Building Permissionless Neobanks

February 11, 2026 | Jay Yu

Storing, Spending, Growing, and Borrowing Money on Crypto Rails

By Jay Yu

Introduction

Scroll in the UI of any banking or fintech app today – whether it be Bank of America or Revolut, Chase or SoFi – the interface feels almost interchangeable: Accounts, Pay & Transfer, Earn Yield. This design reveals an underlying commonality; banks are interfaces for four fundamental relationships we have with money:

- 1. Store: a place for us to hold our assets

- 2. Spend: a mechanism to transfer money for everyday spending

- 3. Grow: a set of tools to both passively and actively manage our wealth.

- 4. Borrow: a place to borrow capital from

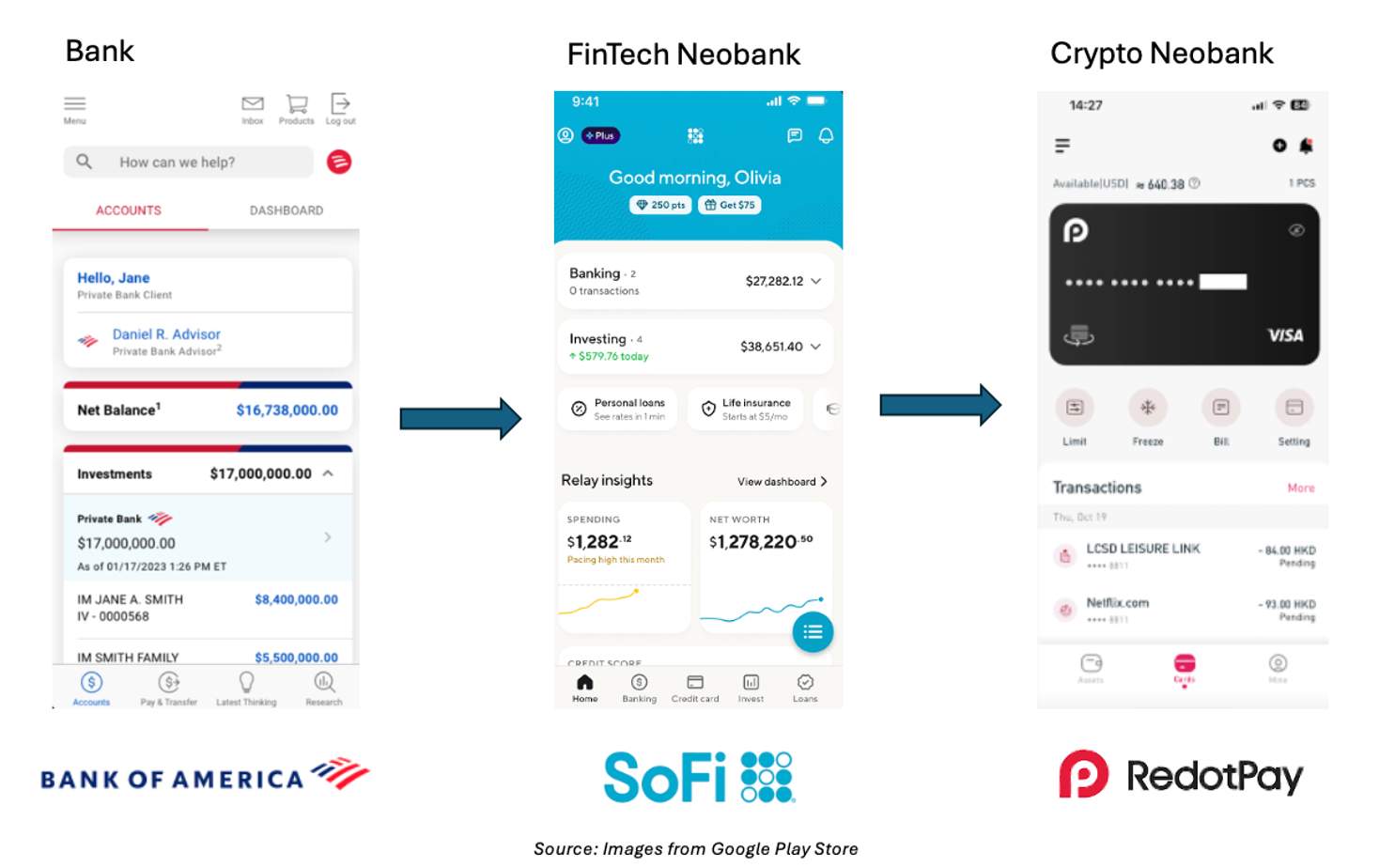

Over the past decade, mobile technology has fueled the rise of “neobank” apps like SoFi, Revolut, and Wise that democratized financial services and redefined what it means to “go to the bank,” replacing physical branches with intuitive, always-on digital interfaces.

Today, as crypto enters its second decade, it offers a new blueprint for what comes next. From self-custodial wallets to stablecoins to onchain credit and yields, the permissionless and programmable nature of blockchains enables banking experiences that are global, instantaneous, and composable. If mobile gave us the neobank, crypto gives us the permissionless neobank: a unified, interoperable, and self-custody interface to store, spend, grow, and borrow money in the onchain economy

A History of Fintech Neobanks

Just like crypto, neobanks rose to prominence in the aftermath of the 2008 financial crisis. Rather than copy the brick-and-mortar layout of a traditional bank, neobanks operate as tech platforms providing banking services through a mobile interface. Most neobanks work with partner banks behind the scenes to provide deposit insurance and compliance infrastructure, while maintaining the front-end customer relationship. With their fast onboarding, transparent fees, and digital-first designs, many neobanks have become the go-to interface for users to store, spend, and grow money [1].

|

Neobank |

Market Valuation |

Initial Wedge |

Growth and Expansion |

|

$33.82B market cap |

Started as a platform to help students refinance their student loans |

Gradually grew from debt optimization to help users “get their money right” with refinancing, investing, credit, and full-stack banking. |

|

|

$75B private valuation |

Beginning as a low-fee foreign exchange app for European and international travelers |

Built wedge around instant, cheap payments, and relied on viral referral marketing and community growth, before expanding into crypto trading and becoming a full-stack neobank. |

|

|

$9.10B market cap |

Started off offering an early paycheck access mechanism and having zero-fee overdrafts |

Grew on a narrative of financial inclusion for the underbanked and aligned their revenue model with user incentives. |

|

|

$11.64B market cap |

Entry point was through cross-border payments, targeting the expensive and slow remittance process |

Grew to become an international financial layer with debit cards, business accounts, and payroll solutions. |

|

|

$80.82B market cap |

Initially offered no-fee credit cards |

Expanded into savings accounts, personal loans, investment products, eventually becoming the largest neobank in Latin America. |

|

|

$3.5B private valuation |

Began as a neobank serving early-stage, venture backed startups that were frustrated with the in-person onboarding and slow support services of traditional banks |

Evolved into a full-stack platform for startups, offering venture debt, capital partnerships, and founder-focused services. |

A Brief Overview of FinTech Neobanks. Note: Market data from Yahoo Finance as of Dec. 10, 2025

Looking at the growth stories of all these multibillion-dollar neobank startups, we see that what they have in common is in owning the customer relationship through a unique digital offering (refinancing, early paycheck access, transparent FX rates), kickstarting a user-driven volume flywheel, before expanding their product suite to upcharge their users. To put in simple terms, fintech neobanks won by owning the customer interface for money, changing the medium users store, spend, grow, and borrow money.

Today, crypto is at a similar junction as neobanks were 5-10 years ago. Over the past decade of development, crypto has already produced its own wedges: censorship-resistant asset storage via self-custodial wallets, accessible digital dollars via stablecoins, permissionless credit markets on protocols like Aave, and 24/7 global capital markets that can turn Internet memes into wealth generators. Just as mobile infrastructure unlocked the neobank era, programmable blockchains now provide a permissionless financial substrate [2][3].

The natural next step is to combine those permissionless backends with the easy-access frontend of a neobank. While the first wave of neobanks moved the frontend of a bank from a physical store to a mobile interface while keeping the banking backend, today crypto neobanks are doing the opposite: keeping the convenient mobile frontend while changing how money moves from traditional banking rails to stablecoins and public blockchains. In other words, if neobanks rebuilt the frontend of banking on mobile rails, crypto now offers the chance to rebuild the backend on permissionless rails.

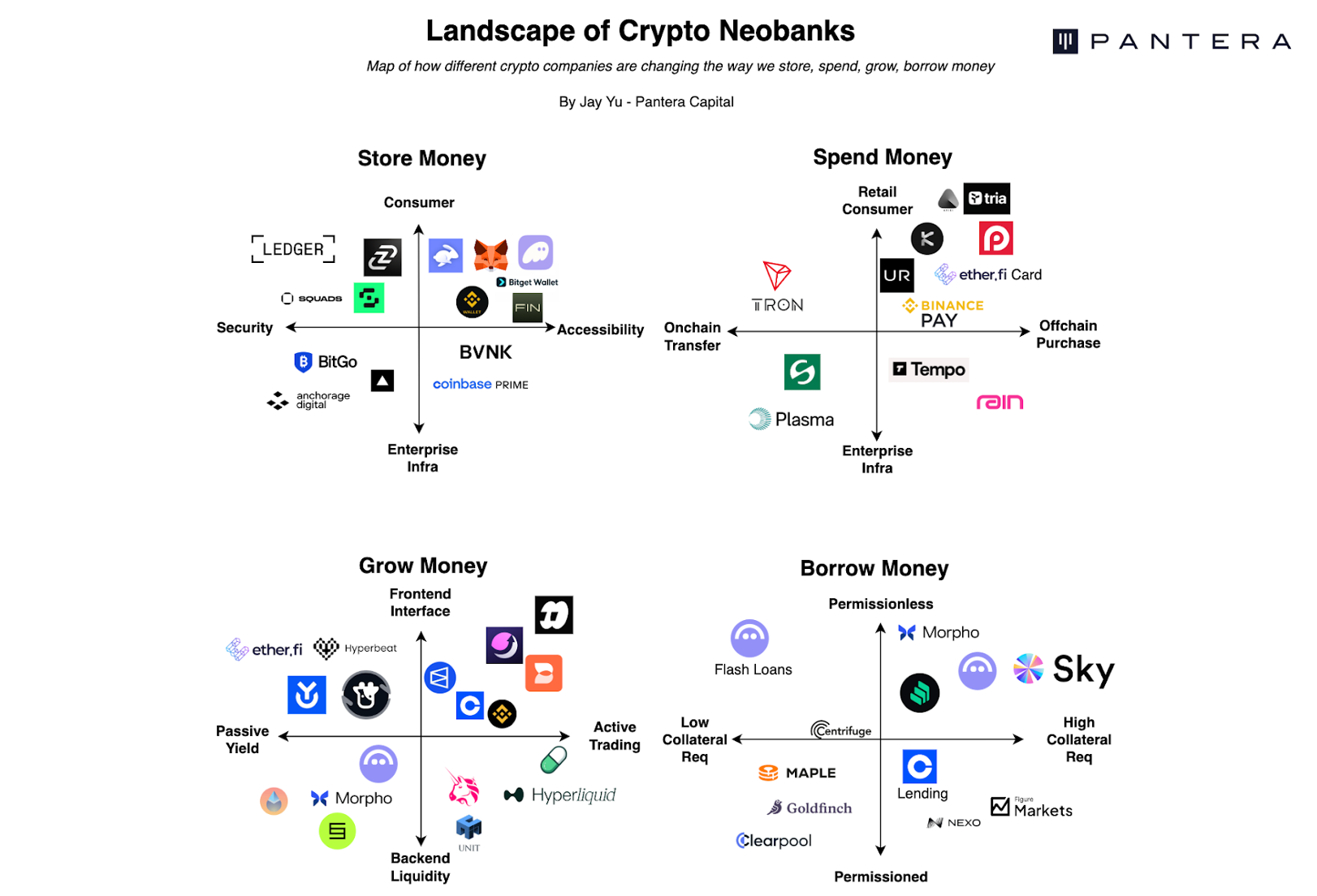

The Landscape of Crypto Neobanks

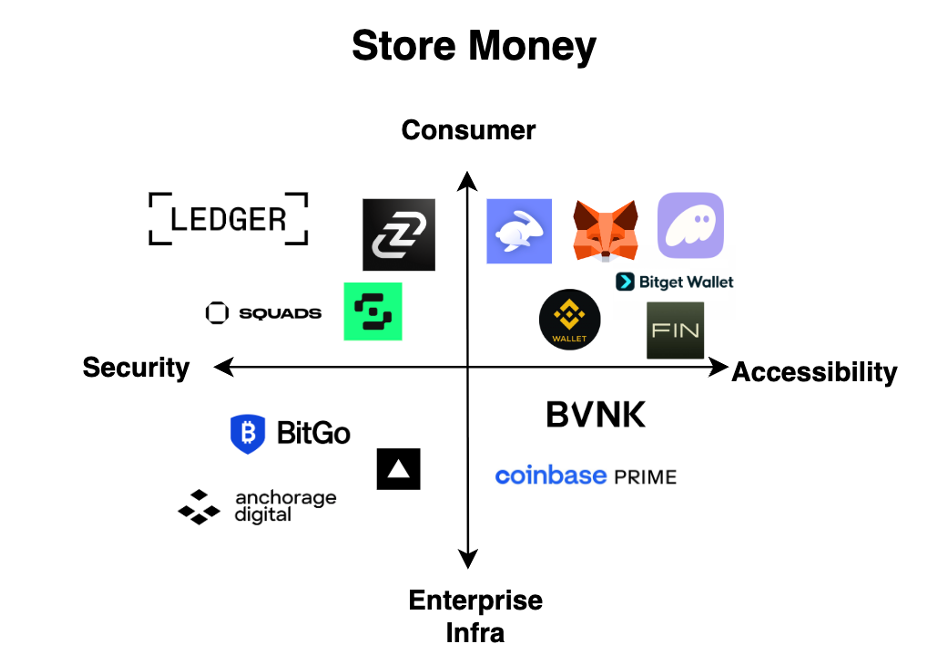

Landscape of Crypto Neobanks. Source: Original Content.

Today, many different projects are converging towards a “crypto neobank” vision. We already see many banking primitives of storing, spending, growing, and borrowing money already being realized on permissionless crypto rails – we can self-custody using Ledger, spend with an Etherfi card or Bitget QR code, grow money by trading on Hyperliquid, and borrow money through Morpho. There are also numerous adjacent players supporting the underlying infrastructure, such as wallets as a service, stablecoin settlements, licensing, localized on-ramp and off-ramp partners, and orchestration routers [26].

Furthermore, in some cases, crypto exchanges like Binance and Coinbase have already made huge strides to become more like a fintech neobank, capturing more and more of an end user’s relationship with their assets. Binance Pay, for example, already powers over 20 million merchants worldwide [4], while Coinbase allows users to automatically earn up to 4% rewards just by holding USDC on platform.

So, with this complicated landscape of crypto neobanks, it is worth walking through this landscape carefully, looking at how different crypto platforms are vying to own the primary financial relationship with users, targeting how users store, spend, grow, and borrow money.

Storing Money with Crypto

To properly self-custody a crypto asset and interact with the blockchain, a user must have some sort of crypto wallet. Roughly speaking, we can categorize the crypto wallet landscape by two axes: a “security to accessibility” axis, and a “consumer application to enterprise infrastructure” axis. Each category has seen differentiated winners with huge distribution power: Ledger for secure, consumer-facing hardware wallets; Fireblocks and Anchorage for secure enterprise wallet infrastructure; Metamask, Phantom, and Privy being consumer-facing wallets focusing on improving accessibility and UX, while Turnkey and Coinbase Prime capturing more of the accessible, enterprise-grade infrastructure.

One of the key advantages of building a neobank from a wallet application as a beachhead is that wallet frontends – such as Metamask and Phantom – often own the entry point by which users interact with their crypto assets. This “fat wallet thesis” argues that the wallet layer captures most of the consumer-grade distribution and order flow, and that for an end consumer, wallets have an incredibly high switching cost [5]. Indeed, today an estimated 35% of Solana transaction volume flows just through Phantom wallet, an incredible moat established by superior mobile UX and user stickiness [6]. Moreover, as consumers (especially retail consumers) would often choose convenience over price, wallets such as Phantom and Metamask can have a take rate of 0.85% [7], whereas the swapping protocol, such as Uniswap, might only introduce a 0.3% fee for swapping tokens [8].

On the other hand, creating an entire neobank from just a single wallet platform is actually surprisingly difficult. This is because achieving profitable scale here requires users to not just store tokens, but actively use them inside of the wallet. Phantom, Metamask, and Ledger may be able to boast household recognition, but they’re not able to monetize if all the user is treating their crypto wallet like a cash shoebox underneath their bed. In other words, wallets must become active trading and transaction platforms to convert their distribution to revenue.

Both MetaMask and Phantom seem to be moving in this direction. MetaMask, for example, recently launched the MetaMask card as a way to upcharge their existing crypto-native demographic and become a default solution for “spending crypto.” Phantom has also followed suit with its Phantom Cash launch, and moving into the “grow money” sector by integrating with Hyperliquid’s builder codes to offer in-app perp trading. As Blockworks puts it, “though Drift or Jupiter might be [Solana] hometown favorites, Hyperliquid is where the money already is” [9]. This is a lesson universally applicable to companies in the wallet space – you must not only capture the user’s wallet, but also capture the volumes moving in and out of that wallet via spend, grow, and borrow.

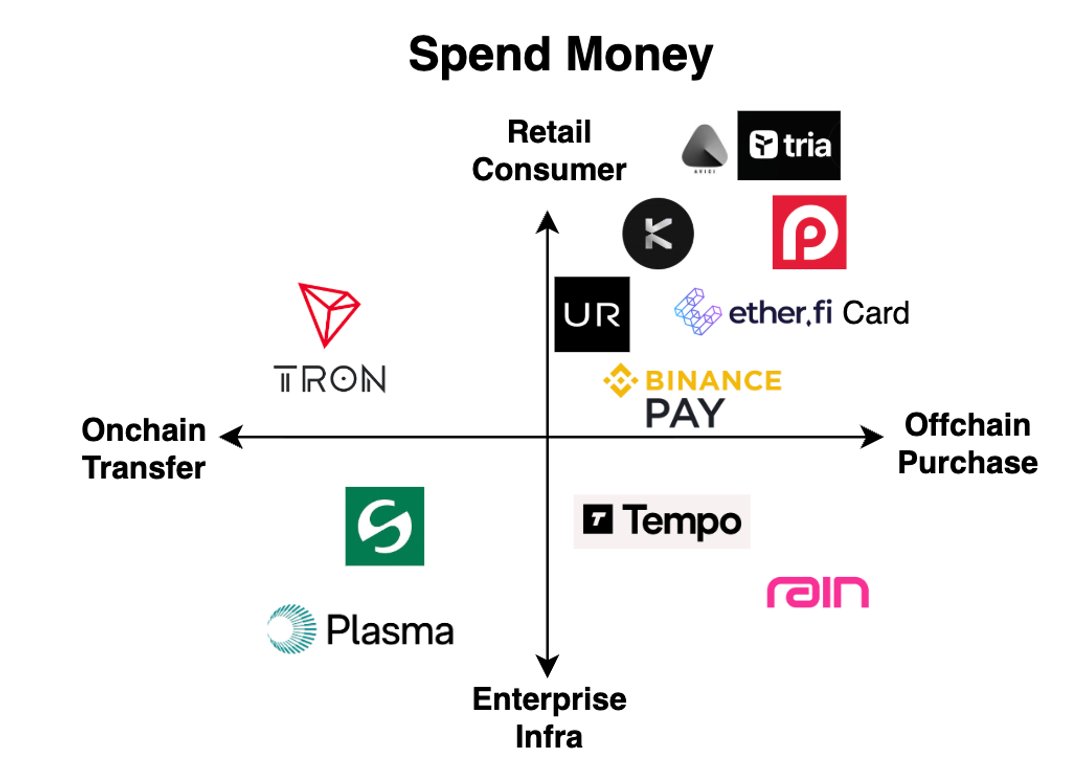

Spending Money with Crypto

The second category of crypto neobank contenders are platforms that allow users to spend money with crypto. Just like in the case of “storing money with crypto,” we can categorize these crypto spending applications along two axes: from onchain transfers to offchain purchases (eg. buying a coffee), and from retail-facing applications to enterprise-focused infrastructure.

Interestingly, most of the newer “neobank” projects that have gained traction over the past few months, such as Kast, Tria, Tempo, and Stable all attempt to tackle this wedge of spending money with crypto. In particular, we have seen much of the buzz within the neobank trend has been happening in two areas of “spending crypto” – (1) retail consumer apps with stablecoin card integrations, such as Avici, Tria, Redotpay, and EtherFi, as well as (2) “stablecoin-focused chains” such as Stable, Plasma, and Tempo meant as infrastructure for enterprise use cases.

The first category of retail-centric “spending apps” fundamentally makes crypto apps much similar in their user experience and interface as traditional banking and neobank apps, with familiar tabs like “Home, Banking, Card, and Invest.”

As crypto card issuers like Rain and Reap have matured, along with Visa and Mastercard’s expanded stablecoin support, crypto cards are becoming a commoditized offering. The real differentiation comes from driving and retaining transaction volume – whether it be through novel cashback mechanisms, geographical “ground game”, and onboarding non-crypto natives onto these platforms. This trajectory echoes the rise of fintech neobanks, where success wasn’t about issuing a card or building an app, but about owning a particular customer segment – from students (SoFi) to low-income families (Chime) to international travelers (Wise and Revolut) – and scaling trust, loyalty, and volume from there. If done right, these payment-first neobanks could become a large adoption vector for crypto that fuels adoption of blockchain infrastructure.

Crypto neobanks could also guide users towards a next-generation system of payments that move beyond legacy card rails. Card-based spending could just be a temporary, transitional model still dependent on Visa and Mastercard’s rails and inherit their centralized constraints. Early signals of what’s next are already emerging: wallets like Bitget Wallet have already rolled out QR-based stablecoin payments with merchant pilots in Indonesia, Brazil, and Vietnam, pointing toward a future where crypto-native settlement could potentially bypass legacy issuers entirely.

The second class of recent “neobank” applications have been stablecoin infrastructure projects built for enterprises, including Stable, Plasma, Tempo, Arc, often dubbed “stablecoin chains”. A major reason for their rise may be the increased interest from institutional players – traditional banks, FinTechs like Stripe, incumbent payment networks – wanting more efficient rails to move money. Many of these “stablecoin chains” are designed to have similar features [10], such as stablecoin gas tokens, which stabilize gas fees by removing the price variable of a custom gas token, streamlined consensus mechanisms to “fast-track” simple, high-volume payments from A to B, better privacy for token transfers such as with Trusted Execution Environments (TEEs), and customization of data fields to better fit international payments standards such as ISO 20022 [11].

However, these technical improvements alone do not guarantee adoption. For payment chains, the moat is the merchant. It is a question of how many merchants and enterprises decide to move their business operations onto a particular chain. Tempo, for example, attempts to leverage Stripe’s massive merchant customer base and payments rails to drive volumes, adoption, and revenue [12], onboarding a completely new cohort of merchants onto crypto rails. Other chains, such as Plasma and Stable, aim to become “first-class-citizens” for Tether’s USDT to move the stablecoin between different institutions.

One of the most instructive case studies here is Tron, which processes 25-30% of global stablecoin transaction volume [13]. Tron’s rise can largely be attributed to its dominance in emerging markets, such as Nigeria, Argentina, Brazil, and Southeast Asia. Due to its low fees, fast finality, and global reach, Tron rose to become a common settlement layer for many merchant payments, remittances, and dollar-denominated savings accounts [14]. For all these newer payment chains, Tron is the incumbent that they must overcome. This requires a 10x improvement on an already cheap, fast chain with global reach – a task that requires a laser focus on merchant onboarding and network scale rather than on marginal technological improvements.

Growing Money with Crypto

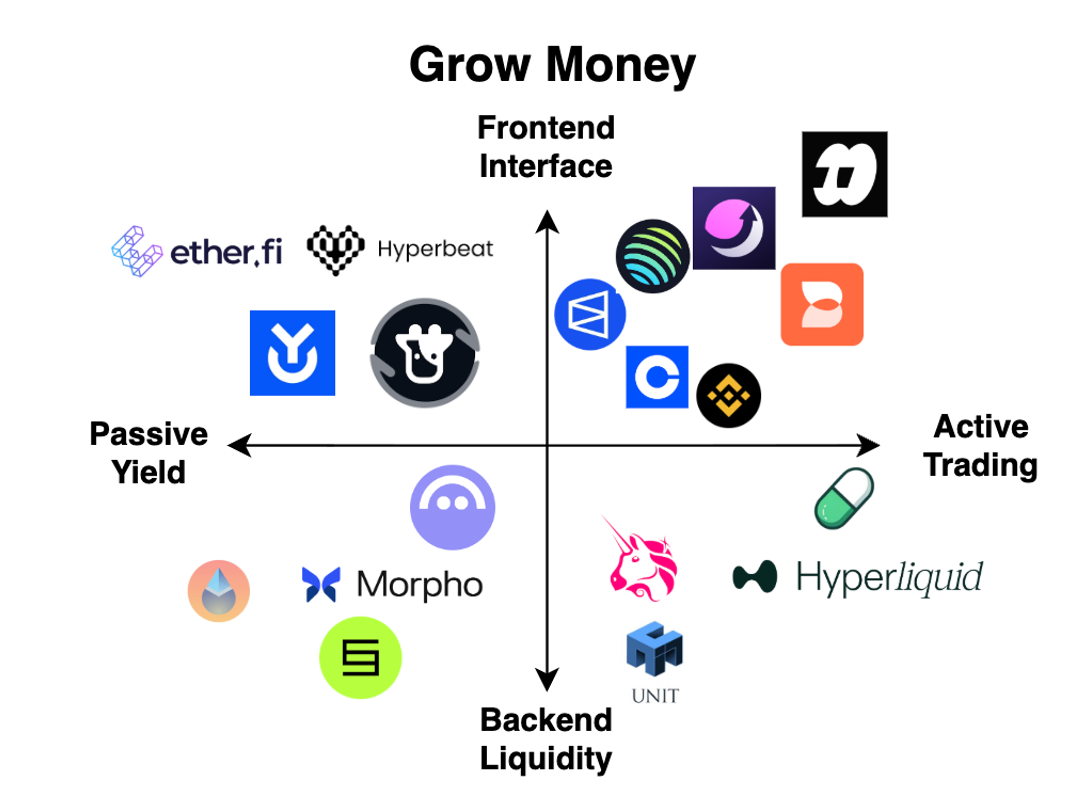

The third relationship that a “crypto neobank” can have with its customer is the ability to “grow money.” This is the area of crypto that has had the highest degree of innovation, accelerating the growth of several 0 to 1 primitives from staking vaults to perps trading to token launchpads and prediction markets. As before, we can classify applications that help us to “grow money” along two different axes – from passive yield to active trading, as well as from frontend interface to backend liquidity.

The most classic example of how a “growing money” application gradually develops into an all-encompassing “neobank” is that of a centralized crypto exchange, such as Binance or Coinbase. CEXs started out as offering a simple but effective value proposition – “this is the place you go to trade crypto to grow your wealth”. As trading volumes gradually ramped up, exchanges became the quintessential venues to not only grow wealth, but also store and manage it [15]. Both Coinbase and Binance have launched their own blockchains, wallets, institutional offerings, and crypto cards, upcharging their core demographic through new products and network effects. Binance Pay, for example, has seen growing adoption as vendors use it to accept crypto payments for everyday goods.

The same playbook has been borne out for DeFi projects. EtherFi, for example, started out as a liquid staking protocol for Ethereum, offering passive yield for stakers as they restake ETH on EigenLayer [16]. Next, they began offering “Liquid,” a DeFi strategy vault that put users’ money to work within the DeFi ecosystem for higher yields and managed risk. Then, they expanded to EtherFi “Cash” product, which was a groundbreaking credit card product that allowed users to spend their EtherFi balance in real world settings. This expansion roadmap clearly resembles that of a fintech neobank – gain a foothold through a unique product offering (passive staking and yield), become seen as best-in-class in that category to capture volume, before expanding across the product suite to upcharge those customers (via the EtherFi card).

Crypto today has already delivered several 0 to 1 innovations that allow users to “grow money” [27] – perps trading platforms like Hyperliquid have become some of the most profitable crypto companies, while prediction markets like Polymarket have also broken into the mainstream. It is very plausible that the next step for these platforms too will be in upcharging via novel product offerings – allowing consumers to spend more and store more on these platforms while leveraging network scale.

One of the major advantages of starting out as a “growing money platform,” especially as an active trading platform, is that there are typically very high volumes and frequent transactions. Hyperliquid, for example, has processed 3 trillion USD in volume over the last 18 months [17]. This means that compared to “store money platforms” and “spend money platforms,” “grow money platforms” have a far more sticky user flywheel. This means that there is a larger captive customer base to translate and upcharge as they move across to other platforms. At the same time, these platforms are greatly market dependent, and have the reputation of being “financial casinos.” This could be a stigma that limits their ability to onboard a truly global retail audience. After all, people generally have a very different attitude towards a bank than they do with a casino.

Borrowing Money with Crypto

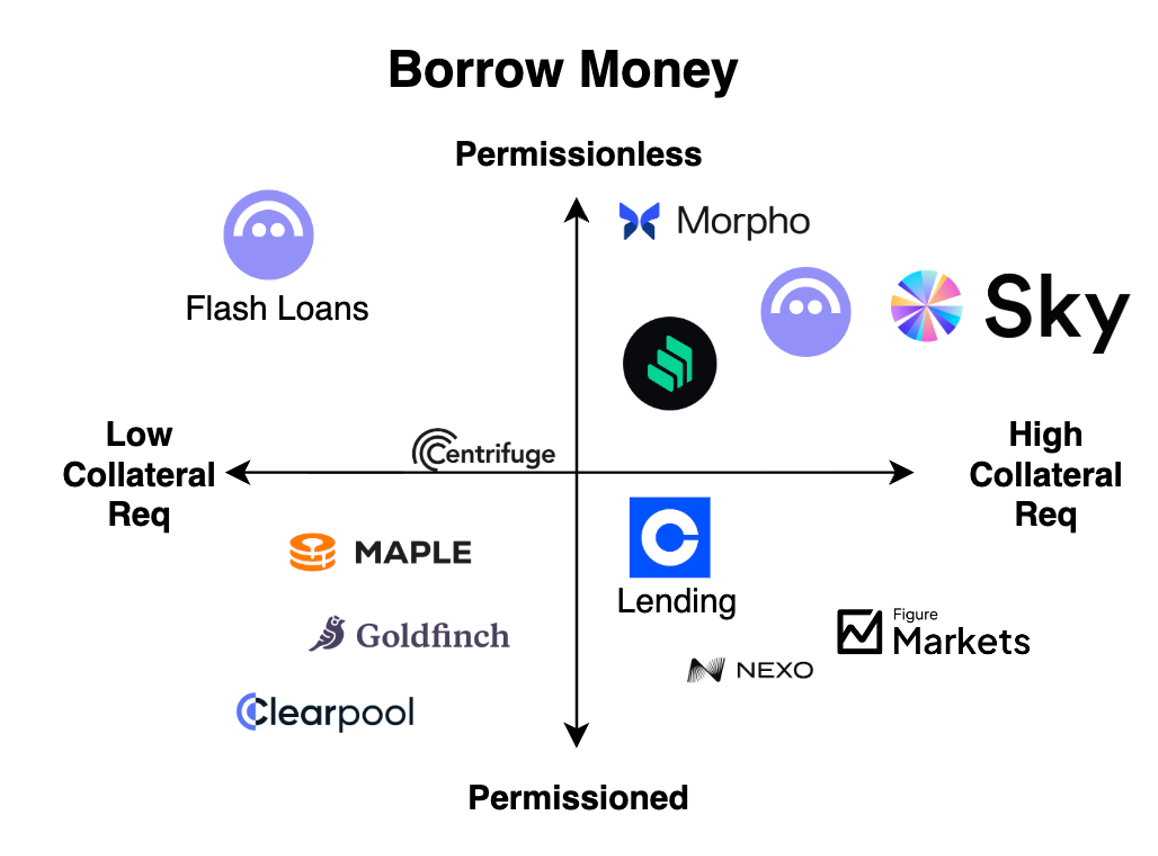

Just as in the case of traditional economies, the ability to borrow capital in crypto is a huge driver for the growth of the onchain economy. For crypto neobanks, borrowing is also one of the most important sustainable generators of yield. Whereas in the traditional world borrowing is a highly permissioned activity, mediated by KYC, credit profiles, and borrowing history, crypto borrowing systems have both permissioned and permissionless models, with different requirements for collateral capital.

The dominant model in crypto today is in permissionless, onchain systems with overcollateralization requirements. DeFi giants like Aave, Morpho, and Sky (fka. MakerDAO) embody the crypto ethos in operating on a code-is-law premise: because blockchains inherently don’t have access to users’ FICO scores or reputation, they demand solvency through overcollateralization [22], trading off capital efficiency for broader accessibility and security against defaults. Morpho, in particular, represents the next generation of evolution in this model [23], allowing for increased capital efficiency by introducing a more modular, permissionless system with more efficient risk-pricing.

On the other side of the spectrum is permissioned lending, which has gained adoption primarily as more institutional capital allocators begin interacting with DeFi, such as through market making. Protocols like Maple Finance, Goldfinch, and Clearpool all try to target this institutional audience, effectively building a traditional credit desk onchain. They allow for undercollateralized loans by having a permissioned system with strict KYC and offchain legal agreements with institutional borrowers [24]. Their moat is not just in liquidity (as is the case with permissionless pools), but also in the regulatory scaffolding and BD expertise that comes with selling a B2B product. Other protocols in the permissioned lending landscape, such as Figure Markets, Nexo, and Coinbase’s Lending product target a retail borrowing audience with a compliance-first approach. They require both the KYC of borrowers as well as overcollateralization of these assets, and sometimes “wrap” around protocols like Morpho, as in the case of Coinbase Lending [25]. In these cases, the main appeal may be the faster settlement and access of capital compared to traditional bank loans.

However, the “holy grail” unlock of crypto lending is undercollateralized consumer credit – the wedge that generational fintech products such as SoFi and Chime mastered to “bank the unbanked”. Crypto has yet to fully step up here, and replicate the “consumer credit flywheel” that fintech neobanks created. This is because crypto lacks a robust sybil-resistant identity layer and sufficient consequences for default. The only exception to this is “flash loans” – a purely crypto-native form of ephemeral uncollateralized lending from blockchain mechanism quirks, but these remain mostly a tool for arbitrage bots and sophisticated DeFi strategies rather than everyday consumers.

For the next generation of crypto neobanks, the race may be to move toward the center of this map, combining the speed and transparency of permissionless DeFi with the capital efficiency of traditional lending. The winner will likely be a platform that either solves decentralized identity layer or commoditizes it to unlock consumer credit, allowing crypto to effectively rebuild the mechanism of a consumer credit card. Until then, perhaps crypto neobanks will continue to rely on existing mechanisms of overcollateralized lending to power the yields of DeFi.

Making Money Move Faster

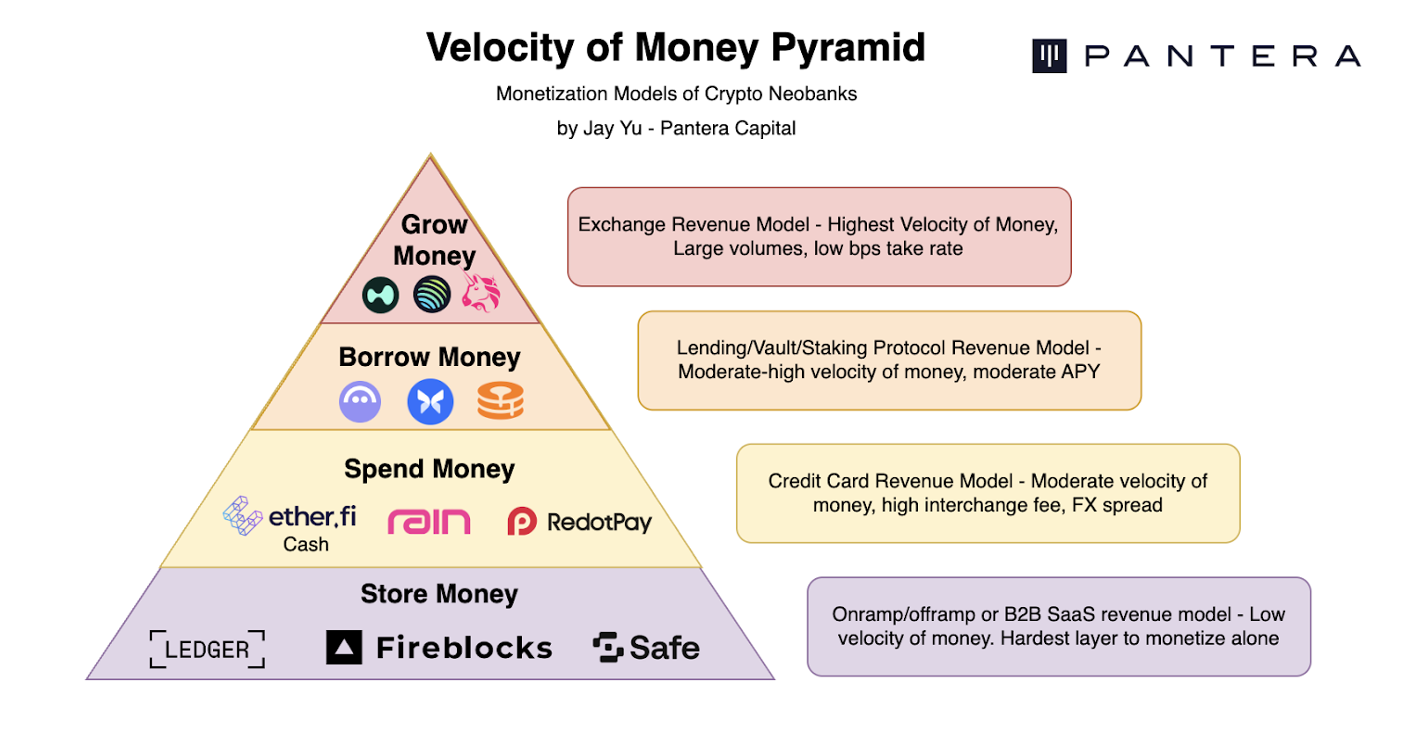

Fundamentally, the core value proposition of a crypto neobank is to make money move faster – just as Fintech neobanks like SoFi and Chime did via mobile apps in the decade before. Blockchain rails effectively “flatten” the distance between any two arbitrary accounts into just a single transfer, rather than needing to hop between international banks, SUIFT, and countless arcane systems.

While each relationship of money – storing, spending, growing, and borrowing – leverages this “blockchain flattening” differently, offering different tradeoffs and monetizing models, I believe that they ultimately form a pyramid defined by their “velocity of money.” At the top is “growing money,” where the velocity of money is the highest (eg. Hyperliquid trading fees), followed by lending (monetization via interest), spending (via interchange and FX spreads), and lastly storage (on/offramp charges and B2B integrations).

From this perspective, perhaps the easiest path to building a crypto neobank is to start at the growth and lending layer, where capital velocity and user engagement are highest. Protocols that first capture value in motion can later go down the pyramid to turn existing users into full-stack financial customers.

Opportunities for Neobanks

So, what might be next for crypto neobanks? What are the opportunities out there to build the next generation of permissionless neobanks? I believe that there are several (interconnected) directions that still need further exploration: (1) privacy and compliance parity, (2) real world composability, (3) leveraging permissionlessness, (4) localization vs. globalization, (5) undercollateralized lending and credit

1 – Privacy and Compliance Parity

Stablecoins and crypto rails allow for several advantages over traditional rails, especially around speed and ease of use. However, for crypto neobanks to directly compete with their fintech predecessors and incumbent banking rails, they must reach feature parity in two key dimensions: privacy and compliance.

While privacy may not seem to be a significant priority for retail consumer use cases and stablecoins have reached significant scale without guaranteed privacy, it becomes a critical factor as more enterprise applications – such as payroll, supply chain financing, and international settlement move onto onchain rails [18]. This is because public transactions for B2B transfers are likely to reveal trade secrets and other sensitive information. I believe this is part of the reason why many of the new stablecoin chains being released have emphasized privacy on their roadmaps.

On the flip side, crypto neobanks need to consider how their platforms can reach compliance parity as their predecessors. This includes gradually building up a global regulatory moat and licensing regime, and assuring both consumers and merchants that a crypto solution is just as compliant as a traditional one – perhaps through novel technical advances like zero knowledge proofs. It is only by addressing these dual concerns of enterprise-grade privacy and compliance that crypto neobanks can truly scale beyond their fintech predecessors.

2 – Real World Composability

Composability – through common standards, frameworks, and smart contracts – is often touted as a strength of crypto rails. But oftentimes this composability is restricted towards other components within the crypto sphere: with other DeFi primitives, yield protocols, and across (largely EVM) blockchains. The true challenge of composability is about bridging these blockchain standards with legacy real-world standards from various eras: international banking systems like SWIFT, merchant POS systems and standards like ISO 20022, and local money rails like ACH or Pix. With the proliferation of crypto cards and increased use of stablecoins in international payments, the space seems to be moving positively in this direction.

Moreover, today many crypto card products typically target crypto-native customers, serving as the offramp infrastructure for “crypto whales.” But the true challenge for crypto neobanks will be to expand beyond the crypto-native demographic, and onboard a net new cohort of customers on to these rails, through offering both real-world composability as well as fundamentally innovative primitives. Crypto neobanks that solve these problems of composability will have much better onramp and offramp UX, allowing them to better onboard user volume.

3 – Leveraging Permissionlessness

Fundamentally, crypto neobanks are about reinventing a more efficient standard for money – one that is designed to be instantaneous, have global liquidity, be infinitely programmable, and cannot be bottlenecked by single actors or governments. Anyone with a crypto wallet can currently trade on Hyperliquid, send a USDC transfer, or earn yield from an EtherFi vault, without being mediated by fiat authority. Crypto neobanks should leverage their fundamentally permissionless nature to accelerate the movement of money to create a more efficient system.

With crypto rails, global capital flows at the speed of the Internet, coordinated by incentives and game theory instead of fiat decree. The next generation of neobanks will leverage this permissionlessness of blockchain systems to quickly allow novel primitives – such as perps, prediction markets, staking, and token launchpads to compose with existing financial rails.

In addition, in economies where stablecoin adoption is high, there is also the opportunity to build a permissionless card network, similar to Visa or Mastercard. Such a system may act as an inverse of the existing crypto card flow. Instead of using fiat acquirers and offramping stablecoins at the point of sale, settlement would be onchain by default through a crypto-native acquirer. In order to maintain compatibility with traditional payment methods (such as fiat credit cards), these systems would onramp fiat payments into stablecoins.

Of course, permissionlessness does not just stop with human users – it also may enable the blossoming of a new, agentic economy. For an AI agent, it is far easier to get a crypto wallet than a bank account, and with stablecoins, AI agents can craft onchain transactions either with user signature permission or through pre-approved policies. I have written extensively about emerging agentic payments standards, such as Coinbase’s x402, and how they can unlock a new form of ecommerce. Permissionless neobanks are the substrate for that to happen, and the interface for the human-agent economy – AI agents can be autonomous wealth managers, shopping assistants, help you secure credit lines and more.

4 – Localization vs. Globalization

Crypto neobanks also face a strategic choice between depth and breadth. Some may follow the Nubank model, dominating a single region through deep localization, cultural fit, and regulatory expertise before expanding outward, such as through various remittance corridors (eg. US/EU/UAE and India/LatAm/SEA) and supply chains (eg. EU/US/LatAm with China/HK). Others may pursue a global-first model, launching permissionless products worldwide and doubling down where network effects emerge fastest. Both paths are viable: the former wins through local trust and distribution, the latter through scale and composability. Stablecoins may operate as the international payment highway, but crypto neobanks still need the “local exits”, with deep integrations with regional payment systems like Pix, UPI, Alipay, and VietQR to ensure local usability and merchant acceptance.

In particular, crypto-first neobanks have the unique opportunity to “bank the unbanked”, providing access to capital (both dollar and crypto denominated) in places where there is either a lack of financial infrastructure or weak local currencies, just as Argentina’s hyperinflation has catalyzed crypto adoption in the country [19]. Thus, the future may see regional “superapps” coexisting with borderless, globally composable neobanks, each leveraging the permissionless substrate in its own way.

5 – Undercollateralized Lending and Consumer Credit

Finally, undercollateralized lending and consumer credit is perhaps the “holy grail” of crypto neobanks. It combines many of the above challenges. First, on the compliance/KYC front, undercollateralized lending requires a robust identity and sybil resistant system, unlike existing overcollateralized lending platforms (eg. Aave, Morpho, MakerDAO). This robust identity mechanism could take shape in Worldcoin-style biometric verification, or through ZK-based methods such as DECO. Secondly, it requires a protocol to bridge an offchain credit profile with an onchain one (eg. via 3Jane), as well as let onchain defaults affect your offchain record. This difficulty is compounded by potential regional and geographical differences in credit models and credit profiles, and the need for compatibility with legacy systems. These difficulties may be the reason why undercollateralized lending in DeFi today has mainly revolved around institutional private credit (eg. Maple Finance, Goldfinch) rather than consumer credit, despite the latter being orders of magnitude larger in the TradFi world [20] [21].

Perhaps part of the answer could lie with unique mechanism design. Flash loans, for example, are an excellent example of a crypto-native uncollateralized (albeit brief) loan born from blockchain properties. Similarly, there is a large opportunity to build secured revolving credit lines against stablecoins and yield-bearing collateral (LSTs/LRTs), with real-time LTV management, automation liquidation buffers, auto-repayment from staking yield. These smarter collateral management techniques could all reduce the collateral requirements for onchain lending. Indeed, if successful, undercollateralized lending and credit onchain will accelerate the velocity of money onchain, provide a compelling reason for the unbanked to come onchain, and turbocharge the onchain economy – just as real-world undercollateralized lending drives economic growth.

Conclusion

Just like the rise of fintech neobanks a decade ago, today the rise of crypto neobanks aim to reinvent how we store, spend, grow and borrow money in the digital era. But while fintech neobanks primarily innovated on the frontend, partnering with FDIC banks to provide services on the backend while creating an intuitive, mobile frontend, crypto neobanks aim to update that banking backend – creating a global, composable, censorship-resistant method of sending money using stablecoins and public blockchains. In this way, a crypto neobank app is not just an interface, but a potential gateway to a new, programmable financial system.

Yet, the journey is only beginning. Building a full-stack “crypto neobank” means more than launching a crypto card or a simple wallet protocol with a UI. Like fintech neobanks, crypto neobanks need to consider what their wedge audience is – whether that is “banking the unbanked” or allowing for seamless stablecoin QR code payments to merchants in emerging economies – and rapidly scaling across the product suite. While each banking vertical – storing, spending, growing, and borrowing – has its own monetization model and set off tradeoffs, revenues come from taking advantage of value-in-motion. From this perspective, perhaps the largest opportunities for crypto neobanks may be first in the areas with a high velocity of money – in lending and borrowing – before moving down the “velocity of money pyramid” into spending and storage.

As neobanks continue tackling privacy and compliance, real world composability, leveraging permissionlessness, navigating regional differences, and providing undercollateralized consumer credit they have potential to evolve from niche gateways for digital assets into the default operating system for the global economy. Just as the first wave of neobanks changed the interface of banking by adopting mobile; this next wave is poised to rewrite the fundamental logic of money itself with crypto.

Many thanks to Ryan Barney from Pantera, Darshan Gandhi from Polaris Fund, Garrett Harper and Stepan Simkin from Squads, Ram Kakarlamundi from Avici, Vijit Katta from Tria, Aaron Lee from Redotpay, Yix Lee from Laguna, Noah Levine from Visa Crypto, Kofi Owusu from Cr3dentials, Sam Ruskin from Messari Research, and Lacie Zhang from Bitget Wallet for comments and suggestions.

References

[1] https://medhaa.medium.com/a-fintech-market-map-5662878aff3e

[2] https://panteracapital.com/blog-the-trillion-dollar-opportunity/

[3] https://messari.io/newsletter/unqualified-opinions/the-rise-of-crypto-neobanks

[4] https://www.binance.com/ar/blog/payments/3770220832170281311

[5] Fat wallet thesis: https://members.delphidigital.io/reports/the-fat-wallet-thesis#looking-ahead-8699

[6] Phantom Solana volume: https://coinlaw.io/phantom-wallet-statistics/

[7] Phantom swap fees: https://help.phantom.com/hc/en-us/articles/6048249796243-How-to-swap-crypto-in-Phantom

[8] Uniswap token swap fees: https://docs.uniswap.org/contracts/v2/concepts/advanced-topics/fees

[9] https://blockworks.co/news/phantom-hyperliquid-integration-winners

[10] https://www.coingecko.com/learn/what-are-stablecoin-chains

[13] https://visaonchainanalytics.com/

[15] https://decrypt.co/11327/the-inside-story-of-binance-explosive-rise-to-power

[16] https://etherfi.medium.com/staking-is-just-the-beginning-9640bac104df

[17] https://defillama.com/protocol/hyperliquid

[18] https://a16zcrypto.com/posts/article/state-of-crypto-report-2025/

[19] https://finance.yahoo.com/news/argentina-peso-crisis-fuels-crypto-073531217.html

[20] https://www.newyorkfed.org/microeconomics/hhdc

[21] https://www.mckinsey.com/industries/private-capital/our-insights/the-next-era-of-private-credit

[22] https://onekey.so/blog/learn/cdp-the-classical-aesthetics-of-stablecoins/

[23] https://docs.morpho.org/build/borrow/get-started

[24] https://docs.maple.finance/syrupusdc-usdt-for-lenders/lending

[25] https://www.coinbase.com/blog/earn-competitive-yields-by-lending-your-usdc

[26] https://www.stablecoinsmap.com/

[27] https://messari.io/report/the-crypto-theses-2026

Footnotes and Important Disclosures

[1] All registered or unregistered service marks, trademarks and trade names referred to in this article are the property of their respective owners, and Pantera’s use herein does not imply an affiliation with or endorsement by the owners of these service marks, trademarks and trade names.

This document is made available by Pantera Capital Partners LP (“Pantera”) for informational and educational purposes only. It does not contain all information pertinent to an investment decision. Nothing in this document constitutes an investment recommendation or an offer of investment advisory services. This document cannot be relied upon in making an investment decision. Nothing contained herein constitutes an offer to sell, or a solicitation to buy, any securities. This document contains information believed to be reliable, and has been obtained from sources believed to be reliable, but no representation or warranty is made (express or implied) of any nature, nor is any responsibility or liability of any kind accepted, with respect to the fairness, accuracy, completeness, or reasonableness of the information or opinions contained herein. Forward-looking statements should not be relied upon. There is no guarantee that investments in any instrument described herein will be profitable – all investments carry the inherent risk of total loss. Analyses and opinions contained herein (including market commentary, statements or forecasts) reflect the judgment of the author as of the date this document was published, and may contain elements of subjectivity (including certain assumptions) or be based on incomplete information. There is no duty or obligation to update the contents of this document. This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments or trading decisions in connection with such instruments without further notice. This document solely reflects the opinion of the author, and does not reflect Pantera’s opinions.