Investing in Arch Network

April 22, 2025 | Ishanee Nagpurkar, Jonathan Gieg

BITCOIN: CRYPTO OF CHOICE

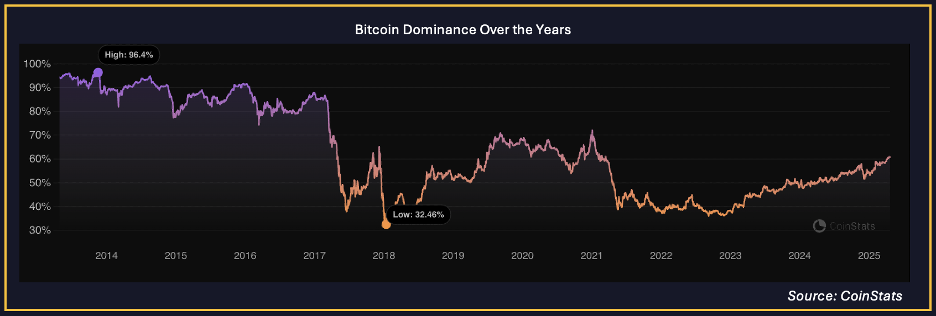

Bitcoin dominance has always been high since the inception of the industry. The recent cycle of 2024-2025 shows similar trends as more corporations and nation states added Bitcoin to their treasuries. Companies are on track to IPO following the suite of MSTR strategy by denominating their balance sheet in $BTC and hoping to be traded above NAV in the public markets.

Bitcoin holds $1.6T+ in market value with a community who is acutely focused on self-custody and sensitive to (and knowledgeable of) security risks. But, ironically, Bitcoin’s lack of native programmability has led to most Bitcoin lending operations being dominated by off-chain centralized companies. Bitcoin is not turing-complete. It has no virtual machine (VM), no ability to create programmable multi-sigs, nor the ability to execute more complex computations outside of basic ‘if this then that’ logic — which is not enough to build any high functioning DeFi protocol let alone a composable ecosystem.

Recent upgrades have led to a surge in activity on the network, with the emergence of Ordinals, Runes, and BRC-20s showing promise. However, the friction for Bitcoin developers was high, deterring them from benefiting from that momentum to build dApps and unlock DeFi on Bitcoin.

Attempts at Bitcoin programmability required trade-offs that Bitcoiners have never been comfortable with (most critically, bridging their Bitcoin on insecure “bridges” or locking funds in a multisig). We’re seeing a growing demand for BTC-native applications with minimal trust assumptions. However, its core programming limitations have kept its use cases narrow for over a decade.

Since its inception, Bitcoin has lacked an app ecosystem or significant transaction volumes.

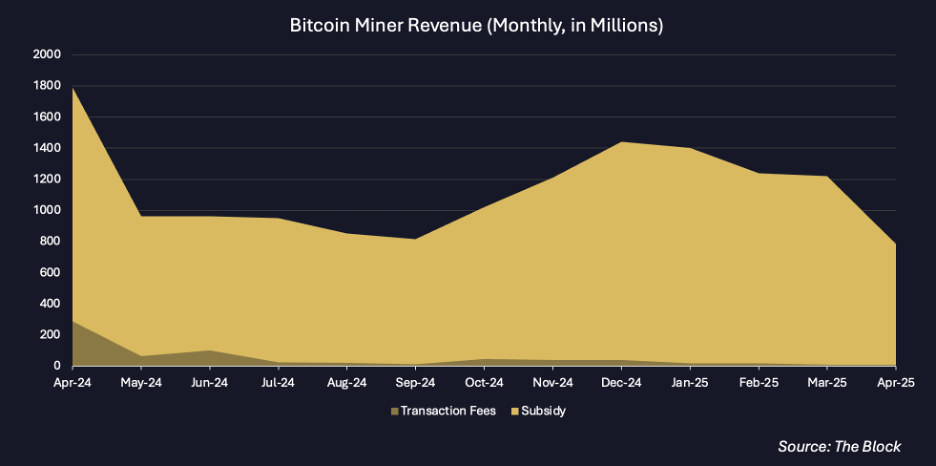

Ensuring network activity and demand for blockspace generates transaction fees for miners – the most sustainable way to usher in the “golden age” of Bitcoin mining, securing the network’s longterm health and success.

ENTER ARCHVM

Composable with Bitcoin Base Layer

Arch has been capturing mindshare as one of the go-to Bitcoin-native execution layers. We saw early developer migration to Arch from bridge-based EVM L2s without the same security or settlement guarantees. Due to its unique architecture, Arch Network is composable with existing Bitcoin base layer applications and established Bitcoin wallets like Xverse or Magic Eden. We believe Arch is positioned as a foundational piece of Bitcoin’s programmable future.

We’re excited about the early signs of an organic ecosystem forming on Arch including teams like SaturnDEX , Wasabi and many more yet to come, bringing new use cases to Bitcoin and opportunities for yield. Arch’s SVM-modified architecture is a unique opportunity for Rust developers, allowing them to build fast Bitcoin dApps. The team welcomes any developer to reach out to them to learn more about their technical decisions and support.

Ecosystem Pillars

At Pantera, we’re excited to see the Arch team focus on the key pillars of building any crypto economy: lending, stablecoins and trading. Bitcoin DeFi requires a unique custody construction since it has sizable demand from institutions that only use qualified custodians such as Anchorage and Fordefi to store or trade. It’s been great to see the Arch team working with QCs so early on behalf of Arch developers — helping them cross the chasm for distribution in the future.

MEET THE TEAM

Matt Mudano, CEO: Matt has over a decade of experience in crypto, having started mining Bitcoin in 2012. He is a serial entrepreneur with multiple successful exits in startups at the intersection of consumer products and tech. His ability to drive execution has been a key factor in Arch’s momentum.

How did you get into crypto and in building Bitcoin?

Matt: “My journey into crypto started with Bitcoin — I was mining on several laptops in my college dorm room, fascinated by the idea of a decentralized digital currency. That early exposure shaped my perspective as both an investor and entrepreneur.

“During the ICO boom, I explored Ethereum-based projects, but that cycle was mostly speculative ideas without real product-market fit. While I continued building businesses outside of crypto, I stayed engaged, participating in DeFi farming, NFTs, and digital asset speculation during the 2020 cycle.

“But it wasn’t until early 2023, when I saw the Ordinals boom, that I had a true catharsis moment — realizing that programmability on Bitcoin was the biggest unlock of the next two cycles. That’s when I decided to go all-in, joining the Bitcoin Startup Lab accelerator and leveraging everything I’ve learned as an entrepreneur, investor, and builder to push Bitcoin forward. In many ways, it feels like coming full circle: back to where my journey started, but now with the tools and experience to help shape its future.”

Amine ElQaraoui, CTO: Amine is an ENSIAS graduate with a specialized engineering degree in artificial intelligence and over ten years of programming experience. His deep expertise spans Bitcoin Script, zkVMs, EVM, and SVM, a rare combination that makes him uniquely capable of bridging Bitcoin-native development with broader blockchain ecosystems. He previously worked in the banking industry, managing data infrastructure for Moroccan banks.

Having tried to build on Bitcoin before Arch, what were the biggest challenges that you and other developers faced?

Amine: “Having built on Bitcoin before Arch, the biggest challenges I faced were the limitations of Bitcoin’s native scripting language and the lack of Turing completeness—it made developing even moderately complex applications feel like building with stone tools. There was also minimal infrastructure available to support developers, and the unpredictable nature of Bitcoin’s fee market made it incredibly difficult to design applications with reliable user experiences. These constraints are exactly what inspired us to build Arch.”

FROM THE TEAM ON VISION & MISSION OF ARCH NETWORK

What do you consider as the North Star Metric for Bitcoin L2s such as yourselves?

Matt: “Our North Star Metric is sustained Bitcoin-denominated economic activity. The best Bitcoin execution platform is the one that makes BTC more useful and productive without forcing it to leave the Bitcoin economy. Success isn’t just about TPS or TVL—it’s about creating real, self-sustaining financial activity denominated in BTC and ultimately settled back to Bitcoin.”

What are you most excited to see built on Arch?

Matt: “While I’m excited for the on-chain Bitcoin economy to develop—all the typical DeFi primitives and the composable protocols that sit between them—what truly excites me are the net-new financial products that are only possible because of Bitcoin’s global acceptance and pristine collateral properties.

“The DeFi primitives that are familiar from Ethereum (lending, DEXs, structured yield) represent a massive and unprecedented opportunity — the building blocks of a $400B on-chain Bitcoin- economy.

“Bringing that level of capital efficiency to Bitcoin is an enormous unlock. But what excites me even more are the financial products that don’t just replicate what exists on Ethereum, but uniquely leverage Bitcoin’s role as the most widely recognized and neutral monetary asset.

“These are innovations that only make sense using Bitcoin as the medium, such as:

-

-

-

Global BTC-denominated trade finance

-

-

-

-

-

Cross-border settlement networks without intermediaries

-

-

-

-

-

Bitcoin-backed structured products that institutional capital actually trusts

-

-

“Bitcoin is already the reserve asset of crypto, and increasingly, of the broader financial system. Unlocking these new financial primitives—ones that align with Bitcoin’s role as a universal, censorship-resistant, and trust-minimized asset—is what will make Bitcoin’s smart-contract platform truly transformative.”

LAST THOUGHTS

As the Bitcoin ecosystem evolves, we believe Arch Network is positioned to play a key role in bringing programmability and liquidity to Bitcoin in a way that is both scalable and secure. We’re excited to lead their $13 million Series A round and support them in growing their ecosystem, expanding their developer community, and helping drive adoption for Bitcoin-native DeFi and beyond.

Pantera continues to be excited about the potential of the Bitcoin Economy — reach out to us if you’re building something we’d like to fund!

For more information, please visit https://www.arch.network/