Table of Contents

1. The Path to Adoption: Blockchain’s Next 100x Opportunity

2. Predictions for Crypto in 2025

3. Crypto: The Ironic Answer to De-Dollarization

5. “Buy the Rumor, Buy the News”

THE PATH TO ADOPTION: BLOCKCHAIN’S NEXT 100X OPPORTUNITY[1]

By Franklin Bi, General Partner

What does the path to crypto’s mainstream adoption look like?

When you look beyond the noise and speculation, that’s the only question that matters. As investors, our job is to map out the path to adoption because it’s where we’ll find the next 100x opportunity.

But the best venture investors don’t predict the future. They see the present with great clarity. One thing is clear about the year ahead: 2025 will be a turning point for the crypto industry.

Imagine the state of the Internet if Jeff Bezos went to jail for online book sales. If Steve Jobs were sanctioned for launching the App Store? Or, if Jensen Huang was forced to build Nvidia outside of the US because Operation Chokepoint closed his bank account? That’s the twilight zone that our industry is emerging from.

2025 marks the first time in blockchain’s history that entrepreneurs, regulators, and policymakers can finally unblock the path to adoption.

Facing the now-open road, we return to our original question: What lies ahead on the path to adoption? Where will the biggest opportunities emerge—the next 100x or even 1,000x investment?

As “SoLoMo” (social / local / mobile) unlocked the Internet’s potential in the 2010s, the convergence of three mega-trends will unlock crypto adoption from 2025 onwards:

– Gateways – bringing the legacy financial system onto blockchain rails;

– Developers – making it easy to build on the Internet’s native economic layer; and

– Applications – building meaningful applications for everyday life.

Gateways

Wall Street has undergone a 50-year-long software upgrade, from the introduction of electronic trading in the 1970s to the digitization of payments today. The steady, inevitable march of software eating finance has taught us one thing: All financial assets eventually migrate to wherever they can flow most freely, trade most efficiently, and command the highest value.

Today, blockchain networks secure $3 trillion in crypto assets (Bitcoin, Ethereum, etc.) and a small but mighty base of asset-backed tokens (tokenized dollars and Treasuries). The total financial assets held globally by households, governments, and corporations exceeds $1,000 trillion ($1 quadrillion!). That leaves 300x of potential growth still ahead of us.

Which inning are we in? The players haven’t even left the buses. The global balance sheet is now beginning its migration to blockchain rails. To succeed, we’ll need gateways that bridge us from the legacy financial system.

We must scale platforms that can effectively onboard new users and existing assets. Regional on-ramps like Bitso in Latin America are processing over 10% of US-Mexico remittances using blockchain. Tokenization platforms like Ondo are going head-to-head with Franklin Templeton and BlackRock to bring $20+ trillion of US Treasuries onchain.

Crypto is giving rise to the first truly global capital markets, enabled by real-time settlement and borderless liquidity. But global markets need global trading venues. Exchanges like Figure and Avantis are bringing together global supply and demand, while transforming markets in FX, credit, and securities.

Finally, we need products that work with existing systems, not just a parallel crypto universe. They may look like Fordefi‘s advanced wallet for institutions. Or, like TipLink‘s easy, grandma-friendly solution for sending payments.

What will it look like when we get there? We believe there will come a day when your net worth is worth more onchain than offchain. Once migrated onchain, your wealth can flow instantly across the world. It can trade cheaply without middleman fees and access global demand to achieve its highest value. That’s the point of no return.

Developers

There are about 100,000 developers building on blockchains today. That’s half of a single Silicon Valley tech giant. To enable mainstream adoption, we need to increase that by 100 times and onboard 10 million developers.

Unlocking the creative potential of blockchain technology is paramount. Just as better tools for mobile developers unlocked the potential of Apple’s App Store, we need tools that simplify building onchain apps and creating useful new products.

In 2025, the blockchain development stack will take a major leap forward. A crucial step depends on making blockchains themselves more developer-friendly. Scaling solutions like Arbitrum‘s optimistic rollup tech have created crypto’s first “broadband moment.” But, upgrades like Arbitrum Stylus may have a greater impact. Stylus enables developers to write smart contracts in multiple major programming languages like C, C++, and Rust, opening the door to over 10 million developers globally.

Zero-knowledge technology was once considered too intimidating for practical development. But, new tools like StarkWare‘s development kit are making zero-knowledge implementations easier than ever before. Today, zk-proofs are powering products like Freedom Tool, Rarimo’s blockchain-powered voting tool, already deployed in Russia, Georgia, and Iran to improve democratic participation.

The tools and infrastructure supporting blockchain development will play a vital role in driving progress. Platforms like Alchemy are helping developers to build and deploy onchain applications at scale. By streamlining the development process, Alchemy has already helped many projects achieve success, from decentralized finance (DeFi) protocols to gaming applications. As the blockchain ecosystem continues to evolve, it’s imperative that these developer platforms keep pace, allowing developers to push the boundaries of what’s possible onchain.

In 2025, the multichain universe will keep growing, likely at an accelerated pace. As developers face more complex challenges, new chains are emerging to tackle them, each with its own strengths and weaknesses in computation, execution, or decentralization. To cater to specific use cases like gaming or trading, application-specific infrastructure like B3 is taking shape. This explosion of chains, Layer 2s, and appchains demands seamless connectivity, which is where cross-chain liquidity solutions like Everclear and interoperability protocols like Omni come in – freeing developers to focus on building novel applications.

Web development has progressed from raw coding to intuitive no-code solutions, with AI now taking the wheel. We expect a similar evolution in blockchain development on the horizon. Each wave of technical advances and developer-focused tools will usher in a fresh wave of talent. Ultimately, building on-chain applications may become as simple as a conversation with ChatGPT.

Applications

How many people are onchain today?

By most estimates, the number is around 80 million onchain users. Much of that growth comes from crypto’s appeal as “Wall Street 2.0” – a new place to raise capital, speculate, and send money. But expanding 100x to 8 billion people will depend on crypto’s shift from Wall Street to Main Street.

2025 will likely be the tipping point for crypto’s mainstream adoption. It will be a “FarmVille moment” for blockchain technology. FarmVille was Facebook’s first social gaming hit. It drove the network’s first exponential growth, turning it from a photo-sharing app into a global platform.

Crypto is accelerating toward its own “FarmVille moment.” Onchain features are being integrated into new games and social applications. Gaming studios like InfiniGods are creating first-time onchain users. Their mobile casual game, King of Destiny, has already over 2 million app downloads over the past year, bringing people onchain who spend more time on Candy Crush than Coinbase.

Onchain gaming, social, and collectibles activity comprise ~50% of today’s unique active wallets. As we onboard a diverse user base that engages in onchain commerce, it’s clear that blockchains will disrupt more than just Wall Street.

A new class of “productive” apps is ushering in a new Industrial Revolution. The rise of corporations is giving way to the rise of Industrial Networks. Also known as DePINs, these applications focus on underserved markets in areas such as wireless connectivity, hyperlocal data, and human capital. They achieve this through on-chain coordination and market-driven mechanisms. Hivemapper is a decentralized mapping network that has mapped more than 30% of the world’s roads, thanks to over 150,000 contributors, capable of more up-to-date and precise data than Google Maps.

Importantly, these “productive” applications are tapping into genuine revenue streams. In 2025, we believe the DePIN sector will exceed 2024’s annualized revenue of $500 million. These industrial-grade cash flows provide a path to profitability based on real-world utility, setting up a strong commercial engine for new capital to flow into the onchain economy.

But how do we get these applications into the hands of 8 billion people? 2025 will see new distribution models that are capable of reaching hundreds of millions of consumers at scale. Crypto exchanges like Coinbase, Kraken, and Binance are creating their own chains to bring customers onchain. Telegram and Sony are incorporating Web3 features into their platforms with massive reach. Gaming companies are relaunching beloved games like MapleStory with onchain features, potentially converting millions of players. Institutions like PayPal and BlackRock are introducing onchain finance and payment solutions.

The convergence of these trends in 2025 will lead to a critical inflection point. When the average person has a reason to spend 60 minutes a week onchain, “being onchain” can become the new “being online.” Forget the “killer app.” Just as we swipe between apps on the Internet, people will have many reasons to spend time onchain. They may do it for fun, connection, or money. At that point, the onchain economy will be on pace to become a part of our everyday lives.

Looking Forward

The coming year will kick off an era where blockchain technology begins to blend into our daily lives, much like the Internet. The transition from Wall Street to Main Street isn’t just happening — it’s accelerating, driven by applications in entertainment, commerce, and practical utility.

In order to get there, we’ll need to invest in more accessible gateways, improved technology and developer tools, and applications that solve real-world problems. The path ahead of us in 2025 is still full of 100x opportunities, as crypto’s mainstream adoption becomes a reality. As a wise person once said: “The best way to predict the future is to create it.”

![]()

PREDICTIONS FOR CRYPTO IN 2025[2]

By Paul Veradittakit, Managing Partner

This year, I enlisted the help of investors on the Pantera team. I’ve split my predictions into two categories: rising trends and new ideas.

Rising Trends:

1. RWAs (excluding stablecoins) will account for 30% of onchain TVL (15% today)

Real-world assets (RWAs) onchain increased over 60% in 2024, to $13.7 billion. Around 70% of RWAs are private credit and most of the rest are in T-bills and commodities. Inflows from these categories are accelerating, and 2025 may see the introduction of more complex RWAs.

First, private credit is accelerating because of improving infrastructure. Figure accounts for almost all of this, increasing by almost $4 billion worth of assets in 2024. As more companies enter this space, there is increasing ease to use private credit as a means to move money into crypto.

Second, there are trillions of dollars worth of T-bills and commodities offchain. There is only $2.7 billion worth of T-bills onchain, and their ability to generate yield (as opposed to stablecoins, which allow the ones who mint the coin to capture the interest), makes it a more attractive alternative to stablecoins. Blackrock’s BUIDL T-bill fund only has $500 million onchain, as opposed to the tens of billions of government bills it owns offchain. Now that DeFi infrastructure has thoroughly embraced stablecoins and T-bill RWAs (integrating them into DeFi pools, lending markets, and perps), the friction to adopt them has drastically decreased. The same goes for commodities.

Finally, the current extent of RWAs is limited to these basic products. The infrastructure to mint and maintain the RWA protocols has drastically simplified, and operators have a much better understanding of the risks and appropriate mitigations that come with onchain operations. There are specialized companies that manage wallets, minting mechanisms, sybil sensing, crypto neo-banks, and more, meaning it may finally be possible and feasible to introduce stocks, ETFs, bonds, and other more complex financial products onchain. These trends will only accelerate the use of RWAs heading into 2025.

2. Bitcoin-Fi

Last year, my prediction of Bitcoin finance was strong but didn’t reach the 1-2% of all bitcoins TVL mark. This year, pushed by Bitcoin-native finance protocols that do not require bridging (like Babylon), high returns, high bitcoin prices, and increased appetite for more BTC assets (runes, Ordinals, BRC20), 1% of Bitcoins will participate in Bitcoin-Fi.

3. Fintechs become crypto gateways

TON, Venmo, PayPal, and WhatsApp have seen crypto growth because of their neutrality. They are gateways where users can interact with crypto, but do not push specific apps or protocols; in effect, they can act as simplified entryways into crypto. They attract different users; TON for its existing 950 million Telegram users, Venmo and PayPal for their respective 500 million payments users, and WhatsApp for its 2.95 billion monthly active users.

Felix, which operates on WhatsApp, allows instant money transfers via a message, to be either digitally transferred or picked up in cash at partner locations (like 7-Eleven). Under the hood, they use stablecoins and Bitso on Stellar. Users can now buy crypto on MetaMask using Venmo, Stripe acquired Bridge (a stablecoin company), and Robinhood acquired Bitstamp (a crypto exchange).

Whether intentionally or because of their ability to support third-party apps, every fintech will become a crypto gateway. Fintechs will grow in prevalence and may perhaps rival smaller centralized exchanges in crypto holdings.

4. Unichain becomes the leading L2 by transaction volume

Uniswap has a TVL of almost $6.5 billion, 50-80k transactions per day, and volume of $1-4 billion daily. Arbitrum has ~$1.4 billion of transaction volume a day (a third of which is Uniswap) and Base has ~$1.5 billion of volume a day (a quarter of which is Uniswap).

If Unichain captures just half of Uniswap’s volume, it would easily surpass the largest L2s to become the leading L2 by transaction volume.

5. NFT resurgence but in an application-specific way

NFTs were meant as a tool in crypto – not a means to an end. NFTs are being used as a utility in onchain gaming, AI (to trade ownership of models), identity, and consumer apps.

Blackbird is a restaurant rewards app that integrates NFTs into customer identification in their platform of connecting Web3 into dining. By integrating the open, liquid, and identifiable blockchain with restaurants, they can provide consumer behavior data to restaurants, and easily create/mint subscriptions, memberships, and discounts for customers.

Sofamon creates Web3 bitmojis (which are NFTs), called wearables, unlocking the financial layer of the emoji market. They recognize the increasing relevance of IP onchain and embrace collaboration with top KOLs and K-pop stars, for example, to fight digital counterfeiting. Story Protocol, which recently raised $80 million at a $2.25 billion valuation, has the broader goal of tokenizing the world’s IP, putting originality back as the centerpiece of creative exploration and creators. IWC (the Swiss luxury watch brand) has a membership NFT that buys access to an exclusive community and events.

NFTs can be integrated to ID transactions, transfers, ownership, and memberships, but can also be used to represent and value assets, leading to monetary, possibly speculative growth. This flexibility is what brings NFTs power.

Its use cases will only increase.

6. Restaking launches

In 2025, restaking protocols like EigenLayer, Symbiotic, and Karak will finally launch their mainnets, which would pay operators from AVSs and slashing. It seems that through this year, restaking lost relevance.

Restaking draws power as more networks use it. If protocols use infra that is powered by a particular restaking protocol, it derives value from that connection, even if it is not direct. It is by this power that protocols can lose relevance but still hold huge valuations. We believe restaking is still a multi-billion dollar market and as more apps become appchains, they harness restaking protocols, or other protocols that are built on restaking protocols.

New Ideas:

7. zkTLS bringing offchain data onchain

zkTLS uses zero knowledge proofs to prove the validity of data from the Web2 world. This new technology has yet to be fully implemented, but when it (hopefully) does this year, it will bring in new types of data.

For example, zkTLS can be used to prove that data came from a certain website to others. Currently, there is no way to do this. This tech takes advantage of advancements made in TEEs and MPCs, and may be further improved to allow some of the data to be private.

This is a new idea, but we predict that companies will step up to begin building this and integrating it into onchain services, like verifiable oracles for nonfinancial data or cryptographically secured data oracles.

8. Regulatory support

For the first time, the U.S. regulatory environment seems crypto-positive. 278 pro-crypto house candidates were elected versus 122 anti-crypto candidates. Gary Gensler, an anti-crypto SEC chair, announced that he will be resigning in January. Reportedly, Trump is set to nominate Paul Atkins to lead the SEC. He was previously an SEC Commissioner from 2002-2008 and is outspokenly supportive of the crypto industry and an advisor to the Chamber of Digital Commerce, an institution focused on promoting the acceptance of crypto. Trump also named David Sacks, a tech investor and former CEO of Yammer and COO of PayPal, to head the new role of “AI & crypto czar”. Notably, in Trump’s announcement, he said that “[David Sacks] will work on a legal framework so the crypto industry has the clarity it has been asking for.”

We hope for a winding down of SEC lawsuits, clear definitions of crypto as a particular asset class, and tax considerations.

![]()

CRYPTO: THE IRONIC ANSWER TO DE-DOLLARIZATION

By Jeff Lewis, Product Manager, Hedge Funds and Erik Lowe, Head of Content

The growing trend of de-dollarization — where nations and institutions diversify away from the U.S. dollar in global trade and financial transactions — has sparked concerns about the long-term dominance of the greenback.

The most common measure of dollar dominance — USD share of FX reserves — has been in a secular downtrend, falling 13 percentage points since 2000.

We believe a reversal of this trend is imminent, driven ironically by what most U.S. policymakers and central bankers would have viewed five years ago as an accelerant of the dollar’s decline: blockchain technology and tokenization. What was once perceived as a potential disruptor to the dollar’s status is now positioning itself as its greatest enabler.

“The most ironic outcome is the most likely.”

– Elon Musk

Supercharged Dollars

Public blockchains supercharge fiat money, putting it at the fingertips of five billion smartphone users worldwide and enabling it to move across borders with ease. The demand for tokenized fiat currencies; i.e., stablecoins, has created a whopping $200 billion industry – of which the U.S. dollar has a commanding share of the market. Castle Island and Brevan Howard published a report which included the below graphic showing the near-100% dominance of U.S. dollar collateral for stablecoins relative to other economic categories.

Source: Castle Island and Brevan Howard report

16 of the top 20 fiat-backed stablecoins have “USD” in their name.

Source: rwa.xyz

The general perception of blockchain has been little changed over its 16-year existence. Bitcoin’s initial champions indeed saw the potential for crypto to challenge the dollar’s primacy. In recent years, Bitcoin has increasingly been viewed as a vehicle to store wealth rather than a medium of exchange, minimizing its threat in that regard. The stablecoin/RWA phenomenon has risen up to allow blockchain to make good on Bitcoin’s initial promise, by providing a means of exchange with stability and, ultimately, yield. Rather than eroding the dollar’s relevance, it is amplifying it.

Emerging Markets

In emerging markets, dollar-backed stablecoins serve as a practical alternative to holding physical cash or relying on fragile banking systems. When given the option, merchants and citizens in countries with unstable currencies will increasingly prefer the stability of a digital dollar. In Castle Island and Brevan Howard’s report, they published survey results of existing crypto users in emerging markets. A key takeaway: USD-denominated savings is a huge driver for emerging markets.

– 47% of respondents said their primary use case for stablecoins is to save money in dollars (this was just under the 50% that said they use stablecoins primarily to trade crypto or NFTs)

– 69% of respondents have converted their local currency to a stablecoin, unrelated to trading

– 72% of respondents expect to increase their usage of stablecoins in the future

Note: countries surveyed were Nigeria, Indonesia, Turkey, Brazil, and India

Whether the user is a small-balance-holding consumer or a multinational corporation, the dollar may crowd out other local currencies as economic agents gravitate toward the safest and most liquid options available.

In the United States’ Best Interest – Stablecoin Legislation in 2025?

Legislative momentum is building, with expectations for stablecoin-focused regulations to pass in the Trump administration. There is bipartisan support for Patrick McHenry’s stablecoin bill, which was initially introduced in 2023 and recently brought to the House by Rep. Maxine Waters. Stablecoin legislation has long been viewed as the first step in achieving regulatory clarity in the United States. We believe we will see meaningful progress in 2025, especially as policymakers increasingly recognize the strategic role of stablecoins in expanding the dollar’s reach.

Stablecoins are in the United States’ best interest because they will increase the percentage of transactions denominated in dollars and create demand for US Treasury collateral. A country with $37 trillion of outstanding debt needs distribution, and crypto is here to provide it.

Stablecoins vs. CBDCs

For the sake of clarity, fiat-backed stablecoins and a central bank digital currencies (CBDC) are two similar but fundamentally different technologies that must not be conflated.

J.P. Morgan put out a report in October on the growing trend of de-dollarization. One of the potential drivers they highlighted was the drive for payments autonomy via new technologies. They referenced projects like mBridge, a multi-central bank digital currency initiative, as a potential alternative to dollar-based transactions.

While emerging payment systems like foreign CBDCs further de-dollarization pressures, we believe the booming market for dollar-backed stablecoins counters this narrative. In our view, stablecoins built on decentralized, permissionless blockchains will be the preferred choice as they offer better privacy, censorship resistance, and interoperability across platforms.

Demand for U.S. Treasuries through Tokenized Products

According to the U.S. Department of the Treasury, $120 billion of stablecoin collateral is directly invested in U.S. Treasuries, contributing to increased demand for short-dated securities.[3] In addition to stablecoins, direct tokenization of U.S. Treasuries is also a growing trend. Companies like BlackRock through Securitize, Franklin Templeton, Hashnote, and Pantera portfolio company Ondo are at the helm of this $4 billion market.

Ondo offers two core products in this space:

– USDY (US Dollar Yield Token): A tokenized note secured by short-term U.S. Treasuries and bank deposits, providing stable, high-quality yields for non-U.S. investors.

– OUSG (Ondo Short-Term U.S. Government Treasuries): Offers liquid exposure to short-term U.S. Treasuries, allowing instant minting and redemption for qualified purchasers.

Products like USDY offer those who live overseas much simpler access to U.S. dollars and treasuries than do traditional avenues.

A New Era for Dollar Dominance

Far from eroding the dollar’s supremacy, blockchain technology has created a digital infrastructure that fortifies it. The ability to tokenize and mobilize dollar assets globally allows the dollar to remain indispensable even as geopolitical and technological forces drive de-dollarization pressures. As J.P. Morgan noted in their report, the structural factors supporting the dollar’s dominance — deep capital markets, rule of law, and institutional transparency[4] — remain unparalleled. Stablecoins extend these advantages to a digital, borderless context.

The U.S. dollar, once viewed as a vulnerable incumbent in the face of blockchain innovation, is now its greatest beneficiary. The “killer app” of blockchain may very well be the dollar itself, a testament to how technology can reinforce legacy power structures while transforming them. With supportive regulatory frameworks on the horizon and a surging appetite for tokenized assets, the dollar’s migration onchain may cement its role as the cornerstone of global finance. Whether U.S. regulators or legislators are Democrats or Republicans, they will agree that any force that supports demand for U.S. Treasuries is a force to be harnessed rather than resisted, making meaningful regulatory progress almost a fait accompli.

![]()

THREE TRENDS IN DEFI

By Mason Nystrom, Junior Partner

DeFi is evolving rapidly, as improved UX/UI and maturing protocols continue to attract new users and capital. In a blog post, I explore three key trends shaping DeFi. Below is a preview of one of those trends. You can read the full piece here.

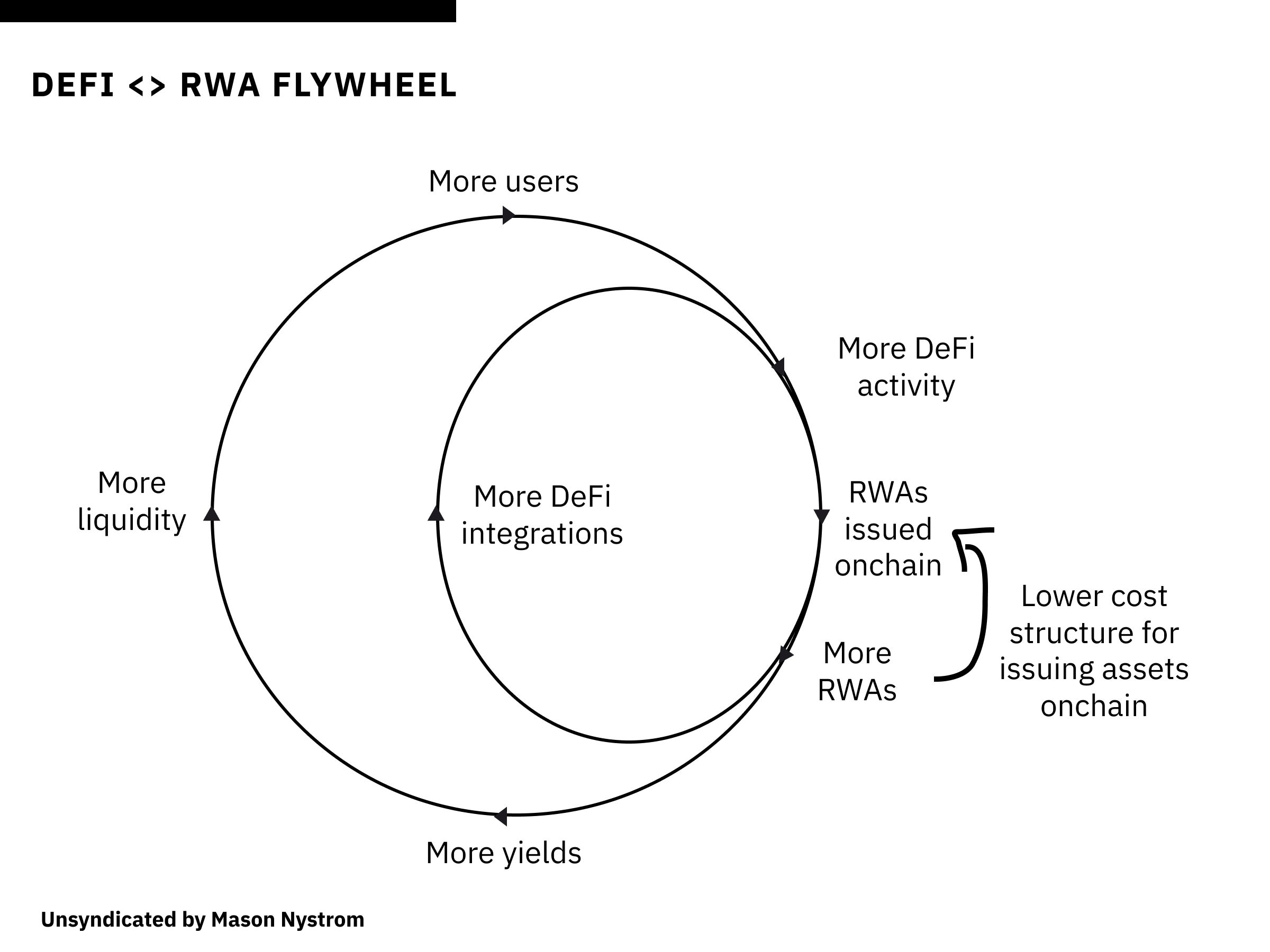

The RWA Flywheel: Endogenous vs Exogenous Growth

High interest rates since 2022 have supported a massive influx in real-world assets (RWAs) onchain. But now, the transition from offchain finance to onchain finance is accelerating as large asset managers like BlackRock realize that issuing RWAs onchain brings meaningful benefits including: programmable financial assets, lower cost structure for issuing and maintaining assets, and greater asset accessibility. These benefits, like stablecoins, are a 10x improvement over the current financial landscape.

According to RWA.xzy and DefiLlama, RWAs account for 21-22% of assets on Ethereum. These RWAs are mostly in the form of grade-A, American Eagle-backed, US Treasury bills. The growth has largely been driven by high rates that make it easy for investors to be long the Fed over DeFi. And while the macro winds are shifting to make T-bills less appealing, the Trojan horse of onchain asset tokenization has entered the walls of Wall St, opening the floodgates for more RWAs to come onchain.

As more traditional assets move onchain, this will kick off a compounding flywheel effect, slowly merging and replacing legacy financial rails with DeFi protocols.

Why does this matter? The growth of crypto comes down to exogenous capital vs endogenous capital.

Most of DeFi is endogenous – largely circular within the DeFi ecosystem – and capable of growing on its own. However, it has historically been quite reflexive: it goes up, it goes down, and then back around. But over time, new primitives have steadily expanded the DeFi pie.

Onchain lending via Maker, Compound, and Aave expanded the use of crypto-native collateral as leverage.

Decentralized exchanges, in particular AMMs, expanded the universe of tradable tokens and jumpstarted onchain liquidity. But DeFi can only grow its own market to a certain extent. Although endogenous capital (e.g., the speculation of onchain assets) has driven the crypto markets to a robust asset class, exogenous capital – capital that exists outside of the onchain economy – is necessary for the next wave of DeFi growth.

RWAs represent a massive amount of latent exogenous capital. RWAs – commodities, stocks, private credit, FX, etc. – present the greatest opportunity to expand DeFi beyond the circular siphoning of capital from the pockets of retail to the loins of traders. Just as the stablecoin market has required growth via more exogenous uses beyond onchain financial speculation, so too will other DeFi activities (e.g., trading, lending, etc.).

The future for DeFi is for all financial activity to move onto blockchains. DeFi will continue to see two parallel expansions: the similar endogenous expansion via more onchain native activity, and exogenous expansion from real-world assets moving onchain.

Read about other trends in DeFi here.

![]()

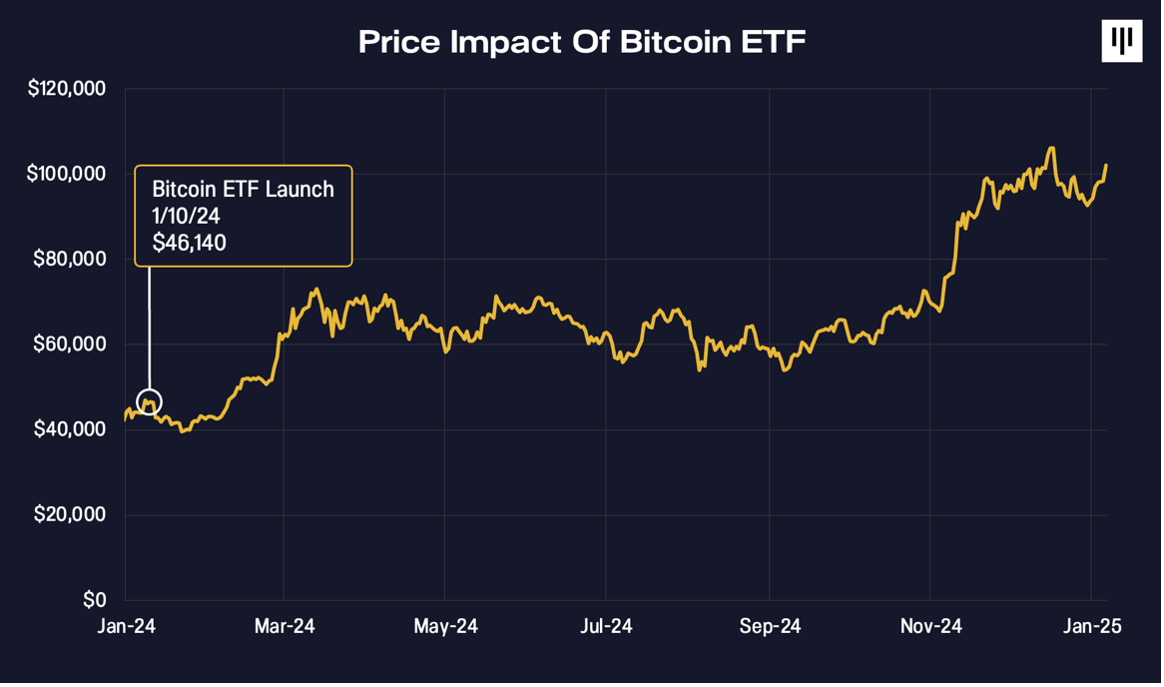

“BUY THE RUMOR, BUY THE NEWS”

A year ago, we published our November Blockchain Letter entitled “Impending Bitcoin ETF :: Buy The Rumor, Buy The News”.

We believed the old Wall Street adage would not apply to the launch of the spot bitcoin ETFs despite it working perfectly for the days CME bitcoin futures went live and Coinbase publicly listed.

Since the launch of the bitcoin ETFs, bitcoin is up 103%.

BlackRock’s bitcoin ETF surpassed its 20-year-old gold ETF in total assets in just eleven months.[5] It broke records and is being regarded as the “greatest launch in ETF history” after surpassing $50 billion in assets five-times quicker than the next fastest ETF to reach that milestone.[6]

Next month I’ll write about why I believe the impact of the U.S. election is not fully understood and certainly not priced into the bitcoin market.

The U.S. election is another “Buy The Rumor, Buy The News”.

![]()

All the best for 2025,

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[7]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Liquid Token Fund Investor Call

Tuesday, January 14, 2025 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

The Year Ahead

A discussion of Pantera’s outlook for crypto in the year 2025, including commentary on the markets and themes to look out for.

Thursday, January 16, 2025 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Early-Stage Token Fund Investor Call

Tuesday, February 11, 2025 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Fund V Call

An overview of Pantera’s fifth venture-style fund that offers exposure to the full spectrum of blockchain assets.

Tuesday, February 18, 2025 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PANTERA FUND V

We’ve found that most investors view blockchain as an asset class and would prefer to have a manager allocate amongst the various asset types. This compelled us to create Pantera Blockchain Fund (IV) in 2021, a wrapper for the entire spectrum of blockchain assets. We are opening its successor, our fifth venture-style fund, Pantera Fund V, in 2025.

Similar to its predecessor, Blockchain Fund (IV), we believe this new fund is the most efficient way to get exposure to blockchain as an asset class. It is a continuation of the strategies we have employed at Pantera for a decade across eight venture and hedge funds.

Limited Partners have the flexibility to invest in just venture (Class V for “Venture”), or in venture, private early-stage tokens, and locked-up treasury tokens (Class P for “Privates”), or the all-in-one Class A.

Limited Partners have the flexibility to invest in just venture (Class V for “Venture”), or in venture, private early-stage tokens, and locked-up treasury tokens (Class P for “Privates”), or the all-in-one Class A.

As in all previous Pantera venture funds, we strongly support helping our LPs get access to deals in this fund. Fund LPs with capital commitments of $25mm or more will have the option to collectively co-invest in at least 10% of each venture equity, private token, and special opportunity deal that the Fund invests over $10mm in. There is no management fee or carried interest on co-investments for those with co-investment rights.

We will endeavor to offer co-investment opportunities, on a capacity available-basis, to other LPs as well. These co-investment opportunities are subject to 1/10% fees.

Pantera Fund V will have its first closing on June 30, 2025. We are targeting $1 billion.

You may register interest in the Fund below.

A member of our Capital Formation team will be in touch.

To learn more about the Fund, we invite you to participate in the upcoming call for Pantera Fund V. The call will be held on Tuesday, February 18, at 9:00am PST / 12:00pm EST. You may register by clicking the button below.

Pantera donates 1% of revenue from all new funds to 1% For The Planet.

PORTFOLIO COMPANY OPEN POSITIONS[8]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Below are open positions that our portfolio companies are actively hiring for:

-

Nexus – Community Marketer (San Francisco)

-

0x Labs – Product Manager (Remote)

-

Sentient – Director of Legal (Remote)

-

M^0 – Group Product Manager (Remote)

-

Omni Network – Content Manager (Remote)

-

Figure – Senior Product Counsel (San Francisco)

-

TipLink – Product Manager (New York)

-

Sahara Labs – DevRel Engineer (Remote)

-

Avantis Labs – Fullstack Engineer (Remote)

-

Sentient Foundation – Director of Legal (Remote)

-

Ondo Finance – PR and Communications Lead (Remote)

-

TON Foundation – GamFi Lead (Remote)

-

Morpho – Product Lead (Remote)

-

Offchain Labs – Site Reliability Engineer (Remote)

-

Azra Games – Analytics Lead (California)

-

Alchemy – Software Engineer, Rust (New York or San Francisco)

-

StarkWare – Senior Software Engineer (Netanya, Israel)

-

Obol – Fullstack Engineer (Remote)

-

Flashbots – Product Manager (Remote)

-

Waterfall – Software Engineer (New York)

-

Braavos – Senior Full Stack Engineer (Tel Aviv)

-

Metaplex – Business Development Manager (Remote)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

-

Investment Analyst, Liquid Strategies – (New York City)

-

Investor Relations Associate – (San Francisco)

-

Senior Investor Relations Associate – (San Francisco)

-

Executive Assistant to the Founder, Managing Partner – (San Juan)

-

Lead Executive Assistant to the Founder, Managing Partner – (New York City, San Francisco, or San Juan)

-

Family Office Accountant – (San Juan)

-

Executive Assistant – (San Francisco)

-

Executive Assistant/Office Manager – (San Francisco)

If you have a passion for blockchain and want to work in New York City, San Francisco, Menlo Park, San Juan, or London, please follow this link to apply. Some positions can be done remotely.

[1] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically-marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

[2] The opinions expressed are those of the author as of the date of publication and are subject to change. Predictions are not guarantees of future outcomes.

[3] https://home.treasury.gov/system/files/221/CombinedChargesforArchivesQ42024.pdf

[4] https://www.jpmorgan.com/insights/global-research/currencies/de-dollarization#section-header#4

[5] https://www.investopedia.com/blackrock-s-bitcoin-etf-assets-surpass-those-of-its-almost-20-year-old-gold-etf-8742363

[6] https://finance.yahoo.com/news/blackrock-bitcoin-fund-became-greatest-141253984.html

[7] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[8] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.