1,000x :: PANTERA BITCOIN FUND[1]

Pantera Bitcoin Fund recently achieved an insane milestone – 1,000x.

The post-election surge has taken the fund a further 30% higher. The Fund’s lifetime return is now 131,165% – net of fees and expenses.

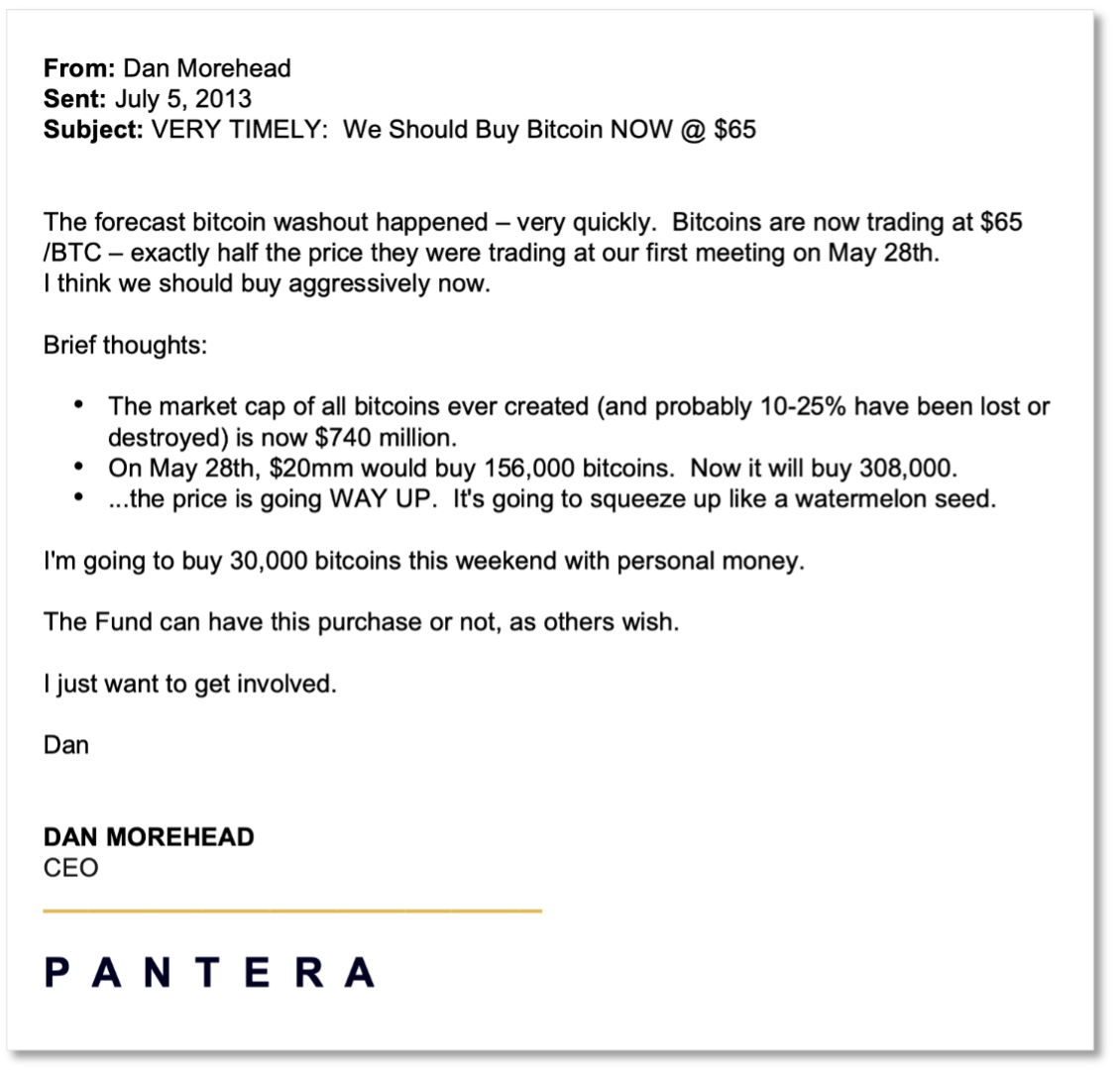

I wanted to share the original logic – as it is equally compelling to me today.

The day we chose to launch Pantera Bitcoin Fund was literally the low print of the last eleven years.

That first investment memo still reads well.

In 2013-15 we bought 2% of the world’s bitcoins.

Even after eleven years, bitcoin is **still** squeezing up like a watermelon seed.

Honestly, I just can’t help thinking that we still have many more years of very compelling returns.

GOLD IN 1000 BC

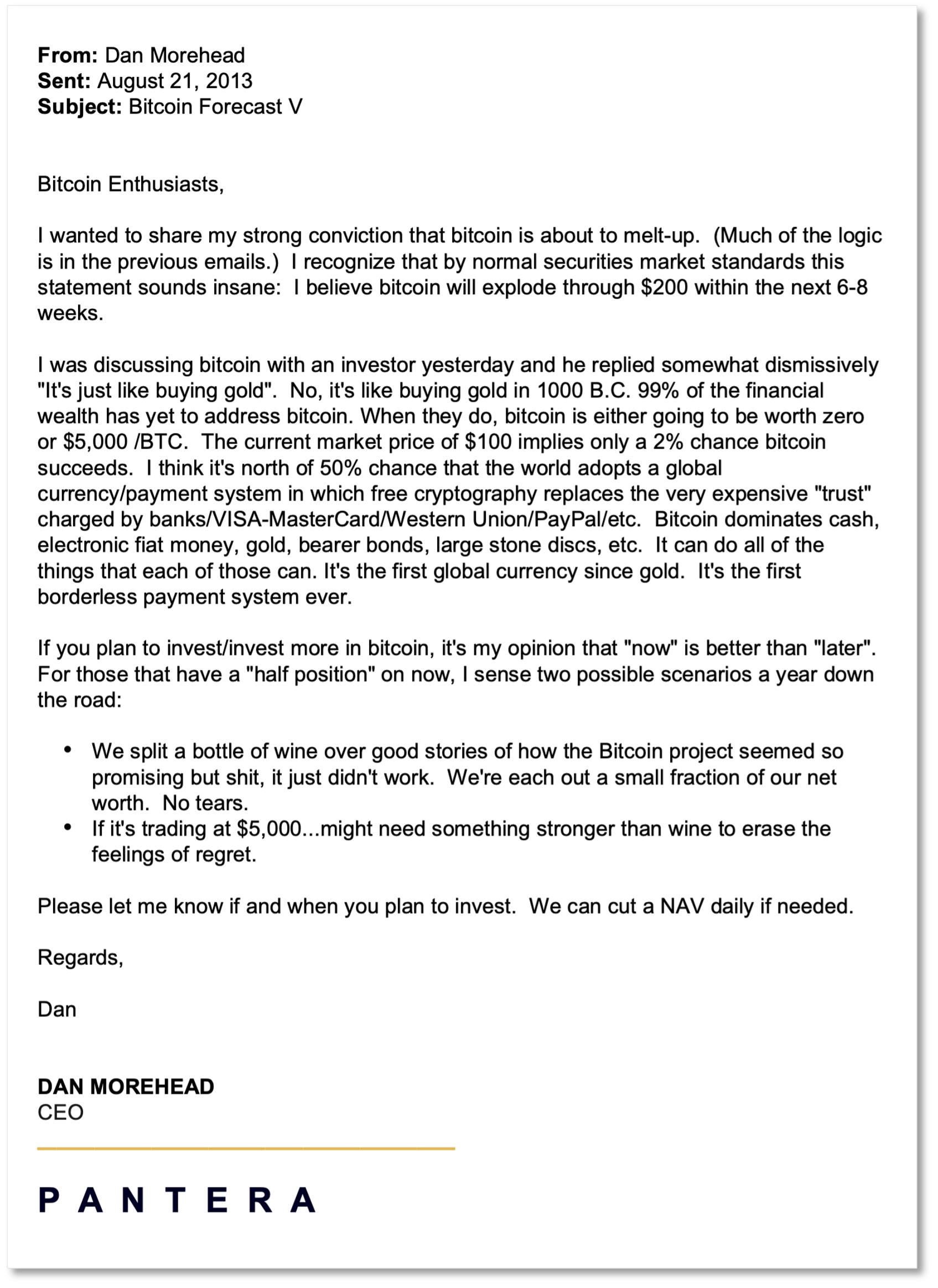

The core of my view was written a month later:

“I was discussing bitcoin with an investor yesterday and he replied somewhat dismissively ‘It’s just like buying gold’. No, it’s like buying gold in 1000 B.C. 99% of the financial wealth has yet to address bitcoin. When they do, bitcoin is either going to be worth zero or [up orders of magnitude].”

As an industry, we’ve made some progress. Now it’s something like “only” 95% of financial wealth has yet to put their full-sized position on.

The catalyst for the change – from 5% in 2024 to a much higher number – just happened: regulatory clarity in the United States. Massive institutional managers like BlackRock, Fidelity, and others are now offering incredibly cheap, efficient access to anyone with a brokerage account. This new ease of access will finally allow tens of millions of investors and individuals to get exposure to this important new asset class.

We believe the broader industry will benefit greatly from the first pro-blockchain U.S. president in office. In our view, blockchain’s success is in the best interest of the nation and we believe everyone in Congress will eventually adopt a neutral or pro-blockchain stance – it’s beginning to happen. Blockchain’s 15-year regulatory headwinds are now turning into tailwinds.

I still passionately believe what I wrote eleven years ago:

“I think it’s north of 50% chance that the world adopts a global currency/payment system in which free cryptography replaces the very expensive ‘trust’ charged by banks/VISA-MasterCard/Western Union/PayPal/etc. Bitcoin dominates cash, electronic fiat money, gold, bearer bonds, large stone discs, etc. It can do all of the things that each of those can. It’s the first global currency since gold. It’s the first borderless payment system ever.”

[With bitcoin at $104]

That’s still exactly how I feel. We’re still early. 95% of financial wealth has not addressed blockchain. They are just beginning this massive transformation now. When they do, bitcoin might be at something like $740,000 /BTC.

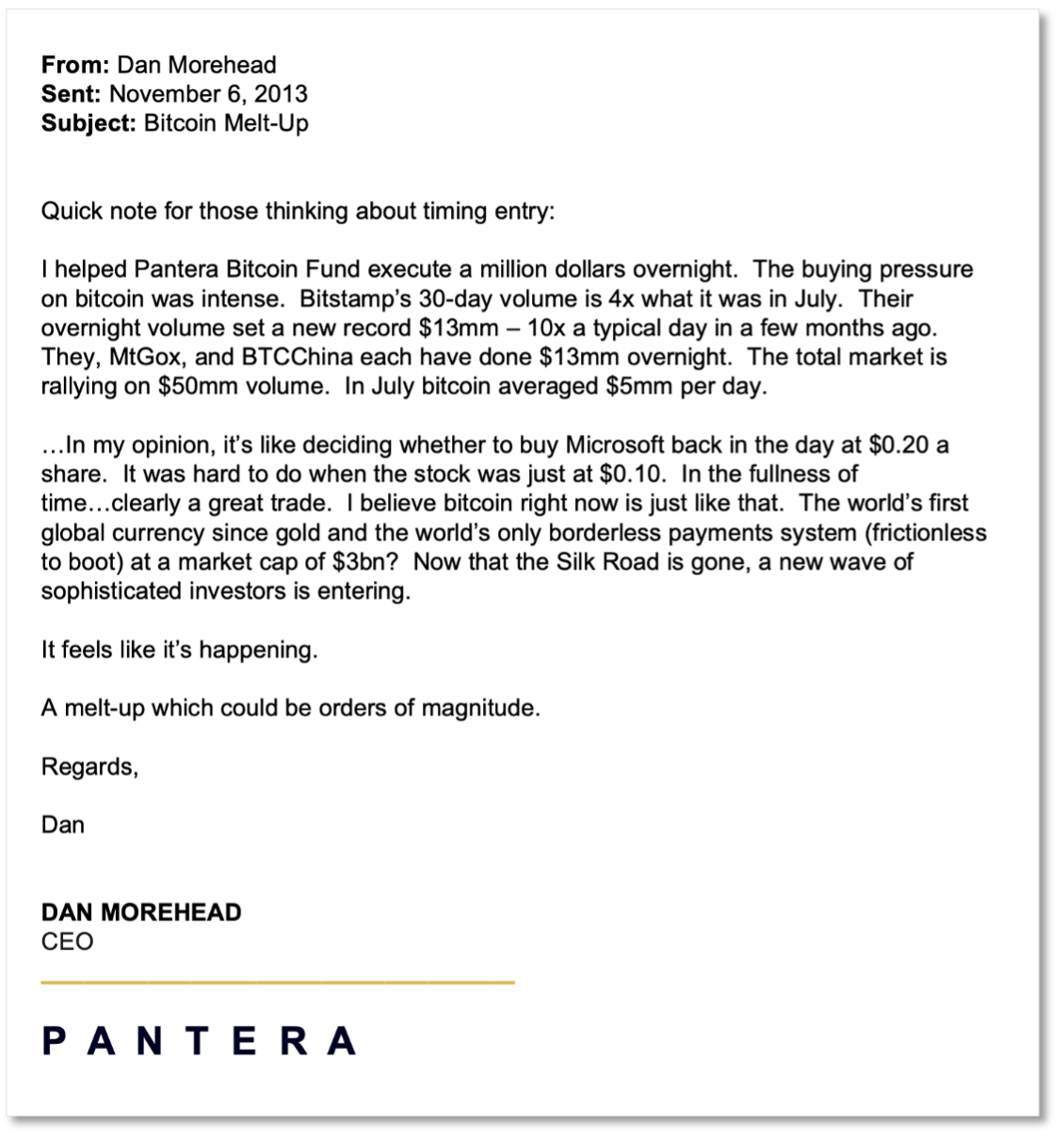

[With bitcoin at $254]

The market did melt-up. It was at $1,000 in less than a month – and now three orders of magnitude higher.

![]()

11-YEAR CAGR OF 88%

I can imagine an investor thinking: “Bitcoin has doubled this year. Well, I guess I missed it.” and giving up.

No, that’s the wrong mindset. On average, it almost doubles **every** year. The compound growth rate since we launched the fund eleven years ago is 88%.

ORDERS OF MAGNITUDE

It’s already done three orders of magnitude. Another one seems plausible. If and when bitcoin gets to $740,000 /BTC, that’s a market cap of $15 trillion. Not an inconceivable number, relative to $500 trillion[2] in financial assets.

While the past does not necessarily predict the future, if the trend were to continue, bitcoin would hit $740,000 in April 2028.

I think it will take a few years longer, but I do think there’s a decent chance of doing so.

That’s been my mentality: I wouldn’t bet my life on it, I’m not 100.00% sure blockchain assets will go up, but when you multiply the chance it goes up times the order of magnitude or more the industry is potentially going to go up – the result ends up being way better than other assets one could invest in. The expected value of the trade is the most compelling I have seen in almost forty years of doing this.

![]()

WASN’T EASY

It now may seem obvious, but it was hard.

After the -87% crash beginning December 2013, bitcoin faded from relevance. The market was still down three-plus years later. By 2016 almost everybody had given up on bitcoin. Investors had no interest.

I flew all around the world and did 170 investor meetings that year. The sum result of all that effort – we could only raise $1mm.

The management fees on that were $17,241. A hundred bucks a meeting.

![]()

WE COULDA BOUGHT THE HOTEL!!!

By nature I’m such a loyal team player. I’ve always wanted Team Bitcoin to win. Over the years we’ve tried to help the community in every way we can. So, when Expedia announced they would take bitcoin in 2014 we did all our travel expenditure on Expedia with bitcoin.

In 2015 our team did 59 nights on the road – spending an average of 1.5 BTC on each night – 88 bitcoins in total.

That’s $8,683,136 in today’s paper money!?!?!

We coulda bought two hotels!

![]()

AMAZING BLOCKCHAIN INDUSTRY GROWTH

When we prepared to launch Pantera Bitcoin Fund in 2013, I set up accounts at a couple of exchanges and wired money to be ready. When I first walked into Wells Fargo down Market Street in San Francisco from our office to wire money to Ljubljana, Slovenia, I didn’t even know how to spell Ljubljana. It all felt super-sketchy. So much so that the bank manager came over and interrogated me for a long time on what I was doing.

(I now know that Slovenia is a lovely country just to the right of Venice and below Austria.)

But, at the time I wondered if I was crazy. The other wire I did was to an unknown little startup that sounded equally sketchy.

The price of Bitcoin was at $130 or so. Over the next days I watched as the bitcoin price fell from $130 through $100. It’s funny to think back, it’s still essentially the same Fear, Uncertainty, Doubt that skeptics say when we’re in a bitcoin bear market today. Even with all the issues when it hit $65, I decided to go ALL IN – to launch Pantera Bitcoin Fund. Thirty years of trading intuition led me to believe that was the day.

I sent the email above out to a tiny list of bitcoin enthusiasts, which was maybe twenty people at the time saying, “I just want to get involved.”

(That list is now hundreds of thousands and the subsequent letters have been read 2.7 million times.)

I went onto this startup called Coinbase and I tried to buy 30,000 bitcoins. A popup said that the Fund’s daily limit was 50 bucks – and, not like in Wall Street lingo where “bucks” sometimes means millions. Like one Ulysses S. Grant per day. I almost had a heart attack.

Since it was a trendy start-up they had no address or phone number. In a panic I sent an email – titled uncharacteristically in ALL CAPS – to their support email address “I WANT TO BUY TWO MILLION DOLLARS OF BITCOIN”. Four days later their only employee – a guy named Olaf – wrote back, “Okay, your limit’s now $300.” Even at my newly-expanded trading limit it would take 6,667 days to transact that amount.

I’d still have 2,522 days to go!

Thankfully I was able to buy the bitcoins on Bitstamp and the industry grew. Today, the cryptocurrency markets trade $130 billion a day. Simply amazing how far the industry has come.

![]()

BLOCKCHAIN AS AN ASSET CLASS

I sometimes feel like a gorilla in the forest who notices a shiny object on the ground…picks it up…rotates it…wondering what it is…

Bitcoin!

I certainly don’t understand all the nuances of the incredible technology projects happening in the space, but I feel like I’ve seen this movie before.

I was the first asset-backed securities trader at Goldman Sachs. Now everyone recognizes ABS as an asset class. I was there when they did the GSCI. Now everyone thinks of Commodities as an asset class. In the 90’s I was investing in emerging markets. Now everyone thinks of EM as an asset class.

Blockchain will be just like that. I believe that in the not-too-distant future every investment firm will have a blockchain team and a sizable, permanent blockchain allocation.

![]()

ASYMMETRIC TRADE

My global macro background is what got me into blockchain in the first place. The asymmetry of this trade – working on the largest markets in the world – make this opportunity orders of magnitude larger than the trades we’ve typically chased around the world. I believed it’s the most asymmetric trade I’d ever seen.

This theme is best illustrated by a comparison from the second Pantera Blockchain Summit, March 2014:

“At the dinner a few hours before the late-night poker game, Morehead had joked about the fact that, at the time, all the bitcoins in the world were worth about the same amount as the company Urban Outfitters, the purveyor of ripped jeans and dorm room decorations – around $5 billion. ‘That’s pretty wild, right?’ Morehead said.

“ ‘I think when they dig up our society, all Planet of Apes-style, in a couple of centuries, Bitcoin is probably going to have had a greater impact on the world than Urban Outfitters.’ ”

– Nathaniel Popper, 2015, Digital Gold

When I updated that in November 2020, Bitcoin’s market cap was the same as L’Oréal. Waterproof mascara is undoubtedly an amazing invention, but I still thought there was an asymmetry.

Digging further…

“At L’Oréal, our mission is to democratize…the best of accessible and quality beauty in skincare, makeup, hair care, and hair color.”

Awesome. Bitcoin’s mission is surprisingly similar-sounding: to democratize financial access.

I thought the financial one would end up bigger.

Bitcoin has recently overtaken Meta (f.k.a. Facebook). Photo sharing is really cool and all, but I think that financial inclusion for everybody on Earth with a smartphone is gonna be bigger.

Five left to cross off….

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[3]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Post-Election Crypto Market Update

A discussion of the post-election crypto market environment and expectations for the industry as the first pro-crypto President takes office.

Wednesday, December 4, 2024 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

The Year Ahead

A discussion of Pantera’s outlook for crypto in the year 2025, including commentary on the markets and themes to look out for.

Thursday, January 16, 2025 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Pantera Fund V Call

An overview of Pantera’s fifth venture-style fund that offers exposure to the full spectrum of blockchain assets.

Tuesday, February 4, 2025 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

[1] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically-marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

[2]https://www.mckinsey.com/industries/financial-services/our-insights/the-rise-and-rise-of-the-global-balance-sheet-how-productively-are-we-using-our-wealth

[3] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.

This document has been prepared by Pantera Capital Management Puerto Rico LP and its affiliates (“Pantera”) in order to present certain information to the recipients, including prospective and existing investors in Pantera Bitcoin Fund LP (the “Fund”). This document is presented for informational purposes only and contains unaudited figures that are subject to update. Nothing contained herein constitutes an offer to sell or a solicitation to buy any securities, including, but not limited to, the securities of the Fund or any other vehicle managed by Pantera. This document does not contain a representation or warranty as to the future performance of the Fund, or any instrument, and it cannot be relied upon in making any investment decision, including any decision to invest in the Fund.

All information contained herein should be read in conjunction with, and is qualified in its entirety by, the Fund’s Confidential Private Placement Memorandum, which should be carefully reviewed prior to making an investment decision. Pantera is under no obligation to update the information contained herein, or to notify the recipient that any items included here have been updated or have been identified as inaccurate subsequent to the date that this document was distributed. Pantera is not acting as an adviser or in a fiduciary capacity vis-à-vis any investor in the Fund, and investors are encouraged to consult their own advisors.

Performance Information. Fund performance contained herein is calculated for a model Limited Partner that has been invested in the Fund since the beginning of the period without making subscriptions or redemptions, and is eligible to participate in new issues (including initial coin offerings). Performance is calculated to include the reinvestment of dividends, capital gains and other earnings. Unless otherwise indicated, all performance is net of fees and expenses. Net returns reflect the deduction of a management of 0.75% per annum and incentive allocations of 0% per annum, as well as applicable expenses. All returns are estimates that are subject to revision until completion of the annual audit. The actual results achieved by an investor may vary materially from these figures due to a number of factors including, but not limited to, eligibility to participate in certain investments, the timing of capital contributions, applicable fee structures, and withdrawals. Past performance is not necessarily indicative of or a guarantee of future results.

Certain information contained herein constitutes “forward-looking statements,” and due to various risks and uncertainties, actual events or results or the actual policies, procedures and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated herein, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as the Investment Manager’s representation that the Funds will achieve any strategy, objectives or other plans.

Any financial indicators or market benchmarks shown are for illustrative and/or comparative purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities or instruments) that are different from the Funds. The Bloomberg Galaxy Crypto Index, which is a capped market capitalization-weighted index designed to measure the performance of the largest digital assets traded in USD, (the “Index”) is referenced herein. The Index is presented because Pantera feels that it serves as a useful point of comparison with aspects of the Funds’ portfolio management and composition. The Funds will not replicate any Index and no guarantee is given that performance will match any Index; it is not possible to invest in any index. There are significant differences between the Funds’ investments and the Index. For instance, the Pantera Funds may invest in securities that have a greater degree of risk and volatility, as well as less liquidity, than those securities contained in an Index. Moreover, each Index is not subject to any of the management fees or expenses that the Funds must pay. It should not be assumed that the Funds will invest in any specific securities that comprise the Index, nor should it be understood to mean that there is a correlation between the Funds’ returns and the performance of the Index.