HSDT – Building the Preeminent Solana Treasury

September 15, 2025

We are pleased to announce that Pantera has closed more than $500 million in funding to launch a Solana-backed Digital Asset Treasury (DAT) called Solana Company (NASDAQ: HSDT), with up to $1.25bn in potential gross proceeds from the PIPE offering.

Read the official press release from this morning here.

In partnership with Pantera and Summer Capital, Solana Company is dedicated to building the preeminent Solana (SOL) treasury. By leveraging capital markets opportunities and onchain activity, Solana Company is designed to maximize SOL per share and provide public market investors optimal exposure to Solana’s secular growth via a familiar equity instrument.

Watch the CNBC Squawk Box Interview here, September 15, 2025

Why Now, Why Solana Company

Providing investors access to the full spectrum of blockchain assets has always been at Pantera’s core, and Solana Company is an extension of that goal.

Our aim is to substantially increase institutional and retail access to the Solana ecosystem and help fuel its adoption around the world.

Pantera has been at the forefront of the emerging DAT industry, anchoring the first Digital Asset Treasury company launches in the US, including DeFi Development Corp. (DFDV) and Cantor Equity Partners (CEP). We were also an anchor investor in BitMine (BMNR), where Fundstrat’s Tom Lee serves as chairman. Pantera manages over $1 billion in DAT exposure and has made over 15 investments, making it one of the largest investors in this space. We are now taking all the lessons learned from that track record and channeling that into setting up what we believe will be the most productive Solana treasury in the market.

The public equities markets have clearly embraced digital assets this year, and we believe Solana Company will provide a new cohort of investors access to the leading monolithic blockchain. Solana Company is where global capital meets Solana’s growth flywheel. We are aligning our long-term Solana conviction, Wall Street credibility, and expertise in DATs to drive Solana into its next phase of adoption.

The DAT Thesis

By Cosmo Jiang, General Partner

The investment case for Digital Asset Treasury companies (DATs) is grounded in a simple premise:

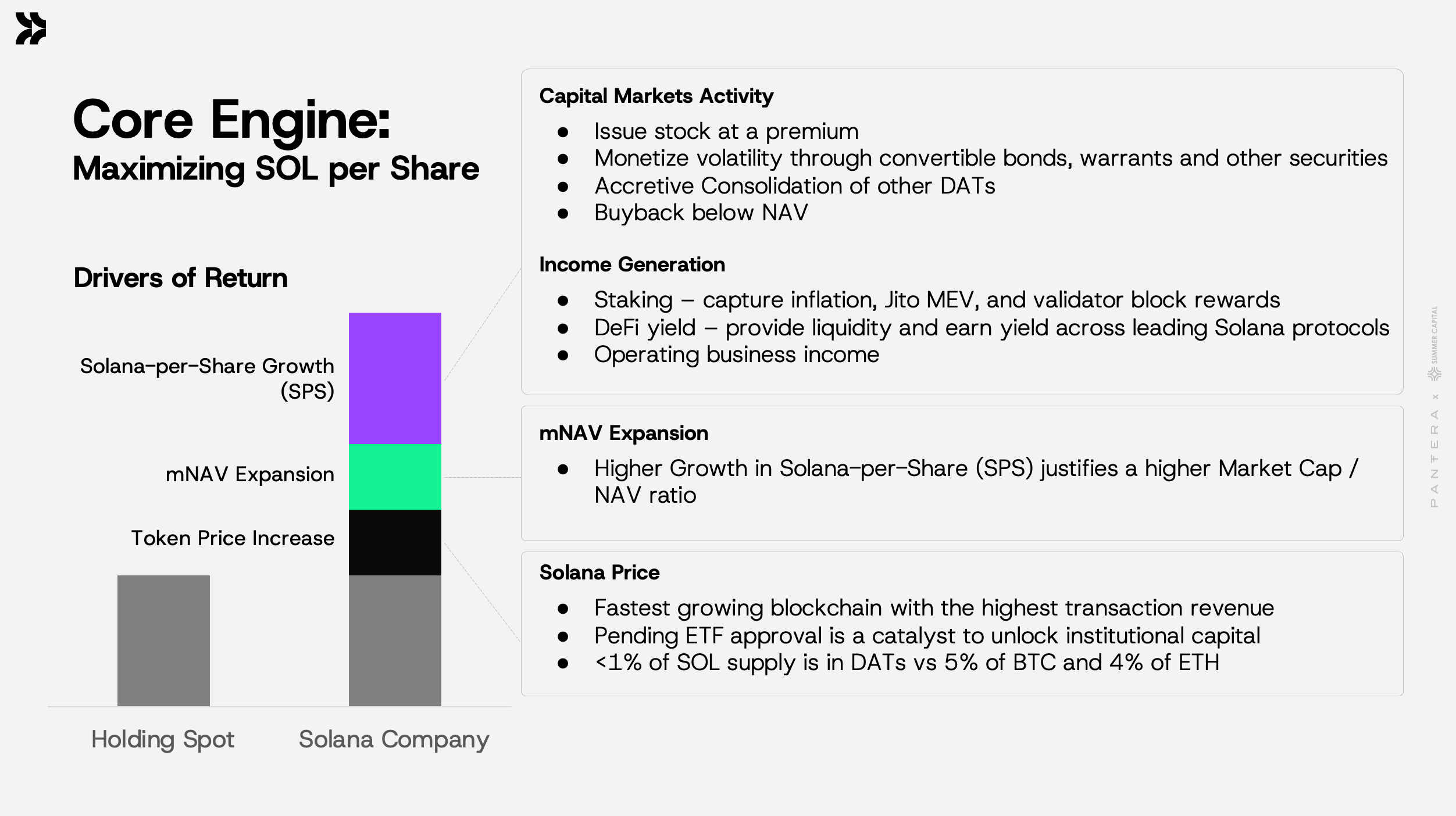

DATs can generate yield to grow net asset value per share, resulting in more underlying token ownership over time than just holding spot.

Therefore, owning a DAT could offer higher return potential compared to holding tokens directly or through an ETF. One key determinant of a DAT’s success is the long-term strength of its underlying token. That is why Solana is our primary treasury reserve asset.

Solana: The Most Commercially Viable Blockchain

We believe Solana is positioned to become the premier destination for consumer applications and decentralized finance, powered by its highly scalable infrastructure, ultra-low transaction fees, and ease of accessibility to anyone with an internet connection.

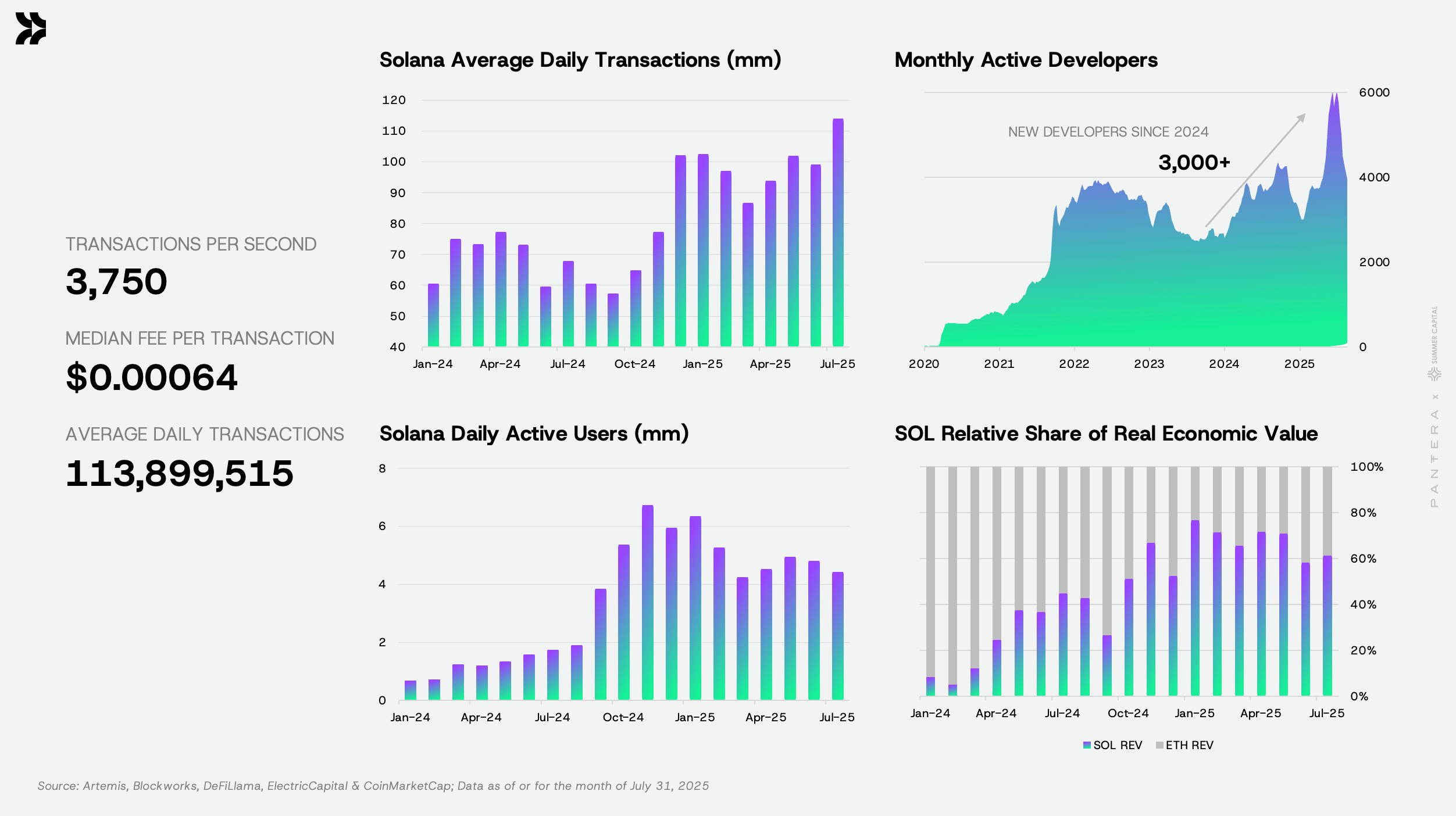

Solana has emerged as a secular share gainer of onchain economic activity and we believe it will continue to be in the coming years.

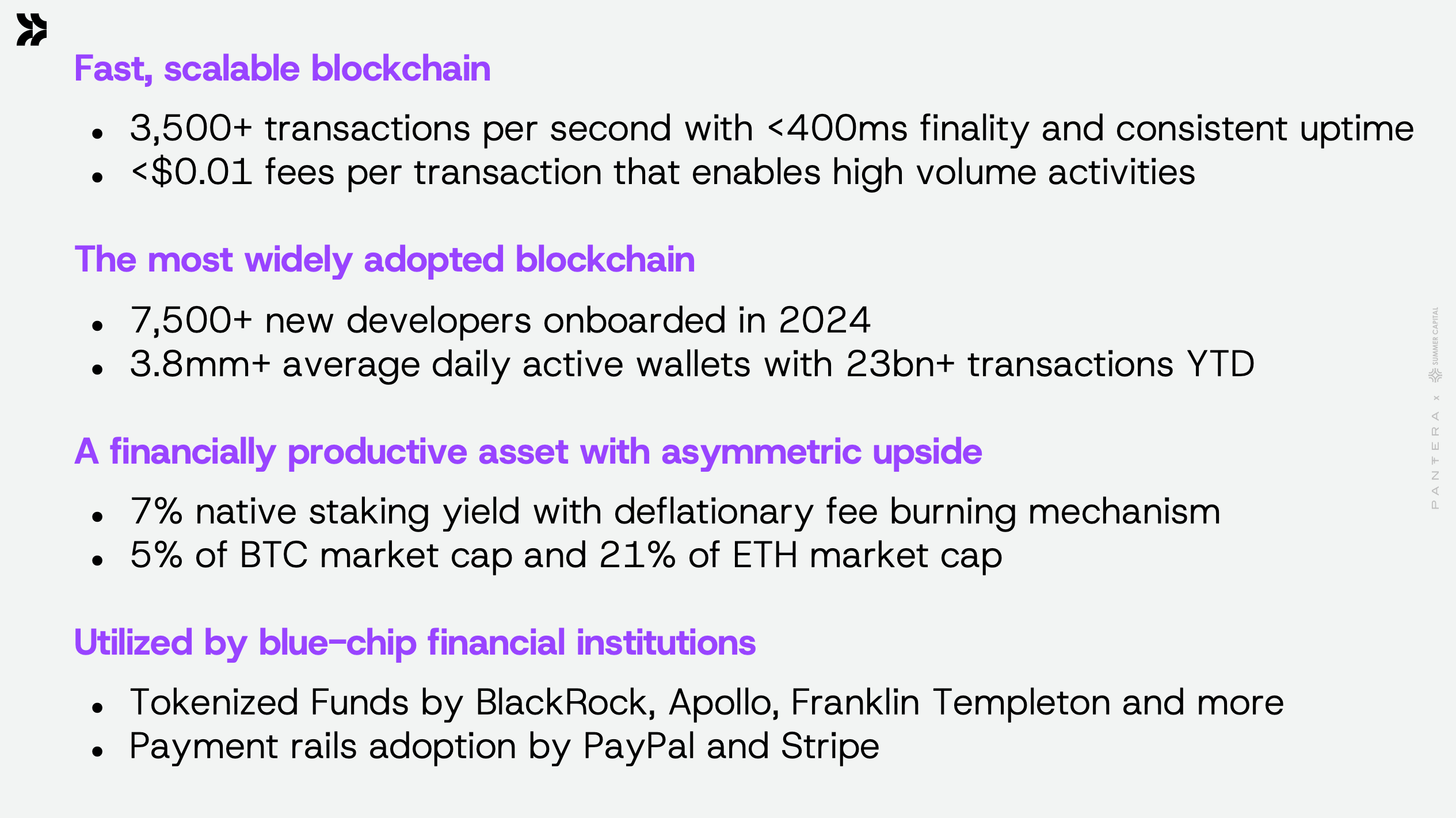

Blue-chip financial institutions such as BlackRock, PayPal, and Stripe have recognized its practicality and are already building on its user- and developer-friendly architecture.

Solana’s strengths are evident across technology, user adoption, economic productivity, and real-world integrations:

The case for Solana is simple, it’s:

Fast, affordable, and accessible.

I often think back to what Jeff Bezos described as the “holy trinity of consumer wants”, the cornerstone of Amazon’s philosophy and what drove that company to great heights. I see that same clarity of vision and that same trinity in Solana, underscoring my conviction.

Solana has taken a “monolithic” design approach, focused on creating a unified user experience and maximizing the capability of its core chain, similar to the design philosophy of Apple. Solana has been designed from the ground up to be high-performance and low-cost, capable of handling tens of thousands of transactions per second at the base layer.

The differences matter, especially for mainstream consumer adoption where users demand reliable Web2-like speed and affordability. That is why the vast majority of novel blockchain applications have launched on Solana in the last year – across payments, gaming, social apps, and DePIN.

I believe we are at the early stages of blockchain adoption, with a more than 100x increase in blockchain activity ahead. For these mass-market applications, we believe Solana has the user experience edge.

The stats are beginning to paint that picture.

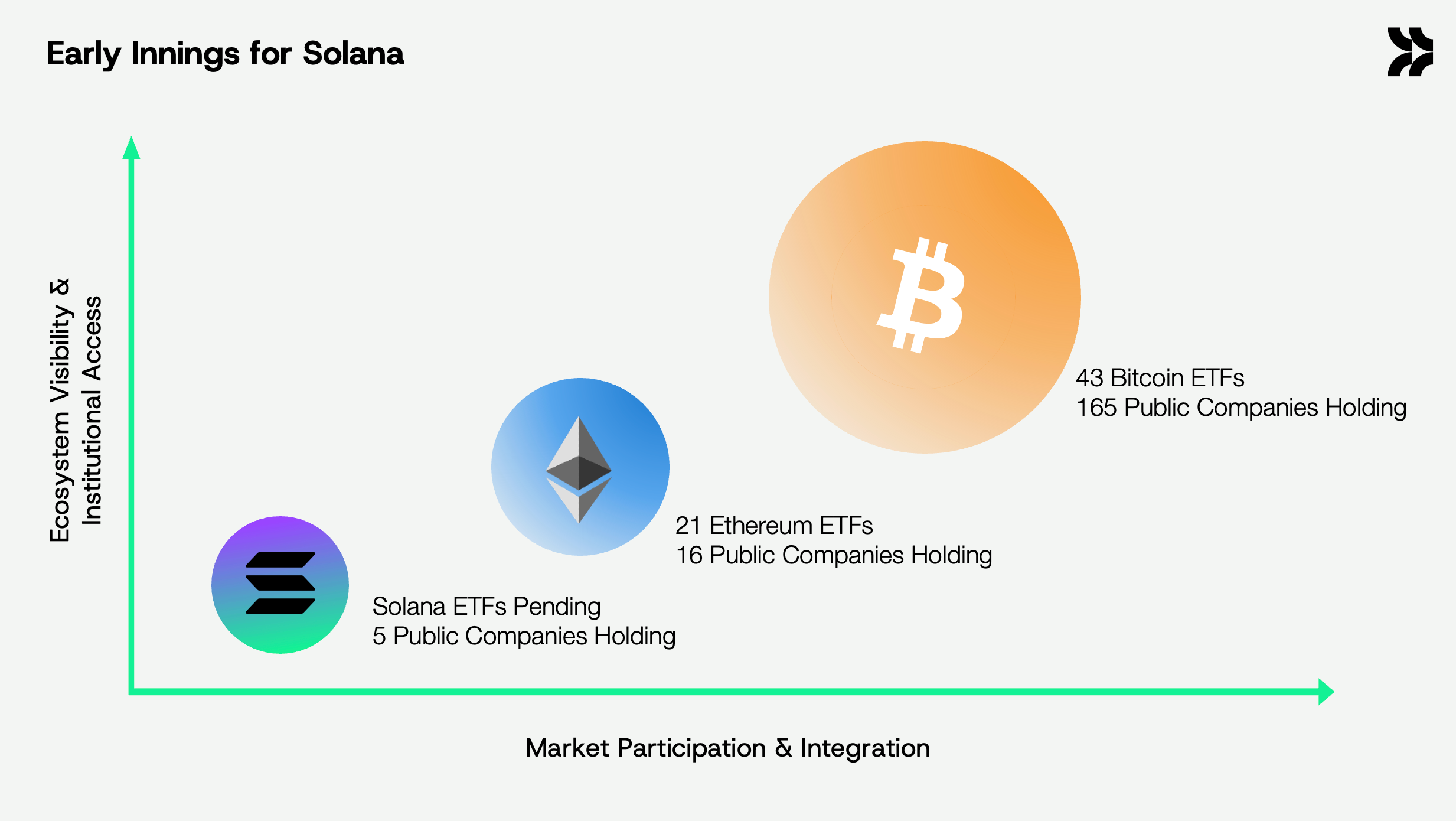

Inflection Point In Solana’s Institutional Adoption

The launch of the bitcoin ETFs in January 2024 was a major turning point in bitcoin’s acceptance as an institutional asset. While the launch of the ethereum ETF had less of an immediate impact, many of the regulatory headwinds that had held it back have reversed in the Trump Administration, and it too is having its institutional moment. We believe Solana is next in line.

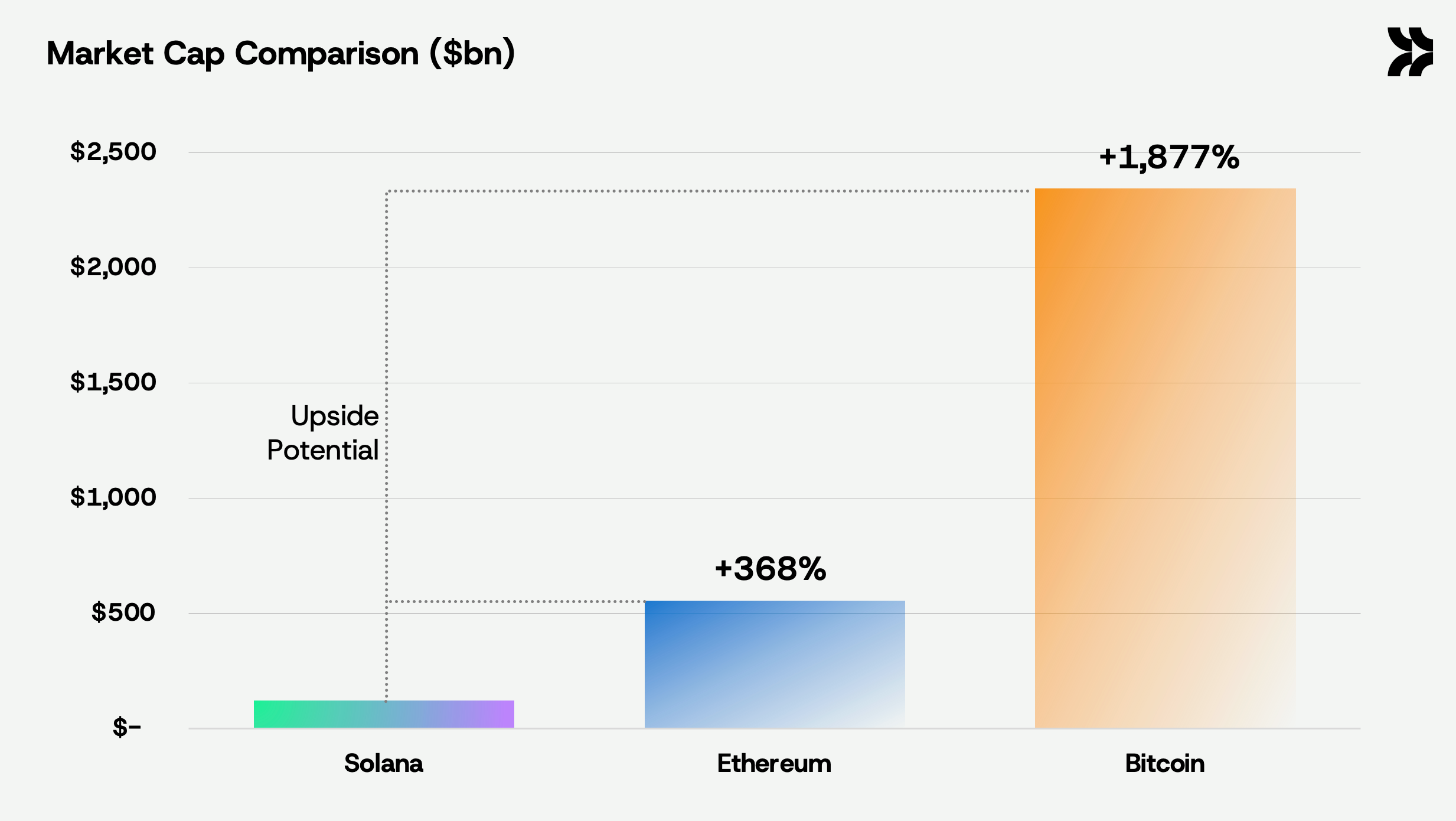

In terms of market capitalization, Solana is still just a small fraction of Ethereum and Bitcoin, yet it has more daily active wallets. The Solana ecosystem is also attracting the most incremental new developers, having onboarded 7,500+ new developers in 2024 alone.

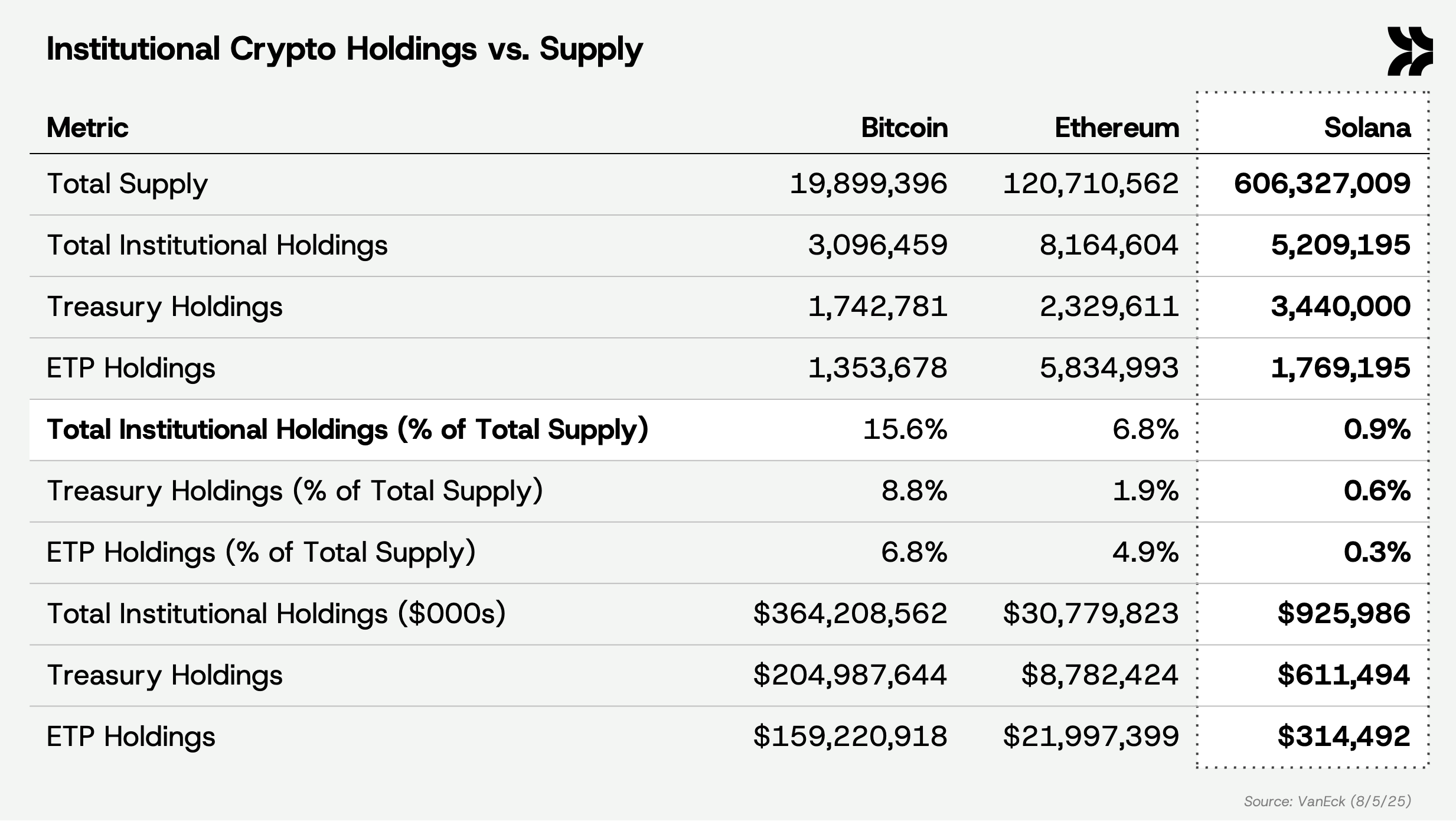

Institutions are currently under-allocated, holding less than 1% of the total SOL supply, compared to 7% ownership of ETH and 16% of BTC. With a Solana ETF approval expected as early as Q3/Q4 2025, we believe the SOL adoption story is just beginning and offers asymmetric upside potential.

Strategy and Execution: Maximizing Solana Per Share (SPS)

Solana Company is positioned to provide investors with optimal exposure to Solana, being designed to maximize SOL per share under the management of Summer Capital Founder Joseph Chee as Chairman (former Head of Investment Banking, Asia at UBS) with Pantera as the asset manager responsible for executing the treasury strategy.

SOL is financially productive by design, whereas BTC is non-yield-bearing. Solana Company intends to leverage those innate properties of Solana’s architecture.

The framework below highlights HSDT’s core engine – three expected return drivers to deliver long-term value.

HSDT bridges public markets with Solana, channeling liquidity into staking and onchain activity – powering a flywheel that fortifies the network and compounds value for shareholders.

We view this as more than a holding vehicle.

It’s an active treasury platform built to accelerate Solana’s role in powering the next era of global finance and consumer applications.

Learn more about Solana Company (HSDT) here.

![]()

PUBLIC ACCESS TO SOLANA

For twelve years Pantera has been at the forefront of providing access to blockchain. First bitcoin fund, first blockchain venture fund, first exclusively private token fund, etc.

To date most have had million dollar-minimums and most require investors meet the very high SEC “Qualified Purchaser” wealth standard.

Now we are providing our first access vehicle to the public – HSDT.

There’s a great article about Mark Casey in the Wall Street Journal yesterday. His journey with Digital Asset Treasury companies.

It’s a great framework to understand why we’re supporting DATs.

Mark is a friend and neighbor. Years ago I was so busy with other blockchain things I hadn’t given MicroStrategy much thought. When I heard he owned more than 10% of the entire company I had to ask “Why?”

His answer still resonates: “I’m a 40 Act mutual fund. It’s the only way I can get access to bitcoin.”

That decision has made his investors huge returns. Capital Group has turned an investment of less than $1bn into more than $6bn.

Solana is our largest position. We manage $1.1 billion.

Without a Solana ETF it’s very difficult for investors to get access to Solana. HSDT changes that. Now anyone with a brokerage account can get access to the largest position in Pantera.

Lastly on why Solana is important in a portfolio.

Pantera Bitcoin Fund has returned over 1,500x. Bitcoin has been the best-performing asset I’m aware of in my career. It’s generated $2.3 trillion of returns for hundreds of millions of people. Pantera itself has distributed bitcoins worth over $10bn today. We’ve also generated $5bn in direct profits for our investors.

Solana is earlier in its development. Solana trades at only 5% of bitcoin’s market cap. They serve very different purposes so I’m not going to argue one replaces the other. My point being, from here Solana is likely to have more upside.

![]()

|

|

“Put the alternative back in Alts”

SOLANA COMPANY INFORMATION

Read the official press release here.

Follow Solana Company on X: https://x.com/Solana_Company

Website: https://www.solanacompany.co/

The information provided in this note and the official press release is intended for informational purposes only and does not constitute investment advice, endorsement, analysis, or recommendations with respect to any financial instruments, investments, or issuers. Investment in cryptocurrency and DeFi projects involves substantial risk, including the risk of complete loss. This note does not take into account the investment objectives, financial situation, or specific needs of any particular person and each individual is urged to consult their legal and financial advisors before making any investment decisions.

Important Disclosures – Certain Sections of this Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Partners LP and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically marked sections of this this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.