Investing in Doppler

January 28, 2026 | Mason Nystrom

Onchain IPOs

“Capital markets are the story we tell ourselves about the future—and the collective bet we place on it.”

— Anonymous

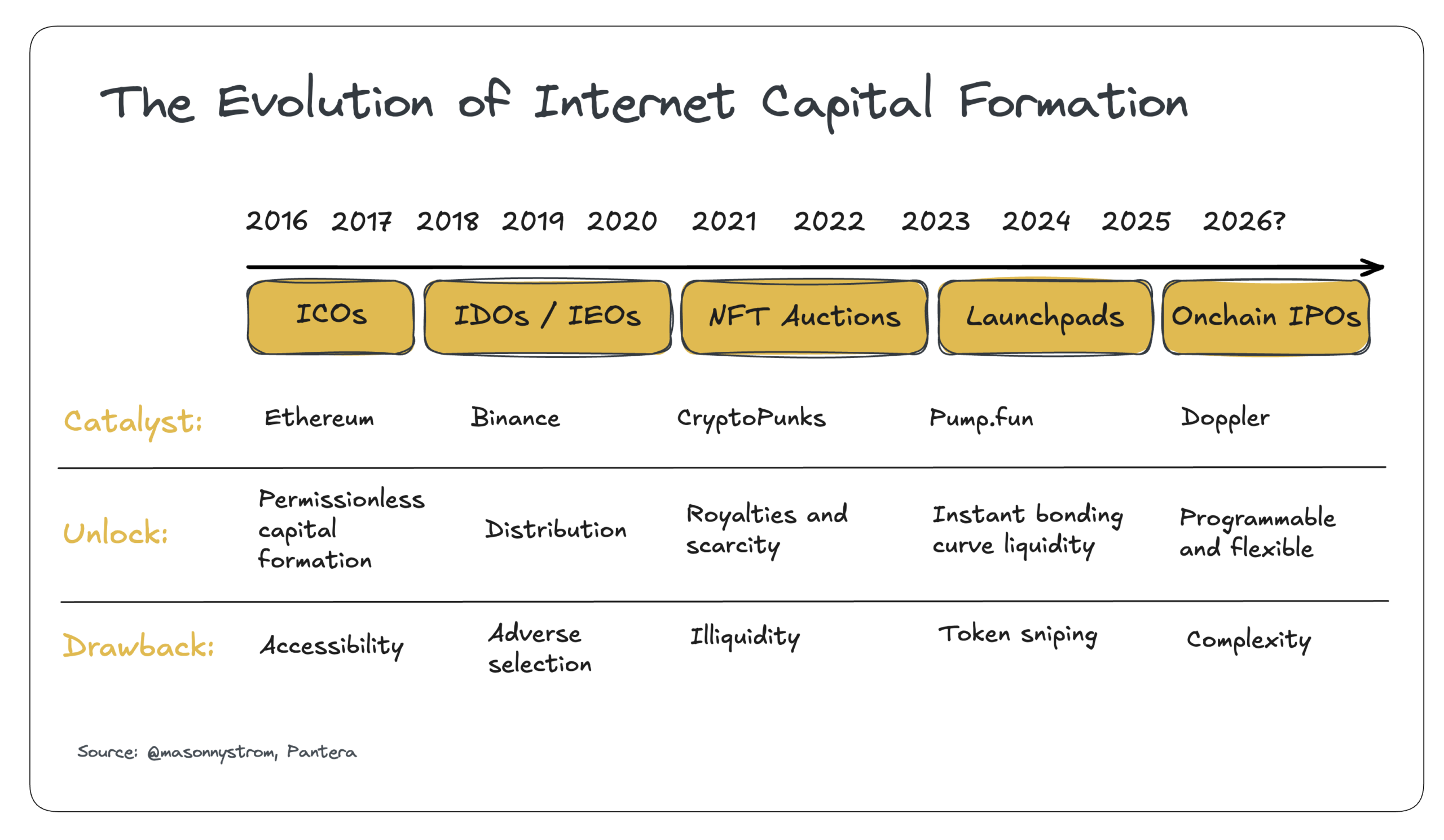

The original primitive of Ethereum was permissionless capital formation and launching tokens in the form of initial coin offerings (ICOs).

Over the past decade that primitive – permissionless capital formation – has evolved multiple times over. ICOs were effectively permissionless crowdsales, but lacked programmability and robust liquidity management. The most recent iteration of capital formation has been around launchpads like Pump which pioneered a simple mechanism to launch tokens and bootstrap liquidity that has led to a resurgence of permissionless capital formation.

Capital markets are iterative systems, constantly evolving towards efficiency. The next phase of capital markets is the inevitable shift towards being internet-native and programmable.

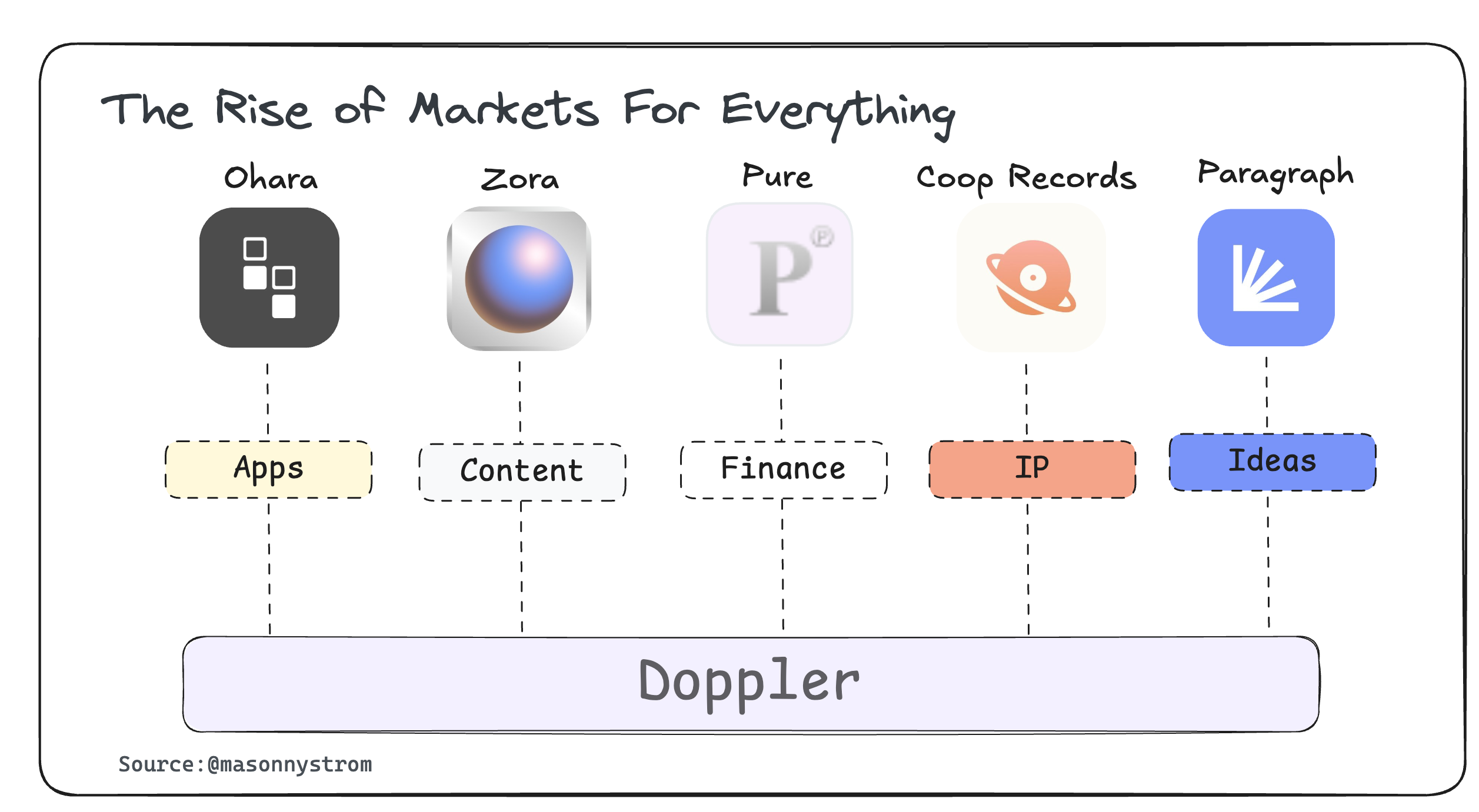

Today, we’re excited to announce our Seed Round investment in Whetstone, the makers of Doppler Protocol, a custom capital markets protocol for asset issuance and trading. Several projects, including Zora, Paragraph, Cooprecords, and Ohara among others have leveraged Doppler Protocol to create tokens for new asset classes around content and AI generated applications.

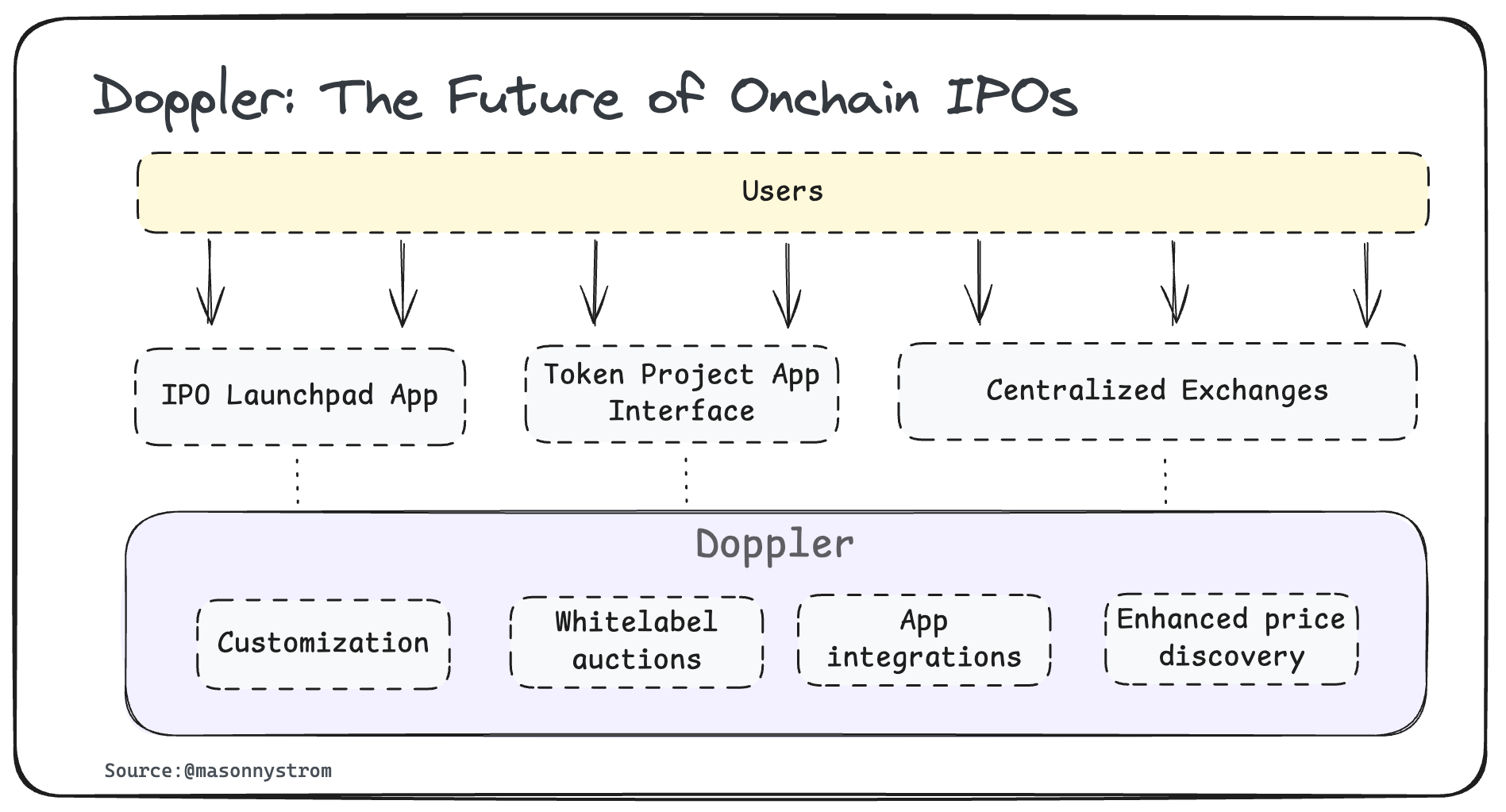

Within its first several months, Doppler has launched 5.5 million tokens, creating an estimated over $1.5 billion in value with assets that have done over $1 billion in trading volume. Doppler provides capital markets infrastructure for companies and token launchers to re-invigorate Ethereum’s founding use case – onchain IPOs.

The Path Towards Onchain IPOs

The traditional IPO process has long been criticized for its high costs, inequitable access, and misaligned incentives that result in predative underpricing and inaccurate price discovery. Direct listings and SPACs emerged as avenues to re-direct capital formation to avoid the issues of IPOs, but to limited success and not without introducing their own disadvantages.

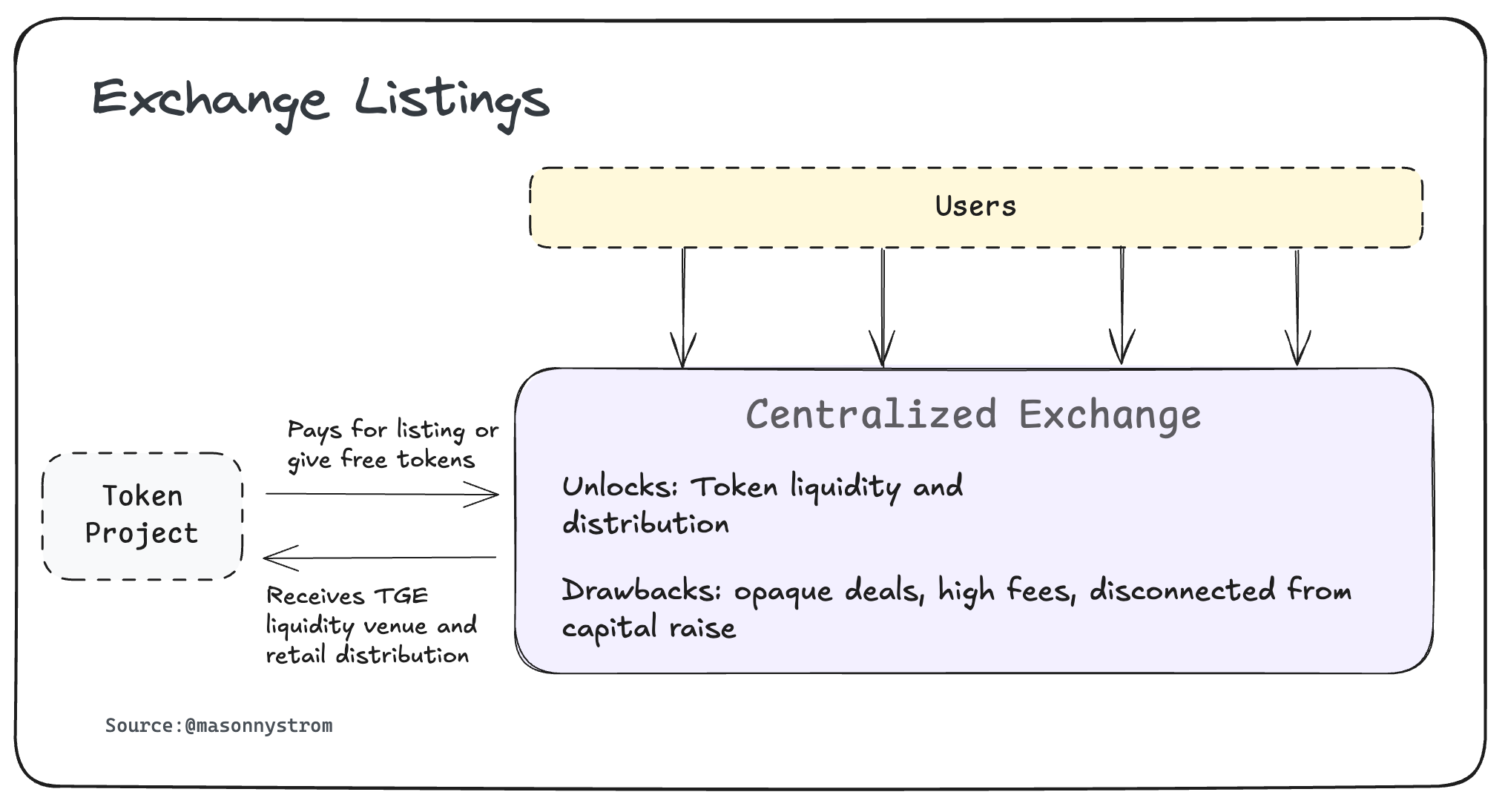

Crypto’s capital formation and listing process has similarly faced issues with capital fundraises often disconnected to liquidity creation (e.g. token generation events/listings).

Initial exchange offerings and exchange listings provided projects distribution and access to broader capital, but have devolved into a game of backroom deals and pay to play structuring that has driven poor incentive alignment and subpar outcomes for all those involved.

Pump’s ICO – which raised $1.3B in total with $600m of it onchain in under 12 minutes – offers a glimpse into a better system, one where onchain IPOs are not only possible, but advantaged over traditional IPOs.

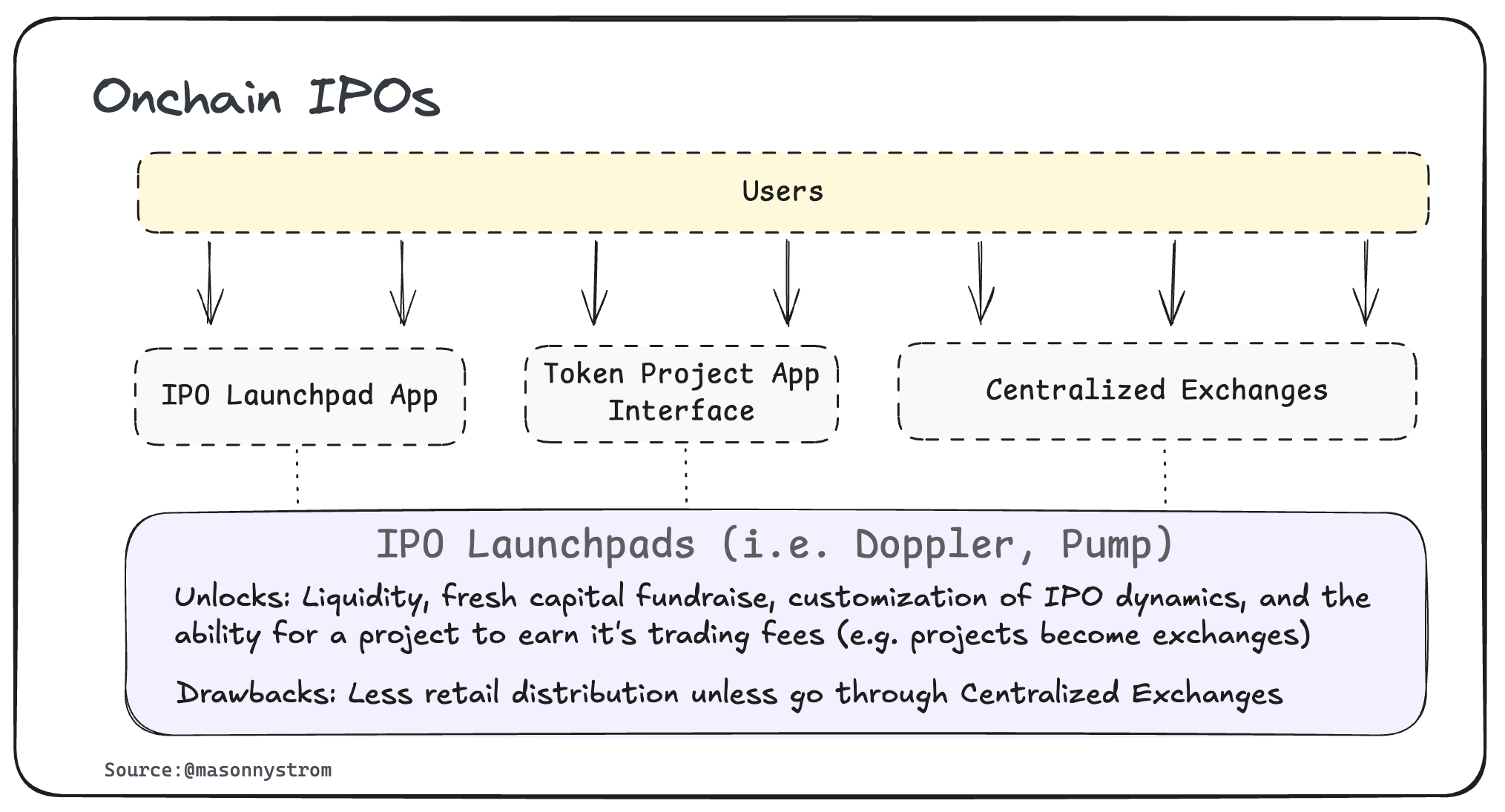

While exchanges were able to purchase tokens on behalf of their users, 75% of participants went through Pump’s auction page versus a centralized exchange. But, it wasn’t without its drawbacks. Of the ~24,000 KYC participants, only 42% of wallets were actually able to purchase tokens, in part due to some users being unable to get purchase orders filled in time. A future where more IPOs are onchain requires more customization and programmability around capital formation and token issuance.

Doppler enables projects to launch tokens with more functionality, including customizing vesting terms, controlling participant allocations, preventing market maker sniping, and improving price discovery. Even more notably, tokens launched through Doppler have the ability to monetize their token’s core asset – the trading fees. By tokenizing the LP position of a token and assigning it to the token’s treasury, the token LP becomes a revenue generating asset for the project. Instead of exchanges benefiting exclusively from token appreciation, tokens can monetize their own volatility.

Whetstone, and Doppler, are founded by Austin Adams. Prior to Whetstone, Austin was a core protocol researcher at Uniswap Labs and helped design Uniswap V4. Before joining Uniswap, Austin worked as a researcher at the Federal Reserve where he focused on global capital markets.

We’re incredibly excited to back Austin and the Whetstone team. Austin has deep expertise in mechanism design and building financial markets protocols. The Whetstone team is a collection of markets obsessed builders and operators, focused on innovating on the structure of internet capital markets.

Doppler is a story on the future of custom capital markets.

If you’re a team looking to launch onchain, book a 15 minute discovery call to learn more about how Doppler can help:

Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. All investments involve risk and unless otherwise stated, are not guaranteed. There can be no assurance that this investment will provide a return for the investing fund. Be sure to consult with a tax professional before implementing any investment strategy. Investment Advisory Services offered through Pantera, a Registered Investment Advisor with the U.S. Securities & Exchange Commission. Registration does not imply a certain level of skill or training. Past performance is not indicative of future results.