FIGURE GOES PUBLIC[1]

I’ve known Mike Cagney for decades, since our days managing Macro hedge funds in San Francisco.

Every conversation I’ve had with him I’ve been absolutely captivated by his understanding of where the future will be – and what he’s doing to personally create it. I struggle to take in all he says!

His understanding of the Global Macro markets was amazing.

I then watched he and three co-founders create a new lending model with SoFi.

We met in 2017 as he was beginning to create Figure with his co-founder June Ou. I vividly remember that meeting as he described exactly how to change finance. One of the four or five massive disruptions he planned was building a Layer 1 blockchain to reinvent the mortgage market.

I had started trading as a mortgage-backed securities trader in the 80’s when there were literally cardboard boxes of whole loans stacked up – a very visible reminder of how inefficient financial markets were. (They really still are – and that’s why Figure’s going to crush it!)

For the past few years I’ve had the privilege of serving on the board of Figure Markets. Frankly I’m not sure how much I’ve contributed. In board meetings I mainly sit mesmerized listening to his fast-talking description of the future that Figure is creating.

Well, they’ve arrived. Figure has executed exactly what he said in 2017.

They’ve done $17bn HELOCs (Home Equity Line Of Credit) on the Provenance blockchain. That places them second behind only Ethereum in Total Value Locked (TVL).

Eight years later other payments companies are just announcing interest in Layer 1s: Stripe’s Tempo, Circle’s Arc, Google, etc.

Figure was just so far ahead of everyone in seeing – and creating the future.

Today they went public.

I’m so proud of them – Mike Cagney, Michael Tannenbaum, June Ou, their entire team, and my partner helping on this deal, Ryan Barney. Congrats!

Figure and the Future of Real-World Assets

By Mike Cagney, Co-Founder and CEO of Figure and Ryan Barney, Partner at Pantera Capital

Note: This piece blends my (Ryan’s) perspective with excerpts from Mike Cagney’s founder letter to highlight the vision behind Figure and the significance of the IPO. You can read Mike’s full letter here.

Today’s IPO isn’t just a milestone for Figure — it’s a watershed moment for blockchain.

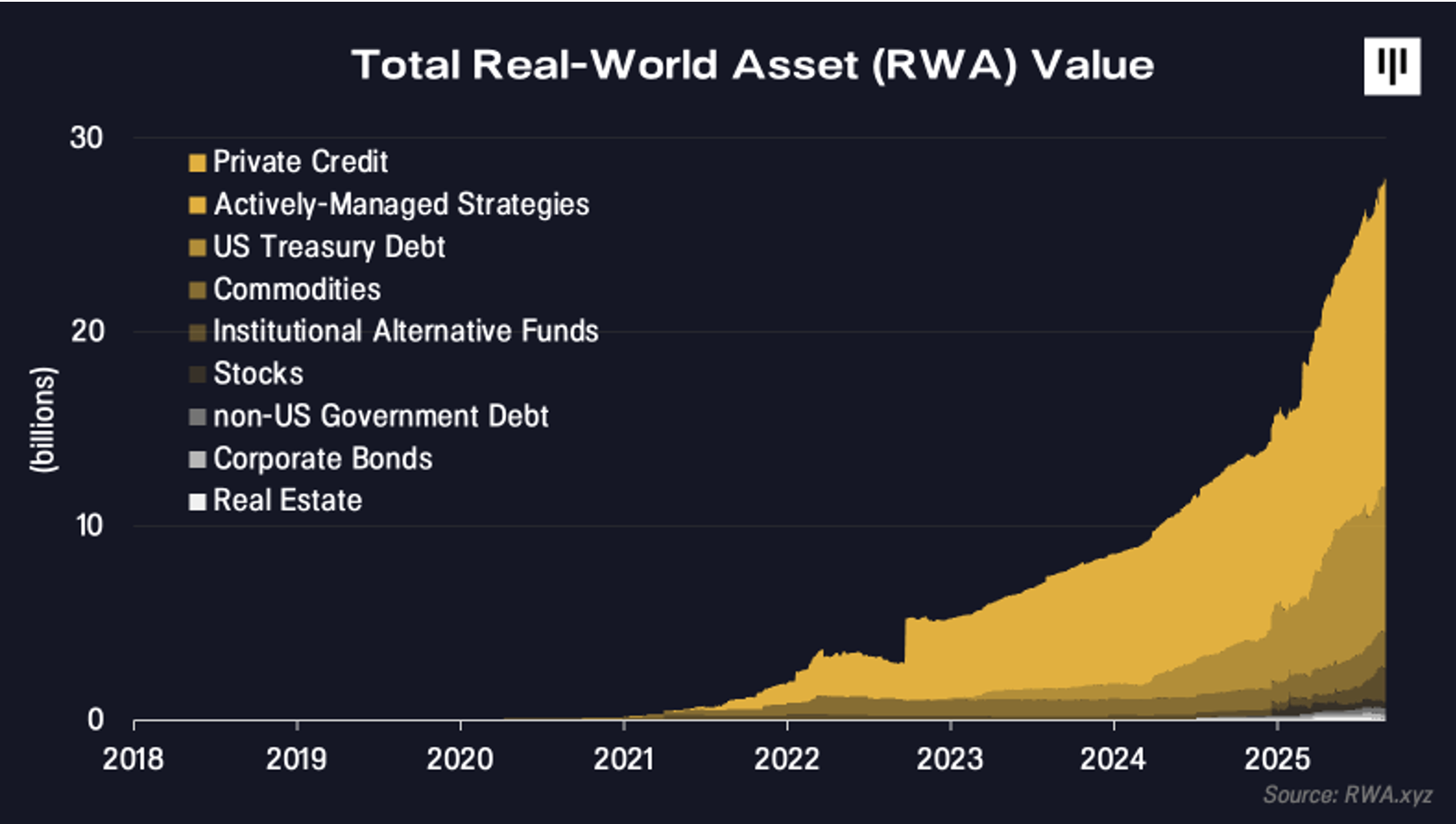

For years, we’ve argued that the most powerful use cases of blockchain are the ones that touch the real economy. Stablecoins are a breakout example. We believe real-world assets are another. Just look at RWA.xyz: the market has grown nearly fivefold in the past three years to over $28 billion on-chain, and the projections are staggering — tens of trillions of dollars of assets tokenized by the next decade.

“At the tail end of 2017 I had my ‘aha’ moment on blockchain. … The ability to create a native digital asset, where everyone knows true ownership, composition and history without trust. Where the asset can transact real time, bilaterally, without counterparty or settlement risk. Where lenders can get immediate and true digital perfection and control of collateral. Blockchain completely reinvents how assets are originated, traded and financed.”

Within that, Figure stands apart. Mike Cagney and his team weren’t content with abstract pilots or theoretical white papers. They built. They originated loans directly on-chain, they ran the first blockchain securitization, they earned the industry’s first AAA-rated securitization. Since inception, they’ve originated over $17 billion in loans and facilitated more than $50 billion in public blockchain transactions.[2] Along the way, they became the largest non-bank HELOC lender in the United States — not by using blockchain as a buzzword, but by proving it could solve inefficiencies that had plagued capital markets for decades. To do this, they actually built their own Layer 1 Blockchain, Provenance.

“In 2018, the predominant blockchains were built on proof of work. Proof of work faced real challenges for adoption in financial services, including cost, speed and most importantly, predictability. Proof of stake was beginning to gain momentum by addressing these issues… June and her team built and launched Provenance Blockchain, a public, proof of stake decentralized blockchain built for financial services.”

The results are showing up in the numbers. Figure generated $339 million in adjusted net revenue in 2024 with topline growth north of 60%, and in the first half of 2025 reported $191 million in revenue and $29 million in profit. That combination — high growth and real profitability — is still rare in fintech, let alone in blockchain. And the engine is only getting stronger: in Q2 this year, Figure processed over $2 billion in loan volume, with nearly half coming through Figure Connect, its partner marketplace where third parties originate directly into blockchain capital markets.

“Blockchain can do more than disrupt existing markets. By taking historically illiquid assets – such as loans – and putting these assets and their performance history on-chain, blockchain can bring liquidity to markets that have never had such. That liquidity – coupled with the ability to achieve true digital perfection and control of the asset – opens financing opportunities that weren’t accessible before.”

“We quickly expanded our model to B2B2C – where we now have over 168 third parties using our technology to originate loans on-chain – including half of the top 20 retail mortgage shops.”

What’s most impressive is the vision driving it all. Mike has always had the ability to see around corners — and in this case, around multiple corners at once. YLDS, the SEC-approved yield-bearing stablecoin, is one such example: a regulated, blockchain-native product that connects the demand for yield with trillions of dollars in global liquidity. It’s a preview of what happens when capital markets are rebuilt on programmable rails.

“In 2022 and 2023, a $1 trillion outflow of bank deposits nearly crippled the financial system. If the Treasury is right in size and scope of flows, something needs to step in to fill that void. We believe that is DeFi, and we are leading the way here in RWAs.”

We often talk about the “Magnificent Seven” of tech companies in Web2. Mike and us believe we’re at the beginning of a comparable cohort in Web3 — and Figure will be one of them. The reason is simple: they are proving that blockchain can re-architect the foundation of capital markets, not just disintermediate a few steps.

“Just as there is a Magnificent Seven of stocks in web 2.0 today, I believe there will be a comparable set of companies representing blockchain technology in web 3.0. Our IPO moves us closer to being a leader in that peer set. While we have been able to build a profitable, rapidly growing company built on blockchain in one of the most difficult regulatory environments possible, we are incredibly optimistic about how the regulatory changes and public market acceptance of blockchain will drive the industry – and the opportunity – in the coming years.”

– Mike Cagney, Founder Letter

That is the future of credit, of securities, and ultimately, of finance itself.

Congratulations to Mike, Michael, June, Macrina, Todd, Ron, and the entire Figure team. This IPO is a milestone — but also just the opening act in a much larger transformation of global markets. We are so excited to continue on this journey!

![]()

Figure IPO Stats

Capital Raised $787.5mm

Target Price Range: $18-20

Priced: $25

IPO valuation: $5.3bn

Opened for trading at: $36

Opening valuation: $7.6bn

![]()

PANTERA’S THIRD PORTFOLIO COMPANY IPO THIS YEAR[3]

In addition to Figure, two other Pantera portfolio companies have gone public this year – Circle and Amber – bringing our total to four portfolio companies that are now trading on public exchanges, with more potentially on the horizon.

This year has been defined by the public equity market’s embrace of crypto, following years of regulatory uncertainty in the US that essentially held our industry back. What may look like sudden euphoria in the public equity markets is, in fact, the release of a six- to eight-year backlog of companies now being allowed to go public.

![]()

SALT WYOMING BLOCKCHAIN SYMPOSIUM 2025 :: PANEL HIGHLIGHTS

I spoke at SALT Wyoming Blockchain Symposium last month on the institutionalization of digital assets. The breadth of attendees was incredible to see, emblematic of the industry’s maturity. The huge change was the positive engagement and presence of multiple U.S. Senators, Fed Governors, the SEC Chairman, and other regulators. So good to see them engaging with the industry and their constituents.

The SALT event coincided with the Fed’s annual Jackson Hole conference, where central bankers from around the world gather.

I wanted to share some of my dialogue from the conversation.

How institutions’ perspectives on blockchain have evolved since 2013

“I think the way that I visualize it is there used to be an incredibly long list of reasons to say no. There’s no custodian, there’s all these [other reasons], and we’ve really crossed all of them off. And the last one was regulatory clarity, which was a code word, but it really was just one agency in one country. All 200 other countries were pretty neutral on blockchain and all the rest of the agencies in the US, like the IRS ruled on Bitcoin in 2013. It’s been great. It was really just the SEC that was making it very scary for entrepreneurs to build things in the US.

“And so I think the election last November is a massive unlock because it takes that regulatory uncertainty off the table. We’ve already gotten the stablecoin legislation done, working on the market structure legislation. And I think that is literally the last reason to say no to crypto is that old issue. And once that’s off the table, I think institutions will come in greater force. And the point I love making is the median holding of cryptocurrencies and blockchain venture of the institutional investor out there is 0.0, right? The majority still have zero exposure to the space. So this hasn’t even started, we got decades more.”

The case for blockchain venture capital evidenced by Pantera’s track record

“I think the irony is there’s this perception that blockchain is super scary and risky. The reality is literally the polar opposite, that we’ve been investing in venture companies for 13 years, and in the real world, 70% go broke and a couple do okay and one helps your fund make 1.7x on average. In our experience in blockchain, we’ve made money on 86% of the things we’ve invested in, and partly it’s because our team’s very good and we work really hard, but it’s partly in a great space, a rising tsunami is floating all boats. You have some exposure to this space. Anyone in the audience that still hasn’t invested in this space. It has a 0.1 correlation with the S&P 500, and on average Bitcoin has roughly doubled for 13 years every year. That is the dream asset to have in a portfolio, and so I think that’s the one thing we’re trying to help institutions.

“And the other one is the IPO pipeline in the normal world’s been stuck for four or five years, so investors in private equity haven’t gotten any capital back for a long time, whereas in the blockchain space everything happens so much faster. We’ve returned all of our venture fund’s capital within four years and then typically multiples within five or six. And that just isn’t happening in the normal private equity world. So that’s the other thing we’re trying to help institutions see is that we’ve been able to recycle 3 billion in cash back to people, a hundred thousand bitcoins, and help them get money to put into the next fund.”

Why the equity markets have been embracing crypto

“I actually don’t think so. The way I think about it is the regulatory issues in the US essentially held our industry back for six or eight years. The potential euphoria you might be suggesting in the equity side of our business is really just a result of eight years of things that are been stuck in the pipeline coming out. And so things like Circle surged and MicroStrategy and all those things, but I think it’s just a natural reaction to having been repressed for so long that they’re surging up. But over the next couple of years, like you said, there’re going to be a bunch of companies go public and try and satiate all that demand. I think it’s just a natural demand for this new asset class. And again, with the median institution having 0.0, it is not a bubble. There are so many people that have yet to get any exposure. And I do think these digital asset treasury companies are a great example of how there’s just an incredible demand in the public markets to get exposure to this really dynamic space to get these great returns and supply will… I just don’t see what the risk is. And hey, in the real world, banks blow up every 15 years. All kinds of problems happen in the normal world, but I don’t worry about it in crypto right now.”

Why education is important for addressing cryptocurrencies as an investment opportunity.

“Yeah, I would say if you haven’t addressed cryptocurrencies, you really should. I’ve been doing this for 13 years and so many people have been so skeptical and all these very, very, very shallow reasons to be dismissive of it. But if someone actually spends a couple of days reading about it, the virality rate is 99% when someone actually does the work, and this is my favorite example, is there are a bunch of Warren Buffett type people that do these: ‘It’s rat poison’ kind of lines. I’ve been asking for this for 13 years, never found it, a multipage paper that’s negative on crypto. There’s no intelligent person that’s ever sat down written a multipage paper that’s negative. And even a lot of the haters now, there’s a lot of famous Wall Street people that used to be haters that are now selling bitcoins to their customers. And so if you haven’t, if you’re negative, if you are stuck on it, just spend the time, read a couple of papers and 99% of people go, “Oh man, I got to buy some of that.”

– Dan Morehead, SALT Wyoming Blockchain Symposium 2025

![]()

JOINING PANTERA AS PRESIDENT

By Scott Lawin, President

I’m thrilled to announce that I’ve joined Pantera Capital Management as President.

A pioneer in the digital asset space since 2013, Pantera Capital has played a pivotal role in the industry’s development and evolution by supporting visionary founders and backing more than 20 blockchain unicorns such as Coinbase, Circle, Arbitrum, Bitstamp (acuired by Robinhood), Ondo Finance and Figure. [4] It is a true honor to partner with Dan Morehead and the entire Pantera team to shape the next chapter of the firm’s growth. With mainstream adoption of crypto and blockchain on the rise, the opportunity to build, innovate, and deliver long-term value for investors and the broader ecosystem has never been greater.

As we chart the path forward, my focus will be building on Pantera’s strong foundation, fostering deeper partnerships, and continuing to champion the entrepreneurs who are defining the future of finance and technology.

Excited for what’s ahead!

![]()

Scott was a COO at Fortress, Pantera’s largest Day One investor. Not in the blockchain era…the original launch in 2004!

I’ve worked with him a great deal over the decades – while he was Fortress, Moore Capital, and recently as CEO of the digital asset company Candy. I’m excited to be partnered with Scott.

![]()

Let’s go blockchain IPOs!

This is really such a coming out moment for blockchain industry.

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[5]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Pantera Fund V Call

A deep dive on the compelling investment themes in blockchain and how Fund V is structured to capture value in the evolving digital asset landscape.

Tuesday, September 16, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Liquid Token Fund Investor Call

Tuesday, October 14, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Venture Fund II Investor Call

Tuesday, October 21, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Venture Fund III Investor Call

Tuesday, October 28, 2025 12:00pm Eastern Daylight Time / 17:00 Central European Standard Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Blockchain Fund (IV) Investor Call

Tuesday, November 4, 2025 12:00pm Eastern Standard Time / 18:00 Central European Standard Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Early-Stage Token Fund Investor Call

Tuesday, November 11, 2025 12:00pm Eastern Standard Time / 18:00 Central European Standard Time / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Fund V Call

A deep dive on the compelling investment themes in blockchain and how Fund V is structured to capture value in the evolving digital asset landscape.

Tuesday, December 9, 2025 12:00pm Eastern Standard Time / 18:00 Central European Standard Time / 1:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PANTERA FUND V

We’ve found that most investors view blockchain as an asset class and would prefer to have a manager allocate amongst the various asset types. This compelled us to create Pantera Blockchain Fund (IV) in 2021, a wrapper for the entire spectrum of blockchain assets. We are now opening its successor — Pantera Fund V — for subscriptions.

Similar to its predecessor, we believe this new fund is the most efficient way to get exposure to blockchain as an asset class. It is a continuation of the strategies we have employed at Pantera for twelve years across twelve venture and hedge funds.

Limited Partners have the flexibility to invest in just venture (Class V for “Venture”), or in venture, private tokens, and locked-up treasury tokens (Class P for “Privates”), or the all-in-one Class A.

As in all previous Pantera venture funds, we strongly support helping our LPs get access to private deals in this fund. Fund LPs with capital commitments of $25mm or more will have the option to collectively co-invest in at least 10% of each venture equity, private token, and special opportunity deal that the Fund invests over $10mm in. There is no management fee or carried interest on co-investments for those with co-investment rights.

We will endeavor to offer co-investment opportunities, on a capacity available-basis, to other LPs as well. These co-investment opportunities are subject to 1/10% fees.

We are now accepting subscriptions for Fund V. If you’re ready to invest, please click the button below to begin the process.

If you are new to Fund V and would like to receive additional information, click here.

Pantera donates 1% of revenue from all new funds to 1% For The Planet.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

-

Director, Capital Formation – US East – (New York City)

-

Senior Director, Capital Formation – Gulf Region – (Abu Dhabi)

-

Senior Director, Capital Formation – Asia Pacific – (Singapore)

-

Head of Capital Formation – (New York City)

-

Capital Formation Associate – (New York City)

If you have a passion for blockchain and want to work in New York City, San Francisco, San Juan, Abu Dhabi, or APAC region, please follow this link to apply. Some positions can be done remotely.

[1] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Partners LP and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically-marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

[2] Mike Cagney’s Founder Letter

[3] Pantera’s portfolio consists of over 260 portfolio companies.

[4] A “unicorn” is defined as a private or public company or protocol with a value over $1 billion. Once unicorn status is achieved, its sustainability may be subject to change. There can be no assurance that investments made in the future will have similar characteristics or results. A comprehensive list can be provide upon request. “Unicorn status” is not a proxy for investment performance, and such status does not account for the timing of any Pantera investment or take into account the structure, holdings, transaction history, or other relevant considerations, each of which are critical aspects of investment performance.

[5] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.