Table of Contents

1. The Great Onchain Migration

3. CNBC The Exchange Interview

THE GREAT ONCHAIN MIGRATION[1]

By Franklin Bi, General Partner

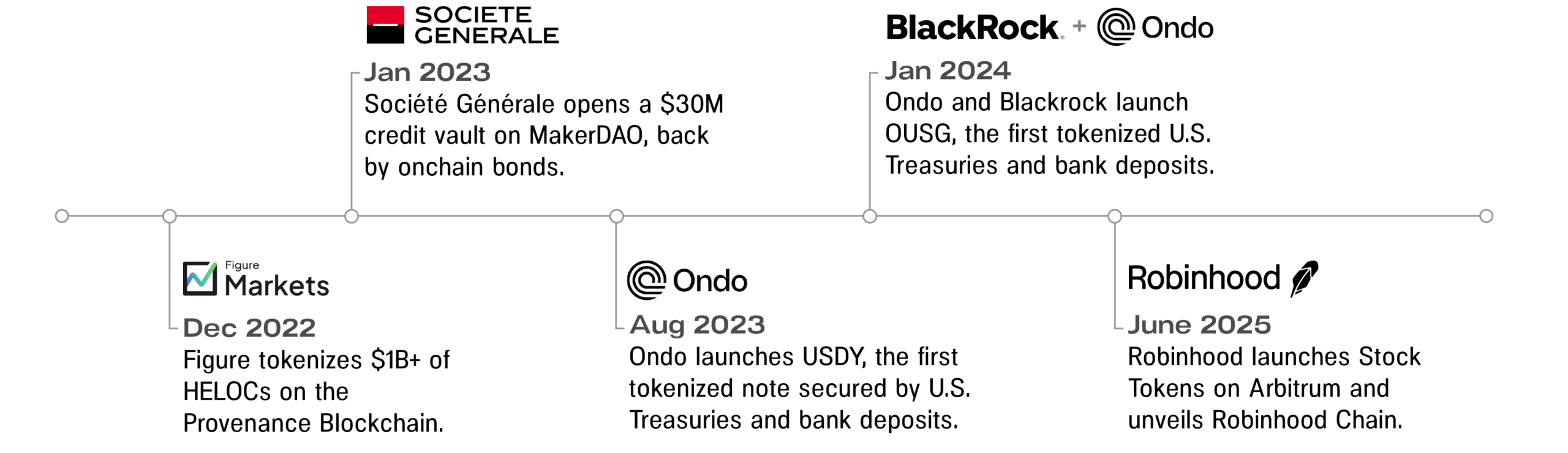

In 2025, tokenization crossed from concept into inevitability.

It’s been nearly a decade since I helped draft J.P. Morgan’s initial designs for asset tokenization. At the time, the idea that securities could settle on public infrastructure felt radical. But one thing was clear: once the rails became programmable, the structure of capital markets would eventually follow.

Today, that hypothesis is playing out at hyperspeed.

More than $24 billion in real-world assets now exist on public blockchains, up more than 3x since the start of 2023. Nearly 200 issuers, from BlackRock and Franklin Templeton to Siemens and J.P. Morgan, have placed real capital onchain. Fintechs aren’t satisfied being modern interfaces for legacy rails anymore; they’re building the new rails themselves. And for the first time, corporates are issuing on public blockchain infrastructure.

Several weeks ago, Robinhood broke new ground in announcing the launch of Stock Tokens: tokenized stocks, ETFs, and private company shares issued on Arbitrum, the leading Layer 2 on Ethereum. CEO Vlad Tenev shared his company’s ambition to build Robinhood Chain, an Arbitrum-powered network optimized for 24/7 global trading of tokenized assets.

A deeper shift is underway. The infrastructure of capital markets is moving onchain. And with it, the strategic playbooks of fintechs, corporates, and investors are being rewritten in real time. We’re witnessing a mass migration of assets, issuers, and investors to the next generation of infrastructure for moving, clearing, and valuing capital assets.

A gravity well is now forming around early liquidity flows into tokenized assets. We believe it will pull the center of gravity for price discovery, capital formation, and liquidity away from Wall Street’s ancient pipes and onto modern blockchain rails.

The question now is: what happens next?

Financial Physics in Motion

If Isaac Newton worked on Wall Street, I believe his first law of financial physics would be:

“Assets will move in the direction of least resistance (unless acted upon by regulation).”

In other words: Assets will eventually flow to where they can:

1. Move most freely (global access, 24/7, software speed)

2. Trade most cheaply (minimal middlemen, software costs)

3. Be valued most completely (global price discovery, maximum utility and composability)

Blockchains are finally making that possible. I’ve watched this migration unfold from inside a global bank at J.P. Morgan and across the venture ecosystem at Pantera. What looked impossible to my Wall Street colleagues in 2015 is now operational and accelerating.

Like eurodollars in the ‘60s, ADRs in the ‘90s, or ETFs in the ‘00s, the liquidity for tokenized assets will pool first on the margins and then cascade toward the center. Tokenized treasuries, private credit, and now equities are the early signals:

Today, Figure has processed over $41 billion in RWA transactions and holds $13 billion onchain today, including the first publicly rated HELOC ABS issued natively on blockchain rails. Ondo has issued $1B+ in tokenized Treasuries and is now expanding to tokenized equities through Ondo Global Markets, with plans to offer 1,000+ tokenized NYSE and Nasdaq stocks.

Tokenization is expanding the footprint of capital markets to be truly global for the first time. We believe the most desirable issuers will follow liquidity and access global capital pools in one click, made possible only through onchain settlement. The most forward-thinking investors will demand portability, transparency, and the utility that only onchain primitives can offer.

The New Fintech Playbook

The winning playbook for disruptive FinTechs used to be: “Become the bank before the bank becomes you.”

Tokenization has unlocked a new way to win. Don’t become a bank. Become the infrastructure.

Robinhood’s recently announced launch of Robinhood Chain is a blueprint. Rather than compete on front-end UX or margin rates, Robinhood is turning its user base into liquidity for its own blockspace.

Here’s how Robinhood’s CEO and his team described the Robinhood Chain:

“This is the first blockchain with the technology and regulatory infrastructure needed to carry the entire traditional financial system on its back into the future…. Our goal with stock tokens on the Robinhood Chain is that in the near future, you will be able to seamlessly transfer your assets in seconds and your ability to trade will not be reliant on any individual broker or counterparty.”

Wait, but reducing reliance on brokers would hurt Robinhood’s core business as a digital brokerage, right?

Not if it gives them the opportunity to transform the entire capital markets stack and re-position themselves as a dominant, vertically-integrated platform. The logic is simple: If you own the distribution (users), and the interface (app), why wouldn’t you also serve as the rails (infrastructure)?

Historically, Robinhood and other platforms have suffered from:

– A permanent storage tax paid to custodians and central depositories,

– Slow, expensive settlement cycles, enforced by clearinghouses and banks,

– Limited access to new assets, due to bottlenecks from exchanges and legacy rails.

By migrating onchain, Robinhood is escaping the hidden taxes of financial sharecropping and the overhang of legacy infrastructure.

Robinhood isn’t alone in launching its own chain. Coinbase’s layer-2 chain Base is among the fastest-growing ecosystems. It’s also driven over $100 million of revenue to date for Coinbase. But more important, these new corporate chains represent a step towards internalizing the benefits of programmable finance: fees, flows, and future optionality.

In every case, the model is the same: own the sequencer, own the economics. As vertically-integrated market venues, they can capture trading spreads, custody fees, and infrastructure rents that previously belonged to legacy institutions. But owning the sequencer isn’t simply about capturing fees. It’s about owning liquidity, owning distribution, and eventually owning capital formation.

Fintechs that control all three won’t need to ask permission from transfer agents, clearing firms, or exchanges. They’ll launch global capital markets from a wallet app – with composable apps, enforceable rights, and real economic gravity.

With a vertically integrated chain, a fintech business can:

– List tokenized assets as permissionlessly and as easily as an API.

– Monetize transaction volumes more fairly and cheaply, disrupting traditional Wall Street fees with usage-based pricing, as SaaS models have done to many industries.

– Let third-party developers build apps on top of their liquidity flows and asset inventory, such as asset lending, structured products, insurance, and portfolio management tools.

– Demonstrate transparency and programmable controls for regulatory compliance.

Robinhood doesn’t need to build a securities lending desk for tokenized equities. Morpho can deploy on Robinhood Chain, while Robinhood simply routes users to Morpho’s smart contracts. This is an evolution from app developer to platform operator.

We’re entering a new phase of the tokenization cycle, where the most powerful distribution platforms on Wall Street can launch new infrastructure for themselves and become the most desirable venue for trading, payments, and capital formation.

The Re-Platforming of Capital Markets

It’s not just fintechs. Some of the most systemically-important institutions in the world are now issuing and settling assets onchain.

When I departed J.P. Morgan’s blockchain team in 2018, it was partly out of impatience. I assumed corporate adoption of public blockchains would take two more years. That turned out to be ambitious. Seven years later, the inflection point is here.

BlackRock’s BUIDL fund crossed $375 million AUM within six weeks of launch. It now exceeds $2.6 billion and pays USDC-denominated dividends natively on Ethereum. J.P. Morgan’s blockchain platform processes intraday repo trades on a private Ethereum fork, settling collateral in minutes instead of days. In 2023, Siemens issued a €60 million digital bond directly on public Ethereum – no bankers required. Similarly, Société Générale issued a digital green bond on Ethereum in 2023, with participation from regulated institutions like AXA and Generali. Those successful pilots were the early indicators of a coming wave.

Institutions are now waking up to the fact that we no longer need:

– Investment banks to facilitate capital access.

– Correspondent banks to patch together global distribution.

– T+2 settlement cycles that delay liquidity and inflate risk.

Public blockchains offer global reach, instant settlement, and programmable logic. For corporates facing rising capital costs and fragmented investor bases, the ability to issue debt (and eventually equity) at the click of a button and instantly tap into global liquidity is too attractive to ignore.

Fintechs are building chains to own distribution and monetization. Corporates are issuing onchain to lower their cost of capital and expand access.

Both are converging on the same conclusion: Public blockchains are the most credible infrastructure for operating the world’s first truly global capital markets, always on and universally accessible.

Issuing the Right to Travel, but Not to Own (Yet)

Yet most of what’s called “tokenization” today is still incomplete. We’ve built the highways. But the gates into the city center – the courts, the cap tables, the governance – are still locked.

Today, you can trade tokenized stocks and Treasuries onchain. But don’t mistake that for full ownership. Your rights – to vote, inspect, or enforce – remain trapped in offchain constructs: SPVs, custodians, transfer agents. We’ve given investors the right to travel, but not the right to own (yet).

As liquidity grows and investors experience the benefits of their tokenized portfolios, there will be mounting pressure on issuers to extend full shareholder rights to tokenholders. Some investors won’t wait. They’ll tokenize their portfolios themselves, then ask for forgiveness later.

This tension of issuer rights vs. investor rights will likely be one of the definitive battlegrounds during the next decade in tokenization. Who controls shareholder privileges when the asset lives onchain, but the registry doesn’t? What happens when tokenholders want more than transferability and price discovery – when they want the power that comes with true ownership?

As SEC Commissioner Hester Peirce recently put it, the promise of tokenized securities is “enchanting, but not magical.” That promise won’t be fulfilled by wrapping assets in digital form. It will require issuers to shift their mindset towards native onchain issuance, from an experimental sandbox to the default path for accessing global capital pools.

The Tipping Point for Tokenization

The rise of tokenized assets today mirrors the early days of ETFs.

When the first U.S. equity ETF (SPY) launched in 1993, it crossed $1 billion in AUM within a year. But the real inflection point wasn’t its size. It was when ETF volumes began consistently matching and eventually exceeding mutual fund flows. That’s when market structure changed and investor behavior soon followed.

We believe tokenization will hit a similar moment in broad market structure transformation and issuer and investor behavior. I believe that the tipping point arrives when any of the following occur:

– Daily onchain equity volume exceeds $1B, comparable to lower-tier ADRs or long-tail ETFs.

– Tokenized equity AUM crosses $100B, giving confidence to systemic allocators (sovereign wealth funds, pensions, endowments) to embrace tokenization’s benefits in their portfolios.

– A top public company (S&P 500 or Nasdaq 100) see more liquidity onchain than their home exchange or ADR equivalent.

– A global IPO listing bypasses New York entirely and issues onchain directly or in a financial hub with stronger regulatory and policy frameworks for onchain issuance.

Today, we’re still early: Tokenized equities currently trade ~$300M in average monthly volume. But what matters is the acceleration rate. This represents a 350% increase in volume over the past month, with many prominent launches like Robinhood’s Stock Tokens and Ondo Global Markets still in the early stages.

If adoption continues at this healthy pace, the $1B daily volume threshold could be achievable within 2-4 years, depending on a few potential catalysts:

– Regulatory clarity around tokenized asset wrappers and natively-issued onchain equity.

– Financial app-specific chains reaching scale in performance and liquidity, e.g., Robinhood Chain, Ondo Chain, Provenance Blockchain (and certainly more to come).

– Abstraction of UX barriers that bring onchain assets to retail investors without wallets or gas requirements.

– Portable compliance layers that abstract KYC/AML checks and travel natively alongside tokens, unlocking cross-border liquidity safely and compliantly.

When it happens, it will feel obvious in hindsight as tokenization’s “ETF moment.” Today’s early adopters are focused on applying a better set of rails, but the biggest story is the structural shift in the future of capital markets. Once the migration is complete, blockchains will be recognized as the default destination for capital formation, price discovery, and value transfer. The first and last stop for issuers and investors.

Having helped develop some of the earliest blueprints for tokenization, I can say with conviction today: the rails are here, the liquidity is flowing in, and the momentum is real.

The gravity well has formed. Now we watch what gets pulled in.

![]()

PANTERA DAT FUND II

By Jeff Lewis, Product Manager, Hedge Funds, and Erik Lowe, Head of Content

Last month, we launched Pantera DAT Fund to provide investors access to Digital Asset Treasuries (DATs) at formation, leveraging Pantera’s robust pipeline of opportunities. Within a week, the Fund was oversubscribed, and we’ve since been able to fully deploy the capital into high-quality deals.

Our pipeline remains strong, and so we’ve decided to open Pantera DAT Fund II to investors. If you are interested in this fund, please submit your interest by end of day Monday, July 28 using the button below. Alternatively, you can email our team directly at invest@panteracapital.com.

Should interest exceed capacity, we will aim to prioritize allocations based on the order in which commitments are received.

Pantera has been at the forefront of the emerging DAT industry, anchoring the first Digital Asset Treasury company launches in the US, including DeFi Development Corp. (DFDV) and Cantor Equity Partners (CEP). More recently, we were an anchor investor in BitMine (BMNR), where Fundstrat’s Tom Lee serves as chair and is helping shape their ethereum treasury strategy. Pantera currently manages $750mm in DAT exposure, and is one of the largest investors in this space.

The interest we’ve received is emblematic of the equity market’s embrace of digital assets this year – from Coinbase’s inclusion in the S&P 500 to Circle becoming one of the best-performing IPOs of the past five years (up 7.3x). DATs are an extension of this trend, whereby traditional investors are seeking exposure to digital assets through familiar instruments and intermediaries.

We discuss our investment thesis and strategy in more detail here.

The Case For Digital Asset Treasury Companies with Tom Lee :: Thematic Call Highlights

For those who may have missed it, we invited Tom Lee to unpack the investment case for DATs with Cosmo Jiang. The two addressed common concerns surrounding this new industry and argue why DATs may be a superior vehicle for crypto exposure than owning an ETF or the underlying token itself.

Below are highlights from the conversation. The full video can be accessed here.

Cosmo: “What is it about the market setup and market structure today that’s really enabling digital assets to take off now?”

Tom: “When we look at 2025, the market’s leadership is coming from two categories. It’s still AI and the MAG 7 and that complex, but this year the leadership has also surged from crypto-related equities….

“I think what’s happened is that the AI boom is really an enablement in the sense that it has now made it clear to investors that there is a move towards a digital economy. And I think that that has captured the imagination and now investors are very interested in programmable money. And I think that’s where stablecoins have become the ChatGPT story of crypto because we’ve seen mainstream adoption by consumers, merchants, and banks.”

Cosmo: “For Digital Asset Treasuries, what’s the investor demographic seeking that exposure?

Tom: “There has been an eye-opening interest in digital assets by both institutional investors and retail. On the institutional side, I think it’s not only Circle, it’s also MicroStrategy, because MicroStrategy has really changed the nature of convertible markets and debt markets because their issuance – his preferred notes, his convertible bonds, his bond issuances – have been the best performing bonds in their category. If you don’t own his bonds, you’ve been underperforming those broad indices….

“I was surprised just like you. I was like, “When the ETFs come, do you really need a MicroStrategy? Because hey, you can just buy bitcoin at NAV and you buy a bitcoin and it’s always going to be a bitcoin forever, less a small fee.” It turns out that these Digital Asset Treasury companies, and the ones that do it correctly, they’re really in a position to grow your holdings of crypto per share. That is a big advantage versus owning an ETF straight. Because both will rise on price, but one is giving you additional units of that crypto every year.

Cosmo: “There’s this perception that Digital Asset Treasuries are just highly levered crypto plays, but it’s a lot more nuanced. How would you break down the major drivers of DAT performance?”

Tom: “I see five distinct advantages for a crypto treasury, and it all comes down ultimately to a sixth element, which is management. But the first driver is capital markets. That a crypto treasury company, if it trades at a premium, let’s say it trades at two times premium. That means every time they do an equity issuance they’re buying two units for one issued unit that they sold, because that’s the price premium. They’re actually growing your holdings by selling stock, which is a really strange concept, but it’s accretion.

“The second thing that drives that is an ETF holder has a cost of money. Let’s say you went to whoever and had to borrow money, you’d be paying 10%. Well, a crypto ETF number one is a corporation, so they can borrow money cheaper than most individuals, but then the corporation can take advantage of volatility of the crypto and actually lower their cost of money by using convertibles or derivatives, or even the bond market. So, essentially they can borrow money at effectively zero, MicroStrategy is borrowing money at 0%.

“The third advantage is that a public company can actually issue equity. Imagine there’s another Digital Asset Treasury company – let’s say there’s one that, there’s two that have Ethereum, but one’s trading at NAV. The one that has a premium can acquire the one at NAV and then suddenly grow your holdings of ETH per share again.

“And then, another difference is they can actually build an operating company that could in turn grow the holdings per share. For instance, within Ethereum this Ethereum Digital Asset Treasury company could actually be involved in the Ethereum ecosystem and therefore actually accumulate more ETH, and finally they can stake yield.

“But it all comes down to whether the market believes the story. And so I think it really is important that the management team that’s in place has a clear vision about how to achieve all the things I just described. And the ones where markets believe it, I think will trade at meaningful premiums. That’s why the Metaplanets trade at seven times. And I think the ones, especially in a new token space, could really hold onto a five, seven times premium for a long time actually.”

Cosmo: “Yeah, I think the last two pieces that you talked about, this ability to generate yield and participate in growing the ecosystem is something unique to the non-Bitcoin treasury companies.”

Cosmo: “You’ve drawn an interesting analogy to another industry in the past where valuations also were based on the reserve, but it traded above reserve value. What was that and why is that?”

Tom: “There’s some precedents, and I think maybe the easiest one for people to relate to is the oil industry or commodities….”

“The largest stock in 1990 was ExxonMobil, and for 25 years it was a top five stock in the S&P 500. So, for your entire career you would have said, ‘Okay, well the biggest stock in the market is ExxonMobil.’ Here’s the interesting thing. It never traded on earnings, and it only traded on proven reserves and it always traded at a premium to proven reserves. Because investors said, “Hey, this is Exxon. They’re smart, they’re going to drill, they’re going to always find more oil.” So, you always valued it at a premium to its underlying oil holdings.”

Cosmo: “Not all of these Digital Asset Treasuries are created equal. In your mind, what are the qualities and characteristics of a good DAT?”

Tom: “It is really important for investors or equity investors to believe two things about a company. One is that there’s intrinsic value of the operations, and then they believe that the company can then out-earn the cost of capital and therefore they’re going to reward companies….

“And then the second part is that you actually have to find leading investors that are really credible. The challenge in a Digital Asset Treasury company is that you actually have to signal belief in both the crypto world, because they’re going to partner with you, and then the traditional finance world, Wall Street. I think it’s going to be very difficult for many Digital Asset Treasuries to figure out….

Cosmo Jiang: “I’ve probably seen 60 coming on 70 pitches now. And I totally agree with you. One of the most important things is team. It is pretty clear you need the capital markets engine, you need a good marketing engine.”

Cosmo: “BitMine is an Ethereum treasury company. Why did you choose Ethereum?

Tom: “Ethereum to us seemed like the perfect place to start with a Digital Asset Treasury company. Ethereum really caught our attention, because we realized that Ethereum is really where this idea of real-world assets are being tokenized and put onto the blockchain. That is the majority of real-world assets are. A good example is stablecoins. Stablecoins, which is what Circles IPO is about, is basically a dollar that’s put on the blockchain and then you use it in crypto….

“Now the banks actually have gotten quite interested in this as well. So, JPMorgan is going to create its own stablecoin, Goldman too. JPMorgan is going to be using Ethereum. And Robinhood just announced some tokenization efforts, tokenizing some private assets. But again, a lot of this is going to end up on the Ethereum blockchain.

“Think of Ethereum as like the software, some people say it’s like the oil, but it’s the software powering all this activity. If you look at the technology stack, typically when you get to that layer, you usually get the highest multiples. And so, I think Ethereum probably is dramatically undervalued relative to Circle on that basis. And of course, as we think stablecoin demand could actually 10x. Treasury Secretary Bessent thinks it could be a $2 trillion market. From 200 billion today, that’s 10 times growth. That’s exponential. That would create exponential demand for Ethereum.

Cosmo: “What are the risks that you think about or what we should be considering, what might we be missing?

Tom: “There’s definitely risks, but actually interestingly, one could argue that in some ways a Digital Asset Treasury company could have less risk than an ETF. I think the first risk that’s common to both is that there’ll be what they call a crypto winter, that we’ll have a price cycle and a peak and then prices decline. And in the case of an ETF, you’re holding a constant amount of the crypto, let’s say Ethereum per share. So, if it declines you’re going to have that proportionate decline. But during the holding period of owning a crypto ETH Treasury, that entity might have tripled or 10 times increase your holdings of Ethereum.

“Let’s say a Digital Asset Treasury company has let’s say $4 of Ethereum, but by two years later they have $20 of Ethereum per share, or $30, if Ethereum has a bear market and it falls 40%, you’re actually not going to have your share price decline, because you have dramatically more ETH per share. I guess that’s one of the risks, but it’s mitigated by the fact that you can grow your ETH per share.

“The second is that the capital markets become unfriendly, and so then it’s very difficult to finance. And so, the five or six engines I described to become only one or two ways to grow your NAV per share, and maybe multiples could decline. I think that’s a possibility. But again, because it’s a publicly traded equity, this will create really an appetite for consolidation, and that again creates scarcity, and so the premium could resume. I think there’s ways, there are risks, but then there’s offsets to those risks.”

Cosmo: “There are risks, certainly there’s volatility….

“But I agree largely with you that there are many offsets. And one thing that people like to bring up is the relation to Grayscale, right? The Grayscale bitcoin trade, I think was which ended up trading at a discount to NAV for a very long time. That was just a very different situation. The reality is that Grayscale, it was a closed-end trust. These are not closed-end vehicles, they’re public companies. And so, they can go out and they can do buybacks in the end state where I think there’s consolidation, they can do M&A of any of these trade below one times NAV.’

Tom: “Actually Cosmo has a great point. Not that any Digital Asset Treasury wants to do this, but if they traded at a discount to NAV, they will sell the digital asset in theory and buy back the stock, because that would be what an efficient market would want. Or it would be the reason to drive mergers between two companies for the same reason.”

![]()

CNBC THE EXCHANGE INTERVIEW

I went on CNBC The Exchange to discuss the success of blockchain IPOs like one of our oldest investments Circle and the embrace of blockchain equities by traditional markets. I was also touched on why I believe blockchain is a great place to be investing in the current macro environment.

Kelly: “Do you look at Circle’s IPO and go, other than rejoicing, go like, okay, come on, we’re getting a little carried away.”

Dan: “No, I think you have to understand in the context. No blockchain companies were allowed to go public for a long time. So, there’s a pent-up demand in the public markets. You MicroStrategy trading over a hundred billion in market cap. Circle’s at $45 or $50 billion. That is pent-up demand that’s been there for years and years. Over the next three or four years, there’ll probably be dozens more companies that come public and things may even out a bit. But I do understand why there’s such a pent-up demand.”

Kelly: “But to take that exact explanation, as more companies come to market, shouldn’t the hype and excitement around any particular one of them, whether it’s Circle or other, shouldn’t that settle down? These are infrastructure players. If this all matures and proceeds, this is going to be the stuff that’s too boring to talk about in another three to five years.”

Dan: “I agree. But hey, we’re here to make investments and so we’re looking out over a period of months, and I think it’ll take years for enough public companies to come out in the blockchain space to even out all that demand. The demand is in the hundreds of billions. It’s a very large demand.”

Kelly: “Yeah, I know, but it still feels like this is kind of artificially restricted supply as opposed to fundamentally innovative and exciting business models. Is that fair?”

Dan: “I’d say both are true. They are incredibly innovative business models. Circle and Coinbase did USDC seven years ago. They’ve been way ahead of the curve. These are very innovative business models, but there might be a little hype too.”

Kelly: “I’ve seen a lot of different takes on Circle and even on some of the recent legislation and who’s going to win in the long run from keeping things within the crypto ecosystem or who could lose, and is it the traditional banking system? If you had to look around at the publicly-traded companies available today, where do you think investors are best off putting their money? And even for something like the price of bitcoin, where do you really think that goes from here? It’s kind of been stalling out lately.”

Dan: “Sure, the bitcoin one is easier. We’ve been invested in bitcoin since 2013. Pantera Bitcoin Fund has, on average, almost doubled every year for over twelve years. That’s my forecast and it keeps doing that. I think if you’re trying to ask where should one invest, investing in cryptocurrencies has provided returns you just literally cannot get in the normal securities market. I think crypto is a much better place to store your wealth, especially with all these uncertainties about tariffs and inflation and fiscal deficits as far as the eye can see.

…I would agree with your view that in the long run, and this is a ten-year view, stablecoins will have taken a major fraction of bank deposits. They’re unlevered like banks are. Banks blow up every 20 years, stablecoins are fully backed by US Treasury bills, much safer, much more transparent. In the long run, and again, this is a ten-year forecast, banks will have lost a large fraction of the deposit basis to stablecoins.”

![]()

FEDERAL DEFICIT

“Annual income twenty pounds, annual expenditure nineteen nineteen and six, result happiness.

Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.”

― Charles Dickens, 1850, David Copperfield

Now the United States is spending as much as when fighting a global pandemic – EVERY year.

#BuyBitcoin

![]()

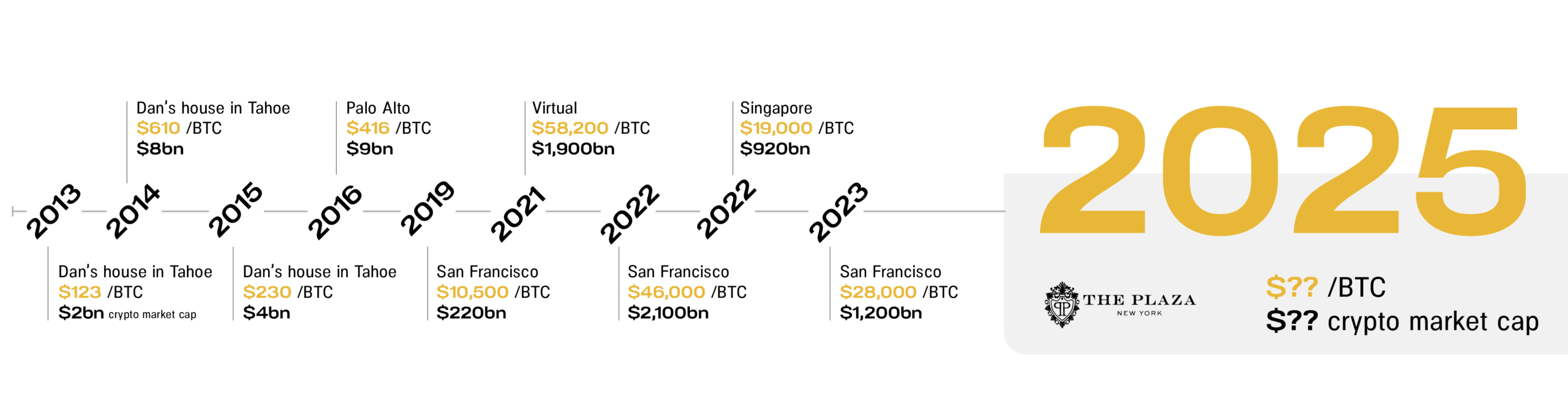

PANTERA BLOCKCHAIN SUMMIT 2025

Our tenth summit in a series of gatherings we began hosting in 2013 – back when blockchain was just a small project – only a few tokens and few startups worth $2 billion. It’s now a $4 trillion publicly-traded industry.

Pantera Blockchain Summit focused on the most important topics in the blockchain industry. The goal is to bring together investors, founders, academics, policymakers, and our investment team to discover valuable insights through thought-provoking discussions.

Our 2013 Summit served as the basis of Nathaniel Popper’s book Digital Gold. It was a small gathering in a private residence with thirty ultimate OGs – including Jesse Powell of Kraken, Brad Garlinghouse of Ripple, Gavin Andresen, who was the Chief Scientist of Bitcoin at the time, and our own General Partner, Marco Santori.

Since then, the community has come a long way! The timeline of our summits is a proxy for the growth of the industry:

You can view highlights from past Pantera Blockchain Summits here.

Speakers for this year’s summit include:

-

– Mike Cagney, Co-founder and CEO of Figure Markets, Co-founder of SoFi

-

– Daniel Vogel, Co-founder and CEO of Bitso

-

– Spencer Spinnell, VP Americas at Circle

-

– Nikil Viswanathan, Co-founder and CEO of Alchemy

-

– Michael Wu, Co-founder and CEO of Amber Group

-

– Pramod Viswanath, Co-founder of Sentient, Princeton Professor

The Summit historically concludes with a poker tournament. At Pantera poker tournaments, paper money is no good. You can only buy in with bitcoin. In 2015, everybody threw in a bitcoin, which was a couple hundred bucks at the time. The 23 BTC pot is $2.7 million in today’s paper money.

Pantera Blockchain Summit 2025 will be taking place on October 7, 2025 at The Plaza, New York City.

If you are interested in attending, you can submit an application here and a member of our Capital Formation team will be in touch regarding availability.

![]()

Have a wonderful summer,

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[2]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Early-Stage Token Fund Investor Call

Tuesday, August 5, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Venture Fund II Investor Call

Tuesday, September 9, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Fund V Call

An overview of Pantera’s fifth venture-style fund that offers exposure to the full spectrum of blockchain assets.

Tuesday, September 16, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

https://panteracapital.com/future-conference-calls/

Venture Fund III Investor Call

Tuesday, September 23, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Blockchain Fund Investor Call

Tuesday, October 14, 2025 12:00pm Eastern Daylight Time / 18:00 Central European Summer Time / 12:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PANTERA FUND V

We’ve found that most investors view blockchain as an asset class and would prefer to have a manager allocate amongst the various asset types. This compelled us to create Pantera Blockchain Fund (IV) in 2021, a wrapper for the entire spectrum of blockchain assets. We are now opening its successor — Pantera Fund V — for subscriptions.

Similar to its predecessor, we believe this new fund is the most efficient way to get exposure to blockchain as an asset class. It is a continuation of the strategies we have employed at Pantera for twelve years across twelve venture and hedge funds.

Limited Partners have the flexibility to invest in just venture (Class V for “Venture”), or in venture, private tokens, and locked-up treasury tokens (Class P for “Privates”), or the all-in-one Class A.

As in all previous Pantera venture funds, we strongly support helping our LPs get access to private deals in this fund. Fund LPs with capital commitments of $25mm or more will have the option to collectively co-invest in at least 10% of each venture equity, private token, and special opportunity deal that the Fund invests over $10mm in. There is no management fee or carried interest on co-investments for those with co-investment rights.

We will endeavor to offer co-investment opportunities, on a capacity available-basis, to other LPs as well. These co-investment opportunities are subject to 1/10% fees.

We are now accepting subscriptions for Fund V. If you’re ready to invest, please click the button below to begin the process.

If you are new to Fund V and would like to receive additional information, click here. We also invite you to join our next call on Pantera Fund V on Tuesday, September 16, at 9:00am PDT / 12:00pm EDT. You may register here.

Pantera donates 1% of revenue from all new funds to 1% For The Planet.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

-

Director, Capital Formation – US East – (New York City)

-

Senior Director, Capital Formation – Gulf Region – (Abu Dhabi)

-

Senior Director, Capital Formation – Asia Pacific – (Singapore)

-

Head of Capital Formation – (New York City)

-

Capital Formation Associate – (New York City)

-

Content Associate – (New York City)

-

Investor Relations Associate – (San Francisco)

-

Senior Investor Relations Associate – (San Francisco)

If you have a passion for blockchain and want to work in New York City, San Francisco, San Juan, Abu Dhabi, or APAC region, please follow this link to apply. Some positions can be done remotely.

[1] Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Partners LP and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically-marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

[2] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed, or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.