ON BANKING, WITH FORMER SEC CHAIRMAN JAY CLAYTON[1]

I had a fun conversation on banking and blockchain with former SEC Chairman Jay Clayton at the Bloomberg Invest Conference on June 8th. Here are the important excerpts of our talk, moderated by Carol Massar of Bloomberg:

Carol Massar: “On lending and banks, regional banks, obviously the other crisis….”

Dan Morehead: “I think the crisis is a harbinger for the future. If you think about it, banks are a terribly-designed stablecoin.

“I’ll pitch you a stablecoin idea…”

Carol Massar: “Do you agree? Do you agree, Jay?”

Jay Clayton: “Banks serve an incredibly important function and they have been the source of liquidity transformation throughout the growth of our economy.”

Dan Morehead: “Let me pitch a stablecoin idea:

I invest $15 million in equity in my project.

Then I sell to the public $195 million stablecoins.

With those proceeds I buy $210 million in risky assets.

I promise the stablecoin holders incredible liquidity. With just one click on their smartphones, they can get their money back same-day – in unlimited amounts.

When asked:

‘Isn’t 13-to-one leverage kind of aggressive on a stablecoin?’

I’m honest – I tell everybody the truth: ‘If the risky assets go up, I’m keeping all the profits. But, if they fall in value, I’m going to stiff the taxpayer.’

“Unfortunately, that’s what a bank is.”

Jay Clayton: “Look, I’ll put my bank hat on. I think that’s about as stark as you could do it, because that’s why we have bank regulation. We actually need liquidity transformation in our society.”

BANKS, TERRIBLY-DESIGNED STABLECOINS

If I pitched that 13-to-1 leveraged stablecoin idea – where I get all the upside and others get all the downside – on Twitter, the backlash would probably break the internet.

But that’s exactly what a bank is. Recent massive failures in U.S. banks were just that. The only difference is putting the word “billions” in where I used “millions”.

Banks are terribly-designed stablecoins.

TRADITIONS

Carol Massar [to the audience]: “How many people buy Dan’s explanation of the banking system? How many are with Jay – more traditional?”

Jay Clayton: “Hey, I’m always traditional.

“Dan did wear a tie today.”

Dan Morehead: “I was born and raised on Wall Street.”

MEDICI

It’s not that banks weren’t once a good idea. They were.

In the 15th century, the Medici used the power of a newly-invented technology called double-entry accounting to build a global banking empire. They pioneered what we now call distributed ledger technology (DLT). They literally distributed physical ledgers to their various nodes (offices in Florence, Milan, London, Geneva, Bruges, etc.).

And the world paid these banks vast profits to maintain the ownership books of their letters of credit (now called tokens).

Banks still take a huge amount of value out of society. They account for the third largest sector market capitalization of the S&P 500 behind Information Technology and Healthcare.

The Bitcoin ledger is the next evolution in distributed ledgers.

U.S. GOVERNMENT IS BOTH SIDES

Let’s get to Chairman Clayton’s important comment: “We actually need liquidity transformation in our society.” We do, or at least did before blockchain – but do banks actually do private sector liquidity transformation anymore?

Dan Morehead: “The stark reality of some of these regional bank failures is that the US government is on both sides of their balance sheet. It’s half of their assets and all of their deposits.

“Why is a bank getting paid to intermediate between two parts of the US government?”

The sad thing in the bank blowups is that the US Government is both the lender and the borrower (not to mention the regulator, as well). In SVB’s case, the U.S. government was 43% of the lending side and ultimately 100% of the borrowing side (all of SVB’s deposits were bailed out by the government).

What a weird system where the Fed gives “forward guidance” to banks – telling them that the entity that controls rates doesn’t plan to raise them. That encourages banks like SVB to use 43% of their assets as loans to the U.S. government.

Bank shareholders and management got all the upside. Now we, the taxpayers, get all the downside.

Banks are terribly-designed stablecoins.

SAME STORY :: S&L CRISIS

Unfortunately this is the same old story.

During the week that SVB was going under, a young analyst on our team did a ton of work on the situation. He came back so proud of his analysis:

Apparently what had happened was that banks bought a bunch of long-term, fixed-rate bonds when yields were very low. This was fine when the Fed was providing unlimited money for free. But the Fed found themselves way behind the inflation curve and began normalizing the funding rate. As the funding rate rose above the interest the banks were earning on the bonds, they became insolvent.

The analyst was crestfallen when his Nobel dreams were shattered. I told him, unfortunately we’ve seen this movie before – it’s called the S&L Crisis.

Since November 2021 we’ve been making the point that economic policies have created the 70’s all over again. It would have been helpful if banking regulators read the Wikipedia entry on the S&L Crisis – pretty much sums up what just happened:

“Starting in October 1979, the Federal Reserve of the United States raised the discount rate that it charged its member banks from 9.5 percent to 12 percent in an effort to reduce inflation. At that time, S&Ls had issued long-term loans at fixed interest rates that were lower than the newly mandated interest rate at which they could borrow. When interest rates at which they could borrow increased, the S&Ls could not attract adequate capital from deposits and savings accounts of members for instance. Attempts to attract more deposits by offering higher interest rates led to liabilities that could not be covered by the lower interest rates at which they had loaned money. The end result was that about one-third of S&Ls became insolvent.”

– Wikipedia[2]

SATOSHI

Bitcoin was created in response to the penultimate financial crisis. Satoshi Nakamoto was concerned that governments were forever bailing out wealthy bank clients with printed money over centuries. Satoshi created a form of money that could not be debased. People all around the world could save their earnings in bitcoin without fear of their savings being diluted by excessive money printing.

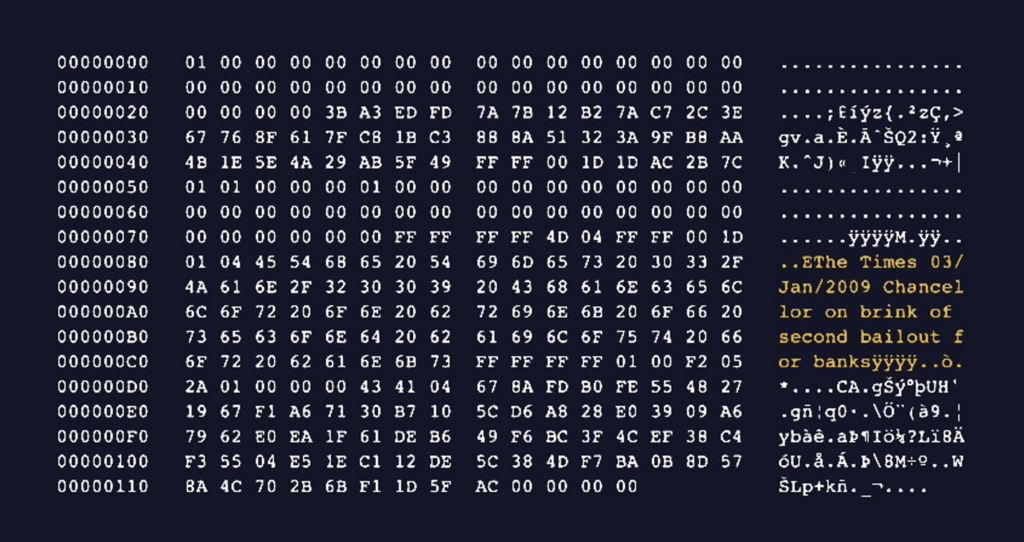

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Satoshi appended that bailout headline from The Times (of London) in the first block of Bitcoin – the so-called genesis block:

I really miss the quaint old days when somebody could get really pissed off about a £50 billion bailout. So mad indeed, that Satoshi started a 300-million-person movement in response.

The US prints that amount of money every four days now. The Fed printed $300 billion in funding just to bail out deposits at SVB and Signature Bank in March.[3]

SATOSHI’S THESIS

Bitcoin’s original thesis is reaffirmed by the recent crisis in banking. Bitcoin was born out of the 2008 financial crisis in response to the failures of our banking system.

This does prove the need for trustless systems — a theme that has guided us for a long time. That any time you have groups of humans involved — hubris, risk taking, or whatever ultimately happens and bad things often result. But decentralized systems work 24/7 and they can’t be compromised, they don’t take excessive leverage, they are transparent and honest, which is what it really comes down to.

Transparency is the key, and that’s been the problem with FTX, Celsius, BlockFi, and now SVB. Not enough people knew what risk they were taking. Whereas with blockchain, all the risks are clearly defined and everyone know what they’re getting into.

THE FUTURE

We have the answer – blockchain. Transparent, open blockchain ledgers are the future. The opaque, leveraged old-school ledgers that we call banks are the half-a-millennia-old past.

Each time this happens lots of handwringing and promises that we will never let this happen again. Banks can’t get too big to fail. Laws are passed.

Jay Clayton: “Technology has enabled an evolution in credit creation and we’re in the middle of it. Banks are going to be here 10, 15, 20, 50 years from now. They’re going to provide services, but the banking industry’s dominance of credit formation, that’s a thing of the past.”

Dan Morehead: “I definitely agree with Jay that…it’s going to take time. But, in the end, blockchain is the future, banks really are the past. The Medici used a very new thing called double entry bookkeeping to create banks. Now, we have distributed ledger technology. It’s the future. That’s where we’re heading.”

MR. MARKET SPEAKS

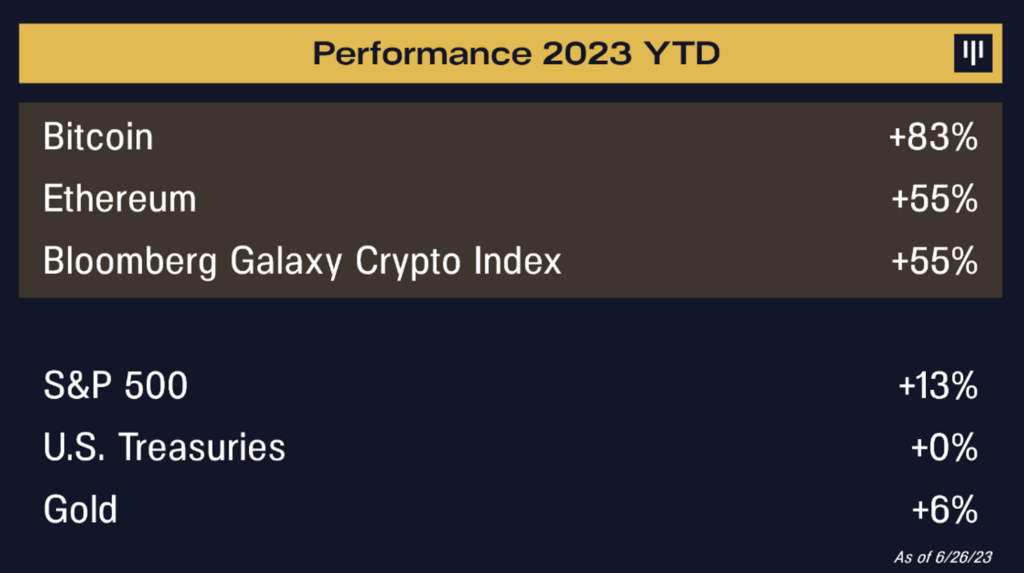

I’m not just some Bitcoin nut saying this. Mr. Market spoke:

Credit Suisse was sold for one-third of Dogecoin’s market capitalization.

For those of you who don’t know, Dogecoin is a slightly modified copy of Bitcoin. Dogecoin is currently the 6th most valuable cryptocurrency (excluding stablecoins).

Honestly, that’s just wild. As bullish as I am on blockchain, it’s happening very quickly. Credit Suisse was founded in 1856 to fund the development of Switzerland’s rail system. The market now values the future – blockchain’s version of the decentralized distributed ledger technology – over the past – the Medici’s version of expensive, over-leveraged, centralized “DLT”.

BLOCKCHAIN WORKED

Over the SVB crisis weekend, we checked in with all of our portfolio companies. Most were fine, but a few really did have an existential crisis because they had all of their cash at the bank and were trying to figure how to make payroll. Everybody is sitting there on a Sunday stressing, “The FDIC shut down our bank, wires aren’t open on Sunday, how can we make payroll?”

It’s called Bitcoin!

Bitcoin and other cryptocurrencies are the answer. Nobody can shut them down, close them, they operate 24/7. You don’t need Janet Yellen’s permission to make payroll.

It was a fantastic moment for blockchain. Blockchain is the answer.

USDC

Alongside Bitcoin and Ethereum, USDC is another great way of making payroll in crises like these and in the long run, normal course of business. USD Coin (USDC) is a digital stablecoin pegged to the United States dollar. USD Coin is managed by a consortium called Centre, which was founded by Circle and includes members from the cryptocurrency exchange Coinbase.

Over the weekend, free markets were open when banks were frozen. Circle’s stablecoin USDC traded down to 87 cents on the dollar because of concern that USDC used SVB for 8% of its deposits.

In our opinion, this was not that worrisome because, at worst, they could lose 10-20% of that. The beauty of USDC is that they are making 4.7% on the float, so it wouldn’t take very long to pay all that back. Centre and USDC did very well with this and it really does highlight that blockchain has huge advantages over centralized systems.

I also really love the irony of a blockchain project being hammered for having exposure to a fiat bank.

But, the market’s logic was backward as a fully-collateralized, transparent unleveraged stablecoin is much safer than a regional bank could have been.

USDC functioned 24/7. No centralized entity must give you permission to use it.

DEFI WORKED

As with all of the other crises in the last twelve months caused by centralized finance, all of DeFi (decentralized finance) showed its resilience.

On March 8, Silicon Valley Bank and Signature Bank were both, according to public disclosures, “well capitalized,” the optimal level of health by federal regulatory standards.

A lot of government hearings already on How Could We Have Known?!??

“The question we were all asking ourselves over that first week was, ‘How did this happen?’”

– Federal Reserve Chair Jerome Powell

Bank regulators could have seen this disaster looming with one question:

“How many Ginnie 2.5s do you own?”

This is what we got.

“The supervisory team was apparently very much engaged with the bank [and] repeatedly was escalating.”

– Federal Reserve Chair Jerome Powell

Not even really sure what “escalates” means, but what I do know is DeFi executes.

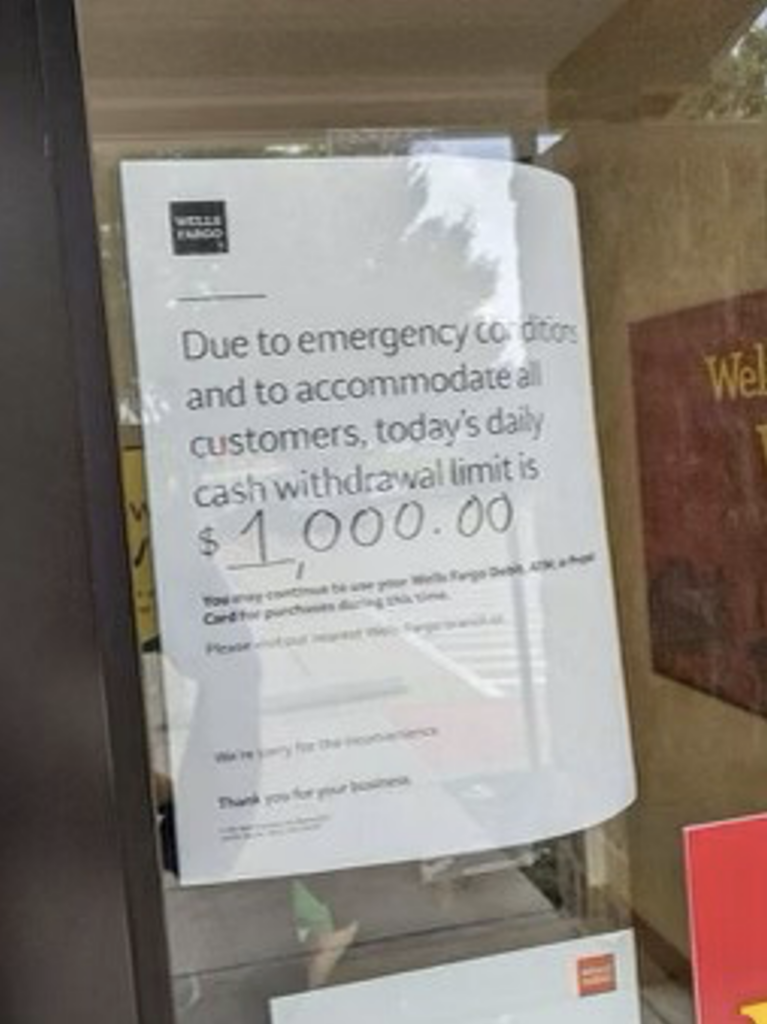

And, DeFi never does this to you:

![]()

BLOCKCHAIN (FINALLY) DECOUPLING

Carol Massar: “What was really interesting is that as regional bank stocks sold off, I saw crypto moving up. How are we supposed to think about. … I think initially we thought about the crypto world, Dan, as kind of a disconnect, a way to hedge stuff that’s going on in the rest of the market. Although, we have seen some correlation as well between regular assets or traditional assets selling off in crypto. We certainly saw that last year. How are you thinking about it?”

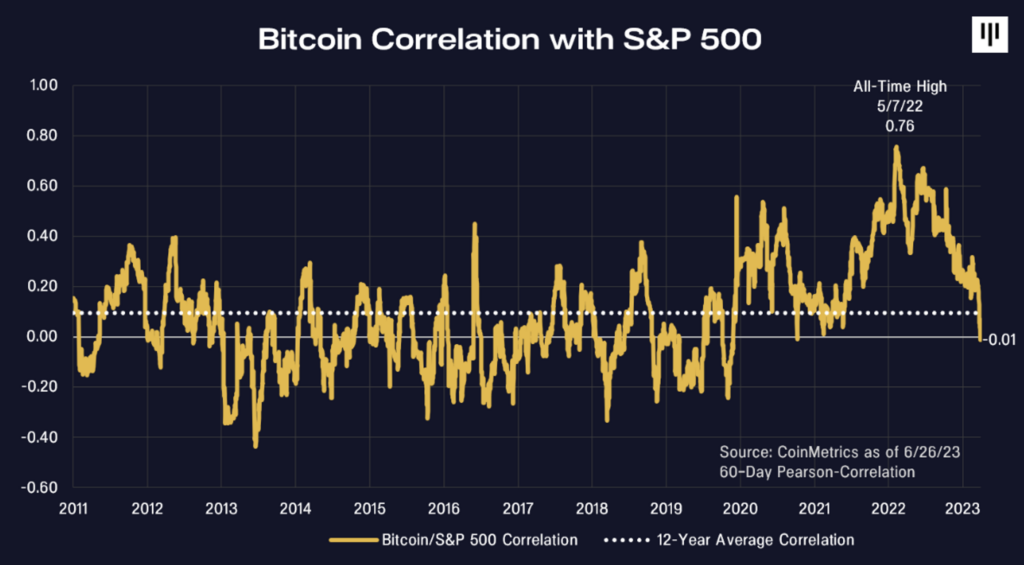

This is a hugely important development. For most of the history of blockchain assets they had essentially no correlation to risk assets. Using Bitcoin as a proxy for blockchain, the correlation with the S&P 500 over its first nine years of existence was 0.03.

Blockchain has been rallying through its first twelve years because it’s a massive, secular trend. There should be only short-term correlations to cyclical changes in interest-rate-sensitive asset classes like stocks and bonds.

That was a huge part of the argument: when you find a new asset class with incredibly high historical returns and essentially no correlation with typical assets – that’s the dream investment.

Unfortunately, all of the excessively-leveraged centralized entities and the alleged criminal Sam Bankman-Fried in our space, caused the correlation to spike up. In the middle of last year, correlation peaked at 0.76.

As blockchain is in no way connected to interest rates, it should have a very low correlation to the main asset classes (stocks, bonds, real estate), which are all tightly driven by rates.

Our thesis is playing out this year. In fact, over the past few days, the correlation has gone back to zero.

Many asset classes are directly linked to interest rates. However, there are some assets which have no direct connection to rates, such as gold and other commodities.

We believe that “digital gold” (blockchain) can decouple and trade independently like gold. In the first rising interest rate environment in forty-two years, there will be a desire to invest in things that don’t have to continue to go down as the Fed unwinds its twin mistakes. In our view, blockchain and other commodities are likely the only place to hide in a world with massively rising rates.

It’s beginning to happen.

![]()

IN EVERY COUNTRY’S NATIONAL INTEREST

Carol Massar: “Then how do you think of the role of crypto and blockchain? I know we kind of lump a lot of stuff together, but how do you think about it, Jay, going forward. It’s not going away. The US is not going to not have a role in it.

Jay Clayton: “What do we know? We know that blockchain is unlikely to be going away. We do need to update our technology stack in the financial system. No one disagrees with that. It’s not going away. What’s also not going away is rigorous regulation of retail investment products. That’s not going away. Those two things have to be reconciled. That’s where we stand today.

“They’re being reconciled in the courts, being reconciled in other places, but I think the blunt approach that blockchain/crypto is somehow bad is wrong.”

Carol Massar: “Some of the reporting that we’ve done, in the last week or so, or just this week, is this thinking that as the SEC is widening its pursuit of crypto pretty aggressively that the US is ultimately turning its back and won’t have a role globally. Do you see it that way? Dan, do you see it that way?

Dan Morehead: “I think it is a risk because if you think about the internet, the U.S. government literally built the internet, ARPANET. All of the major internet companies are based in the United States or a Chinese version of them. I think, as an American citizen, that’s great, that it accrues to our country.

“Blockchain really is the polar opposite. Regulation, or more specifically, lack of regulatory clarity, in the US has been scary enough that 18 out of the top 20 protocols are outside the United States. At a time last year, 95% of all trading of crypto assets was offshore of the United States.…It’s better to have [trading] happen in the United States. I’d love to see that flip where we prioritize bringing blockchain onshore.”

Jay Clayton: “We have a few data points recently that support what Dan is saying. Other governments are supporting blockchain based issuances of sovereign debt. We all know that at the core of every financial system is the sovereign debt. If you’re going to modernize, you’re going to modernize your technology stack, starting with sovereign debt, repo, that type of thing is a very effective way to do it. It’s interesting that we’re turning away from that when other countries are now turning toward it.”

![]()

10TH ANNIVERSARY BLOCKCHAIN SUMMIT

In April, we hosted our 10th Anniversary Summit in San Francisco.

The Summit is curated by the Pantera investment team and focused on the most important topics in the blockchain industry. Our goal is to uncover valuable insights, foster great conversations, and empower the entire Pantera network to move our industry forward.

We are excited to share video recordings of some of the sessions.

|

Fireside Chat with Caroline D. Pham CFTC Commissioner Caroline Pham discusses the present landscape of crypto-asset regulation and shares insights on its potential trajectory in years to come with Katrina Paglia, General Counsel and CCO at Pantera. |

|

|

Founders and CEOs of leading international crypto enterprises share their unique perspectives on the global adoption of crypto and its transformative potential for the world economy. |

|

|

Members from various Web3 initiatives share their perspectives on the cryptocurrency ecosystem in 2033, outlining the roles their organizations play in shaping that future. |

|

![]()

MORE BLACK SWANS?!?!?

Closing out the Bloomberg Invest panel, the moderator asked me what black swans we should expect. I wanted to share my response:

Carol Massar: “We’ve lived in a year, or a couple of years, where I think there are things that just keep happening that we thought never would happen. Pandemic…complete shutdown…financial crisis. Dan, let me ask you, what’s the black swan event that you think, when we talk about stress points, that we should keep on our radar?”

Dan Morehead: “Yeah, I used to sit next to [your previous speaker] Nassim Taleb on a Wall Street trading desk a long time ago.

“Everybody ignores black swans until one happens. Then all everybody wants to talk about is ‘the next shoe to drop’. I would say the biggest surprise is that we already had all these massive shoes drop last year – and it’ll be nothing crazy happening.

“But if you make me say something, I would say regulatory clarity is the one thing nobody’s expecting. There are a few ways that could happen.”

Carol Massar: “That could be the black swan?”

Dan Morehead: “That could be the positive black swan that we’re all concerned about. The next ‘shoe to drop’ could be a nice thing.”

Carol Massar: “Nice flip on that. How about Jay?”

Jay Clayton: “No, I’m going to agree with Dan that we have these positive and negative inflection points.”

Let’s hope.

![]()

Good luck out there,

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[4]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Navigating Today’s Blockchain Investing Landscape

A discussion of the blockchain opportunity set and how Pantera’s funds are structured to capture value in the current and evolving market environment.

Tuesday, July 11, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Pantera Early-Stage Token Fund Investor Call

Tuesday, July 25, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Thematic Call :: Exploring MEV With Flashbots

A discussion on everything Maximal Extractable Value, commonly referred to as “MEV“, which is a controversial strategy used by miners/validators to extract value on-chain by reordering blocks, with Quintus of Flashbots and Matt Stephenson, Head of Cryptoeconomics at Pantera.

Tuesday, August 8, 2023 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PORTFOLIO COMPANY OPEN POSITIONS[5]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Our portfolio companies are actively hiring for the following roles:

-

Offchain Labs – Product Manager (Remote)

-

Alchemy – Engineering Manager (New York or San Francisco)

-

0x Labs – Platform Engineer (Remote)

-

Obol – Validator Relations (Remote)

-

Rarify – Head of Business Development (Remote)

-

Rift Finance – Protocol Engineer (Remote, New York)

-

Starkware – Business Development Manager (Netanya, Israel)

-

Circle – Sr. Software Engineer (Remote)

-

Cosmos – Full Stack Rust Engineer (Remote)

-

Worldwide Webb – Graphic Designer (London)

-

Waterfall – Software Engineer (New York)

-

Injective Protocol – Rust Developer (Remote)

-

Wintermute – Quant Developer (Hybrid, London)

-

Audius – Social Media & Marketing Strategist (Remote)

-

Protocol Labs – Sr. Software Engineer (Remote)

-

Bitso – Head of Compliance (Mexico)

-

InfiniGods – Experienced UI/UX Designer (Hybrid)

-

CoinDCX – Engineering Manager (Remote)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

[1] Important Disclosures – Certain Sections of this Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically marked sections of this this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial or other advice or recommendation.

[2] https://en.wikipedia.org/wiki/Savings_and_loan_crisis

[3] https://www.pbs.org/newshour/economy/federal-reserve-lent-300-billion-in-emergency-funds-to-banks-in-the-past-week

[4] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[5] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.