UPDATE ON FTX :: BY JOEY KRUG [1]

We want to provide an update on the FTX situation and how it has and hasn’t affected us. The summary is that this week, FTX and Alameda Research over-levered by borrowing against their FTT token. Both firms have filed for bankruptcy as of this morning. The total losses from this are unclear, but online estimates suggest it’s in the high single digit billions. Deposits on FTX are trading at pennies on the dollar. This likely means those with funds on FTX lose most of their money.

In general, our approach towards situations like these first focuses on safeguarding the portfolio as much as possible. Then, once we’ve taken every possible measure, we can update our LPs on what we’ve done and what things look like for our funds. But first and foremost, our objective is to mitigate the risk of permanent capital loss. The markets are down a lot on this news, and that’s going to show up in our performance, but when the markets bounce back, we expect to too. The main thing we aim to avoid in situations like this is losing assets in a way where the assets are gone permanently, where you never get them back.

Our approach is to aim to have little exposure to centralized counterparties in general while maintaining some flexibility to trade. Our main risk/losses from the FTX event come from our Blockfolio acquisition proceeds, which were denominated in FTT and FTX stock. We liquidated as much of this FTT as possible on Tuesday, November 8th. Prior to the collapse, on Monday night, our FTX equity and FTT token positions totaled under 3% of our total firm AUM.

Following the news of FTX/Alameda’s distressed status on Tuesday morning, our team immediately assembled a virtual war room to assess the impact to our early-stage portfolio and take action. Our goal was 1) to identify the potential risks that our portfolio teams may be exposed to; and 2) to reach out to at-risk teams directly and offer any help we can.

We have conducted this exercise in similarly stressed environments for our industry (e.g., Three Arrows bankruptcy, 2018 crypto winter). In times of crisis, “we must act and act quickly.” Speed can make all the difference for a business being caught in the contagion to come vs. surviving and emerging stronger on the other side of this crisis.

We identified and reached out to portfolio teams from our universe of early-stage token and blockchain venture companies that we determined could have potentially significant counterparty or custodial exposure to FTX/Alameda. After speaking with, or receiving an investor update, the large majority of contacted portfolio teams reported that they have little to no counterparty or custodial exposure to FTX/Alameda. Our initial impression is that this limited exposure is partially attributable to the proactive risk management and custody/treasury management practices that we seek out, and regularly emphasize with, our founders, but we expect the coming weeks and months will lend more insights.

In the short term, there will be pain for those who lost funds held on FTX’s exchange. More broadly, we expect further price volatility across the crypto ecosystem as fears of contagion drive asset holders to adjust their portfolios. Assets linked to FTX (Solana and projects built on it, Aptos, etc.) will likely be hit hardest. The episode will also probably be a setback to adoption, as some retail users who lost funds choose to leave the space, and others who may have joined sooner are scared into staying on the sidelines. We expect institutions previously wary of the space to deepen their skepticism. This is to be expected and, while unfortunate, not sufficiently significant to warrant alarm. They may take longer, but we are confident they will come eventually and sooner than many expect.

A regulatory response is likely, though we are cautiously optimistic it will yield medium- and long-term positive results. As this crisis has made apparent, centralized intermediaries of financial transactions are opaque and often untrustworthy. Nothing could have made more obvious the need for decentralized, trustless protocols that allow users to trade, hold, and transfer their assets without relying on entities like FTX, Celsius, or Voyager. As centralized intermediaries exist in the crypto space, they should – and likely will soon be – subject to stricter oversight of reserves, audits, and risk controls, especially if those intermediaries interact with retail users. Conversely, decentralized protocols are public, open, and more transparent, and do not require users’ trust in the same way. We are hopeful that regulators will come to see this and shift their attention away from regulating DeFi to concentrate on regulating centralized institutions operating in the space.

On a personal level, the implosion of FTX has reminded us of what we’re doing here. Our mission – as a firm and as an ecosystem – is not to replicate the risks and inefficiencies in traditional finance. It is to build a more efficient, decentralized, and open financial ecosystem. We are more energized by that vision and more grateful for the support of LPs who share it than we ever have been. The journey may not always be easy or smooth, but it is necessary. And we want to thank each of you for being on it with us.

![]()

BITCOIN HALVING :: BACKGROUND [2]

The money supply function of the Bitcoin protocol is the polar opposite of Quantitative Easing. The Bitcoin code states a total of 21 million coins will be released and the supply of new coins will decrease over time.

Today 6.25 bitcoins are issued every ten minutes. There’s no “Greenspan put” if a politically-powerful group like homeowners or people who own equities is suffering. It’s just 6.25 BTC every ten minutes.

Every four years that “block reward” is cut in half, thus it’s referred to as “the halving”. This process repeats until the year 2140 A.D., when the Zeno’s Paradox ceases at 21 million bitcoins.

Bitcoin’s supply and coin distribution ruleset is based purely on mathematics – predictable and transparent by design.

“Total circulation will be 21,000,000 coins. It’ll be distributed to network nodes when they make blocks, with the amount cut in half every four years. First four years: 10,500,000 coins. Next four years: 5,250,000 coins. Next four years: 2,625,000 coins. Next four years: 1,312,500 coins. Etc. . . .”

— Satoshi Nakamoto, The Cryptography Mailing List, January 8, 2009

![]()

THE HALVING IS NIGH

The next halving is projected to occur on April 20, 2024. The mining reward will decrease from 6.25 BTC per block to 3.125 BTC per block.

Efficient Markets Theory would hold that if we **all** know it’s going to happen, then it has to be priced in. Paraphrasing a line attributed to Warren Buffet on the dogma, “The markets are almost always efficient, but the difference between almost and always is $80 billion to me.” Thus, even if we think everybody knows something, it doesn’t mean there isn’t a ton of money to be made.

“Investing in a market where people believe in efficiency is like playing bridge with someone who has been told it doesn’t do any good to look at the cards”

— Warren Buffet, 1984, as cited by Davis, 1990

If the demand for new bitcoins stays constant and the supply of new bitcoins is cut in half, this will force the price up. There has also been an increased demand for bitcoin before the halving event because of the anticipation of a price increase.

Over the years we have stressed that the halving is a big event – but it takes years to play out. The typical trough is 1.3 years before the halving and, on average, the market peaks 1.3 years after. The whole process has taken 2.6 years to see the full impact.

Bitcoin has historically bottomed 477 days prior to the halving, climbed leading into it, and then exploded to the upside afterwards. The post-halving rallies have averaged 480 days – from the halving to the peak of that next bull cycle.

IF history were to repeat itself, the price of bitcoin would trough December 30, 2022. We would then see a rally into early 2024 and then a strong rally after the actual halving. The following chart shows what might happen if Bitcoin repeats the performance around previous halvings.

BITCOIN HALVING :: STOCK-TO-FLOW PRICE PROJECTION

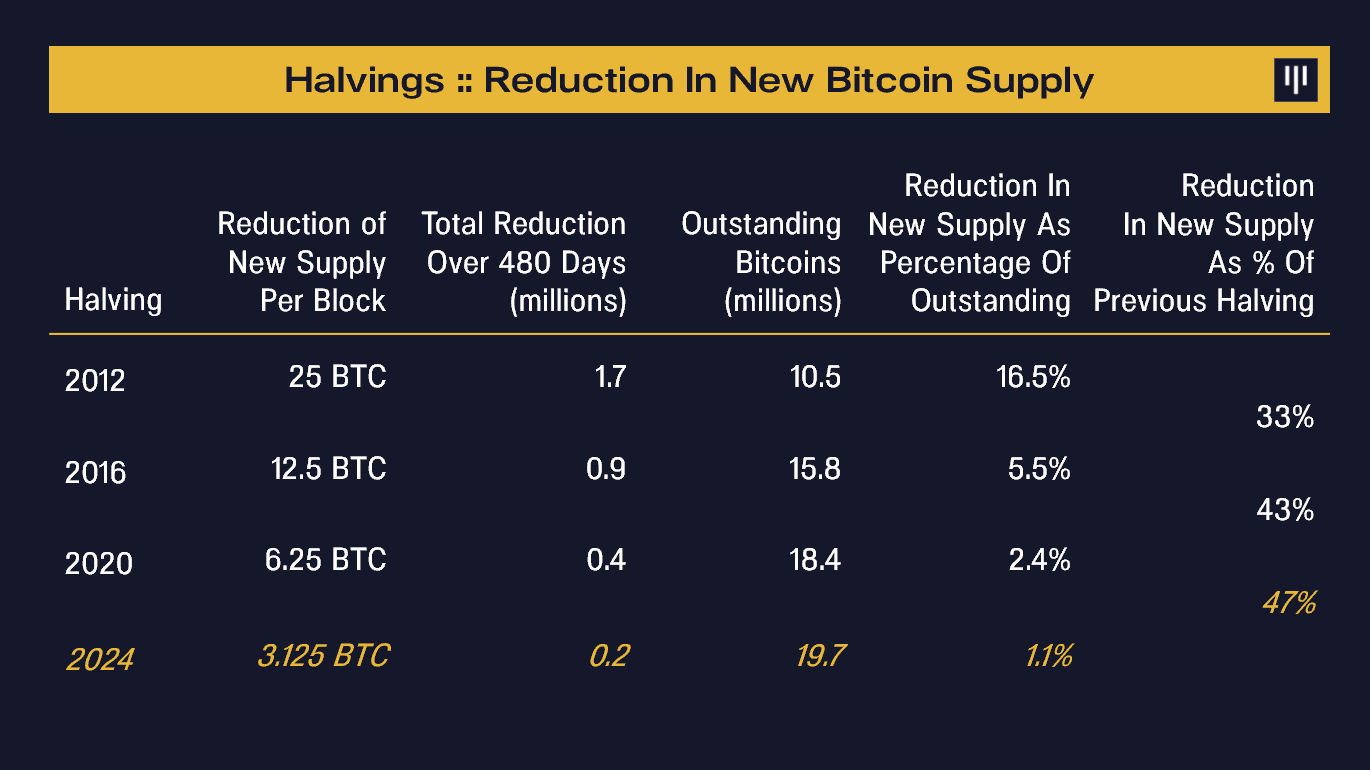

The framework we’ve used for analyzing the impact of halvings is to study the change in the stock-to-flow ratio across each halving. The first halving reduced the supply of new bitcoins by 17% of the total outstanding bitcoins. That’s a huge impact on new supply and it had a huge impact on price.

Each subsequent halving’s impact on price will likely taper off in importance as the ratio of reduction in the supply of new bitcoins from previous halvings to the next decreases. Below is a chart depicting past halvings’ supply reductions as a percentage of the outstanding bitcoin at the time of the halving.

The 2016 halving decreased the supply of new bitcoins only one-third as much as the first. Interestingly, it had exactly one-third the price impact.

The 2020 halving reduced the supply of new bitcoins by 43% relative to the previous halving. It had a 23% as big an impact on price.

The next halving is expected to occur on April 20, 2024. Since most bitcoins are now in circulation, each halving will be almost exactly half as big a reduction in new supply. If history were to repeat itself, the next halving would see bitcoin rising to $28k before the halving and $117k after.

Closing thought:

When people wonder if the halving is fully priced in, I’m reminded of a great line from Jesse Powell, co-founder of Kraken. On a conference call with our investors during the previous halving:

Q: Is the halving priced in?

“I don’t think bitcoin is priced into bitcoin.”

— Jesse Powell, Pantera Bitcoin Halving Conference Call, May 12, 2020

![]()

WHEN WORLDS COLLIDE :: TRAD-FI WELCOMES DE-FI IN NEW INSTITUTIONAL TRIALS

By Jesus Robles III, Content Associate

Decentralized finance (DeFi) employs public blockchain networks and smart contracts to build open, transparent, composable, and non-custodial financial protocols.

Many take the disruptive potential of blockchain and DeFi to mean “complete replacement” of the technologies, products, tools, or services blockchain and DeFi intend to disrupt. However, as can be seen from how blockchain and crypto-asset adoption has unfolded over recent years (e.g., no crypto “completely replacing” Visa or gold), replacement like this simply will not be the case.

Instead, traditional technologies, products, tools, and services will coexist with blockchain and DeFi, as they do now, interoperating and interfacing more closely as time and development go on. For the best effect, smart money is taking advantage of and building with ALL technologies, products, tools, and services at their disposal, regardless of traditional vs. decentralized/novel.

Indeed, major and central banks are recognizing this edge, and do not shy away as they may have in the past, what with the overwhelming institutional backing and legitimacy blockchain technology has thus far earned.

To this point, two institutional projects have caught our attention recently — Project Guardian and Project Mariana — wherein major players like JPMorgan, the Monetary Authority of Singapore, and the central banks of France and Switzerland have not hesitated to embrace the potential of DeFi technologies, products, services, and tools. Instead, understanding the incredible value of these, they are seeking to usher in the institutional adoption of DeFi with no undue haste.

PROJECT GUARDIAN :: JPMORGAN, DBS, & THE MONETARY AUTHORITY OF SINGAPORE (MAS)

Just recently, JP Morgan became the first major bank ever to execute cross-border DeFi trades via public blockchains, a significant achievement following the bank’s tokenization of money market funds for collateral settlements in partnership with BlackRock earlier this year.

The trades consisted of live, cross-currency transactions involving tokenized Japanese yen (JPY) and Singaporean dollar (SGD) deposits, in addition to a simulated exercise involving the buying and selling of tokenized government bonds.

In short, the trade was executed on Ethereum layer-2 network Polygon using a modified version of the Aave protocol’s smart contracting code. Polygon is a decentralized Ethereum scaling platform that enables developers to build scalable, user-friendly dApps with low transaction fees without sacrificing security. Aave is a decentralized non-custodial liquidity market protocol where users can participate as depositors or borrowers.

To learn more about the technicals behind how the trades were conducted, we recommend reading the great twitter thread following Tyrone Lobban’s initial tweet, linked here.

“Over time, we think tokenizing U.S. Treasury’s or money market fund shares, for example, means these could all potentially be used as collateral in DeFi pools . . . . the overall goal is to bring these trillions of dollars of assets into DeFi, so that we can use these new mechanisms for trading, borrowing [and] lending, but with the scale of institutional assets.”

— Tyrone Lobban, head of Onyx Digital Assets at JPMorgan, speaking at Consensus 2022

Lobban envisions two components to making institutional DeFi to an eventual reality:

1. One component is JPMorgan’s blockchain-based collateral settlement system that was extended last month to include tokenized versions of BlackRock’s money market fund shares, a kind of mutual fund invested in cash and highly liquid short-term debt instruments. That kind of application on the Onyx Digital Assets blockchain, which is settled in the bank’s in-house digital token JPM Coin, has had $350 billion in trading volume, Lobban pointed out.

2. The second piece of the puzzle is this pilot being led by the MAS and includes JPMorgan, DBS Bank, and Marketnode, dubbed “Project Guardian.” It tests institutional-friendly DeFi using permissioned liquidity pools that are made up of tokenized bonds and deposits.

Project Guardian was first officially launched in May 2022, which came about a month after a partnership was made between JP Morgan and DBS to build a new blockchain interbank platform to complement the work of central bank digital currencies (CBDCs).

In a September 2022 report, Boston Consulting Group estimated the total size of tokenized illiquid assets will reach $16.1 trillion annually by 2030.

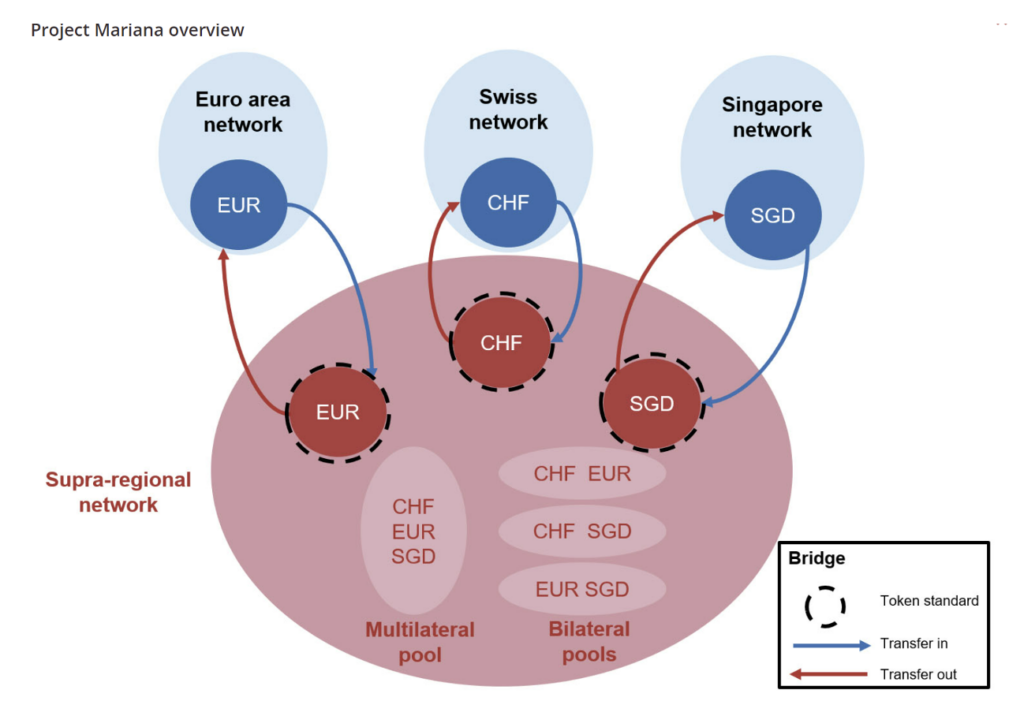

PROJECT MARIANA :: THE CENTRAL BANKS OF FRANCE, SWITZERLAND, & SINGAPORE

The decentralized exchange of tokenized assets via automated market makers (AMMs) is one of the primary functions within DeFi. On traditional exchanges, buyers are matched with sellers and the exchange of assets requires the consent of both parties. On decentralized exchanges, smart contracts use liquidity pools to transfer digital assets between peers automatically, without intermediary asset custody or pre-trade consent.

As DeFi popularity and utilization rises, it would behoove central banks to understand the impact of DeFi and its applications on, e.g., cross-border payments as they are traditionally understood.

Project Mariana is a collaborative research endeavor between the Switzerland, Singapore, and Eurosystem BIS Innovation Hub Centers, the Bank of France, the Monetary Authority of Singapore, and the Swiss National Bank. The project explores the use of AMMs to simulate cross-border exchange of Swiss franc, euro and Singapore dollar wholesale CBDCs (central bank digital currencies) to settle and potentially improve foreign exchange trades.

AMM protocols that determine the prices between two or more tokenized assets seem poised to usher in a new generation of financial infrastructure, facilitating, for example, the cross-border exchange of CBDCs.

“DeFi and its applications have the potential to become systemically important parts of the financial ecosystem. . . the basis for a new generation of financial infrastructure.”

— The Bank of International Settlements on Project Mariana

The project has three main objectives:

1. Investigate the architecture and implementation of AMMs for wholesale CBDCs.

2. Explore if a supra-regional network makes cross-border settlement more efficient while not sacrificing trust and security.

3. Research potential wholesale CBDC governance models within that network.

We anticipate the success of these pilot programs to drive even greater institutional investment into DeFi research and development. From the invention of computers to the invention of programmatic money (e.g., Bitcoin, Ethereum, etc.), the next ten-year focus of the digital age is programmable, disruptive, decentralized finance.

![]()

RECENT PORTFOLIO COMPANY INVESTMENTS :: FROM THE PANTERA INVESTMENT TEAM [3]

The Pantera Blockchain Fund IV specializes in investing in the most promising of early-stage venture equity and token deals, as part of our broad thesis on the potential of DeFi, Web3, NFTs, blockchain for gaming, and the Metaverse.

Below we feature two of our most recent and exciting inclusions in our portfolio, Braavos and Waterfall. Braavos is making it easier and friction-free for novice users to onboard into DeFi ecosystem, while the Waterfall protocol implements a sort of futures-style market to achieve truer pricing for NFTs.

INVESTING IN BRAAVOS

What was your first crypto wallet?

It’s a question not asked much, but one with a variety of answers where many have had a frustrating experience using a new technology. New users are often inundated with terms like “private keys”, “multisig”, and “DeFi” before they even have a chance to make a crypto transaction.

There’s also the ever-present fear of forgetting your password and losing your assets forever.

Braavos hopes to eliminate this area of friction by making an easy-to-use wallet with a unique “forgot password” function that emulates similar offerings by centralized custodial services.

“For us at Braavos, it is all about the user experience. We think that current crypto solutions in the self-custodial world are not accessible to everyday users. We want to give users a better experience so they won’t have to default to centralized custodial services, which can contradict the true values of crypto.

“We are taking the first step in making the crypto experience frictionless for everyday users. In the near future we will introduce the very first decentralized ‘forgot password’ mechanism in crypto to the Braavos wallet in order to provide a smooth segue for users into the crypto world”.

– Motty Lavie, Founder and CEO of Braavos

WHY BRAAVOS?

Braavos has enabled industry-standard security features such as two-factor authentication where a transaction requires signatures from both their mobile and desktop wallets.

Moreover, Braavos supports elliptic curve cryptography that utilizes isolated security chips built into mobile devices. These mobile Hardware Security Modules (HSM) are dedicated isolated subsystems that can sign, encrypt, and generate cryptographic keys. The private keys generated by the module cannot be read by the software and are kept secure even when the Application Processor kernel becomes compromised. In other words, similarly to Apple’s Secure Element technology, Braavos offers protection of users’ assets at a hardware level.

The Braavos wallet utilizes this dedicated security chip and allows users to secure their accounts and approve transactions using facial recognition or fingerprints as biometric identifiers, reaching a security level that is greater than most hardware wallets.

Users can also divide their assets between accounts, implement withdrawal limits, and schedule time delays for future transfers, akin to having separate but interactable checking and savings accounts per traditional banking.

Braavos also allows users to swap tokens with mySwap, an integrated decentralized exchange. Another unique feature of the Braavos wallet is that it is built on StarkNet, a permissionless decentralized ZK-Rollup. Using this layer-2 chain enables dApps to scale on an unlimited basis without sacrificing security.

Demystifying, simplifying, and securing how curious, new users interact with the DeFi ecosystem is as imperative as it was in the early days of crypto for DeFi adoption (e.g. Bitcoin wallets). In this regard, we believe Braavos is leading the way.

Pantera led the $10 million round with participation from Crypto.com, BH Digital, StarkWare, and more.

WATERFALL: THE PRICING CHALLENGE

The Overstreet Comic Book Price Guide was first published in 1970 and quickly became the industry standard for valuations in the then-nascent world of comic book collecting.

Comic prices in the early 1970s were determined by aggregating dealer sale prices and scouring fanzines/newsletters to browse classified ads. Overstreet wasn’t the only price guide, but it was the first in the world of comics to gain mainstream attention within the industry. The ability to easily find a book’s price was novel and made it easier for both buyers and sellers. Most important, it was the spark that made comic book collecting the multi-billion-dollar industry it is today.

Pricing an item that recently became collectible has always been a challenge, becoming more difficult when it is a unique “1/1” piece.

WHY WATERFALL?

The biggest challenge that is preventing large-scale liquidity and access of NFTs is pricing and we are excited to be investing into Waterfall to solve that problem.

Pricing feeds into the valuation and fractionalizing of NFTs and will bring the next wave of institutional and retail collectors.

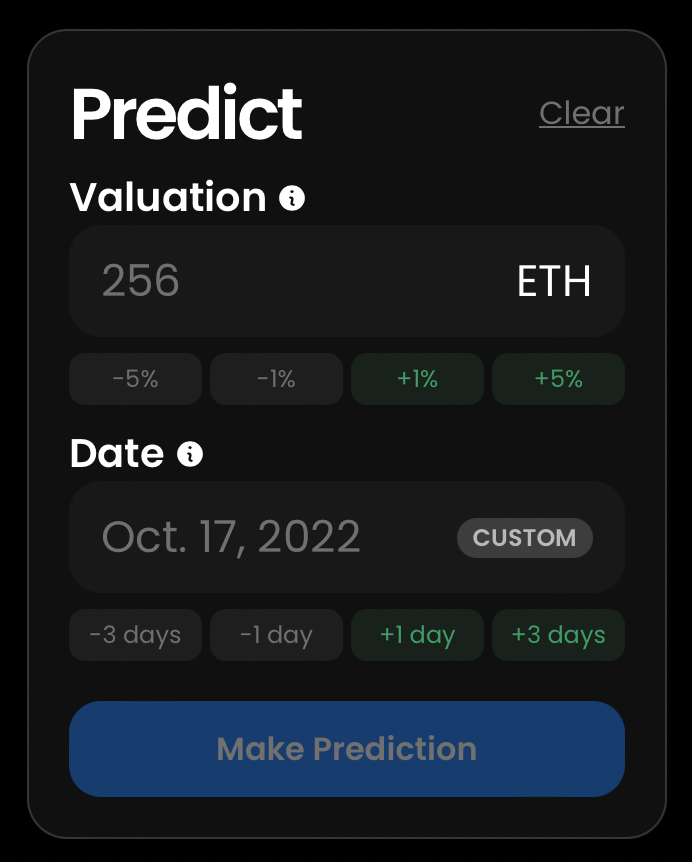

Waterfall’s solution is to allow users to trade chips to predict NFT prices, providing instant price discovery for both liquid and illiquid assets.

Decentralized governance acts as a double-edged sword when it comes to fractionalizing NFTs, as most chip holders cannot agree on what price makes sense during an NFT’s recombination. Waterfall removes the need for consensus with its novel re-listing approach, thus introducing much-needed velocity into the recombination process.

HOW WATERFALL WORKS

When an NFT is listed, it is fractionalized into a specified number of chips: ERC-1155 tokens that represent predictions on the NFT’s future valuation.

Users can predict NFT prices by purchasing and trading chips however they’d like, but all chips must be listed at all times. The valuation of the NFT is the sum of all chips’ listings. This way, people’s price predictions are immediately reflected in the NFT’s valuation.

Since each chip needs to be listed at all times, chip traders must provide two pieces of financial metadata to represent their prediction:

1. Prediction price: a prediction of the chip’s value by some date

2. Expiration date: the date the prediction market ends

The protocol will then immediately re-list the purchased chips at the prediction price until the expiration date. If a chip has not sold by its expiration date, they automatically start Dutch auctioning down to 0.

For example, let’s say we think the NFT will be worth at least $200 by next month. To make a prediction, we’d input $200 as the strike price, next month’s date as the expiration date, and select the number of chips we want to purchase.

In other words, you can make predictions on NFTs’ future valuations on Waterfall by buying chips.

In order to prevent NFTs from getting locked up, the protocol imposes a Harberger Tax-like fee: the higher the predicted valuation and the further away the predicted date, the higher the fees a buyer has to pay. This process of predicting NFT prices ends when somebody decides to buy the NFT.

Like traditional NFT marketplaces, Waterfall can serve both sellers and buyers. But its trading and pricing protocol introduces an additional layer, the chip traders, to make the markets more efficient.

With all of the ambiguity and subjectivity involved in accurately valuing NFTs, we believe Waterfall’s approach will bolster the price accuracy and legitimacy of NFTs and their marketplaces.

Pantera co-led the $4 million seed round alongside Electric Capital.

![]()

PANTERA BLOCKCHAIN SUMMIT ASIA

Final highlights from Pantera Blockchain Summit Asia below.

Lessons Learned From 10 Years of Blockchain Investing

Pantera Vision and Roadmap

![]()

FED ON HOUSING INFLATION :: ADDING 1.1% TO CPI FOR TWO YEARS [4]

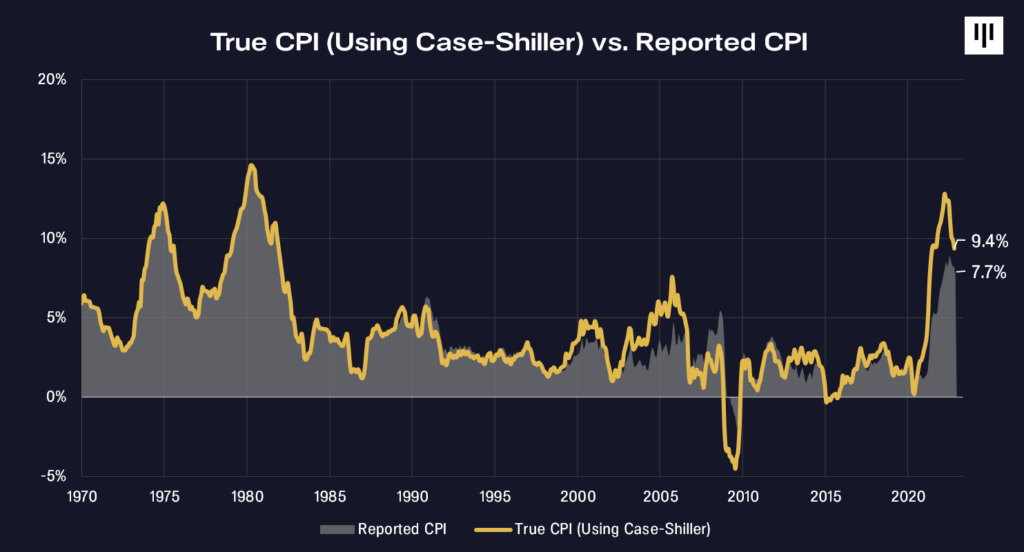

We’ve written several times over the past year about the lagged impact of owners’ equivalent rent on CPI. Long story short, in 1982 CPI was changed from housing inflation to a complex lagging formula. The graph below shows the divergence in what we call “True CPI” – CPI using the widely-respected S&P CoreLogic Case-Shiller U.S. National Home Price Index for the true inflation in housing. Using that measure for the shelter component of CPI, true inflation is running at 9(.)4%.

The government CPI rent index is only up 5% since the money-printing began two years ago. Anybody that’s tried to rent a home or apartment knows it’s much much higher.

Economists at the San Francisco Federal Reserve released a study that quantifies the future inflation readings that are already baked in.

“In this Economic Letter, we develop an empirical model to predict future rent inflation using data on current asking rents and current house prices in 15 metropolitan statistical areas (MSAs). Our panel model predicts that future rent inflation could increase by about 3.4 percentage points (pp) in both 2022 and 2023 relative to the pre-pandemic five-year average. This prediction translates into an additional 1.1pp increase in overall CPI inflation for both 2022 and 2023.

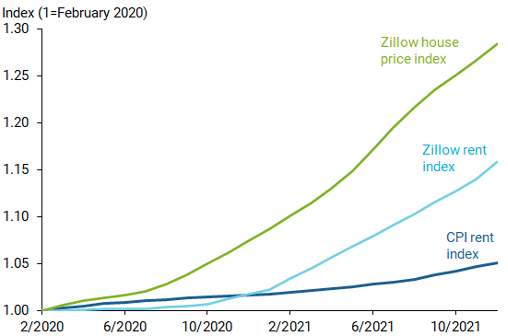

“Figure 3 plots the cumulative growth in the Zillow rent and house price indexes together with the CPI rent index since February 2020, the month before the onset of the COVID-19 pandemic in the United States. Zillow’s rent index is up 15.9% over the past 23 months while Zillow’s house price index is up 28.4%. In contrast, the CPI rent index is up only 5.0% over the same period. Given that current asking rents and current house prices are leading indicators of future rents, the pattern in Figure 3 suggests some risk that the CPI rent index could rise faster, which in turn would push up future overall inflation.”

— Lansing, Oliveira, and Shapiro, Will Rising Rents Push Up Future Inflation?, Federal Reserve Bank of San Francisco, February 14, 2022

Even if the Fed could miraculously make housing stop going up and all the other components of CPI go to 2.0% from today forward, past OER baked in would add 1.1 pp simply due to historical OER push. CPI would be 3.1% for the next two years.

In order hit its 2% “price stability” inflation target, the Fed needs to get everything else down to 0.9% inflation.

Unfortunately the Fed has a lot more tightening to do.

![]()

MASSIVE TRANSFER OF WEALTH

“Our revised statement emphasizes that maximum employment is a broad-based and inclusive goal. This change reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities. . . .

“This change may appear subtle, but it reflects our view that a robust job market can be sustained without causing an outbreak of inflation.”

— Fed Chair Powell, Navigating the Decade Ahead: Implications for Monetary Policy symposium, August 27, 2020

“Missed it!”, as my kids say.

Their policies are the polar opposite. They are great for the wealthy but have been very hard on low-and moderate-income communities.

The Fed’s policies are quite negative for the majority of Americans. 35% of Americans do not own a home. The majority have no direct stock ownership. The majority have yet to buy cryptocurrencies. Artificially driving mortgage rates to record lows is bad for the majority of Americans. It’s creating the inflation which has driven real average hourly earnings negative.

2021 was the first year in history that the rise in equity value for the median home exceeded the median American’s earnings from working. The median American homeowner made more being long real estate than they did in their job.

That’s crazy – and obviously unsustainable.

“Zillow Group Inc.’s home value index, which estimates the value of the typical U.S. home, rose 19.6% in 2021 to $321,634, an increase of $52,667 from 2020. That figure was slightly higher than what the median U.S. full-time worker earned, which was about $50,000 last year before taxes, according to Census Bureau data cited by Zillow.

“That marked the first time that the annual nationwide dollar growth for the typical home value exceeded the inflation-adjusted median pretax income, according to a Zillow analysis, which goes back to 2000.

“The surge in home prices last year has been a boon to homeowners but has made it more difficult for first-time home buyers to enter the housing market.”

— Wall Street Journal, ‘Rise in Home Values Surpassed Jobs Pay’, by Nicole Friedman, March 17, 2022

“The people who are winning the housing bids, typically, are folks who have higher incomes or have the equity from their previous home that they’re able to put forward.

“When we consider first-time buyers, renters, people who don’t already own a home and aren’t really benefiting from that equity, that’s definitely a big challenge.”

— Nicole Bachaud, an economist at Zillow, March 17, 2022

![]()

MASSIVE TRANSFER OF WEALTH

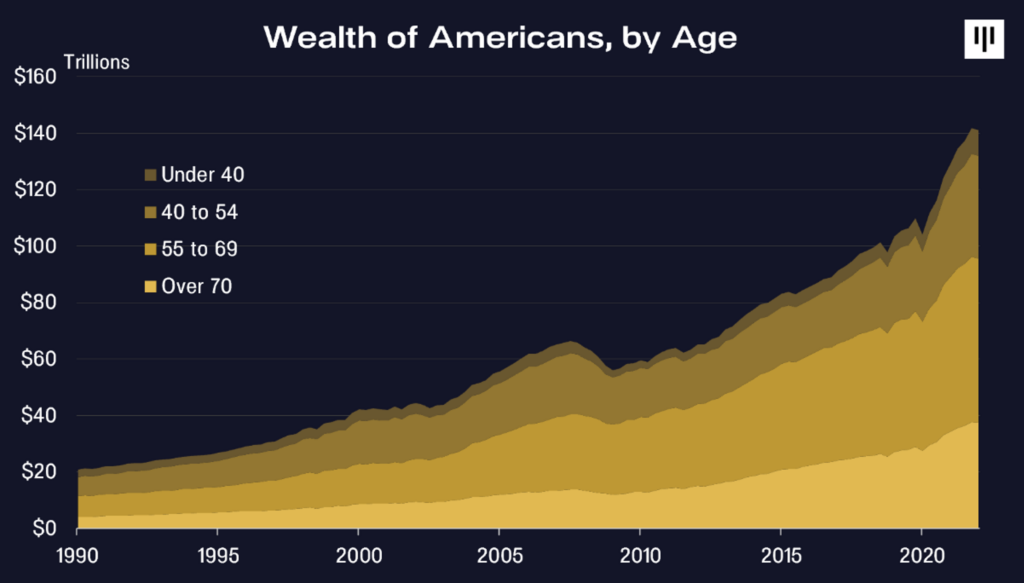

The Fed’s policies have been particularly hard on the younger generations.

Millennials and those in the younger generations now make up more than half of the U.S. population.

(The data, which was released by the Census Bureau last month and analyzed by the Brookings Institution, reveals the 166 million Americans under the age of 40 – Millennials, Gen Z, and younger generations – make up 50.7% of the population as of July 2019. There are 162 million Americans in the combined Gen X, baby boomer, and older cohorts.)

The Fed has engineered a massive transfer of wealth — from the majority of Americans, particularly those under 40 — to a minority of older Americans who own homes and stocks.

The majority of our population is in that tiny sliver on the top of this graph.

The Fed should unwind its massive manipulation of the government and mortgage bond markets – and let all of our citizens compete in a fair and free market for housing and mortgages.

THE SOCIETAL IMPACT OF THE FED’S MANIPULATION OF THE MORTGAGE MARKET

“American home buyers are older, whiter and wealthier than at any time in recent memory, with first-time buyers accounting for the smallest share of the market in 41 years, the National Association of Realtors found in its annual profile of home buyers and sellers.

“White buyers accounted for 88 percent of home sales during the survey period, up from 82 percent during the same period a year earlier, reaching the highest level in 25 years, according to the association’s findings. . . .

“Historically, first-time buyers made up about 40 percent of the market. But the share of first-time buyers fell to 26 percent during the 12-month survey period, from July 2021 through June 2022, plummeting to the lowest level since the trade association began tracking such data in 1981.

“The median age for first-time buyers was, at 36, the oldest it has ever been since 1981, as was the median age for repeat buyers, which rose to 59, during the survey period.

“Together, Black and Asian/Pacific Islander buyers accounted for just 5 percent of all home sales, as their shares in the market dwindled in the survey year compared to the previous year. Latino and Hispanic buyers accounted for 8 percent during that period, according to the nationwide survey of 4,900 recent buyers of primary residences.”

— The New York Times, ‘Older, White and Wealthy Home Buyers Are Pushing Others Out of the Market’, November 3, 2022

![]()

DEMOCRATIZING ACCESS

Blockchain democratizes access to financial assets.

In a new national survey conducted on its behalf by The Harris Poll, Grayscale Investments examined how Americans view the state of the economy and cryptocurrency against the backdrop of the 2022 United States election.

The Harris Poll confirms that cryptocurrency is democratizing access to finance:

-

Nearly half of Americans are familiar with cryptocurrency (49%), and familiarity rises among younger investors, including 70% of those aged 18-34 and 62% of those aged 35-44.

-

Familiarity is also higher among minorities, including 60% of black and 62% of Hispanic Americans, compared to 43% of European-Americans.

-

Interest in cryptocurrency seems to translate to adoption, particularly among young and diverse investors. About one-third of black (34%) and Hispanic (32%) Americans, as well as those under 45 years old (37%), say inflation and the current economic climate have made them more interested in cryptocurrency. Nearly one-third of Black (30%) and Hispanic (32%) Americans, as well as those under 45 years old (33%), already own cryptocurrency.

— Grayscale/The Harris Poll, GlobeNewswire, November 1, 2022

Blockchain technology devolves power from centralized and all-too-fallible bureaucracies, returning it back to the people.

Blockchain is changing the world for the good.

![]()

Good luck out there,

“Put the alternative back in Alts”

CONFERENCE CALLS [5]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

The State of Crypto and Macro

Thursday December 8, 2022 8:00am PST / 17:00 CET / 12:00am China Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Pantera Blockchain Fund V Launch Call

Tuesday, January 17, 2023 9:00am PDT / 18:00 CET / 1:00am China Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Pantera Liquid Token Fund Investor Call

Tuesday, January 24, 2023 9:00am PDT / 18:00 CET / 1:00am China Standard Time

Open only to Limited Partners of the fund.

Pantera Early-Stage Token Fund Ltd Investor Call

Tuesday, January 31, 2023 7:00am PDT / 16:00 CET / 11:00pm China Standard Time

Open only to Limited Partners of the fund.

Pantera Early-Stage Token Fund Investor Call

Tuesday, January 31, 2023 9:00am PDT / 18:00 CET / 1:00am China Standard Time

Open only to Limited Partners of the fund.

[1] Important Disclosures — General Market Commentary / No Offer of Advisory Services: This document (including this section) primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial or other advice or recommendation.

[2] Important Disclosures — General Market Commentary / No Offer of Advisory Services: This section provides educational content and general market commentary. Except for specifically marked sections of this this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial or other advice or recommendation.

[3] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory services. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[4] Important Disclosures — General Market Commentary / No Offer of Advisory Services: This section provides educational content and general market commentary. Except for specifically marked sections of this this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial or other advice or recommendation.

[5] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.