THE YEAR OF STRUCTURAL PROGRESS[1]

By Erik Lowe, Head of Content

Given the level of excitement heading into 2025 – finally a pro-crypto administration, Gary Gensler’s resignation, potential rate cuts – bitcoin being up 25% since the presidential election might feel underwhelming. [Kalshi odds for bitcoin hitting $150k in 2025 reached 53% in mid-July]

It’s a bit reminiscent of Peter Thiel’s famous line: “They promised us flying cars, and all we got was 140 characters.”

While prices may have fallen short of expectations, this year delivered more structural progress than any in crypto’s history.

Setting price aside for a moment, here’s what we actually got:

-

A pro-crypto Administration

-

A White House AI & Crypto Czar and a working group focused on digital asset markets

-

Gary Gensler’s resignation

-

A pro-crypto SEC Chair, Paul Atkins

-

SAB 121 rescinded – removed barriers for financial institutions to offer crypto custody services

-

The establishment of a U.S. strategic bitcoin reserve and digital asset stockpile

-

Major crypto lawsuits dropped by the SEC

-

Coinbase added to the S&P 500 – the first crypto-native company ever to be included

-

Robinhood launching tokenized stocks

-

Stablecoin legislation signed into law

-

Market structure legislation passed through the House

-

Solana and XRP ETFs

-

Nine blockchain company IPOs

-

Vanguard’s ban on crypto ETFs reversed, opening access for 50mm clients and $11tn in assets

-

SEC Chair Paul Atkins announced plans for an “innovation exemption” for crypto products

-

235% increase in Real-World Asset (“RWA”) value onchain

-

$100 billion increase in stablecoins

From that perspective, we believe there hasn’t been a more important year for the industry than 2025. This is the year we began laying the deep caissons to support durable, long-term growth.

Below, Pantera Chief Legal Officer Katrina Paglia delves further into these structural developments, providing a comprehensive update on crypto regulation and policy.

![]()

CRYPTO REGULATORY AND POLICY UPDATES

By Katrina Paglia, Chief Legal Officer and Andrew Harris, Platform Manager

As we have done in prior years, we want to provide a year-end update on key policy and regulatory developments in the crypto asset space in 2025 – a year of profound change for U.S. crypto regulation. There has been a near-total reversal on U.S. crypto policy and regulation under the Trump administration. A new, crypto-positive path is evident at regulatory agencies such as the Securities and Exchange Commission (“SEC”) and the Commodity Futures Trading Commission (“CFTC”), and in the actions of the Executive branch. Below, we examine major executive, regulatory, and legislative actions that have shaped the policy environment in 2025.

The President’s Working Group on Digital Assets

Within days of taking office, President Trump signed an executive order to “establish regulatory clarity” for crypto assets. It established a “Presidential Working Group on Digital Asset Markets,” chaired by AI & Crypto Czar David Sacks and consisting of the Secretary of the Treasury, the Chairman of the SEC, the Chairman of the CFTC, and other heads of agencies and departments.

The Working Group was tasked with reviewing existing regulations and recommending changes to regulation to promote crypto assets. In July, the Working Group released a comprehensive report titled “Strengthening American Leadership in Digital Financial Technology.” The report recommended 100 policy and legislative measures on digital asset market structure, banking and digital assets, stablecoins and payments, countering illicit finance, and taxation. Among other things, the report distinguished between digital assets that are securities (regulated by the SEC) and digital assets that are non-securities (regulated by the CFTC). This marks a significant shift from the Biden-era SEC, which saw most crypto assets as securities.

As we discuss below, the SEC and the CFTC have begun acting to further the report’s recommendations.

The SEC, the Crypto Task Force, and Project Crypto

Within days of President Trump taking office, then-acting SEC Chair Mark Uyeda created a “Crypto Task Force” within the Commission, aimed at “developing a comprehensive and clear regulatory framework” for crypto assets. The Crypto Task Force is led by Commissioner Hester Peirce and seeks to create a “sensible regulatory path,” unlike the earlier SEC approach perceived to be driven primarily by enforcement actions.

In August, SEC Chair Paul Atkins delivered a landmark speech, declaring that most crypto assets are not securities and announcing an initiative called “Project Crypto”. Chair Atkins outlined five major elements of Project Crypto:

-

Establishing a clear regulatory framework for crypto asset distributions in the U.S.

-

Ensuring freedom of choice among crypto trading venues and crypto custodians.

-

Embracing market competition and facilitating “super-apps”, through which platforms and intermediaries can offer a range of crypto services and assets — including both securities and non-securities — under a single, efficient licensing structure.

-

Supporting on-chain innovation and decentralized finance (DeFi).

-

Innovation exemptions and commercial viability.

ICOs, Security Status, and Crypto Asset Distributions: The End of the Tunnel?

The single greatest area of regulatory risk for U.S. crypto asset market participants has often been around whether a crypto asset is a security, or is offered to U.S. investors through a securities transaction. The prior administration, and the SEC under former Chair Gensler, viewed most crypto assets as securities and pursued what many considered to be a “regulation by enforcement” strategy against crypto asset issuers and other market participants. That regulatory approach saw many crypto asset issuers move offshore, offering their assets through foundations in the Cayman Islands, Panama, or other jurisdictions. Many crypto exchanges screened U.S. users, and many crypto firms limited or eliminated U.S. engagement altogether.

The SEC under Chair Atkins has taken a very different approach. The current SEC has withdrawn a number of cases against crypto platforms and issuers and has outlined a new, less restrictive taxonomy, which divides crypto assets into four categories:

-

Digital Commodities whose value is tied to a functional, decentralized protocol, and not to managerial promises or the issuer’s ongoing efforts.

-

Digital Collectibles or tokens designed to be collected, such as NFTs.

-

Digital Tools which have practical uses, such as access rights, credentials, or identity features.

-

Tokenized Securities representing traditional securities or financial instruments (e.g., equity or debt), whichcontinue to remain subject to the securities laws.

Even before the SEC Chair announced this four-fold classification, SEC staff had begun to signal this approach through no action letters and statements. Over 2025, the SEC’s staff issued guidance stating that U.S. fiat stablecoins and memecoins were not securities and that protocol staking and liquid staking did not result in the creation of securities.

There is good reason to believe that 2026 will continue to see the SEC take a less restrictive approach to crypto regulation and establish the elements of a regulatory framework for the onshore issuance of network tokens and other crypto assets.

The Unpredictable Rise of Prediction Markets

2025 also saw the rise and growing regulatory acceptance of prediction markets – platforms that allow users to express views on real-world outcomes through event-based contracts. These contracts pay the winner the entirety of their value and pay the loser nothing. A key inflection point came when Kalshi, one of the first prediction markets in operation in the U.S., prevailed in its regulatory battle against the CFTC and was permitted to operate as a CFTC–regulated Designated Contract Market offering contracts tied to elections and other events.

Since Kalshi’s win, interest in prediction markets has accelerated, with additional platforms receiving federal approval and traditional financial and consumer platforms moving into the space (e.g., Robinhood). While regulatory treatment remains uneven – particularly under certain state gambling laws – prediction markets are increasingly viewed as a legitimate financial primitive. Of particular note, several platforms are exploring tokenized or crypto-based implementations, further converging prediction markets with digital asset infrastructure. Coinbase’s announced partnership with Kalshi underscores a trend that may well continue to gather steam into 2026.

Notable Litigation Updates

Withdrawal of Coinbase and Other Crypto-Related Litigation – In 2023, the SEC launched a major lawsuit against Coinbase in the Southern District of New York, and against Binance in the District of Columbia, on a number of claims, including for operating as unregistered broker-dealers, exchanges, and clearing agencies, as well as for unregistered offerings of securities through their respective staking services. In the first quarter of 2025, the SEC entered into a joint stipulation with each of Coinbase and Binance to drop all claims against each of them. (Pantera had predicted this development in our previous annual update.)

The Commission also dismissed ongoing enforcement actions against other crypto market participants including Kraken, Consensys, Ripple, and DRW Cumberland. The SEC noted that its dismissal of these pending enforcement actions was part of the Commission’s ongoing efforts to reform its regulatory approach to the crypto industry, not based on any assessment of the merits of the claims.

The SEC’s New Cyber and Emerging Technologies Unit – The SEC’s reformed approach to crypto-related enforcement is also evident from its formation of a new Cyber and Emerging Technologies Unit, which replaces the Commission’s Crypto Assets and Cyber Unit, which led several enforcement actions against prominent crypto market participants. The new Cyber and Emerging Technologies Unit is expected to focus on fraud and other misconduct, including blockchain-related fraud, and fraud committed using emerging technologies, such as artificial intelligence and machine learning.

Outlook: Consolidating Crypto Gains under the Trump Administration

While the shift in the crypto policy environment is real and clear, there are still a number of regulatory and legislative developments that merit close observation as we head into 2026. We identify some key areas below:

The GENIUS Act – No discussion of 2025 can be complete without a mention of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act – the first significant piece of federal crypto legislation. Passed with bipartisan support, the Act establishes a regulatory framework for “payment stablecoins.”

Under the Act, payment stablecoin issuers will generally be limited to: (1) certain U.S. qualified persons subject to federal or, for certain issuers, state supervision; or (2) certain non-U.S. qualified persons registered with the OCC and subject to a comparable regulatory and supervisory regime (as determined by the Treasury Secretary). The Act imposes licensing requirements on issuers and subjects them to bank-like prudential regulatory and consumer protection standards designed to promote transparency into reserve assets and mitigate perceived risks. Payment stablecoins will not include “algorithmic” stablecoins, and payment stablecoin issuers will be prohibited from paying interest to stablecoin holders. The solicitation of comments under the Act has begun, and aspects such as the prohibition on interest payments by issuers will likely be strongly contested.

Comprehensive Crypto Legislation – Unlike the GENIUS Act, comprehensive crypto market structure legislation continues to work its way through Congress in fits and starts. The Digital Asset Market Clarity Act of 2025, commonly called the CLARITY Act, passed the House with strong bipartisan support in July 2025 but is yet to make progress in the Senate. The CLARITY Act would, among other things, split jurisdiction between the CFTC, regulating “digital commodities,” and the SEC, regulating “restricted digital assets.” The bill also creates a provisional registration pathway until the SEC and the CFTC have finalized rules and provides that assets may transition from security to digital commodity status once a network is decentralized. While some momentum has been lost following the government shutdown, hopes remain high that we could still see comprehensive crypto legislation in 2026.

RWAs, Tokenization and New Frontiers – The tokenization of “real-world assets” also continued in 2025. Unlike “native crypto” assets, the tokenization of RWAs involves placing existing traditional assets on the blockchain, sometimes fractionalizing them in the process. Tokenization has involved assets as diverse as precious metals or other commodities, Treasuries, or private fund interests but a new frontier was reached when NASDAQ recently submitted a proposal to the SEC, asking that investors be permitted to trade existing equity securities in tokenized form. The proposal has attracted significant comment, and the SEC has already signaled its willingness to consider requests to trade existing traditional public securities in tokenized form.

We’ll work to keep our LPs and the broader community updated as these structural changes unfold and as new initiatives emerge. We look forward to what 2026 brings for digital asset policy and regulation.

![]()

Crypto Report Card: Scoring 2025 Predictions

By Paul Veradittakit, Managing Partner

Last year, I made eight predictions for 2025. I wanted to take a moment to reflect on how they played out this year. You can read my original reasoning for these predictions in more detail on CoinDesk and at VeradiVerdict.

Below is a self-assessment of my eight predictions for 2025 based on a scale of 1-5 (5 being most accurate):

#1 RWA Growth

Prediction: By year-end, RWAs (excluding stablecoins) will account for 30% of onchain TVL.

Score: 3 out of 5

When I made this prediction, RWAs excluding stablecoins represented 15% of onchain TVL at $13.7 billion. As of December, the amount grew by 21%, but only reached 16% of TVL at $16.5 billion. So, while the RWA sector has expanded, it remained at a relatively consistent share of onchain TVL. Top sectors include the following:

-

Tokenized Treasures: $6.5 billion | 39%

-

Commodities: $4.1 billion | 25%

-

Private Credit: $1.7 billion-$2.3 billion | 10-14%

-

Institutional Funds: $2.4 billion | 15%

#2 Bitcoin-Fi

Prediction: 1% of Bitcoins will participate in Bitcoin-Fi.

Score: 4 out of 5

In this case, I actually underestimated the participation percentage. The total percentage of Bitcoin-Fi is 1.4% of the 19.9 million supply as of December 13. The largest capital allocation as of mid-2025 was in liquid staking where BTC holders can stake bitcoin for yield while maintaining liquidity through tokenized representations. Projects have included Babylon, Lombard, and Mezo.

Another use case is lending and borrowing with more than $1 billion in BTC-backed loans taking place in 2025. Key developments included the Babylon-Aave partnership, tBTC credit markets, and stacks ecosystem powered by ALEX Lab, Zest Protocol, and other applications.

#3 Fintechs as Crypto Gateways

Prediction: Fintechs will grow in prevalence and may perhaps rival smaller centralized exchanges in crypto holdings.

Score: 5 out of 5

During 2025, fintechs first rivaled smaller centralized exchanges and then went on to surpass them. Robinhood, at $51 billion, already exceeds the holdings of mid-tier CEXs with only Bitfinex at $23 billion still competitively standing as a smaller exchange. This shift reflects fintechs’ structural advantages in user acquisition, regulatory positioning, and integrated financial services.

#4 Unichain L2 Dominance

Prediction: Unichain becomes the leading L2 by transaction volume.

Score: 2 out of 5

Unichain ranks sixth with 29.8 million transactions with 6.6% of Base volume and 3.5% of market share. Currently, Base Chain has a 53.1% market share followed by Polygon PoS (18.2%), World Chain (11.4%), Arbitrum One (9.9%), and Optimism (6.3%).

#5: NFT Application-Specific Resurgence

Prediction: Flexibility is what brings NFTs power. The use-cases will only increase.

Score: 2 out of 5

Use case types did grow across sectors in 2025, but NFTs as a whole have faced adoption headwinds. Once used largely for speculative art, practical applications of NFTs now include:

-

Gaming ($0.5 trillion market) like World of Dyplans, Pixels, and Seraph

-

Ticketing ($1.3 billion market) like OPEN Ticketing Ecosystem, GUTS Tickets, and SeatlabNFT

-

Decentralized identity systems like Ethereum Name Service, Lens Protocol, and Galxe

Engagement depth has also increased with unique active wallets at 2.1 million in Q3 with traders having an average of 8.4 NFTs per wallet compared to 4.2 in Q1.

#6 Restaking Launches

Prediction: Restaking protocols like Eigenlayer, Symbiotic, and Karak will finally launch their tokens, which would pay operators from AVS and slashing.

Score: 3 out of 5

Restaking in the intended instantiation hasn’t seen as much adoption as intended and, instead, we’ve seen prominent restaking protocols expand into adjacent businesses.

EigenLayer/EigenCloud did activate its slashing mechanism on April 17, 2025 and is fully operational. In October, they also launched EigenAI and EigenCompute on mainnet alpha to expand beyond infrastructure into AI/compute workloads. Symbiotic, however, expanded to insurance, and most restaking protocols have not launched because of a TVL decrease.

#7 zkTLD Trend

Prediction: zkTLS will bring offchain data on-chain.

Score: 5 out of 5

zkTLS already has multiple live product implementations, including these launches:

-

Sophon’s Social Oracle in May 2025

-

TransCrypts in July 2025

-

Humanity Protocol mainnet in August 2025

-

Ongoing zkPass development towards a December 2025 TGE

The technology has generated more than four million proofs with Sophon Bridge processing more than $611 million TVL, peaking in June 2025, demonstrating real world adoption of trustless off-chain data verification onchain.

#8 Crypto-Positive Regulatory Environment

Prediction: We’ll see a winding down of SEC lawsuits, clear definitions of crypto as a particular asset class, and tax considerations.

Score: 5 out of 5

This three-part prediction came with the following levels of accuracy.

First, major SEC lawsuits did wind down in 2025, including ones against Ripple, Binance, Coinbase, Kraken, and more. All were resolved without financial penalties, except for Ripple, which paid $125 million.

The Digital Asset Market Clarity Act passed through the House in July and is now under consideration by the Senate. This Act would give the CFTC jurisdiction over decentralized tokens and the SEC jurisdiction over centralized/investment tokens. Meanwhile, the SEC released a preliminary, nonbinding token taxonomy in November.

Part three of the prediction, clear tax guidance, came close but didn’t happen. Although foundational clarity on digital assets lays out how they are property, subject to capital gains and ordinary income rules, ambiguities still exist in areas like DeFi broker reporting and non-custodial transactions. Areas of progress include phased implementations of mandatory broker reporting that became effective this year; staking safe harbors for publicly-traded trusts/ETFs in November; and ongoing stablecoin regulatory development, post-GENIUS Act.

![]()

STATEFUL PODCAST | State of Crypto VC: $34B Raised, 50% Fewer Deals

In our inaugural episode, host Mason Nystrom sat down with two of crypto’s most experienced investors: Paul Veradittakit, Managing Partner at Pantera Capital with 11 years investing in the space, and Franklin Bi, General Partner who founded JP Morgan’s blockchain team before joining Pantera seven years ago.

What We Cover:

The venture landscape has transformed dramatically since the metaverse mania of 2021-22. While total fundraising hit an all-time high of $34 billion this year, deal count has dropped nearly 50%. We break down what this flight to quality means for the industry and why later-stage rounds are dominating the market.

Paul and Franklin discuss the catalysts reshaping crypto venture – from Circle’s IPO finally completing the exit story for VCs, to Bitcoin ETFs opening institutional floodgates, to the explosive rise (and recent cooling) of Digital Asset Treasuries. We explore why DATs represent a fundamental shift in how markets capture value from digital assets, and where this new vehicle class goes from here.

The team also explores investment themes for the next cycle:

-

Tokenization: Why this multi-decade play is still in its first inning, and how it compares to newspapers going online in the early internet era

-

ZK-TLS and Web Proofs: The non-custodial data revolution that aims to solve blockchain’s “trash in, trash out” problem

-

Stablecoins and Payments: How regulatory clarity may unlock the original “money over IP” vision

-

Prediction Markets: From Polymarket’s $2B raise to the democratization of information markets

In addition, Paul and Franklin weigh in on:

-

Robinhood vs. Coinbase stock (3-year time horizon)

-

Stablecoin payment chains and the distribution advantage

-

Privacy as venture category vs. privacy as feature

-

The future of the L1 trade and application-specific chains

Watch the full episode here.

![]()

VANGUARD REVERSES BAN ON CRYPTO ETFS AND MUTUAL FUNDS

By Erik Lowe, Head of Content

When the U.S. bitcoin ETFs launched in January 2024, Vanguard – the world’s largest provider of mutual funds and the second-largest asset manager globally – took a firm stance against offering access to those products on their platform. They sidelined 50 million accounts representing $11 trillion of wealth from buying bitcoin ETFs such as BlackRock’s IBIT, Bitwise’s BITB, and others.

After nearly two years, Vanguard finally reversed their ban on crypto ETFs and mutual funds. That valve is now open.

As we’ve discussed a few times this year, convenient access has been – and should continue to be – a key driver for mainstream participation. Over the past two years, public-access vehicles like ETFs and DATs brought in $150 billion of capital, serving as key on-ramps for both retail and institutional investors.

Vanguard’s policy shift acknowledges the demand for exchange-listed crypto products on traditional platforms using familiar intermediaries. Blocking access to them has become increasingly difficult to justify from both a client-service and competitive standpoint.

For the broader ecosystem, we believe this move further validates digital assets as an investable category alongside equities, fixed income, commodities, and alternatives. This is an important step toward integrating crypto into the core of global capital markets.

![]()

FUND V BETA BRIDGE OPPORTUNITY[2]

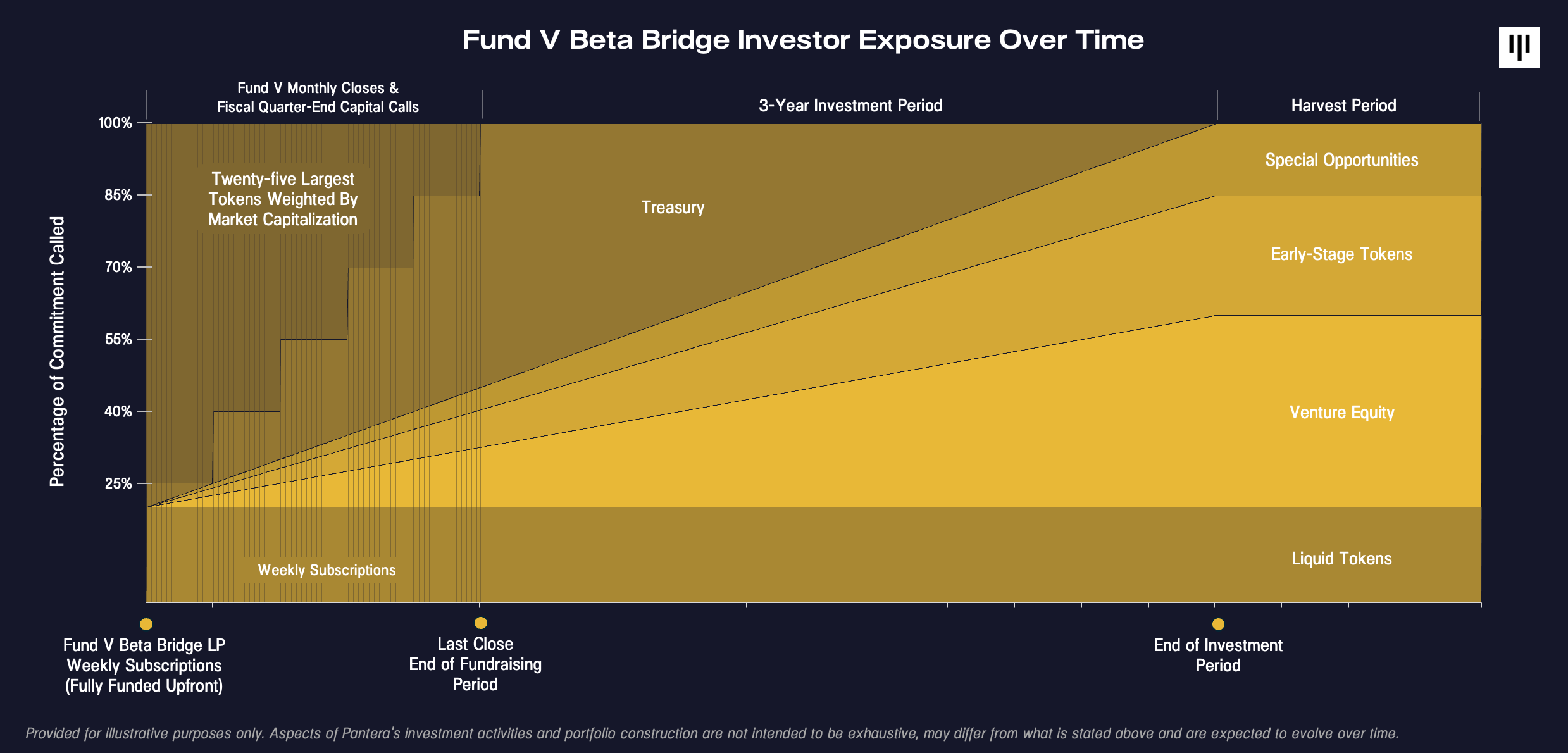

If you are planning to invest in Fund V and are interested in getting full market exposure now while the markets have pulled back, you can do so via Fund V Beta Bridge. Fund V Beta Bridge is a subscription to Fund V which will hold a market capitalization-weighted position in the twenty-five largest cryptocurrencies on a fee-free basis until the capital is needed for each of the Fund V capital calls.

Crypto has almost doubled, on average, each year for the twelve years we’ve managed money in the space. Our confidence in continued appreciation allows us to reduce the fund minimum for Fund V Beta Bridge investors to $500,000.

Below is a visual of a Fund V Beta Bridge investor’s exposure over time.

If you would like more information about Pantera Fund V or Fund V Beta Bridge, please feel free to reach out to our team at invest@panteracapital.com.

![]()

THE YEAR AHEAD CALL

We would like to invite you to join us for our call on January 27, 2026 to discuss the year ahead in crypto, including investment themes we are most excited about and how we believe the policy landscape will evolve. Please feel free to register by clicking the button below.

Happy holidays,

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[3]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Liquid Token Fund Investor Call

Tuesday, January 6, 2026 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

The Year Ahead

A discussion of Pantera’s outlook for crypto in the year 2026, including commentary on the markets and themes to look out for.

Tuesday, January 27, 2026 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Early-Stage Token Fund Investor Call

Tuesday, February 10, 2026 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Fund V Call

A deep dive on the compelling investment themes in blockchain and how Fund V is structured to capture value in the evolving digital asset landscape.

Tuesday, February 24, 2026 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

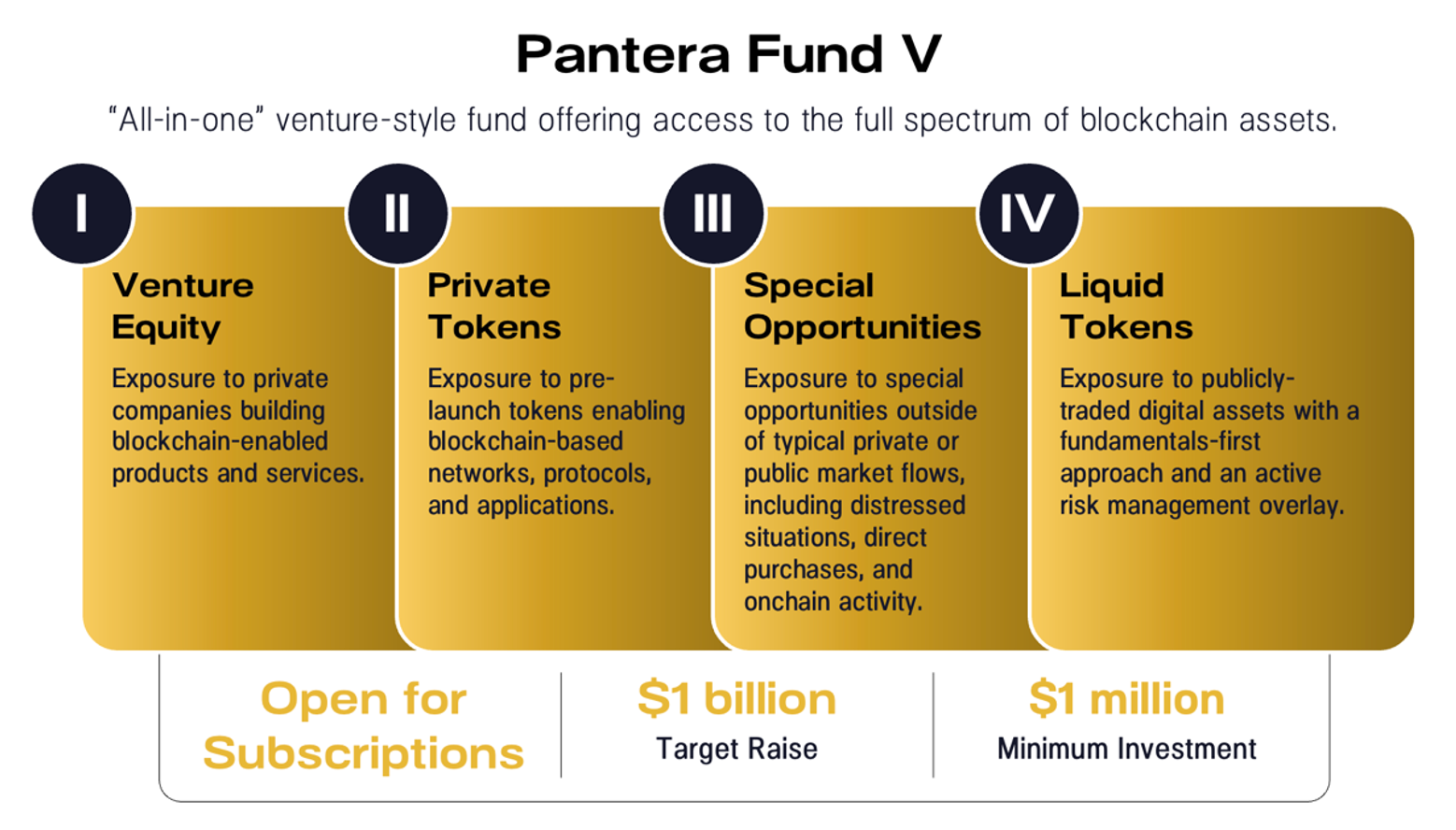

PANTERA FUND V

We’ve found that most investors view blockchain as an asset class and would prefer to have a manager allocate amongst the various asset types. This compelled us to create Pantera Blockchain Fund (IV) in 2021, a wrapper for the entire spectrum of blockchain assets. Its successor — Pantera Fund V — is now open for subscriptions.

Similar to its predecessor, we believe this new fund is the most efficient way to get exposure to blockchain as an asset class. It is a continuation of the strategies we have employed at Pantera for twelve years across twelve venture and hedge funds.

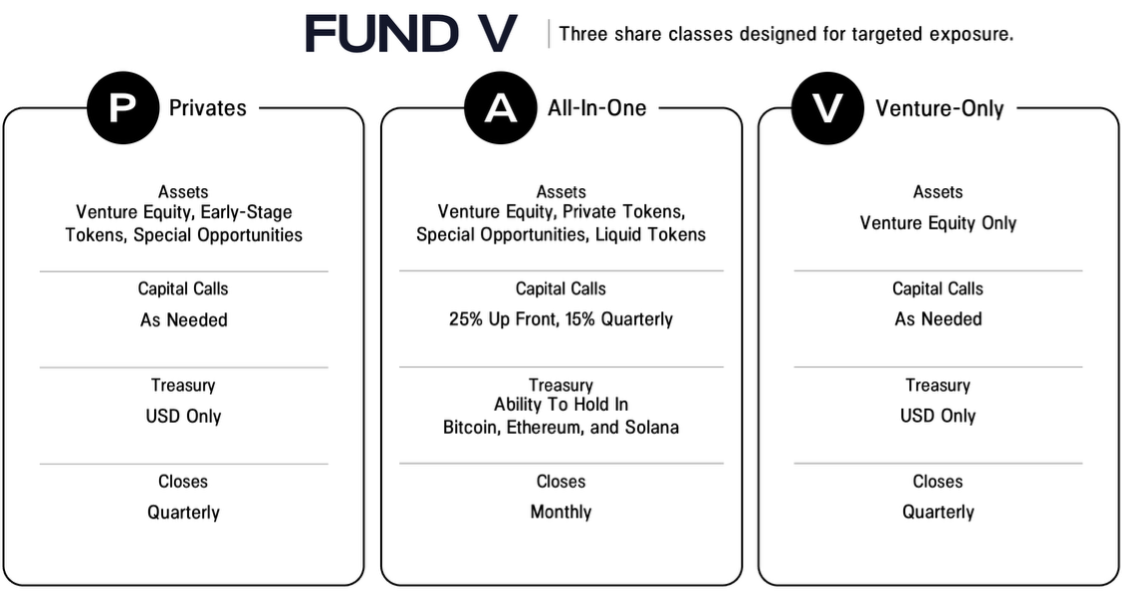

Limited Partners have the flexibility to invest in just venture (Class V for “Venture”), or in venture, private tokens, and locked-up treasury tokens (Class P for “Privates”), or the all-in-one Class A.

As in all previous Pantera venture funds, we strongly support helping our LPs get access to private deals in this fund. Fund LPs with capital commitments of $25mm or more will have the option to collectively co-invest in at least 10% of each venture equity, private token, and special opportunity deal that the Fund invests over $10mm in. There is no management fee or carried interest on co-investments for those with co-investment rights.

We will endeavor to offer co-investment opportunities, on a capacity available-basis, to other LPs as well. These co-investment opportunities are subject to 1/10% fees.

We are now accepting subscriptions for Fund V. If you’re ready to invest, please click the button below to begin the process.

If you are new to Fund V and would like to receive additional information, click here. We also invite you to join our next call on Pantera Fund V on Tuesday, February 24, at 12:00pm Eastern Time. You may register here.

Pantera donates 1% of revenue from all new funds to 1% For The Planet.

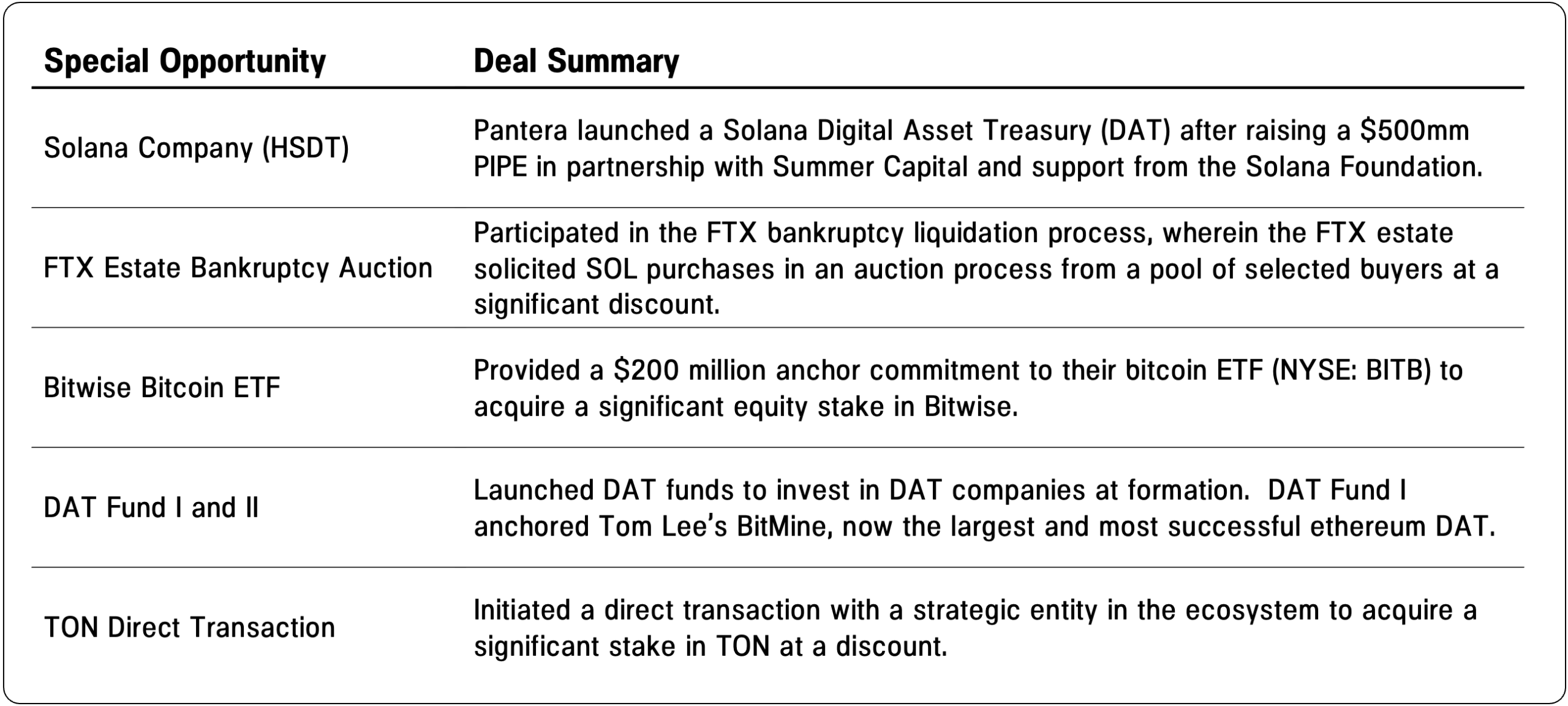

PANTERA SPECIAL OPPORTUNITIES

Pantera Special Opportunities Funds allow investors to gain access to event-driven, special situation dealflow.

With more than twelve years of experience investing across the blockchain ecosystem, we leverage our expertise, deep network, flexible capital structure, and industry leadership to identify and execute on distinctive opportunities. Below are examples of special opportunities we’ve engaged in.

For those who are interested in being notified of future Special Opportunities, please register your interest here.

PORTFOLIO COMPANY OPEN POSITIONS[4]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Below are open positions that our portfolio companies are actively hiring for:

-

Coinflow – Technical Recruiter (Chicago)

-

Azra – Director of Operations (San Francisco)

-

Subzero/Rialo – Engineering Manager (Remote)

-

Meanwhile – Technical Recruiter (San Francisco)

-

Wintermute – Business Development & Partnerships Director (New York)

-

M^0 – VP of Marketing (New York)

-

Nexus – Infrastructure Engineer (San Francisco)

-

0x Labs – Head of GTM (Remote)

-

Offchain Labs – Corporate Counsel (Remote)

-

Ondo Finance – VP of Finance (Remote)

-

StarkWare – Technical Product Manager (Netanya, Israel)

-

Symbiotic – Senior Blockchain Engineer (Remote)

-

Fin – Compliance Manager (New York)

-

Altius Labs – DevOps Engineer (Remote)

-

Sahara Labs – Finance Manager (Remote)

-

Avantis Labs – Fullstack Engineer (Remote)

-

Morpho – Product Lead (Remote)

-

Bitso – Head of Treasury (Mexico)

-

Alchemy – Head of Product Design (San Francisco)

-

Zama – Product Designer (Paris)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

-

Investment Analyst, Liquid Strategies – (New York City)

-

Director, Capital Formation – US East – (New York City)

-

Senior Director, Capital Formation – Asia Pacific – (Asia Pacific)

-

Head of Capital Formation – (New York City)

-

Capital Formation Associate – (New York City)

-

Cybersecurity and Technology Analyst – (New York City)

-

Executive Assistant – (New York City)

-

Operations Associate – (San Francisco)

-

Executive Assistant to the Founder, Managing Partner – (San Juan)

-

Executive Assistant to the Founder, Managing Partner – (New York City)

-

Content Strategist – (New York City)

If you have a passion for blockchain and want to work in New York City, San Francisco, San Juan, Abu Dhabi, or APAC region, please follow this link to apply. Some positions can be done remotely.

[1] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Partners LP and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically-marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

[2] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes. The terms summarized here are provided for informational purposes only and do not constitute a complete overview of the terms of Fund V. Terms are subject to further review and are qualified in their entirety by Fund V’s offering and governing documents. No offer of new or additional investment advisory services is contained herein, and no offer of securities is made in this document–any such offer may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

[3] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[4] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Partners LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase, any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. Analyses and opinions contained herein (including market commentary, statements or forecasts) reflect the authors’ judgment as of the date this letter was published, and may contain elements of subjectivity (including certain assumptions) or be based on incomplete information. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This letter is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements” (including predictions), which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Funds may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Funds will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results. There is no guarantee that investments in any instrument or type of instrument described herein will be profitable – all investments carry the inherent risk of total loss.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.