DAT VALUE CREATION[1]

By Cosmo Jiang, General Partner, and Erik Lowe, Head of Content

Our investment thesis for Digital Asset Treasury companies (DATs) is grounded in a simple premise:

DATs can generate yield to grow net asset value per share, resulting in more underlying token ownership over time than just holding spot.

Therefore, owning a DAT could offer higher return potential compared to holding tokens directly or through an ETF.

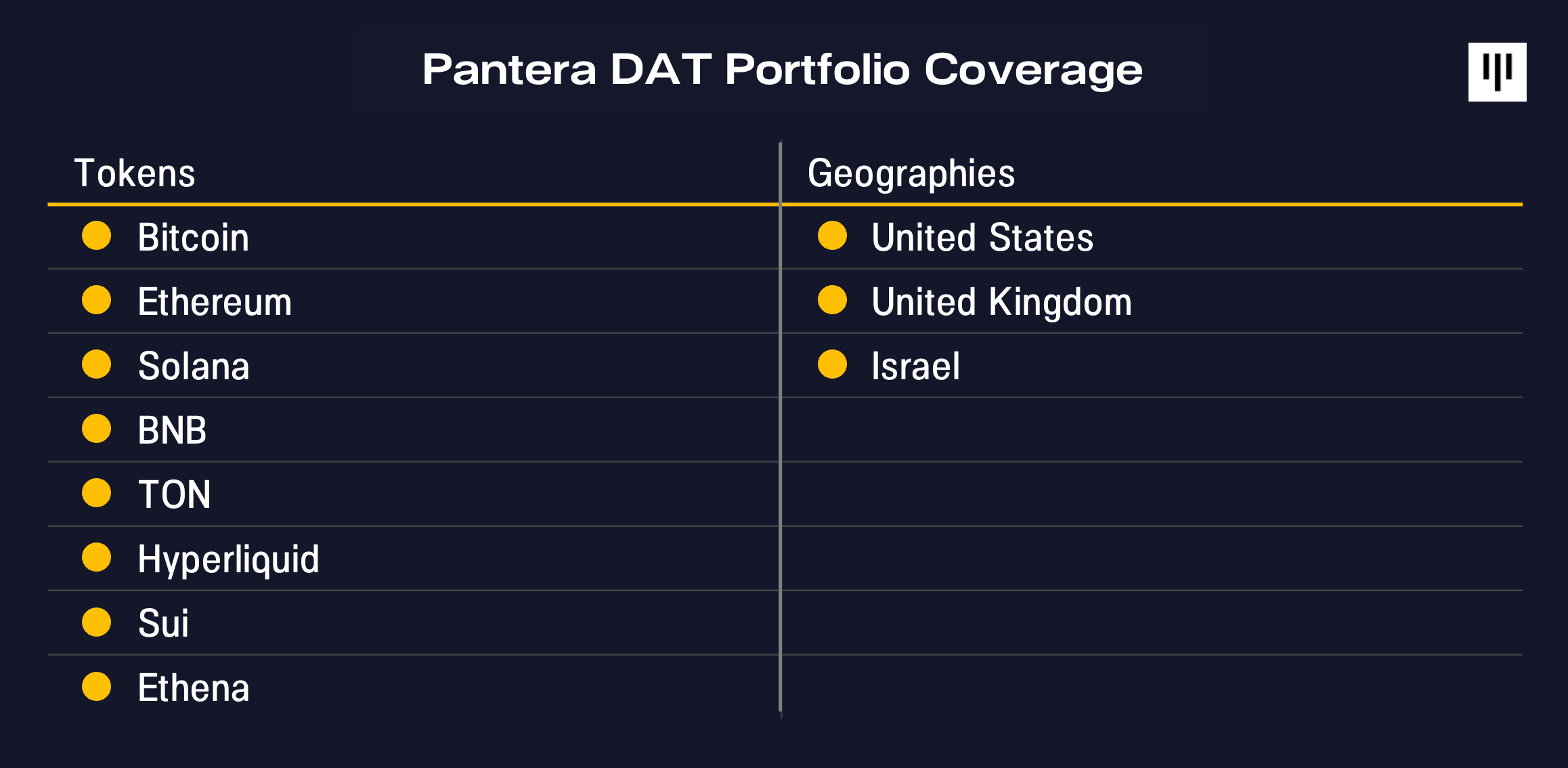

Pantera has deployed over $300 million in DATs across various tokens and geographies. These DATs are taking advantage of their unique situations to employ strategies to grow their digital asset holdings in a per-share accretive way. Below is a snapshot of our DAT portfolio coverage.

BitMine Immersion (BMNR), the first investment out of Pantera DAT Fund, exemplifies a company with a clear strategic roadmap and the leadership to execute it. As Chairman, Tom Lee of Fundstrat has laid out BitMine’s long-term vision of acquiring 5% of total ETH supply – what they call “The Alchemy of 5%”. We think it is useful to walk through BMNR as a case study of the value creation of a DAT that is executing at a high level.

BitMine (BMNR) Case Study

Since BitMine launched their treasury strategy, they have become the largest ETH treasury and the third largest DAT globally (behind Strategy and XXI), holding a total of 1,150,263 ETH, worth $4.9 billion (as of August 10, 2025). BMNR is also the 25th most liquid stock in the US, trading $2.2 billion per day (five-day trailing average basis as of August 8, 2025).

The Case for Ethereum

The most important element of a DAT’s success is the long-term investment merit of the underlying token. BitMine’s DAT is grounded in the thesis that Ethereum will be one of the biggest macro trends for the next decade as Wall Street moves onchain. As we wrote in last month’s letter, The Great Onchain Migration is underway as innovations in tokenization and the growing importance of stablecoins are unfolding. $25 billion in real-world assets now exist on public blockchains – this is on top of $260 billion in stablecoins, which are collectively now the 17th largest holder of US treasuries.

“Stablecoins have become the ChatGPT story of crypto.”

– Tom Lee, Chairman of BitMine, Pantera DAT Call, July 2, 2025

Most of this activity is occurring on Ethereum, positioning ETH to benefit from rising demand for blockspace. And as financial institutions increasingly rely on Ethereum’s security to support their operations, they’ll be incentivized to participate in its proof-of-stake network – driving demand for even further ETH accumulation.

Growing ETH Per Share (“EPS”)

After establishing the investment merit of the underlying token, a DAT’s business model is maximizing its token ownership on a per share basis. There are a few main ways to grow tokens per share:

1. Issue stock at a premium to the token net asset value (“NAV”) per share.

2. Issue convertible bonds and other equity-linked securities to monetize the volatility embedded in both the stock and the underlying token.

3. Generate staking rewards, DeFi yield, and other operating income to acquire more tokens. Note that this is an additional lever that ETH and other smart-contract token DATs have that the original bitcoin DATs, including Strategy, did not.

4. Acquire another DAT that is trading close to or below NAV.

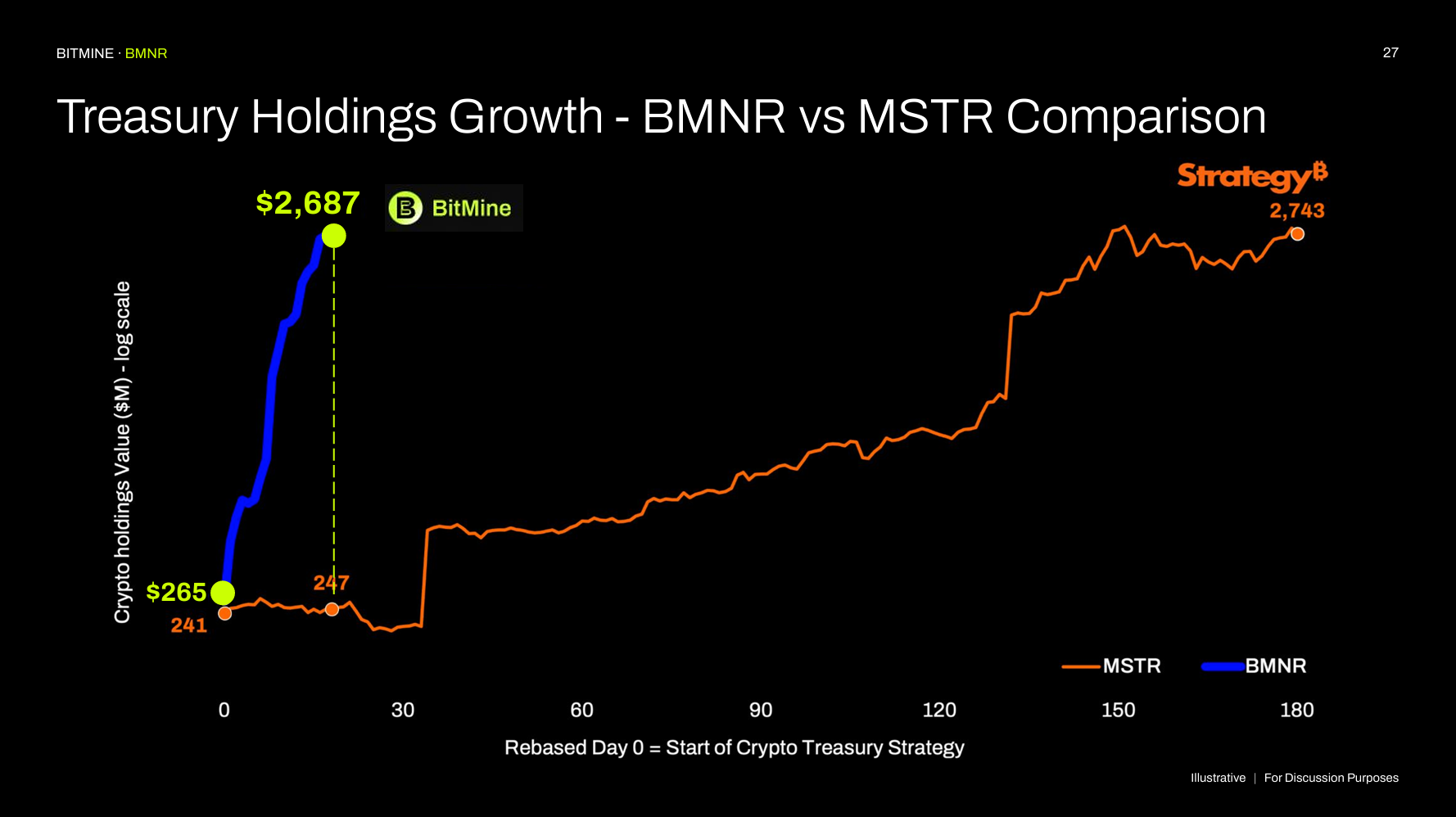

On this count, BitMine has grown its ETH per share (coincidentally, “EPS”) at an impressive rate in its first month since launching its ETH treasury strategy, trouncing that of other DATs. BitMine has accumulated more ETH in its first month than Strategy (formerly MicroStrategy) did in its first six months executing the strategy.

BitMine has primarily grown EPS by issuing stock and generating staking rewards, and we believe BitMine will likely expand its menu to issue convertible debt and other instruments soon.

Source: BitMine Corporate Presentation, July 27, 2025

Value Creation in Action

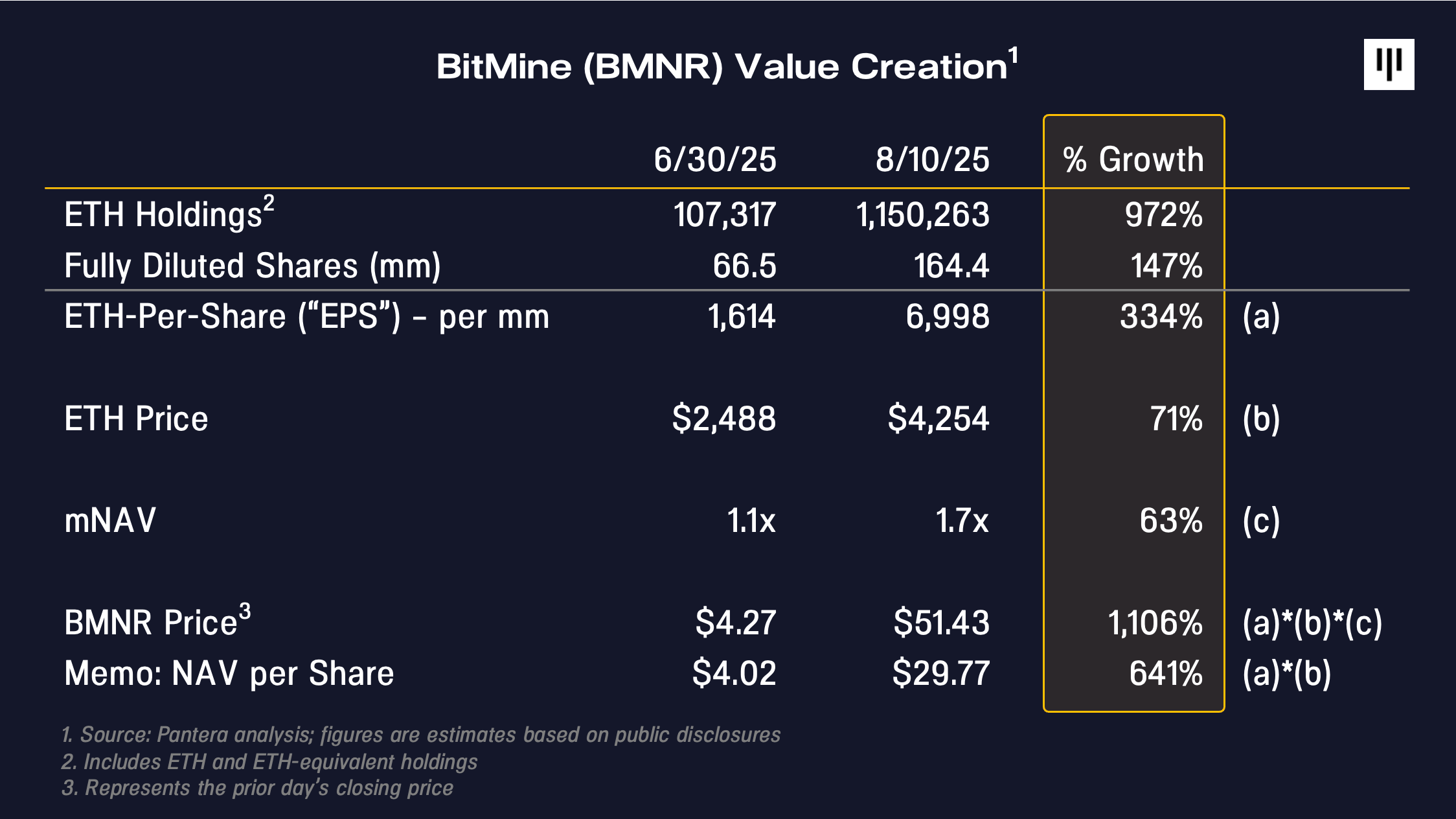

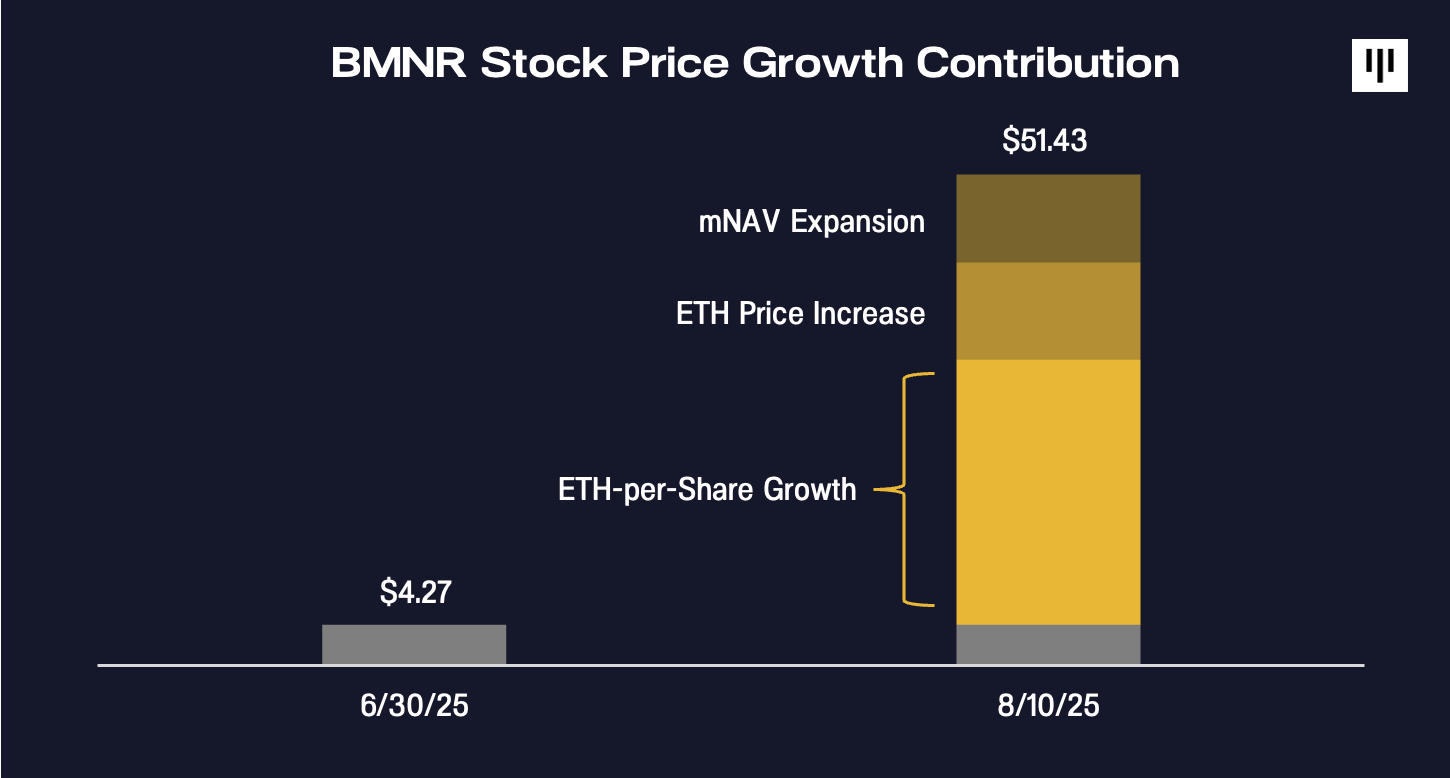

A DAT’s price can be broken down as the product of three things: (a) tokens per share, (b) underlying token price, and (c) multiple of NAV (“mNAV”).

At the end of June, BMNR traded at $4.27 per share, roughly 1.1x its $4 NAV/share pro forma for its initial DAT capital raise. Just over a month later the stock closed at $51, or about 1.7x its estimated $30 NAV/share. This represents a 1,100% price increase in just over a month, with (a) EPS growth of ~330% contributing ~60% of that increase, (b) ETH price increase from $2.5k to $4.3k contributing ~20% of that increase, and (c) mNAV expansion to 1.7x contributing ~20% of that increase.

That means the vast majority of BMNR’s stock price appreciation was fueled by an increase in underlying ETH-per-share (EPS), the core engine within management’s control that separates a DAT from just owning spot.

The third factor we haven’t examined yet above is mNAV. Naturally, one might ask: why would someone buy a DAT at a NAV premium? I find it useful here to make an analogy to balance-sheet-based financial businesses, including banks. Banks seek to generate yield on their assets, and investors reward a valuation premium to those they believe can sustainably generate yield above their cost of capital. The highest quality banks trade at a premium to NAV (or book value), such as JPM at >2x. Similarly, investors may choose to value a DAT at a premium to NAV if they believe it can sustainably grow NAV per share. We believe BMNR’s ~640% month-over-month growth in NAV per share justifies an mNAV premium.

BitMine’s ability to sustainably execute on its strategy will play out over time, and inevitably there will be challenges along the way. BitMine’s management team and track record to date have already attracted backing from traditional finance institutional heavyweights including Stan Druckenmiller, Bill Miller, and ARK Invest. We expect that the growth story of the highest quality DATs will come to be appreciated by more institutional investors, just like what has happened with Strategy.

![]()

ETHEREUM’S TENTH ANNIVERSARY

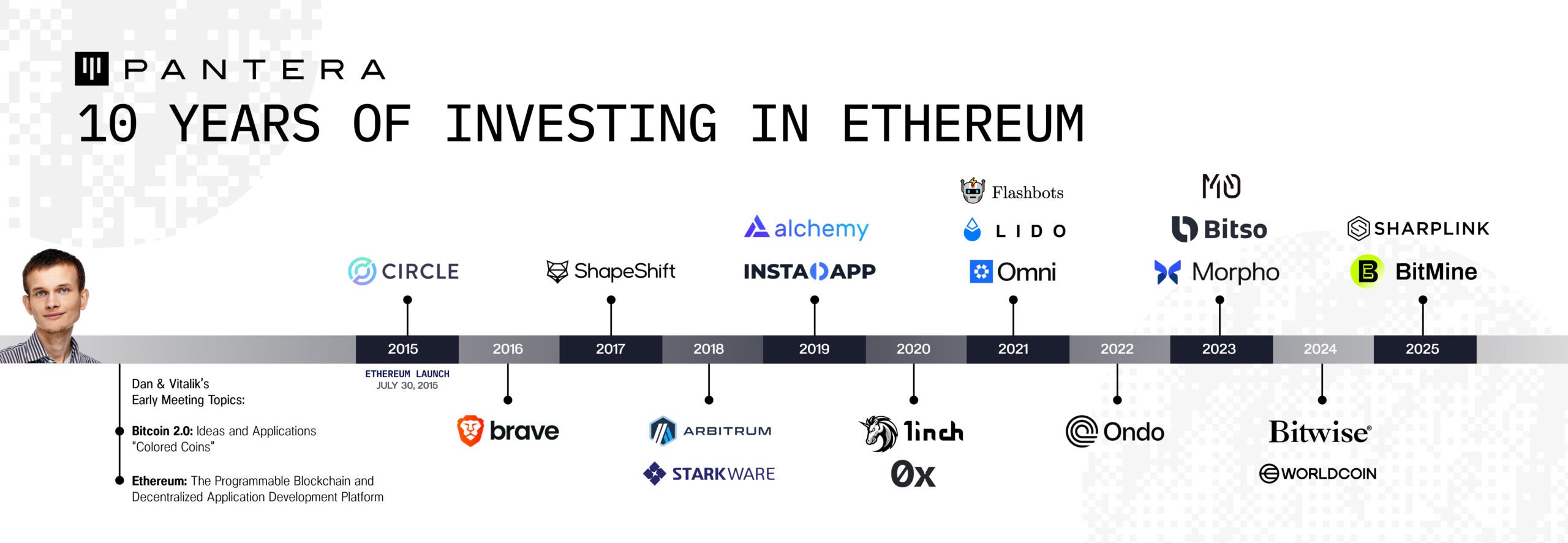

Ethereum turned ten years old on July 30th.

I first met Vitalik Buterin when he was a 17-year-old reporter for Bitcoin Magazine!

We then meet on Colored Coins in 2014 – a fascinating precursor to today’s RWAs, NFTs, and various asset-backed tokens. He laid out the concept of Ethereum in January 2015.

Amazing how far it’s come. Ten years of uptime and continuous transactions. A decade of innovation and reshaping the future of global markets.

We’ve supported so many visionary teams and developers building the applications and infrastructure that advance Ethereum’s mission. Our commitment to the ecosystem remains stronger than ever. Job’s not finished.

![]()

Prediction Market Renaissance: Markets for Everything

By Mason Nystrom, Junior Partner

The prediction market renaissance is underway. While new prediction markets have emerged periodically, there is now an abundance of prediction exchanges across various market event types, form factor (e.g. mobile, tinder-swipe style, terminals), and geographies.

This renaissance has been catalyzed by a few events:

1. The success of Polymarket and Kalshi: Prediction markets consistently garner billions in monthly volume. Their success – in particular in the election markets after the 2024 U.S. presidential election – has proven out the demand for event-based markets.

2. Regulatory clarity for prediction market event contracts: On October 2, 2024, the D.C. Circuit Court of Appeals denied the stay, allowing Kalshi to launch its election contracts. Robinhood listed election markets within the same month. It’s amazing what regulatory clarity can do for companies innovating in financial markets.

3. Growth in the speculation generation: The median age for first-time home buyers is 38, rising significantly over the past several years. Retail zero-day option trading is about to hit two-thirds of all daily option volumes, which demonstrates how retail investors demand quick wins in a volatile market. The TikTokification of financial markets continues, and with it, the desire to bet on more markets until there are none left to conquer.

While the speculative allure of prediction markets fuels engagement, these markets are far from frivolous. By aligning incentives with information, they can help surface accurate information and insights.

Markets help predict outcomes, and a variety of new markets are emerging – including political events, corporate earnings predictions, weather forecasts, and FDA drug approvals, among other valuable markets.

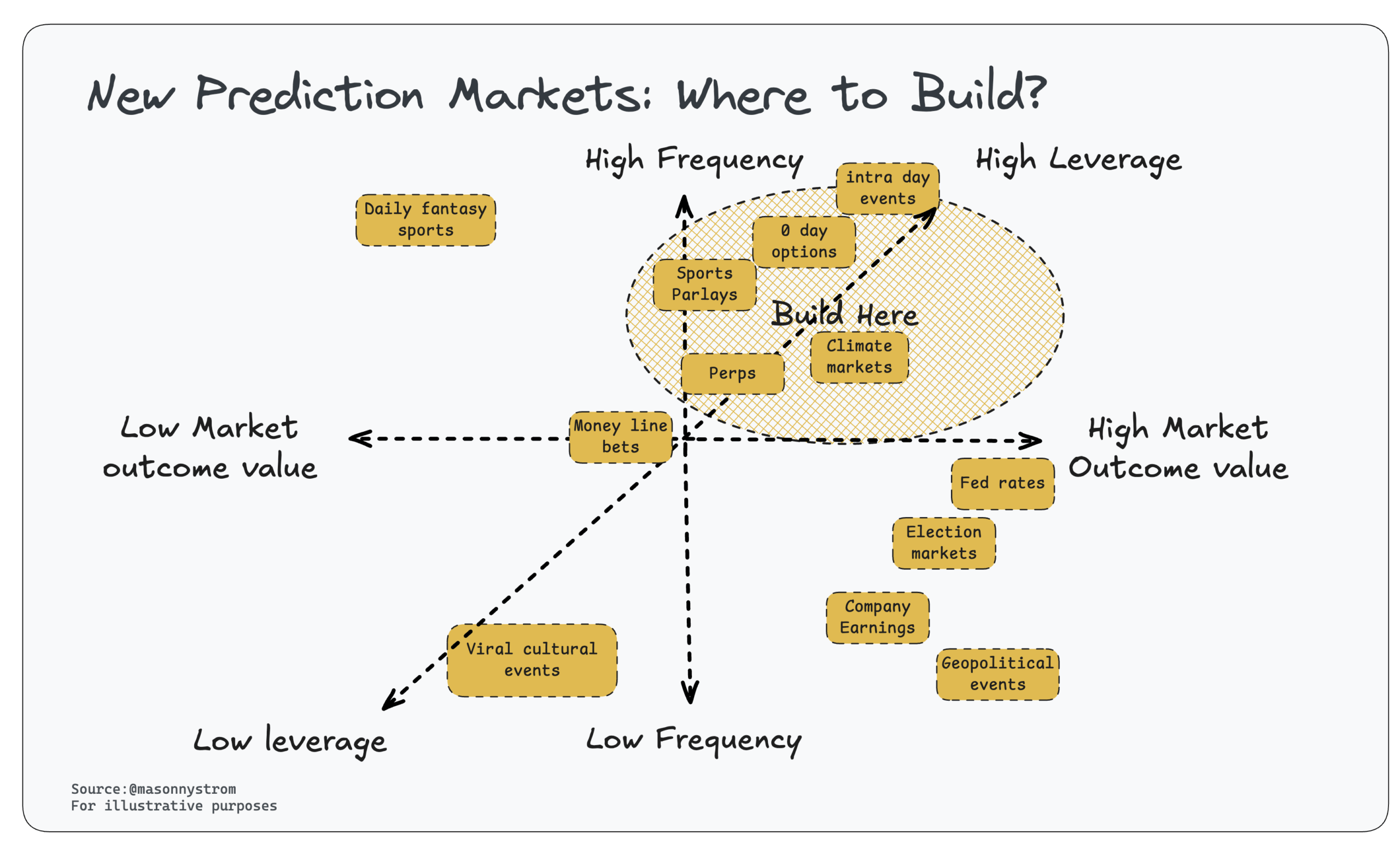

With the growth of prediction markets, there are a lot of teams taking differing product directions and GTM approaches. From an investment perspective, I believe that the new prediction markets that see long-term success will focus on building great products that serve markets with common characteristics:

1. Markets that have very frequent events

2. Markets with high leverage or the ability to win big sums with little capital risked

3. Markets with high outcome value – there’s signal in the predictive value

Let’s discuss them in more detail.

High Leverage

Users want to have high leverage or stack odds to increase payouts. Parlays, perps, intraday event markets – all of these prediction market products have the potential to increase demand for prediction market events. Imagine the Midterm elections and someone taking a parlay on correctly predicting them all. Given the rise of zero-day options, intraday markets (half-days, hours, minutes) also warrant consideration.

Highly Frequent Markets

Prediction markets are habitual – users come to bet on the markets they’re interested in. More markets help keep users engaged, but what truly matters is the presence of highly frequent markets that drive user retention.

Users that want to bet on high volume, singular events – presidential elections, pop-cultural events, etc. – can do so from any platform and they’ll likely end up using the platform that they frequent. Having more recurring markets will also create better economics for the platforms, enabling them to list more markets, pay for customer acquisition, or otherwise be more competitive. This already occurs in sports betting, where platforms like DraftKings utilize DFS (daily fantasy sports) as a valuable acquisition and retention tool to foster habitual user behavior.

High Market Outcome Value

Elections aren’t that frequent but have high signal value. This draws lots of capital to those markets. Polymarket recently released FDA approval outcomes, on which decisions make or break billion-dollar businesses. Kalshi’s climate markets have predictive signal value and there are additional types of derivatives contracts that can theoretically be built on top of a corpus of daily predictive signals. Markets with high outcome value will drive more volume and deeper liquidity. Conversely, many pop-culture markets – reality TV, Grammy winners, Nobel prize winners – are fun to bet on, but have low outcome value. Sometimes the low outcome value is in part because the outcomes are gameable. A prediction market coupled with a live TV show like Survivor would be entertaining, but with large enough stakes, people will find ways to manipulate the markets.

The rebirth of prediction markets will leverage efficient markets to generate valuable prediction insights and offer a form of leveraged entertainment to the same customers who trade individual stocks or bet on sports. We’re about to see an explosion in the types of markets and things that people will bet on. Markets for everything are coming.

![]()

ENTERING PHASE 2 OF THE BULL CYCLE

By Erik Lowe, Head of Content

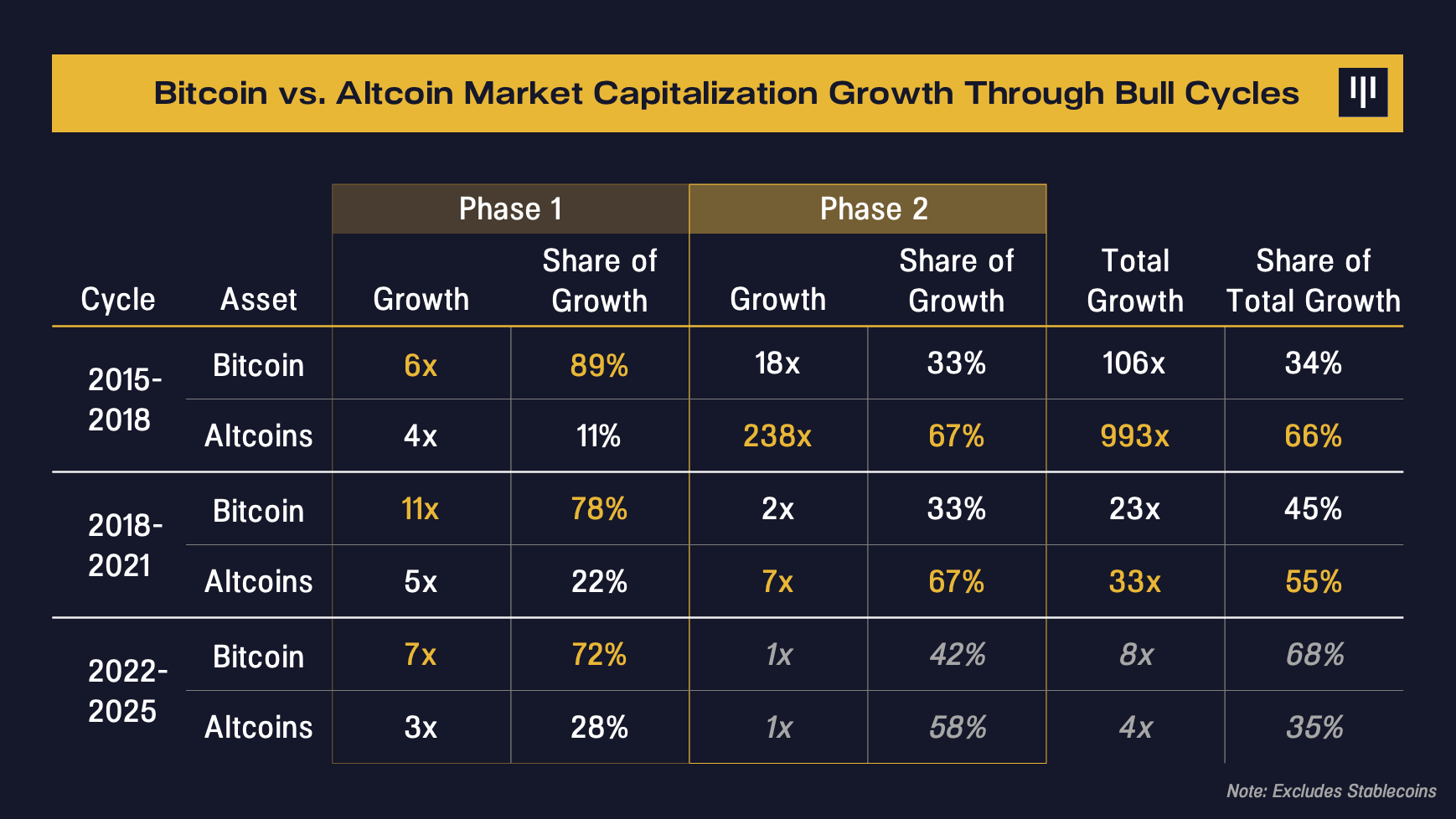

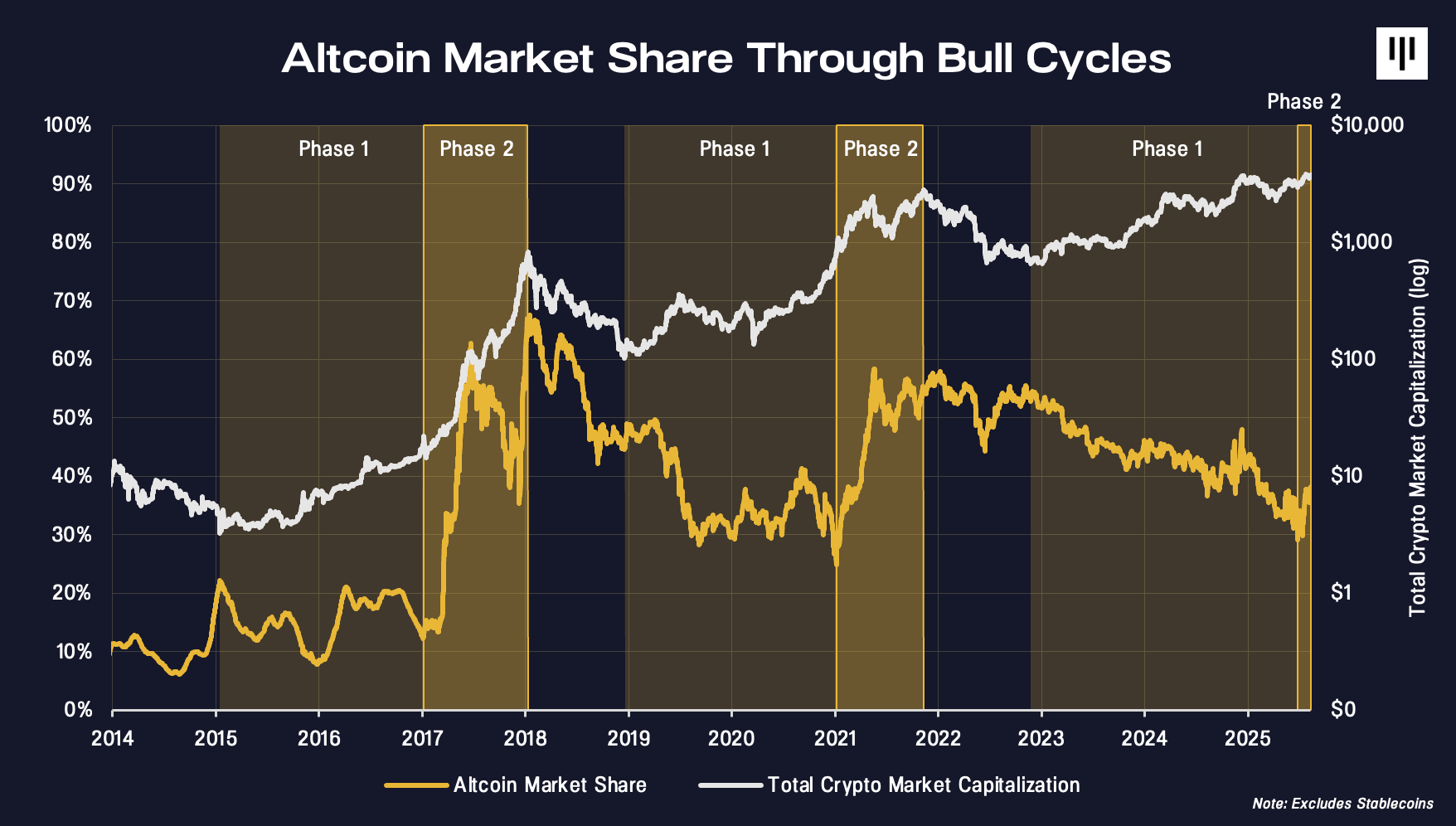

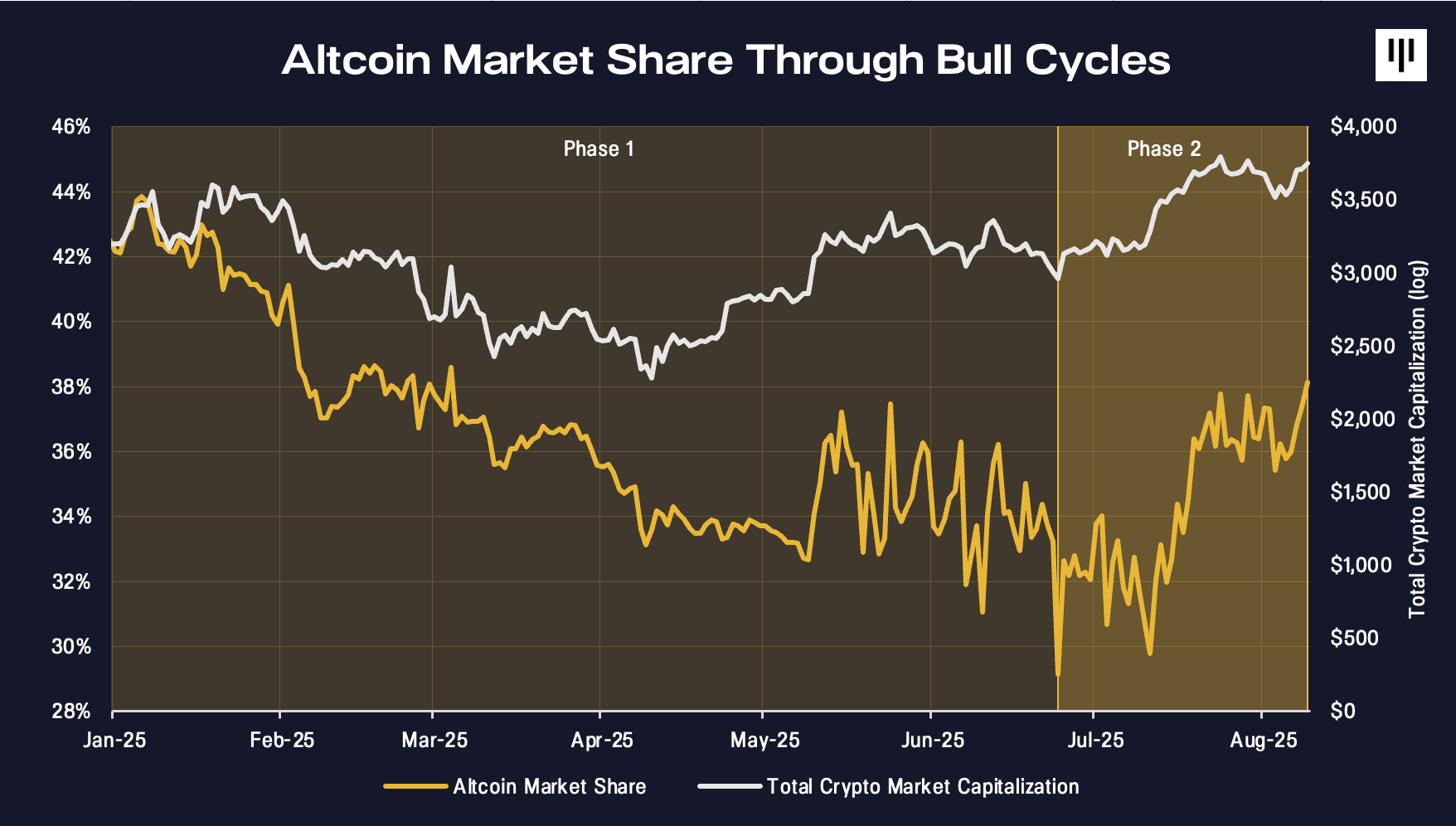

Bitcoin tends to lead bull cycles, with altcoins trailing early on. As the cycle progresses, altcoins tend to gain momentum and outperform bitcoin in the tail end of the cycle. We refer to this as the “phase 1” and “phase 2” of bull markets.

Importantly, altcoins have comprised the majority of value creation in the past two cycles. During the 2015–2018 cycle, alts accounted for 66% of the total growth in crypto market capitalization. In the 2018–2021 cycle, they contributed 55%.

So far this cycle, alts represent 35% of total market growth.

Bitcoin has long benefited from regulatory clarity – not only regarding its classification as a commodity, but also in the well-understood role it plays as “digital gold.” This has been a key driver of its outperformance throughout the early innings of this cycle relative to altcoins, which have historically faced far greater regulatory uncertainty – until recently. The dynamic is shifting under the new Administration, with meaningful progress toward promoting digital asset innovation.

The clarity and tailwinds that have historically favored bitcoin are now starting to extend to altcoins. The market is beginning to reflect that.

Momentum is building as regulatory wins continue to stack up. Last month, President Trump signed the GENIUS Act into law, creating the conditions for a boom in US-regulated stablecoins that can become an engine for financial transactions globally. The CLARITY Act, which has passed the House of Representatives, seeks to establish clearer boundaries between digital commodities and securities – helping resolve long-standing jurisdictional uncertainty between the SEC and CFTC. A shift is underway, and it’s reasonable to believe that non-bitcoin tokens will be among the biggest beneficiaries.

Innovation and development are already accelerating, especially within tokenization. Robinhood recently launched Stock Tokens facilitated by Arbitrum, with the goal of democratizing access to equities and creating more efficient markets. Major U.S. banks like Bank of America, Morgan Stanley, and JPMorgan are exploring issuing their own stablecoins. BlackRock’s BUIDL Fund has amassed $2.3 billion in tokenized treasuries. Figure has processed over $50 billion in blockchain native RWA transactions. In addition to its tokenized treasury funds, Ondo plans to offer over 1,000 tokenized stocks on NYSE and Nasdaq through Ondo Global Markets. The onchain migration is underway.

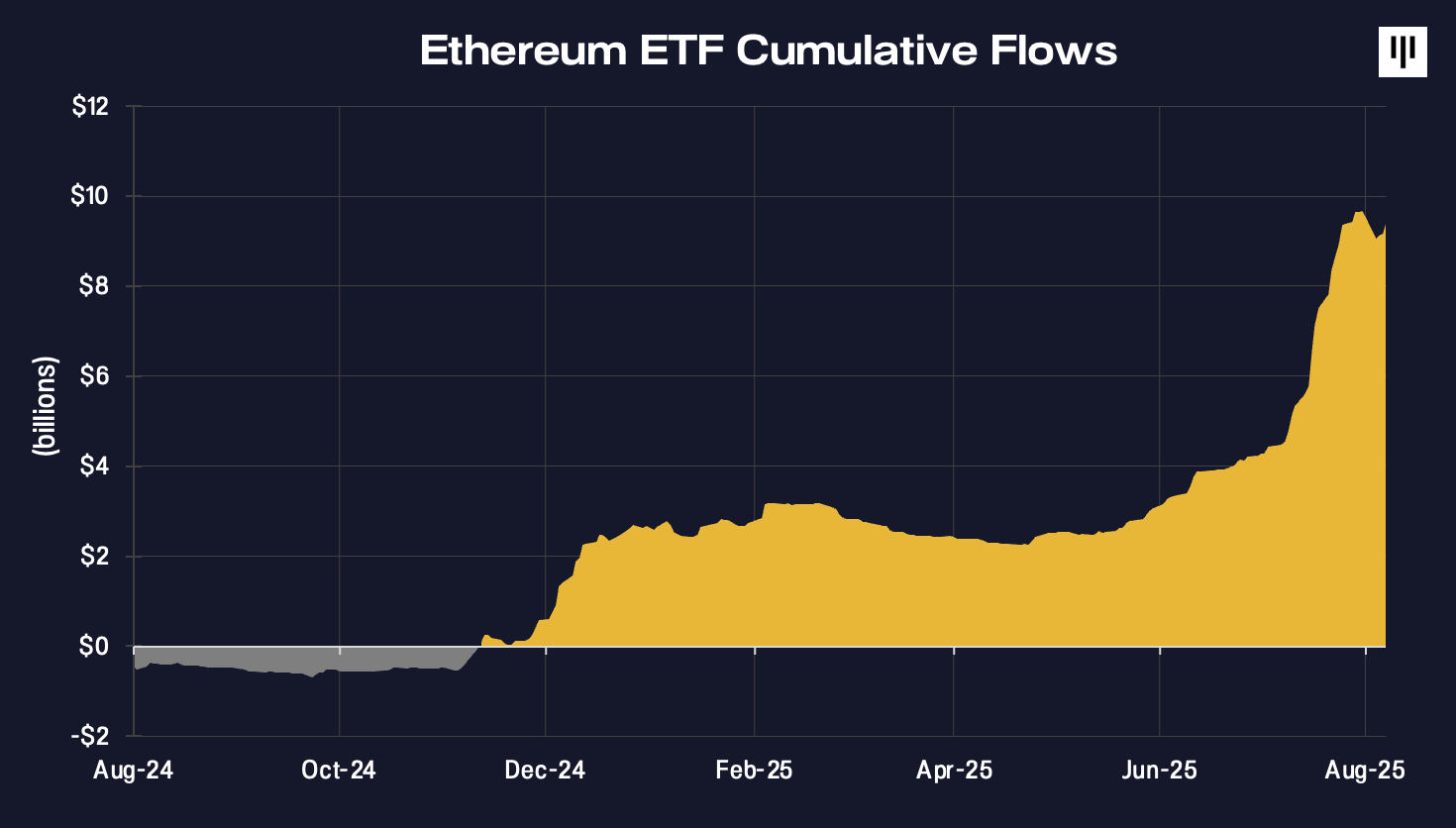

Ethereum Driving Growth in Non-Bitcoin Market Share

The majority of real-world assets are flowing onto Ethereum. Of the $260 billion stablecoin market, 54% of stablecoins are issued on Ethereum. 73% of onchain treasuries are on Ethereum. DATs are accumulating at unprecedented levels. Wall Street is waking up to this and the demand for ETH is surging.

The price of ethereum in bitcoin terms is up 103% since bottoming in April 2025.

![]()

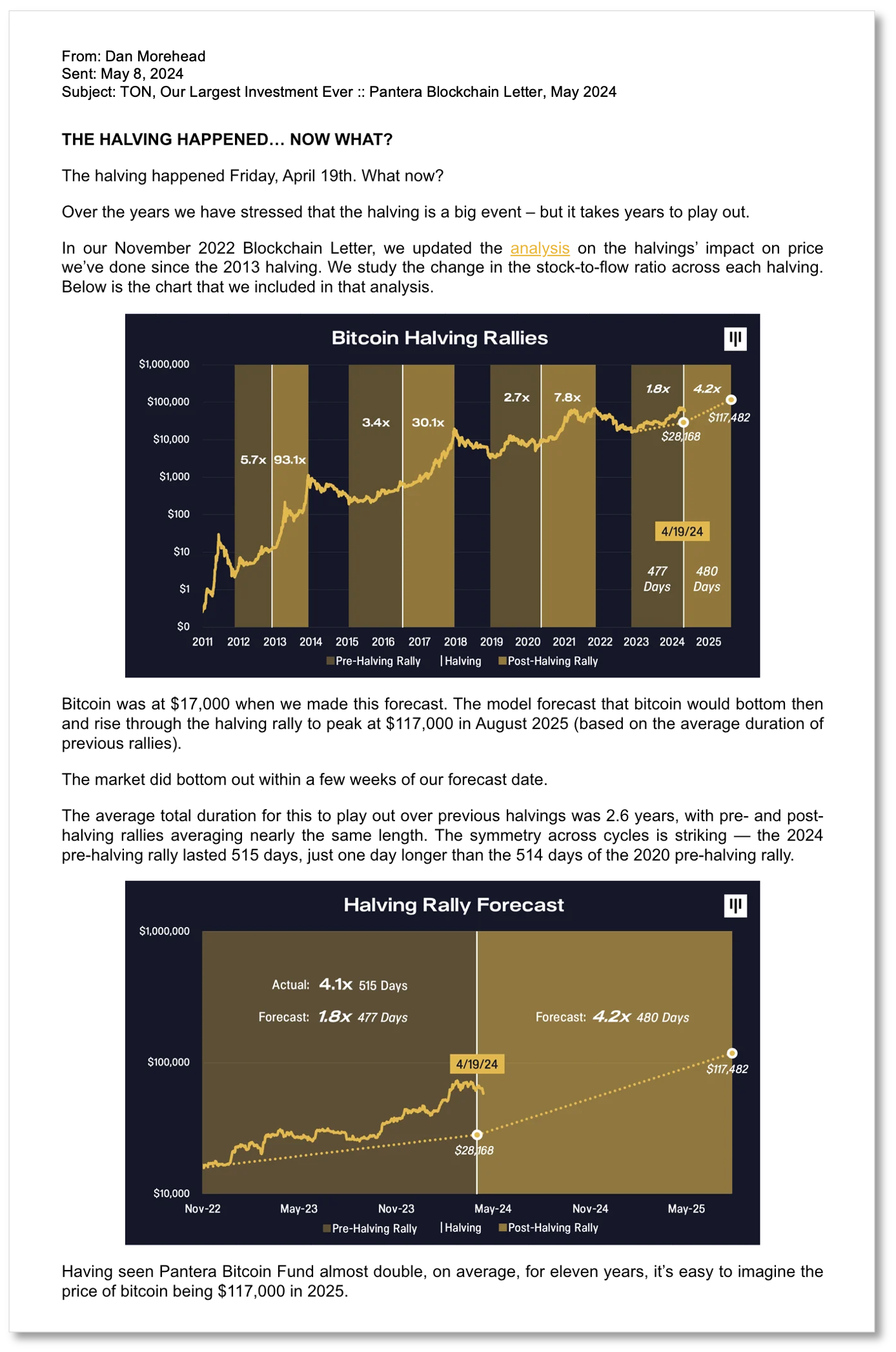

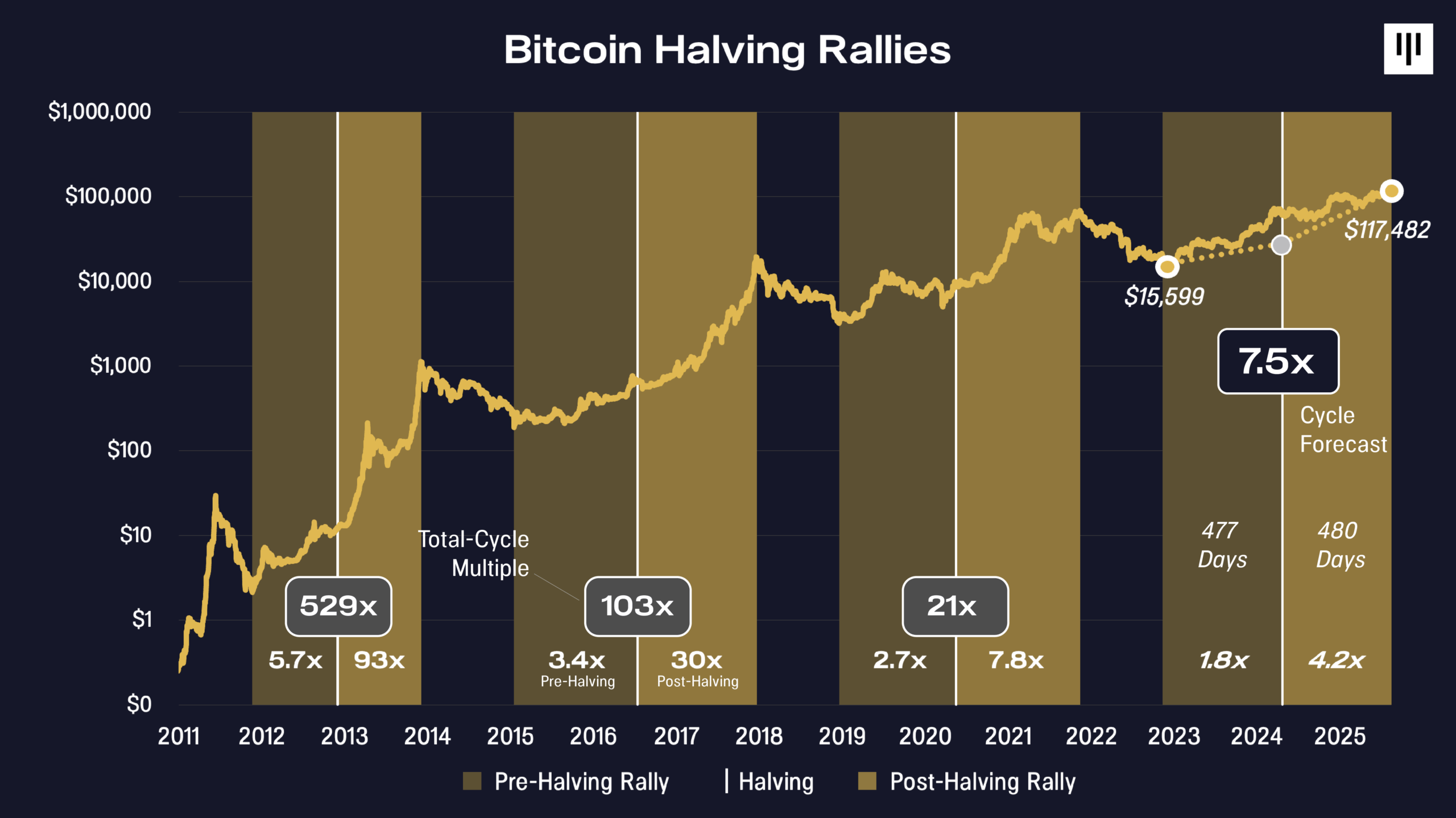

BITCOIN HALVING CYCLE NAILS TARGET

This is wild!

During the crypto winter we used our work on the previous three bitcoin halvings to forecast that bitcoin would hit $117,482 on August 11, 2025.

It did!!!

THE HALVING HAPPENED… UPDATE

In our November 2022 Blockchain Letter, we updated the analysis on the halvings’ impact on price we’ve done since the 2013 halving. We study the change in the stock-to-flow ratio across each halving. Below is the chart that we included in that analysis updated to today.

![]()

FORTUNE ARTICLE :: BITCOIN, THE FIRST DECADE ORIGIN

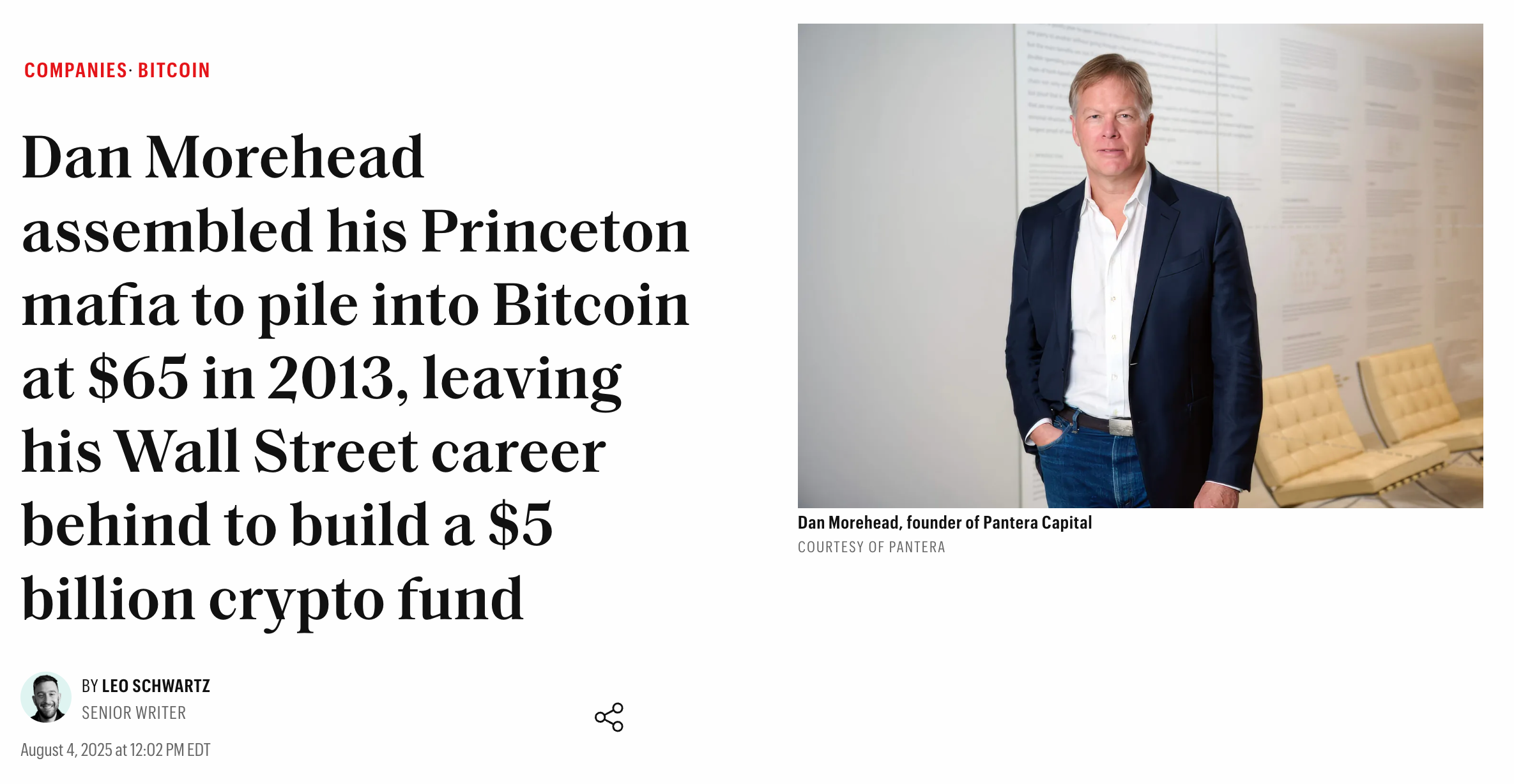

I recently spoke with Leo Schwartz at Fortune – reflecting on my journey into Bitcoin – including the early days and the people who were there from the start, many of whom happened to be my college friends.

Here’s the article.

![]()

Have a wonderful August,

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[2]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Pantera Fund V Call

An overview of Pantera’s fifth venture-style fund that offers exposure to the full spectrum of blockchain assets.

Tuesday, September 16, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Venture Fund II Investor Call

Tuesday, October 16, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Venture Fund III Investor Call

Tuesday, October 21, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Blockchain Fund Investor Call

Tuesday, November 4, 2025 12:00pm Eastern Standard Time / 18:00 Central European Standard Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Early-Stage Token Fund Investor Call

Tuesday, November 11, 2025 12:00pm Eastern Standard Time / 18:00 Central European Standard Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PANTERA FUND V

We’ve found that most investors view blockchain as an asset class and would prefer to have a manager allocate amongst the various asset types. This compelled us to create Pantera Blockchain Fund (IV) in 2021, a wrapper for the entire spectrum of blockchain assets. We are now opening its successor — Pantera Fund V — for subscriptions.

Similar to its predecessor, we believe this new fund is the most efficient way to get exposure to blockchain as an asset class. It is a continuation of the strategies we have employed at Pantera for twelve years across twelve venture and hedge funds.

Limited Partners have the flexibility to invest in just venture (Class V for “Venture”), or in venture, private tokens, and locked-up treasury tokens (Class P for “Privates”), or the all-in-one Class A.

As in all previous Pantera venture funds, we strongly support helping our LPs get access to private deals in this fund. Fund LPs with capital commitments of $25mm or more will have the option to collectively co-invest in at least 10% of each venture equity, private token, and special opportunity deal that the Fund invests over $10mm in. There is no management fee or carried interest on co-investments for those with co-investment rights.

We will endeavor to offer co-investment opportunities, on a capacity available-basis, to other LPs as well. These co-investment opportunities are subject to 1/10% fees.

We are now accepting subscriptions for Fund V. If you’re ready to invest, please click the button below to begin the process.

If you are new to Fund V and would like to receive additional information, click here.

Pantera donates 1% of revenue from all new funds to 1% For The Planet.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

-

Director, Capital Formation – US East – (New York City)

-

Senior Director, Capital Formation – Gulf Region – (Abu Dhabi)

-

Senior Director, Capital Formation – Asia Pacific – (Singapore)

-

Head of Capital Formation – (New York City)

-

Capital Formation Associate – (New York City)

-

Content Associate – (New York City)

-

Investor Relations Associate – (San Francisco)

If you have a passion for blockchain and want to work in New York City, San Francisco, San Juan, Abu Dhabi, or APAC region, please follow this link to apply. Some positions can be done remotely.

[1] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Partners LP and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically-marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

[2] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.