NEWSFLASH, CRYPTO OWNERS VOTE[1]

The majority of Americans are under the age of 40.

The majority of young people love blockchain.

[Lightbulb moment…]

One of the American Presidential candidates came out strongly in favor of blockchain.

Very crafty move – as many of the young people who own crypto are so passionate about its importance to the world that they are single-issue voters. This stance seems likely to draw young people to a candidate that they might not have considered supporting before.

2 + 2 = 21e6

The other then scrambled to change his administration’s position. A massive 180 with the SEC now rushing to get ethereum ETFs approved. The market odds of the SEC approving this ETF went from 6% to effectively 100% in the space of only two weeks.

I can’t remember seeing such an entrenched policy changing so quickly.

Without regulatory drag, hundreds of millions of people – and soon billions – can enjoy the benefits of blockchain.

My colleagues discuss the chain of events that have occurred and potential outcomes further below in the letter.

![]()

SOLANA: THE “MAC OS” OF BLOCKCHAINS

By Franklin Bi, General Partner, Cosmo Jiang, Portfolio Manager, Liquid Strategies, and Eric Wallach, Investment Analyst

Introduction – Blockchain Oligopoly

How many blockchains will exist? It’s a common question we hear, but a better question is: How many blockchains must exist? In other words, what is the least number of blockchains needed to reach the technology’s full potential? To attack this question, we should focus on the root of the blockchain ecosystem: developers.

The “customers” of blockchains are developers. Developers build the applications and protocols that drive demand for onchain bandwidth (i.e., blockspace). The preferences and cultural norms of developers will heavily influence crypto’s evolutionary path.

Historically, developer-facing technologies have converged around a small number of dominant players – typically oligopolies of two or three, each with a distinct approach catering to different developer preferences. We see this in operating systems (Windows, macOS, Linux), gaming consoles (Sony, Microsoft, Nintendo), and mobile platforms (Apple, Android). As the technology cycle matures, 70-90% of the market can consolidate with the biggest players. Eventually, the market nears an equilibrium, unless a new breakthrough disrupts and resets the process.

A similar pattern is emerging in the blockchain ecosystem.

Solana Ascending

Historically, Ethereum has held a dominant share of blockchain developer activity with around 70-80% of blockchain developers building on Ethereum or chains compatible with the Ethereum Virtual Machine (EVM). But Ethereum’s dominance appears to be yielding to the multi-polar model.

Solana has gained significant share over the past year. The shift is reminiscent of Microsoft’s dominance of the early desktop computer market, until Apple broke through with its vertically integrated approach. Solana is now a major contender for the future of blockchain development.

Solana’s monolithic architecture has a product roadmap focused on optimizing every component of its own blockchain, similar to Apple’s approach with its vertically integrated hardware and software stack in macOS. This approach offers several benefits:

-

Seamless UX: With no need to bridge between multiple chains, Solana offers a smooth, intuitive experience for both developers and end-users.

-

Faster innovation: Solana’s streamlined architecture allows for more efficient product upgrades and faster iteration cycles.

-

Enhanced security: By minimizing dependencies and points of failure, Solana’s single-chain design can provide better security and stability, much like how Apple’s tight control over its ecosystem can lead to better security and stability.

Solana in Action

Solana’s architectural advantages enable a range of use cases and user experiences that may be more challenging to implement on modular blockchains like Ethereum and Cosmos. These characteristics are particularly valuable for use cases such as content distribution, DePIN (decentralized physical infrastructure networks), and CLOBs (central limit order books).

One notable example of an application that leverages Solana’s capabilities is DRiP, a platform for earning free collectibles like music, art, videos, and more from creators. To date, DRiP has sent 168.95mm collectibles to 2.27mm wallets (link). Its success is largely due to its ability to send millions of NFTs for free to collectors worldwide — something that is only possible on Solana. The platform’s seamless and instantaneous user experience is enabled by Solana’s high-performance blockchain, which allows for fast, low-cost transactions, as well as the compressed NFTs standard built by Metaplex, a technology that reduces the cost of minting NFTs to fractions of a cent.

Another application that showcases Solana’s strengths is Hivemapper, a decentralized mapping network that enables the creation of highly accurate, up-to-date, and detailed maps using data collected from dashcams, drones, and other sensors. The project uses Solana’s high-speed, low-cost transactions to process the large volumes of data generated by the network’s contributors and to reward them with tokens for their participation. Solana’s scalability and efficiency make it possible for Hivemapper to create a decentralized alternative to traditional mapping services, with the potential to disrupt industries such as transportation, logistics, and urban planning.

Solana’s high-performance blockchain also enables the creation of capital-efficient financial markets. For example, Phoenix is a Solana-based decentralized exchange built on an on-chain CLOB (central limit order book). This approach can unlock a trading experience similar to the Nasdaq or CME by tapping into Solana’s processing capacity of 4,000 transactions per second, 400ms block times and low fees. Similarly, MarginFi is a Solana-based lending protocol that can enable borrowing against long-tail, volatile assets by managing collateral with greater speed and predictability. Solana’s speed and low fees are key to MarginFi’s hyper-efficient liquidations, which help minimize the impact of bad debt on other market participants – a feature that would’ve been particularly useful during Wall Street’s last financial crisis.

These are just a few examples of how Solana’s monolithic architecture enables compelling applications. As more developers recognize the advantages of building on Solana, we can expect to see a growing number of innovative projects that capitalize on its high-performance blockchain.

Strong Fundamental Growth

The case for Solana is playing out in real-time, with key fundamentals like user growth and transaction fees accelerating rapidly. Solana has emerged as the primary destination for retail users and memecoin traders, displacing Ethereum’s NFT dominance from the previous cycle.

Solana’s unique active addresses have skyrocketed from a mere 14k in October 2020 and a local bottom of 202k in October 2023 to nearly 1.34mm, showcasing the platform’s staggering growth in user activity. Simultaneously, priority fees on the network have exploded, surging from under $100k per month in mid-2023 to an all-time high of over $60mm in March 2024, underlining the intensity of demand for block space on Solana.

One of the clearest signs of Solana’s surging retail adoption is the explosive growth in new tokens in its ecosystem. Starting in January 2024, Solana saw a massive influx of new tokens, far outpacing other chains like BNB, Ethereum, and Polygon. By May 2024, Solana accounted for 85% of all new tokens appearing on DEXs, up from 50% a year ago. This rise in Solana-based tokens reflects its strength in retail usage, driven by memecoin activity.

The flood of retail users to Solana is further evidenced by the dominance of Phantom, Solana’s leading wallet, in the iOS app store rankings. From late May to early June, Phantom consistently ranked as the #1 app in the finance category. Even more impressively, it claimed the top spot among all free apps across every category, beating out hugely popular social media, entertainment and gaming apps. For a crypto wallet to become the most downloaded app in the entire US app store is a remarkable feat, pointing to massive mainstream adoption of Solana. This retail influx is closely intertwined with the memecoin trading boom on Solana DEXs.

Speaking of DEXs, Solana’s share of decentralized exchange volume has skyrocketed from virtually 0% in early 2021 to over 24% by May 2024. The pace of growth has been astonishing, with Solana capturing over 60% of incremental DEX volume in May 2024 alone. This demonstrates the incredible momentum behind Solana’s DEX ecosystem and highlights how its high-performance architecture is enabling it to rapidly gain market share from competitors.

Crucially, Solana’s soaring user activity and DEX volumes are translating into real economic value capture for SOL token holders. The total value accrued from Solana transactions, as measured by Transaction Fees + MEV, has grown to the point where it now rivals that of Ethereum. This underscores how Solana’s rising adoption is creating a powerful flywheel effect – more usage drives more fees, which in turn attracts more stakers, making the network more decentralized and secure.

Taken together, the combination of Solana’s expanding retail user base, record-breaking token launches, dominant DEX growth, and surge in staking rewards presents a compelling fundamental case. Solana’s architectural advantages are enabling it to capture an outsized share of the new demand coming into the blockchain space, accelerating its ascent as a rival to Ethereum. With fundamentals firing on all cylinders, Solana appears poised to extend its upward trajectory.

Conclusion

Solana’s monolithic design and relentless focus on optimization offer distinct advantages in terms of user experience, developer agility, and security. As the blockchain industry matures, these strengths position Solana to thrive and gain market share from competing ecosystems.

While the road ahead is not without challenges, Solana’s fundamentals are firing on all cylinders. Retail adoption is surging, developers are flocking to build groundbreaking applications, and value capture is accelerating. As its ecosystem continues to evolve and mature, Solana’s architectural advantages and vibrant community point towards a bright future.

![]()

CRYPTO’S POLITICAL INFLUENCE

By Cosmo Jiang, Portfolio Manager, Liquid Strategies, and Erik Lowe, Head of Content

The regulatory and political sentiment around digital assets in the United States is shifting in real-time. Recent developments have signaled a potential inflection point that could pave the way for innovation and growth to flourish in the US. An impediment to the growth of our industry has been the stance of the current administration and the SEC, which has presented headwinds that have discouraged innovation and forced many entrepreneurs to move their blockchain-based businesses overseas. We are excited to see the first signs of change.

Republican Candidate Endorses Crypto

In early May, momentum for pro-crypto policies began to build. Former President Trump openly shifted to a pro-crypto stance, hosting a dinner at Mar-a-Lago for buyers of his NFT trading cards on May 8th and declaring he wanted digital assets businesses to stay in the US. On May 21st, he also made history by accepting crypto donations for his campaign, a first for a major party presidential candidate.

“I am very positive and open-minded to cryptocurrency companies, and all things related to this new and burgeoning industry. Our country must be the leader in the field.”

– Donald Trump, Former President of the United States, Truth Social, May 25, 2024

One may speculate that this endorsement of crypto was in response to a few factors. First, the presidential election is a close race and appealing to the crypto community could lead to a meaningful boost for Trump. Security.org conducted a study showing that 40% of American adults now own crypto in 2024.[2] In addition, RFK was the first explicitly pro-crypto candidate. Recent polls have shown that he’s taking crucial votes in swing states. Ultimately, politicians reflect the demands of the marginal voter, and the major political parties are realizing being pro-crypto is a winning strategy.

There is a good deal of speculation that the Democrats and Biden team, seeing Trump elevating crypto into some of his campaign speeches and taking donations denominated in crypto, decided to take a more pro-industry turn as well. This resulted in a quick succession of further wins for the industry.

FIT21 Bill Passes in House of Representatives with Bipartisan Support

The next pivotal moment was the passage of the Financial Innovation and Technology for the 21st Century Act (“FIT21”) in the House of Representatives soon thereafter on May 22nd . The bill seeks to establish a comprehensive regulatory framework for digital assets. Garnering bipartisan support with 279 votes in favor (67%)[3], this signals that crypto is becoming an increasingly important issue in the political landscape.

FIT21 aims to provide a clear and safe pathway for blockchain projects to raise capital, launch tokens, and operate secondary markets within the United States.

It also delineates when digital assets are classified as securities or commodities based on their level of decentralization – a long-discussed topic as it determines whether the SEC or the CFTC will oversee regulation of certain assets.

For example, digital assets can start as investment contracts and become digital commodities over time. FIT21 establishes the criteria for “decentralization”, one of which is that no issuer or affiliated person should control 20% or more of the digital asset’s token supply or its voting power.[4] This measure is intended to define when a project has become sufficiently decentralized for its token to be considered a digital commodity.

The bill also introduces measures to protect American consumers investing in digital assets, establishing rules on trading such as the segregation of customer funds, lock-up periods for token insiders, and limitations on annual sale volumes.

“FIT21 is a first step to establish a regulatory framework for digital assets – and it must be improved by working with the Senate and the Administration. While building a foundation for responsible innovation, we must take further action to strengthen guardrails for consumers, investors and taxpayers.

“Digital currency is already integrated into our economy and will only grow in significance in the years to come. Millions of Americans own cryptocurrency. American companies are the cutting edge of global financial technology. Many jobs in my Bay Area community are dependent on this industry.

“The digital asset industry needs clearer rules of the road and the federal government needs stronger enforcement authority in order to ensure the responsible development of this emerging technology.”

– Nancy Pelosi, Speaker Emerita of the United States House of Representatives Statement on FIT21 Legislation, May 22, 2024

Despite initial opposition from President Biden, SEC Chair Gary Gensler, and some House Democratic leaders, the bill passed without a veto threat from the President. The bill will undoubtedly continue to evolve, and it still needs to pass through the Senate, but nonetheless this is a meaningful starting point. We’ll continue to monitor this as it develops.

Separately, earlier on May 17th, the Senate conducted a bipartisan vote to overturn the SEC’s SAB-121 rulemaking, further underscoring the changing sentiment. The primary contention with SAB-121 was its stringent and burdensome requirements for financial institutions to record crypto assets on their balance sheets, which was a deterrent for banks to offer custody services for digital assets.

On May 31st, Biden vetoed the vote to overturn SAB-121 on the basis that it would “inappropriately constrain the SEC’s ability to set forth appropriate guardrails and address future issues”.

Concluding his statement, Biden affirmed a favorable stance toward onshore crypto innovation which signals a shift in tone in the current administration.

“My Administration is eager to work with the Congress to ensure a comprehensive and balanced regulatory framework for digital assets, building on existing authorities, which will promote the responsible development of digital assets and payment innovation and help reinforce United States leadership in the global financial system.”

– Joe Biden, President of the United States, Message to the House, May 31, 2024

We believe Biden’s veto more likely reflects his reluctance to publicly oppose his appointed commissioner, choosing instead to take the quieter path of asking the SEC to change the rule on their own. We believe the passage of the FIT21 bill in the House represents a significant step toward creating a more defined regulatory environment for cryptocurrencies, and although the Senate’s move against SAB-121 was vetoed, it showcases a broader push to balance regulation with innovation in the crypto space.

While the Biden Administration is shifting its tone on the digital asset sector – there have been reports of Biden’s re-election campaign reaching out to players in the blockchain space requesting guidance on crypto policy moving forward – SEC Chair Gensler remains somewhat steadfast in his views. He expressed reservations about FIT21.

“The Financial Innovation and Technology for the 21st Century Act (“FIT 21”) would create new regulatory gaps and undermine decades of precedent regarding the oversight of investment contracts, putting investors and capital markets at immeasurable risk.”

– Gary Gensler, Chairman of the SEC, Statement on the FIT21, May 22, 2024

Ethereum ETF Approved

There is a good deal of speculation that the quick shift toward being pro-crypto across both sides of the aisle drove the SEC to approve the ethereum ETFs, marking another landmark development. All eight issuers, including Grayscale, Bitwise, BlackRock, VanEck, Ark 21Shares, Invesco, Fidelity, and Franklin, received approval to launch commodity-based trust shares.

The approval came as a surprise. Polymarket, a decentralized prediction market platform, had the odds of an ethereum ETF approval by May 31st at 6% as of May 5th.

The issuers themselves believed the SEC’s lack of engagement was indicative of an expected denial of ethereum ETFs on the May 23rd deadline. Instead, in a sudden about-face, the SEC contacted ETF issuers three days before the deadline asking for next-day turnaround on revisions to their 19b-4 filings. The first step of the process is the approval of the 19b-4s, which were granted on May 23rd. The timeline for these ETFs to launch is expected to be in the next 1-3 months, as issuers prepare the more complex S-1 filings with guidance from the SEC.

Bitcoin ETFs Were a “Buy the Rumor, Buy the News” Event, Will Ethereum ETFs Be?

In our November 2023 Blockchain Letter, we discussed our view that the launch of spot bitcoin ETFs would be a “buy the rumor, buy the news” event.

We wrote that the ETF would fundamentally change access to bitcoin, and contrary to prior major launches that did mark the peaks of previous cycles (CME futures going live and Coinbase going public), this time was different.

The launch of the bitcoin ETF was a “buy the rumor, buy the news” event. Below are the results:

Upon initial news of a likely ethereum ETF approval, the market responded positively. Ethereum shot up 25% initially upon early indications that the ETFs could be approved. The discount on ETHE, Grayscale’s closed-end ethereum Trust, narrowed dramatically from 21% to just 1% in a few days.

Similar to the bitcoin ETFs earlier this year, the ethereum ETFs could drive a substantial influx of new investors, unlocking access for those who were previously sidelined due to compliance reasons or the limitations of their brokerage accounts. In addition, we believe that for a certain cohort of investors, the Ethereum pitch as a “tech platform” may be easier to understand and accept than Bitcoin’s pitch as “digital gold”.

Some may argue that ethereum’s underperformance over the past 1.5 years could make it a strong catchup trade candidate. In addition, low expectations for inflows could present a prime opportunity for a surprising upside.

However, potential outflows from ETHE, similar to what was witnessed with outflows from Grayscale’s converted bitcoin ETF (GBTC), could present some initial headwinds. Although, compared to GBTC, there are fewer forced sellers like 3AC and Genesis; therefore, outflows may be less material.

Also, in contrast to the one-day lag between the SEC’s approval of the spot bitcoin ETFs and their subsequent trading, the ethereum ETFs will begin trading much later after their approval date. Therefore, investors will have had ample time to act on this information.

Possible Knock-On Effects of the Ethereum ETF and Recent Regulatory Developments

We believe the combination of the ethereum ETF approval coupled with the passing of FIT21 and the shifting sentiment in the political and regulatory landscape for crypto will have knock-on effects for the industry. In particular, we believe that the long tail of digital assets may benefit greatly.

Market Growth and Diversification – While the introduction of a bitcoin ETF was meaningful, especially as it relates to crypto’s use case as a store of value, the existence of an ethereum ETF may have strong implications for the broader spectrum of tokens. Increased attention on ethereum may spill over to the broader universe of protocols as investors explore Ethereum as a technology platform.

Technological Advancements and Innovation – Should FIT21 pass in the Senate and/or clear frameworks be put in place for token projects to adhere to, this may accelerate the pace of innovation as entrepreneurs have a defined path to launch their projects with less regulatory drag.

Integration with Mainstream Financial Products – The bitcoin ETFs and now ethereum ETFs will be available alongside 2,844[5] other securities at the typical RIA. We believe that, over time, blockchain will come to be seen as just another asset class.

More Cryptocurrency ETFs – Earlier this year, many speculated that the approval of bitcoin ETFs may pave the way for other cryptocurrency ETFs. It happened. Now the question is, with the ethereum ETFs approved, what’s next? BlackRock’s ETF approval record now stands at 577/1. Monitoring their next move may be telling.

Tokens as a Form of Capital Formation – One of our core theses is that many blockchain-based businesses will choose to organize using tokens rather than equity. Creating a regulatory framework whereby these tokens can start reflecting the fundamental value creation of the underlying protocol, with novel ways of sharing those cash flows with tokenholders that contribute to the protocol, is a critical step in realizing that future.

In conclusion, the passing of the FIT21 bill and the approval of ethereum ETFs represent a significant shift in the regulatory and political landscape for cryptocurrencies in the United States. For a while, it seemed that the industry was at a standoff with no visibility as to when things would get moving. We are now moving.

While this regulatory framework will undoubtedly go through many revisions, it offers a promising start. These developments could bring a new era of crypto innovation, attract a broader base of investors and users, and ensure that the U.S. crypto industry does not fall behind the rest of the world.

![]()

THE INTERSECTION OF AI AND WEB3 TECHNOLOGIES

Will the two most widely discussed technologies for their disruptive potential ultimately complement each other? On our recent thematic call, we explore the opportunities emerging at the intersection of AI and crypto.

The moderator for the discussion, Matt Stephenson, is our Research Partner and has done meaningful work in the AIxCrypto space. He co-authored the paper “Cooperative AI via Decentralized Commitment Devices” with researchers from the Ethereum Foundation and Pantera portfolio company Flashbots, which was presented at the prestigious AI conference NEURIPs. Below is one of his takes on the intersection of crypto and AI.

“Crypto is positioned to be the ‘picks and shovels’ investment for AI.”

Pantera Research Engineer Ally Zach has compiled highlights from our thematic call which you can read below.

Intersection of AI and Crypto

The panel discussed how AI and crypto can mutually benefit each other. AI can enhance blockchain technologies by automating and optimizing voting mechanisms in DAOs, improving smart contract audits, and optimizing Oracle networks. Conversely, blockchain can provide the decentralized infrastructure and economic models necessary to incentivize AI development and data sharing.

“AI can help crypto by enhancing voting mechanisms in DAOs, improving code audits, and optimizing Oracle networks.”

– Matt Stephenson, Research Partner at Pantera

“Both AI and crypto are organizational technologies. One adapts neural networks towards a loss, and the other organizes incentives.”

– Jacob “Const” Steeves, Co-Founder of Bittensor

“In the new internet that we’re building in Web3, AI needs to be user-governed and focused on individual and community success.”

– Illia Polosukhin, Co-Founder of NEAR

Economic Models and Incentives

The panelists explored the economic models and incentives that can drive innovation and efficiency in the AI and Web3 space. They discussed how decentralized markets and crypto incentives can attract top talent and foster competitive, high-quality contributions, in contrast to the inefficiencies of traditional centralized organizations.

“There’s no centralized organization in the world that can organize people like crypto incentives can….

“We’re about to enter an era where information technology, specifically AI, is the prime ingredient. How do we want to structure that?….

“Markets have the ability to allocate resources and incentivize people to do things much better than what a centralized organization does.”

– Jacob “Const” Steeves, Co-Founder of Bittensor

Challenges and Opportunities

The discussion focused on the challenges and opportunities in the AI and Web3 space, particularly around data biases, the need for competitive decentralized AI solutions, and the importance of proper reward mechanisms for data contributors. The panelists highlighted the need for transparency, fairness, and innovative solutions to these challenges.

“Every centralized company actually has this problem [bias in data selection] and will face this. The internet is messy, and so those choices [in data selection] will affect how you do things.”

– Illia Polosukhin, Co-Founder of NEAR

Illia points out the inherent bias and challenges in centralized data selection processes and the need for more transparent and diverse data handling.

“The current AI economy is broken. There is a huge opportunity to incentivize and properly reward data contributors for AI models….

“Many crypto AI projects are not generating AI assets that can be as competitive as those from centralized providers.”

– Sean Ren, Co-Founder and CEO at Sahara AI

Privacy and Security

Panelists discussed the crucial role of privacy and security in AI development within the Web3 space. They emphasized the need for new approaches that prioritize user data sovereignty and protect proprietary knowledge. Blockchain technologies were highlighted as key to achieving these goals through cryptographic and economic incentives.

“We need a completely different alternative where the IP and the developments of these models are targeted to the user. Crypto-economic incentives, are part of this.”

– Illia Polosukhin, Co-Founder of NEAR

“User data privacy and proprietary knowledge must be protected in AI applications to avoid broken economies….

“We need AI development that prioritizes user privacy and data sovereignty, ensuring secure and equitable access for all users.”

– Sean Ren, Co-Founder and CEO at Sahara AI

Future of Decentralized AI

The future of decentralized AI was discussed, focusing on the potential for democratizing access to AI technologies and ensuring fair rewards for contributions. The panelists envisioned ecosystems that are user-focused, secure, and equitable, leveraging decentralized AI to benefit individual and community success.

“We should make it so that everyone can have a piece, anybody can contribute, that it’s incentivized, competitive, and not controlled by a small group.”

– Jacob “Const” Steeves, Co-Founder of Bittensor

“Decentralized AI should prioritize the user, ensuring models are targeted to benefit individual and community success….

“The future of AI and Web3 lies in building ecosystems that are user-focused, secure, and equitable.”

– Illia Polosukhin, Co-Founder of NEAR

Real-World Applications and Impact

The panel discussed real-world applications and the impact of AI and Web3, emphasizing the potential for these technologies to revolutionize industries by providing secure, efficient, and user-centric solutions. Collaborative efforts and innovative economic models were highlighted as key drivers for the adoption and success of decentralized AI technologies.

“We’re building a new internet that is user-focused and decentralized, leveraging AI to improve user experiences and ensure security.”

– Illia Polosukhin, Co-Founder of NEAR

“Sahara AI aims to build a blockchain platform for AI that prioritizes asset sovereignty, security, and accessibility for all users.”

– Sean Ren, Co-Founder and CEO at Sahara AI

“Decentralized AI development can democratize access to AI technologies and ensure fair rewards for contributions.”

– Jacob “Const” Steeves, Co-Founder of Bittensor

![]()

EVIDENCE OF TON’S EXPANSIVE AND GROWING COMMUNITY

Pantera recently made the largest investment in its history in TON.

TON is a Layer 1 network originally designed by Telegram and continued by the open source community. We believe TON has the capacity to introduce crypto to the masses because it is used extensively within the Telegram network. Telegram has over 900 million monthly active users on its future-facing, fast, and secure messaging platform that is used for personal and group communications, large-scale community building, content sharing, and more.

Last month’s Blockchain Letter focused on TON and our investment rationale.

That letter was our most-read letter ever – evidence of the strong community and movement that Pavel Durov and Telegram have helped create.

If you haven’t read it already, you can check it out here.

![]()

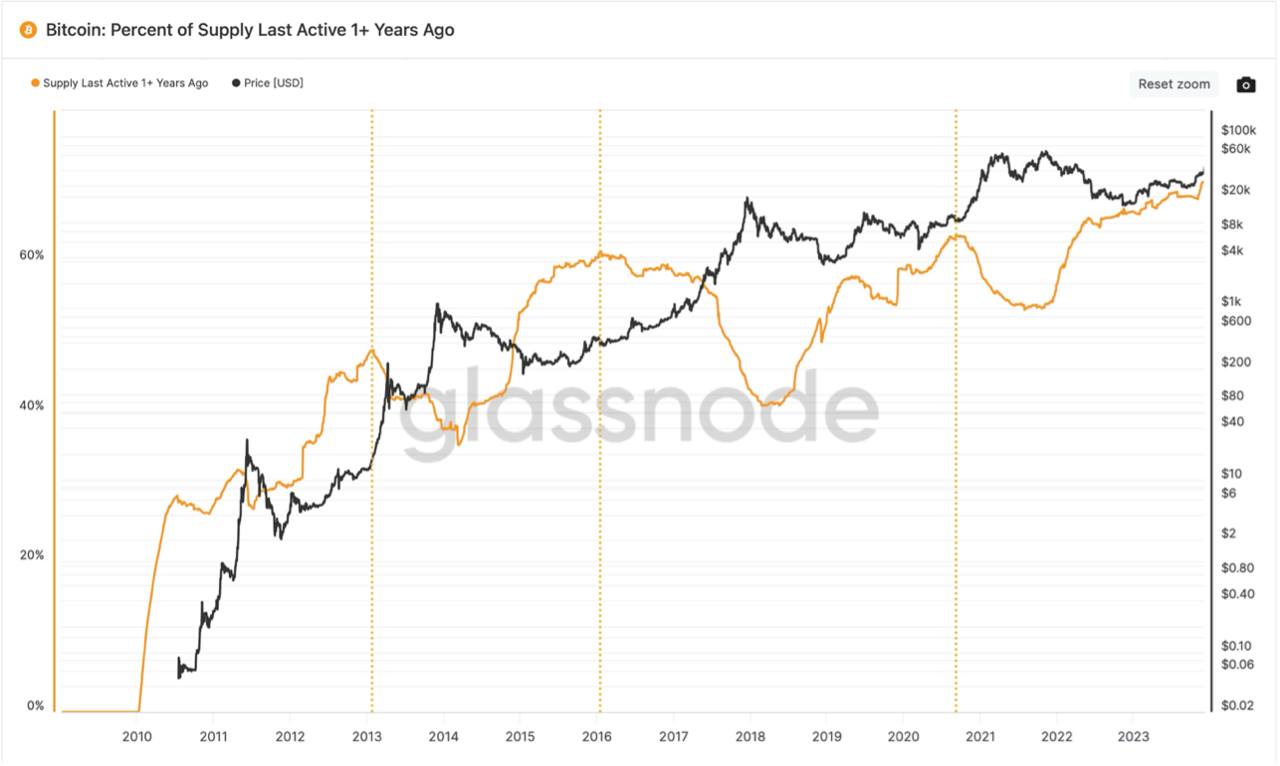

MARKET CYCLE UPDATE :: REVISITING BITCOIN HODL WAVE ANALYSIS

By Erik Lowe, Head of Content

In our December 2023 Blockchain Letter, we did an analysis of the 1-Year HODL Wave indicator, a metric that tracks the percentage of all bitcoins that have not been moved from one wallet to another for at least one year.

We believe it’s a useful metric that can help contextualize the maturity of a bull market cycle. In our original analysis, we wrote:

“As bitcoin’s price approaches a new cycle peak, there’s a noticeable reduction in the percentage of coins held for over a year. This trend is partly attributed to holders of these coins opting to realize profits by selling, leading to these coins no longer being categorized as 1yr+ in this analysis. As a result, the 1-Year HODL Wave, represented by the orange line, declines while the price, shown by the black line, rises.

“Historically, the price of bitcoin has increased slowly and steadily into the indicator’s peaks.

“After peaking and rolling over, the price has ramped up quickly and steeply, with those rallies lasting 1.3 years on average from the indicator peak to the peak in price.

“For this cycle, we haven’t seen any clear indication that the indicator has topped out.

“The punchline is: if historical price action around peaks in the 1-Year HODL Wave is any indication of future performance, the majority of gains this cycle have yet to come.[6]

“A natural follow-up question would then be, ‘when does the indicator peak this cycle and we see a sharp run-up in price?’

“What’s interesting is that the peaks in the indicator have occurred no more than two quarters from Bitcoin Halvings – 0.2, 0.5, and 0.3 years before or after halvings. The next halving is expected to occur at the end of April 2024.”

Let’s look at the chart today.

The indicator appears to have topped out on November 29, 2023. If so, that would align with the trend of peaks occurring within two quarters of the halving.

As we’ve pointed out, the majority of gains have occurred after the indicator begins to roll over. Below is a table showing the rallies heading into the peaks and after.

As of May 31, bitcoin is up 78% since the 1-Year HODL Wave topped out in November. Post-peak rallies have lasted 484 days on average.

![]()

THESE SCAM COINS ARE GETTING OUT OF HAND

![]()

Good luck out there,

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[7]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Liquid Token Fund Investor Call

Tuesday, July 9, 2024 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Early-Stage Token Fund Investor Call

Thursday, August 13, 2024 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Fund V Launch Call

An overview of Pantera’s fifth venture-style fund that offers exposure to the full spectrum of blockchain assets.

Tuesday, September 10, 2024 9:00am PDT / 18:00 CEST / 12:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

-

Junior Partner, Venture Strategies – (San Francisco)

-

Investment Analyst, Liquid Strategies – (New York City)

-

Junior Accountant – (San Juan)

-

Investor Relations Associate – (San Francisco)

-

Senior Investor Relations Associate – (San Francisco)

-

Executive Assistant to Founder – (San Juan)

-

Lead Executive Assistant to Founder – (New York City, San Juan, or San Francisco)

If you have a passion for blockchain and want to work in New York City, San Francisco, Menlo Park, San Juan, or London, please follow this link to apply. Some positions can be done remotely.

PORTFOLIO COMPANY OPEN POSITIONS[8]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Below are open positions that our portfolio companies are actively hiring for:

-

Omni Network – Senior Solidity Engineer (Remote)

-

Avantis Labs – Fullstack Engineer (Remote)

-

M^0 – Senior Solidity Engineer (Remote)

-

Nexus – Rust Engineer (Remote)

-

Helika – Senior Full-Stack Engineer (LATAM)

-

Synfutures – Business Development Lead (South Korea)

-

Offchain Labs – Site Reliability Engineer (Remote)

-

Ondo Finance – Sales Director (Remote)

-

Alchemy – Software Engineer, Rust (New York or San Francisco)

-

Starkware – Senior Software Engineer (Netanya, Israel)

-

0x Labs – Director of Engineering (Remote)

-

Obol – Senior Protocol Engineer, Go (Remote)

-

Flashbots – General Counsel (Remote)

-

Waterfall – Software Engineer (New York)

-

CoinDCX – Engineering Manager (Remote)

-

Braavos – Senior Full Stack Engineer (Tel Aviv)

-

NEAR – Senior Protocol Engineer (Remote)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

[1] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

[2] https://www.security.org/digital-security/cryptocurrency-annual-consumer-report

[3] https://www.congress.gov/bill/118th-congress/house-bill/4763/all-actions

[4] https://www.congress.gov/bill/118th-congress/house-bill/4763

[5] https://www.ici.org/faqs/faq/etfs/faqs_etfs_market

[6] Past performance is not necessarily indicative of or a guarantee of future results. No assurance can be made that profits will be achieved or that substantial or complete losses will not be incurred.

[7] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[8] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.