Investing in Waterfall

October 13, 2022 | Tony Sakich, Paul Veradittakit, and Sehaj Singh

THE PRICING CHALLENGE

The Overstreet Comic Book Price Guide was first published in 1970 and quickly became the industry-standard for valuations in the then-nascent world of comic book collecting.

Comic prices in the early 1970s were determined by aggregating dealer sale prices and scouring fanzines/newsletters to browse the classified ads. The Overstreet wasn’t the only price guide, but it was the first in the world of comics to gain mainstream attention within the industry. The ability to easily find a book’s price was novel and made it easier for both buyers and sellers. Most importantly, it was the spark that made comic book collecting the multi-billion dollar industry it is today.

Pricing an item that recently became collectible has always been a challenge, becoming more difficult when it is a unique 1/1 piece.

WHY WATERFALL?

The biggest challenge that is preventing large scale liquidity and access of NFTs is pricing and we are excited to be investing into Waterfall to solve that problem.

Pricing feeds into the valuation and fractionalizing of NFTs and will bring the next wave of institutional and retail collectors.

Waterfall’s solution is to allow users to trade chips to predict NFT prices, providing instant price discovery for both liquid and illiquid assets.

Decentralized governance acts as a double-edged sword when it comes to fractionalizing NFTs as most chip holders cannot agree on what price makes sense during an NFT’s recombination. Waterfall removes the need for consensus with its novel re-listing approach, thus introducing much needed velocity into the recombination process.

HOW WATERFALL WORKS

When an NFT is listed, it is fractionalized into a specified number of chips: ERC-1155 tokens that represent predictions on the NFT’s future valuation.

Users can predict on NFT prices by purchasing and trading chips however they’d like, but all chips must be listed at all times. The valuation of the NFT is the sum of all chips’ listings. This way, people’s price predictions are immediately reflected in the NFT’s valuation.

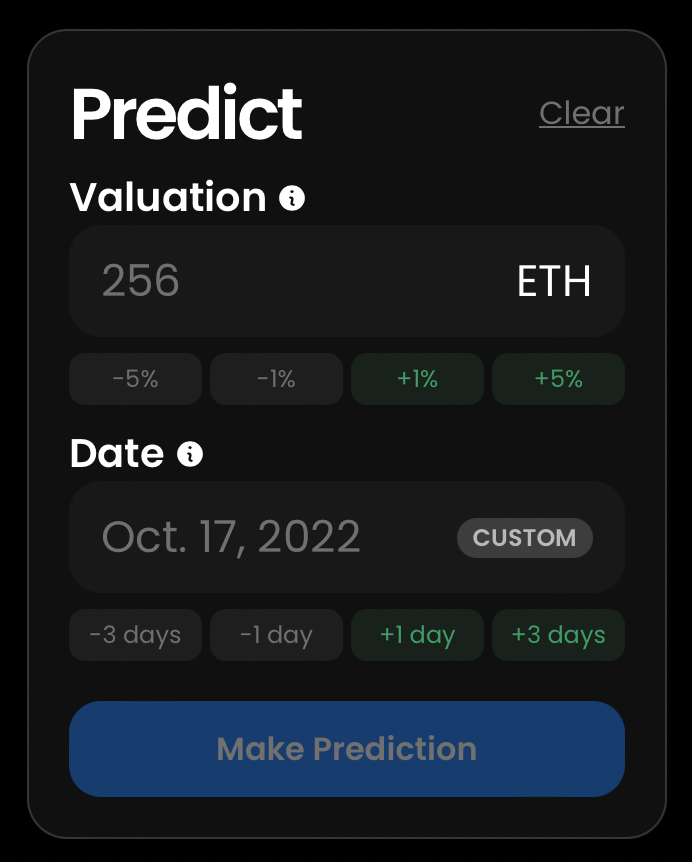

Since each chip needs to be listed at all times, chip traders must provide 2 pieces of financial metadata to represent their prediction:

1. Prediction price: a prediction of the chip’s value by some date

2. Expiration date: the date the prediction market ends

The protocol will then immediately re-list the purchased chips at the prediction price until the expiration date. If a chip has not sold by its expiration date, they automatically start Dutch auctioning down to 0.

For example, let’s say we think the NFT will be worth at least $200 by next month. To make a prediction, we’d input $200 as the strike price, next month’s date as the expiration date, and select the number of chips we want to purchase.

In other words, you can predict NFTs’ future valuations on Waterfall by buying chips.

In order to prevent NFTs from getting locked up, the protocol imposes a Harberger Tax-like fee: the higher the predicted valuation and the further away the predicted date, the higher the fees a buyer has to pay. This process of predicting on NFT prices ends when somebody decides to buyout the NFT.

Like traditional NFT marketplaces, Waterfall can serve both sellers and buyers. But our trading and pricing protocol introduces an additional layer, the chip traders, to make the markets more efficient.

Learn more about Waterfall here, follow them on Twitter @Waterfall_mkt and explore open roles here.