PROGRESSIVE’S DREAM

If you asked a Progressive think tank to design a new product for financial inclusion they would ask for these features:

Anyone on Earth can use it

Cellphone-based

Borderless

Permissionless

Instantaneous

Migrants don’t have to pay a month’s wages for remittance any longer

No bank/SWIFT money transfer fees

Payments at a small fraction of Visa-Mastercard fees

No cost to store your money or your savings

Yields available

Use of your funds 24x7x365

No more bank bailouts

Central banks can’t devalue it

No inflation (actually appreciating 90% a year for eleven years)

Totalitarians can’t repress it, steal it

Discrimination eliminated by the use of an alphanumeric identifier

Women can use it in repressive gender-based nations (2.3 billion women don’t have access to a bank account)

Women anywhere can save their wages without the men in their lives drinking it away

Banking the unbanked – including teenagers who are also unbanked

Complete democratization of the world’s financial products

Access even to the remotest corners of the world

4 billion people joining the financial system

All this given to the world for free – opensource, no patents

The wonderful news is you don’t have to pay a think tank, Satoshi already got it done.

That **is** bitcoin.

It’s all Alice In Wonderland – “up is down, down is up” – that the Democrats got this completely upside-down.

“I don’t really see why it’s partisan. Being against bitcoin is like being against cell phones.”

— Congressman Ro Khanna (D-CA)

While I agree with his line that bitcoin should be as non-partisan as other technologies like the cellphone, if either party should have seized it it’s the Dems! Bitcoin is the Progressive’s dream product.

“I am not usually holding hands with the CEOs of multibillion-dollar banks. But this is a matter of national security.”

— Senator Elizabeth Warren (D-MA), replying to Jamie Dimon’s comments,

Congressional Hearing, December 6, 2023

What rabbit hole did I fall down to see Senator Warren holding hands with Jamie Dimon, the Progressive’s antichrist? It boggles the mind that a Progressive can’t see the sublime beauty of bitcoin.

Senator Warren is right – it is an issue of national security.

The U.S. government built the internet (ARPANET). The U.S. government then empowered early internet companies with a myriad of Congressional advantages. In particular, the U.S. gave them safe harbor against regulation and provided an 8.25% discount versus their brick-and-mortar competitors via no sales tax. The result is that all the largest internet companies in the free world are in the United States.

The U.S.’s regulatory enforcement-only approach in the blockchain era has had the polar opposite effect. It scared 95% of blockchain trading to move offshore to places like the Bahamas and opaque firms like FTX instead of being in the United States. Similarly, 93% of the market cap of blockchain protocols are domiciled outside our country.

The majority of Americans are under 40. They love blockchain.

They vote.

It’s great to see the Democrats getting in front of this reality last week.

VICE PRESIDENT HARRIS ENDORSES BLOCKCHAIN

The Vice President made a very important policy leap.

“Think of Alexander Hamilton having the foresight to build the manufacturing capabilities of our new nation. Think of Lincoln and the transcontinental railroad. Think of Eisenhower and the Interstate Highway System; Kennedy committing America to win the space race and spurring innovation across our society.

“From our earliest days, America’s economic strength has been tied to our industrial strength, and the same is true today.

“So, I will recommit the nation to global leadership in the sectors that will define the next century.

“We will invest in biomanufacturing and aerospace; remain dominant in AI and quantum computing, blockchain, and other emerging technologies; [and] expand our lead in clean energy innovation and manufacturing so the next generation of breakthroughs from advanced batteries to geothermal to advanced nuclear are not just invented but built here in America by American workers.”

— Vice President Harris, The Pittsburgh Economic Club, September 25, 2024

A good start.

“A journey of a thousand miles begins with a single step.”

— Lao Tzu, ancient Chinese philosopher

In policy, that first step is just so hard. Once you’ve done it, it’s easy to continue along that path.

Now I’m confident that whichever candidate wins, the United States will have rational policy on blockchain.

FORMER PRESIDENT USES BITCOIN

I got invited by the former President to go to a bitcoin dive bar on the Lower East Side – called Pubkey – so he could be the first head of state in US history to use bitcoin – buying a round of cheeseburgers.

The political pivot on blockchain is massive.

![]()

SOLANA BREAKPOINT DEBATE RECAPS

We’ve summarized the debate below. The full video can be viewed here.

Opening Statements: General Views on DePIN

Matt Stephenson’s Position (Optimistic Skeptic) Matt opens by expressing that he is overall optimistic about the value well-designed DePIN projects may offer, but he has a stringent framework for assessing DePIN projects and remains cautious about the broader sector’s overall approach. He shares concerns underpinned by early experiences in 2019 as a PhD economist and working on early wave DePIN-like projects. He argues that DePINs should be assessed along the dimensions of monitoring and capital costs, which are the two main factors known to affect cooperative ownership in the economy more broadly. While he acknowledges that DePIN has potential, he is cautious about its structure and implementation and believes many projects fall short on these dimensions.

“Unfortunately, I think DePIN fails on these two counts. Generally speaking, monitoring costs are high. DePIN by its definition is a big oracle problem with a token incentive putting pressure on this already fragile oracle problem….

“And then two, capital costs. Some projects can be a little better and a little worse on this, but my fear with DePIN is that the overall long-term capital trajectory is still pretty high capital….

“I’m pretty skeptical of DePIN as the name of a category. To me, it seems like naming a problem, not a solution.”

Abhay Kumar’s Position (Proponent) Abhay takes a contrasting view, suggesting that DePIN addresses foundational human needs and is central to the future of infrastructure development within crypto. He argues that the hype and capital influx are necessary to drive innovation and solve issues like connectivity and resource distribution.

“Crypto has the opportunity to really solve for Maslow’s hierarchy. And for me, I think DePIN is really the only real point of all this infrastructure we’re building in crypto….

“We need this capital in here. We need this hype in here, because ultimately crypto is for DePIN not the other way around.”

Capital Efficiency

Abhay presents DePIN as a necessary counter to traditional capital-intensive infrastructure models. He notes that the U.S. has spent trillions on connectivity infrastructure, yet significant gaps remain. DePIN, by comparison, could offer a more capital-efficient solution, especially in rural areas.

“U.S. ISPs have basically spent almost $2 trillion between the 90s and 2020 roughly….

“In the last several years, you’re seeing anywhere between $60 to $80 billion being spent every year. What have we actually got?….

“DePIN is another way of building this kind of infrastructure. It’s complimentary to what’s being done out there, and it seems to be a lot more capital efficient so far, but we haven’t seen the end yet and that’s why it’s worth investing in right now.”

Matt argues that DePIN projects struggle with capital efficiency due to dynamic costs and challenges in coordinating large decentralized networks. He emphasizes that much of the value DePIN networks create isn’t actually captured by the network itself, but instead by external organizations.

“My fear with DePIN is that the overall long-term capital trajectory is still pretty high capital….

“The issue is that actual value that accrues to the network is usually not the network itself, meaning it’s not what the people who are buying the devices are usually getting….

“I think the capital that accrues in the business is one that’s going to be hard to decentralize unless you become a DAO. And I think that winds up being the long-term vision for DePIN – that the ‘D’ is going to have to stand for ‘DAO’ at the end of the day and the economic capital in it is the only way you can decentralize something that can then manage these dynamic capabilities, especially the upgrading capability, generating new hardware, convincing people to get it, etc., and then defending the oracle being the two big ones.”

Is DePIN Overhyped?

Abhay acknowledges the hype but argues that it’s important for innovation. He compares the proliferation of DePIN projects to the boom in ride-sharing and food delivery services, where early experimentation and diverse approaches led to market winners.

“It is important for the market to support a lot of experiments at the same time so we can finally resolve to some true value output….

“This is the nature of experimentation. It’s the nature of investment and we should see more of these kinds of things.”

Matt is concerned that the hype around DePIN is overshadowing the need for pragmatic solutions to the real technical challenges DePIN faces. He believes that while experimentation is important, the hype surrounding the sector could lead to the overestimation of its long-term viability, and reiterates the challenges of keeping monitoring costs and capital costs low.

“DePIN as a category is a cursed category even though there are some good projects within it.”

Outlook on DePIN and Crypto Broadly

Matt remains cautiously optimistic on DePIN as a category and emphasizes the importance of low monitoring and capital costs. He also shares his general bullish sentiment on other exciting verticals like the intersection of AI and crypto and stablecoins.

“DePIN in particular, I would say, is especially just case by case….

“I always want to figure out: have you thought about these two, the monitoring and capital cost thing especially well?”

Abhay is eager to see more experimentation, particularly in mobile and energy infrastructure. He believes that DePIN can unlock new efficiencies and create valuable infrastructure that benefits humanity, with the potential for large-scale applications beyond the current scope.

“I want to see more people exploring the mobile space….

“There’s some hype around energy right now, which is kind of interesting. I think there’s a lot of opportunity in manufacturing.”

We’ve summarized the debate below. The full video can be viewed here.

Opening Statements: Should Every Large App Launch Its Own L1 or L2?

Mason Nystrom’s Position (Proponent) Mason opens by advocating for the idea that every large app should eventually launch its own L1 or L2 chain. He argues that applications naturally evolve towards launching their own chains as they scale, driven by three core reasons: 1) the desire for greater control over economics and value capture, 2) control and customization of blockspace, and 3) demand for blockspace will eventually exceed capacity on mainnet.

“The lifecycle of an application typically starts on an app launching on general purpose chain in order to get access to users distribution liquidity until it gets sufficiently large where it can launch its own chain….

“Apps already see the reality of today. They want to own their own economics, they want own their own blockspace. The rational take is that the future of Solana is modular and that is a bright future.”

Ben Chow’s Position (Opponent) Ben takes a more cautious stance, arguing that apps launching their own chains leads to isolation and a lack of collaboration with other projects. He believes that building within an ecosystem has many benefits, such as growing your user base, forming alliances, and ultimately building better solutions.

“If you’re choosing to build your own app chain, it’s like you’re looking to go on an island and build by yourself….

“Being on a thriving ecosystem, there’s a lot of power in being able to integrate, compose, and work together with other projects to grow your user base.”

The Value of Building on an Existing Ecosystem

Mason argues that while apps initially benefit from being part of a general-purpose chain, they eventually reach a point where the economic incentives push them towards launching their own chain. He cites Worldcoin as an example of an app that became a large portion of the activity on Ethereum and therefore would benefit from having its own dedicated chain.

“When you end up being a large percentage of the reason for the economic activity in any given chain, it makes more sense for you to just launch your own chain because then you don’t have to compete with other applications….

“With the exception of DeFi, the composability you get is typically not quite worth the customization and cheaper blockspace that you can get [from launching your own chain].”

Ben counters that creating your own chain for a specific application will make it a homognous chain and susceptible if the purpose/function doesn’t pan out. He argues that a heterogeneous network is more resilient, where certain niches can come and go but the chain will still thrive.

“If you’re just one sector, that’s your entire chain. You’ll go down. What do you do?”

What Incentives Are Driving Certain Solana Apps to Launch Their Own Chains?

Mason emphasizes the economic incentives for apps to launch their own chains, particularly in terms of internalizing transaction fees, capturing more of the value they create, or that the activity doesn’t need to be tied to mainnet. He utilizes Helium as an example of a project that started off as an L1, then decided to go on Solana mainnet, but then announced plans to become an L2 for the benefits.

“You would rather internalize all of the economic activity that happens and I think that is a driving force.”

Ben acknowledges that there are technical reasons for apps to consider launching their own chains but warns that these decisions may be driven by short-term constraints that could be addressed in the future.

“In a specific case like Helium, maybe sometimes there are technical requirements, they just need it now, and so they have to make some hard decisions and choices and maybe they found out that integrations or composability with other parts of the ecosystem isn’t as valuable to them.”

DeFi is the Exception

Mason acknowledges that DeFi is the exception where launching your own chain may not make sense. He does pose the possibility of a sufficiently large DeFi application, like a DEX, possibly launching its own chain to become a global liquidity layer.

“DeFi is maybe the exception. An initial pool of capital, like that liquidity, is initially sticky and you want access to it.”

Ben agrees it’s a possibility and expresses concern that he hasn’t seen enough composability, hoping the trend will reverse.

“I see more apps actually centralizing, building more features themselves, more services broadening out.”

Balancing User Utility and Protocol Value Capture

Ben is more focused on users and the long-term sustainability of applications. He argues that apps should prioritize building a strong, loyal user base rather than focusing on value capture for token holders.

“You need a user base. You need people who love to use a product and are not there to farm you….

“The harder thing which takes time is ‘how do I have product market fit? How do I get my users to stay?’”

Mason agrees that the vision for crypto is where users get more value from the applications than what is extracted from them. He reaffirms the importance of value capture for protocols.

“Protocols and apps that succeed have a very virtuous flywheel where the application provides service on top of the protocol. The protocol itself can be a public good, but the application needs to somehow be able to drive growth as well as protocol development.”

Outlook on Blockchain Modularity

Mason concludes by reiterating that the future of blockchain is modular, where apps will seek to capture more value and control over their ecosystems by launching their own chains. He views this as a natural progression, one that benefits both the mainnet and the apps.

“The future is modular, and that’s okay. Apps and the protocols can both capture a lot of value and more importantly give value to users….

“Blockspace is quickly becoming a commodity, which is why I think applications will seek to own it.”

![]()

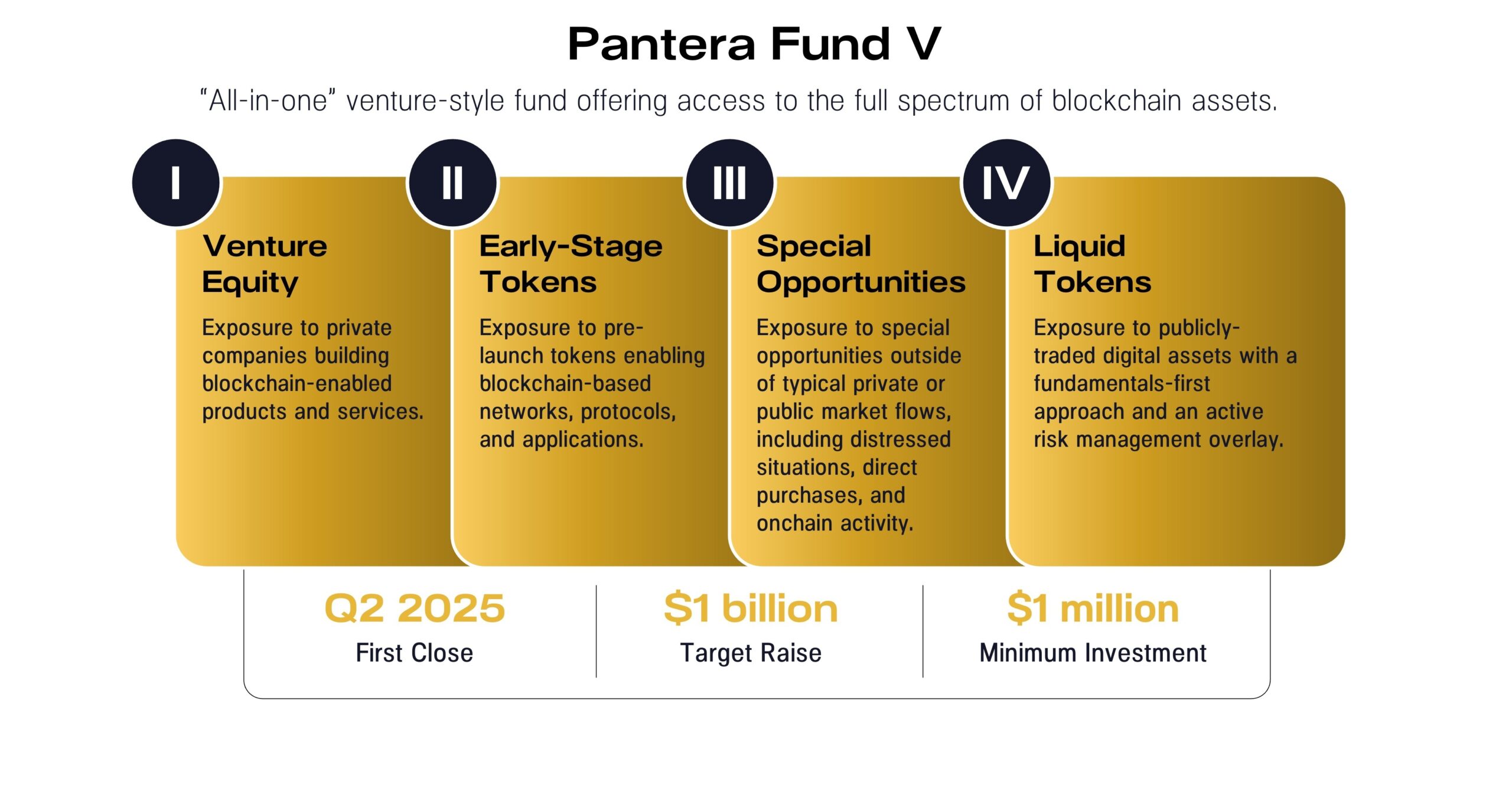

PANTERA FUND V

We’ve found that most investors view blockchain as an asset class and would prefer to have a manager allocate amongst the various asset types. This compelled us to create Pantera Blockchain Fund (IV) in 2021, a wrapper for the entire spectrum of blockchain assets. We are opening its successor, our fifth venture-style fund, Pantera Fund V, in 2025.

Similar to its predecessor, Blockchain Fund (IV), we believe this new fund is the most efficient way to get exposure to blockchain as an asset class. It is a continuation of the strategies we have employed at Pantera for a decade across eight venture and hedge funds.

Limited Partners have the flexibility to invest in just venture (Class V for “venture”), or in venture, private early-stage tokens, and locked-up treasury tokens (Class I for “illiquids”), or the all-in-one Class A.

As in all previous Pantera venture funds, we strongly support helping our LPs get access to deals in this fund. Fund LPs with capital commitments of $25mm or more will have the option to collectively co-invest in at least 10% of each venture equity, private token, and special opportunity deal that the Fund invests over $10mm in. There is no management fee or carried interest on co-investments for those with co-investment rights.

We will endeavor to offer co-investment opportunities, on a capacity available-basis, to other LPs as well. These co-investment opportunities are subject to 1/10% fees.

Pantera Fund V will have its first closing in Q2 2025. We are targeting $1 billion.

You may register interest in the Fund here.

A member of our Capital Formation team will be in touch.

To learn more about the Fund, we invite you to participate in the upcoming call for Pantera Fund V. The call will be held on Thursday, November 21, at 9:00am PST / 12:00pm EST. You may register by clicking the button below.

Pantera donates 1% of revenue from all new funds to 1% For The Planet.

![]()

TODD SLATTERY JOINS PANTERA AS COO

We are excited to announce that Todd Slattery has joined Pantera as Chief Operating Officer. Todd spent eleven years at BlackRock as a Managing Director, serving as COO for the alternatives platform, Americas region, and the institutional client business. Prior to that, he spent eleven years at Goldman Sachs, holding comparable leadership roles. With his extensive experience at leading global asset managers, Todd will play a pivotal role in advancing our mission to grow the digital asset economy while delivering results for our Limited Partners.

![]()

All the best,

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[1]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Blockchain Fund Investor Call

Tuesday, October 1, 2024 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Liquid Token Fund Investor Call

Tuesday, October 8, 2024 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Thematic Call :: Unlocking Value Through Web3 Gaming

Explore how Web3 gaming revolutionizes the gaming experience by enabling players to own, trade, and monetize in-game assets.

Tuesday, October 22, 2024 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Pantera Fund V Call

An overview of Pantera’s fifth venture-style fund that offers exposure to the full spectrum of blockchain assets.

Tuesday, November 5, 2024 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Early-Stage Token Fund Investor Call

Tuesday, November 12, 2024 9:00am PST / 18:00 CET / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

-

Investment Analyst, Liquid Strategies – (New York City)

-

Marketing & Communications Lead – (New York City or San Francisco)

-

Investor Relations Associate – (San Francisco)

-

Senior Investor Relations Associate – (San Francisco)

-

Executive Assistant to the Founder, Managing Partner – (San Juan)

-

Lead Executive Assistant to the Founder, Managing Partner – (New York City or San Francisco, San Juan)

-

Executive Assistant – (New York City)

-

Partner, Venture Strategies – (San Francisco)

If you have a passion for blockchain and want to work in New York City, San Francisco, Menlo Park, San Juan, or London, please follow this link to apply. Some positions can be done remotely.

PORTFOLIO COMPANY OPEN POSITIONS[2]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Below are open positions that our portfolio companies are actively hiring for:

-

Nexus – Community Marketer (San Francisco)

-

Omni Network – Marketing Mangager (Remote)

-

Figure – Financial Ops Lead (San Francisco)

-

Sahara Labs – Solutions Architect (Remote)

-

Avantis Labs – Fullstack Engineer (Remote)

-

Bitso – Head of Sales (LATAM)

-

Helika – Software Engineer (Philippines)

-

Ondo Finance – Director of Business Operations (Remote)

-

Morpho – Community and Social Lead (Remote)

-

Offchain Labs – Site Reliability Engineer (Remote)

-

Alchemy – Software Engineer, Rust (New York or San Francisco)

-

Starkware – Senior Software Engineer (Netanya, Israel)

-

0x Labs – Head of Product (Remote)

-

Obol – Chief Product Officer (Remote)

-

Flashbots – Cryptography Researcher (Remote)

-

Waterfall – Software Engineer (New York)

-

Braavos – Senior Full Stack Engineer (Tel Aviv)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

[1] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[2] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.