TABLE OF CONTENTS[1]

1. Reflections On Centralized Finance And Software

2. Reflections On Consumer Applications Of The Blockchain: Gaming, Metaverse, And Brands

3. Bitcoin Price Cycle Analysis

4. Investing in Obol – Distributed Validator Technology

5. ZIRP, Out

![]()

REFLECTIONS ON CENTRALIZED FINANCE AND SOFTWARE

By Ryan Barney, Senior Investment Associate

2023 Will Be The Year For Rebuilding Trust In Centralized Finance (CeFi)

2022 was a year of booms and major busts, especially as it pertains to CeFi. In the span of a few months, the world saw Three Arrows Capital collapse, Do Kwon’s LUNA disintegrate, Voyager Digital go bankrupt, and Sam Bankman-Fried’s (SBF) FTX empire shatter.

What did all these events have in common? The headlines like to suggest that it was crypto or Web3 that failed. But, in fact, it was a combination of bad actors skirting lines in jurisdictions without clear regulations. If 2022 was the year of breaking rules and failing, I believe 2023 is the year that entities instead follow the rules and enjoy the rewards of doing so.

The original promise of crypto included complete decentralization, to fully disable the potential for bad actors to be involved in the financial system. Although this may be true on the longest of horizons (decades not years), for crypto to become widely adopted and used by individuals, institutions, and governments, centralized entities still have a role to play. For this to happen, centralized institutions must first focus on rebuilding the trust that was lost to the tumult of the past year.

This has already begun. Pantera portfolio company Coinbase was first to remind customers that it “carries crime insurance that protects a portion of digital assets held across [its] storage systems against losses from theft, including cybersecurity breaches”, in the wake of FTX. Leading exchange by volume Binance has implemented a proof-of-reserve mechanism for proving customer deposits. After a major entity like FTX falling, these two companies and other CeFi exchanges are proving to be clear short-term winners. They will continue to win and take market share as they prove trust with their customers, and work with regulators to develop clear frameworks that make sense in the crypto context, as well as the broader exchange/banking context in which these companies too reside.

The next set of winners will likely consist of those companies that design innovative ways to attract customers in specific jurisdictions. This is akin to building vertical SaaS (software-as-a-service) vs. horizontal SaaS in the Web2 world. Essentially, places where massive companies were allowed to be created because either regulation was more lenient than in the U.S. or because regulation prohibited out-of-country exchanges. Look to Pantera portfolio companies CoinDCX in India, Valr in South Africa, and Pintu in Indonesia to blaze the trail in creating massive opportunities by working with regulators and establishing greater customer confidence as a result.

DeFi (decentralized finance) should not be overlooked in this year of building trust in CeFi. In fact, I think DeFi will be a powerful tool for CeFi companies to differentiate themselves and attract customers. I think that CeFi companies will act as the front-end for users’ utilization of DeFi. A great example is the Liquid Collective. This company is a DAO (decentralized autonomous organization) that allows liquid staking but doing so through CeFi front-ends. A user could log-on to their Coinbase account and access the protocol. This is a win-win. Regulator KYC/AML requirements are satisfied by the Coinbase front-end. Customers are able to use a trusted entity with a simplified user experience to interact with the DeFi world comprising the back-end.

Let’s begin putting the failures of people and equally fallible third-parties behind us as we look towards the rest of 2023 — but let’s not forget them completely. The best entrepreneurs will learn from the mistakes and centralization failures of those before them, while regulators should accelerate the creation of a clear framework and rules. This combination will allow blockchain-based CeFi to resurge on a jurisdiction-by-jurisdiction level.

Software Is *Still Eating* The World

The crypto bull market run of 2021/2022 was felt in many seams of the world. Headlines were all about the promise of crypto, bitcoin price increasing, NFTs generating record sales, Web3 gaming exploding, and Facebook rebranding to Meta. Family and friend gatherings were saturated with whispers of Apes, Punks, and Chainrunners.

What did this mean for Web3 companies? Application companies were the most obvious winners in this market environment. With the entire world focused on the crypto asset class, user acquisition was never easier or as inexpensive for software providers (except for those pesky Super Bowl ads and stadium naming deals…). Per the explosion of Web3 users, companies needed to quickly develop more robust backends, security, HR, etc. The solution to most of these gaps in company robustness has been and will continue to be: software.

Behind every great application company is an even better software stack. Many of these applications consist of vendor products rather than stack elements built in-house. The dirty little secret of these software companies is that they are incredibly resilient to market swings — even in crypto. They typically charge on a recurring basis and sometimes mix in a usage component. This means that, regardless if a bull or bear market, software providers are still generating revenue — still winning regardless of market conditions.

Software companies took the opportunity of the bull market to sell into all the booming application companies. They will still be capitalizing on those sales as the bear market blossoms. These are companies like Pantera portfolio company Alchemy (developer tooling), Pinata (storage), and Definitive (analytics). They help companies accelerate growth regardless of market conditions.

We are looking forward to finding and helping support the next generation of Web3 software companies developing infrastructure that will power the crypto-asset ecosystem regardless of market sentiment, the price of bitcoin, or… SBF’s legal status.

![]()

REFLECTIONS ON CONSUMER APPLICATIONS :: GAMING, METAVERSE, AND BRANDS

By Sehaj Singh, Investment Associate

Games and “Metaverse” experiences enabled by Web3 continue to remain a topic of great excitement and debate. As we look back upon 2022, the following stands out:

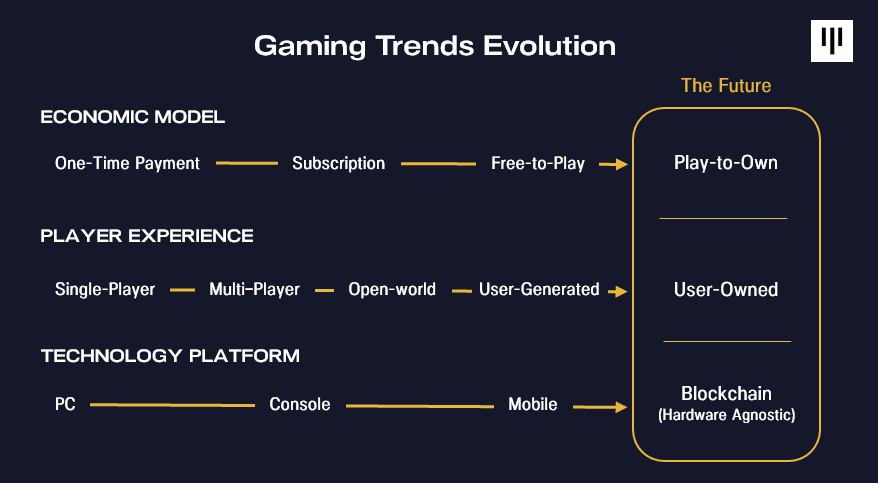

Despite Flawed Implementations, Blockchain’s Core Value Proposition For Games Remains Unchanged

By empowering gamers to truly own their in-game assets, blockchains turn the value-extractive framework of the traditional gaming industry on its head. This thesis was validated by Axie Infinity — one of the first blockchain games developed by Sky Mavis — which went viral in 2021 with its “Play-to-Earn” mechanics (i.e., generating inflationary tokens as new players enter the game). At its peak, Axie was generating north of $10M in daily marketplace fees, but as of January 2023, that figure is down to less than $5K.

While Axie showed how implementing NFTs and creating secondary markets via true ownership adds a crucial economic layer to games, it also proved that there is no free lunch, and if Web3 games are to succeed, they need to work on making economies more sustainable. 2021 was the year of “Gamified DeFi” — applications that take simple DeFi concepts like liquidity provision and farming, gamifying those concepts by creating an immersive wrapper around them. These “games” were far from being fun or engaging and 2022 has (thankfully) seen their inevitable demise.

Today, there are several hundred well-funded indie studios (often founded by veterans of the free-to-play gaming industry) experimenting with blockchain gaming models and combining the best of what works in traditional gaming with the ownership and monetization layers of Web3. A recent trend pioneered by Limit Break (a Web3 gaming firm) is the concept of “Free-to-Own”, which involves gaming studios giving away NFTs for free to their most engaged users, who then help evangelize the game and drive more value to the NFTs they hold. This is a tectonic shift from how marketing/distribution occurs in traditional studios and a trend we expect to see more of in 2023. Gaming is a dynamic industry that continues to evolve to suit players’ needs and we think the blockchain-enabled future is already here to stay.

Web3 No Longer A Differentiator

In 2021, gaming studios that would otherwise struggle to raise funds were able to raise massive rounds just by simply integrating blockchains (even if the integration was shallow and/or deeply flawed). Blockchain gaming was a new phenomenon and many investors saw blockchains as a key success lever for gaming studios, often disregarding other important facets of the business.

In 2022, the sentiment has reverted to the mean, as investors and builders face the sobering realization that making genuinely fun and engaging games will always be the key differentiator for a studio’s success. Web3 can help fuel that success, as long as it meaningfully adds to the player’s experience, and the studio’s distribution, marketing, and business models.

Venture Funding :: Flight To Quality

2022 was a remarkable year for blockchain gaming investments, but deal activity (volumes and number of studios funded) slowed significantly versus 2021. This has everything to do with a change in game economy incentives and a flight to quality, which we believe are meaningful drivers in the long-term success of Web3 games. Short-term investors — betting on token price action from inorganic volume — have also fled the space. Axie’s game-economy relied heavily on a two-token model: one governing the game itself and the other an inflationary token rewarding players for winning in games. This model — though heavily flawed, in hindsight — was adopted by several other gaming studios. As the in-game economies of these copy-cat games imploded, players never returned, investors soured, and builders became skeptical, making both follow-on and new fundraises challenging.

That said, the best builders and innovators in the space continue to raise fresh capital, as shown by free-to-play industry veteran Gabe Leydon’s studio Limit Break recently raising $200M.

Brands Finally Arrive

Per Oxford, “Metaverse” was a runner-up for “2022’s Word of the Year” (first place went to “Goblin Mode”). We’ve gone past the hype cycle of consumer brands simply using the buzz around creating their “Metaverse” for marketing purposes, to brands actually developing immersive digital experiences built on the blockchain — with a focus on utility for and engagement of their core audience. Marquee companies like Reddit, Nike, Dolce and Gabbana, Gucci, and Tiffany all participated in selling NFTs, with Nike earning more than $185M from NFT sales.

2023 OUTLOOK

Blockchains On The Back-End, Not Front-End

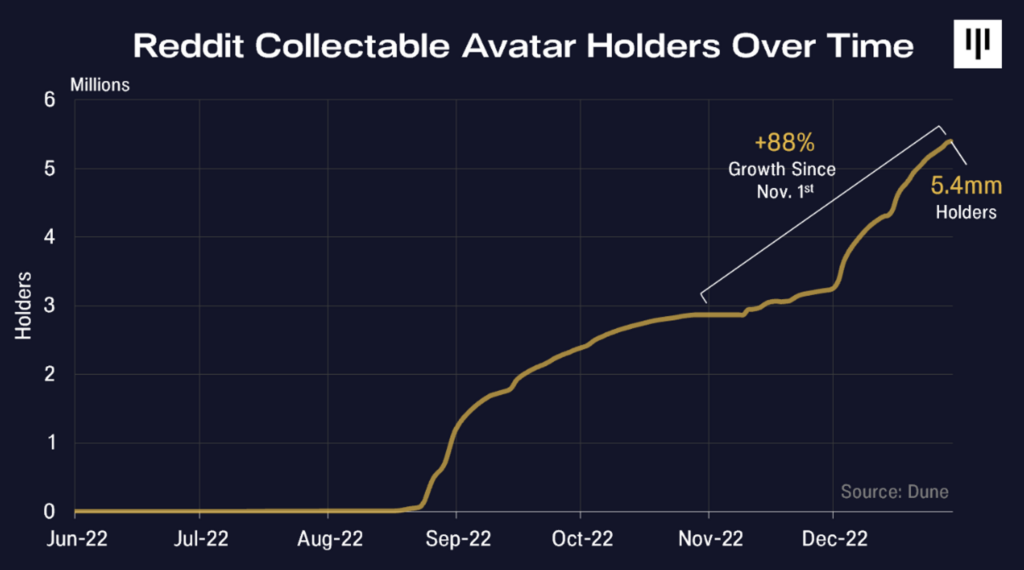

Reddit, a prominent chat-based social network, pioneered the use of blockchains and NFTs in deepening engagement within its communities. To-date, Reddit’s “Collectible Avatar” NFTs have been minted by over 4 million unique users. The key to its success was not mentioning blockchain or NFT anywhere (Reddit calls its NFTs “digital collectibles”), avoiding any connotative toxicity which could stymie adoption. 2023 will see prominent companies continue to adopt this strategy of “blockchains on the back-end, not front-end”, leading to a smoother adoption curve for their consumers.

Less Talk Of The Metaverse, More Building

We view the Metaverse as any digital environment where one can experience a digital immersion of the self, with blockchains providing infrastructure for digital identity and ownership. While 2021-2022 were both pivotal years for educating brands on the Metaverse (and at best, brands dipping their toes into the space by selling NFTs), we believe that 2023 will be the year where big brands actually implement Web3 in a meaningful way to deepen consumer engagement. Starbucks is the best example of this, with their use of the Polygon protocol to create “Starbucks Odyssey”, a Web3 addition to their existing loyalty program meant to offer digital collectibles, greater community building, and new coffee experiences. We believe loyalty programs, promotions, token-gated experiences, and gamified interactions will power several novel brand initiatives this year.

Web3 Gaming And The Innovator’s Dilemma

Despite investor interest in Web3, most large game publishers like Activision-Blizzard, TakeTwo, Rockstar, and Mojang will continue to stay away from NFTs and will rely primarily on the free-to-play model. For these companies, the risk of integrating Web3 via ownable assets (custody risk, smart contract risk, or anti-blockchain players churning away) still outweighs the rewards from any added monetization capabilities or player engagement. Without much guidance from the gaming giants, we expect a high failure rate for newly funded Web3 studios that are still finding the way. We believe that the Web3 native studios that survive will go on to become much larger and pave the path for sticky business models that will be adopted by traditional gaming studios for years to come.

Utility > Speculation

The speculative mania of the 2021 NFT bull run has already come to an end, but we expect utility-based NFTs from top Web3 games to drive healthy (i.e., not speculative) volumes in the 2023 NFT market. This does not necessarily mean that NFT volumes will return to 2021 levels (given those were driven by speculation), but we suspect that the transfer of NFTs will primarily be based on owners deriving (or exhausting) actual in-game utility. While it is almost impossible to point out the timing for such shifts, especially given the “hits-driven” nature of games, Axie’s case study proves that it only takes one successful Web3 game studio to drive every other Web3 (and potentially Web2) studio towards a sustainable, future-ready business model.

![]()

BITCOIN PRICE CYCLES ANALYSIS[2]

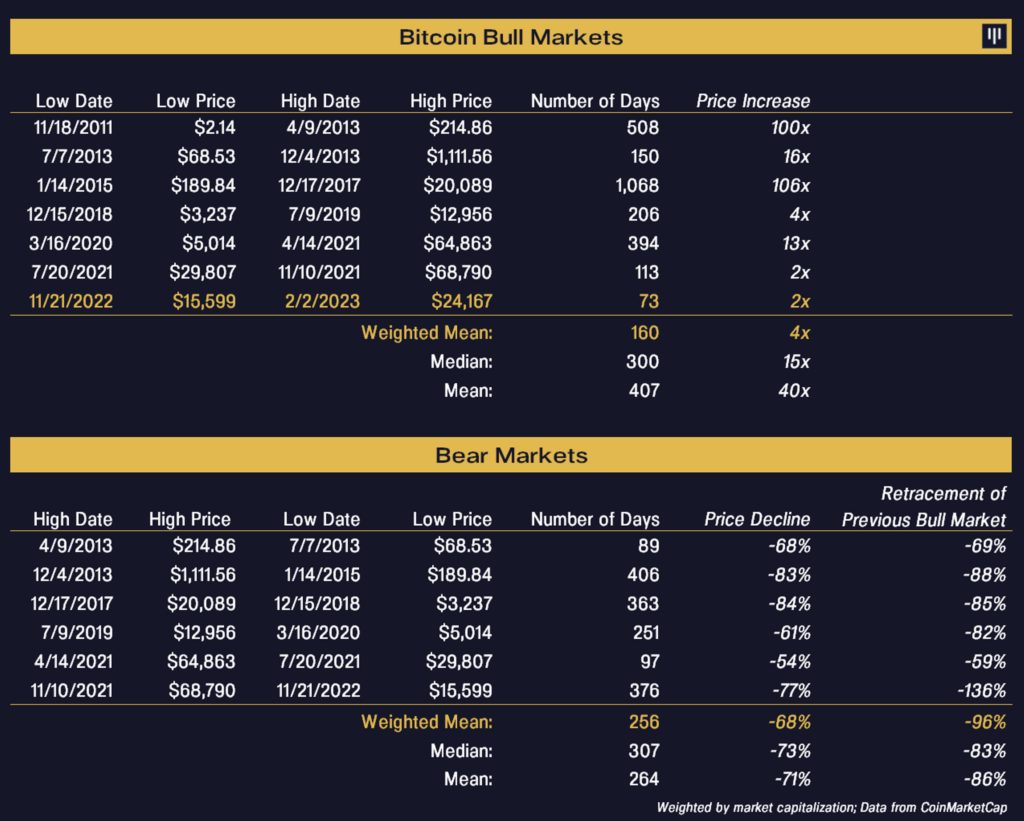

Blockchain will change the world. Unfortunately, that massive promise causes market participants to go wild – both too bullish at times and too bearish at times. We’ve invested through four “crypto winters” already.

Over the long-term, Bitcoin price has been in a secular uptrend of 2.3x annually over the past twelve years, on average.

Major Bitcoin Price Cycles

Pantera has been through ten years of bitcoin cycles and I’ve traded through 35 years of similar cycles. I believe that blockchain assets have seen the lows and that we’re in the next bull market cycle – regardless of what happens in the interest-rate-sensitive asset classes.

The decline from November 2021 to November 2022 was the median of the typical cycle. This is the only bear market to more than completely wipe out the previous bull market. In this case giving back 136% of the previous rally.

The median downdraft has been 307 days and the previous bear market was 376. The median drawdown has been a -73% downdraft and the latest bear market ended at -77%.

I think we’re done with that and beginning to grind higher. I believe that blockchain assets have seen the lows and that we’re in the next bull market cycle – regardless of what happens in the interest-rate-sensitive asset classes.

That would be the seventh bull cycle, after six bear cycles. (Pantera’s been investing through twelve of the thirteen moves!)

![]()

INVESTING IN OBOL

By Tony Sakich, Director of Marketing & Communications, and Will Reid, Investment Associate

2022 was a landmark year for Ethereum. The platform finally switched from a proof-of-work consensus mechanism to proof-of-stake. This change greatly reduced the Ethereum network’s carbon footprint (by ~99.98%) and created a new means of securing the network through staked ETH.

Obol is creating a core piece of infrastructure to support the burgeoning staking ecosystem called Distributed Validator Technology (DVT). DVT is considered so integral to the Ethereum stack that Vitalik Buterin included it as a key milestone in “The Merge” section of the Ethereum roadmap.

At its core, Obol is creating a low-cost risk management software for Ethereum stakers that serves two core functions: reducing “slashing” risk and the risk of yield losses due to validator downtime.

The risk of “slashing” – or losing part or all of one’s staked ETH due to malicious intent or accident – is seen as such a material risk, that LidoDAO (Lido is the market leader in ETH staking) was at one point spending 25% of its revenues on slashing insurance.

Obol’s DVT solution significantly mitigates this risk. We believe it could enable a new wave of institutional staking adoption in the medium to long-term. As institutional users increase their share of the staking market, we predict that well over 50% of staked ETH could leverage Obol’s DVT.

DVT also has broad-based appeal for all types of validators, types which can be split into three categories:

1. Large Validators: DVT allows larger validators to run more validation nodes with fewer machines, reducing hardware costs and increasing efficiency. Additionally, it provides active redundancy and reduces slashing risk (which significantly reduces slashing insurance costs!). With DVT, validators can run multiple nodes in a group, diversifying the risk of failure and increasing their overall reliability.

2. Liquid Staking Protocols (LSPs): DVT’s ability to increase efficiency and reduce risk allows for higher operator participation, which is crucial for LSPs. With the added redundancy provided by DVT, LSPs can remove their dependency on any one operator, reducing the chance of network downtime. By organizing operators into different clusters, even if one goes down, the full validator node is unaffected, as other active operators will meet the thresholds for attestation. This ultimately improves the performance of the protocol for stakers, making it more reliable and efficient.

3. Community & At-Home Validators: DVT also benefits smaller validators and users, who can now run their nodes with more confidence, delivering uptime and efficiency that is comparable to larger validators. This can be achieved by at-home validators working together as a community – and not relying on any single machine. Furthermore, the ETH requirement for running a node is lowered, as multiple nodes can be grouped together to meet the 32 ETH requirement for validation. With this, DVT has the potential to greatly increase participation from at-home validators, which would result in a more decentralized and resilient network for all.

We’re also excited that Obol is planning on expanding its core DVT solution to alt-L1s (alternative Layer-1s) like Cosmos. Obol is also planning on exploring the decentralization of various other components of the Layer-2 stack (such as the block builder, sequencer, or prover).

As an integral part of the emerging “Ethereum middleware” sector (alongside re-staking pioneer Eigenlayer and MEV (maximal extractable value) R&D powerhouse Flashbots), we’re thrilled to support Obol’s mission of continuing to de-risk and decentralize the core components of Layer-1 and Layer-2 blockchain infrastructure.

Learn more about Obol at Obol.Tech, follow them on Twitter @ObolNetwork and join Obol’s Discord community here.

![]()

PANTERA BLOCKCHAIN SUMMIT 2023

Pantera Blockchain Summit 2023 will be taking place on April 4th 2023 in San Francisco. This is our ninth summit in a series of gatherings we’ve hosted since 2013.

This year also marks the 10th anniversary of the blockchain fund industry in the U.S., starting with the launch of Pantera Bitcoin Fund, and our team is especially honored to bring together our family of portfolio companies, partners, and investors for a day of learning, inspiration, and connection.

Pantera Blockchain Summit 2023 is curated by the Pantera investment team and focused on the most important and exciting topics in the blockchain industry. Our goal is to uncover valuable insights, foster great conversations, and empower the entire Pantera network to move our industry forward. We host industry leaders of diverse backgrounds including entrepreneurs, developers, and regulators at our summits.

Confirmed speakers for 2023 include:

-

Sunayna Tuteja, Chief Innovation Officer of the Federal Reserve

-

Chris Giancarlo, Former CFTC Chairman

-

Christine Moy, Partner and Head of Digital Assets at Apollo Global Management

-

Caroline Pham, Commissioner of the CFTC

-

Oli Harris, Head of Digital Assets at Goldman Sachs

-

Fred Lardieg, Partner at Mubadala Ventures

-

Mike Belshe, Co-Founder and CEO of BitGo

-

Amir Bandeali, Co-Founder of 0x Labs

-

Roneil Rumburg, CEO of Audius

-

Ola Doudin, Co-Founder and CEO of BitOasis

-

Bradley Kam, Co-Founder of Unstoppable Domains

-

Sumit Gupta, Co-Founder and CEO of CoinDCX

-

Eric Chen, Co-Founder and CEO of Injective

-

Nathan Allman, Co-Founder and CEO of Ondo Finance

-

Arisa Toyosaki, Co-Founder and CEO of Cega

-

Don Ho, Managing Director at Quantstamp

You can check out highlights from Pantera Blockchain Summit 2022 here.

If you are interested in attending, please indicate your interest here and a member of our Capital Formation team will contact you regarding availability.

![]()

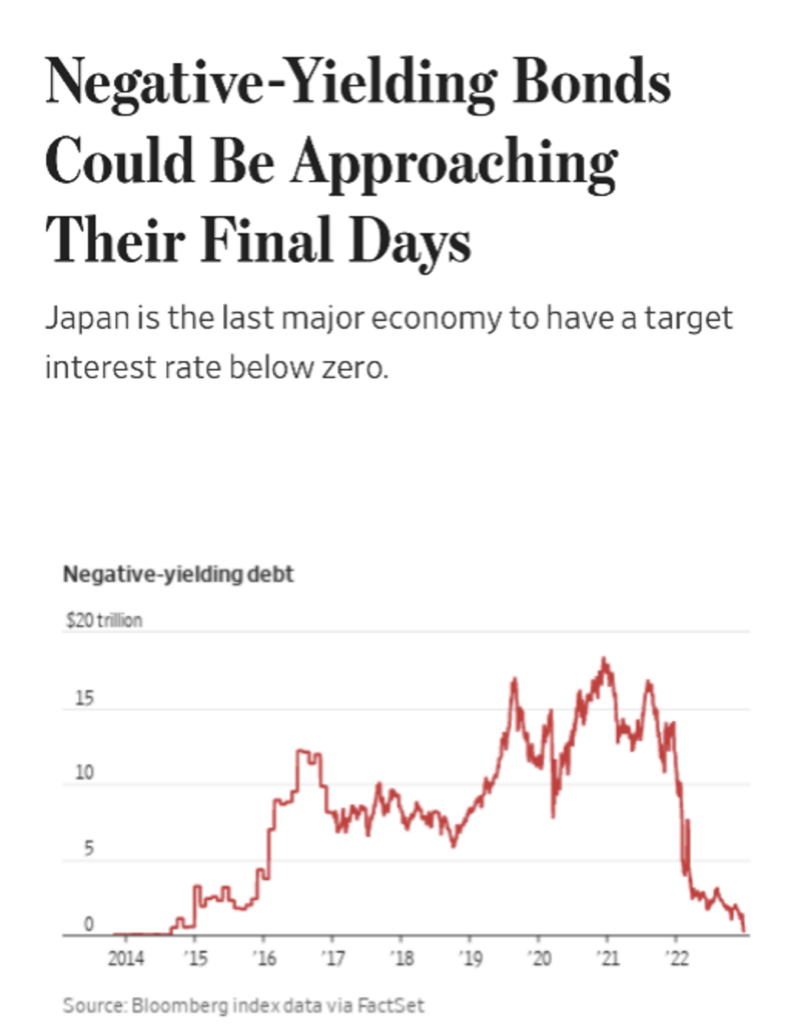

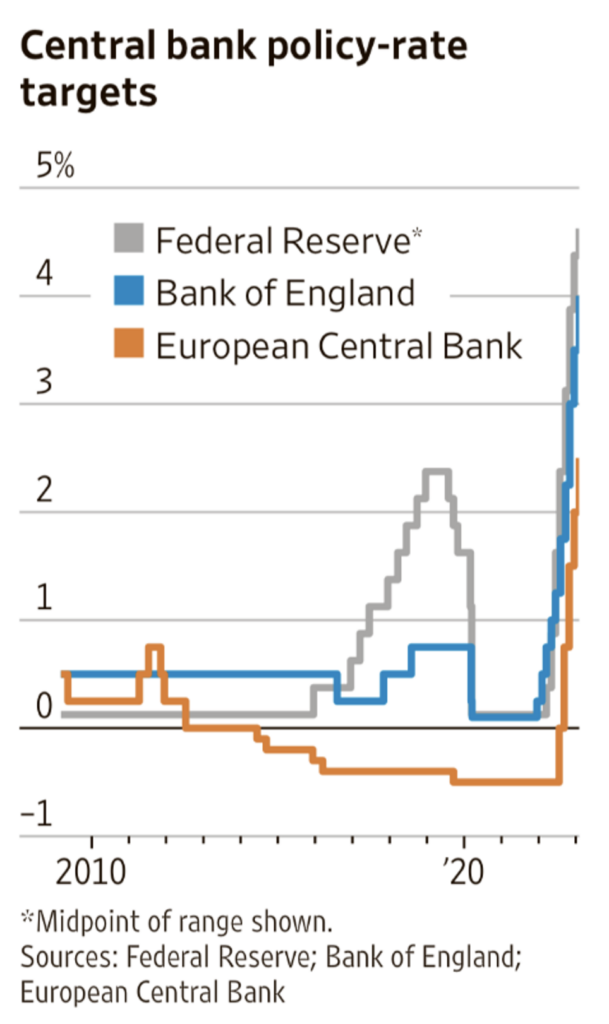

ZIRP, OUT

Japan invented ZIRP – Zero Interest Rate Policy. Love it that they sent it away.

We’re done with the era of negative yields – where investors are forced to get return-free risk.

![]()

All the best,

“Put the alternative back in Alts”

PANTERA CONFERENCE CALLS[3]

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Pantera Fund V Launch Call

Fund V offers exposure to the full spectrum of blockchain assets. Like its predecessor, Blockchain Fund (IV), the venture-style fund will invest in venture equity, early-stage private tokens, and liquid tokens.

Thursday, February 23, 2023 8:00am PDT / 17:00 CET / 12:00am Singapore Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Pantera Blockchain Fund Investor Call

Wednesday, March 15, 2023 9:00am PDT / 18:00 CET / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Venture Fund II Investor Call

Tuesday, March 21, 2023 9:00am PDT / 18:00 CET / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Pantera Venture Fund III Investor Call

Tuesday, March 28, 2023 9:00am PDT / 18:00 CET / 1:00am Singapore Standard Time

Open only to Limited Partners of the fund.

Join us in learning more about the industry, the opportunities we see on the horizon, and our funds.

PORTFOLIO COMPANY OPEN POSITIONS[4]

Interested in joining one of our portfolio companies? The Pantera Jobs Board features 1,500+ openings across a global portfolio of high-growth, ambitious teams in the blockchain industry. Our companies are looking for candidates who are passionate about the impact of blockchain technology and digital assets. Our most in-demand functions range across engineering, business development, product, and marketing/design.

Our portfolio companies are actively hiring for the following roles:

-

Rarify – Head of Business Development – (Remote)

-

Arbitrum – Blockchain Developer (Remote)

-

Alchemy – Engineering Manager (New York or San Francisco)

-

NEAR Foundation – Head of Brand & Growth (Remote)

-

Bitso – Java Engineer – (Remote)

-

Aurora – Legal Counsel (Remote)

-

0x Labs – Lead Platform Engineer (Remote)

-

CoinDCX – Chief Financial Officer (Bengaluru, India)

-

Starkware – Product Manager (Netanya, Israel)

-

Pintu – Sr. Software Engineer – (Hybrid Remote)

-

Cosmos – Full Stack Rust Engineer (Remote)

-

Waterfall – Software Engineer (New York)

-

Cega – Front End Engineer – (Remote)

-

Injective Protocol – Rust Developer (Remote)

-

Brine Finance – Infrastructure Engineer (Bangalore, India)

-

Wintermute – Quant Developer – (Hybrid, London)

-

Audius – Software Engineer Full Stack (Remote)

-

Rift Finance – Head of Design (Remote, New York)

-

Protocol Labs – VP of Engineering, PL Starfleet (Remote)

-

Abra – Quantitative Developer – (Remote)

Visit the Jobs Board here and apply directly or submit your profile to our Talent Network here to be included in our candidate database.

[1] Important Disclosures – Certain Sections of this Letter Discuss Pantera’s Advisory Services. Certain sections of this letter discuss the investment advisory business of Pantera Capital Management Puerto Rico LP and its affiliates (“Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences.

[2] Important Disclosures — General Market Commentary / No Offer of Advisory Services: This section provides educational content and general market commentary. Except for specifically marked sections of this this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial or other advice or recommendation. Statements that the historical performance of any asset or sector are not a guarantee of futures outcomes or returns.

[3] Important Disclosures – This Section Discusses Pantera’s Advisory Services. Information contained in this section relates to Pantera’s investment advisory business. Nothing contained herein should be construed as a recommendation to invest in any security or to undertake an investment advisory relationship, or as any form of investment, legal, tax, or financial advice or recommendation. Prospective investors should consult their own advisors prior to making an investment decision. Pantera has no duty to update these materials or notify recipients of any changes.

[4] This section does not relate to Pantera’s investment advisory services. The inclusion of an open position here does not constitute an endorsement of any of these companies or their hiring policies, nor does this reflect an assessment of whether a position is suitable for any given candidate.

This letter is an informational document that primarily provides educational content and general market commentary. Except for certain sections specifically marked in this letter, no statements included herein relate specifically to investment advisory services provided by Pantera Capital Management Puerto Rico LP or its affiliates (“Pantera”), nor does any content herein reflect or contain any offer of new or additional investment advisory services. Nothing contained herein constitutes an investment recommendation, investment advice, an offer to sell, or a solicitation to purchase any securities in Funds managed by Pantera (the “Funds”) or any entity organized, controlled, or managed by Pantera and therefore may not be relied upon in connection with any offer or sale of securities. Any offer or solicitation may only be made pursuant to a confidential private offering memorandum (or similar document) which will only be provided to qualified offerees and should be carefully reviewed by any such offerees prior to investing.

This letter aims to summarize certain developments, articles, and/or media mentions with respect to Bitcoin and other cryptocurrencies that Pantera believes may be of interest. The views expressed in this letter are the subjective views of Pantera personnel, based on information that is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of the information and opinions. The information contained in this letter is current as of the date indicated at the front of the letter. Pantera does not undertake to update the information contained herein.

This document is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments, including taking both long and short positions, in connection with such instruments without further notice.

Certain information contained in this letter constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual policies, procedures, and processes of Pantera and the performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements, and no undue reliance should be placed on these forward-looking statements, nor should the inclusion of these statements be regarded as Pantera’s representation that the Fund will achieve any strategy, objectives, or other plans. Past performance is not necessarily indicative of or a guarantee of future results.

It is strongly suggested that any prospective investor obtain independent advice in relation to any investment, financial, legal, tax, accounting, or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate, or other market or economic measure.

This document is confidential, is intended only for the person to whom it has been provided, and under no circumstance may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient.