CRYPTO MARKET UPDATE[1]

By Cosmo Jiang, General Partner

After a six-month rally from the April bottom, the digital asset market pulled back in October. Part of the pullback in risk appetite is attributable to building macro concerns – including the Fed striking a hawkish tone with regard to future rate cuts, the US government shutdown (as of this week resolved, for now), the brief US China tariff dispute, credit quality concerns rising as a number of large frauds were uncovered (see Howard Mark’s recent memo “Cockroaches in the Coal Mine”), and a more mixed earnings season than in prior quarters as investors balked at ever growing AI CapEx plans.

Digital assets performed worse than other risk markets due to additional idiosyncratic issues it faced, including the major selloff on October 10th when President Trump proposed China tariffs after markets closed. We’ve seen a few times now this year that, as the only market that trades on weekends, digital assets bore the brunt of the selling pressure.

Unfortunately, this resulted in the largest single liquidation event in the history of the industry (more than during COVID or after FTX’s collapse). The liquidations, while large in scope, were concentrated in tokens without fundamental support and that trade on less regulated offshore exchanges. Ultimately, we believe this washout sets the stage for a healthier base off which the industry can grow – particularly by accelerating a much-needed shift in focus toward protocols grounded in sound fundamentals. However, after such a severe event, the market will likely experience some near-term indigestion as the industry sorts through the losses.

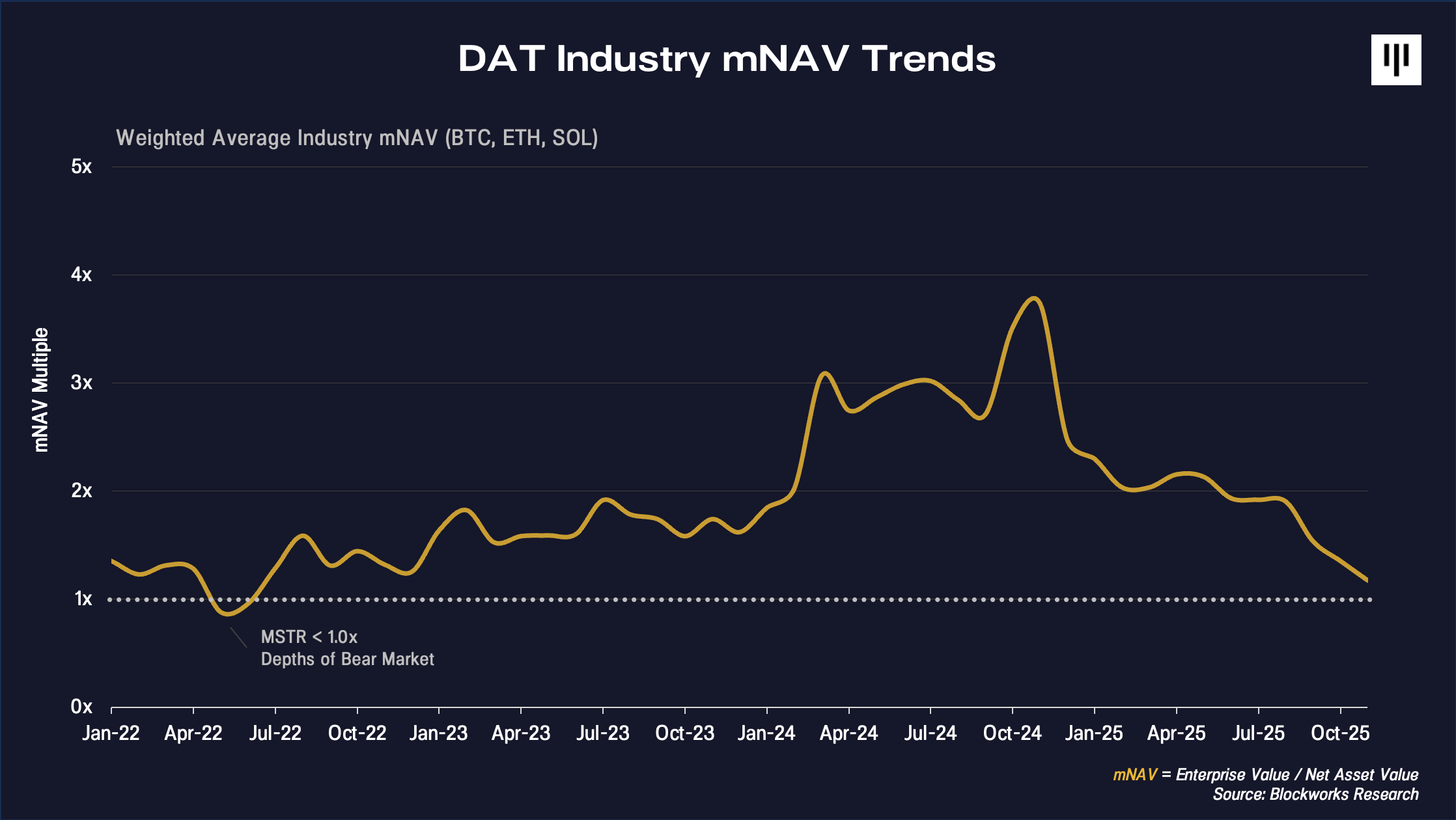

DATs Cooling Off

Another headwind has been the meaningful slowdown and valuation compression in digital asset treasuries (DATs). DATs have been the largest buyers of tokens with over $30bn of capital raised, either via PIPEs or follow-on offerings, over the last six months (the vast majority of that from MSTR and BMNR).

Pantera has been at the forefront of this emerging new industry. We developed the conviction to make what was then a non-consensus bet in early April of helping anchor and bring to life the first DAT launches in the US. This space has grown much faster than we could have possibly anticipated. At that time, we did an exercise of mapping out the white space for DATs, and on looking back today it is clear we are at the end of the genesis phase, or the initial phase when there are many startups tackling white space.

Capital Returns by Edward Chancellor (link) is an important read for students of market history, and the basic premise is that any industry with excess returns attracts incremental competition, which in turn lowers returns. We are seeing that play out now. The space has gotten crowded and it appears that, at least for now, the equity market demand for DATs has waned.

Now that the white space is largely taken, the industry is entering the execution and consolidation phase. This is where the strongest DATs will prove themselves and win out through execution. The vast majority of returns are created in the public markets, and we believe the best DATs can be amazing long-term outcomes for both shareholders and tokenholders. A larger number of DATs will be outcompeted and have uninteresting outcomes, ultimately resulting in healthy industry consolidation.

As we’ve outlined in our thesis, DATs can outperform the underlying token if managed properly. For example, Solana Company (HSDT) is the only registered SOL DAT that continues to trade at a premium to NAV and, since launch, has outperformed the underlying SOL price by around 20%.

With DATs no longer a buyer at the moment, the rate of change in flows for digital assets has shifted rapidly. DATs should trade with more reflexivity to the upside and the downside than the underlying token, so until the market turns more positive again, we don’t anticipate meaningful positive flows. It is interesting to note that, on a go-forward basis, with many DATs now trading below NAV, the risk/reward skew is favorable again.

Near-term Outlook

We remain optimistic about digital asset prices into year end, even after a weak start to November. The drumbeat of adoption continues – from Western Union and Zelle adopting stablecoins, to Morgan Stanley opening up crypto to wealth advisors, to the prediction market company Polymarket raising $2bn from ICE – and could accelerate after the passage of a Market Structure bill (we believe within months). Market structure is also a lot healthier now that leverage has been washed out, sentiment is back squarely in the “fearful” zone and RSI indicators near oversold levels. Bitcoin has been consolidating at the $100,000 round number level this last week.

That fact pattern leads me to believe that positive fundamentals are leading price, and I believe price will ultimately catchup. The digital asset market needs to digest some of the recent damage and some of the macro headwinds need to clear out, but we expect that after some consolidation that risk markets will successfully climb the wall of worry.

![]()

PANTERA BLOCKCHAIN SUMMIT 2025

This was our tenth summit in a series of gatherings we began hosting in 2013 – back when blockchain was just a $2 billion industry. It’s now $4 trillion. 2,000x.

Pantera Blockchain Summit is an invitation-only event, focused on the most important topics in the blockchain industry. The goal is to bring together investors, founders, academics, policymakers, and our investment team to discover valuable insights through thought-provoking discussions.

The theme for this year was “The Next Decade”.

From BitMine Chairman Tom Lee to Ripple CEO Brad Garlinghouse and former CFTC Chairman Rostin Behnam, one message resonated throughout the day – blockchain is becoming part of the system.

In 2018, we sent our LP David Kelsey to the World Series of Poker after getting free tickets from a portfolio company. This year, he came back to win the Pantera Poker Tournament!

Pantera Blockchain Summit Website

We launched a new website for Pantera Blockchain Summit which hosts the complete set of sessions from this year’s summit. Check it out here!

In addition, we’ve highlighted a few sessions below.

Pantera Founder Dan Morehead sat down with Brad Garlinghouse, CEO of Ripple Labs, for a wide-ranging conversation on the evolution of blockchain technology and the journey from “money over IP” to mainstream adoption. Garlinghouse reflected on Ripple’s decade-long role at the intersection of crypto and traditional finance, specifically how early conviction, regulatory perseverance, and enterprise-grade infrastructure helped shape one of the industry’s most enduring platforms. Watch Ripple, Regulation, & Real-World Utility.

Pantera General Partner Franklin Bi led a conversation with senior leaders from Bitwise, Fidelity, and Franklin Templeton on how major institutions are integrating digital assets into their strategies. The panel explored how regulatory clarity and political tailwinds have shifted crypto from a niche exposure to a core portfolio consideration, as financial advisors and asset managers move to onboard the next wave of investors. Watch Investor Perspectives.

Pantera General Partner Cosmo Jiang sat down with Tom Lee for a wide-ranging conversation on the emergence of Digital Asset Treasuries (DATs) and Ethereum’s growing role at the center of global finance. Lee – whose firm BitMine has become the world’s largest Ethereum treasury – shared how public-market vehicles like BitMine are accelerating institutional adoption and redefining how investors gain exposure to blockchain assets. Watch The DAT Revolution.

Pantera General Partner Franklin Bi opened with a look at how traditional finance is finally joining the blockchain era – what he calls “The Great Onchain Migration”. As global institutions begin issuing and trading assets natively on blockchain, the conversation explored what it means when Wall Street’s infrastructure meets crypto’s efficiency. Watch Wall Street Goes Onchain.

Pantera General Partner Paul Veradittakit sat down with Nikil Viswanathan, Co-Founder and CEO of Alchemy, for a wide-ranging conversation on the evolution of crypto’s developer economy and the institutional shift toward blockchain infrastructure. Viswanathan shared how Alchemy grew from a scrappy startup demoed in a park to a $10B+ company powering over $100B in annual transactions, serving as the AWS of Web3. Watch the Alchemy Story.

![]()

ZCASH AT THE CENTER OF CRYPTO’S PRIVACY REVIVAL

By Erik Lowe, Head of Content

The recent interest in Zcash has reignited one of crypto’s oldest and most powerful ideas: the right to transact without surveillance.

The earliest cypherpunks saw privacy not as an add-on, but as a cornerstone of self-sovereign money. But at the time Satoshi released Bitcoin, the technology for fully anonymous transactions simply didn’t exist. As a result, Bitcoin was born as a pseudonymous global payment network, where anyone could track the flow of bitcoins between public addresses. Linking an address to a person or entity is mostly a matter of time and effort.

Over the past decade, the privacy stack has matured substantially – from Zcash’s shielded transactions to modern zero-knowledge proofs that enable private transfers and scalable rollups across multiple chains. What began as a set of theoretical constructs on cryptography mailing lists has become real infrastructure securing billions of dollars in value.

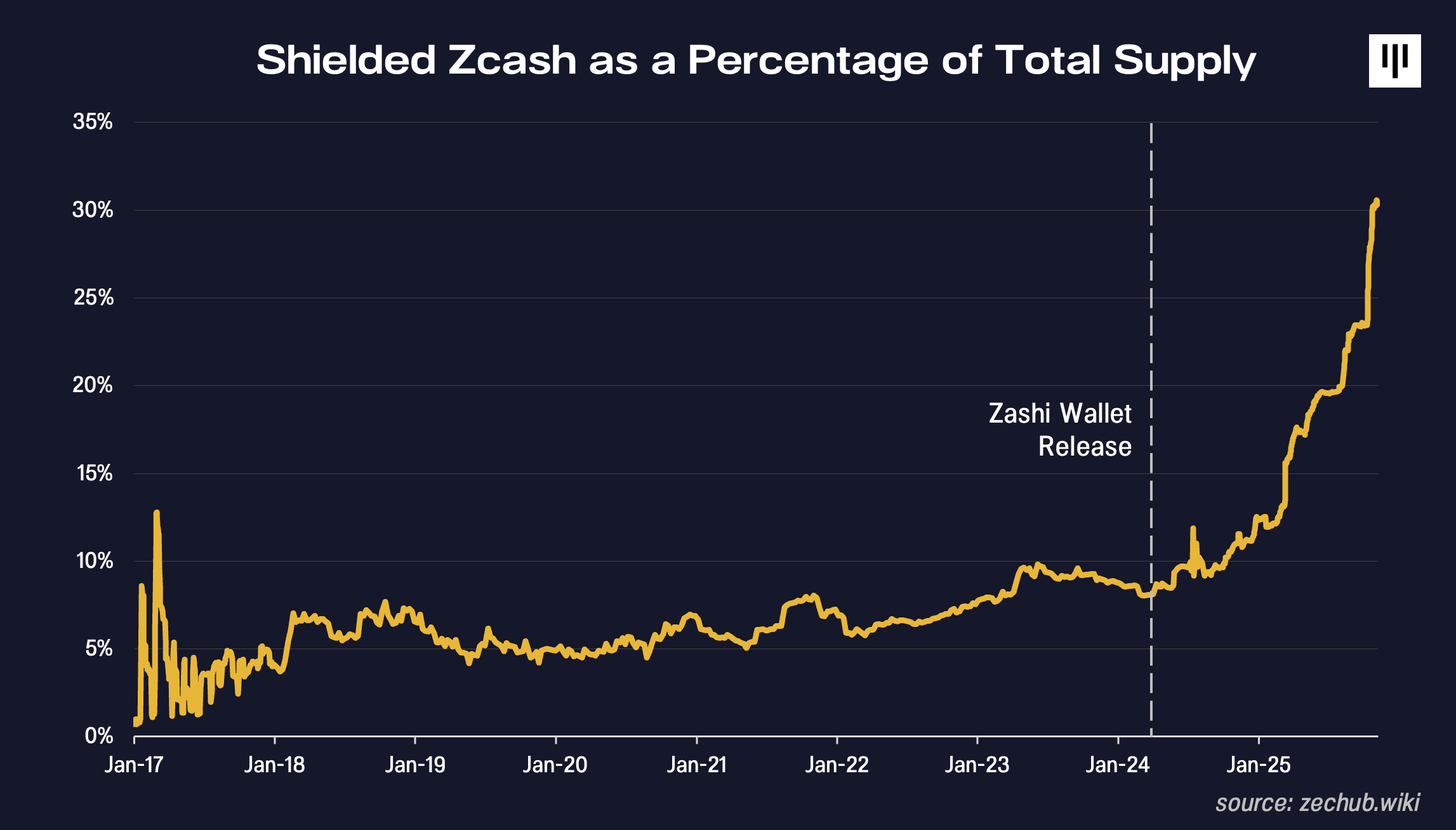

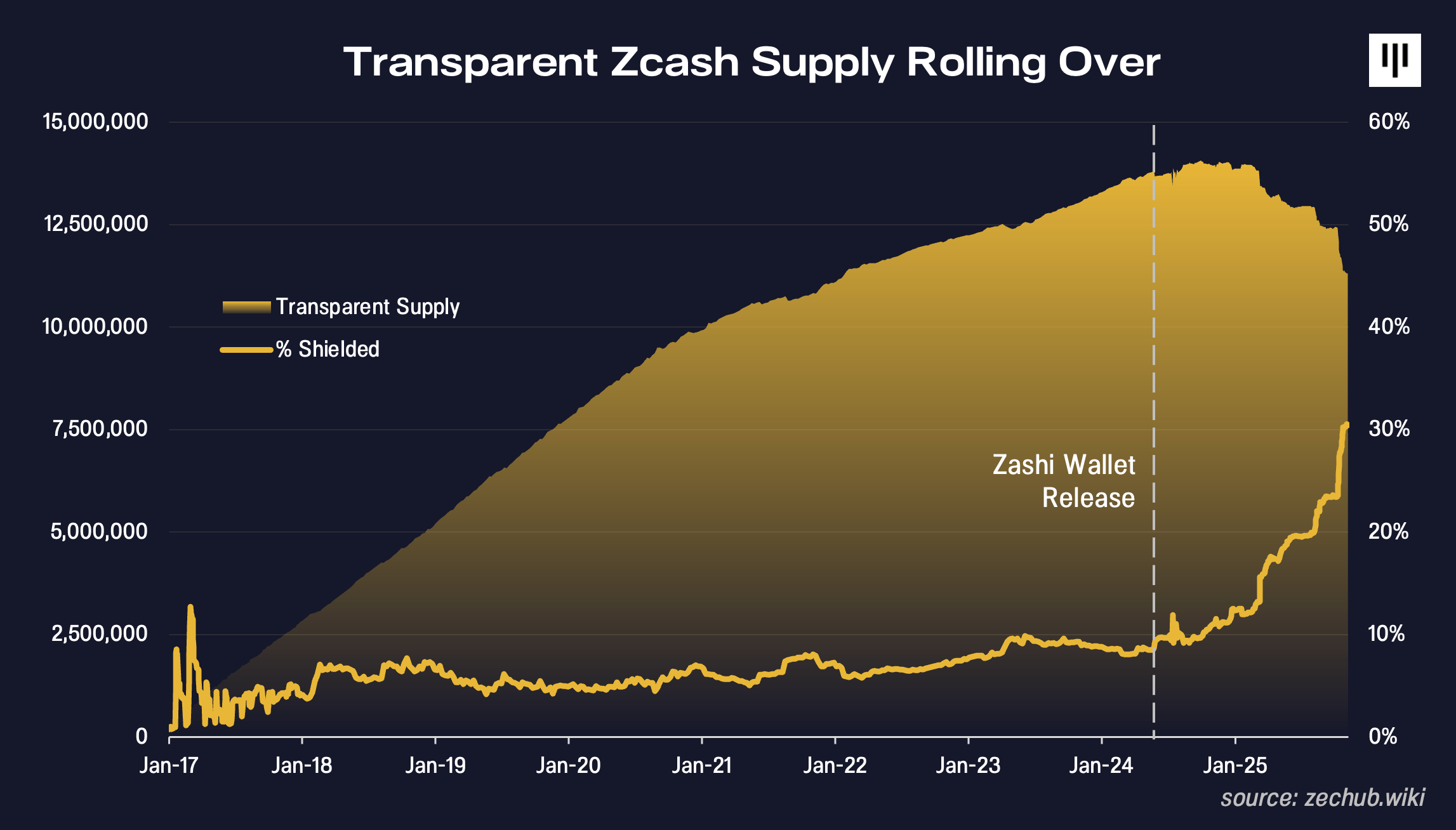

A major catalyst in this latest resurgence has been the improved usability of Zcash. The March 2024 launch of the Zashi Wallet – bringing shielded transactions to a much wider audience – helped spark the recent surge of attention around the cryptocurrency that first brought zero-knowledge proofs into mainstream crypto.

As seen in the charts below, shielded usage has accelerated meaningfully, and supply that has been “transparent” is now rolling over – a sign that users increasingly prefer the full privacy features of Zcash. Outside of the token’s price – up 10x over the past two months at the time of writing – Zcash is delivering on its core value proposition: privacy.

At the same time, new interoperability layers like NEAR Intents have quietly expanded what Zcash users can do across the broader crypto economy. With Zashi’s integration of NEAR Intents, users can now perform non-custodial swaps and cross-chain actions with ZEC by simply stating a desired outcome, or “intent”, dramatically improving usability beyond the base chain. This added utility has been an underappreciated catalyst behind the renewed excitement in the asset.

Pantera has been investing in the privacy and interoperability areas since the early days. Venture Fund II invested in Zcash back in 2015. Later fund vintages invested in protocols like NEAR, StarkWare, MINA, and more, reflecting our long-held view that privacy is an important component of digital asset ownership and value transfer.

With regulatory winds shifting and demand rising for secure, programmable value transfer – from consumers to institutions to AI agents – privacy infrastructure is poised to become a core pillar of crypto’s next era.

Privacy isn’t merely coming back; it’s becoming easy, intuitive, and built into the user experience.

![]()

REIMAGINING AGENTIC PAYMENTS WITH x402

By Jay Yu, Junior Partner

The Internet was born with an “original sin”: while HTTP became the universal language for moving information, it never embedded a native way to move money. Buried in the protocol was a placeholder status code – HTTP 402: Payment Required – meant to make payments as seamless as loading an image or a video.

What HTTP 402 envisioned was a world of Internet-scale micropayments: a peer-to-peer cash system as seamless as the peer-to-peer flow of information. But back then, such a system simply did not exist. So 402 was left undefined, and instead of protocol-native micropayments, the web economy of the 2000s and 2010s became cluttered with advertisements, walled gardens, and ad-hoc credit card forms ill-suited to the burgeoning digital economy.

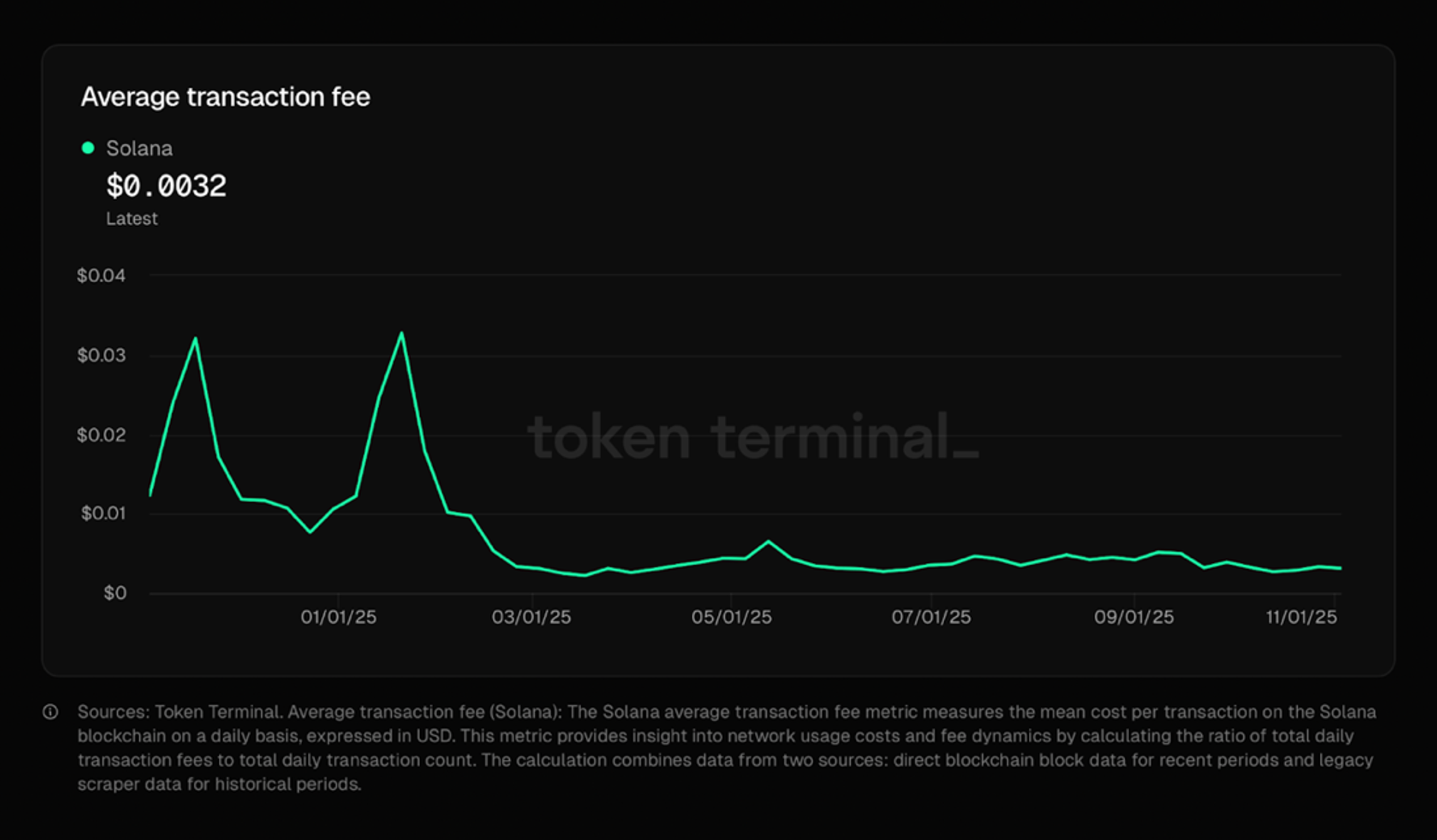

Today, with the global rise of stablecoins and cheap, fast blockchain rails, that world may finally be here. Stablecoin supply has surged from under $2 billion in 2019 to over $246 billion in 2025. Meanwhile, blockchain infrastructure has matured, with L1s and L2s offering sub-cent level fees – as of November 5, Solana averages just $0.0031 per transaction – making HTTP 402’s vision of instant, per-request payments feasible at last.

Whereas credit card forms always assume a human being at checkout, requiring a name, expiry date, and ZIP code, AI agents can use stablecoins as smoothly and as permissionlessly as a human. With stablecoins, AI agent can craft an on-chain transaction, either asking the user to sign or executing directly under a pre-approved policy. After all, it is far easier for an AI agent to get access to a crypto wallet than to a bank account.

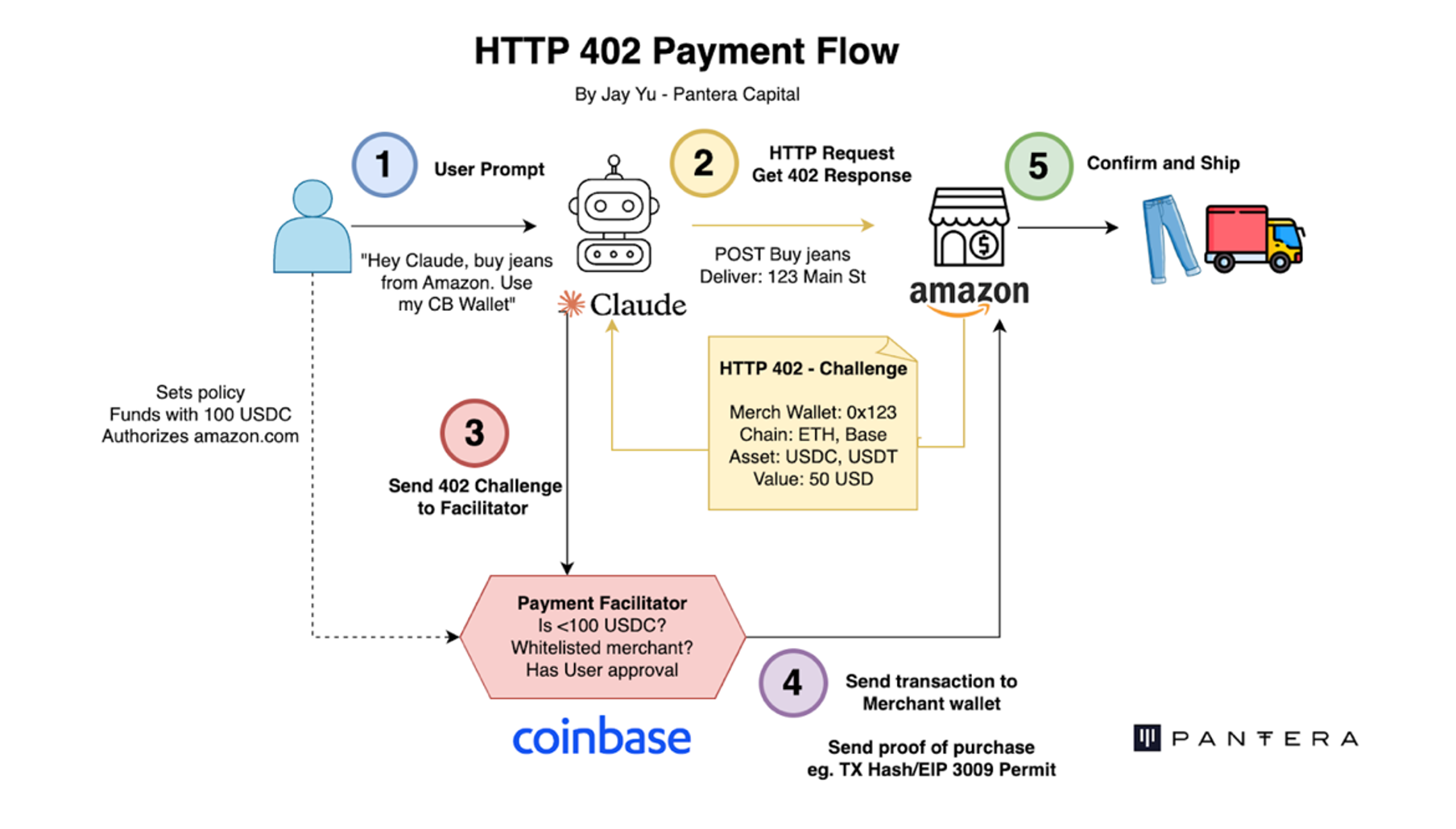

Technical architecture of HTTP 402 payment flow

With these advances in stablecoins and blockchain rails, HTTP 402 is getting a modern makeover. Coinbase and Cloudflare has recently pioneered the x402 standard for agentic payments, revamping HTTP 402 to allow a user to purchase a fridge or research article with a single prompt, using stablecoins as the medium of transaction.

Jay Yu sharing our thesis on x402 with students, founders, builders at UC Berkeley

This past week, I hosted a discussion session with Blockchain at Berkeley on x402, where we brought together students, founders, and researchers to discuss the vision and technical architecture of x402. We also outlined several exciting opportunities for builders in the space, such as:

1. Client-side integrations: what does the UI for the end user look like?

2. Vendor integrations: how can we allow AI agents to buy things from more platforms across the Internet?

3. Facilitator creation: how can we create the payment gateways so that AI agents can pay for these goods and services using HTTP 402?

4. Underlying stablecoin rails: how can we make these payments faster, smoother, and cheaper?

Many of our portfolio companies are already making great strides to address all of these challenges. NEAR intents, for example, abstracts complex transactions behind a single user prompt to provide a better client-side experience. Pinata allows for any AI agent to use x402 to buy IPFS storage space online. Openmind takes x402 into the realm of robotics, allowing robots to pay each other for collaborative services. Coinflow is becoming a leading solution to processing the underlying stablecoin payments.

As AI agents seep into our everyday lives, we believe they will reimagine ecommerce – we can easily see a world in which AI agents not only recommend what to buy, but also buy them on our behalf over stablecoin rails.

And along the way, we may finally absolve the Internet of its “original sin,” creating an open, peer-to-peer system of money just as programmatic as the Internet itself.

Read our full HTTP 402 thesis here.

![]()

FIRST SOLANA STAKING ETF LAUNCH BY BITWISE

By Erik Lowe, Head of Content

Congratulations to our partners at Bitwise on launching the first Solana staking ETF in the US. They had a record-breaking first week, taking in $417mm of inflows, leading all crypto ETPs and ranking 16th overall in flows across all ETFs globally.

Incredible work by Hunter, Hong, Matt, and the entire team for executing on their vision!

DATs vs ETFs :: Cosmo Jiang on CNBC Fast Money

As institutional and retail investors adopt digital assets, DATs and ETFs offer distinct strategies. DATs actively manage to maximize tokens per share. ETFs passively track the market.

Pantera General Partner Cosmo Jiang, who recently joined the board of Solana Company (HSDT), appeared on CNBC Fast Money to discuss the differences between the two vehicles:

“When people think about digital asset treasuries versus ETFs, like ‘why would I own a bitcoin in a box if I could just own a passive ETF?’ It really comes down to active management versus passive. DATs are all about giving you active management, whereas ETFs – they’re great for a lot of people – but they’re passive.

“There’s a way to add a lot of value through active management, whether that’s through marketing the token, advocacy, capital markets strategies, or just simply buying and selling more intelligently than passively.

“I believe over time that some of these digital asset treasuries, like HSDT, can really outperform the underlying token if they execute well.”

– Cosmo Jiang, General Partner, Pantera

![]()

REAL VISION PODCAST

Recap by Erik Lowe, Head of Content

Dan joined his long-time friend Raoul Pal on Real Vision for a discussion of the macro backdrop and what it means for crypto. They covered topics like:

– Global debt trap and fiat debasement

– Inflation and housing affordability

– Institutional adoption and portfolio allocation

– Tokenization and the future of capital markets

Below we’ve provided key takeaways and perspectives. You can watch the full recording here.

Institutional Inertia and the Path to Adoption

“You know, there are all these headlines and marketing decks about institutional adoption of crypto. And obviously, we’ve made huge strides in the last 10 years, but in the grand scheme of things, it’s still early. There’s just a lot of institutional inertia. If you look at the big wirehouses and banks and asset managers, it takes time for them to move. But they are moving. That’s the important part.”

A $100 Trillion Opportunity

“The really exciting thing is that we’re not competing for a tiny sliver of the pie anymore. Crypto isn’t just this sideshow asset class that a few tech-savvy investors dabble in. We’re talking about a real chance to rewire global finance – to digitize money, assets, contracts. That’s a hundred trillion-dollar opportunity. We’re in the first innings.”

Bitcoin ETF Catalyst – But Still the First Step

“Spot Bitcoin ETFs were a huge milestone. They took a decade, but they’re here. And that legitimizes the space for a whole new class of investors. But if you think that’s the endgame, you’re missing the point. That’s just the entry point. Tokenized treasuries, stablecoins, onchain funds – that’s where the real disruption happens.”

The Innovation is Distribution

“People always focus on the product—like tokenized Apple stock or tokenized bonds—but the real innovation is distribution. You can give anyone, anywhere, access to U.S. treasuries. That’s a huge shift. Tokenization is really about making markets more global, more liquid, more accessible. That’s the value unlock.”

Crypto = The Infrastructure Layer for Global Capital

“What excites me most is that crypto is finally being seen as infrastructure. Not just a speculative trade. It’s the rails for money movement, for ownership, for compliance, even. This is the next evolution of the financial system.”

Watch the full recording here.

![]()

“I have to say Paul, Dan, Franklin, and the team have just been absolutely instrumental for us. We would not be here today without these guys. They honestly believed in us in a time that very few people even believed in crypto. I remember during our series A, we heard a lot of ‘Bitcoin’s not going to be a thing, crypto’s not going to be a thing. AWS for crypto is not a thing.’ And now everyone says, ‘Oh, I didn’t say that. I didn’t say that. That wasn’t me. That was my other partner.’ ”

– Nikil Viswanathan, Co-Founder and CEO, Alchemy, Pantera Blockchain Summit 2025

Not us. We’ve been ALL IN since 2013. Three -85% crypto winters…four bubbles…the whole ride.

We think there are decades of compelling returns still to come.

“Put the alternatives back in Alts”

PANTERA CONFERENCE CALLS[2]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

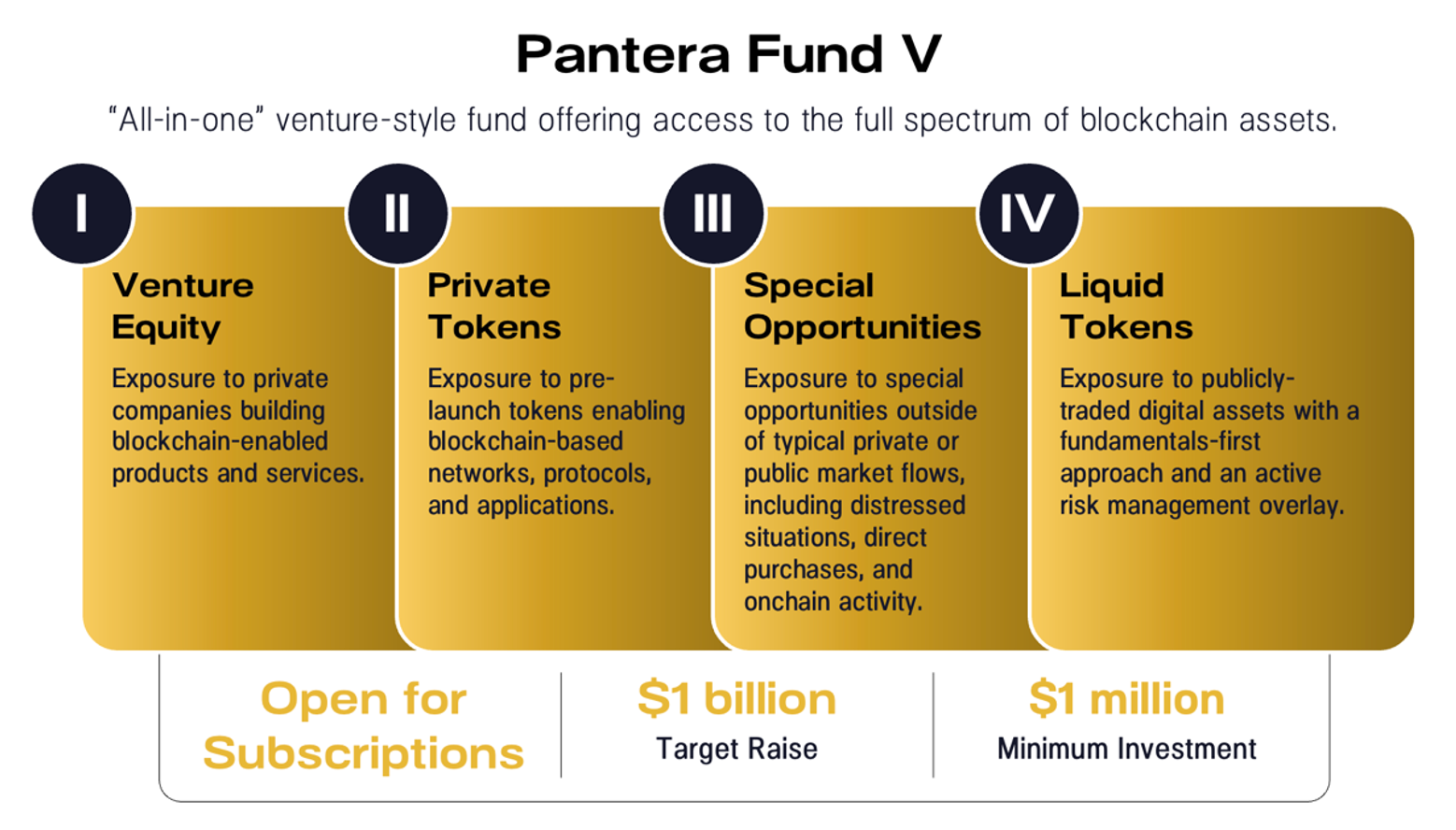

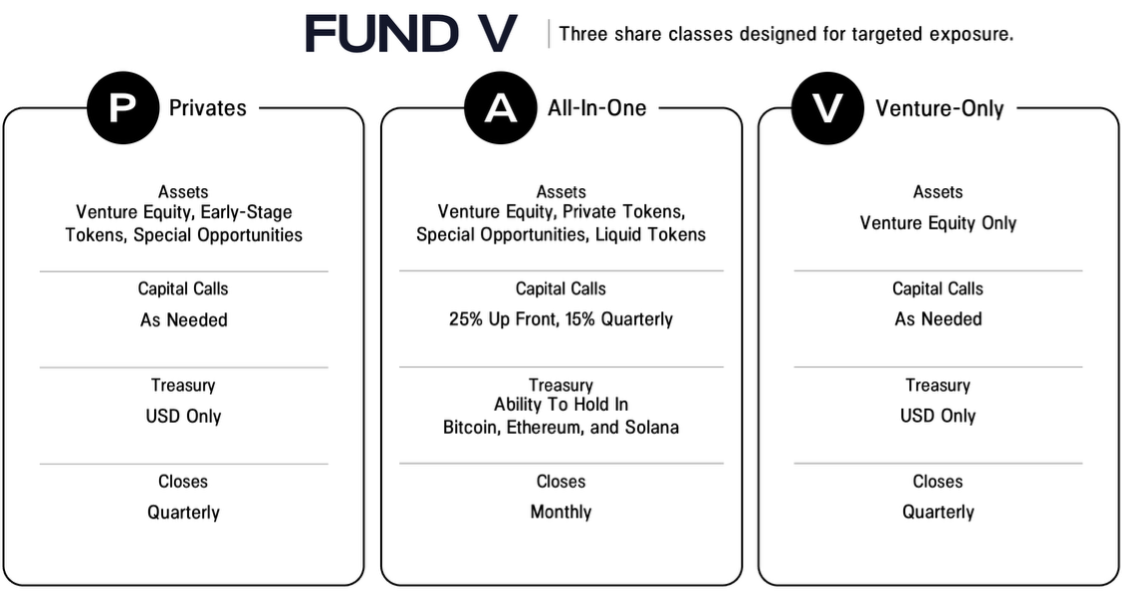

Pantera Fund V Call

A deep dive on the compelling investment themes in blockchain and how Fund V is structured to capture value in the evolving digital asset landscape.

Tuesday, December 9, 2025 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Liquid Token Fund Investor Call

Tuesday, January 6, 2026 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Early-Stage Token Fund Investor Call

Tuesday, February 10, 2026 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Fund V Call

A deep dive on the compelling investment themes in blockchain and how Fund V is structured to capture value in the evolving digital asset landscape.

Tuesday, February 24, 2026 12:00pm Eastern Standard Time / 18:00 Central European Time / 1:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PANTERA FUND V

We’ve found that most investors view blockchain as an asset class and would prefer to have a manager allocate amongst the various asset types. This compelled us to create Pantera Blockchain Fund (IV) in 2021, a wrapper for the entire spectrum of blockchain assets. Its successor — Pantera Fund V — is now open for subscriptions.

Similar to its predecessor, we believe this new fund is the most efficient way to get exposure to blockchain as an asset class. It is a continuation of the strategies we have employed at Pantera for twelve years across twelve venture and hedge funds.

Limited Partners have the flexibility to invest in just venture (Class V for “Venture”), or in venture, private tokens, and locked-up treasury tokens (Class P for “Privates”), or the all-in-one Class A.

As in all previous Pantera venture funds, we strongly support helping our LPs get access to private deals in this fund. Fund LPs with capital commitments of $25mm or more will have the option to collectively co-invest in at least 10% of each venture equity, private token, and special opportunity deal that the Fund invests over $10mm in. There is no management fee or carried interest on co-investments for those with co-investment rights.

We will endeavor to offer co-investment opportunities, on a capacity available-basis, to other LPs as well. These co-investment opportunities are subject to 1/10% fees.

We are now accepting subscriptions for Fund V. If you’re ready to invest, please click the button below to begin the process.

If you are new to Fund V and would like to receive additional information, click here. We also invite you to join our next call on Pantera Fund V on Tuesday, December 9, at 12:00pm Eastern Time. You may register here.

Pantera donates 1% of revenue from all new funds to 1% For The Planet.

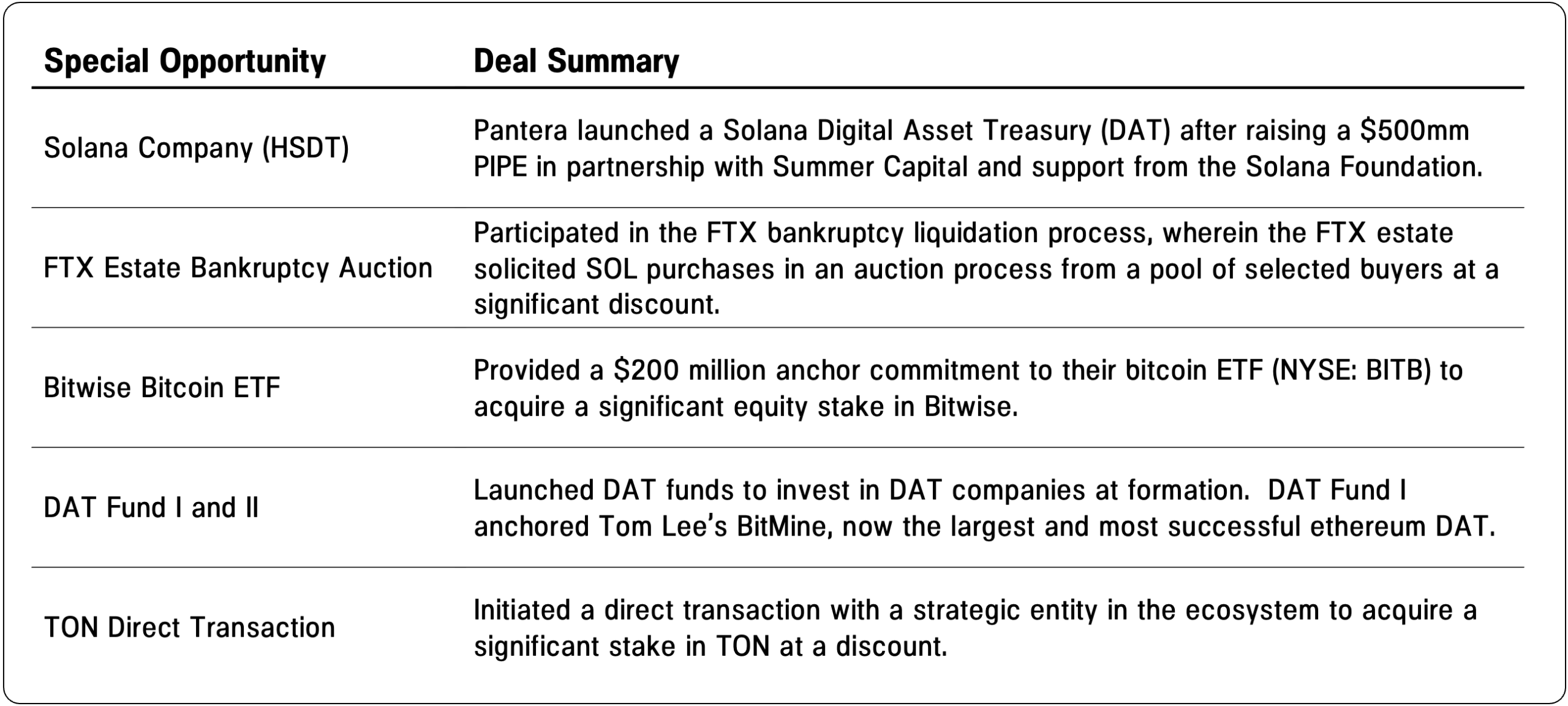

PANTERA SPECIAL OPPORTUNITIES

Pantera Special Opportunities Funds allow investors to gain access to event-driven, special situation dealflow.

With more than twelve years of experience investing across the blockchain ecosystem, we leverage our expertise, deep network, flexible capital structure, and industry leadership to identify and execute on distinctive opportunities. Below are examples of special opportunities we’ve engaged in.

For those who are interested in being notified of future Special Opportunities, please register your interest here.

PORTFOLIO COMPANY OPEN POSITIONS[3]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Below are open positions that our portfolio companies are actively hiring for:

Subzero/Rialo – Engineering Manager – (Remote)

Meanwhile – Engineering Lead – (San Francisco)

Wintermute – Business Development & Partnerships Director (New York)

M^0 – VP of Marketing (New York)

Nexus – Head of Security (San Francisco)

0x Labs – Head of GTM (Remote)

Offchain Labs – Corporate Counsel (Remote)

Ondo Finance – VP of Finance (Remote)

Starkware – Technical Product Manager (Netanya, Israel)

Symbiotic – Senior Blockchain Engineer (Remote)

Ton Foundation – Head of Social Media (Remote)

Tiplink – Product Manager (New York)

Altius Labs – DevOps Engineer (Remote)

Sahara Labs – DevRel Engineer (Remote)

Avantis Labs – Fullstack Engineer (Remote)

Morpho – Product Lead (Remote)

Bitso – Growth Marketing Lead (Mexico)

Alchemy – Engineering Manager, Front End (San Francisco)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

Investment Analyst, Liquid Strategies – (New York City)

Director, Capital Formation – US East – (New York City)

Senior Director, Capital Formation – Gulf Region – (Abu Dhabi)

Senior Director, Capital Formation – Asia Pacific – (Asia Pacific)

Head of Capital Formation – (New York City)

Capital Formation Associate – (New York City)

Cybersecurity and Technology Analyst – (New York City)

Executive Assistant – (New York City)

Operations Associate – (San Francisco)

Executive Assistant to the Founder, Managing Partner – (San Juan)

Executive Assistant to the Founder, Managing Partner – (New York City)

If you have a passion for blockchain and want to work in New York City, San Francisco, San Juan, Abu Dhabi, or APAC region, please follow this link to apply. Some positions can be done remotely.

[1] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Partners LP and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically-marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

[2] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[3] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.