PANTERA DAT FUND[1]

By Cosmo Jiang, General Partner

Pantera has created a fund that provides investors access to Digital Asset Treasury (“DAT”) opportunities.

Pantera has been at the forefront of this emerging new industry, having the conviction to be the anchor investor in the first DAT launches in the US, including DeFi Development Corp. (DFDV) and Cantor Equity Partners (CEP). Our diligence process has translated into a number of investments with strong performance in a short period of time. Pantera’s early role and initial success kickstarted what has become a larger trend. As a result, we are in the fortunate position to be a first call for many prospective DAT teams, many in the early stages of their ideation and seeking our strategic guidance to navigate potential pitfalls.

We have a robust pipeline of opportunities to deploy fresh capital and are opening access to investors through Pantera DAT Fund. Over the last few months, we have seen over fifty pitches and observed what has helped some succeed and others fail, honing our investment diligence process and our ability to support the companies we choose to back. Pantera’s investment strategy is grounded in judiciously backing high-quality entrepreneurs, and we are excited to do so in a new emerging category.

A Timely Opportunity

The equity markets this year have been characterized by the embrace of digital assets from more traditional investors – whether that is through the ETFs, IPOs like Circle, or DATs. One big driver has been the inclusion of Coinbase into the S&P 500. Now every manager in the world has been forced to include digital assets in its index and is required to pay attention. We believe this story is in the early innings and will continue to be a long-term durable tailwind that elongates this cycle.

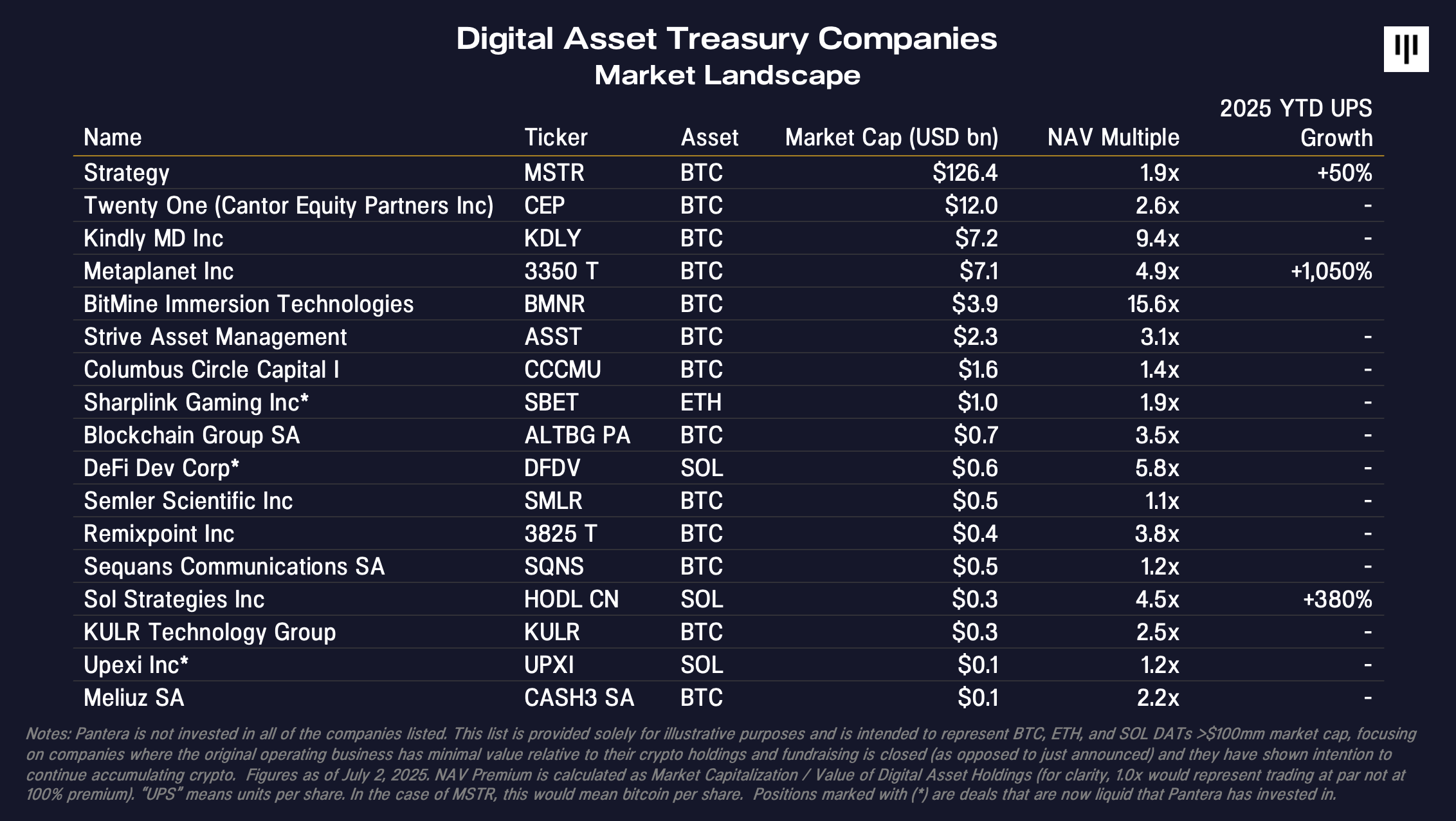

DATs are a new frontier for public market crypto exposure that has benefited from this broader secular tailwind. DATs allow equity market investors to get crypto exposure through familiar instruments and intermediaries. We believe the universe of Digital Asset Treasury companies will grow meaningfully and there is still an opportunity to be at the vanguard of this formation.

That is why we believe investing in this fund is timely. It is rare to find oneself at the start of a new category, so recognizing that and being quick to respond is critical to take advantage of the investment opportunity.

In our prior Blockchain Letter, we detailed our investment thesis and the fundamental case to invest in DATs and the justification for why they may sustainably trade at a premium to their underlying net asset value (NAV). With that context, we thought it would be helpful to further elaborate on why Pantera DAT Fund’s investment strategy is compelling.

Asymmetric Risk/Reward Potential

Pantera DAT Fund has access to deals to invest in DATs at their inception. This means we are investing at or near underlying token value (1.0x NAV), or before the DATs trade in the open market at a potential premium. We believe doing so has an asymmetric risk/reward, particularly relative to owning the underlying token, in a “heads you win, tails you don’t lose much” situation.

Below is a simple visualization of the asymmetric return profile for DAT deals.

Upside – “heads you win”: the near-term upside in a DAT investment is the potential NAV premium (note that the DAT peer set trades 1.5x-10.0x NAV) and the longer-term upside comes from growing NAV-per-share and sustaining that premium.

Downside – “tails you don’t lose much”: downside is limited because even if the DAT does not trade at a premium, investors invest at roughly 1.0x NAV and still retain their pro rata share of the underlying NAV and the underlying token return (e.g., spot BTC, ETH). In addition, we believe there’s opportunity for consolidation as the space becomes more saturated and if DATs begin trading below 1.0x NAV. An important part of our diligence process is filtering for incentive-aligned management teams, so that we can trust them to not be empire builders and do the right thing – whether M&A or buybacks – in a downside scenario.

There is a high degree of excitement in the market for DATs and the trend has grown much faster than we anticipated when we funded the first one. As with any industry, I expect excess returns to invite competition, which drives down returns. That is why this window of opportunity to invest in an emerging category is so timely. The price action on DATs is and will continue to be volatile, and as with any new trend, some will succeed and some will fail. We strongly believe that our intellectual leadership, value-added strategic guidance, deal structuring, and rigorous diligence process will drive continued success.

Market Landscape for DATs

Thematic Call :: The Case For Digital Asset Treasury Companies

Fundstrat Managing Partner and Head of Research Tom Lee and Pantera General Partner Cosmo Jiang will unpack the rising trend of DATs. The two will address common concerns surrounding DATs and make the investment case for this new frontier in public market crypto exposure.

Pantera is proud to be an anchor investor in BitMine Immersion Technologies, where Tom will serve as chairman and help establish the company’s ethereum treasury strategy. This is the first of a handful of deals we expect to make out of Pantera DAT Fund.

Please join us for this live discussion on Wednesday, July 2 at 1pm EDT. You can register by clicking the button below.

Indications Of Interest Are Needed By Monday, July 7, 2025

A number of new and existing Pantera LPs have already made commitments to the Pantera DAT Fund. We expect to deploy $100mm into DAT deals.

Given the influx of deals we are seeing and the timeliness of this opportunity, indications of interest need to be submitted by end of day Monday, July 7, using the form below. Alternatively, you can email our team directly at invest@panteracapital.com. Should interest exceed capacity, we will aim to prioritize allocations based on the order in which commitments are received.

For more information, you can access the fund presentation here.

Pantera donates 1% of revenue from all new funds to 1% For The Planet.

![]()

CIRCLE IPO

By Jeff Lewis, Product Manager, Hedge Funds, and Ryan Barney, Partner

Circle went public on the New York Stock Exchange on June 4th. Its stock jumped 168% on the first day of trading. Pantera first invested in Circle’s Series B in 2014, backing Jeremy Allaire based on his track record and early belief in crypto’s potential. Congrats to Jeremy and team! We are so humbled to have been able to partner with you!

Over the years, we partnered closely with Circle through major milestones: the Poloniex acquisition, the creation of USDC, the dollar-pegged stablecoin that has become a core part of the crypto economy, and much more. As one of Circle’s earliest and largest backers, we helped bring stablecoins into the portfolios of companies like Bitso and co-invested with Circle Ventures to expand the ecosystem.

Our thesis was clear: stablecoins would power decentralized finance as a reliable unit of account and eventually become the go-to payment rail. Jeremy’s focus on USDC helped make that vision real.

Circle’s story began with a well-designed crypto brokerage aimed at consumers. During the 2018 ICO boom, the company acquired Poloniex. But the turning point came with CENTRE, a project designed to solve crypto’s volatility and scalability problems by issuing blockchain-based dollars. This was one of the early versions of the partnership between Coinbase and Circle aimed at distribution and governance of crypto dollars. At the time, bitcoin was still the default way to transfer value, but its volatility made it impractical for everyday use. CENTRE offered a new path: stable, programmable money that could move globally, instantly, and affordably.

We invested in Circle because we believed a price-stable digital asset would become critical infrastructure for crypto. The original plan called for a decentralized model, but Circle ultimately launched a centralized version that became USDC. That decision proved wise. USDC is now a foundational piece of crypto and becoming a foundational piece of payments and remittance worldwide.

Circle’s IPO is not just a company milestone. It reflects a much broader shift. Investor demand for blockchain exposure is growing rapidly. The success of the bitcoin and ethereum ETFs, the rise of tokenization platforms, and the emergence of real regulatory progress all point to crypto entering a new chapter.

On June 17, the U.S. Senate passed the GENIUS Act, establishing the first federal framework for payment stablecoins. The bill requires one-to-one backing with liquid assets like U.S. dollars or Treasuries, mandates monthly disclosures, and prohibits interest payments. Large issuers with more than ten billion dollars in issuance will be regulated by the Federal Reserve or the Office of the Comptroller of the Currency. The bill now moves to the House, where it will be reconciled with the STABLE Act before advancing to the President. Years of work in Washington by crypto advocates are starting to produce meaningful results.

Corporates are acting in parallel. As recently as last week:

– Fiserv launched FIUSD, a bank-aligned stablecoin developed with Circle and Paxos, designed to work alongside PayPal’s PYUSD

– Mastercard joined Paxos’s Global Dollar Network, enabling support for USDC, PYUSD, USDG, and FIUSD across more than 150 million merchants using Mastercard Move and the Multi-Token Network

Regulatory clarity and corporate integration are converging. Stablecoins are no longer a crypto side project. They are on the path to becoming core infrastructure for global payments. 2025 will mark the moment stablecoins move from niche to mainstream.

For more of our writing on the Stablecoin stack, see here.

![]()

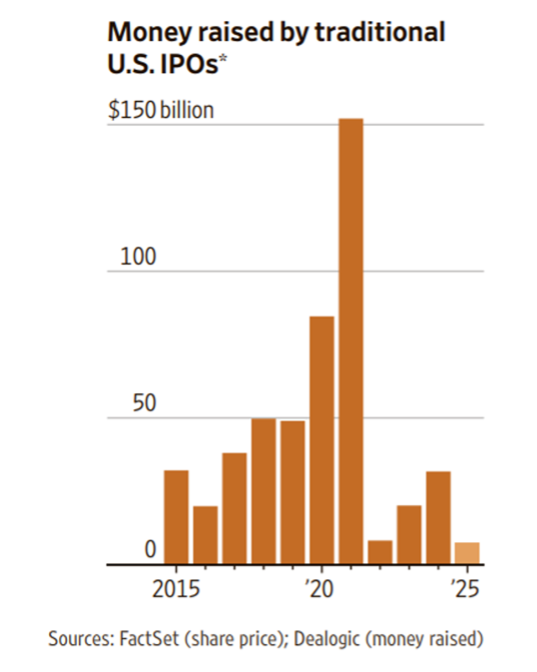

IPOs

The demand for blockchain IPOs stands in incredibly stark contrast to the rest of the capital markets. Very few non-blockchain companies have gone private since 2021.

![]()

BLOOMBERG INTERVIEW

I joined Sonali Basak and Matt Miller again on Bloomberg to share views on the macro and geopolitical landscape — both of which reinforce the case for hard assets like bitcoin. A key theme we’ve been talking about for a decade is now happening: the separation of money and state.

Sonali: “Dan, you were a whale in the bitcoin community. You still also are a Tiger Cub, and so when you look at the market right now, how would you be trading it across assets?”

Dan: “I think equities are rich relative to bond yields and I think the bond market really has no way out. There’s high inflation, the deficit is as large as it’s ever been, and everything’s as good as it’s ever been. So, if something bad happens, the deficit goes even higher. I think it is tricky to be in the traditional markets and that’s why I do favor being in hard assets like cryptocurrencies.”

Matt: “So, just to clarify for my mom, right, a Tiger Cub means that you traded global macro for Julian Robertson, and then on your own, so basically one of the most important global macro traders of the world for a quarter of a century. How does this rank in your experience in terms of geopolitical events?”

Dan: “It does seem like it’s probably contained, as the previous guest said, there’s really not much that Iran probably can do, so I think it will be relatively contained.”

Sonali: “I realize by asking you this, you said cryptocurrency is a hard asset, a lot of people would debate that because they are now trading gold these days. When you think about the safe havens that are out there, how do you think about bitcoin relative to gold, relative to the bond market?”

Dan: “I think it’s a great question. I think all these geopolitical issues highlight a theme we’ve been talking about for a decade:

The separation of money and state.

“Back in the day, money was separate from the state. It was hard assets like gold.

“We’ve had this era where governments print money. They’re printing a lot of it now. I think we are going back to where people store their wealth in hard assets. Gold’s great, gold’s doing very well, but “digital gold”, bitcoin, is also relevant for people’s portfolios. It can’t be undermined by policies, tariff wars, real wars. You can’t print more of it. It has all the attributes that gold has.”

Matt: “We always talk about the dollar as a world reserve currency, and obviously it is still the number one choice there, but I guess my thinking is you have a percentage weight to the dollar and some to gold and the euro and the yen and the Swiss franc even, and bitcoin now. That weight has obviously grown from zero to wherever it is now for bitcoin. Is it taking from the dollar?”

Dan: “Oh, I think it is. And remember, the reserve currency has changed a lot of times over the years. It used to be the Portuguese escudo and the British pound; it’s the dollar right now. It could easily be cryptocurrency in the future and you’re seeing governments now….”

Matt: “But it’s not binary, is my point. This is what Sonali and I talk about every morning. So, it’s not like it either is or isn’t. It’s just a bigger part or a smaller part of your portfolio, right?”

Dan: “A great way to put it. The US stores 11 million worker-years’ wages in gold. I don’t see any reason why they couldn’t store the same amount in bitcoin in ten years. I think states, the US government, foreign governments are all going to have more than just one reserve currency. It is likely to be the US dollar plus bitcoin.”

Sonali: “What do you think the value of stablecoin is in this environment? We saw, of course, a recent listing. Matt was always saying….“

Matt: “Still mind blowing.”

Sonali: “If he was the investment banker for it, he said he would wait for longer until you got that higher price, but there’s some debate around that.”

Matt: “Circle sold shares at $31, and it’s trading right now at well over, here, $276. I feel like they left a lot of money on the table. Other people tell me it was a very small float and difficult to short, but….“

Sonali: “Is it safer than bitcoin right now to be more involved in the stablecoin world if you’re a large investor?”

Dan: “It’s a different use case. We’ve been investors in Circle for twelve years and I’m so happy for Jeremy Allaire and the team. But you think about it, we like investing in bitcoin because we think it will appreciate. It’s on average doubled each year for the twelve years that we’ve been invested in it. Stablecoins are better for cross-border payments, storing your wealth if you don’t want that risk, so they both have really important use cases.”

Matt: “You’re raising a billion dollars right now, so how is the fundraising environment, and when do you expect to close that?”

Dan: “Yes. Fundraising is much better now. I think the change in the administration has really taken away some of the uncertainty about regulatory issues so big institutions are more likely to want to invest now. We’re also investing in these Digital Asset Treasury companies.

“We led the first, DFDV, and Cantor Equity Partners. We’re raising a fund to invest in more, because there’s a huge amount of appetite in the public markets to get invested. And so far, there’s still only a few publicly-listed companies like Circle, Coinbase.”

Sonali: “I also want to point out that not everything has been rosy at all times with new listings in the space. SharpLink in particular was a sharp decline after you saw that initial registration. Do you think that you’re going to see more of that for treasury companies, where you see maybe a pop and then a cool down after you see perhaps dilution that investors are expecting with some of these companies?”

Dan: “Well, you see with [Micro]Strategy, a hundred billion market cap, there’s such an intense demand to invest in crypto via the public markets, and in 10 years there’s going to be hundreds of public companies in the crypto space. Right now, there’s only a few. I think you will see potentially excessive speculation where things go up a bit, but they’re all still trading way above their net asset value, or their holdings, so the space is still doing quite well.”

![]()

SEPARATION OF MONEY & STATE

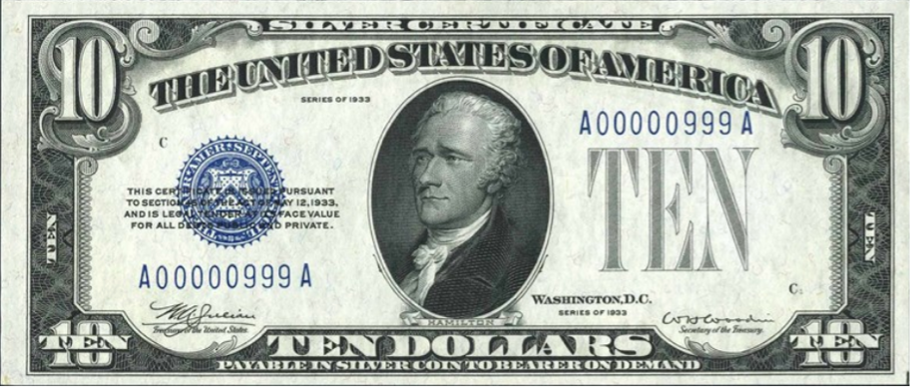

Back in the day money was separate from the state. It was gold.

Princes found they could print their own gold money. Wasn’t long before they began debasing their coins with lesser metals. Governments then realized paper was even cheaper than metals. Paper money!!!

At first it was fully backed by and convertible into gold and, in the U.S., silver. For example, the old $10 bill was fully convertible into silver (line on the bottom center).

Then they started printing more pieces of paper than they had of gold and silver. So easy!!!

As two-thirds of the earth’s landmass is covered with trees, there’s no stopping it.

The British pound sterling obviously used to be backed by/convertible into a pound of sterling silver. It now takes 315 pounds sterling to buy a pound of sterling (silver). 315 pieces of state-issued paper money to buy one pound of old school money.

The history of the U.S. one cent coin is a classic example:

For ages it was 13 grams of copper.

The government faced two options: a difficult one and an easy one. They chose EASY!

They debased the coin with nickel…then tin…then zinc…then less and less of each metal…

Until it’s now a sad ghost of the past – a 2-gram thing that’s only 2% copper.

The amount of intrinsic value/copper has been debased 99.5%.

As an aside, the most recent Consumer Price Index (CPI) data point for the US is a level of 321.465, according to the Bureau of Labor Statistics (BLS).

1/321.465 – 1 = -99.7% debasement

That is not a surprise. It’s really the value of paper money that’s moving.

Even that is not enough – the penny is being canceled in 2026 because the government has printed so much paper money that it costs 3.69 cents of hard assets to produce each one cent coin, according to the Treasury.

Here’s the intrinsic value of the penny (measured in grams) over time: 13.5…10.9…4.7…3.1…2.7…2.5…and now…POOF!…it’s gone. Zero.

The penny is now just a weightless remembrance of hard money.

![]()

J.P. Morgan :: “EVERYTHING ELSE IS CREDIT”

This interchange is just so awesome:

Mr. Untermyer (Committee Counsel): “Is the basis of banking credit?”

Mr. Morgan: “Not always. That is evidence of banking, but it is not the money itself. Money is gold and nothing else.”

Mr. Untermyer: “Do you not know that credit is money?”

Mr. Morgan: “No. Credit is not money.”

Mr. Untermyer: “What is money?”

Mr. Morgan: “Gold is money. Everything else is credit.”

– Testimony of J.P. Morgan before the Bank and Currency Committee of the House of Representatives at Washington D.C., December 18 and 19, 1912, link

That is just so good. Things that can’t be debased/printed/inflated are money. Everything else is just credit/dross.

The 21st century version of his line:

Gold and bitcoin/crypto are money. Everything else is credit.

J.P. concluded his testimony with another very insightful statement – which resonates in the crisis of confidence swirling in today’s markets:

Mr. Untermyer: “Is character important in banking?”

Mr. Morgan: “It is everything. Money, after all, is based on confidence and character.”

I **know** it sounds self-serving for the bitcoin guy to say, but…

#BuyBitcoin

It really is the best place to store your wealth when confidence in the markets, institutions like the Fed, and the paper money they print is in crisis.

All the rest is just credit – “backed” by unsustainable policies.

![]()

WORLD :: A MISSION CRITICAL IDENTITY SOLUTION

By Cosmo Jiang, General Partner, and Cody Poh, Investment Analyst

We have been spending a lot of our time researching how blockchain fits into a world with accelerating AI adoption. Proof-of-human is one area that stands out. In a future world where AI agents and AI-generated content become increasingly ubiquitous, the demand to know what is truly human and distinguish from bots will increase. For many things we are okay with (and may even prefer) interacting with bots. However, for key use cases, including advertising, dating, or government services, there is an acute need to authenticate unique humans. What better way to verifiably authenticate that personhood online, in a global and censorship-resistant way, than using a permissionless blockchain?

World (formerly known as Worldcoin) is a blockchain protocol that is scaling a global, privacy-preserving identity and financial network using the concept of “Proof of Personhood”, which refers to proving an individual is both human and unique. World authenticates users as unique humans after they undergo an iris scan with a World Orb, a biometric imaging hardware device, and issues each unique human a World ID on Worldchain, the World blockchain. Tools For Humanity (“TFH”) is the software company developing World’s technology and signing up people across the globe. WLD is the native token of the World protocol. It is expected to be used as a global internet currency and for governance of the World protocol.

Sam Altman, CEO of OpenAI, is also co-founder of World. He co-founded World as a tool he saw necessary in the future so humans stayed special and central in a world where the internet was going to have lots of AI driven content. If broadly adopted, World could offer a scalable, reliable global solution to distinguish humans from AI online while safeguarding user privacy. This capability carries profound implications as World can expand economic opportunities and facilitate global democratic processes.

It has been a privilege for our team to get to meet Sam Altman, TFH CEO Alex Blania, and the rest of the team since we invested last year. World hosted its latest public event on April 30, where they gave investors and those interested in the space deeper insight into World’s product roadmap and growth strategy. Coming out of that, we thought it was a compelling time to share our investment thesis, how it is coming to life, and some of the things we’re excitedly looking forward to.

Read our investment thesis here.

![]()

BITCOIN 2025 LAS VEGAS :: PANEL HIGHLIGHTS

Recap by Erik Lowe, Head of Content

Dan, Dan Tapiero, and Adam Back shared the stage at Bitcoin 2025 Las Vegas to discuss the institutionalization of bitcoin as a macro asset. Below are highlights from the conversation.

Institutional Adoption of Bitcoin

Dan: “This is the first asset class I’ve seen in 40 years of investing where the quote, ‘smart money’ isn’t in yet. It’s individuals that are driving this and surveys say 30 percent of institutions have direct exposure to either cryptocurrencies themselves or blockchain venture. That means two thirds have zero. That’s why I’m still so bullish: that individuals have driven this new asset class and the majority of institutions have zero exposure. It’s not over yet.”

Bitcoin Treasury Companies and IPOs

Dan: “There’s tremendous, frustrated demand for people in the public markets to get exposure to bitcoin and other crypto assets. MicroStrategy has done well, but there’s really only a couple of public companies, until Galaxy went public on the NASDAQ recently, that is allowing institutions, say a 40 Act mutual fund, to get exposure to bitcoin or Solana or whatever. And so I think they [DATs] are very important. Maybe 20 years from now, they won’t be as important as they are today, but they are necessary now. I think it’s one of the important themes of the market.”

Dan Tapiero: “Trump has said he wants to make the US the crypto capital of the world. I think one of the ways is to encourage as many of the larger businesses to list here on NASDAQ and NYC. And so, one of our companies, eToro, had a successful IPO last week. We had another company a few weeks ago, Deribit, purchased by Coinbase. Circle, another company we’ve invested in. I think there are going to be quite a few more.”

Challenges to Institutional Entry

Dan Tapiero: “The reality is the volatility is not going away. I think most larger investors, even if they have a multiple return over some period of time, if there’s a year where the asset goes down 60 to 70%….

“So I still think that that’s a natural resistance, and I don’t think that’s going away.”

The Unlock: U.S. Regulatory Clarity

Dan: “I’ve been evangelizing for Bitcoin for 12 years, and when we started and met Adam back in 2013, there was an incredibly long list of reasons to say, ‘no’. No custodian, no this, no that. The last one was regulatory clarity, and we just got that, right? We have a change in the government in the United States, change in many of the agencies. Congress is working on it. To my mind, that is the big unlock.”

Price Forecasts and Final Takeaways

Dan: “$750,000.” (Five-year price target)

Dan Tapiero: “I was thinking in 10 years, we’re at a million.”

Adam: “A million, easy.”

![]()

CONSENSUS 2025 TORONTO :: PANEL HIGHLIGHTS

Recap by Erik Lowe, Head of Content

Dan and Dan Tapiero shared the stage (again) at Consensus 2025 to share their perspectives on crypto in the broader macro context. Below are highlights from the conversation.

Discovering Bitcoin/Crypto

Dan: “Dan [Tapiero] and I actually both were at Tiger Management, looking for asymmetric trades – trades that have three or four times the upside compared to the downside. And in 2011, my brother introduced me to Bitcoin, and I read about it, thought it’d be a cool idea, but I didn’t really do anything. And then in 2013, Pete Briger of Fortress said, ‘Hey, let’s work on this together….’

“I realized it’s the biggest trade of a generation. It’s already done 10x three times. I think it can do 10x again. If you have a trade like that, that is just so asymmetric, there’s so much upside relative to the downside, everyone should have some of it in their portfolio.”

Dan Tapiero: “In 2012, ’13, I have a physical gold sales and storage business called GBI. And that company integrated with a firm called BitReserve, which today is the Uphold Wallet. And so, we spent a year integrating with that platform. We became the first place you could buy or sell gold, to buy or sell bitcoin or Ripple (XRP). So that was my introduction to it.”

Investing in Tokens vs. Venture

Dan: “To your question of tokens versus private equity versus special opportunities, liquid tokens, I think the best is to get a chunk of all four of those types of asset classes, because each one has their pros and cons. And then they go in these wild pendulum swings, where sometimes tokens are really expensive and venture’s cheap, sometimes it’s the opposite. As an investor, I always advocate people investing in a wide spectrum of both tokens and venture.”

Macro Outlook, Tariffs, and the Case for Blockchain

Dan: “The whole thing with tariffs is so unpredictable, and it’s so hard for any investor to be able to cogently invest around that. And I think it’s value-destroying, ultimately, because increasing uncertainty, which makes people put a bigger risk premium on whatever asset they’re in. And it’s not a surprise that over the last 12 months, the only thing up is crypto. Bitcoin is up 50-something percent. All crypto generally is up about 40%. And most things like stocks, bonds, real estate, are essentially flat. And that is the paradigm I see for the next three or four years.”

![]()

I was thinking how far we’ve come.

I grew up in hedge funds in the early 90’s when they were truly alternative. Then everything became the same. Thousands of funds sprang up and it all became the same. Twelve years ago I put that cheeky tagline in our investor letter – prompting people to consider putting a new and quite alternative asset class into their portfolio.

It’s pretty amazing that now important institutions, policy makers, investors say “Of course bitcoin should be [in public companies, S&P500, Strategic Bitcoin Reserve, or whatever]…”

It’s becoming less alternative.

Yay!

“Put the alternative back in Alts”

O.G. STILL LONG BITCOIN

My son Mackenzie recently sent me this interview. It’s a tiny bit dated, but Paul Jones has just been so right for almost half a century – and this is spot on – that I wanted to share it with you all.

In his CNBC Squawk Box interview with Andrew Ross Sorkin his lines are just what we’re saying above:

“I’m long gold, I’m long bitcoin…

“Every 100 basis points, given where our debt/GDP right now, every 100 basis points is worth about $90 billion a year to the deficit – $90 billion. So yes, if we’re trying to stabilize debt/GDP, we want to run the most dovish monetary policy that we can without letting inflation become too much of a tax on the citizenry. So yes, all roads lead to inflation.”

– Paul Tudor Jones, CNBC Squawk Box Interview, October 22, 2024

Andrew Ross Sorkin: “We are here in Downtown Soho, joined by a very special guest this morning. Paul Tudor Jones is here. He’s the founder, chief investment officer of Tudor Investment Corporation. Of course, he is also the founder of the Robin Hood Foundation, which is hosting its annual investor conference in partnership with JP Morgan right here, that’s going to begin tomorrow. And we’re thrilled to have you on the program.”

Paul Tudor Jones: “So good to see you again.”

Andrew Ross Sorkin: “So good to see you. We got to talk about a lot of things, because we are now 14 days away from the election, and I think everyone is trying to make sense of this market and where things are headed, and where things are going, and maybe, depending on who you think is going to win the presidency, how that’s going to impact this. So where are we?”

Paul Tudor Jones: “For me, and in the hedge fund world, this is kind of the macro–Super Bowl coming up on November 5th. And I think this one – some elections are not that binary – this one is binary not so much because of which candidate wins, but it’s binary in the sense that what is the market’s response going to be to either candidate if they win. And so, we can either continue down the path we’ve been on, which I’m going to kind of frame here in a second, or we may have that point of recognition where all of a sudden, the markets have different ideas than what the candidates have been espousing.”

Andrew Ross Sorkin: “Before you lay out where you think that piece of it is, let me ask you this: Stan Druckenmiller said that he’s convinced by market indicators right now that Trump will win. And I’m curious if you agree with that thesis. Part of it is that he’s looking at the Poly market and the betting markets. Part of it is he’s looking at the shares of DJT. Part of it he’s looking at bitcoin.”

Paul Tudor Jones: “Yeah, certainly the markets are saying he’s going to win. I think they’re heavily skewed by Republicans. So, I don’t know if I necessarily believe the betting markets, but I don’t have any great insights. I really don’t. I just would be more skeptical of them than I would normally. It’s the same way – look in football betting. You can get a huge home bias where the line doesn’t reflect reality. So yeah, I know what they’re saying, and I respect him.”

Andrew Ross Sorkin: “What about other investors? Dan Loeb recently came out with a report to his investors saying that he’s positioning, or repositioning, his portfolio around the thesis that President Trump will become the president.”

Paul Tudor Jones: “And I have also, if I’m being honest – primarily because I see the polling numbers, have clearly moved in this direction….”

Andrew Ross Sorkin: “You say also meaning you’ve repositioned as if when President Trump.

Paul Tudor Jones: “Yes, I have moved in that direction. For sure.”

Andrew Ross Sorkin: “And what does that mean?”

Paul Tudor Jones: “It just means more inflation trades, which I’d love to get to, but I think it’s really important that we frame where we are right now. And where we are is an incredible moment in US history. And what I really want to talk about is the debt trajectory that we’re on. So, we’ve gone, in the space of 25 short years, from debt/GDP at the federal level, from about 40% to almost 100%. 60% in 25 years. And if you look at what our trajectory, what CBO projects our trajectory to be, as well as what we see is – and we’re going to project further than CBO. So, CBO says that we go from 98 to 122, I think 124. That’s very conservative over the next 10 years. If you extrapolate that 30 years, you get to 200% debt/GDP. And so that’s something, obviously, something that can’t go on forever – won’t. And the question is, after this election, will there be some point of recognition, particularly with all the tax cuts that are being promised by both sides and the spending plans – I mean, they’re handing out tax cuts like their Mardi Gras beads. We’re doing tax cuts on everything from tips to toucans. So, it’s crazy what’s being promised. After the election, I think the fact that you’ve got 7-8% budget deficits, as far as the eye can see – the question is, will the markets allow either candidate – I think under Trump the deficit goes up by $500 billion per year. Under Harris’ plan, it goes up by an additional $600 billion per year. I have a feeling all those are just pipe dreams. I think the chances of any of those being enacted are-”

Andrew Ross Sorkin: “You mean that the tax cuts that they’re putting on the table during the campaign….”

Paul Tudor Jones: “Those have zero chance of being enacted in my mind. I think the markets will unequivocally – debt markets for sure. The Treasury market won’t tolerate it.”

Andrew Ross Sorkin: “Why do you think that the Treasury market continues to tolerate it now?”

Paul Tudor Jones: “Well, it’s so funny, because financial crises percolate for years, but they blow up in weeks. That’s kind of the history of them. And so, for me, this election becomes one of those seminal points where all of a sudden – Hmm, let me really think whether this proposition that the US government is making me is something that I actually want to participate in. And I just want to try to frame, in layman’s term – let’s assume that I’m making $100,000 a year. You’ve lent me, because we’re such great friends, $700,000. That’s what you’ve lent me. And I come to you and say, “Okay Andrew, I’m gonna pay all that back to you in 30 years.” But between now and when I ultimately pay you back, I wanna borrow $40,000 every year for the next 30 years. And then at the end of 30 years, I’m gonna pay the whole thing back. Would you lend me that money?”

Andrew Ross Sorkin: “Unlikely.”

Paul Tudor Jones: “You son of a bitch. I thought you were my friend!”

Andrew Ross Sorkin: “Well, this is the problem that we have.”

Paul Tudor Jones: “Okay, so that’s actually the proposition that the US government makes to every bondholder today. That’s the exact same proposition. So, think about this. We owe $35 trillion. Our tax take is $5 trillion. So, we owe 7x what our tax take will be this year – our revenues will be this year. And our deficit is $2 trillion, and is $2 trillion right now, as far as the eye can see. That is literally the proposition that the US government is making to someone who buys a 30-year bond.”

Andrew Ross Sorkin: “I’m not disagreeing with you. The question is, life is relative, so some people would say, “Sure, you can either buy bonds from the US, or you could buy bonds from some other country that has an even worse situation.”

Paul Tudor Jones: “Or you can not buy bonds. So anyway, I was watching this Vince McMahon documentary, and in it – and I love wrestling, particularly when Stone Cold and The Rock, and all of them – and in it, there’s a term that I’d never heard of, called kayfabe. And in wrestling parlance, that represents the unspoken, unwritten, tacit agreement between the wrestlers and the fans about the illusion that’s going on in the ring – the suspension of disbelief that was going on the ring is actually – we know it’s scripted, and we know it’s a performance, but they ask us to think it’s genuine and real. And so, we’re in an economic kayfabe right now. And it’s not just the United States. We’re in it in the in the UK and France, Greece, Italy, Japan – Japan being the biggest of all. It’s this economic kayfabe, and the question is, after this election, will we have a Minsky moment here in the United States and the U.S. debt markets? Will we have a Minsky moment where all of a sudden there’s a point of recognition that what’s going to happen – or what they’re talking about – is actually fiscally impossible, financially impossible?”

Andrew Ross Sorkin: “So are you betting on a Minsky moment?”

Paul Tudor Jones: “I am clearly not going to own any fixed income, and I’m going to be short the backend of fixed income, because it’s just completely the wrong price. But I just want to add one more thing, and this is why this election, I think, is so – I find it so interesting because the candidates and the parties are so interested in winning this election. But if you look at it, certainly from a fiscal standpoint, you’re winning the booby prize. And let me just make this a little more complicated. In addition to the problems that we have fiscally, the United States has a net international investment position that is -80% of GDP. And so -80% of GDP is roughly over $20 trillion, and that traces the history of our net international investment position. So let me define that real quick. It means foreigners own $20 trillion more of US assets than we own of foreign assets. That’s how you get to the -80% or the $2 trillion. How did we get there? It’s actually a good thing. Why do we have so many of our assets owned by the rest of the world? Because we’re the leader in technology. We’re the greatest arena for free markets that there is. We promote and engender entrepreneurism. We generally hold in high esteem the people the best. So anyway, think about this: The problem with having a $20 trillion net international investment deficit is that you’re also beholden to the kindness of strangers. So now we’re going to have this election. The next president is going to come in, whoever that is, and they’re looking at, okay, I’ve got $20 trillion that could have wings on it, as well as I’ve got a fiscally unsustainable path. What do I do? And that’s why, I’ll tell you – don’t know if you’ve ever seen those goats that kind of perch themselves from the side of dams, and you go, “Gosh, how do they do that? How do they hold themselves on the side of the dam like that?” That’s what I think the next administration, whoever it is, is going to be facing. You’re going to have to have the smartest, and the most sensitive, president, treasury secretary – that Treasury Secretary damn well better be from Wall Street, no markets. It cannot be a corporate head who does not understand the plumbing of the financial system.”

Andrew Ross Sorkin: “So, who do you think is going to get you that Treasury Secretary?”

Paul Tudor Jones: “I don’t know. And frankly, and then – let me just say one last thing. And our Fed chairperson, our Fed chairman, and the next chairperson after that – the three of them have to be brilliantly connected to be able to stick this landing. Because again, if I look at debt/GDP, the path that we’re on, it’s rising faster than the ocean.”

Andrew Ross Sorkin: “Let me ask you this, because also, the only way to solve this is to figure out a way to raise enough money where at least the math starts to make some semblance of sense.”

Paul Tudor Jones: “Yeah, and – but let me just quickly show where we are in terms of our tax take relative to the rest of the world. It goes from the US at the lowest end, 29.3% of GDP is what our tax take is, to France at the highest end, and you can kind of see there’s Canada, Japan, the UK.”

Andrew Ross Sorkin: “Now, before we get into our own math, let me ask this question: One reason why some people would say the US is as successful as it is, is because it is a less of a regulatory state, less of a tax state. When you go down that list and say to yourself, how successful is the US relative to how successful is France? Do you say to yourself that France is less successful because its tax rate is higher?”

Paul Tudor Jones: “I would unequivocally agree with that. It’s like everything. There’s a fine line – there’s a needle that you’ve got a thread. You can also say one of the reasons why the US is so dominant is because we fast forwarded so much future income by spending so much in a deficit standpoint. And it’s really occurred, to be frank with you – the guy that started it was Trump. He inherited a 3% budget deficit in 2016. In 2019, that was close to 5% pre-COVID – COVID. And then, of course, Biden gets in and sees what Trump has done, and says, “Here, let me raise you one with the Inflation Reactivation Act,” and here we are today. So can I just say, between Trump and Harris, you’ve probably got the two people least suited for the job that’s ahead of the… least suited for the job that’s ahead of them. And that’s why it’s going to be, again, after the election, is going to be so important. And I do think they know – I think we’re doing also a political kayfabe with them. They know that they’re not going to do these spending programs. I think they know that. It can’t happen.”

Andrew Ross Sorkin: “Okay, but if both of these folks you think are the wrong people, but it’s still a binary choice, what is your choice?”

Paul Tudor Jones: “I’m going to keep that private. And the reason I’m going to keep that private is because there’s a lot of causes that I’m really invested in. Robinhood’s one of them. The environment. And I’m going to end up working with people on both sides. We’re a really divided country right now, and I want to make sure I have great relations with whichever administration goes on, because I want to continue serving the millions of people that I do, and the billions of critters that I love.

Andrew Ross Sorkin: “Let’s talk about taxes, though, because that’s how the money is going to get raised, one way or the other.”

Paul Tudor Jones: “Correct. Can I just say this? You have to let the tax cuts expire. You have to let those expire! That’s $390 billion. We’re going to have – again – we’re going to be broke really quickly, unless we get serious about dealing with our spending issues. And unless we, only, we can either – I don’t know if we’ll be able to cut spending that much. 60% of our spending are transfer payments.”

Andrew Ross Sorkin: “But if you think we’re going broke, and you think Trump is going to be the president, he’s not going to let those tax cuts expire if he can avoid it. He does not want the corporate tax rate to go to 25% as you’re suggesting it’ll have to, he’s suggesting it should go to 15%.”

Paul Tudor Jones: “I’m saying that to just to get us to the point where we stabilize debt/GDP at where it is right now, here’s what you need to do: You need to let the Trump tax cuts expire. That’s $390 billion. You need to raise the payroll tax on every single working person one percentage point. That’s another big slug. You need to…”

Andrew Ross Sorkin: “What do you think that does to jobs?”

Paul Tudor Jones: “We’re clearly going to have a period of contraction, which hopefully – that’s why I was going to say, it’s going to be really important for the Fed to be able to offset the fiscal contraction that’s going to come.”

Andrew Ross Sorkin: “Then you want to increase the individual tax rate – all the way to the top rate of close to 50%?”

Paul Tudor Jones: “No, no. Hold it. I don’t want to do any of this stuff. What I’m telling you is, is that we’ve got to be serious about where we are fiscally. And so, I’m giving you–there’s a whole set of options. We could go in and cut 25% of the federal workforce. Some people may do that. There’s a whole – there’s a website where you can go look and play with all the options. You can raise the capital gains rate from 21% to 28% – that only gets you $10 billion a year. It actually doesn’t get you what you need. So, I’m simply showing some of the things that you can do. Yes, you’d have to raise the tax rate on the top – I think probably everyone over 200,000 – probably have to raise that to 49.5%. If you do all these things, all these things – raise the Social Security from 65 to 70 – if you do all these things – means test, Medicare, if you do all these things, all you do is you get to a primary balance. What that means is you stabilize debt/GDP. You’re still actually increasing your debt. You’re still actually increasing it because it excludes the interest cost, which, oh, by the way, the interest bill this year, is larger than every single line item except Social Security. It’s larger than defense spending. Larger than Medicare.”

Andrew Ross Sorkin: “I want to talk about why you’re here, which is Robinhood, and this conference. But before we do that, is this – given all of the things you’re saying, are you off buying gold and Bitcoin, and hiding somewhere?”

Paul Tudor Jones: “All roads lead to inflation. We’re going to end up…”

Andrew Ross Sorkin: “But does all roads lead to inflation, therefore gold is a good investment? Is bitcoin a good investment to you?”

Paul Tudor Jones: “I’m long gold, I’m long bitcoin. I think commodities are so ridiculously under owned. So, I’m long commodities. I think most young people find their inflation hedges via the NASDAQ – that’s also been great. It’s probably some combination. I probably have some basket of gold, Bitcoin, commodities, and NASDAQ – something like that. And I would own zero fixed income. If I had my cash, it’d be very short term. The playbook to get out of this – you see it in Japan right now. They have 2% inflation, 30 basis points overnight. They don’t want to raise rates. The playbook to get out of this is that you inflate your way out, and you have a small tax on the consumer, and you run interest rates below inflation and nominal growth above inflation. And that’s how you reduce your debt/GDP. So, you’re going to have the Fed be – they should be easy. They should be easy.”

Andrew Ross Sorkin: “They should be easy. You want them to cut.”

Paul Tudor Jones: “So just real quickly. Every 100 basis points, given where our debt/GDP right now, every 100 basis points is worth about $90 billion a year to the deficit – $90 billion. So yes, if we’re trying to stabilize debt/GDP, we want to run the most dovish monetary policy that we can without letting inflation become too much of a tax on the citizenry. So yes, all roads lead to inflation. That’s historically the way every civilization has gotten out – is they’ve inflated away their debts.”

Andrew Ross Sorkin: “We’re going to run out of time, but I want to talk about this – because this is also your Super Bowl of the Year.”

Paul Tudor Jones: “Best day of the year – best day of the Fall. And that’s our investor conference. It’s sold out. It’s fantastic. We’ve got everyone from Seth Klarman, Jamie Diamond, David Einhorn, Bill Gates finishes the end of the day. I have a great talk with Ken Tropin. And most importantly, you have to think about – I think about Robinhood and I think New York this way – you’re only as strong as your weakest – the chain’s only as strong is the weakest link. The weakest link in any society are the most needy, the underserved, the people who are at the bottom. So that’s what we do. We’re the spear point for helping those people in this city so we can keep a strong city and a strong society.”

Andrew Ross Sorkin: “Paul Tudor Jones. Kayfabe, right? That’s the phrase?”

Paul Tudor Jones: “Economic kayfabe.”

Andrew Ross Sorkin: “Economic kayfabe. Fascinating. Thank you for this. Appreciate it very much.”

Paul Tudor Jones: “Thank you so much.”

Andrew Ross Sorkin: “You bet.”

PANTERA CONFERENCE CALLS[2]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

The Case For Digital Asset Treasury Companies

Fundstrat’s Tom Lee and Pantera’s Cosmo Jiang will explore the investment case for DATs and common concerns surrounding this emerging sector.

Wednesday, July 2, 2025 at 1:00pm Eastern Daylight Time / 19:00 Central European Summer Time / 1:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Liquid Token Fund Investor Call

Tuesday, July 8, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Early-Stage Token Fund Investor Call

Tuesday, August 5, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Venture Fund II Investor Call

Tuesday, September 9, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Fund V Call

An overview of Pantera’s fifth venture-style fund that offers exposure to the full spectrum of blockchain assets.

Tuesday, September 16, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Venture Fund III Investor Call

Tuesday, September 23, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Blockchain Fund Investor Call

Tuesday, October 14, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

-

Director, Capital Formation – US East – (New York City)

-

Senior Director, Capital Formation – Gulf Region – (Abu Dhabi)

-

Capital Formation Associate (New York City)

-

Content Associate – (New York City)

-

Investor Relations Associate – (San Francisco)

-

Senior Investor Relations Associate – (San Francisco)

-

Executive Assistant/Office Manager – (San Francisco)

If you have a passion for blockchain and want to work in New York City, San Francisco, San Juan, or Abu Dhabi, please follow this link to apply. Some positions can be done remotely.

[1] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[2] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically-marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.