MARTIAN[1]

If a Martian landed and was handed all the economic statistics for the United States and asked what the appropriate monetary policy was, I don’t think there’s any chance it would say: “Immediately cutting to 2.45%”.

That’s what the markets had priced in a few months ago. The Martian would say something like, “7% for several more years”.

The traditional markets may struggle – and blockchain might be a safe haven.

BOND BUBBLE PREDICTION :: 18 MONTHS ON

In our December 2021 Blockchain Letter, It’s A Ponzi Scheme, we forecast Fed funds going from zero to 5% and the 10-year note yield tripling.

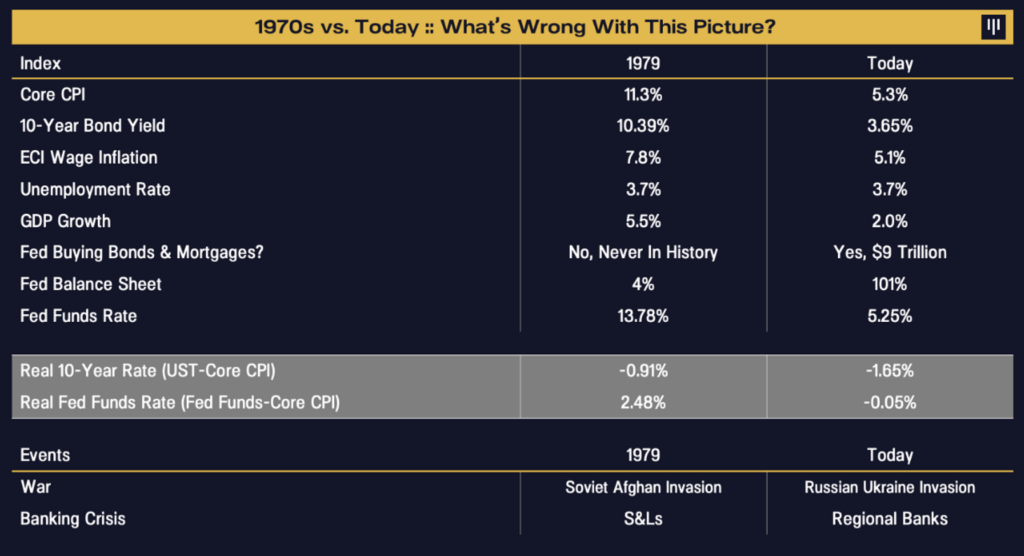

CPI inflation was already at 7.0%. Negative 700 basis points of real rates. No kidding, inflation exploded and an asset bubble happened!

The Fed was still pumping record liquidity into housing and the economy as a whole.

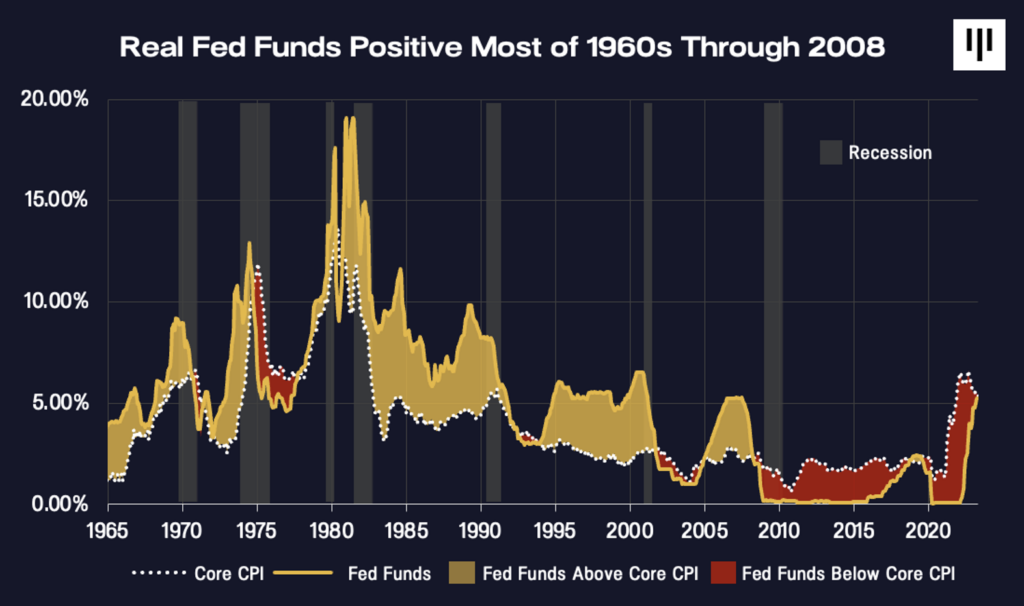

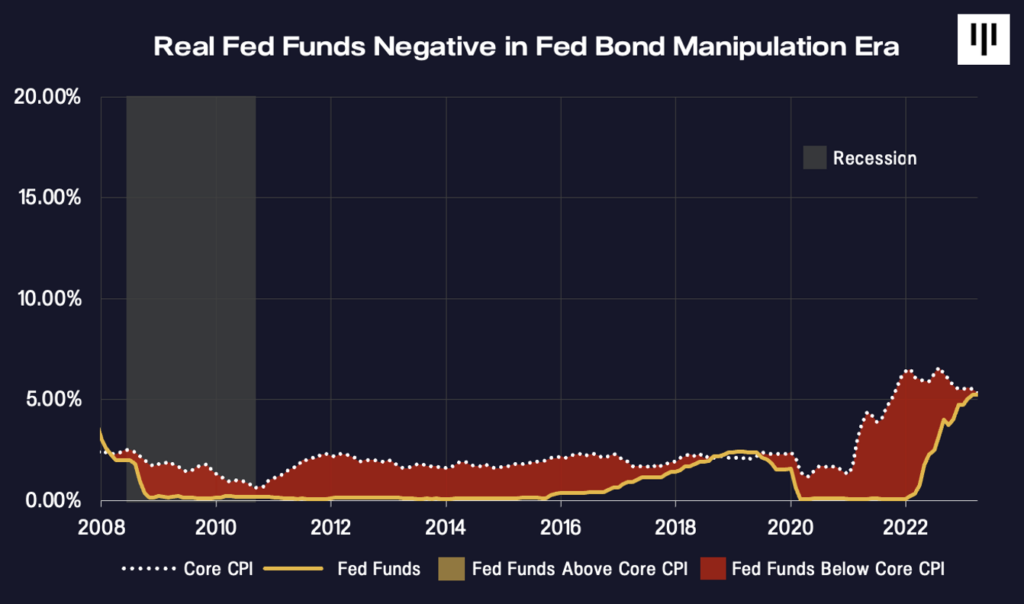

Fed policy was as stimulatory as at any point in history – including the dark days of the 1970’s. Real fed funds – the fed funds rate less core inflation – was as loose as ever (gold shading below). At the same time core inflation (white dotted line) is higher than at most times in history.

The Fed policy error is the red area – the excessive time with fed funds below core inflation.

I put positive real rates in gold because it’s like the “gold standard” of central banking. Paul Volker and many other successful central bankers kept rates above inflation.

Even in the 1970’s there was never such a large gap between the real fed funds rate and the rate of inflation. We’re way past the 70’s.

You don’t have to be an Econ PhD to guess where we’d have the two bouts of high inflation: just after the two periods where the Fed kept lending money well below the rate of inflation (the red area above).

The markets are beginning to come around to the implications of the once-in-42-years tectonic shift, but unfortunately, I believe there’s more to come.

We’re still there. We believe rates have to go higher for longer than the markets think.

FAILURE OF IMAGINATION

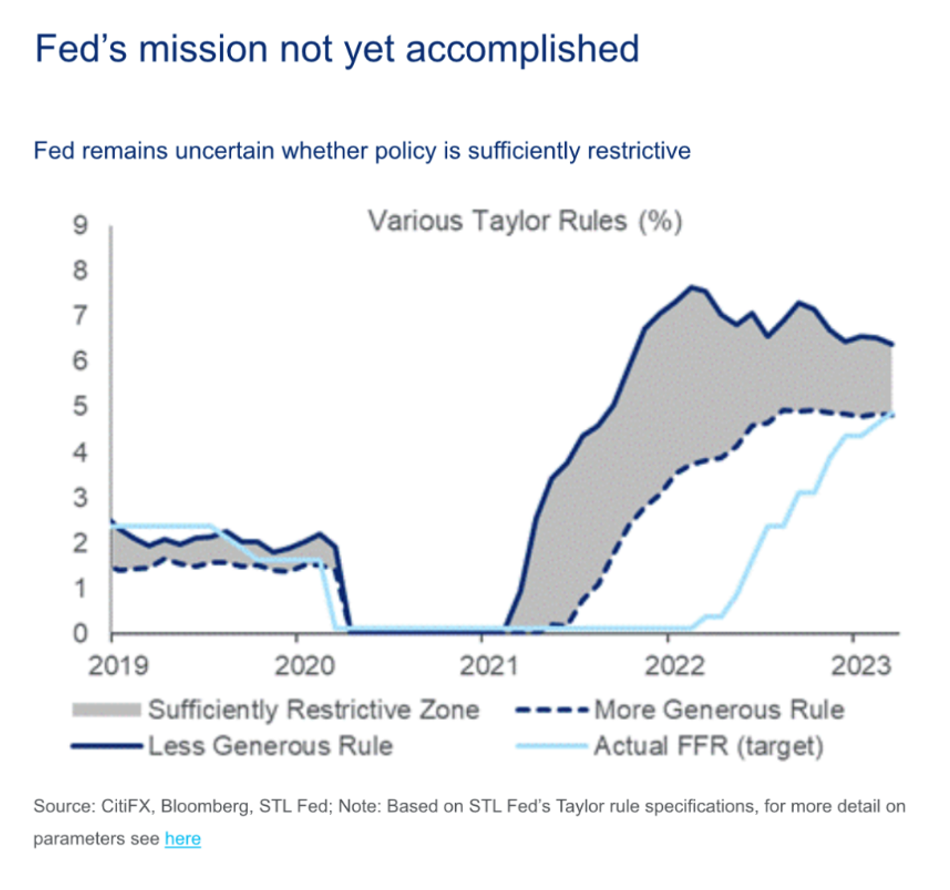

Sometimes robots are better than humans. Professor John Taylor’s Rule would have taken away the record stimulus more than a year earlier and gone much higher than they actually did.

The Fed even kept buying bonds for four more months after inflation hit 7.0% and we predicted the bubble would burst – only stopping in March 2022 when they had goosed housing to a 40% increase in two years.

“The Taylor rule is an equation John Taylor introduced in a 1993 paper that prescribes a value for the federal funds rate—the short-term interest rate targeted by the Federal Open Market Committee (FOMC)—based on the values of inflation and economic slack such as the output gap or unemployment gap.”

— https://www.atlantafed.org/cqer/research/taylor-rule

The cause of all this inflation is clear:

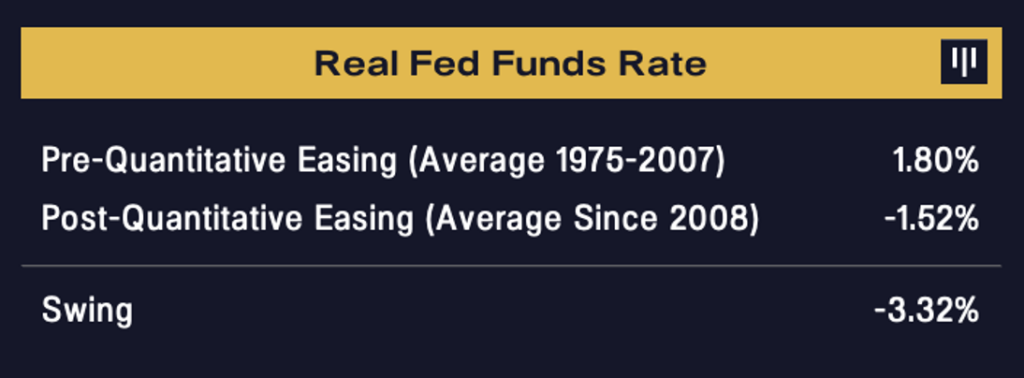

Back in the day, central bankers kept rates above inflation – 1.80% on average. In the new new Quantitative Easing era – they’ve left rates 1.52% below inflation.

It’s a swing of -3.32%!

That gives a massive incentive to borrow, buy homes, and other speculative investing – which is followed by prices rises.

![]()

POLICY GAP

Fed Funds minus Core CPI is coming off its lowest point in the past fifty years (-6.32%) – lower than the previous low in April 1975 (-5.81%). It currently sits at -0.08%.

The Fed needs to continue to raise rates.

WILE E. COYOTE MOMENT

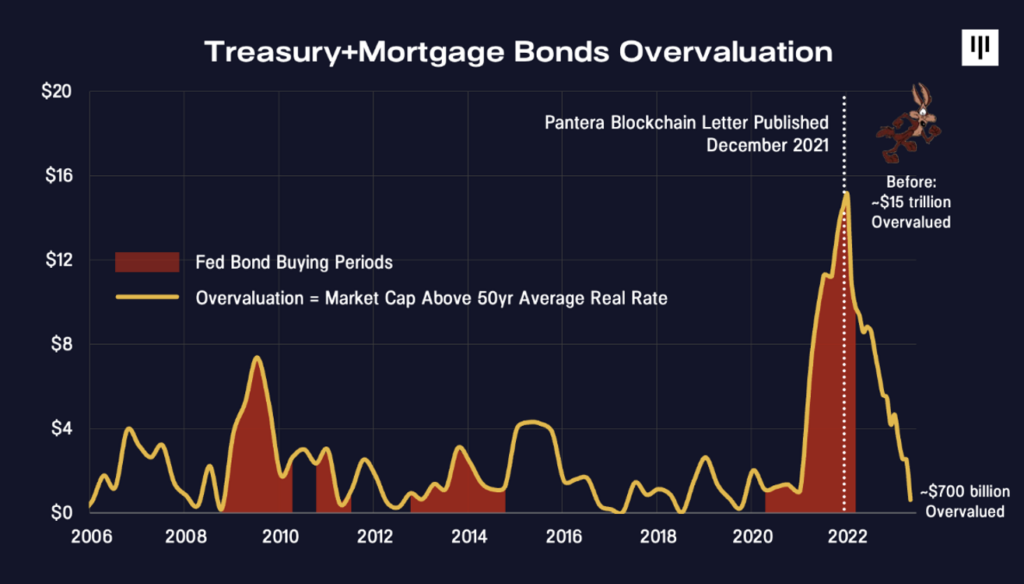

In the 247-year history of the country, the Fed only began manipulating bonds in the past 15 years. The results have been devastating for housing, regional banks, renters, etc.

With the Fed no longer able to manipulate the U.S. treasury and mortgage bond market, bonds are experiencing a Wile E. Coyote moment.

Bonds peaked at $15 trillion overvalued in January 2022, weeks after our prediction. Unfortunately, we still have $700 billion to go.

Investors should be very careful about investing in interest-rate sensitive asset classes. Blockchain should be able to trade independently of rising rates.

![]()

REAL RATES MASSIVELY NEGATIVE

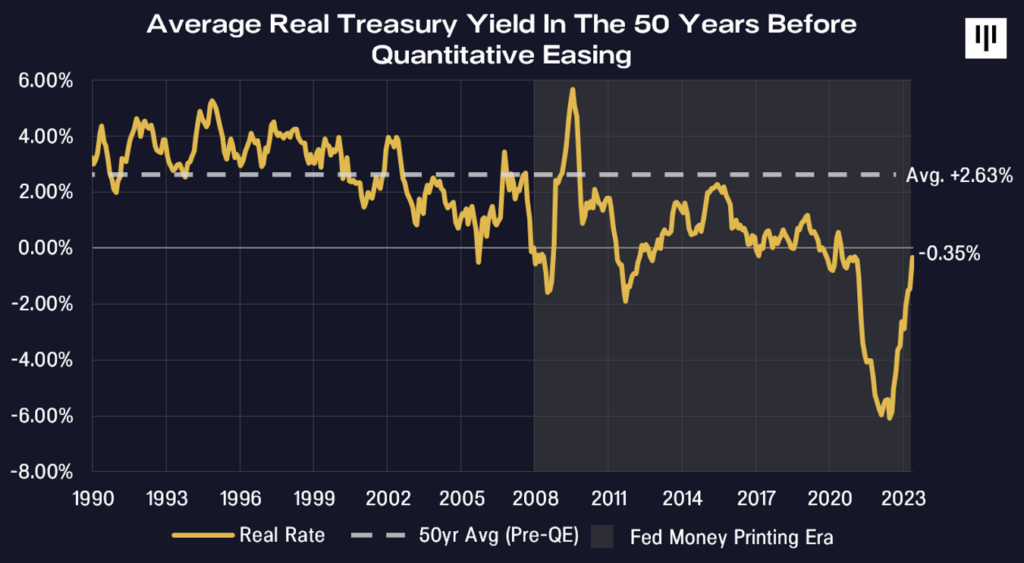

The real rate of return is the yield a bond investor gets after inflation.

For U.S. 10-year notes, the average real rate over the fifty years before money printing started (1957-2007) is 2.63%.

The Fed’s decision to print half of our country’s GDP and use it to push up the price of bonds has forced the real rate to -0.35%.

The gray area in the following chart is our brave new world of unlimited bond purchases. We are still an incredible 2.98 percentage points below the pre-quantitative easing average.

There’s still tons of risk in bonds.

![]()

LONGEST S&P 500 FLAT PERIOD

No working-age person has invested in a rising rate environment.

It’s hard to get one’s head around the difference from what we’re used to: “Buy the dip!”

It destroys value in interest-rate sensitive assets classes. For 18 months our theme has been: It’s the 70’s all over again.

It’s wise to remember that the S&P 500 was flat for the entire 70’s plus a few years on either side.

![]()

BLOCKCHAIN HAS DECOUPLED

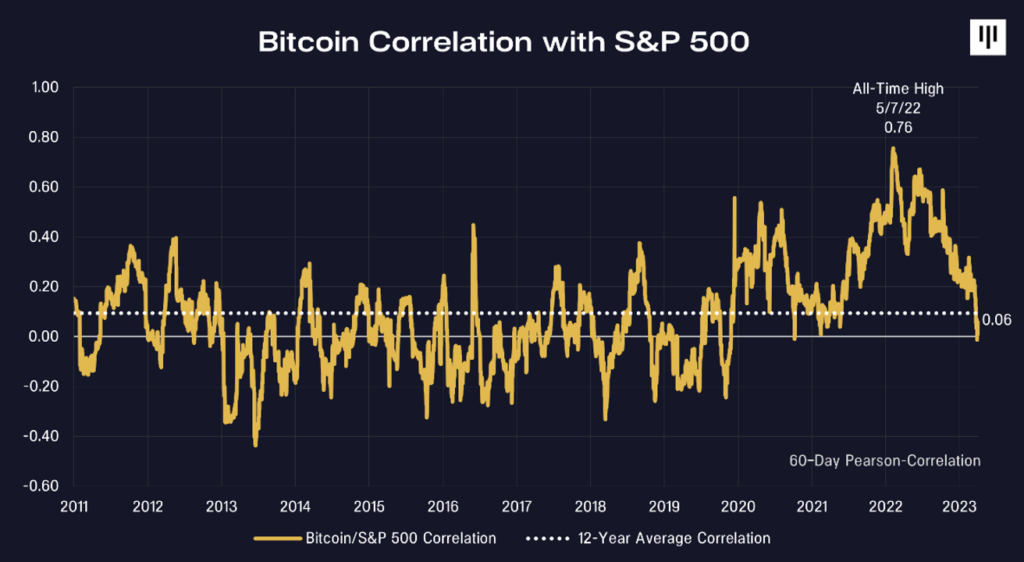

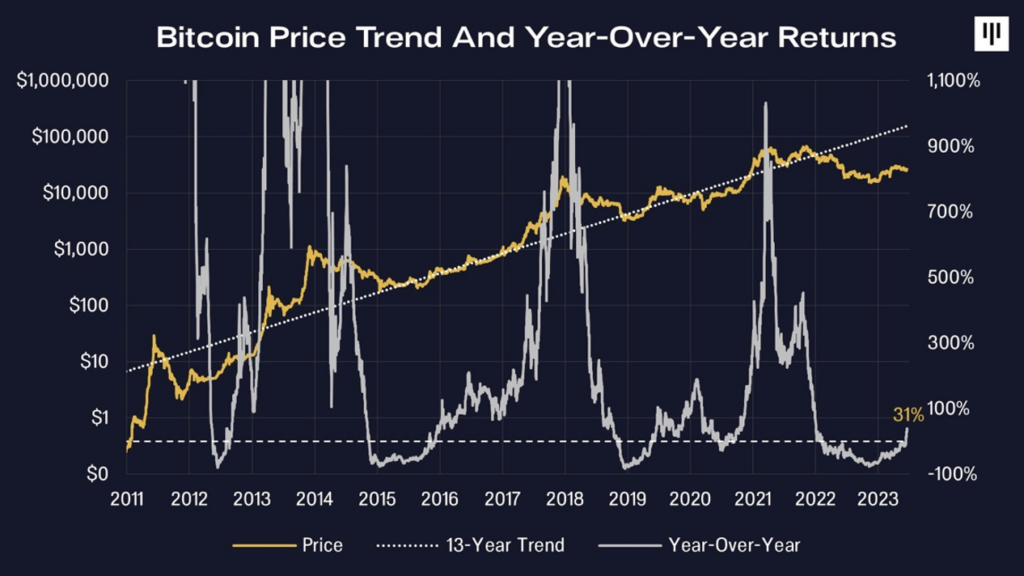

Blockchain has massively decoupled. It’s just hard to notice in the moment.

For most of the history of blockchain assets, they had essentially no correlation to risk assets. Using Bitcoin as a proxy for blockchain, the correlation with the S&P 500 over its first nine years of existence was 0.03.

That was a huge part of the argument: when you find a new asset class with incredibly high historical returns and essentially no correlation with typical assets – that’s the dream investment.

Unfortunately, all of the excessively-leveraged centralized entities and the alleged criminal Sam Bankman-Fried in our space caused the correlation to spike up, peaking at 0.76 last year.

As blockchain is in no way connected to interest rates, it should have a very low correlation to the main asset classes (stocks, bonds, real estate), which are all tightly driven by rates.

Bitcoin’s correlation with the S&P 500 is back to below 0.1.

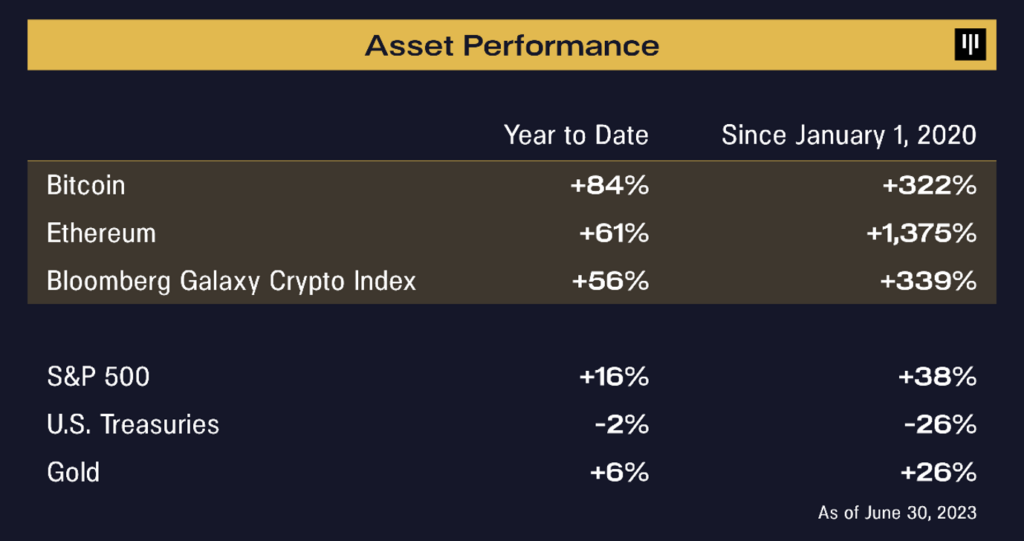

But if you zoom out, the massive out-performance is obvious.

In January 2020 the bitcoin price was $8,000. It’s now $30,000.

IT’S BEEN ENOUGH TIME

Having traded 35 years of market cycles, I’ve learned there’s just so long markets can be down. Only so much pain investors can take.

It’s been a full year since TerraLUNA/SBF/etc. It’s been enough time. We can rally now.

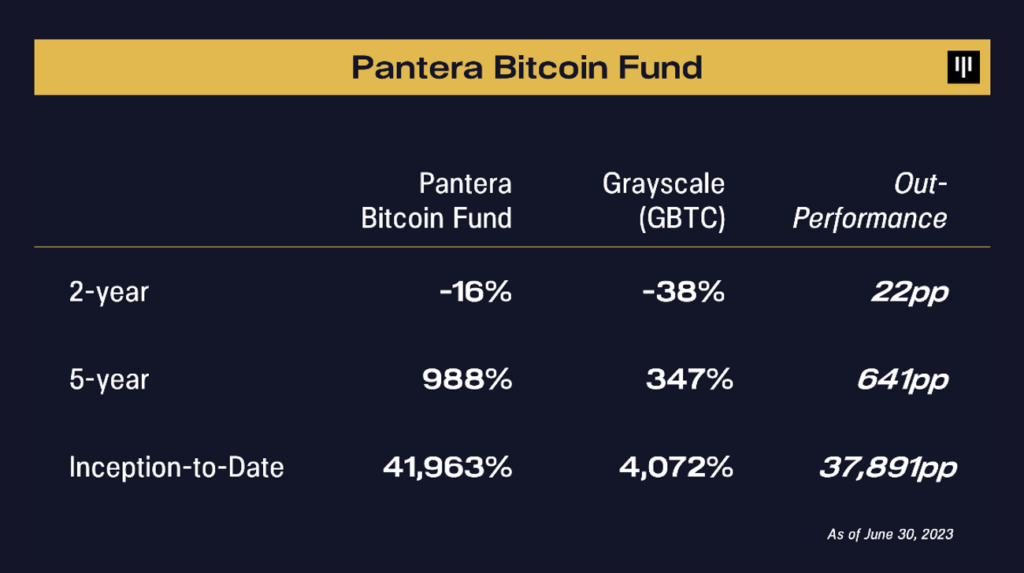

PANTERA BITCOIN FUND 10TH ANNIVERSARY

Ten years ago this week Pantera launched the first cryptocurrency fund in the United States.

The fund is up 41,960%.[2]

There are now over 800 cryptocurrency/blockchain investment funds according to Crypto Fund Research.[3] Most are structured as venture capital funds, followed by hedge funds and hybrid funds. According to Pitchbook’s Q1 2023 report, over $72 billion has been invested into crypto projects since 2012 by venture capital firms.[4]

Fun to see what the next decade brings.

“WHAT’S THE DIFFERENCE? IT’S JUST A BITCOIN FUND”

I **know** it sounds counter-intuitive that it really matters which bitcoin fund you pick, but it does.

Pantera Bitcoin Fund Advantages

Pantera Bitcoin Fund provides institutions and high-net-worth individuals quick, secure access to large quantities of bitcoin — without the burdens of buying and safekeeping them. The Fund features daily liquidity and very low fees (0.75% management fee and no performance fee).

Pantera Bitcoin Fund offers many advantages over other products in the space. We believe that it is the only bitcoin investment vehicle offering daily liquidity, no lockup, no premium to NAV, low fees, audited financials, and management by an SEC-registered investment advisor.

The fund is great for endowments, foundations, and other entities that can’t or don’t want to directly hold tokens.

The minimum investment is $100,000. For additional information on investing in Pantera Bitcoin Fund, click the button below. Or, you can email our Investor Relations team at ir@panteracapital.com.

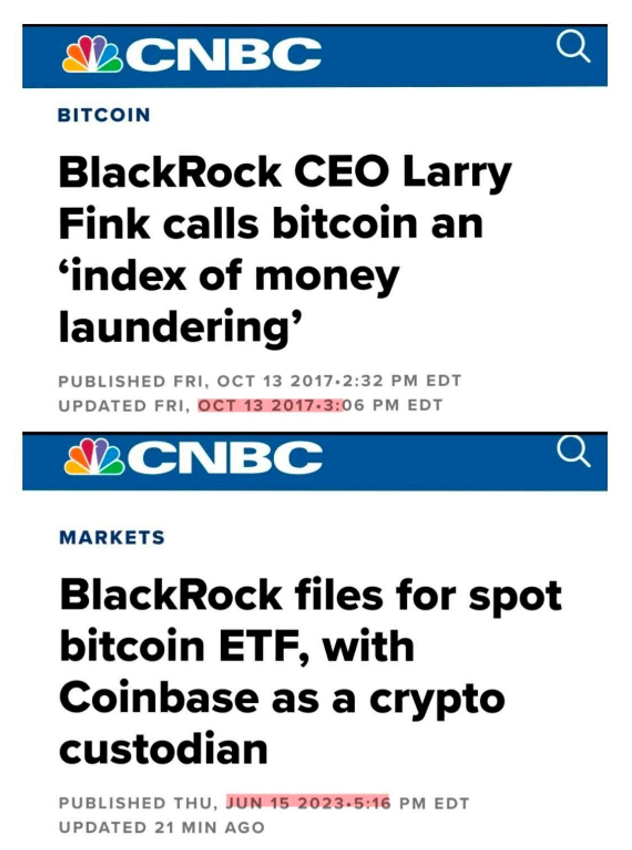

BLACKROCK BITCOIN ETF

There is something that might be even better than Pantera Bitcoin Fund for some investor types: a BlackRock ETF.

If approved, we anticipate a significant impact to crypto similar to the launch of BlackRock’s iShares Gold ETF in January 2005, which coincided when gold was trading at $423 per ounce. Today, the price of gold stands around $1,950 per ounce. Many economic factors have influenced the price of gold, but the launch of an ETF certainly played an influential role in its rise.

Above all else, BlackRock is the firm to do it given their remarkable success rate with its ETF applications to the SEC, with 575 approved and only one rejected.

One must take note of BlackRock CEO Larry Fink’s “180” on crypto.

Six years ago, his stance was:

“Bitcoin just shows you how much demand for money laundering there is in the world….

That’s all it is.”

– Larry Fink, October 13, 2017

Fink recently said in an interview with Fox Business:

“If we can create more tokenization of assets and securities — and that’s what Bitcoin is — it could revolutionize finance.”

– Larry Fink, July 5, 2023

Reaffirms my faith that when smart people actually take the time to read and think about blockchain – not just a reactionary sound bite – 95% of them end up believing it’s going to be massively important.

One new adherent at a time.

![]()

10TH ANNIVERSARY BLOCKCHAIN SUMMIT

As with our first blockchain venture and cryptocurrency funds, Pantera Blockchain Summit celebrated its 10th Anniversary.

The Summit is curated by the Pantera investment team and focused on the most important topics in the blockchain industry. Our goal is to uncover valuable insights, foster great conversations, and empower the entire Pantera network to move our industry forward.

We are excited to share the remaining highlights of sessions at the Summit!

|

Fireside Chat with Emilie Choi Coinbase President Emilie Choi discusses her outlook on the digital asset industry, including Coinbase’s role in the ecosystem and the challenges that lie ahead. |

|

|

The State of Web3 Development with Nikil Viswanathan, Founder & CEO of Alchemy Nikil shares his views on the state of Web3 development as one of the leaders in developer tooling. He also shares his journey growing his company to unicorn status, in addition to his experience being a partner with Pantera from the early innings. |

|

|

Institutional Investor Perspectives Members from various institutions share their perspectives on the cryptocurrency ecosystem and the role digital assets can play in an investor’s portfolio. |

|

![]()

All the best,

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[5]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Navigating Today’s Blockchain Investing Landscape

A discussion of the blockchain opportunity set and how Pantera’s funds are structured to capture value in the current and evolving market environment.

Tuesday, July 11, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Pantera Early-Stage Token Fund Investor Call

Tuesday, July 25, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Thematic Call :: Exploring MEV With Flashbots

A discussion on everything Maximal Extractable Value, commonly referred to as “MEV“, which is a controversial strategy used by miners/validators to extract value on-chain by reordering blocks, with Quintus of Flashbots and Matt Stephenson, Head of Cryptoeconomics at Pantera.

Tuesday, August 8, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PORTFOLIO COMPANY OPEN POSITIONS[6]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Our portfolio companies are actively hiring for the following roles:

-

Offchain Labs – Product Manager (Remote)

-

Alchemy – Engineering Manager (New York or San Francisco)

-

0x Labs – Platform Engineer (Remote)

-

Obol – Validator Relations (Remote)

-

Rarify – Head of Business Development (Remote)

-

Rift Finance – Protocol Engineer (Remote, New York)

-

Starkware – Business Development Manager (Netanya, Israel)

-

Circle – Sr. Software Engineer (Remote)

-

Cosmos – Full Stack Rust Engineer (Remote)

-

Worldwide Webb – Graphic Designer (London)

-

Waterfall – Software Engineer (New York)

-

Injective Protocol – Rust Developer (Remote)

-

Wintermute – Quant Developer (Hybrid, London)

-

Audius – Social Media & Marketing Strategist (Remote)

-

Protocol Labs – Sr. Software Engineer (Remote)

-

Bitso – Head of Compliance (Mexico)

-

InfiniGods – Experienced UI/UX Designer (Hybrid)

-

CoinDCX – Engineering Manager (Remote)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

[1] Important Disclosures – Certain Sections of this Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically marked sections of this this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial or other advice or recommendation.

[2] Pantera Bitcoin Fund estimated net performance as of June 30th, 2023

[3] https://cryptofundresearch.com/cryptocurrency-funds-overview-infographic/

[4] https://pitchbook.com/news/reports/q1-2023-crypto-report

[5] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[6] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.