Pantera Wrapped - A Look Back at 2025

Happy New Year! As we kick off 2026, we expect the year ahead to be even more exciting for crypto than the last. But before turning the page, we want to take a moment to reflect on what 2025 delivered.

2025 was another reminder that crypto never moves in straight lines. Amid historic tailwinds and meaningful progress on U.S. regulatory clarity, markets surged to all time highs, narratives evolved, and momentum periodically reset. While the year ultimately ended below its highs, it marked the reset the industry needed to build toward true escape velocity.

By the Numbers

Deployment

- 31 total venture rounds (21 new, 10 follow-ons)

- 85% lead rate (17 of 20 new investments, excluding Secondaries)

Portfolio

- 265 companies across the crypto ecosystem

- Four IPOs with a combined market cap of ~$33B billion as of January 2026 (Circle, Figure, Gemini, Amber)

- $200M Robinhood acquisition of Bitstamp

- Expanded footprint across 8 countries, 4 regions

Stage Focus

- Series A: 56.7% of capital

- Series B: 29.6% of capital

- Seed: 13.7% of capital

Sector Concentration

- Infrastructure: 33.9% of capital

- Consumer: 17.82% of capital

- AI + Robotics: 16.4% of capital

- Stablecoins: 16.2% of capital

- Internet Capital Markets: 11.9% of capital

- Enterprise: 3.88% of capital

2025 was a marquee year for Pantera. We deployed more capital than ever before, led the majority of our new investments, and expanded our global footprint across sectors and geographies that we believe will define the next decade of crypto. At the same time, our portfolio saw strong public-market validation, with four portfolio company IPOs and major strategic acquisitions.

In 2025, Pantera deployed capital across 31 total investment rounds (excluding investments in Digital Asset Treasuries and liquid strategies), which included:

- 21 new portfolio companies

- 10 follow-on rounds supporting existing investments

Bringing Pantera’s venture portfolio to 265 companies. Behind that number are hundreds of founders and thousands of engineers, operators, and builders tackling some of the hardest problems in finance, infrastructure, and decentralization. Over the past 13 years, we’ve been fortunate to have a front-row seat to the full arc of company-building. It’s this scale of experience that continues to sharpen our perspective and deepen our conviction in the builders shaping what comes next.

What Makes 85% Different

In 2025, Pantera didn’t just participate, we led. In fact 17 of our 20 new investments (excluding Secondaries), or 85%, were Pantera-led. This isn’t normal. In an industry where “co-leading” (sharing risk) and following (avoiding hard decisions) have become the default, leading decisively is rare.

For us, leading means:

- Doing critical due diligence

- Taking the first board seat

- Setting the terms that everyone else follows

- Writing the check before the round is “hot”

It’s harder, riskier, and requires more conviction. But it’s how we’ve built relationships with hundreds of founders over the years, and it’s why we are able to see opportunities others may miss.

Public Markets Validate the Thesis

Four Pantera portfolio companies went public in 2025, with a combined market cap of ~$33B billion as of January 2026. We believe this demonstrates that public investors see long-term value in crypto rails and businesses.

The IPO Wave:

- Circle (June 2025): Enabling global dollar movement through USDC

- Figure Markets (September 2025): Bringing credit and structured products on-chain

- Gemini (September 2025): Institutional-grade custody and trading

- Amber Group (March 2025): Institutional crypto financial services

And it’s important to note that these were not tokens. They were equity offerings to traditional capital markets. Public investors bought the thesis that stablecoins, tokenized credit, and institutional infrastructure represent the future of financial plumbing.

Strategic Validation: Robinhood Acquires Bitstamp

In June 2025, public company Robinhood (NASDAQ: HOOD) closed its $200 million acquisition of Bitstamp, the industry’s longest-running exchange (founded 2011). We invested in Bitstamp over a decade ago in 2014.

The all-cash deal brought:

- 50+ global licenses across EU, UK, US, and Asia

- 5,000 institutional clients (Robinhood’s first institutional crypto business)

- $95M in trailing revenue

- Infrastructure for lending, staking, and white-label exchange services

The IPO window for crypto companies is open and validating infrastructure plays at traditional fintech valuations. We believe crypto infrastructure is becoming core financial infrastructure, worthy of public company multiples and strategic M&A premiums.

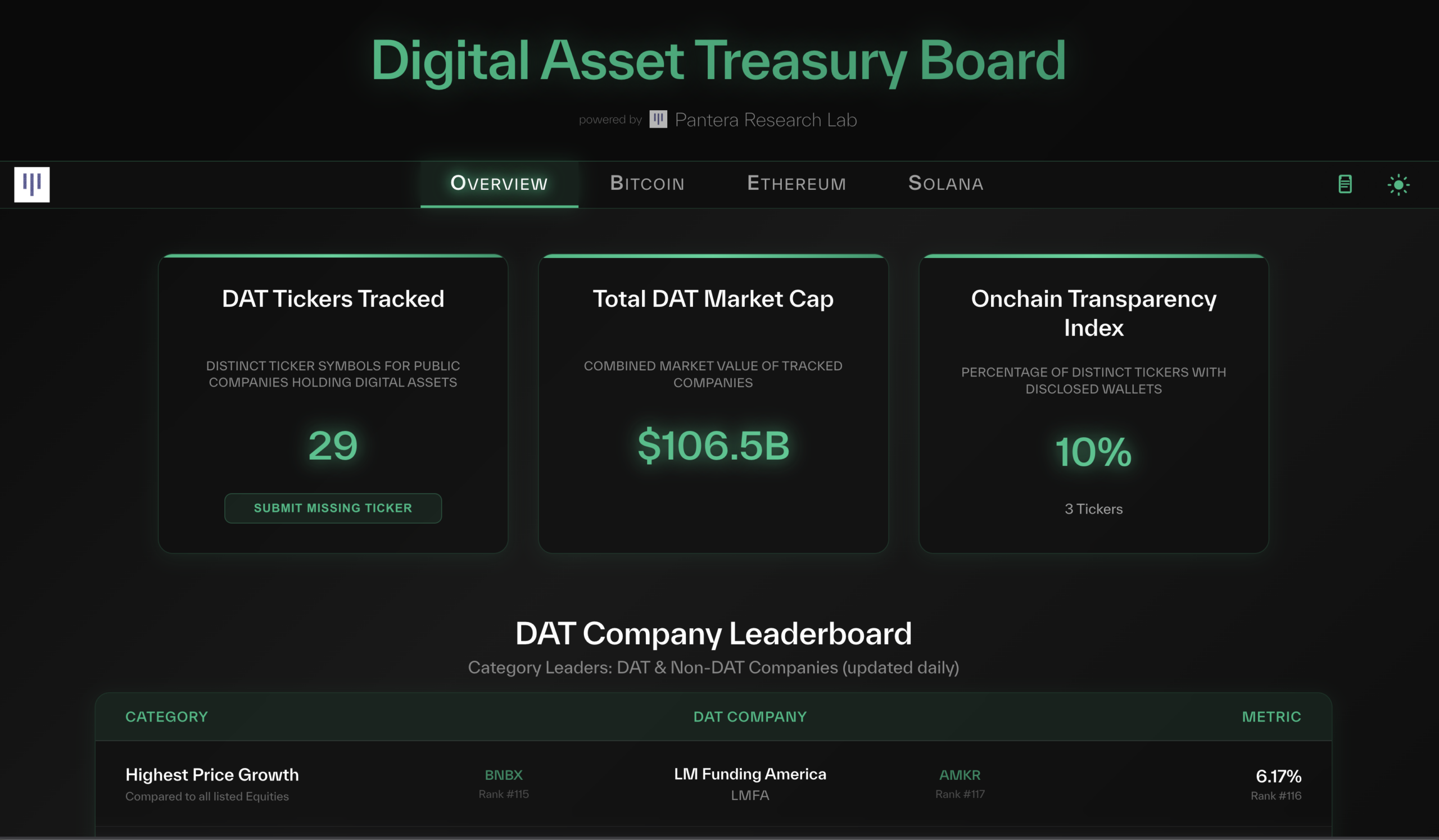

Public Market Exposure to Crypto through DATs

Now for DATs. Digital Asset Treasuries were one of the three major defining themes of 2025 alongside stablecoins and prediction markets, and Pantera spearheaded the development of this asset class and broader industry. The overall market saw over $26B in inflows into DATs.

Through our positions, we gained exposure across a diversified set of public-market vehicles designed to hold, compound, and generate yield on core digital assets. While the category has faced near-term volatility and growing skepticism as markets reset, we view DATs as an early expression of a longer-term structural shift: the integration of crypto assets into public-market balance sheets, capital allocation frameworks, and institutional portfolios.

As with prior cycles, we believe the strongest platforms, managers, and structures will emerge through periods of consolidation, setting the foundation for a more durable and scalable version of this model in the years ahead.

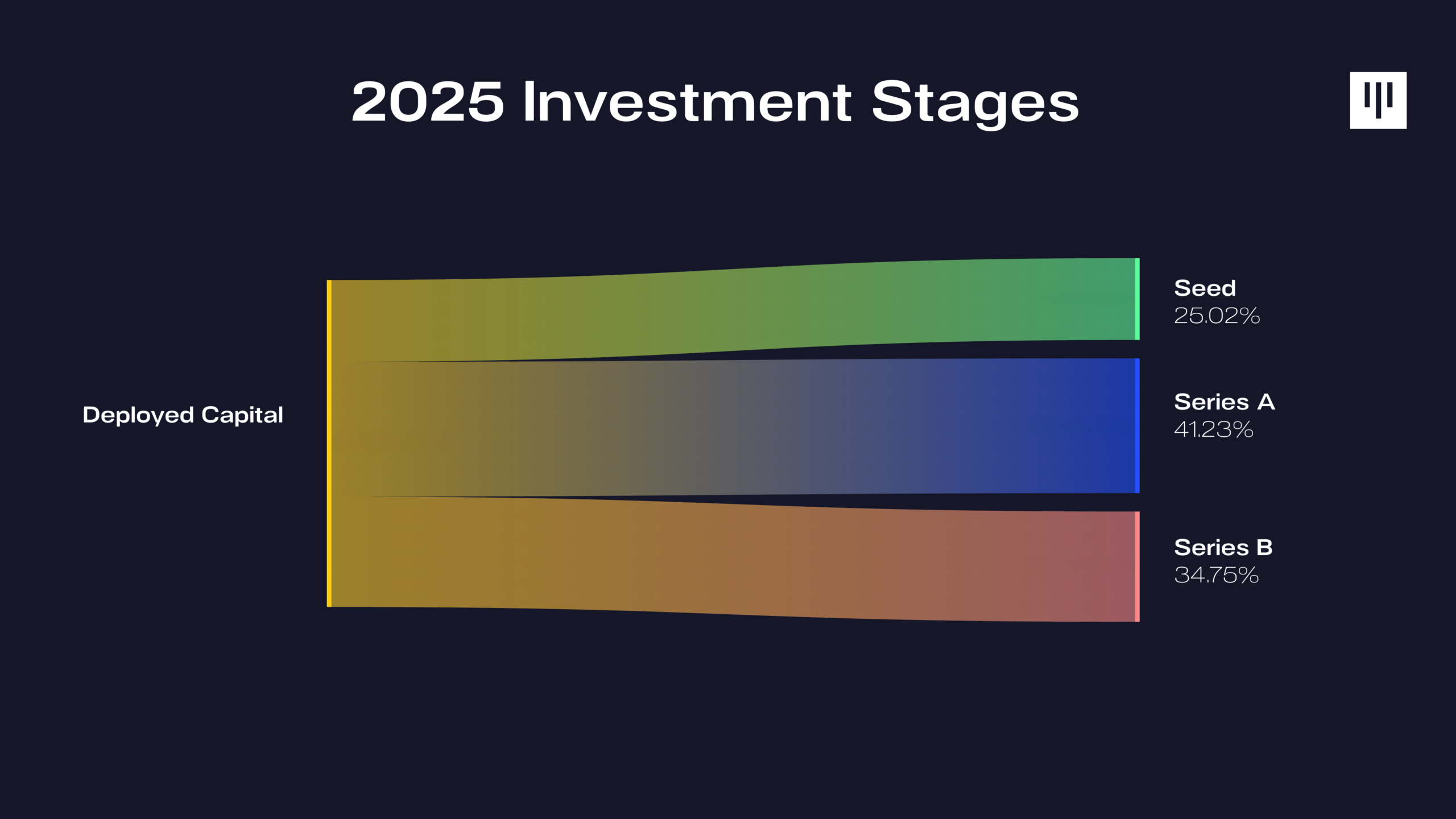

The Series A Thesis

We concentrated capital at stages where companies are transitioning from early product validation to real scale, often the most pivotal period in a company’s lifecycle, while remaining selective at both the earliest and later stages. This reflects where we believe we can add the most value from a platform perspective.

To make that tangible, it’s helpful to look at our deployment through two lenses: deal count and capital deployed.

Fund deployment by stage by deal count (31 total investments):

- Series A (48.4%)

- Seed (25.8%)

- Series B (25.8%)

Fund deployment by stage by capital deployed:

- Series A (56.71%)

- Series B (29.59%)

- Seed (13.70%)

Viewed together, these rankings tell a consistent story. We were most active at Series A by deal count because it is often the inflection point where product-market fit is proven and the path to scale becomes clear. Capital deployment skewed even more heavily toward Series A and B, reflecting where conviction is highest and where larger checks can meaningfully accelerate a company’s trajectory. Seed remains an important entry point for early relationships and pattern recognition, while Series A and B are where we can really lean in with capital and platform support.

Sector Concentration

Our portfolio activity in 2025 spanned a wide range of crypto-native and adjacent categories, with clear concentration in foundational layers of the stack.

Top sectors represented by deal count (31 total investments):

- Infrastructure (38.71%)

- Internet Capital Markets (16.3%)

- Stablecoins (12.9%)

- Consumer (12.9%)

- AI + Robotics (12.9%)

- Enterprise (6.45%)

Top sectors represented by capital deployed:

- Infrastructure (33.85%)

- Consumer (17.82%)

- AI + Robotics (16.36%)

- Stablecoins (16.2%)

- Internet Capital Markets (11.9%)

- Enterprise (3.88%)

Infrastructure ranks first by both deal count and capital deployed, reinforcing its role as a pillar of the portfolio and a core area of sustained conviction. Consumer, AI + Robotics, and Stablecoins each move up in rank when viewed through the lens of capital deployed due to higher average check sizes and more concentrated bets in sectors where differentiation, adoption, or scale dynamics justify greater capital intensity.

On the other hand, Internet Capital Markets ranks second by deal count but falls to fifth by capital deployed because the category spans a wide range of opportunity types, from category-defining platforms such as Uniswap to earlier-stage financial primitives. Enterprise remains the smallest category across both deal count and capital deployed, reflecting its position as a growing niche within the portfolio.

Let’s dive in below.

Infrastructure

Infrastructure remained the backbone of our deployment this year. As stablecoins, on-chain FX, institutional custody, and compliance-first rails moved from “emerging” to “mission-critical,” we leaned into teams building the plumbing required for crypto to operate at global scale. The dominant themes we saw were real-time settlement, regulatory-aware design, and infrastructure that looks familiar to Web2 users but runs on crypto rails underneath.

- Altius – VM-agnostic, parallel execution framework built for L1s, rollups, and appchains seeking high-performance execution and multichain atomic composability. | Follow on X

- Arch Network – Bitcoin-native smart contract and settlement infrastructure used by developers building applications directly on BTC without bridges. | Follow on X

- Radius – Decentralized sequencing and blockspace network adopted by rollups and L2 teams to monetize blockspace, improve UX, and enable shared ordering infrastructure. | Follow on X

- Raiku – Solana-native blockspace marketplace and network extension framework used by Solana appchains and high-throughput applications to guarantee inclusion and capture MEV. | Follow on X

- Rialo – Modular, omni-chain programmable network built for developers enabling low-latency cross-chain execution, agentic workflows, and autonomous interactions. | Follow on X

- Symbiotic – Generalized shared security layer used by new and existing decentralized networks to bootstrap sovereign security without sacrificing governance or token design. | Follow on X

- Zama – Open-source cryptography infrastructure powering enterprises, developers, and governments to run private computation, confidential smart contracts, and privacy-preserving AI using FHE. | Follow on X

Stablecoins

Stablecoins continued to solidify their role as crypto’s most important real-world bridge, and the numbers validate the thesis:

- $46T in total stablecoin transaction volume (up 106% YoY)

- $9T adjusted volume (up 87% YoY, filtering bots)

- Approaching ACH network scale in moving dollars globally

*Source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2025/*

We invested across the stablecoin stack, from issuance and middleware to payments and FX, supporting platforms that make digital dollars usable, compliant, and globally scalable for both consumers and institutions.

- Coinflow – Unified fiat and crypto payments platform serving high-risk and high-volume merchants with compliant checkout, embedded fraud protection, and chargeback insurance. | Follow on X

- Fin – Payments platform enabling individuals, creators, and businesses to instantly send and receive stablecoins, NFTs, and crypto globally with minimal friction, designed for payouts, peer-to-peer transfers, and embedded payment flows. | Follow on X

- [Stealth] – Decentralized money middleware used by institutions, protocols, and asset issuers to connect off-chain liquidity with on-chain markets.

- [Stealth] – Real-time cross-border FX settlement infrastructure serving fintechs, payment companies, and global enterprises moving high-value payments instantly and transparently.

- RedotPay – Consumer-focused stablecoin payments and card platform serving underbanked users and crypto holders who want to spend stablecoins globally via Visa rails, with strong traction across Africa and Asia. | Follow on X

Internet Capital Markets

Crypto-native capital markets matured meaningfully in 2025. We backed platforms modernizing issuance, liquidity, disclosure, and trading infrastructure, bringing institutional-grade standards to on-chain markets. These companies are working to preserve the openness and programmability that make crypto structurally superior to legacy finance.

- Accountable – Privacy-preserving financial data and reporting infrastructure used by institutional investors, issuers, and exchanges to verify yield, risk, and disclosures for crypto-native financial products. | Follow on X

- [Stealth] – Institution-backed crypto exchange built for broker-dealers, market makers, and large asset managers as market structure shifts toward multi-venue best execution.

- Meanwhile – Crypto-native life insurance and annuities platform serving Bitcoin holders seeking regulated downside protection and long-term BTC-denominated financial products. | Follow on X

- [Stealth] – Decentralized exchange and liquidity protocol used by traders, developers, and liquidity providers for permissionless token trading and on-chain price discovery.

- [Stealth] – Token liquidity bootstrapping and capital formation infrastructure used by token issuers and on-chain projects to launch assets, seed deep liquidity, and capture long-term trading fees via Uniswap v4–native mechanisms.

Enterprise

As crypto infrastructure matures, institutions increasingly require secure, compliant, and programmable systems that extend beyond asset custody alone. In 2025, we backed enterprise platforms becoming foundational infrastructure for crypto-native organizations, powering how assets are managed, permissions are enforced, and sensitive data is verified across both on-chain and off-chain environments.

- [Stealth] – Institutional-grade custody and transaction management platform used by funds, DAOs, and enterprises to securely manage assets, tokenization, and DeFi workflows.

- TransCrypts – Self-sovereign identity and data verification protocol used by enterprises to verify income, employment, and financial data via zkTLS while preserving user ownership and privacy. | Follow on X

Consumer (Games, Gaming & Prediction Markets)

Consumer crypto in 2025 moved decisively beyond novelty toward products that demonstrate real retention, monetization, and scale. We focused on teams building crypto-native consumer experiences where blockchain meaningfully improves engagement, liquidity, or economics rather than acting as a superficial feature. Games, sports, and prediction markets stood out as categories where strong brands, differentiated UX, and crypto rails combine to unlock entirely new consumer behaviors.

- [Stealth] – Crypto-native casino and sportsbook platform serving players with a compliance-first, brand-driven, and VIP-focused gaming experience.

- [Stealth] – Two-sided sports prediction exchange enabling retail bettors, professional traders, and liquidity providers to trade moneylines, spreads, parlays, and props via a CLOB-style marketplace, delivering tighter pricing and a superior mobile-first experience.

AI + Robotics

AI shifted from a horizontal trend to a vertical-specific unlock across crypto and adjacent systems. We saw the strongest traction where AI is deeply embedded into core workflows such as research, execution, verification, and physical-world reasoning.

- OpenMind – An open-source AI and robotics infrastructure platform building the software and physical reasoning layer for general-purpose robots, enabling scalable, intelligent interaction with the real world through a global machine network. | Follow on X

- Surf AI – Crypto-native AI research and execution platform used by traders, analysts, exchanges, and KOLs to generate real-time, on-chain-backed intelligence faster than general-purpose AI tools. | Follow on X

- Vigil – AI-powered trading and research platform building a discretionary hedge fund augmented by a proprietary reasoning system, designed for active traders, hedge funds, and other market participants. | Follow on X

- [Stealth] – Formal reasoning and verification infrastructure used by blockchain foundations, enterprises, and government-adjacent organizations to mathematically prove code correctness and eliminate hallucinations in mission-critical systems.

A Global Portfolio

Crypto remains inherently global, and our portfolio continues to reflect that reality. In 2025, we backed founders operating across multiple continents, building products designed for global users from day one. At the same time, we saw a meaningful shift in where new companies are choosing to build, driven in large part by increasingly constructive crypto policy and regulatory clarity in the United States.

Our investments last year spanned eight countries in four regions.

- North America (64.52%)

- Asia (16.13%)

- Europe (9.68%)

- Middle East (9.68%)

While crypto innovation remains global by nature, the U.S. re-emerged in 2025 as a leading hub for company formation, talent, and capital deployment. Across North America, Asia, Europe, and the Middle East, we partnered with teams navigating diverse regulatory environments, payment rails, and user behaviors, often simultaneously. Many of these companies operate with distributed teams and global customer bases, reflecting a shift toward crypto products that are built to scale internationally from inception.

We believe this combination of global reach and renewed U.S. momentum will be a defining advantage for the strongest companies in the next phase of the ecosystem.

The Builders

At the center of everything is our network of incredible founders.

This year, we partnered with both first-time founders taking their first leap and repeat founders applying hard-earned lessons. Across the portfolio, teams scaled engineering, product, and go-to-market functions, often in challenging conditions. The consistency, adaptability, and ambition we saw reinforced why backing people remains the core of our strategy.

We had the privilege to sit down with a few of these teams to hear their stories firsthand and highlight the people behind the success.

Daryl Xu, Viktoriya Hying, Sean Geng, B3

Community & Ecosystem

Beyond investing, we focused on showing up for the broader crypto ecosystem.

Throughout the year, we hosted founder gatherings, roundtables, private dinners, happy hours, and more across multiple cities around the world. We made thousands of introductions across hiring, partnerships, customers, and capital. We also continued sharing research and perspectives aimed at supporting long-term builders.

DAT Board powered by Pantera Research Labs

The Pantera Research Lab spent the year going deeper on one of crypto’s fastest-evolving market structures: Digital Asset Treasuries. By assembling the most complete DAT dataset available and developing new analytical frameworks beyond mNAV, the team redefined how investors understood risk, leverage, and value creation in the space.

Pantera’s 2024 Blockchain Compensation Survey

We curated and released the largest Web3 compensation dataset ever made public, capturing how teams across the crypto ecosystem are building, compensating, and scaling. With responses from more than 1,600 professionals spanning 77 countries, the survey offers a transparent, global view into salaries, incentives, and evolving workforce trends in Web3.

Pantera Capital Blockchain Summit 2025

In 2025, we hosted our annual Pantera Blockchain Summit at The Plaza Hotel in New York City, continuing a tradition we began in 2013. The Summit brought together hundreds of investors, founders, builders, regulators, and industry leaders for a day of candid discussions, deep insights, and meaningful connections.

We also kicked off Pantera’s inaugural podcast, Stateful, to share the insights we’ve been collecting over years of investing in the space. Our first episode with Paul Veradittakit, Franklin Bi, and Mason Nystrom on YouTube, Apple Podcasts, and Spotify.

Looking Ahead to 2026

From tokenization and real-world assets to AI, our Managing Partner Paul Veradittakit shared his 2026 Predictions, outlining the major shifts we expect to define the next chapter of crypto. From real-world assets and institutional adoption to AI-driven security, prediction markets, and the evolution of global financial rails, it’s a forward-looking complement to the themes we saw take shape across the portfolio this year.

At Pantera, our focus has remained constant for over a decade: be a founder-first partner to those building in blockchain. Through every cycle we’ve stayed disciplined in our belief that this technology is still in its earliest chapters, which is why we are a multi-stage fund, investing in companies and entrepreneurs from inception to IPO. We’re grateful for the trust of our founders, partners, and community who made 2025 one of learning, progress, and momentum as we head into what comes next. Let’s have a great 2026 together!

Important Disclosures

This article has been prepared by Pantera Capital Partners LP and its affiliates (“Pantera”) in order to present high-level information regarding Pantera’s investment activities in 2025 and market commentary. The article is made available for informational purposes only.

This article does not contain all information or material terms pertinent to an investment decision. Nothing contained herein constitutes an offer to sell, or a solicitation to buy, any securities, nor does this article contain any investment recommendation. The article does not contain a representation or warranty as to the future performance of any fund or instrument, and it cannot be relied upon in making any investment decision. All information contained herein should be read in conjunction with, and if applicable, is qualified by, the applicable governing and offering documents of Panera’s funds, which will be provided solely to qualified offerees, when such documents are available.

The information contained in this article is current as of the date indicated. Such information is believed to be reliable, and has been obtained from sources believed to be reliable, but Pantera makes no representation or warranty (express or implied) of any nature, nor accepts any responsibility or liability of any kind, with respect to the fairness, accuracy, completeness, or reasonableness of the information or opinions contained herein. Analyses and opinions contained herein (including market commentary, statements or forecasts) reflect the judgment of Pantera as of the date indicated, and may contain elements of subjectivity (including certain assumptions) or be based on incomplete information. If assumptions used in formulating analyses or opinions are altered or shown to be incorrect, the analyses or opinions contained herein may change. Pantera’s relationships and resources are only one of many factors that relate to the success of an investment. Additionally, Pantera is under no obligation to update, modify or amend this article or to otherwise notify you in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

Certain information contained in this article constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures and processes of Pantera and the performance of Pantera’s funds may differ materially from those reflected or contemplated in such forward-looking statements and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that its funds will achieve any strategy, objectives or other plans.

This article contains references to certain Pantera investments and classifies such investments by listed categories (e.g., sector, round, size). Category determinations are made based on information that is believed to be reliable; however, these classifications incorporate certain subjective judgments and could differ form classifications made by a third-party source.

Pantera is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity vis-a-vis any investor or prospective investor in its funds. Therefore, it is strongly suggested that any prospective investor make an independent evaluation of any possible transactions, including obtaining independent advice in relation to any investment, financial, legal, tax, accounting and/or regulatory issues discussed herein.

An investment in a Pantera fund is speculative and entails substantial risks, including the fact that such an investment would be illiquid and be subject to significant restrictions on transferability. No market is expected to develop for interests in Pantera’s funds. Past performance is not a guide to future performance (although performance is not shown herein). Financial instruments and investment opportunities discussed or referenced herein may not be suitable for all investors, and potential investors must make an independent assessment of the appropriateness of any transaction in light of their own objectives and circumstances, including the possible risk and benefits of entering into such a transaction. An investor in a Pantera fund could lose all or a substantial amount of his or her investment. Returns generated from an investment in Pantera’s funds may not adequately compensate investors for the business and financial risks assumed. While Pantera’s funds are subject to market risks common to other types of investments, including market volatility, the funds employ certain speculative investment practices that may increase the risk of investment loss. The products and strategies in which Pantera’s funds expect to invest may involve above-average risk. Nothing herein is intended to imply that Pantera’s funds’ investment methodologies may be considered “conservative”, “safe”, “risk free” or “risk averse”.

Any case studies presented herein were selected by Pantera to provide information and context with respect to Pantera’s investment processes, and nothing in the article is meant to convey or imply that all investments in Pantera’s portfolio will be selected on the basis of similar criteria. Case studies are not a reflection of all of Pantera’s investments, which may have materially different attributes. Pantera and its principals have made investments in some of the instruments discussed in this article and may in the future make additional investments or trading decisions in connection with such instruments without further notice.

The opinions in videos presented herein solely reflect the opinions of the speakers, and do not reflect Pantera’s opinions.

Geographic classifications based on headquarters domicile. Many portfolio companies operate globally; headquarters location does not reflect operational presence or customer base.

Specific investments named in this document were invested during 2025 and have publicly announced funding rounds disclosing Pantera Capital as an investor. Selection criteria were based on announcement status and timing, not performance. These examples do not represent all investments made in 2025, and Pantera has made additional investments that remain confidential or unannounced.

This document contains links to third-party websites and social media accounts, including portfolio company X (formerly Twitter) accounts. Pantera Capital was not involved in the preparation of content on these third-party sites and does not endorse, control, or assume responsibility for the accuracy or completeness of information contained therein. These links are provided for informational purposes only. Third-party content may change without notice and Pantera has no obligation to update or monitor such content.

Fund deployment by stage reflects combined investment activity across Pantera’s Blockchain Fund (BCF) and Early-Stage Token Fund (EST). Stage classifications (Seed, Series A, Series B) refer to the funding round designation at the time of Pantera’s investment. Data excludes other Pantera fund vehicles.

Portfolio construction criteria and targeted companies described in this article are for illustrative purposes only. Past strategies are not intended to limit Pantera’s future investment activities in any way. There is no guarantee that investment opportunities similar to those described herein will be available or that Pantera will make such investments. Relationships and resources are only one of many factors that relate to the success of an investment or strategy.

All registered and unregistered service marks, trademarks and trade names referred to in this article are the property of their respective owners, and Pantera’s use herein does not imply an affiliation with or endorsement by the owners of these service marks, trademarks, and trade names.

Pantera is an investor in several of the DAT companies included in the DATBoard. Additionally, Pantera is a strategic advisor to at least one DAT company. The DATBoard does not include information on every DAT in existence and does not reflect the views, statements, or positions of any of the referenced DAT companies.