposits. Arcoin, a fully KYC-AML compliant tokenized money fund, can be transferred peer-to-peer seamlessly.

“PayPal USD (PYUSD) is fully backed by U.S. dollar deposits, short-term U.S. treasuries and similar cash equivalents, and can be redeemed 1:1 for U.S. dollars….

PayPal USD is designed to reduce friction for in-experience payments in virtual environments, facilitate fast transfers of value to support friends and family, send remittances or conduct international payments, enable direct flows to developers and creators, and foster the continued expansion into digital assets by the largest brands in the world.”

– PayPal Stablecoin Press Release, Aug. 7, 2023

Whether the market winner is PayPal’s entry or something else, PayPal 2.0 is coming. Why do we use PayPal instead of banks? Because it is faster and easier to use. Well, what if PayPal 2.0 has a market yield and is verifiably, visibly safe? We get the first true mass-adoption of a token AND we unleash the next great wave of growth in the entire crypto ecosystem, as consumers can focus on the value of the products and services within the crypto ecosystem instead of the tokens issued by those projects.

![]()

PAUL JONES LIKES GOLD AND DIGITAL GOLD

Legendary macro investor Paul Jones recently doubled down on his favorable stance on Bitcoin during his interview on CNBC Squawk Box.

Andrew Ross Sorkin: “I said I wanted to talk about Robinhood, but I also just looked on the screen behind you, and I saw the price of Bitcoin. I know every time we’ve spoken, you’ve had a take on Bitcoin. Do you have a new take? Still holding?”

Paul Tudor Jones: “I think now the Barbarous relics and I would lump gold and Bitcoin together, I think they probably take on a larger percentage of your portfolio than historically they would, because we’re going to go through both a challenging political time here in the United States, and we’ve obviously got a geopolitical situation.”

Andrew Ross Sorkin: “But high interest rates were supposed to be the thing that was actually going to be unhelpful to Bitcoin?”

Paul Tudor Jones: “Well, I think on a relative basis, look what’s happened to gold. It actually has been – clearly, it suppressed it. So you know that more likely than not, we’re going to go into recession. There’s some pretty clear cut recession trades. The easiest are the yield curve gets really steep. Term premium goes into the backends of debt markets, into 30-year, and 10-year, and 7-year paper. The stock market typically, right before recession, declines about 12%. That’s probably going to happen at some point from some level. You look at the big shorts and gold, more likely than not in a recession, the market’s typically really long assets like Bitcoin and gold. So there’s probably a $40 billion worth of buying that has to come into gold at some point between now and if that recession actually occurs. I like Bitcoin and I like gold.”

![]()

REGULATORY UPDATE

By Andrew Harris, Senior Platform Associate

Our Platform Team publishes a newsletter covering developments in the regulatory landscape for crypto. If you’re interested in receiving this newsletter, please register your interest in regulation using this form and include any other topics you’d like to learn more about.

The most-recent edition dives into key recent actions from the SEC and CFTC, as well as an update on ongoing court battles. Below is a summary of key takeaways:

1. Following a decision in the SEC’s favor in its case against Terraform, the federal court for the Southern District of New York is now split on the treatment of crypto assets as securities. Particularly, the justices on the court have released conflicting opinions in the Ripple and Terra cases as to whether and when on-exchange transactions in crypto assets amount to offers and sales of investment contracts. Until the Second Circuit resolves the tension between these two rulings, the Ripple ruling appears to have very limited precedential value and as a result, there will continue to be short-term regulatory confusion for the crypto industry.

2. The SEC announced its first two public actions against NFT issuers under the federal securities laws. Questions still remain if NFTs that are marketed appropriately and do not present some key characteristics that the SEC has taken issue with can be treated as non-security collectibles instead of securities.

3. Bittrex and its former CEO settled charges with the SEC. The settlement may play a role in and set precedent for any potential settlements with Coinbase and/or Binance, who are still litigating with the SEC.

4. The SEC charged Richard Heart, Hex, PulseChain, and PulseX, with conducting unregistered offerings of crypto asset securities that raised more than $1 billion in crypto assets from investors. The SEC’s complaint directly mentions that HEX transactions often occurred on Uniswap and that Heart described PulseX as a fork of Uniswap’s so-called decentralized trading platform, perhaps signaling an eventual action against Uniswap.

5. Uniswap Labs and several related parties found victory in the Southern District of New York, with an attempted class action against the DeFi exchange getting dismissed.. The plaintiffs claimed that they lost money after investing in various “scam tokens” that were issued and traded on the Uniswap Protocol trading platform. The ruling is a major victory for Uniswap, and potentially for DeFi exchanges. It would be premature to celebrate the ruling as establishing a clear path forward for DeFi as the judge noted that this was a “case of first impression”, and other courts, and even other judges in the SDNY might disagree with the reasoning. Further, this was a class action brought by private litigants, and not an SEC enforcement action. In any future enforcement action, the SEC may bring other facts and data relating to Uniswap, or to DeFi more generally, that could cause a Federal court to see things differently. Finally, it is not clear whether and to what extent, the findings made with respect to the Uniswap Protocol can be generalized to clearly apply to other DeFi systems.

![]()

PANTERA COMPENSATION SURVEY

By Nick Zurick, Head of Talent, and Enzo Bachaumard, Content Associate

Web3 is an ever-evolving industry where new skill sets and job functions are continuously emerging. In this space, talent has become one of the biggest bottlenecks to growth. At Pantera, we believe that more transparency can help drive new talent to the ecosystem, furthering the innovation of technologies that we believe will revolutionize financial markets and empower individuals economically around the globe.

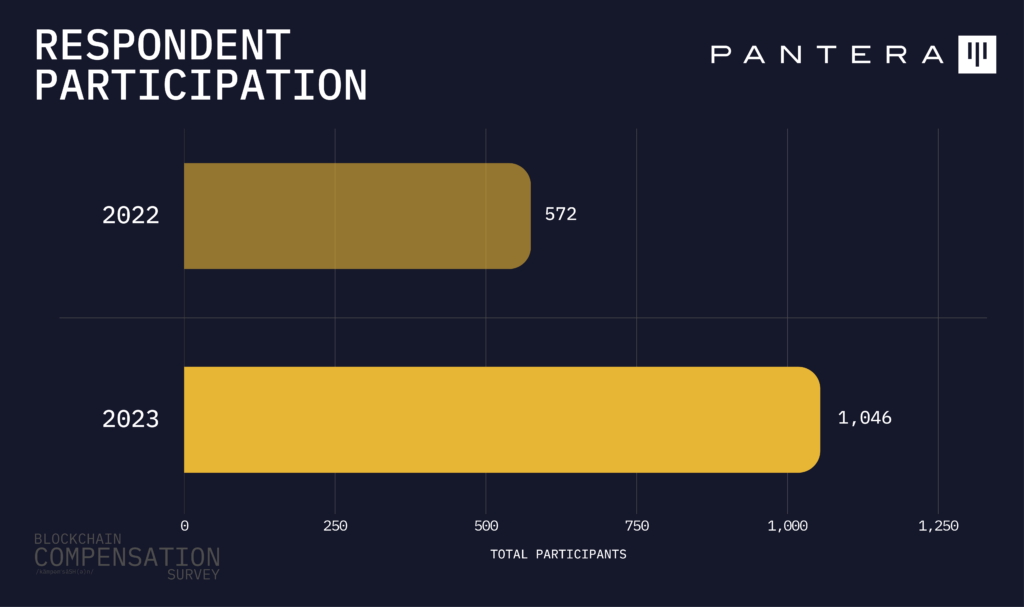

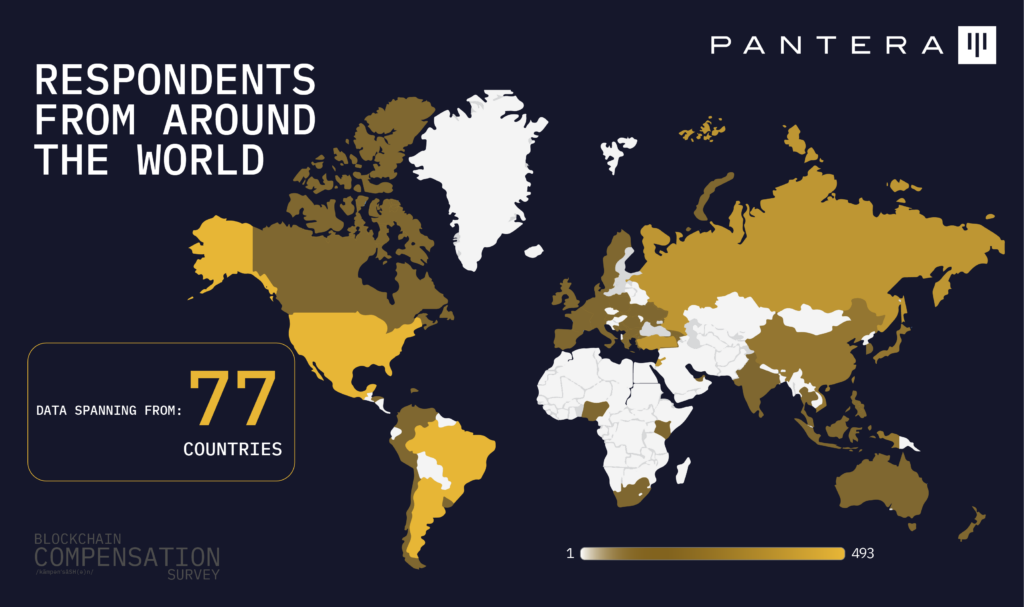

Nine months ago, Pantera successfully launched its first compensation survey. Our goal with these studies is to create more transparency around compensation in the crypto ecosystem. For our second survey, we gave ourselves a lofty goal. We set out to build the largest repository of crypto compensation data in the industry. Now with over 1,600 respondents, we believe we have achieved that goal. After doing the analysis, we want to share our findings with you.

About the Respondents

Our data set contains over 1,600 responses of which 99% of respondents were professionals within the crypto community. This year we saw a 55% increase in responses from 2022 – we are grateful to everyone who participated.

The data we have gathered spans across 77 unique countries. The United States, United Kingdom, and Brazil are just a few of the top five countries where our participants reside.

Access the full report here:

![]()

WALL OF WHITE PAPER

The wall of paper money which washed over us, the housing market, consumer prices, etc. is disheartening. Time to reflect on an improved money – bitcoin.

Today is Bitcoin’s 15th birthday.

I believe Nakamoto-san’s white paper will change the world – in so many wonderful ways: financial inclusion, property rights, migrants no longer working an entire month just to pay their remittance company, refugee identity/direct aid transfers, etc.

Blockchain democratizes access to financial assets.

Blockchain technology devolves power from centralized and all-too-fallible bureaucracies, returning it back to the people.

The mind-blowing bit is the revolution was sparked by just 3,192 words.

Bitcoin: A Peer-To-Peer Electronic Cash System easily fits on a wall of our NYC office.

To share a sense of how distilled the genius in the paper is, we’ve shown how few words it took to convey this powerful idea to the world. The word count of the bitcoin white paper is shown below in relation to a selection of globally-influential texts:

My favorite – it took Satoshi only 5% as many words to completely describe the entirety of a project which has already impacted 220 million lives as were used in writing Blockchain for Dummies.

Go figure.

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[5]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Early-Stage Token Fund Investor Call

Tuesday, November 7, 2023 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Investing in Blockchain Conference Call

A discussion of the blockchain opportunity set and how Pantera’s funds are structured to capture value in the current and evolving market environment.

Tuesday, January 16, 2024 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PORTFOLIO COMPANY OPEN POSITIONS[6]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Below are open positions that our portfolio companies are actively hiring for:

-

Omni Network – Senior Blockchain Engineer (Remote)

-

Injective Labs – VP of Engineering (New York / Remote)

-

Cega – Software Engineer, Solidity (Remote)

-

Offchain Labs – Product Manager (Remote)

-

Ondo Finance – Sales Director (Remote)

-

Alchemy – Engineering Manager (New York or San Francisco)

-

StarkWare – Senior Software Engineer (Netanya, Israel)

-

Rarify – Head of Developer Relations (Remote)

-

Livepeer – Growth Marketer (Remote)

-

0x Labs – Site Reliability Engineer (Remote)

-

Obol – Technical Recruiter (Barcelona, Remote)

-

Flashbots – Engineering Manager (Remote)

-

Waterfall – Software Engineer (New York)

-

CoinDCX – Engineering Manager (Remote)

-

Brine – Infrastructure Engineer (Bengaluru, Karnataka, India)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

IMPORTANT DISCLOSURES

[1] Important Disclosures – Certain Sections of this Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically marked sections of this this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial or other advice or recommendation.

[2] Source: Data provided by Yahoo! Finance as of Oct 2023

[3] Source: Data provided by Yahoo! Finance as of Oct 2023

[4] Source: Data provided by Yahoo! Finance as of Oct 2023

[5] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[6] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.